Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The latest trading session saw SoundHound AI, Inc. ending at $4.62, denoting a -0.86% adjustment from its last day's close. This move was narrower than the S&P 500's daily loss of 1.84%. Meanwhile, the Dow lost 1.51%, and the Nasdaq, a tech-heavy index, lost 2.43%.

Coming into today, shares of the company had gained 18.58% in the past month. In that same time, the Computer and Technology sector lost 5.83%, while the S&P 500 lost 0.43%.

Market participants will be closely following the financial results of SoundHound AI, Inc. in its upcoming release. The company plans to announce its earnings on August 8, 2024. The company is expected to report EPS of -$0.09, up 10% from the prior-year quarter. Meanwhile, the latest consensus estimate predicts the revenue to be $13.01 million, indicating a 48.69% increase compared to the same quarter of the previous year.

For the full year, the Zacks Consensus Estimates are projecting earnings of -$0.30 per share and revenue of $71.01 million, which would represent changes of +21.05% and +54.8%, respectively, from the prior year.

Any recent changes to analyst estimates for SoundHound AI, Inc. should also be noted by investors. Recent revisions tend to reflect the latest near-term business trends. As a result, upbeat changes in estimates indicate analysts' favorable outlook on the company's business health and profitability.

Our research demonstrates that these adjustments in estimates directly associate with imminent stock price performance. To capitalize on this, we've crafted the Zacks Rank, a unique model that incorporates these estimate changes and offers a practical rating system.

Ranging from #1 (Strong Buy) to #5 (Strong Sell), the Zacks Rank system has a proven, outside-audited track record of outperformance, with #1 stocks returning an average of +25% annually since 1988. Over the past month, the Zacks Consensus EPS estimate has moved 9.09% higher. SoundHound AI, Inc. is currently a Zacks Rank #2 (Buy).

The Computers - IT Services industry is part of the Computer and Technology sector. This industry, currently bearing a Zacks Industry Rank of 101, finds itself in the top 40% echelons of all 250+ industries.

The Zacks Industry Rank is ordered from best to worst in terms of the average Zacks Rank of the individual companies within each of these sectors. Our research shows that the top 50% rated industries outperform the bottom half by a factor of 2 to 1.

Zacks Investment Research

Shares of SoundHound AI, Inc. have gained 29.5% over the past four weeks to close the last trading session at $5.09, but there could still be a solid upside left in the stock if short-term price targets of Wall Street analysts are any indication. Going by the price targets, the mean estimate of $7.17 indicates a potential upside of 40.9%.

The mean estimate comprises six short-term price targets with a standard deviation of $1.81. While the lowest estimate of $5 indicates a 1.8% decline from the current price level, the most optimistic analyst expects the stock to surge 86.6% to reach $9.50. It's very important to note the standard deviation here, as it helps understand the variability of the estimates. The smaller the standard deviation, the greater the agreement among analysts.

While the consensus price target is highly sought after by investors, the ability and unbiasedness of analysts in setting price targets have long been questionable. And investors making investment decisions solely based on this tool would arguably do themselves a disservice.

But, for SOUN, an impressive average price target is not the only indicator of a potential upside. Strong agreement among analysts about the company's ability to report better earnings than they predicted earlier strengthens this view. While a positive trend in earnings estimate revisions doesn't gauge how much a stock could gain, it has proven to be powerful in predicting an upside.

Here's What You May Not Know About Analysts' Price Targets

According to researchers at several universities across the globe, a price target is one of many pieces of information about a stock that misleads investors far more often than it guides. In fact, empirical research shows that price targets set by several analysts, irrespective of the extent of agreement, rarely indicate where the price of a stock could actually be heading.

While Wall Street analysts have deep knowledge of a company's fundamentals and the sensitivity of its business to economic and industry issues, many of them tend to set overly optimistic price targets. Are you wondering why?

They usually do that to drum up interest in shares of companies that their firms either have existing business relationships with or are looking to be associated with. In other words, business incentives of firms covering a stock often result in inflated price targets set by analysts.

