Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Tinian, a small island in the US territory of the Northern Mariana Islands, could get a second chance at launching a stablecoin after the territory’s Senate voted to override the governor’s earlier veto of its stablecoin bill.

On May 9, the Northern Mariana Islands Senate voted 7-1 to override Governor Arnold Palacios' April 11 veto of the bill, which would allow the Tinian local government to issue licenses to internet casinos and includes a provision for the Tinian treasurer to issue, manage and redeem a “Tinian Stable Token.”

The bill will now head to the 20-member Northern Mariana Islands House, which will need a two-thirds majority vote to override the veto and pass the bill into law.

If the House is quick to pass the bill, the Tinian government could be in the lead for the first US public entity to issue a stablecoin. It’s in a race against the state of Wyoming, which is aiming to issue a stablecoin by July.

Tinian is governed by the local government, the Municipality of Tinian and Aguiguan, and is one of four municipalities in the Commonwealth of the Northern Mariana Islands, a small US territory in the Pacific north of Guam.

Tinian has just over 2,000 residents, and its economy heavily relies on tourism.

Senators push “much-needed” bill despite “deep concerns”

Governor Palacios said in his letter last month that he vetoed the bill as it “presents several legal issues and may be unconstitutional” and would regulate an activity that could not “be clearly restricted” to Tinian.

Democrat Senator Celina Babauta, the only one to vote against overriding the veto, said before the vote that she had “deep concerns with respect to the lack of resources, the lack of manpower” to enforce the gambling law and police use of the stablecoin.

“We are restricted by federal statutes and must comply with that,” she added.

“We struggle with trying to find creative and innovative ways to diversify our economy and our industries,” Babauta said. “I don't believe that gambling is the only thing that we can be looking forward to every single time there's an investor that comes in.”

However, Republican Senator Karl King-Nabors, who represents Tinian and co-authored the bill, said it was “a far more stringent and efficient way to oversee the online gaming aspect.”

“This stablecoin is tracked through software, and if anything, it allows for more transparency when it comes to the Tinian Casino Gaming Control Commission,” he added.

King-Nabors said the bill aligned with “much-needed” economic diversification measures, as the local economy was yet to bounce back from a COVID-19 pandemic-induced slump.

“This legislation stands at a time where we're going through so much economic hardships,” King-Nabors added. “I find it difficult that we're constantly having to step over obstacles when we're trying to incentivize and look for ways to bring in revenue that don't affect our environment, that don't require a brick and mortar, that don't impact our land.”

Tinian bids for fully-backed stablecoin

Republican Senator for Tinian, Jude Hofschneider, led the introduction of the bill in February, which aims to amend a local Tinian law to allow internet-only casino licenses, along with allowing the island to launch a fully backed US dollar-pegged stablecoin.

A four-member Tinian delegation to the Marianas legislature, which includes Hofschneider and King-Nabors, had passed the bill to Governor Palacios in a unanimous vote on March 12.

Statements shared with Cointelegraph in March said the stablecoin is called the Marianas US Dollar (MUSD) and will be backed by cash and US Treasury bills held in reserve by the Tinian Municipal Treasury.

The Tinian government chose tech services firm Marianas Rai Corporation, based in the Northern Mariana Islands’ capital of Saipan, as the exclusive infrastructure provider to issue and redeem MUSD.

MUSD is built on the eCash blockchain, a network that rebranded from Bitcoin Cash ABC in 2021 and is a fork of Bitcoin Cash, a blockchain that split off from Bitcoin in 2017.

Marianas Rai Corp. co-founder and technology chief Vin Armani told Cointelegraph in April that it was “in active discussions with potential partners” about launching the token after Governor Palacios’ veto and was “poised to act quickly” as US Congress is looking to pass stablecoin laws.

In the US, one stablecoin bill, the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, has since stalled in Congress after Senate Democrats pulled support for the bill due to concerns about President Donald Trump’s sprawling crypto ventures.

Another stablecoin-regulating bill in the House, the Stablecoin Transparency and Accountability for a Better Ledger Economy (STABLE) Act, has also lost Democrat support due to Trump’s crypto tie-ups.

Legal Panel: Crypto wanted to overthrow banks, now it’s becoming them in stablecoin fight

Ethereum price started a fresh surge above the $2,350 zone. ETH is now up over 35% and consolidating gains near the $2,500 zone.

