Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

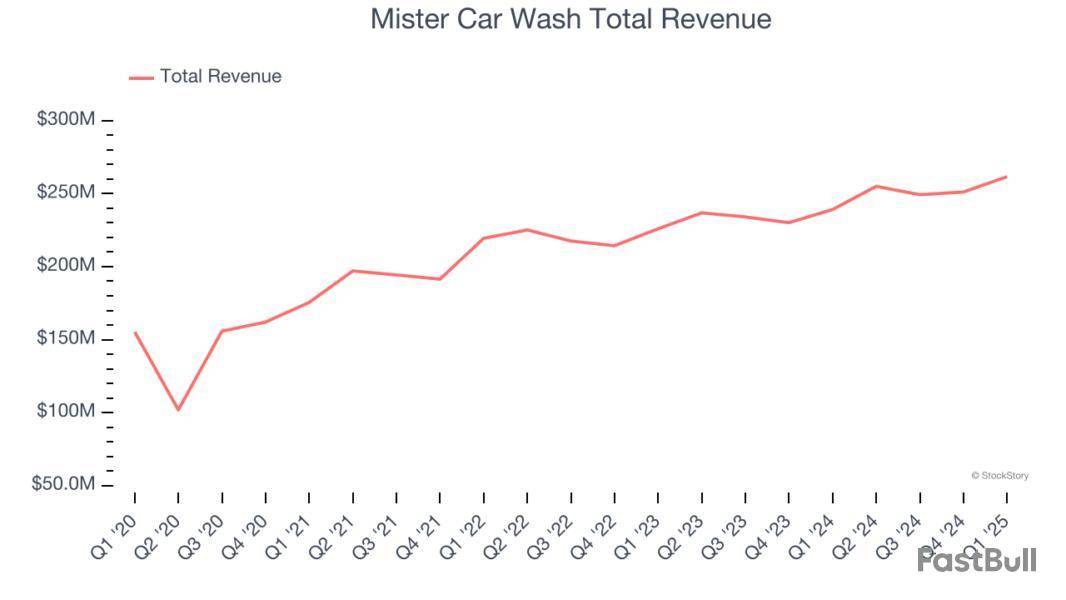

As the Q1 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the specialized consumer services industry, including Mister Car Wash and its peers.

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

The 10 specialized consumer services stocks we track reported a slower Q1. As a group, revenues missed analysts’ consensus estimates by 0.6% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 1.2% on average since the latest earnings results.

Formerly known as Hotshine Holdings, Mister Car Wash (NYSE:MCW) offers car washes across the United States through its conveyorized service.

Mister Car Wash reported revenues of $261.7 million, up 9.4% year on year. This print exceeded analysts’ expectations by 1.6%. Overall, it was a satisfactory quarter for the company with a solid beat of analysts’ same-store sales estimates.

Unsurprisingly, the stock is down 8.6% since reporting and currently trades at $6.27.

Is now the time to buy Mister Car Wash? Access our full analysis of the earnings results here, it’s free.

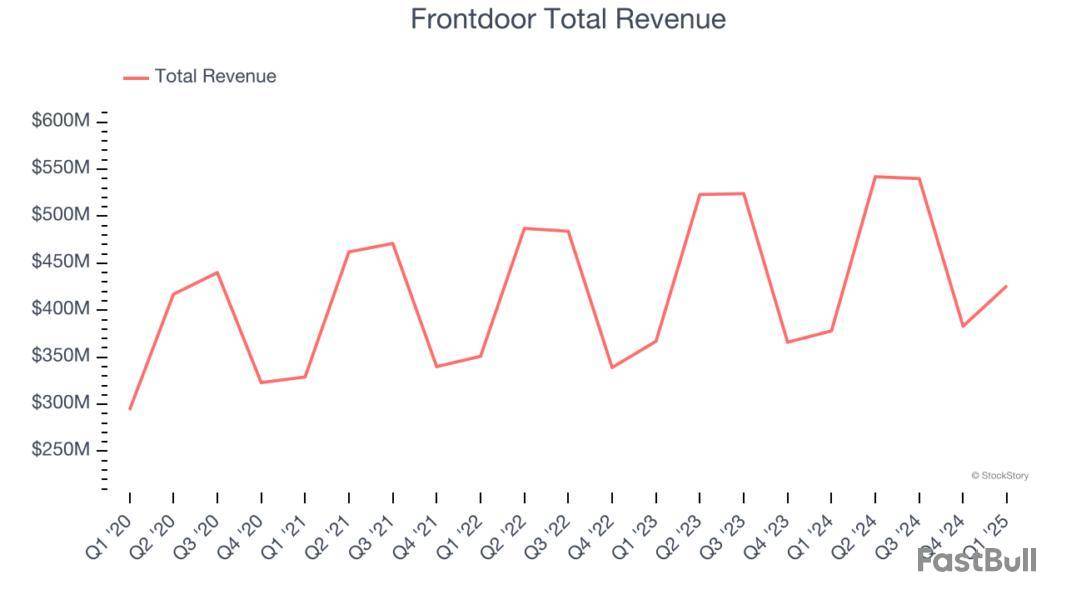

Established in 2018 as a spin-off from ServiceMaster Global Holdings, Frontdoor is a provider of home warranty and service plans.