However, a tight clustering of price targets, which is represented by a low standard deviation, indicates that analysts have a high degree of agreement about the direction and magnitude of a stock's price movement. While that doesn't necessarily mean the stock will hit the average price target, it could be a good starting point for further research aimed at identifying the potential fundamental driving forces.

That said, while investors should not entirely ignore price targets, making an investment decision solely based on them could lead to disappointing ROI. So, price targets should always be treated with a high degree of skepticism.

Here's Why There Could be Plenty of Upside Left in SOUN

Analysts' growing optimism over the company's earnings prospects, as indicated by strong agreement among them in revising EPS estimates higher, could be a legitimate reason to expect an upside in the stock. That's because empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock price movements.

For the current year, one estimate has moved higher over the last 30 days compared to no negative revision. As a result, the Zacks Consensus Estimate has increased 9.1%.

Moreover, SOUN currently has a Zacks Rank #1 (Strong Buy), which means it is in the top 5% of more than the 4,000 stocks that we rank based on four factors related to earnings estimates. Given an impressive externally-audited track record, this is a more conclusive indication of the stock's potential upside in the near term. You can see the complete list of today's Zacks Rank #1 (Strong Buy) stocks here

Therefore, while the consensus price target may not be a reliable indicator of how much SOUN could gain, the direction of price movement it implies does appear to be a good guide.

Zacks Investment Research

In an exclusive interview with Benzinga, Keyvan Mohajer, CEO of SoundHound AI Inc. , shed light on the company’s recent endeavors and its vision for the future.

SoundHound AI is rapidly advancing its footprint in the AI landscape, as underscored by Mohajer during the interview. The company’s innovative approach is capturing attention across multiple sectors, from automotive to hospitality, with its cutting-edge voice AI technology.

SoundHound AI's Cutting-Edge In-Car Voice AI

SoundHound AI has made waves with the deployment of its Chat AI voice assistant in European automotive brands, showcasing its market agility.

As Mohajer proudly states, "Not only were we the first voice assistant provider to integrate generative AI, we were also the first to pilot and launch anywhere in the world."

This cutting-edge in-car voice AI has been launched with six major automotive brands, witnessing a significant rise in usage. Mohajer highlights this success: "Agility and quality are tough to achieve in tandem, but thanks to our long history in voice AI and our highly extensible platform, we've achieved it."

‘Our OEM Partners Really Value This’

The partnership with Stellantis NV is a pivotal milestone for SoundHound AI. Mohajer explains, "We've been working with the automotive industry for nearly a decade, and now millions of vehicles across the globe use our in-vehicle voice assistant in more than 20 languages." This long-standing experience allows SoundHound to manage risks and deliver value. "Our OEM partners really value this," Mohajer adds, emphasizing the company’s unique offering of control over brand and data.

SoundHound AI’s expansion into 17 markets by the end of July highlights its growing influence. The company’s voice technology integrates vehicle controls and real-time data with generative AI responses, offering a seamless user experience.

"What is new for the company is that more auto brands in those markets are fully embracing our category-leading assistant, which combines vehicle controls, real-time data (like weather and navigation), and generative AI responses," Mohajer said.

With enthusiastic responses from OEMs globally, SoundHound AI is setting a new standard in the automotive AI landscape, solidifying its competitive edge.

Read Also: What’s Going On With SoundHound AI Stock?

‘Restaurants Are To SoundHound AI What Books Were To Amazon,’ Says CEO

SoundHound AI is also making waves in the restaurant industry, with over 10,000 locations already using its AI technology.

Mohajer likens the company's foray into AI customer service to Amazon’s early book sales, stating, "Restaurants are to SoundHound AI what books were to Amazon. In time, we look forward to using our extensive AI know-how and leveraging the very latest technology to provide best-in-class solutions right across industries."