Ethereum Price Surges And Clears $2,500

Ethereum price remained supported and started a fresh increase above $2,200, beating Bitcoin. ETH gained pace for a move above the $2,350 resistance zone.

The bulls were able to push the price above the $2,500 resistance zone. The price gained over 35% and recently surpassed the $2,550 resistance zone. A high was formed at $2,606 and the price is now consolidating gains. There was a minor decline below the 23.6% Fib retracement level of the upward move from the $2,272 swing low to the $2,606 high.

Ethereum price is now trading above $2,500 and the 100-hourly Simple Moving Average. Besides, there is a connecting bullish trend line forming with support at $2,480 on the hourly chart of ETH/USD.

On the upside, the price seems to be facing hurdles near the $2,550 level. The next key resistance is near the $2,600 level. The first major resistance is near the $2,620 level. A clear move above the $2,620 resistance might send the price toward the $2,650 resistance.

An upside break above the $2,650 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $2,720 resistance zone or even $2,780 in the near term.

Are Dips Limited In ETH?

If Ethereum fails to clear the $2,550 resistance, it could start a fresh downside correction. Initial support on the downside is near the $2,470 level. The first major support sits near the $2,440 zone and the 50% Fib retracement level of the upward move from the $2,272 swing low to the $2,606 high.

A clear move below the $2,440 support might push the price toward the $2,350 support. Any more losses might send the price toward the $2,270 support level in the near term. The next key support sits at $2,220.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $2,440

Major Resistance Level – $2,550

Bitcoin price started a fresh surge above the $102,000 zone. BTC is rising and might aim for a move toward the $107,500 resistance.

Bitcoin Price Aims More Gains

Bitcoin price started a fresh increase from the $96,500 support zone. BTC formed a base and was able to clear the $98,800 resistance zone. The bulls even pushed the price above $102,000.

The pair spiked above $104,500 and tested $105,000. A high is formed at $104,943 and the price is now consolidating gains above the 23.6% Fib retracement level of the upward move from the $95,825 swing low to the $104,943 high.

Bitcoin is now trading above $103,500 and the 100 hourly Simple moving average. There is also a new connecting bullish trend line forming with support at $103,500 on the hourly chart of the BTC/USD pair.

On the upside, immediate resistance is near the $104,500 level. The first key resistance is near the $105,000 level. The next key resistance could be $105,500. A close above the $105,500 resistance might send the price further higher. In the stated case, the price could rise and test the $106,200 resistance level. Any more gains might send the price toward the $108,000 level.

Are Dips Supported In BTC?

If Bitcoin fails to rise above the $104,500 resistance zone, it could start another downside correction. Immediate support on the downside is near the $103,500 level and the trend line. The first major support is near the $102,800 level.

The next support is now near the $100,500 zone and the 50% Fib retracement level of the upward move from the $95,825 swing low to the $104,943 high. Any more losses might send the price toward the $98,800 support in the near term. The main support sits at $97,500.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $103,500, followed by $102,800.

Major Resistance Levels – $104,500 and $105,000.

Crypto media with the report:

---

BTC update, such flows helping to underpin the price:

