Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

SC Ventures is planning to raise capital to build a $250 million fund that is set to invest in digital assets in the financial services industry, according to Bloomberg.

The global bank's venture capital arm plans to launch the fund in 2026 with backing from investors in the Middle East. The fund aims to invest globally, Gautam Jain, partner at SC Ventures reportedly said Monday at Money 20/20 event in Saudi Arabia.

Jain noted that SC Ventures is also planning a $100 million fund to invest in Africa and is considering setting up its first venture debt fund, according to the report. However, it is unclear whether either fund would focus on digital assets.

The announcement aligns with a broader wave of institutional interest in digital assets. Major banks like JPMorgan and Goldman Sachs have also been expanding their crypto offerings, as seen in JPMorgan's Kinexys and Goldman's tokenized money market fund with BNY Mellon.

Meanwhile, the fund's Middle Eastern backing signals the region's emergence as a crypto and blockchain hub. In the past few years, the UAE and Saudi Arabia have introduced progressive crypto regulations, such as Dubai's Virtual Assets Regulatory Authority and Saudi Arabia's sandbox allowing more room for blockchain innovation.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Ethereum price started a fresh decline from $4,765. ETH is now trading below $4,650 and might extend losses if it stays below $4,620.

Ethereum Price Dips Again

Ethereum price started a fresh decline after it failed to clear the $4,765 zone, like Bitcoin. ETH price corrected gains and dipped below the $4,650 support.

There was a move below the 50% Fib retracement level of the upward move from the $4,268 swing low to the $4,765 high. The bears were able to push the price below $4,550 and the 100-hourly Simple Moving Average. Besides, there is a bearish trend line forming with resistance at $4,610 on the hourly chart of ETH/USD.

Ethereum price is now trading below $4,550 and the 100-hourly Simple Moving Average. On the upside, the price could face resistance near the $4,600 level. The next key resistance is near the $4,620 level.

The first major resistance is near the $4,650 level. A clear move above the $4,650 resistance might send the price toward the $4,720 resistance. An upside break above the $4,720 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $4,765 resistance zone or even $4,800 in the near term.

Another Decline In ETH?

If Ethereum fails to clear the $4,620 resistance, it could start a fresh decline. Initial support on the downside is near the $4,500 level. The first major support sits near the $4,460 zone and the 61.8% Fib retracement level of the upward move from the $4,268 swing low to the $4,765 high.

A clear move below the $4,460 support might push the price toward the $4,385 support. Any more losses might send the price toward the $4,350 pivot level in the near term. The next key support sits at $4,270.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 zone.