The company’s AI now supports various industries, including fitness and personal care, with over 100,000 locations in the pipeline. Mohajer is confident about the future, saying, "We believe AI customer service will be as necessary to every business as wifi and electricity and that creates an incredible opportunity for SoundHound."

Eyeing A $100B TAM In North America Alone

SoundHound AI’s multi-industry approach is built on a three-pillar revenue strategy. "At SoundHound we have a three pillar revenue strategy... we provide a branded digital assistant like SoundHound Chat AI to physical products like cars (as discussed), but also TVs, and smart devices," Mohajer said.

The strategy not only involves providing voice-enabled products, but also AI customer service solutions that operate on a subscription model.

"We're also seeing huge growth in this area, often driven by labor shortages. We estimate its size to be a $100 billion TAM in North America alone," he noted.

SoundHound’s ambitious plans aim to create a seamless voice commerce ecosystem, ultimately generating new revenue streams while enhancing user experience. "We're building the voice commerce ecosystem of the future, and the revenue of this pillar is monetization revenue," Mohajer said.

As SoundHound AI continues to evolve and expand, investors should monitor its strategic partnerships, global market entries, and industry-specific implementations to gauge the company’s future potential and market position.

Read Next:

Photo: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SoundHound AI SOUN shares have jumped 27.3% in the past month, outperforming the Zacks Computer & Technology sector’s decline of 6.4% and the Zacks Computers – IT Services’ growth of 5.2%.

SoundHound AI is benefiting from a strong portfolio, a strong partner base and an expanding clientele. SOUN offers conversational intelligence through independent Voice AI solutions in 25 languages in both cloud-enabled and hardware-embedded devices.

Its prospects benefit from a massive addressable market worth more than $140 billion that includes diverse industries like automotive, restaurants, customer service, entertainment, Smart TVs and Internet of Things (IoT) powered devices.

SoundHound AI had $682 million in cumulative subscriptions and bookings backlog at the end of the first quarter of 2024, up 80% year over year, with an average duration of about seven years. This reflects the strong demand for SOUN’s solutions.

It expects revenues between $65 million and $77 million for 2024. The Zacks Consensus Estimate for SOUN’s 2024 revenues is pegged at $71.01 million, indicating year-over-year growth of 54.8%. The consensus mark for 2024 loss is pegged at 30 cents per share, which has narrowed by three cents over the past 30 days.

SoundHound AI, Inc. Price and Consensus

SoundHound AI, Inc. price-consensus-chart | SoundHound AI, Inc. Quote

SOUN now expects to surpass $100 million in revenues with positive adjusted EBITDA in 2025.

The Zacks Consensus Estimate for SOUN’s 2025 revenues is pegged at $103.91 million, indicating year-over-year growth of 46.3%. The consensus mark for 2025 loss is pegged at 18 cents per share, narrower by four cents over the past 30 days.

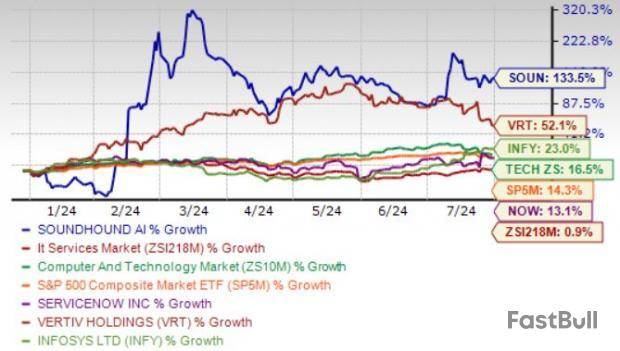

SOUN Stock Beats Sector YTD

Year to date, SOUN shares have surged 133.5% year to date, outperforming the broader Zacks Computer & Technology sector’s return of 16.5% and the Zacks IT Services industry’s gain of 0.9%.

SoundHound AI has also outperformed industry peers like ServiceNow NOW, Infosys INFY and Vertiv VRT over the same timeframe. NOW, INFY and VRT shares have gained 13.1%, 23% and 52.1%, respectively.

