Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

As the Q4 earnings season wraps, let’s dig into this quarter’s best and worst performers in the business process outsourcing & consulting industry, including TaskUs and its peers.

The sector stands to benefit from ongoing digital transformation, increasing corporate demand for cost efficiencies, and the growing complexity of regulatory and cybersecurity landscapes. For those that invest wisely, AI and automation capabilities could emerge as competitive advantages, enhancing process efficiencies for the companies themselves as well as their clients. On the flip side, AI could be a headwind as well as the technology could lower the barrier to entry in the space and give rise to more self-service solutions. Additional challenges in the years ahead could include wage inflation for highly skilled consultants and potential regulatory scrutiny on outsourcing practices—especially in industries like finance and healthcare where who has access to certain data matters greatly.

The 8 business process outsourcing & consulting stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

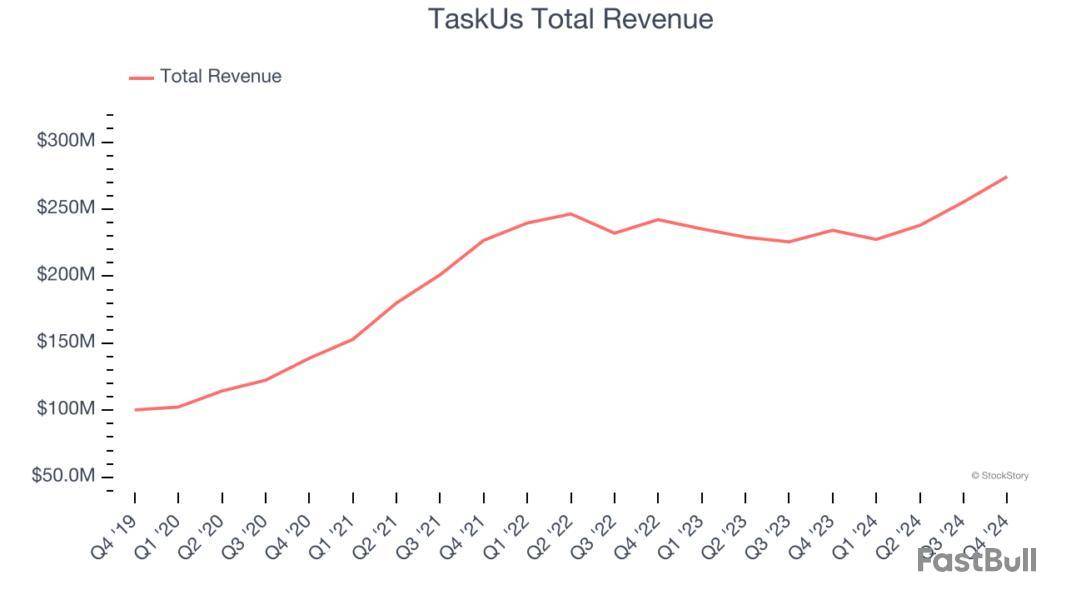

Starting as a virtual assistant service in 2008 before evolving into a global digital services provider, TaskUs provides outsourced digital services including customer experience management, content moderation, and AI data services to innovative technology companies.

TaskUs reported revenues of $274.2 million, up 17.1% year on year. This print exceeded analysts’ expectations by 2%. Despite the top-line beat, it was still a slower quarter for the company with a significant miss of analysts’ EPS estimates.

Interestingly, the stock is up 11% since reporting and currently trades at $17.34.

Read our full report on TaskUs here, it’s free.

