Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

After months of reviewing, the United States may finally see its first ETF launch on Thursday, tomorrow. Bloomberg analysts confirmed that REX-Osprey XRP ETF (XRPR) and the Dogecoin ETF (DOJE) are scheduled to list on September 18, following a short delay from their initial Sept. 12 target.

To make the investment easier, here are the steps to follow.

How to Invest in REX-Osprey XRP ETF?

Sign up with a U.S. broker or investing app that offers the XRPR ETF of Rex Osprey. Popular ones in the US include Fidelity, Charles Schwab, E*TRADE, or TD Ameritrade, where people can open investment accounts to buy and sell things like stocks, ETFs, mutual funds, and more.

Deposit U.S. dollars using a bank transfer , wire, or any other payment options your broker supports.

The next step is to locate the XRP spot ETF using its ticker “XRPR” via the broker’s trading platform. You can check the price there.

Choose how many shares to buy and place a market or limit order during market hours. Shares can be bought and sold like any other stock or ETF, typically with a T+2 settlement period, meaning the trades will settle in two business days.

Track your investment from your brokerage dashboard, review daily price updates, and consider the potential volatility and fees. Typically, management fees are low, but it’s important to confirm exact rates with the fund documentation.

ETF Market to Become Payment Centric?

According to Forbes, this XRP ETF launch can extend crypto’s integration into the regulated financial system. It will evolve from Bitcoin’s ‘digital gold’ and Ethereum’s ‘smart-contract fuel’ to XRP’s payments-centric asset.

XRP is currently ranked at the top 3, and is popular across the world for its fast and feasible payment service. But despite its wide utility and big market cap, it is still important to follow SEC notices for updates. The agency sought public comments to review the ETF before approving, aiming to eliminate the risk factors.

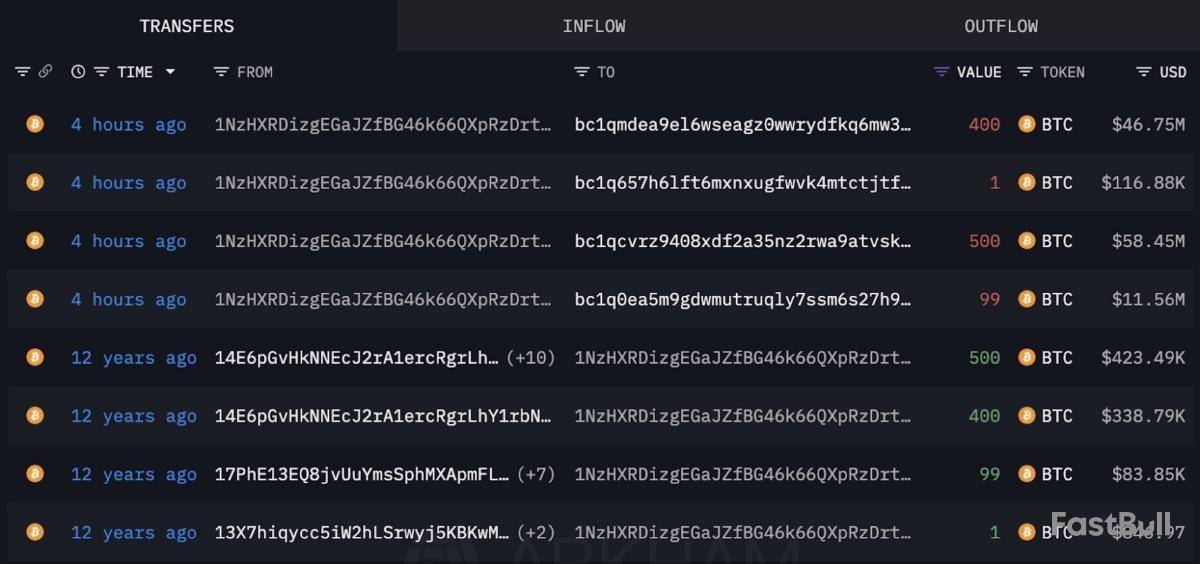

A long-dormant Bitcoin whale moved around $116 million worth of the cryptocurrency after 12 years, just before the US Federal Reserve’s closely watched interest rate decision.