YTD Performance

However, SOUN stock is not so cheap, as the Value Style Score of F suggests a stretched valuation at this moment.

In terms of the forward 12-month Price/Sales ratio, SoundHound AI is trading at 18.14X, higher than its median of 8.85X and the Zacks Computer & Technology sector’s 6.18X.

Price/Sales Ratio (F12M)

SOUN Stock to Benefit From Expanding Footprint

SoundHound AI’s prospects benefit from its expanding footprint in industries like automotive and restaurants, driven by its innovative portfolio. It has more than 270 patents currently, with over 155 granted and more than 115 pending.

Automotive presents a significant growth opportunity for SOUN. TAM for the global light vehicle auto market is currently pegged at roughly 88 million and is expected to hit 95 million units by 2028.

SOUN has strengthened its footprint in the automotive industry by introducing its advanced SoundHound Chat AI voice assistant, integrated with ChatGPT, into Peugeot, Opel and Vauxhall vehicles across 11 European markets, including Austria, France, Germany, Italy, Spain and the U.K.

SOUN’s collaborations with NVIDIA, ARM, Perplexity, Olo and Oracle are expanding its portfolio. SoundHound AI launched an advanced in-vehicle voice assistant leveraging NVIDIA DRIVE, enabling real-time and generative AI capabilities for seamless, offline access to vehicle intelligence and personalized assistance.

SoundHound AI partnered with Perplexity to enhance SoundHound Chat AI through the integration of the latter’s online Large Language Model capabilities for advanced, real-time voice assistant responses.

TAM for the restaurant market is currently pegged at roughly $3.3 trillion and is expected to hit $4.4 trillion units by 2028, thereby offering significant growth prospects for SoundHound AI.

SOUN partnered with Olo to bring its voice AI technology to approximately 77,000 restaurant locations, enabling high-speed, accurate order processing and enhancing the guest experience. It announced the integration of its Smart Ordering voice AI technology with Oracle MICROS Symphony point-of-sale (POS) for restaurants, enhancing order efficiency and customer experience in the hospitality industry.

SOUN’s acquisition of SYNQ3 bolstered its presence in the restaurant sector, contributing positively to the revenue mix and customer base expansion. The acquisition of SYNQ3 added approximately $3 million to SoundHound’s revenue in the first quarter of 2024.

The acquisition of key assets from Allset, an online ordering platform that connects restaurants with local customers, enhanced its capabilities in Voice AI.

Conclusion

SoundHound AI is a risky bet for growth-oriented investors, given the uncharted Voice AI domain. However, its innovative portfolio makes SOUN well-positioned to benefit from the strong TAM of global automotive and restaurant markets.

This Zacks Rank #1 (Strong Buy) stock has a Momentum Style Score of A, a favorable combination that offers a strong investment opportunity, per the Zacks Proprietary methodology. You can see the complete list of today’s Zacks #1 Rank stocks here.

Zacks Investment Research

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

Let's take a look at what these Wall Street heavyweights have to say about SoundHound AI, Inc. before we discuss the reliability of brokerage recommendations and how to use them to your advantage.

SoundHound AI currently has an average brokerage recommendation of 1.67, on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell, etc.) made by six brokerage firms. An ABR of 1.67 approximates between Strong Buy and Buy.

Of the six recommendations that derive the current ABR, four are Strong Buy, representing 66.7% of all recommendations.

Brokerage Recommendation Trends for SOUN

While the ABR calls for buying SoundHound AI, it may not be wise to make an investment decision solely based on this information. Several studies have shown limited to no success of brokerage recommendations in guiding investors to pick stocks with the best price increase potential.

Do you wonder why? As a result of the vested interest of brokerage firms in a stock they cover, their analysts tend to rate it with a strong positive bias. According to our research, brokerage firms assign five "Strong Buy" recommendations for every "Strong Sell" recommendation.

This means that the interests of these institutions are not always aligned with those of retail investors, giving little insight into the direction of a stock's future price movement. It would therefore be best to use this information to validate your own analysis or a tool that has proven to be highly effective at predicting stock price movements.