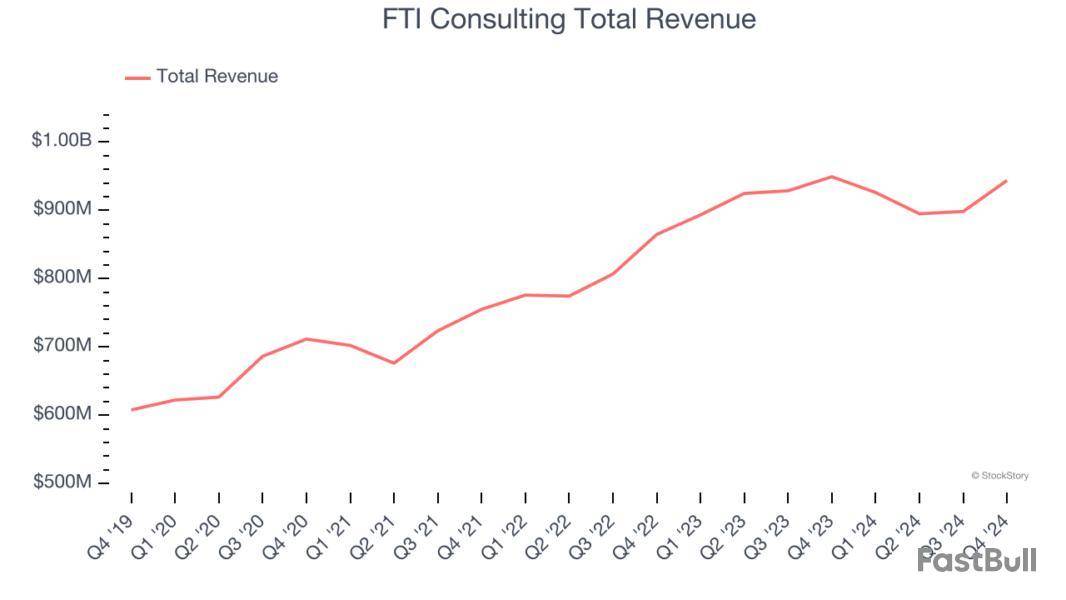

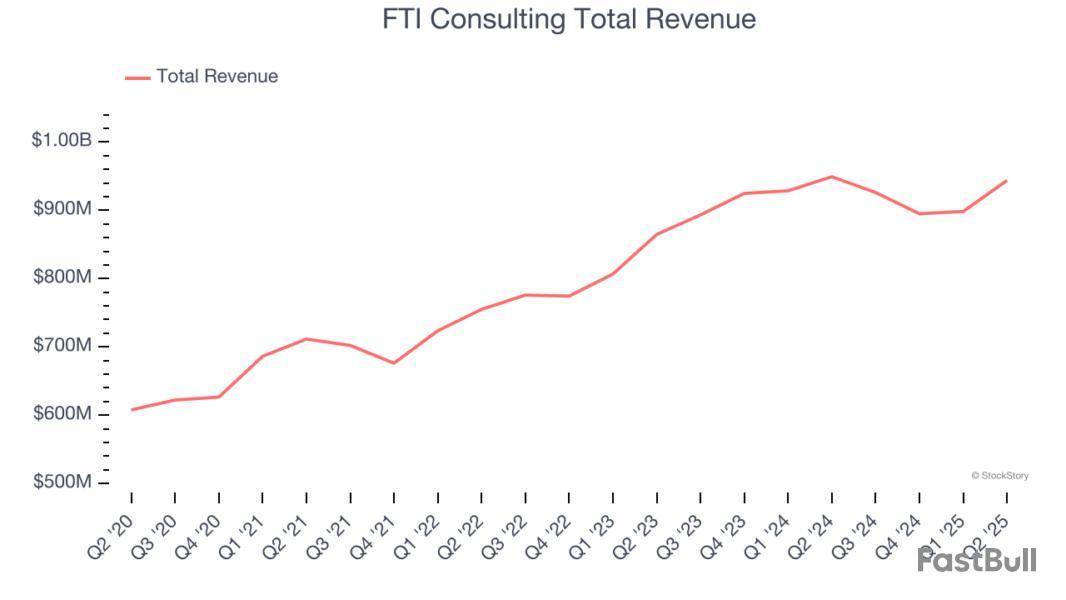

With a team of experts deployed across 30+ countries to tackle complex business challenges, FTI Consulting is a global business advisory firm that helps organizations manage change, mitigate risk, and resolve disputes across financial, legal, operational, and regulatory matters.