The unknown whale woke up after 12 years of dormancy to transfer 1,000 Bitcoin — worth around $116 million at current prices — which he initially acquired for around $847 per coin. The BTC was worth around $847,000 at the time, which the whale hodled for over a decade before transferring the holdings to new wallets on Wednesday, according to blockchain data platform Lookonchain.

The over $100 million transfer occurred shortly before Wednesday’s upcoming Federal Open Market Committee (FOMC) meeting, a highly anticipated event that may deliver the first US interest rate cut of the year.

Crypto traders brace for market volatility ahead of FOMC meeting

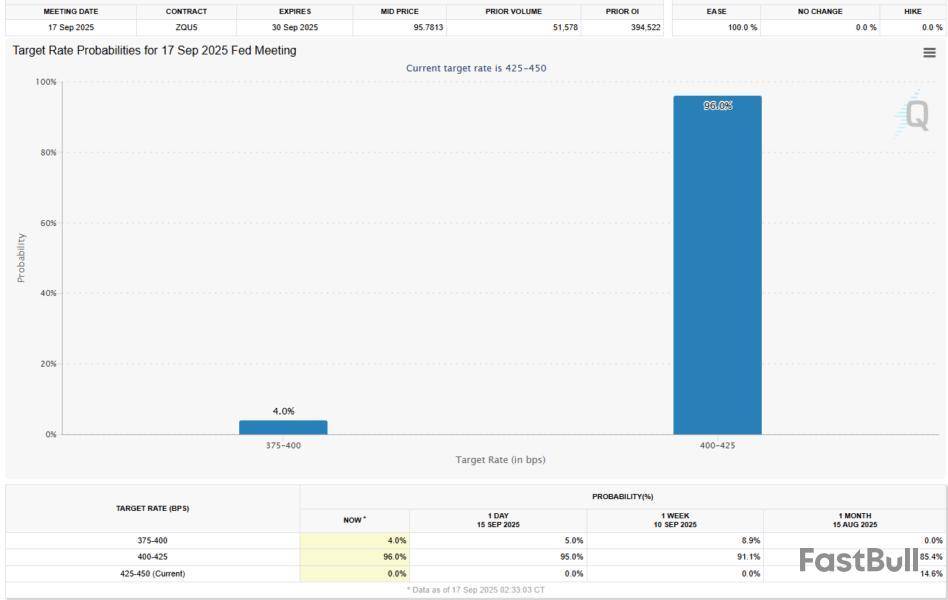

Market watchers are calling the Fed’s decision one of the most significant of the year, with 96% of participants anticipating a 25 basis point cut, according to the CME Group’s FedWatch tool. That estimate was up from 85% a month ago.

“Tomorrow is the most important FOMC of our lives …until the next one,” said the founder and CEO of Into The Cryptoverse, Benjamin Cowen, in a Wednesday X post.

Despite the optimistic outlook, most cryptocurrency traders are positioning themselves for a short-term decline in the crypto market.

Over 57% of Bitcoin holders across all exchanges are currently short, meaning that they are betting on Bitcoin’s price decline, while only 42% remain long, according to blockchain data from CoinAnk.

Meanwhile, Bitcoin futures open interest fell by over $2 billion in five days, signaling more de-risking amid futures traders ahead of the FOMC meeting, Cointelegraph reported on Monday.

