Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

SoSoValue, a crypto market data provider best known for its ETF data tracking daily inflows and outflows, is set to airdrop a total of 49 million SOSO tokens for the first season.

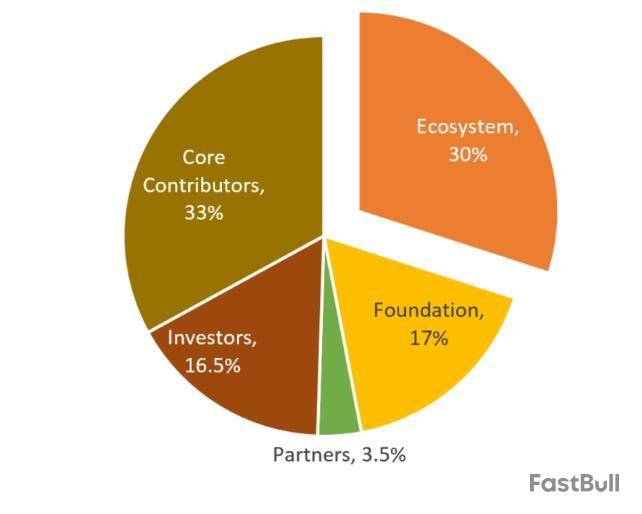

This allocation represents 4.9% of the total supply of 1 billion tokens, SoSoValue co-founder Jessie Lo told The Block in an interview. The majority of the airdrop comes from the platform's 30% ecosystem allocation, Lo said.

SoSoValue token allocation details; Source: SoSoValue

The airdrop is divided into three parts: 4 million SOSO tokens via crypto exchange Bybit's Launchpool platform; 15 million tokens under the proof of work (PoW) program, distributed at the token generation event; and 30 million tokens for proof of stake (PoS) rewards during Season 1, scheduled from Jan. 25 to Feb. 25.

"The Bybit Launchpool allocation comes from the foundation's 17% share, while the PoW and PoS distributions are drawn from the ecosystem allocation," Lo said.

SoSoValue token launch details

SoSoValue will launch its token next week on Ethereum, with Bybit as the first exchange to exclusively list the token, Lo said — adding that additional exchange listings will follow.

The snapshot for the PoW program, which allocates 15 million tokens, has already been taken today, Lo said. These tokens have no vesting period, meaning they can be liquidated as soon as the token is launched, she added.

The PoS portion of the airdrop, totaling 30 million tokens, will take place after the token launch and will be distributed over a 31-day period, Lo said. The PoS rewards are tied to SoSoValue's recently launched index tokens, and users will need to purchase these tokens, earn experience points (EXP) and meet eligibility criteria to participate in the airdrop.

Regarding future airdrops from the remaining 255 million tokens allocated to the ecosystem pie, Lo said that further details will be announced at a later date. However, she emphasized that all future distributions are intended to benefit the SoSoValue community.

SoSoValue's token launch details follow its recent $15 million Series A funding round at a $200 million valuation, which reflects the platform's fully diluted token valuation, as The Block reported last week. This marks a 300% increase from its $50 million post-seed valuation in June last year.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2024 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

De bekende Solana meme coin, dogwifhat (WIF), is vandaag met zo’n 8% gestegen naar $1,85. Momenteel ligt hij onder een sterke resistance, maar als hij hier bovenuit weet te breken, kan de meme coin met nog eens 50% stijgen.

Is WIF klaar voor een comeback of zal hij zijn downtrend voortzetten? De huidige crypto hype – die lijkt toe te nemen – geeft dogwifhat een kans om te exploderen in de komende dagen en weken.

Gaat dogwifhat verder stijgen? Dit zeggen de on-chain signalen

De interesse in meme coins zoals dogwifhat is weer aan het stijgen, een veel-voorkomend fenomeen wanneer de crypto markt stijgt. Wanneer grote cryptomunten stijgen, neemt het vertrouwen en risicotolerantie van investeerders toe.

Dit zorgt ervoor dat meme coins, de meest speculatieve crypto’s op de markt, ook stijgen. Dankzij hun volatiliteit, kunnen meme coins veel harder stijgen dan grote cryptomunten.

