Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

What Happened?

A number of stocks jumped in the afternoon session after the SaaS sector continued to rally as favorable inflation data bolstered hopes for a Federal Reserve interest rate cut.

This optimism was largely driven by a benign July Consumer Price Index (CPI) report, which solidified investor expectations for a Federal Reserve interest rate cut. Following the release of the inflation data, which showed a year-over-year increase of 2.7%, the probability of a rate cut in September surged to over 96%. Lower interest rates are typically beneficial for growth-oriented technology stocks, as they can reduce borrowing costs and increase the present value of future earnings. Adding to the positive sentiment was a 90-day delay in the imposition of higher tariffs on Chinese goods, which reduced trade-related uncertainty for the technology sector.

The stock market overreacts to news, and big price drops can present good opportunities to buy high-quality stocks.

Among others, the following stocks were impacted:

Zooming In On Alarm.com (ALRM)

Alarm.com’s shares are not very volatile and have only had 5 moves greater than 5% over the last year. In that context, today’s move indicates the market considers this news meaningful, although it might not be something that would fundamentally change its perception of the business.

Alarm.com is down 3.1% since the beginning of the year, and at $57.95 per share, it is trading 15.8% below its 52-week high of $68.81 from December 2024. Investors who bought $1,000 worth of Alarm.com’s shares 5 years ago would now be looking at an investment worth $1,012.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

What Happened?

A number of stocks jumped in the morning session after cooler-than-expected inflation data ignited investor optimism for a potential Federal Reserve interest rate cut. The July Consumer Price Index (CPI) report, an important measure of inflation, came in cooler than expected, showing prices holding steady at an annual rate of 2.7%. This data has led to speculation that the Federal Reserve might lower interest rates. For growth-focused sectors like SaaS, lower interest rates are particularly beneficial as they increase the present value of companies' future earnings, making their stocks more appealing.

The stock market overreacts to news, and big price drops can present good opportunities to buy high-quality stocks.

Among others, the following stocks were impacted:

Zooming In On Manhattan Associates (MANH)

Manhattan Associates’s shares are somewhat volatile and have had 12 moves greater than 5% over the last year. In that context, today’s move indicates the market considers this news meaningful but not something that would fundamentally change its perception of the business.

The previous big move we wrote about was 20 days ago when the stock gained 8% on the news that the company reported second-quarter results that beat analyst expectations and raised its full-year guidance. The company announced adjusted earnings per share of $1.31 on revenue of $272.4 million for the quarter. These figures surpassed Wall Street's consensus estimates, which had predicted earnings of $1.13 per share on $263.6 million in revenue.

A key driver of the strong performance was a 22% year-over-year increase in cloud subscription revenue. The company also reported that its remaining performance obligations (RPO), a metric indicating future revenue under contract, grew by 26% and surpassed the $2 billion mark. Following the strong quarter, Manhattan Associates lifted its financial forecast for the full year. It now expected adjusted earnings per share to be between $4.76 and $4.84, up from a previous forecast. The company also raised its full-year revenue guidance to a range of $1.071 billion to $1.075 billion. This positive "beat and raise" report signaled strong demand for its supply chain solutions, even in a challenging economic environment.

Manhattan Associates is down 21.2% since the beginning of the year, and at $211.86 per share, it is trading 31.6% below its 52-week high of $309.78 from December 2024. Investors who bought $1,000 worth of Manhattan Associates’s shares 5 years ago would now be looking at an investment worth $2,286.

Home security and automation software provider Alarm.com reported Q2 CY2025 results topping the market’s revenue expectations, with sales up 8.8% year on year to $254.3 million. The company’s full-year revenue guidance of $993.2 million at the midpoint came in 0.7% above analysts’ estimates. Its non-GAAP profit of $0.60 per share was 18.1% above analysts’ consensus estimates.

Is now the time to buy ALRM? Find out in our full research report (it’s free).

Alarm.com (ALRM) Q2 CY2025 Highlights:

StockStory’s Take

Alarm.com’s Q2 results came in ahead of Wall Street expectations, with management pointing to broad-based contributions across its business units. CEO Stephen Trundle highlighted the strength of the commercial, international, and EnergyHub segments, each growing close to 25% year-over-year, as key drivers. He also noted that robust hardware sales contributed to the quarter’s performance, aided in part by service providers building inventory due to tariff uncertainty. Trundle emphasized the company’s efficiency in customer acquisition, stating that its channel partners and low sales and marketing spend remain a competitive advantage.

Looking forward, management is banking on continued momentum in the commercial, international, and energy markets to sustain growth and profitability through the rest of the year. CFO Kevin Bradley indicated that tariff pass-throughs and stable inventory positions should help the company manage cost pressures. Trundle explained, “We’re not anticipating or modeling a significant change in the macro in the back half of the year,” underscoring that security remains a must-have service even in uncertain economic conditions. The company also expects recent regulatory changes to strengthen its long-term cash flow outlook.

Key Insights from Management’s Remarks

Management attributed the quarter’s outperformance to steady residential demand and above-plan contributions from hardware, commercial, and energy solutions, alongside strategic inventory management amid tariff concerns.