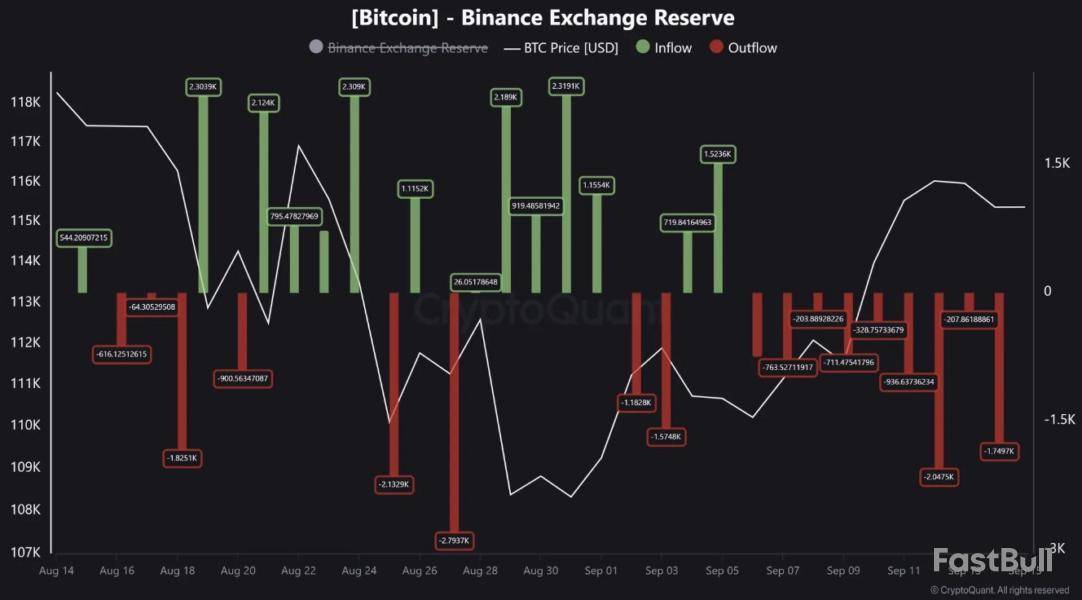

However, traders on the world’s largest exchange, Binance, have been buying Bitcoin ahead of the key interest rate decision.

Binance saw nine days of “constructive outflows” for Bitcoin leading up to the FOMC meeting, a trend that appears to be a “major driver behind Bitcoin’s recent bounce from $108k to +$115k,” according to onchain insights platform CryptoQuant.

Analysts at Bank of America expect at least two interest rate cuts by the Fed in 2025 — September and November — while economists at Goldman Sachs are projecting three 25 BPS cuts for this year, Cointelegraph reported on Sept. 6.

BNB is now within striking distance of four digits, trading near $958 after a 14% gain over the past month. Unlike other major coins weighed down by profit-taking, BNB has shown resilience. Long-term holders are adding to their stacks, exchange balances are falling, and the BNB price has broken out of a bullish pattern.

Together, these signals show conviction, even as profit-taking risks remain high.