Major Support Level – $4,460

Major Resistance Level – $4,620

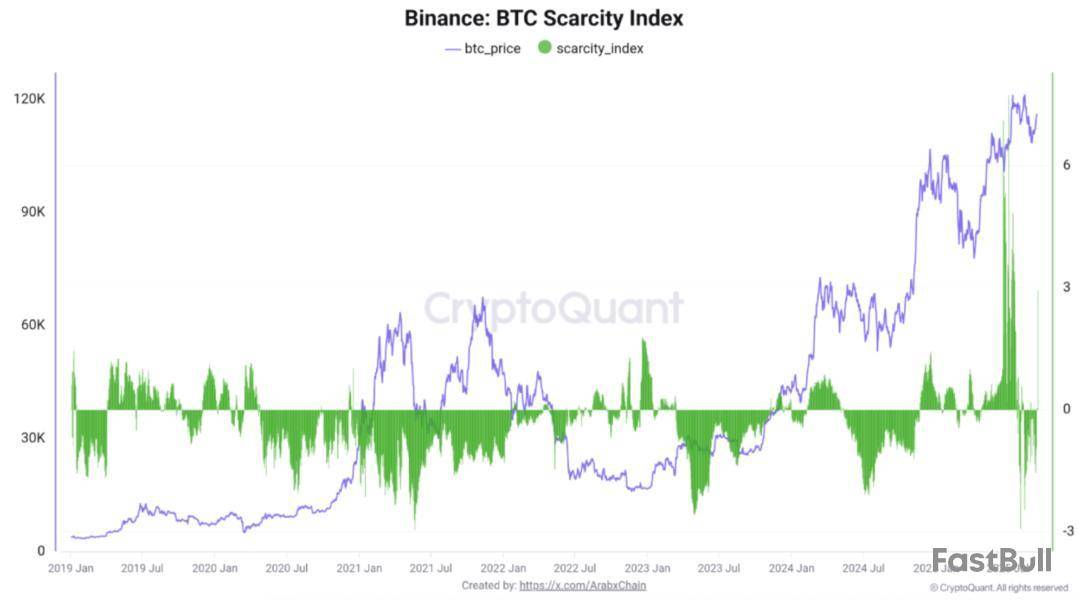

After hitting a weekend high of $116,689 on September 15, Bitcoin (BTC) fell slightly, trading just above $114,000 at the time of writing. However, fresh data from Binance crypto exchange indicates that the Bitcoin Scarcity Index recently witnessed its first spike since June 2025.

Bitcoin Scarcity Index Spikes, Will BTC Rally?

According to a CryptoQuant Quicktake post by contributor Arab Chain, the Bitcoin Scarcity Index witnessed its first spike yesterday since June 2025. The analyst referred to the latest exchange data from Binance to confirm the spike in Bitcoin Scarcity Index.

For the uninitiated, the Bitcoin Scarcity Index measures how limited the available supply of Bitcoin is on exchanges relative to immediate buying demand. A spike in the index usually indicates strong accumulation by large investors or institutions, signaling potential price pressure to the upside.

In their analysis, Arab Chain remarked that the latest spike in the Bitcoin Scarcity Index means that either a large amount of BTC was withdrawn from Binance, or the volume of sell orders fell significantly on the exchange.

As a result, the available supply of BTC on Binance suddenly became scarce. Notably, such movements are usually associated with the entry of large investors – such as whales or sharks – who hold substantial quantities of BTC. Arab Chain added:

The index jumps when immediate buying power exceeds available supply, as if buyers are racing to acquire Bitcoin on the market This type of spike is often linked to positive news or sudden capital inflows. The same pattern occurred last June and persisted for several days, after which Bitcoin climbed to around $124,000.

BTC may confirm the beginning of a strong accumulation phase and the continuation of the uptrend if the Bitcoin Scarcity Index remains positive for several consecutive days.

However, if the index rises rapidly – followed by an equally quick descent – it may suggest speculative activity or order liquidations. Such a phase is often followed by a period of calm or a price correction.

In recent months, the Bitcoin Scarcity Index has reached new all-time highs (ATH). The chart below shows the metric reaching as high as +6, before quickly falling toward neutral and even negative territory.

Is BTC Losing Momentum?

Arab Chain concluded by saying that the contrast between BTC’s high price, and the index’s quick move back to or below zero suggest that some strong buying momentum has started to decline.

That said, some positive signs persist. For example, the flagship cryptocurrency recently broke above the mid-term holder breakeven, hinting that a fresh rally to the upside may be on the horizon.

From a technical perspective, BTC recently flashed the Golden Cross, a rare bullish signal that has crypto pundits forecasting a potential price appreciation of 100%. At press time, BTC trades at $114,601, down 0.9% in the past 24 hours.

Bitcoin price is correcting gains from $116,500. BTC is now consolidating and might start a fresh decline if it stays below the $116,500 resistance zone.

Bitcoin Price Struggles To Continue Higher

Bitcoin price started a fresh upward wave above the $113,500 zone. BTC managed to climb above the $114,500 and $115,000 resistance levels.

The bulls were able to push the price above $116,000 and $116,200. The price traded as high as $116,743 and recently started a downside correction. There was a minor decline below the $116,000 zone. The price even dipped below the 23.6% Fib retracement level of the recent move from the $110,815 swing low to the $116,743 high.

Bitcoin is now trading below $115,500 and the 100 hourly Simple moving average. Besides, there is a bearish trend line forming with resistance at $115,350 on the hourly chart of the BTC/USD pair.

Immediate resistance on the upside is near the $115,350 level. The first key resistance is near the $116,150 level. The next resistance could be $116,750. A close above the $116,750 resistance might send the price further higher. In the stated case, the price could rise and test the $117,500 resistance level. Any more gains might send the price toward the $118,500 level. The next barrier for the bulls could be $118,800.

Downside Continuation In BTC?