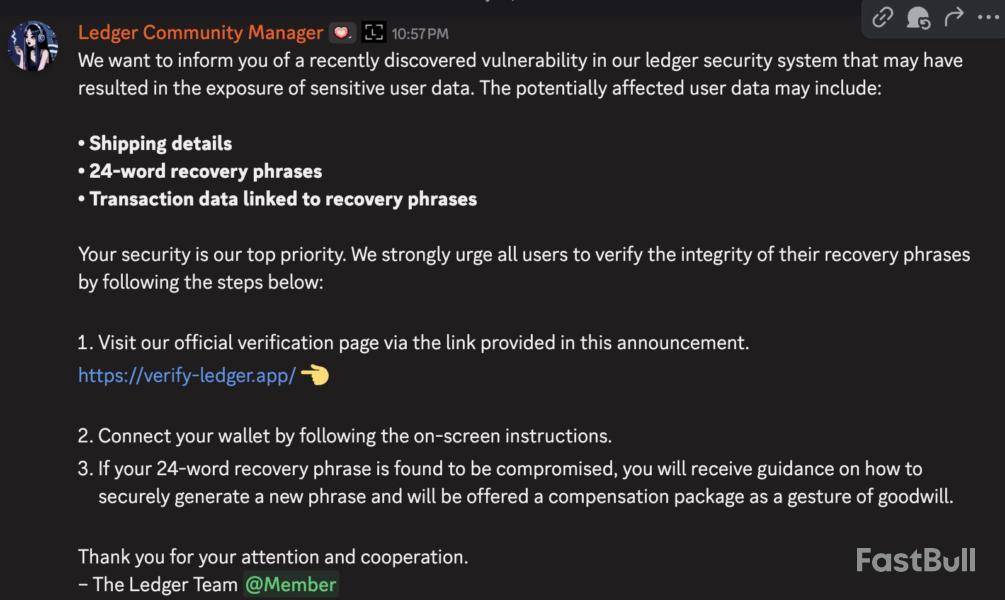

Hardware wallet provider Ledger has confirmed its Discord server is secure again after an attacker compromised a moderator’s account to post scam links on May 11 to trick users into revealing their seed phrases on a third-party website.

“One of our contracted moderators had their account compromised, which allowed a malicious bot to post scam links in one channel,” Ledger team member Quintin Boatwright wrote on the Ledger Discord server.

Some members in Ledger’s Discord channel claimed the attacker abused moderator privileges to ban and mute them as they tried to report the breach, possibly slowing Ledger’s reaction.

Boatwright said the security breach was an isolated incident and that Ledger has taken additional measures to strengthen its security on Discord, a chat platform many crypto projects use to share protocol developments and engage with their community.

Using the compromised Ledger community manager account, the hacker told Ledger Discord members that there was a recently discovered vulnerability in the firm’s security systems and strongly urged all users to verify their recovery phrases with a scam link, according to several screenshots shared on X.

Ledger users were asked to connect their wallets and follow on-screen instructions.

It isn’t clear whether anyone was affected by the security breach. Cointelegraph has reached out to Ledger for comment.

Ledger scammers were sending physical letters last month

In April, scammers were mailing physical letters to owners of Ledger hardware wallets, asking them to validate their private seed phrases in a bid to access and empty the wallets.

The letter used Ledger’s logo, business address and a reference number to feign legitimacy and asked users to scan a QR code and enter the wallet’s recovery phrase.

One Ledger user who received the letter speculated whether scammers were sending letters to Ledger customers whose data was leaked in July 2020.

That incident saw a hacker breach Ledger’s database and dump the personal information of over 270,000 of its customers online, which included names, phone numbers and home addresses.

The following year, several Ledger users claimed to have been mailed fake Ledger devices that were tampered with and designed to install malware upon use, Bleeping Computer reported at the time.

With its recent surge and breakout above the descending wedge pattern that has restrained price action since the beginning of 2025, XRP has been attracting the attention of the market. A confluence of resistances including the 50-day and 100-day exponential moving averages was eventually overcome by the digital asset after weeks of accumulation and sideways consolidation, paving the way for what appears to be a long-term surge.

A more aggressive bullish leg begins when the breakout above the wedge is confirmed by a close above $2.40. Prior to a minor decline, which is completely typical considering the recent moves, vertical character XRP reached $2.1. All of the major EMAs are currently above the price, including the 200-day moving average at $2.01, which serves as strong long-term support. Chart by TradingView">

RSI and other momentum indicators are still high but not extreme, indicating that there is still potential for further growth, particularly if XRP settles in the $2.30-$2.40 range prior to the subsequent leg up. A retest of levels of resistance that have been broken could supply the liquidity required for another push, and the volume has been robust. In order to reach the psychological and technical target of $3, XRP would most likely continue to grind higher.

Following the wedge breakout, this level is consistent with Fibonacci extension projections and previous local highs. Technically speaking, there isn't much substantial opposition until that $3 threshold. A bullish outlook is also supported by on-chain data, which shows enormous wallet activity and a surge in payment volume.

Shiba Inu breaks in

Shiba Inu just gave traders a classic market fake out by breaking above the 200 EMA and then quickly reversing course to return to its prior trading range. SHIB was able to briefly break through the crucial resistance zone on the daily chart close to the $0.000016 level, which corresponds to the 200-day exponential moving average, before reversing course and losing roughly 6.3% in a single daily candle.