Profit-Taking Risk Is High, but Exchange Supply Is Falling

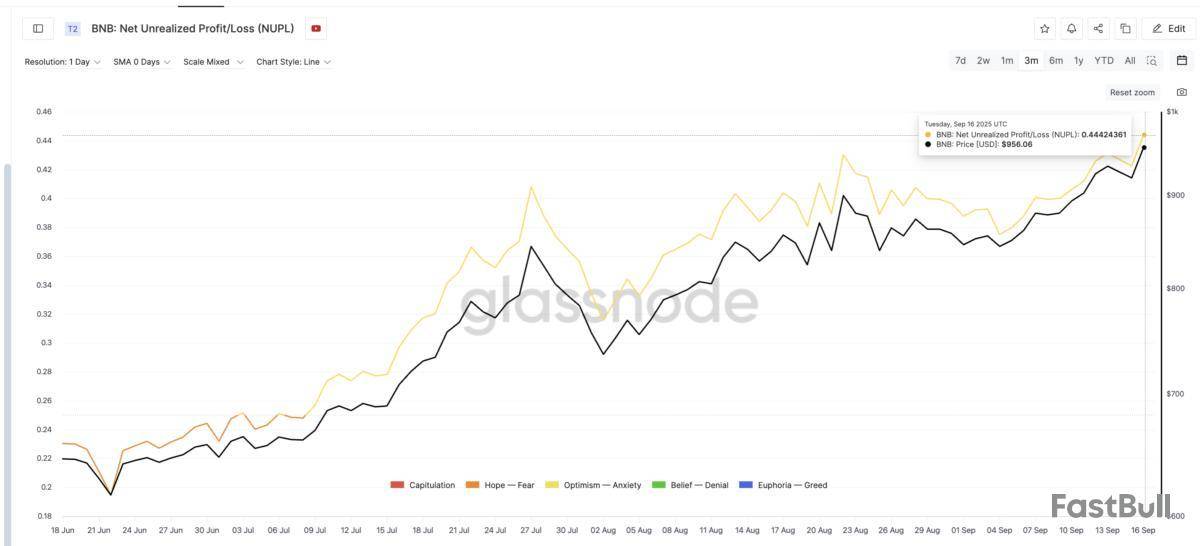

One way to measure selling risk is Net Unrealized Profit/Loss (NUPL), which tracks the percentage of the supply that is in profit. A higher score indicates that investors are sitting on larger gains and may be tempted to sell.

For BNB, NUPL now reads 0.44, its highest level in three months. With BNB up 75% over the past year and nearly 50% in the past three months, profit-taking pressure is a real concern.

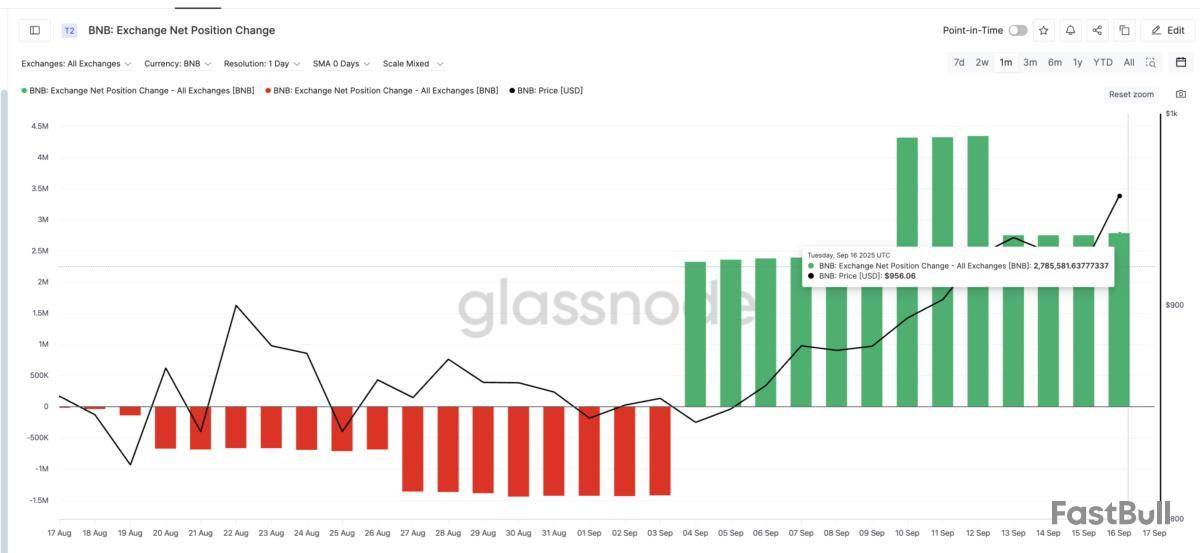

Yet supply on exchanges tells a different story. Exchange net position change — which shows how much BNB sits on trading platforms — has fallen by almost 50% in just four days, from 4.35 million BNB on September 12 to 2.79 million on September 16.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Typically, rising profits are accompanied by increased deposits on exchanges. Here, balances are shrinking, showing conviction even in profit-heavy conditions.

It is worth noting that exchange flows are still positive (lingering sell pressure), but the downward curve while the price peaks does invoke confidence in the BNB price structure. More so when, in the next section, we discover which groups are accumulating.