Zacks Rank, our proprietary stock rating tool with an impressive externally audited track record, categorizes stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), and is an effective indicator of a stock's price performance in the near future. Therefore, using the ABR to validate the Zacks Rank could be an efficient way of making a profitable investment decision.

ABR Should Not Be Confused With Zacks Rank

In spite of the fact that Zacks Rank and ABR both appear on a scale from 1 to 5, they are two completely different measures.

The ABR is calculated solely based on brokerage recommendations and is typically displayed with decimals (example: 1.28). In contrast, the Zacks Rank is a quantitative model allowing investors to harness the power of earnings estimate revisions. It is displayed in whole numbers -- 1 to 5.

It has been and continues to be the case that analysts employed by brokerage firms are overly optimistic with their recommendations. Because of their employers' vested interests, these analysts issue more favorable ratings than their research would support, misguiding investors far more often than helping them.

On the other hand, earnings estimate revisions are at the core of the Zacks Rank. And empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock price movements.

Furthermore, the different grades of the Zacks Rank are applied proportionately across all stocks for which brokerage analysts provide earnings estimates for the current year. In other words, at all times, this tool maintains a balance among the five ranks it assigns.

Another key difference between the ABR and Zacks Rank is freshness. The ABR is not necessarily up-to-date when you look at it. But, since brokerage analysts keep revising their earnings estimates to account for a company's changing business trends, and their actions get reflected in the Zacks Rank quickly enough, it is always timely in indicating future price movements.

Should You Invest in SOUN?

Looking at the earnings estimate revisions for SoundHound AI, the Zacks Consensus Estimate for the current year has increased 9.1% over the past month to -$0.30.

Analysts' growing optimism over the company's earnings prospects, as indicated by strong agreement among them in revising EPS estimates higher, could be a legitimate reason for the stock to soar in the near term.

The size of the recent change in the consensus estimate, along with three other factors related to earnings estimates, has resulted in a Zacks Rank #1 (Strong Buy) for SoundHound AI. You can see the complete list of today's Zacks Rank #1 (Strong Buy) stocks here

Therefore, the Buy-equivalent ABR for SoundHound AI may serve as a useful guide for investors.

Zacks Investment Research

SoundHound AI stock is a bellwether in the fast-growing voice artificial intelligence (AI) market that has attracted plenty of attention in the past year. Consequently, SOUN stock is up north of 132% year-to-date (YTD). However, with the incredible run-up in SoundHound AI stock, some would feel its ascent may be a bit overstretched. Yet, its extensive order backlog, dynamic partnerships in lucrative niches, and strides toward a robust moat underscore its potential. Hence, SoundHound AI stock is a buy, offering a healthy upside ahead.

Adding to its bull case, the company recently announced an agreement to repay its $100 million debt early. The deal allows SoundHound to effectively slash early payment costs while freeing up $14 million in restricted cash. Additionally, it will enable the firm to save upwards of $55 million in interest and fees.

Now debt-free, SoundHound has the impetus to continue enhancing and broadening its partnerships, as we explore in the following sections.

Strategic Alliances: Strengthening SoundHound’s Competitive Edge

With the growing competition in the voice AI space, companies like SoundHound must impress investors with major partnerships — and it has done exactly that. Moreover, the experience helps, considering it has been in the business for over 20 years.

SoundHound’s voice AI technology is making waves, particularly in the service and automotive industries. For instance, its sophisticated voice AI technology has effectively revamped fast-food operators White Castle’s drive-thru experience and Jersey Mike’s fast-food phone ordering system. This strategic deployment has cut operational costs for both fast-food players and added significantly to their service speed and accuracy.

Its breakthroughs are perhaps more pronounced in the automotive industry, where its AI-powered offering transforms the clunky in-car voice assistant landscape. The much-talked-about partnership with Stellantis to add ChatGPT to its plethora of car brands has set new standards for in-vehicle interactions.