In de onderstaande grafiek van Coinglass is te zien hoe het aantal long posities voor WIF vandaag is toegenomen. Momenteel ligt de verhouding op 1,05, met 51% long-posities. Dit betekent dat WIF vandaag wellicht verder kan stijgen.

Op Binance heeft zo’n 80% van het aantal traders een long-positie in WIF/USD perpetuals. Dit is een teken dat traders op Binance rekenen op verdere stijgingen

Momenteel lijken bullish traders en investeerders de macht te hebben, wat WIF kan helpen om vandaag een breakout te maken boven een belangrijke resistance.

WIF koers klaar voor 50% rally

dogwifhat ligt momenteel op een koers van $1,85, maar heeft nog veel in te halen na zijn daling van 28% in de afgelopen maand. Dit is ook positief voor investeerders die vandaag instappen, omdat er minder traders klaarstaan om met winst te verkopen.

Dit wordt verder versterkt door de Relative Strength index (RSI) van 47, die aangeeft dat WIF nog momentum aan het opbouwen is. Pas wanneer de RSI boven de 70 stijgt, neemt het risico voor een correctie toe, omdat meer traders dan met (hoge) winst kunnen verkopen.

De dogwifhat koers ligt vlak op zijn 30-daagse moving average (geel), een resistance die de meme coin sinds begin december heeft onderdrukt. Een breakout boven $1,85 kan het einde betekenen van de downtrend en het begin van een uptrend.

De volgende resistance ligt rond $2,20, gevormd door de piek van begin deze maand en de 200-daagse moving average (blauw). Een stijging naar deze resistance betekent dat $WIF met 18% omhoog kan gaan. Maar een breakout boven dit niveau kan deze stijging uitbreiden tot 50% naar $2,75.

Na de hoge verkoopdruk die WIF heeft ervaren, lijkt dit een uitstekend moment om in te stappen, omdat de bodem wellicht al bereikt is. Als het sentiment van de markt vanaf vandaag weer opfleurt, staan er grote stijgingen te wachten voor WIF en andere meme coins.

Welke crypto meme nu kopen?

De stijging van populaire crypto memes zoals dogwifhat geven aan dat meme coins mogelijk klaar zijn voor een comeback. Dit is niet alleen positief voor grote meme coins met een market cap van $1 miljard of hoger, maar ook voor de kleinere memes. Kleine volatiele meme coins kunnen tijdens een meme coin rally voor hoge winsten zorgen.

In dit artikel kijken we naar 3 opkomende meme coins die veel aandacht hebben gekregen van investeerders. Dit, gecombineerd met een nieuwe rally voor meme coins, kan vroege investeerders mogelijk rijk maken in het eerste kwartaal van 2025. Vandaag kun je deze cryptomunten nog kopen tijdens de presale. Wall Street Pepe ($WEPE)

dogwifhat is niet de enige meme coin die deze week is gestegen. Zo maakt ook Pepe een sterke comeback met een stijging van bijna 9% in de afgelopen 24 uur. Dit is positief voor Wall Street Pepe ($WEPE), een van de grootste meme coin presales van het moment. $WEPE heeft tot zover al $50 miljoen opgehaald met zijn presale.

Na lancering wordt $WEPE vastgehouden door Diamond Hands, want token holders krijgen toegang tot een exclusieve community. Binnen deze community kun je gebruikmaken van elite trading inzichten. Afhankelijk van de kwaliteit hiervan, kun je veel geld verdienen door $WEPE vast te houden, maar kan de meme coin zelf ook veel waard worden.

Wall Street Pepe@WEPETokenJan 15, 2025With great memes comes great responsibility. pic.twitter.com/CmaoJ8z2tI

Koop $WEPE vandaag nog voor $0,00036649 per stuk en stake je tokens direct voor een APY van 25%. Omdat de presale sinds zijn lancering in december ruim $50 miljoen heeft opgehaald, zijn verwachtingen hoog dat de prijs gaat exploderen na de presale.

Nu naar Wall Street Pepe Flockerz ($FLOCK)

Een interessante community token om in januari in de gaten te houden is Flockerz ($FLOCK). Deze nieuwe meme coin heeft met zijn presale ruim $10,4 miljoen opgehaald. Volgende week zal de presale uitverkocht zijn. $FLOCK stelt zijn holders er toe in staat om geld te verdienen, dankzij zijn Vote-to-Earn mechanisme.