Profitable Cohorts Are Accumulating, Not Selling

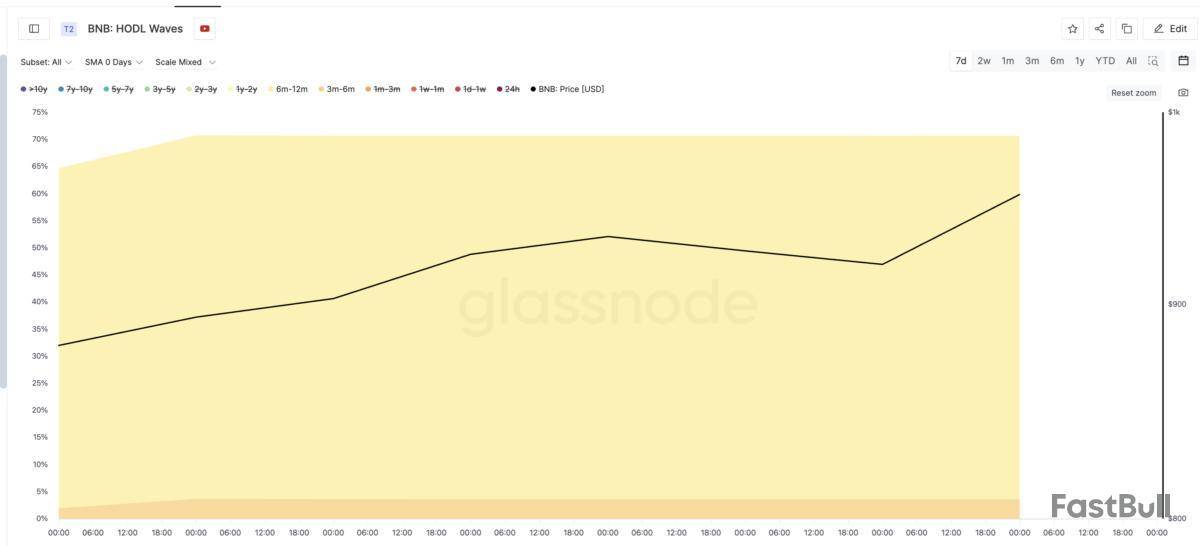

HODL waves track how long coins have been held, helping us see which groups are moving supply. The standout cohorts are 6–12 month holders and 3–6 month holders. Both groups are typically most likely to sell since they are sitting on strong recent gains. Instead, they are accumulating.

From September 9 to September 16, the 6–12-month group grew from 62.8% of supply to 67.1%. The 3–6 month group nearly doubled from 1.9% to 3.6%. These cohorts alone account for the bulk of new holding growth.

This means traders who bought when BNB was much cheaper are not cashing out. Instead, they are tightening supply as the BNB price rises.

BNB Price Chart Points to Higher, 4-Digit Targets

On the daily chart, the BNB price has broken out of an ascending channel, a bullish continuation pattern. Yesterday’s close above the upper trendline confirmed the breakout. Fibonacci extensions highlight resistance at $975 and $1,015, while the next upside target sits around $1,071–$1,080. That zone is the immediate four-digit goal.

The lower end of the target at $1,071 comes from measuring the widest part of the ascending channel — from its lowest swing inside the channel to its highest point — and projecting that distance upward from the breakout. Key support levels, in case the BNB price corrects, sit at $950 and $935.

Still, there’s a clear invalidation. If BNB closes below $910, the breakout structure weakens and deeper pullbacks open. Until then, both on-chain conviction and chart structure support more upside.