Weak hands are often shaken out by this type of price action, which can also surprise breakout traders, particularly those who enter on FOMO without confirmation. A full-bodied red candle after a wick above the 200 EMA indicates that the market, at least for the time being, rejected the breakout attempt. That being said, the bullish momentum of SHIB is still alive.

The key short-term moving averages (20 and 50 EMAs) of the token are sloping upward, and it continues to maintain a structure of higher lows. Support is still present between $0.00001400 and $0.00001380, and another test of the 200 EMA is probably in order if SHIB can create a strong base here.

The pullback's volume was lower than the breakout volume, indicating that there might not be much strength behind the sell-off. Even after this shakeout, the RSI is still above 55, suggesting that the bullish bias is still present. SHIB must hold the $0.000014 zone going forward in order to sustain any upward momentum.

A period of consolidation between $0.000014 and $0.000016 may be required to withstand selling pressure prior to a successful breakout attempt. In summary, this wasn't the real thing, but it also wasn't the end. Better outcomes could come from a different strategy aimed at the 200 EMA if SHIB builds the volume and base to support it. Keep an eye out because this dog may retaliate.

Ethereum finally back

After an exhausting 145-day decline, Ethereum has finally turned things around. Since the beginning of May, ETH has risen 44%, breaking through significant technical barriers from about $1,800 to a peak just above $2,600. On May 8, after a protracted consolidation range, the rally started to pick up significant traction.

Ethereum was able to breach the 50 EMA, 100 EMA and even the psychologically significant 200 EMA in a matter of days, indicating a total reversal in the sentiment of the short- to midterm market. Supported by robust volume, this explosive move suggested that there was organic buying interest rather than speculative pumps. However, there is a catch to the joy: ETH is currently exhibiting indications of a possible short-term reversal after reaching a local high close to $2,650.

The formation of the first red daily candle in this rally along with increased sell volume indicates that some profit-taking is taking place. Furthermore, above 79, which is frequently a sign of cooling-off periods, the Relative Strength Index (RSI) has entered overbought territory. This in no way negates the overall bullish trend.

It is evident that the trend has shifted, and a successful retest of broken EMAs, especially the 200 EMA at about $2,430, could solidify support and pave the way for a move toward $3,000. But without confirmation, it could be dangerous to jump in aggressively at the current levels. Before the subsequent leg higher, Ethereum might be moving into a consolidation or pullback zone.

An appropriate retracement in this case would be a possible launching pad for further growth rather than an indication of weakness. Though short-term caution is still necessary, ETH bulls finally have something to fight for after almost five months of constant bleeding.

Ethereum staking protocol Lido remains "fully secure and operational" after an attacker compromised one of its protocol reporting oracles, draining nearly 1.5 ETH and sparking an emergency DAO vote to rotate the oracle's address.

Chorus One, which operates the oracle, said the attack appears to be an "isolated incident" without further threats to the protocol. "We have thoroughly audited our entire infrastructure and found no evidence of any broader compromise," Chorus One wrote on X.

The attacker drained 1.46 ETH worth about $3,800 from the compromised address, blockchain data shows. "Investigation on all fronts is still ongoing; we will share a full postmortem after we conclude the investigation," Chorus One added on Lido's governance forum. "Activity of the exploiter points towards an automated system, rather than a targeted attack."

Though the attacker was able to drain the oracle address's ETH balance (which was purposely held at a low level, Chorus One said), the attack didn't threaten Lido's operations, as its protocol reporting oracles require a 5-of-9 consensus.

"In the worst case, [compromised oracles] may mean something like stETH rebases (whether positive or negative) take longer to materialize, which will affect stETH holders but mostly in a negligible manner apart from those who may be using stETH in a leveraged manner in DeFi," wrote Lido head of validators Izzy on X.

The Lido DAO vote to rotate the compromised address currently has unanimous support, though it has not yet reached quorum. "Oracles are complex and vary in their usage across DeFi," Izzy wrote. "In Lido, they're a carefully considered part of the protocol, and possible negative impact is meaningfully mitigated through effective decentralization, segregation of duties, and multiple layers of checks."Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up