Een Decentralized Autonomous Organization (DAO) maakt het mogelijk voor communityleden om te stemmen op veranderingen binnen een project. De DAO van Flockerz is net iets anders, want hiermee verdien je $FLOCK tokens wanneer je je stem uitbrengt. Dit maakt Flockers gedecentraliseerd en lucratief voor gebruikers.

Flockerz@FlockerzTokenJan 16, 2025After the vote is over The Flocks still family! pic.twitter.com/P0bgz7Emzy

Investeerders die $FLOCK nog kopen voor $0,0066883 per stuk tijdens de presale, krijgen de gelegenheid om hun tokens te staken met een huidige APY van 269%. Dankzij zijn unieke verdienmodel voor token holders, heeft $FLOCK potentie om na lancering veel waard te worden.

Nu naar Flockerz Mind of Pepe ($MIND)

Mind of Pepe ($MIND) is een gloednieuwe presale die mee kan liften op de hype rondom meme coins als Pepe. Daarnaast profiteert het ook van de groei van AI. In zijn eerste paar dagen heeft de presale al bijna $2 miljoen opgehaald. Ontdek ook de kracht van deze opkomende AI tool, die traders en investeerders kan helpen nog meer geld uit crypto te halen.

De AI Agent van Mind of Pepe kan razendsnel gegevens en berichten van social media scannen. Hierdoor weet hij het huidige sentiment rondom verschillende tokens en kan hij deze inzichten samenvatten voor $MIND holders. Hierbij helpt de AI Agent token holders om cryptomunten te kopen voordat ze exploderen.

De voordelen die $MIND biedt, maakt het nieuwe project zeker een kleine investering waard voor geïnteresseerden. Je kunt $MIND vandaag kopen voor $0,0031384 per stuk. Als een van de eerste investeerders kun je deze tokens nog staken voor een huidige APY van 1049%. Dit staat gelijk aan zo’n 3% extra tokens per dag.

Nu naar Mind of Pepe

Despite Bitcoin experiencing a bullish rally, the prime altcoin, Ethereum , has lagged in relative terms. Ethereum has found the $3,800 price level, a critical resistance it has not breached in the past 30 days.

However, Sandeep Nailwal, the cofounder of Polygon, has made a bold and optimistic prediction about Ethereum’s future price movement.

Bold prediction from Polygon's cofounder

In a post on X, Nailwal contradicts the general sentiment about ETH on the cryptocurrency market. He believes a massive Ethereum pump is "around the corner and it’s going to absolutely melt faces."

Nailwal’s post suggests he expects a substantial price increase on Ethereum very soon. Notably, he anticipates ETH to rise at an astronomical pace once this bull rally kicks in.

Sandeep | Polygon (※,※)@sandeepnailwalJan 17, 2025Contrarian take : Ethereum pump is around the corner and its going to absolutely melt faces

The Polygon cofounder sounds so confident in his prediction of a price surge. He expects the price increase to be so dramatic as to leave more market participants in absolute shock.

Analysts say investors should carefully consider Nailwal’s prediction. They highlighted that Polygon, which he cofounded, was one of the first layer-2 protocols on Ethereum, so his optimism about ETH’s future outlook is not out of place.

As of this writing, ETH is changing hands at $3,405.51, a 2.16% increase in the last 24 hours. The trading volume has, however, dipped slightly by 1.07% to $27.25 billion.

The current price places Ethereum more than 30% away from its all-time high (ATH) of $4,891.70. The coin attained this ATH three years ago, on Nov. 15, 2021.

Catalysts for Ethereum's growth

Ethereum’s slow rise relative to Bitcoin has shocked many market observers, given that the blockchain has undergone several upgrades.

Additionally, Ethereum has a thriving L2 ecosystem, and many expect its price value to breach new levels as the market maintains its growth trajectory.

Nailwal may have factored these considerations into his prediction, particularly as Polygon just inked a partnership with India's multinational Reliance Jio. So, in his estimation, increased activities from this partnership and other L2 ecosystems could serve as a basis to drive up the value of ETH on the market.