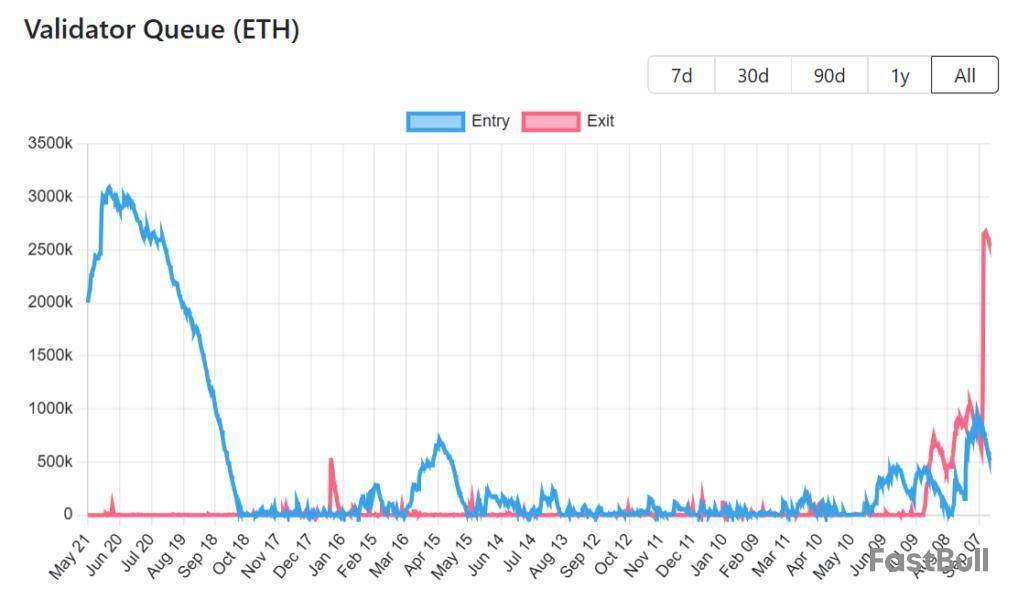

Ethereum’s validator system is under unusual strain. More than 2.5 million ETH, worth roughly $11.3 billion, are currently waiting to exit the network’s staking mechanism, stretching the exit queue to 44 days, the longest on record.

The backlog was triggered when Kiln, a major staking infrastructure provider, withdrew all of its validators on September 9 as a security precaution.

Record Exit Queue for Staked Ethereum

According to Figment’s Benjamin Thalman, around 4.5% of all staked Ethereum is now in line to exit.

“Ethereum’s validator exit queue has spiked, reaching new highs, raising fair questions about timelines and rewards,” Thalman noted in a recent report.

He emphasized that Ethereum functions as designed, with rate-limiting exits protecting network stability and allowing stakers to plan around predictable delays.

Kiln’s decision followed unrelated incidents, the NPM supply chain attack, and the SwissBorg breach, which raised security concerns across infrastructure providers.

Ethereum educator Sassal articulated that Kiln’s decision to exit all ETH validators was voluntary, citing security concerns specific to Kiln’s setup.

Reportedly, the move had nothing to do with the Ethereum network itself.

Though Figment itself was not impacted, the coordinated exit sent 1.6 million ETH tokens into the queue in a single move.

Security, Profit-Taking, and Institutional Shifts

While security is the immediate catalyst, analysts argue that profit-taking is also in play. The Ethereum price has rallied more than 160% since April, tempting institutional treasuries and funds to rebalance.

At the same time, new drivers of staking demand are emerging. The SEC’s May statement that protocol staking is not a security boosted ETH delegations.

“It is the Division’s view that “Protocol Staking Activities” in connection with Protocol Staking do not involve the offer and sale of securities within the meaning of Section 2(a)(1) of the Securities Act of 1933 (the “Securities Act”) or Section 3(a)(10) of the Securities Exchange Act of 1934 (the “Exchange Act”),” the statement read.

Meanwhile, anticipation of staked ETH ETFs could add another 4.7 million Ethereum tokens to validator queues once approved.

The process is complex. Validators in the exit queue continue to earn rewards, but once they formally exit, they face a 27-hour “withdrawability delay” followed by a withdrawal sweep that can take up to 10 days.

If large portions of the existing ETH return to staking, where Figment estimates as much as 75%, nearly 2 million ETH would flood the activation queue.

Combined with future ETF demand, activation wait times could stretch past 120 days.

That delay raises questions about Ethereum’s readiness to host global-scale financial infrastructure.

“Unclear how a network that takes 45 days to return assets can serve as a suitable candidate to power the next era of global capital markets. On Solana, it takes approximately 2 days to unstake,” Marcantonio of Galaxy stated.

For Ethereum, long queues are not necessarily a flaw. They are intentional throttles designed to preserve consensus security during heavy entry or exit periods.