The initiative has resulted in a massive sixfold increase in usage and a 50% increase in interaction frequency in the automobile giant’s luxury DS brand. Additionally, SoundHound has partnered with Nvidia to implement voice-enabled generative AI on NVIDIA DRIVE platforms. Nvidia has been making major in-roads in autonomous technologies and has partnered with some of the biggest automotive brands. SoundHound could tap into even bigger market growth opportunities as the DRIVE platform continues to evolve.

Democratization of Voice AI: Leveling the Playing Field

The voice AI arena is a playground of opportunity, which has everything to do with the commoditization of key technologies such as speech recognition, natural language processing, and text-to-speech. With these tools becoming more affordable and accessible with every passing day, the barriers to entry in the niche are remarkably low, spelling trouble for established players like SoundHound.

Additionally, the development journey has become much smoother, with the top tech giants offering powerful development platforms studded with pre-built models and APIs. On top of that, you have an array of open-source resources, cutting development costs and complexity, allowing the smallest startups to bring fresh, innovative products to the market.

However, despite the competition, SoundHound has held its own and shown why it’s a standout player in its niche. The subscriptions and bookings backlog for the firm is at a whopping $682 million, growing roughly 80% year-over-year (YOY) in the first quarter (Q1). Sales during the quarter were up 73% YOY to $11.6 million, with a GAAP gross margin up at a superb 60%.

Bottom Line on SoundHound AI stock

SoundHound AI is a powerful force in the voice AI space, buoyed by its strategic debt repayment and expanding partnerships. Perhaps the partnerships that stand out are with Stellantis and Nvidia in the automotive space, which could potentially add millions in incremental sales.

These partnerships also transform the company from a young fledgling AI startup to a household name for voice recognition software. As a result, the company’s prospects will likely improve over time, strengthening long-term growth.

Furthermore, with a significant order backlog and solid financial performance, SoundHound remains well-positioned for expansion, making it a compelling bet for investors eager to tap into the expanding voice AI industry. Thus, even though the stock has already experienced stunning growth for the year, I recommend it as a buy with more gas left in the tank.

On the date of publication, Muslim Farooque did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines

On the date of publication, the responsible editor did not have (either directly or

indirectly) any positions in the securities mentioned in this article.

Muslim Farooque is a keen investor and an optimist at heart. A life-long gamer and tech enthusiast, he has a particular affinity for analyzing technology stocks. Muslim holds a bachelor’s of science degree in applied accounting from Oxford Brookes University.

More from InvestorPlace

A Microsoft Office outage has workers annoyed as its causing problems with them being able to use the company’s services.

This newest outage is affecting Microsoft Office and the company’s Microsoft 365 services and features. The company is working to resolve these issues and is advising users to track the outage status from the admin center.

Unfortunately, many users on X are reporting that they can’t even access the admin center due to the outage. That resulted in Microsoft’s Azure Services support account chiming in. It noted that there are also issues with its service that may be hindering users.

Here’s what Mircosoft said about the problems in a post on X.

“We’ve applied mitigations and rerouted user requests to provide relief. We’re monitoring the service to confirm resolution and further information can be found at https://status.cloud.microsoft or under MO842351 in the admin center.”

Microsoft Office Outage: What Happens Next?

It looks like the problems are clearly on Microsoft’s end. That means there’s not much users can do until the company sorts the matter out. Those looking for further updates can find them under the MO842351 ticker in the admin center, so long as they can get to it with the ongoing outage.

It’s also worth noting that this comes not too long after another outage affected Windows computers. Granted, that one was the fault of CrowdStrike pushing out a bad update to users of Microsoft’s operating system.

Investors looking for more of the biggest stock market stories today are in luck!

We have all of the hottest stock market news traders need to know about on Tuesday! That includes everything happening with Cassava Sciences , SoundHound AI and CNS Pharmaceuticals C stock today. All of that info is ready to go at the links below!

On the date of publication, William White did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

More from InvestorPlace

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up