Samson Mow, a vocal Bitcoin supporter and JAN3 chief executive officer, has published a tweet to take a jab at those critics who doubted BTC’s ability to skyrocket to $100,000 and surpass Saudi Aramco by market capitalization size.

He published a tweet with a “quote” that seems to be made up of multiple doubts expressed publicly by various Bitcoin critics when the world’s largest cryptocurrency traded at $10,000. But Mow said that it was one NPS analyst, without revealing the name.

Bitcoin surpassed Saudi Aramco, Mow reminds us

Mow published a tweet that he stated was originally issued by “some random NPC analyst from the past.” The tweet shares the author’s doubts that Bitcoin would ever be able to see an increase from $10,000 to $100,000. This, the BTC critic said, would “make it the 7th largest asset by market cap, ahead of Saudi Aramco.”

“If you’re going to make price predictions at least base them on reality,” he added. Overall, if this was indeed a quote by an analyst, it may be one from a Twitter conversation between him and Mow, but the latter did not share any details.

In a comment, Samson Mow published a screenshot that shows that Bitcoin is currently, indeed, the seventh largest asset in terms of market capitalization size, and the Saudi Aramco oil refineries sit in eighth place, right after BTC. Amazon, Alphabet (the Google parent company), Microsoft and Apple are ahead of Bitcoin on the list.

Bitcoin skyrocketing was not "hopium"

Earlier today, Mow published a similar quote from an anonymous analyst from the much more distant past, when Bitcoin was trading at $100. The analyst predicted that Bitcoin would “go from $100 to $150 this year” (which was likely 2013).

That analyst stated that hitting $1,000 for BTC would be “10x” (as in the tweet above), and that it was, according to the analyst, “just not possible.” He assumed that the maximum possible price for Bitcoin would be $200 but not $1,000. Those who believed it would go much higher were “just smoking pure hopium,” he stated.

Samson Mow@ExcellionJan 16, 2025“Yeah, my prediction is that #Bitcoin will go from $100 to $150 this year. Hitting $1000 would be a 10x and that’s just not possible. It might top out at $200 if things get frothy, but $1000? Those guys are just smoking pure hopium.”

At the time of this writing, Bitcoin is changing hands at $102,221 after staging a 2.13% rise over the last 24 hours. Over the past week, BTC has surged by more than 12%, rising from $90,680 to the current $102,200 zone.

OPENING CALL

Stock futures rose on Friday and both the Dow industrials and S&P 500 looked set for their largest weekly gain since the presidential election, when Donald Trump's victory sent stocks soaring.

Among the gainers were chip makers and cryptocurrency stocks, with the latter helped by bitcoin 's resurgence above $100,000.

Overseas, indexes in China edged higher after the country said its economy expanded 5% last year , following a barrage of stimulus.

In Europe, the U.K. pound and bond yields weakened after disappointing retail-sales data .

Premarket Movers

Apple was up 0.6% after dropping 4% on Thursday. The company fell to third place in terms of market share in China, according to data from research firm Canalys, as domestic manufacturers took advantage of Apple's lack of artificial-intelligence features available on phones purchased in the country.

Cloudflare rose 3.4% after Citi analysts upgraded shares of the cloud computing company to Buy from Neutral and raised their price target on the stock to $145 from $95.

MoonLake Immunotherapeutics was rising 4.9% after Goldman Sachs upgraded the stock to Buy from Neutral with a price target of $82.

Plug Power gained 2.9% after it closed a $1.66 billion loan guarantee from the Energy Department, which the company said would be used to construct up to six U.S. projects to produce and liquify zero- or low-carbon hydrogen.

Rivian Automotive said it closed a loan agreement with the U.S. Department of Energy for up to $6.6 billion to support construction of a new manufacturing facility in Georgia. Shares rose more than 3% premarket.

Activist investor Starboard Value has built a 7.7% stake in chip maker Qorvo, WSJ reported. Qorvo's shares rose in off-hours trading. Other chip makers also gained, with Nvidia and Broadcom each rising more than 1%.

Postmarket Movers

J.B. Hunt Transport Services defied a weak U.S. freight market to post a higher profit in the fourth quarter, although overall revenue fell as lower revenue per load more than offset volume gains. Shares fell 9.3%.