If Bitcoin fails to rise above the $116,150 resistance zone, it could start a fresh decline. Immediate support is near the $114,500 level. The first major support is near the $113,750 level or the 50% Fib level of the recent move from the $110,815 swing low to the $116,743 high.

The next support is now near the $113,200 zone. Any more losses might send the price toward the $112,500 support in the near term. The main support sits at $110,500, below which BTC might decline heavily.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $114,500, followed by $113,750.

Major Resistance Levels – $116,150 and $116,750.

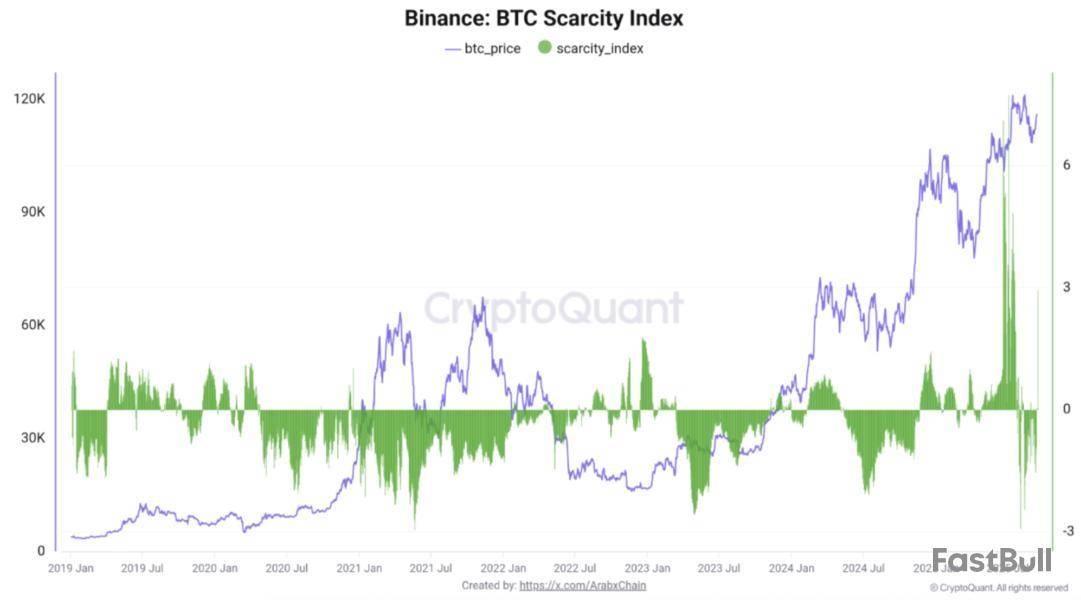

Shares in the healthcare-turned-Bitcoin holdings company KindlyMD Inc. halved on Monday as its CEO, David Bailey, warned of an upcoming increase in “share price volatility,” encouraging short-term traders to exit” if they’re only looking to profit.

“We expect share price volatility may increase for a period of time,” Bailey said in a shareholder letter on Monday, citing the firm’s regulatory filing on Friday registering a $200 million discounted share sale to private investors.

KindlyMD’s deal, called a private investment in public equity (PIPE) offering, raised money by offering its shares at a discount, and its filing on Friday allowed those investors to freely trade their shares.

Analysts have aired concerns about the proliferation of so-called crypto treasury companies as the value of the crypto holdings of many firms is starting to outpace their market capitalizations.

KindlyMD stock drops 55% after shareholder letter

Investors seemingly took Bailey’s advice to exit, as shares in KindlyMD (NAKA) ended trading on Monday at a loss of 55.4% at $1.24.

The stock saw only a slight bump after the bell, gaining 4.8%.

It’s the lowest KindlyMD’s share price has been since early February, long before it announced plans to buy and hold Bitcoin (BTC) for the long term and merged with Bailey’s holding company, Nakamoto Holdings, last month.

Bailey says PIPE deal will flush non-aligned investors

Bailey said in his letter that while the PIPE deal shares entering the market will increase volatility, he sees it “as a critical opportunity for us to establish our base of aligned shareholders who are committed to our long-term vision.”

“This transition may represent a point of uncertainty for investors, and we look forward to emerging on the other side with alignment and conviction amongst our backers,” he added.

Bailey noted on X that KindlyMD shares had seen “intense volume,” but marked it as a “day of transition” where the firm was “upgrading our shareholder base from short-term traders to long-term investors.”