Frontdoor reported revenues of $426 million, up 12.7% year on year, outperforming analysts’ expectations by 2.1%. The business had a very strong quarter with EBITDA guidance for next quarter exceeding analysts’ expectations and an impressive beat of analysts’ EPS estimates.

Frontdoor pulled off the fastest revenue growth and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 41.1% since reporting. It currently trades at $57.99.

Is now the time to buy Frontdoor? Access our full analysis of the earnings results here, it’s free.

Founded in 1976, 1-800-FLOWERS is an online retailer of flowers, gifts, and gourmet foods, serving customers globally.

1-800-FLOWERS reported revenues of $331.5 million, down 12.6% year on year, falling short of analysts’ expectations by 9%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

1-800-FLOWERS delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 7.4% since the results and currently trades at $5.37.

Read our full analysis of 1-800-FLOWERS’s results here.

Established in 1991, Carriage Services is a provider of funeral and cemetery services in the United States.

Carriage Services reported revenues of $107.1 million, up 3.5% year on year. This number beat analysts’ expectations by 2.8%. Taking a step back, it was a mixed quarter as it also produced an impressive beat of analysts’ EPS estimates but full-year revenue guidance slightly missing analysts’ expectations.

Carriage Services delivered the biggest analyst estimates beat but had the weakest full-year guidance update among its peers. The stock is up 11.3% since reporting and currently trades at $44.42.

Read our full, actionable report on Carriage Services here, it’s free.

Originally a death care company, Matthews International is a diversified company offering ceremonial services, brand solutions and industrial technologies.

Matthews reported revenues of $427.6 million, down 9.3% year on year. This result missed analysts’ expectations by 1.8%. It was a softer quarter as it also logged a significant miss of analysts’ EPS estimates.

The stock is up 4.1% since reporting and currently trades at $21.29.

Read our full, actionable report on Matthews here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Not all profitable companies are built to last - some rely on outdated models or unsustainable advantages. Just because a business is in the green today doesn’t mean it will thrive tomorrow.

A business making money today isn’t necessarily a winner, which is why we analyze companies across multiple dimensions at StockStory. Keeping that in mind, here are three profitable companies to steer clear of and a few better alternatives.

TreeHouse Foods (THS)

Trailing 12-Month GAAP Operating Margin: 3.1%

Whether it be packaged crackers, broths, or beverages, Treehouse Foods produces a wide range of private-label foods for grocery and food service customers.

Why Do We Avoid THS?

At $20.44 per share, TreeHouse Foods trades at 10.6x forward P/E. Dive into our free research report to see why there are better opportunities than THS.

Frontdoor (FTDR)

Trailing 12-Month GAAP Operating Margin: 18.2%

Established in 2018 as a spin-off from ServiceMaster Global Holdings, Frontdoor is a provider of home warranty and service plans.

Why Does FTDR Give Us Pause?

Frontdoor is trading at $57.99 per share, or 18.9x forward P/E. To fully understand why you should be careful with FTDR, check out our full research report (it’s free).

Interface (TILE)

Trailing 12-Month GAAP Operating Margin: 10.1%

Pioneering carbon-neutral flooring since its founding in 1973, Interface is a global manufacturer of modular carpet tiles, luxury vinyl tile (LVT), and rubber flooring that specializes in carbon-neutral and sustainable flooring solutions.

Why Do We Think TILE Will Underperform?

Interface’s stock price of $20.07 implies a valuation ratio of 7.3x forward EV-to-EBITDA. Read our free research report to see why you should think twice about including TILE in your portfolio.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return).

The Russell 2000 is home to many small-cap stocks, offering investors the chance to uncover hidden gems before the broader market catches on. However, these companies often come with higher volatility and risk, as their smaller size makes them more vulnerable to economic downturns.

The high-risk, high-reward nature of the Russell 2000 makes stock selection critical, and we’re here to guide you toward the right ones. That said, here are three Russell 2000 stocks that don’t make the cut and some better choices instead.

1-800-FLOWERS (FLWS)

Market Cap: $328 million

Founded in 1976, 1-800-FLOWERS is an online retailer of flowers, gifts, and gourmet foods, serving customers globally.

Why Are We Out on FLWS?

1-800-FLOWERS’s stock price of $5.37 implies a valuation ratio of 17.6x forward P/E. Check out our free in-depth research report to learn more about why FLWS doesn’t pass our bar.

Heartland Express (HTLD)

Market Cap: $685 million

Founded by the son of a trucker, Heartland Express offers full-truckload deliveries across the United States and Mexico.

Why Do We Pass on HTLD?

Heartland Express is trading at $8.92 per share, or 4.4x forward EV-to-EBITDA. Dive into our free research report to see why there are better opportunities than HTLD.

Fulton Financial (FULT)

Market Cap: $3.11 billion

Tracing its roots back to 1882 in the heart of Pennsylvania, Fulton Financial is a financial holding company that provides banking, lending, and wealth management services to consumers and businesses across five Mid-Atlantic states.

Why Are We Hesitant About FULT?

At $17.10 per share, Fulton Financial trades at 1x forward P/B. Read our free research report to see why you should think twice about including FULT in your portfolio.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return).

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up