FTI Consulting reported revenues of $943.7 million, flat year on year, outperforming analysts’ expectations by 3.4%. The business had a very strong quarter with a beat of analysts’ EPS estimates and full-year revenue guidance slightly topping analysts’ expectations.

However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $168.44.

Is now the time to buy FTI Consulting? Access our full analysis of the earnings results here, it’s free.

With a team of approximately 450,000 employees across 75 countries, Concentrix designs and delivers customer experience solutions that help global brands manage their customer interactions across digital channels and contact centers.

Concentrix reported revenues of $2.42 billion, up 1.5% year on year, exceeding analysts’ expectations by 1.2%. Still, it was a mixed quarter as it posted a significant miss of analysts’ EPS estimates.

As expected, the stock is down 10.1% since the results and currently trades at $49.58.

Read our full analysis of Concentrix’s results here.

With over 120 offices across 33 states and a team of more than 6,700 professionals, CBIZ provides accounting, tax, benefits, insurance brokerage, and advisory services to help small and mid-sized businesses manage their finances and operations.

CBIZ reported revenues of $683.5 million, up 62.7% year on year. This result came in 2.6% below analysts' expectations. Aside from that, it was a satisfactory quarter as it put up a beat of analysts’ EPS estimates.

CBIZ scored the fastest revenue growth but had the weakest performance against analyst estimates among its peers. The stock is down 16% since reporting and currently trades at $64.

Read our full, actionable report on CBIZ here, it’s free.

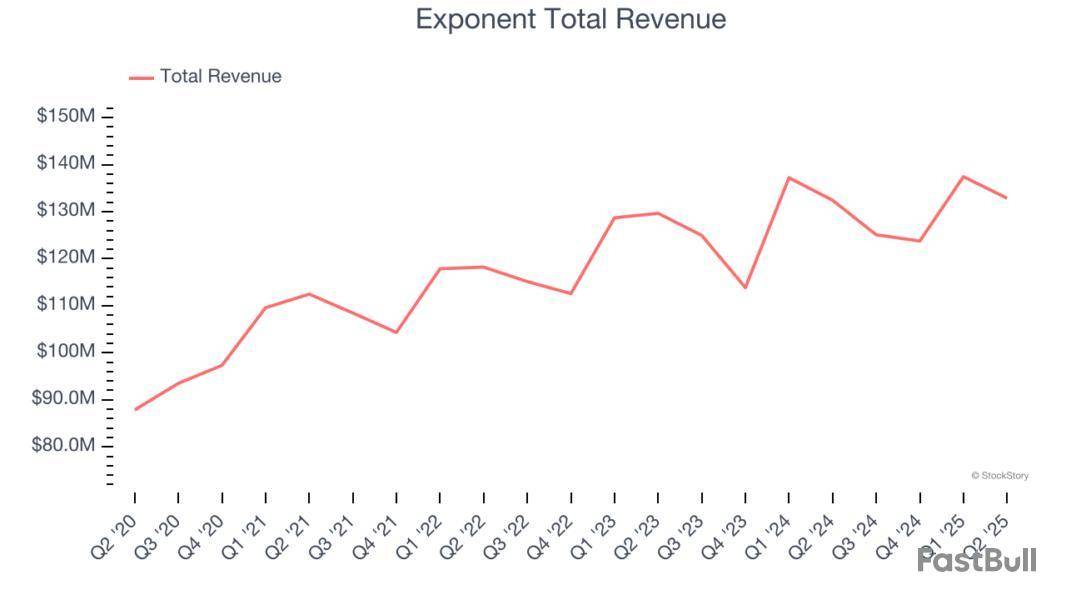

With a team of over 800 consultants holding advanced degrees in 90+ technical disciplines, Exponent is a science and engineering consulting firm that investigates complex problems and provides expert analysis for clients across various industries.