Nukkleus said it regained Nasdaq compliance and will continue to be listed and traded on the exchange. Shares rose 48%.

Versus Systems said it plans to expand its operations to Brazil. Shares rose 31%.

Watch For:

Housing Starts for December; Industrial Production and Capacity Utilization for December; Earnings from State Street, Regions Financial, Citizens Financial

Today's Top Headlines/Must Reads:

- Trump's Own Plans Stand in the Way of Repeating His Economic Success

- Trump Could Kick Off the Trade War Next Week. Why Markets Might Not Be Ready.

- Meta Going Down Twitter's Path Won't End the Same Way

- Inside the Early Days of DOGE

MARKET WRAPS

Forex:

The dollar rose, rebounding slightly after recent falls. Investors are looking ahead to Trump's inauguration on Monday and the prospect of tariffs and growth-boosting measures such as tax cuts.

These are expected to be inflationary and should boost the dollar. "For now, the dollar may stay in a holding pattern, retaining its overvaluation against some tariff-sensitive currencies," ING said.

"Despite stretched positioning and short-term overvaluation, the dollar continues to dodge true catalysts for a correction." Trump could spark volatility in currencies next week, ING said.

Sterling weakened against the dollar and euro after data showed U.K. retail sales unexpectedly fell.

December is typically a good month for retailers due to the Christmas period and these figures could increase the likelihood of an interest-rate cut by the Bank of England next month.

"Despite the festive season, consumers tightened their belts, with ongoing financial pressures and caution around the cost of living weighing heavily on spending," Ebury said.

Meanwhile, falling bond yields, prospects of more interest-rate cuts by the ECB and concerns about high debt levels in many eurozone countries are likely to keep the euro under pressure, Swissquote Bank said.

Traders are looking to sell the euro at levels above $1.0300, it added.

Bonds:

Reactions to the latest jobs and inflation reports show how sensitive the Treasury market is to macro data, SEB Research said.

"With the Fed likely on hold for some time, volatility looks set to continue for months to come."

SEB Research sticks to its end-2025 forecast of 4.75% for the 10-year Treasury yield.

Additionally, SEB Research said that as federal debt is projected to increase significantly relative to GDP in the coming years, there could be structural pressure for a continued rise in the term premium.

"Over time this will result in bond yields, especially longer tenors, rising by more than would be justified by short rate expectations alone."

That said, SEB Research forecasts short-rate expectations, rather than the risk premium, to remain the primary driver of long yields through 2025.

Energy:

Oil prices were on track for weekly gains of more than 2%, boosted by supply disruption concerns following the latest round of U.S. sanctions against Russia.

"From a technicals point of view, the market is in overbought territory and so overdue a correction," ING said.

"However, mounting supply risks continue to provide broad support to oil prices." The market now awaits the return of Trump to the White House for more clarity on trade tariffs and potential sanctions on Iran and Venezuela.

Trump's Treasury Secretary pick Scott Bessent said he would support tightening sanctions against Russia, especially on oil majors, in an effort to end the war in Ukraine.

Metals:

Gold futures slipped, but remained up on week. Despite the downward correction early in the session, the precious metal looked set to end the week up 0.8%.

This reflects a combination of safe-haven demand ahead of Trump's inauguration and U.S. economic data sparking some renewed optimism for monetary policy easing, market watchers said.

That said, gold's potential gains have been capped by continued dollar strength over the past week, BMI said.

In the near term, BMI is bearish toward bullion, and expects spot gold to average $2,500 in 2025 amid a stronger dollar and a more hawkish Federal Reserve.

TODAY'S TOP HEADLINES

Google Search Is Doing Fine. Alphabet May Still Be in Trouble.

Alphabet has become something of a battleground stock. The skeptics maintain that Google Search will inevitably lose market share to artificial intelligence, with some seeing the search disruption already playing out in the form of AI search engines like Perplexity.

In a November Barron's cover story, my colleague Al Root made a compelling argument pushing back against those bears, providing multiple reasons why Google was unlikely to lose its dominant share of the search market anytime soon, thereby protecting the most important part of its $258 billion in annual ad sales.

SpaceX Starship Spacecraft Explodes During Test Flight

An uncrewed vehicle operated by SpaceX exploded during a test flight on Thursday, temporarily disrupting air travel as pieces of it streaked across the sky.