Drivers of Future Performance

Alarm.com’s outlook is shaped by the durability of its recurring revenue base across commercial, energy, and international segments, as well as the company’s ability to navigate tariff and macroeconomic pressures.

Catalysts in Upcoming Quarters

In the coming quarters, the StockStory team will be monitoring (1) the pace of adoption for new AI-powered video analytics within commercial and enterprise accounts, (2) the sustained growth trajectory of the EnergyHub platform as utility demand evolves, and (3) international market expansion, especially in Latin America and the Middle East. Any shifts in housing market activity or regulatory developments around tariffs will also be important for future performance.

Alarm.com currently trades at $53.44, down from $54.38 just before the earnings. Is the company at an inflection point that warrants a buy or sell? The answer lies in our full research report (it’s free).

Now Could Be The Perfect Time To Invest In These Stocks

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return).

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

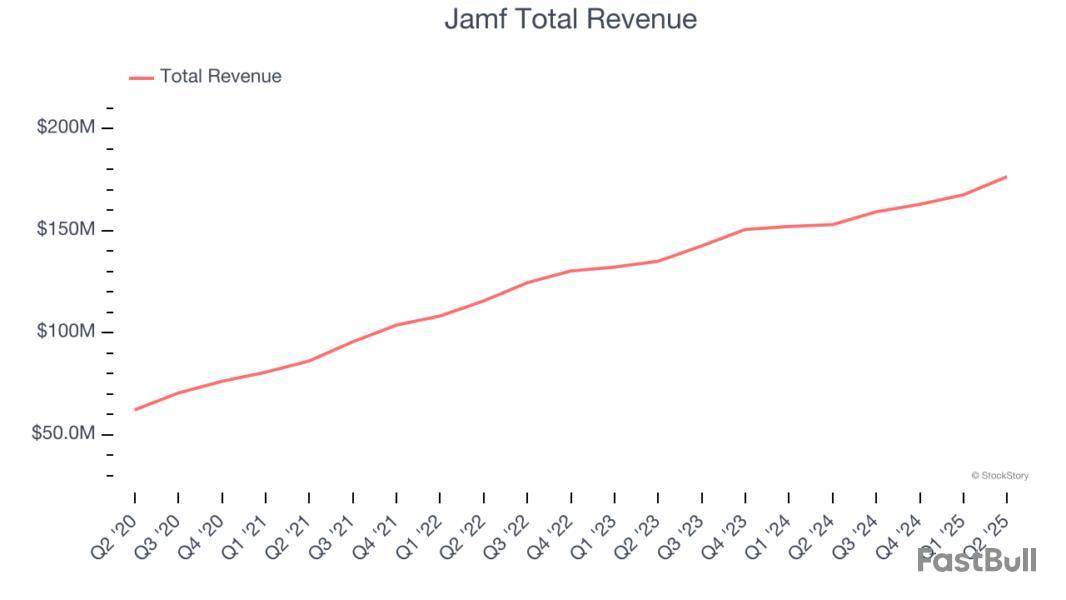

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how automation software stocks fared in Q2, starting with Jamf .

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

The 6 automation software stocks we track reported an exceptional Q2. As a group, revenues beat analysts’ consensus estimates by 9.1% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 8.4% on average since the latest earnings results.

Founded in 2002 by Zach Halmstad and Chip Pearson, right around the time when Apple began to dominate the personal computing market, Jamf provides software for companies to manage Apple devices such as Macs, iPads, and iPhones.

Jamf reported revenues of $176.5 million, up 15.3% year on year. This print exceeded analysts’ expectations by 4.7%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ annual recurring revenue estimates and an impressive beat of analysts’ billings estimates.

Jamf delivered the weakest full-year guidance update of the whole group. Interestingly, the stock is up 7.6% since reporting and currently trades at $7.92.

Is now the time to buy Jamf? Access our full analysis of the earnings results here, it’s free.