Exponent reported revenues of $132.9 million, flat year on year. This number topped analysts’ expectations by 1.5%. More broadly, it was a mixed quarter as it also produced EPS in line with analysts’ estimates but revenue guidance for next quarter slightly missing analysts’ expectations.

The stock is up 1.6% since reporting and currently trades at $70.03.

Read our full, actionable report on Exponent here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Business services providers thrive by solving complex operational challenges for their clients, allowing them to focus on their secret sauce. But increasing competition from AI-driven upstarts has tempered enthusiasm, and over the past six months, the industry has pulled back by 2.6%. This drop was discouraging since the S&P 500 returned 4.7%.

A cautious approach is imperative when dabbling in these companies as many are also sensitive to the ebbs and flows of the broader economy. Keeping that in mind, here are three services stocks best left ignored.

Equifax (EFX)

Market Cap: $30.94 billion

Holding detailed financial records on over 800 million consumers worldwide and dating back to 1899, Equifax is a global data analytics company that collects, analyzes, and sells consumer and business credit information to lenders, employers, and other businesses.

Why Are We Cautious About EFX?

Equifax is trading at $250.66 per share, or 29.9x forward P/E. If you’re considering EFX for your portfolio, see our FREE research report to learn more.

FTI Consulting (FCN)

Market Cap: $5.37 billion

With a team of experts deployed across 30+ countries to tackle complex business challenges, FTI Consulting is a global business advisory firm that helps organizations manage change, mitigate risk, and resolve disputes across financial, legal, operational, and regulatory matters.

Why Is FCN Not Exciting?

At $169.10 per share, FTI Consulting trades at 20.7x forward P/E. To fully understand why you should be careful with FCN, check out our full research report (it’s free).

ManpowerGroup (MAN)

Market Cap: $1.95 billion

Founded during the post-World War II economic boom when businesses needed temporary workers, ManpowerGroup connects millions of people to employment opportunities through its global network of staffing, recruitment, and workforce management services.

Why Do We Avoid MAN?

ManpowerGroup’s stock price of $42.21 implies a valuation ratio of 12.2x forward P/E. Read our free research report to see why you should think twice about including MAN in your portfolio.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return).

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

Let’s dig into the relative performance of Exponent and its peers as we unravel the now-completed Q2 business process outsourcing & consulting earnings season.

The sector stands to benefit from ongoing digital transformation, increasing corporate demand for cost efficiencies, and the growing complexity of regulatory and cybersecurity landscapes. For those that invest wisely, AI and automation capabilities could emerge as competitive advantages, enhancing process efficiencies for the companies themselves as well as their clients. On the flip side, AI could be a headwind as well as the technology could lower the barrier to entry in the space and give rise to more self-service solutions. Additional challenges in the years ahead could include wage inflation for highly skilled consultants and potential regulatory scrutiny on outsourcing practices—especially in industries like finance and healthcare where who has access to certain data matters greatly.

The 7 business process outsourcing & consulting stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 1.2% while next quarter’s revenue guidance was in line.

While some business process outsourcing & consulting stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.1% since the latest earnings results.

With a team of over 800 consultants holding advanced degrees in 90+ technical disciplines, Exponent is a science and engineering consulting firm that investigates complex problems and provides expert analysis for clients across various industries.

Exponent reported revenues of $132.9 million, flat year on year. This print exceeded analysts’ expectations by 1.5%. Despite the top-line beat, it was still a mixed quarter for the company with EPS in line with analysts’ estimates but revenue guidance for next quarter slightly missing analysts’ expectations.

“Second quarter revenues were flat but exceeded expectations, reflecting our team’s disciplined execution and resilience in this dynamic environment,” stated Dr. Catherine Corrigan, President and Chief Executive Officer.

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $69.60.

Is now the time to buy Exponent? Access our full analysis of the earnings results here, it’s free.

With a team of experts deployed across 30+ countries to tackle complex business challenges, FTI Consulting is a global business advisory firm that helps organizations manage change, mitigate risk, and resolve disputes across financial, legal, operational, and regulatory matters.