“Almost 80m [million] shares have traded today,” he later added. “Once again I’m humbled by the support and look forward to meeting all our new shareholders!”

KindlyMD value falls below Bitcoin holdings

KindlyMD’s share price drop has seen its multiple of net asset value (mNAV) fall to 0.7 as the company’s market value has fallen below the value of its Bitcoin holdings.

The firm holds 5,765 BTC at a total value of over $665 million, while its market capitalization is $466 million, according to BitcoinTreasuries.NET data.

Bailey, however, was undeterred in his letter, stating KindlyMD’s mission is to create “the leading Bitcoin-native financial institution,” which he added required a “long-term strategy, creative thinking, and disciplined yet nimble execution.”

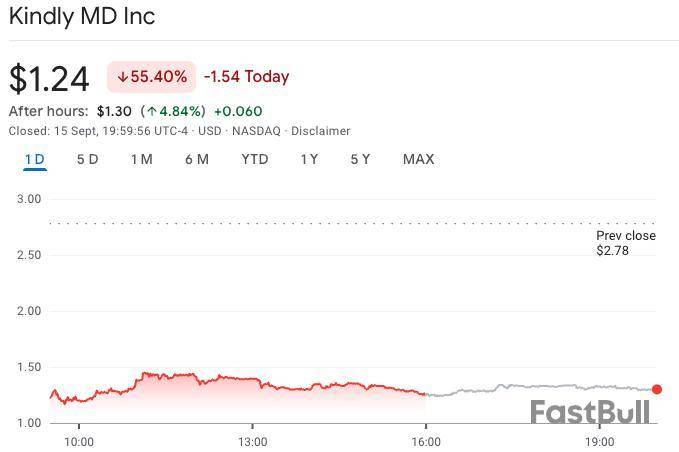

Payments company American Express has launched blockchain-based stamps for customers as a digital keepsake of their travels.

Each travel stamp will be stored as an ERC-721 non-fungible token on the Ethereum layer-2 Base to preserve their travel history and their favorite overseas memories, according to the company’s website.

“Part of the magic of travel is reminiscing about past getaways, and commemorative keepsakes are a powerful way for travelers to relive their favorite trips,” Amex Digital Labs Executive Vice President Luke Gebb said on Monday.

“As physical passport stamps continue to disappear, Amex Passport creates an opportunity for Card Members to celebrate their travels.”

Each stamp can be customized to highlight the best experiences from each trip, such as a special attraction, standout meal, or hotel stay, or favorite activity, Amex said.

Only those holding a US Amex consumer card linked to their online account are eligible for the Amex Passport, and the NFTs can not be transferred.

Each stamp will only show the country or region of the stamp, stamp description, and the date of when the stamp was earned, Amex said, adding that personal information and trip details won’t be visible on Base.

Data from Base’s block explorer, BaseScan, shows that the Amex travel stamp smart contract was created 25 days ago.

The development is the latest example of a public blockchain helping corporations and their users securely store data without a centralized server.

Last month, the US Department of Commerce said it would start publishing economic statistics, including gross domestic product data, on the blockchain.

NFT travel stamps coincide with demand for digital keepsakes

Demand for new travel stamp solutions is strong too, according to a recent Amex survey, which found 73% of respondents wanted more ways to commemorate past trips digitally.

Another 56% said they missed receiving passport stamps when arriving in a new country.

Amex travel stamps can be shared on social media or saved to a camera roll, and trips booked through Amex up to two years ago will be automatically added for customers.

Crypto is slowly being integrated into the tourism sector

The crypto travel industry remains relatively niche but has picked up the pace in recent months.

In February, crypto-native travel platform Travala integrated crypto payment options for 2.2 million hotels on Trivago, a hotel metasearch engine that allows users to compare accommodation prices from various booking sites.

Data from Travala in May showed crypto users typically spend three times more for an average hotel stay and typically stay longer in a certain place to accompany their flexible and remote working lifestyles.

Meanwhile, Triple-A data states that 14% of crypto transactions were spent on travel and hospitality in 2024, while more airlines started accepting crypto for bookings.

Israel’s Ministry of Defense ordered the seizure of 187 cryptocurrency wallets, alleging they were used by Iran’s Islamic Revolutionary Guard Corps (IRGC).