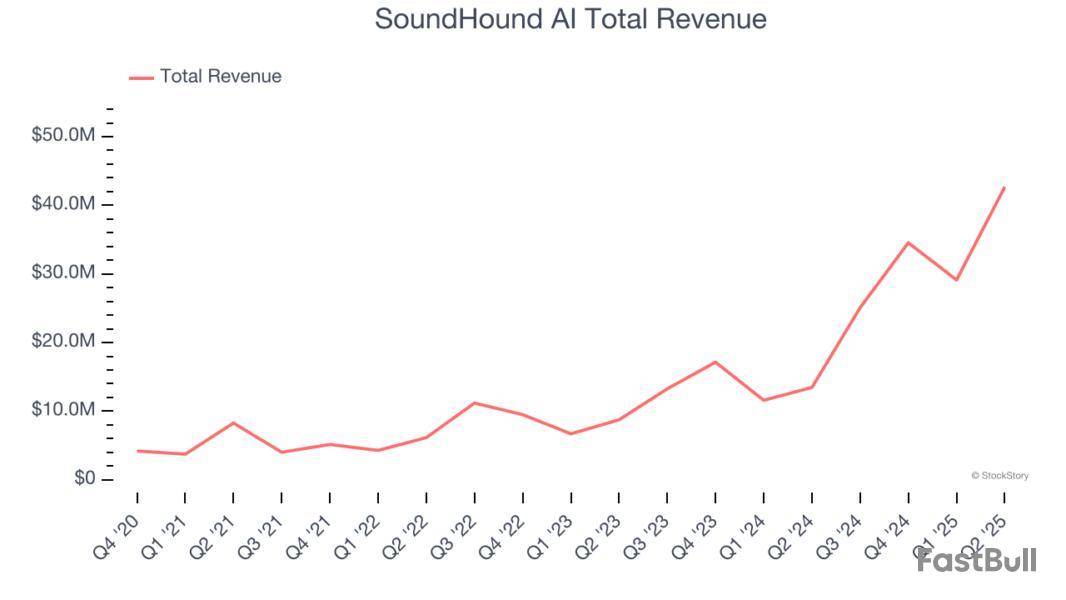

Founded in 2005, SoundHound AI develops independent voice artificial intelligence solutions that enable businesses across various industries to offer customized conversational experiences to consumers.

SoundHound AI reported revenues of $42.68 million, up 217% year on year, outperforming analysts’ expectations by 31.2%. The business had an incredible quarter with a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

SoundHound AI scored the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 45.6% since reporting. It currently trades at $15.65.

Is now the time to buy SoundHound AI? Access our full analysis of the earnings results here, it’s free.

Founded by Alan Trefler in 1983, Pegasystems offers a software-as-a-service platform to automate and optimize workflows in customer service and engagement.

Pegasystems reported revenues of $384.5 million, up 9.5% year on year, exceeding analysts’ expectations by 5.9%. It may have had the worst quarter among its peers, but its results were still good as it also locked in an impressive beat of analysts’ EBITDA estimates.

Pegasystems delivered the slowest revenue growth in the group. The stock is flat since the results and currently trades at $50.74.

Read our full analysis of Pegasystems’s results here.

Founded by Fred Luddy, who coded the company's initial prototype on a flight from San Francisco to London, ServiceNow is a software provider helping companies automate workflows across IT, HR, and customer service.

ServiceNow reported revenues of $3.22 billion, up 22.4% year on year. This number surpassed analysts’ expectations by 2.9%. Overall, it was an exceptional quarter as it also logged a solid beat of analysts’ billings estimates and a solid beat of analysts’ EBITDA estimates.

ServiceNow had the weakest performance against analyst estimates among its peers. The stock is down 10% since reporting and currently trades at $859.50.

Read our full, actionable report on ServiceNow here, it’s free.

Short for microcomputer software, Microsoft is the largest software vendor in the world with its Windows operating system, Office suite, and cloud computing services.

Microsoft reported revenues of $76.44 billion, up 18.1% year on year. This result topped analysts’ expectations by 3.5%. It was an exceptional quarter as it also produced a narrow beat of analysts’ revenue estimates, as Personal Computing, Intelligent Cloud, and Business Services all beat and an impressive beat of analysts’ operating income estimates.

The stock is up 1.6% since reporting and currently trades at $522.30.

Read our full, actionable report on Microsoft here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Not all profitable companies are built to last - some rely on outdated models or unsustainable advantages. Just because a business is in the green today doesn’t mean it will thrive tomorrow.

Not all profitable companies are created equal, and that’s why we built StockStory - to help you find the ones that truly shine bright. Keeping that in mind, here are two profitable companies that leverage their financial strength to beat the competition and one best left off your watchlist.

One Stock to Sell:

Alarm.com (ALRM)

Trailing 12-Month GAAP Operating Margin: 12.9%

Founded in 2000 as a business unit within MicroStrategy, Alarm.com is a software-as-a-service platform that enables users to control their security systems and smart home appliances from a single app.

Why Are We Cautious About ALRM?

Alarm.com is trading at $54.03 per share, or 3.2x forward price-to-sales. To fully understand why you should be careful with ALRM, check out our full research report (it’s free).

Two Stocks to Watch:

Allison Transmission (ALSN)

Trailing 12-Month GAAP Operating Margin: 31.3%

Helping build race cars at one point, Allison Transmission offers transmissions to original equipment manufacturers and fleet operators.

Why Are We Fans of ALSN?

Allison Transmission’s stock price of $87.73 implies a valuation ratio of 12.8x forward EV-to-EBITDA. Is now a good time to buy? See for yourself in our comprehensive research report, it’s free.

Pure Storage (PSTG)

Trailing 12-Month GAAP Operating Margin: 2.9%

Founded in 2009 as a pioneer in enterprise all-flash storage technology, Pure Storage provides all-flash data storage hardware and software that helps organizations manage their data more efficiently across on-premises and cloud environments.

Why Should You Buy PSTG?

At $58.45 per share, Pure Storage trades at 32.3x forward P/E. Is now the right time to buy? Find out in our full research report, it’s free.

Stocks We Like Even More

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return).

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up