“Ethereum is functioning as intended,” Thalman noted.

Still, the bottlenecks highlight trade-offs between resilience and user experience.

For institutional players weighing billions in exposure, weeks-long delays and potential reward gaps during reactivation may complicate portfolio strategies.

The next few months will test whether Ethereum’s validator system can balance security with capital efficiency. This is especially true as corporate treasuries, Ethereum ETFs, and infrastructure providers crowd into the same queues.

Pi Network is heading into one of its most important moments of the year. After months of disappointment following its mainnet launch, all eyes are now on the TOKEN2049 event in Singapore on October 1-2, where the Pi Core team is expected to lay out its plans.

With founder Chengdiao Fan scheduled to deliver a keynote speech, the community is buzzing with hopes of a turning point that could push Pi Coin back toward the $1 mark.

Why TOKEN2049 Is a Make-Or-Break Moment for Pi Network

The excitement around Pi’s sponsorship of TOKEN2049 has less to do with branding and more with trust. Millions of Pi users worldwide want clearer communication from the core team.

At this event, the community expects answers on major issues: the timeline for a public mainnet launch, upcoming protocol upgrades, and real-world use cases that could finally give Pi true utility.

Major exchange listings are also high on the list, as years of promises without concrete action have left many users frustrated.

With Pi founder Chengdiao Fan set to deliver a keynote on October 1, expectations are higher than ever

Four Major Expectations From the Pi Core Team

The community has highlighted four key areas that could restore investors confidence in Pi network.

Pi Coin Price Analysis

Pi Coin’s price is still under pressure even after bouncing from its all-time low of $0.3223. As of now, PI is trading near $0.356, showing a slight dip compared to the previous day.

On the technical side, analysts see a converging triangle pattern forming on the daily chart. The token has tried multiple times to push above the $0.40 resistance level but keeps getting rejected.

If PI manages a breakout, it could rise toward the $0.50 mark in the short run. But stronger momentum, backed by major exchange listings like Binance or Coinbase, could even drive Pi Coin price toward $1 by late 2025 or early 2026.

The Ether Machine, one of the largest Ethereum treasury firms, is moving closer to going public.

This marks an important milestone in the firm’s growth strategy, which shows its ambition to expand its presence in the public markets and set new standards for digital asset treasuries.

Ether Machine Files S-4 With SEC

The firm revealed on Tuesday that it has confidentially filed a draft Form S-4 with the SEC. This filing is part of its plan to go public through a business combination with Dynamix Corporation and The Ether Reserve LLC.

“We’re shifting into the next gear, and officially on its path to full public form,” it shared in an X post.

The Ether Machine@TheEtherMachineSep 16, 2025As of today, we have confidentially filed our S-4 with the SEC. We're shifting into the next gear, and officially on its path to full public form 🔥

“The submission of our Form S-4 is a critical step towards becoming a publicly traded Ethereum company. We have also retained…

Milestone Toward Public Listing

Andrew Keys, Co-Founder and Chairman of The Ether Machine also highlighted the firm’s partnership with KPMG as proof of its commitment to strong governance and transparency.

“We believe The Ether Machine is positioned to set a new benchmark for digital asset treasuries entering the public markets,” he added.

The Ether Machine first unveiled its plan to go public through a merger back in July. The companies aim to close the deal in the fourth quarter, pending standard conditions and shareholder approval.

Treasury Growth and Investments

Earlier this month, The Ether Machine raised $654 million in private ether financing, as it prepares for its planned Nasdaq listing later this year.

At present, the firm holds close to 500,000 ETH, making it the third-largest corporate holder of ether, behind BitMine Immersion Tech and SharpLink Gaming.

Who Holds the Most Ethereum?

BitMine Immersion, the world’s largest Ethereum treasury company, now holds 2.15 million ETH, worth $9.75 billion, after acquiring around 82,000 ETH last week. Its total crypto and cash holdings have also surpassed $10.8 billion.

SharpLink Gaming ranks second, with over 838K ETH while The Ether Machine holds steady in third place with nearly half a million ETH.