The move highlights the increasing use of cryptocurrency in sanctioned states. It comes days after the US Justice Department seized $584,741 in USDT from an Iranian national tied to the IRGC’s drone program.

$1.5B in Crypto Wallets Seized by Israel

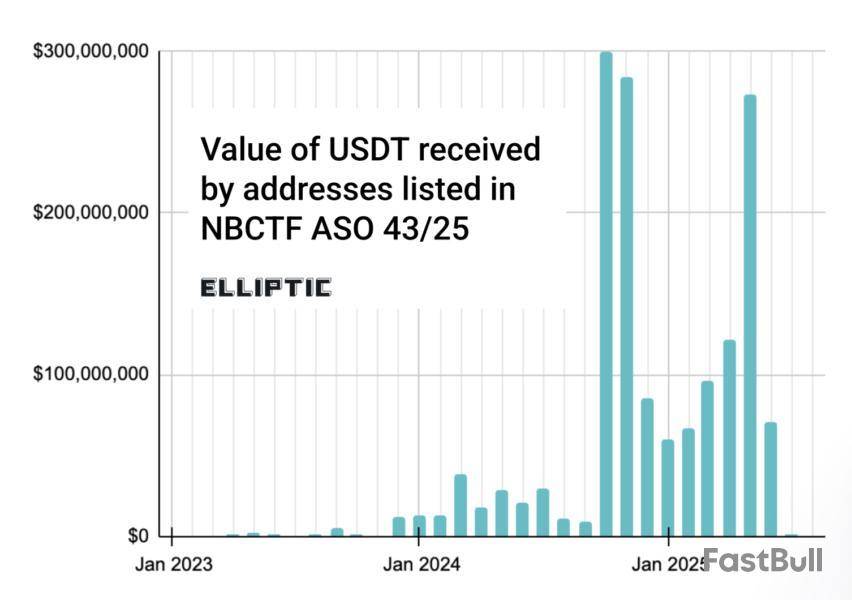

Israel’s National Bureau for Counter Terror Financing (NBCTF) and Defense Minister Israel Katz announced Monday the seizure order against 187 wallets, citing authority under the Anti-Terrorism Law of 2016. Officials said the wallets once processed $1.5 billion in Tether but now hold about $1.5 million.

Katz wrote in the Administrative Seizure Order that the funds were either the property of the IRGC or “used for the perpetration of a severe terror crime.” The IRGC remains designated as a terrorist organization by Israel, the US, the European Union, Canada, and the United Kingdom.

Blockchain analytics firm Elliptic integrated the seized addresses into its monitoring system. This allows exchanges and institutions to screen transactions. Elliptic confirmed the wallets received the funds, but noted that not all may be directly controlled by the IRGC.

“Some of the addresses may be controlled by cryptocurrency services and could be part of wallet infrastructure used to facilitate transactions for many customers,” Elliptic noted.

Tether, issuer of the $110 billion-plus market cap stablecoin, blacklisted 39 of the wallets on September 13, blocking further transactions. The company has a history of cooperating with law enforcement by freezing funds tied to illicit finance, a practice enabled by USDT’s centralized control structure.

A Broader Crackdown on IRGC’s Expanding Crypto Use

The Israeli move is the latest in a series of international actions targeting the IRGC’s crypto networks. The IRGC has faced repeated allegations of using cryptocurrency to skirt sanctions. In June, pro-Israel hacking group Gonjeshke Darande drained $90 million from Iranian exchange Nobitex, accusing it of IRGC links.

In December 2024, the US Treasury sanctioned addresses tied to Sa’id Ahmad Muhammad al-Jamal. He had funneled $332 million in USDT to Yemen’s Houthi movement with IRGC assistance.

Last week, the US Attorney’s Office in Massachusetts filed a civil forfeiture action against Mohammad Abedini. They seized $584,741 in USDT connected to the IRGC’s drone program.

Analysts warn that the latest seizures underscore how cryptocurrencies—while transparent and traceable—can serve sanctioned states seeking liquidity.

“Rumors of IRGC using cryptocurrency to circumvent sanctions have persisted for years,” said Amir Rashidi, director at the Iran-focused nonprofit Miaan Group. “Some cases may involve exchanges not directly part of the IRGC but connected through complex financial networks.”

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up