SpaceX launched its Starship rocket from a company site in Texas a little after 5:30 p.m. ET, the company's seventh mission of a powerful-but-still-experimental vehicle that consists of a booster that propels a spacecraft stacked on top.

Nintendo Shares Slump as Switch 2 Announcement Underwhelms

Nintendo shares fell sharply after the company said the much anticipated successor to its Switch console will go on sale later this year, disappointing investors with a lack of specifics and a design that feels more like an update than a reinvention.

Shares had closed at a new record on Thursday ahead of the Switch 2 announcement, building on the 26% gain last year amid growing expectations for the new hardware. On Friday, the stock fell as much as 7.2% before paring losses to close 4.3% lower at 9,181 yen, equivalent to $59.15. That was its biggest one-day percentage drop since end-September.

Trump May Privatize Fannie Mae and Freddie Mac. What It Means for Shareholders and Homeowners.

Wall Street has a pitch for Donald Trump: Cement your place in history as the "Art of the Deal" president with your biggest deal ever.

Hedge fund managers like Bill Ackman have built huge stakes in Fannie Mae and Freddie Mac, betting the government-sponsored entities will be privatized by the president-elect at some point in his second term. Trump has said he wants to do it. Now that he's taking office, some investors are betting it's just a matter of time and ironing out the details.

Israel Says Gaza Deal Reached, Putting Cease-Fire Back on Track

Israeli Prime Minister Benjamin Netanyahu said negotiators have reached an agreement on a cease-fire in the Gaza Strip that would free Israeli hostages, ending two days of debate that had underscored the pact's fragility.

The prime minister, who had accused Hamas of reneging on parts of an agreement originally announced Wednesday, said the country's security cabinet would meet to approve the deal Friday and that the full cabinet would be convened later to vote on it.

Biden Issues Flurry of Executive Orders in Final Days. Trump Might Roll Them Back.

WASHINGTON-In his final days in office, President Biden issued a flurry of orders to rein in offshore drilling for fossil fuels, accelerate the build-out of data centers for artificial intelligence and promote cybersecurity against hackers.

The moves enacted sweeping changes across major industries, affecting billions of dollars of corporate projects. Some are sure to face challenges in the first days of the Trump administration as the new president seeks to roll back regulations he has said stifle economic growth.

Trump Ready to Bypass Congress on Border and Tariffs WASHINGTON-Days before his inauguration, President-elect Donald Trump made clear in a two-hour private meeting with Senate Republicans that he wouldn't wait on them to start implementing his biggest policy priorities: overhauling the immigration system and dramatically reshaping the country's relationship with its economic allies and adversaries.

With the experience of governing and a better knowledge of the levers of power, Trump has drafted expansive plans for tariffs and border restrictions, the centerpieces of his 2024 campaign. He has already prepared roughly 100 executive orders, Trump told lawmakers in the meeting, and said he would press the limits of his presidential authority at times to go it alone on those issues, according to people who attended.

Write to ina.kreutz@wsj.com TODAY IN CANADA

Earnings:

Nothing scheduled

Economic Indicators (ET):

0830 Nov International Securities Transactions

Stocks to Watch:

Cameco Supports Resolution Reached by Westinghouse Electric in Intellectual Property Dispute With KEPCO and KHNP; Implementation of Agreement Establishes Framework for More Deployments That Benefit of Westinghouse, KEPCO and KHNP

---

Canadian Spirit Resources: CFO Greg Florence Has Resigned; Is Undertaking Search for New CFO

---

I-80 Gold Sets Pricing of Prospectus Offering at C$0.80; Expects to Use Proceeds for Development of Nevada Projects, Working Capital, General Corporate Purposes

---

Titanium Transportation Expands North American Footprint to Texas; Irving, Texas, Office Creates 12th Logistics Office

Expected Major Events for Friday

07:00/UK: Dec UK monthly retail sales figures

09:30/UK: Oct Card Spending statistics

10:00/ITA: Nov Balance of Payments

13:30/CAN: Nov International transactions in securities

13:30/US: Dec New Residential Construction - Housing Starts and Building Permits

14:15/US: Dec Industrial Production and Capacity Utilization

21:00/US: Nov Treasury International Capital Data

All times in GMT. Powered by Kantar Media and Dow Jones.