FTI Consulting reported revenues of $943.7 million, flat year on year, outperforming analysts’ expectations by 3.4%. The business had a very strong quarter with a beat of analysts’ EPS estimates and full-year revenue guidance slightly topping analysts’ expectations.

However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $169.10.

Is now the time to buy FTI Consulting? Access our full analysis of the earnings results here, it’s free.

With a team of approximately 450,000 employees across 75 countries, Concentrix designs and delivers customer experience solutions that help global brands manage their customer interactions across digital channels and contact centers.

Concentrix reported revenues of $2.42 billion, up 1.5% year on year, exceeding analysts’ expectations by 1.2%. Still, it was a mixed quarter as it posted a significant miss of analysts’ EPS estimates.

As expected, the stock is down 12.1% since the results and currently trades at $48.50.

Read our full analysis of Concentrix’s results here.

With over 120 offices across 33 states and a team of more than 6,700 professionals, CBIZ provides accounting, tax, benefits, insurance brokerage, and advisory services to help small and mid-sized businesses manage their finances and operations.

CBIZ reported revenues of $683.5 million, up 62.7% year on year. This print missed analysts’ expectations by 2.6%. Zooming out, it was actually a satisfactory quarter as it put up a beat of analysts’ EPS estimates.

CBIZ pulled off the fastest revenue growth but had the weakest performance against analyst estimates among its peers. The stock is down 16.1% since reporting and currently trades at $63.92.

Read our full, actionable report on CBIZ here, it’s free.

Founded in 2002 during a time of significant regulatory change in corporate America, Huron Consulting Group is a professional services company that helps organizations develop growth strategies, optimize operations, and implement digital transformation solutions.

Huron reported revenues of $411.8 million, up 8.1% year on year. This result came in 0.6% below analysts' expectations. In spite of that, it was a strong quarter as it logged full-year revenue guidance topping analysts’ expectations and a beat of analysts’ EPS estimates.

Huron scored the highest full-year guidance raise among its peers. The stock is up 2.5% since reporting and currently trades at $135.75.

Read our full, actionable report on Huron here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Small-cap stocks can be incredibly lucrative investments because their lack of analyst coverage leads to frequent mispricings. However, these businesses (and their stock prices) often stay small because their subscale operations make it harder to expand their competitive moats.

Luckily for you, our mission at StockStory is to help you make money and avoid losses by sorting the winners from the losers. That said, here is one small-cap stock that could amplify your portfolio’s returns and two best left ignored.

Two Small-Cap Stocks to Sell:

FTI Consulting (FCN)

Market Cap: $5.33 billion

With a team of experts deployed across 30+ countries to tackle complex business challenges, FTI Consulting is a global business advisory firm that helps organizations manage change, mitigate risk, and resolve disputes across financial, legal, operational, and regulatory matters.

Why Do We Think Twice About FCN?

FTI Consulting is trading at $167.85 per share, or 20.5x forward P/E. Dive into our free research report to see why there are better opportunities than FCN.

Taboola (TBLA)

Market Cap: $976.2 million

Often appearing as those "You May Also Like" or "Recommended For You" boxes at the bottom of news articles, Taboola operates a digital platform that recommends personalized content to users across publisher websites, helping both publishers monetize their sites and advertisers reach target audiences.

Why Are We Hesitant About TBLA?

At $3.33 per share, Taboola trades at 8.1x forward EV-to-EBITDA. If you’re considering TBLA for your portfolio, see our FREE research report to learn more.

One Small-Cap Stock to Buy:

F&G Annuities & Life (FG)

Market Cap: $4.60 billion

Founded in 1959 and serving approximately 677,000 policyholders who rely on its financial protection products, F&G Annuities & Life provides fixed annuities, life insurance, and pension risk transfer solutions to retail and institutional clients.

Why Should You Buy FG?

F&G Annuities & Life’s stock price of $34.17 implies a valuation ratio of 1x forward P/B. Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return).

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up