Market Outlook for ETH

The timing of this move coincides with growing optimism in the market. Fundstrat’s Tom Lee believes Ether could make a “monster move” in the next three months if the Fed cuts rates in September.

Investor Ted Pillows notes that Ethereum has bounced off its $4,500 support level. If this level holds, Ethereum could climb toward $4,700; if it breaks, it may revisit the $4,000–$4,200 range.

Thus, the Ether Machine has positioned itself well as a key player to watch as Ethereum edges into its next big market cycle.

Dogecoin price has become a hot topic again with the new ETF approvals making headlines. Traders are curious if this step will help the coin break away from its $0.21 range. At the same time, Shiba Inu is back in focus with new technical patterns and ETF talks.

And while these two old names dominate attention, a fresh Layer 2 project called Layer Brett is pulling investors in with real utility and meme energy. Read this article to see which coin analysts call the best pick right now.

Dogecoin price predictions after new ETF approvals

The U.S. may soon welcome the first Dogecoin ETF, a move that could reshape how investors view this coin. REX Shares has filed under the 1940 Act, a quicker path that could bring the fund to market as soon as this week.

https://www.layerbrett.com/

Dogecoin price has been flat near $0.21, with weak trading volume. Analysts warn that without strong demand, the ETF may end up as a short-lived headline. Still, if institutional inflows arrive, the coin could retest resistance at $0.27 and possibly $0.31.

Chart watchers also point to a megaphone pattern that puts a $1 target in play by 2025, though this would need far more adoption than seen today.

Shiba Inu faces pressure despite bullish setups

Shiba Inu has been stuck in tight ranges, trading near $0.000014. Analysts have noted a completed inverse head and shoulders on the weekly chart, which often signals bullish reversals.

Javon Marks, a market analyst, predicted SHIB could push to $0.000081 if momentum builds. But challenges remain. A recent $2.4 million exploit on the Shibarium bridge raised concerns about security. Investor trust is key, and such issues weigh on sentiment.

On-chain data indicates lower activity on Shibarium, with failed breakouts above $0.000015 trapping late buyers. Without stronger utility and adoption, Shiba Inu may struggle to sustain long-term growth, even with short-term technical rallies.

Layer Brett: The latest L2 invention enticing investors

While Dogecoin and Shiba Inu struggle with old hurdles, Layer Brett is stepping into the spotlight. Built on Ethereum Layer 2, this meme coin offers speed, low fees, and huge staking rewards.

At presale, the token sells for just $0.0058 and has already raised more than $3.7 million. Early buyers can also access staking returns of over 702% APY.

Layer Brett runs with the same meme energy that powers Dogecoin and Shiba Inu, but adds real blockchain use. Transactions process quickly, gas costs drop to pennies, and holders can buy and stake with ETH, USDT, or BNB in seconds.

Analysts highlight that Ethereum Layer 2 networks could process over $10 trillion annually by 2027, and Layer Brett positions itself directly in that growth trend.

https://www.layerbrett.com/Why analysts believe Layer Brett is the best memecoin to buy now

Experts agree that new meme coins with utility have the strongest upside. Sheila Belson, a crypto researcher, explained that projects combining community hype with real technical use cases are likely to attract both retail and institutional demand.

Layer Brett checks these boxes with its Layer 2 foundation, staking system, and transparent tokenomics. Unlike Dogecoin and Shiba Inu, which rely on speculation and outdated community narratives, Layer Brett offers both fun and functionality.

Dogecoin price may rise on ETF momentum, and Shiba Inu still tempts traders with bullish patterns. Yet both face old problems of weak utility and shaky trust.

Layer Brett, by contrast, combines meme culture with Ethereum Layer 2 speed, real staking rewards, and a strong presale push. At $0.0058, it is still early; you shouldn’t miss out.

Don’t miss the opportunity to get in early on the most scalable meme project to ever launch on Ethereum.

Website: https://layerbrett.com

Telegram: https://t.me/layerbrett

X: (1) Layer Brett (@LayerBrett) / X

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up