Expected Earnings for Friday

BOK Financial Corp (BOKF) is expected to report $1.99 for 4Q.

Broadway Financial Corp (BYFC) is expected to report for 4Q.

Capital Bancorp Inc (CBNK) is expected to report $0.24 for 4Q.

Chino Commercial Bancorp (CCBC) is expected to report for 4Q.

Citizens Financial Group (CFG) is expected to report $0.82 for 4Q.

DiDi Global Inc - ADR (DIDIY) is expected to report for Interim.

Environmental Tectonics Corp (ETCC) is expected to report for 3Q.

Evolv Technologies Holdings Inc (EVLV) is expected to report $-0.11 for 3Q.

Fastenal Co (FAST) is expected to report $0.48 for 4Q.

Fastenal Co (FAST) is expected to report.

First Quantum Minerals Ltd (FM.T,FQVLF) is expected to report for Full year.

Huntington Bancshares Inc (HBAN) is expected to report $0.31 for 4Q.

National American University Holdings Inc (NAUH) is expected to report for 2Q.

NexImmune Inc (NEXI) is expected to report for 3Q.

Regions Financial Corp (RF) is expected to report $0.55 for 4Q.

Schlumberger Ltd (SLB) is expected to report $0.88 for 4Q.

State Street Corp (STT) is expected to report $2.43 for 4Q.

Timberland Bancorp Inc (TSBK) is expected to report for 1Q.

Truist Financial Corp (TFC) is expected to report $0.88 for 4Q.

VOXX International Corp - Class A (VOXX) is expected to report for 3Q.

Video Display Corp (VIDE) is expected to report for 3Q.

Webster Financial Corp (WBS) is expected to report $1.35 for 4Q.

World Acceptance Corp (WRLD) is expected to report $1.96 for 3Q.

Powered by Kantar Media and Dow Jones.

ANALYST RATINGS ACTIONS

Advanced Micro Devices Cut to Peer Perform From Outperform by Wolfe Research

AT&T Raised to Buy From Hold by Argus Research

Ball Corp Cut to Underweight From Equal-Weight by Wells Fargo

BlackLine Raised to Buy From Neutral by Citigroup

Blue Owl Capital Raised to Buy From Hold by TD Cowen

CACI International Raised to Buy From Hold by Jefferies

Confluent Cut to Equal-Weight From Overweight by Morgan Stanley

Dana Raised to Buy From Neutral by UBS

Datadog Cut to Equal-Weight From Overweight by Morgan Stanley

DexCom Raised to Outperform From Neutral by Baird

DigitalOcean Raised to Overweight From Equal-Weight by Morgan Stanley

Edwards Lifesciences Cut to Underperform From Peer Perform by Wolfe Research

Enphase Energy Cut to Hold From Buy by Truist Securities

First Solar Raised to Buy From Neutral by Seaport Global

Freshworks Raised to Outperform From Perform by Oppenheimer

Ingram Micro Holding Raised to Overweight From Equal-Weight by Morgan Stanley

Intapp Cut to Neutral From Buy by Citigroup

Netflix Raised to Buy From Neutral by Seaport Global

OneStream Raised to Overweight From Equal-Weight by Morgan Stanley

Paycor HCM Cut to Hold From Buy by Truist Securities

Paylocity Holding Raised to Buy From Neutral by Citigroup

Regeneron Pharma Cut to Neutral From Buy by UBS

Rockwell Automation Raised to Overweight From Equal-Weight by Stephens & Co.

Southwest Airlines Cut to Sell From Neutral by Citigroup

Under Armour Cut to Hold From Buy by Argus Research

United Parcel Service Raised to Buy From Neutral by B of A Securities

This article is a text version of a Wall Street Journal newsletter published earlier today.

Dogecoin is on the rise, with the dog-themed coin rising nearly 11% to a high of $0.419 in the early Friday session — the highest price recorded for DOGE in nearly five weeks. The spike coincides with renewed bullish momentum on the overall cryptocurrency market, with altcoins showing price increases as Bitcoin returns above $100,000.

Following a marketwide slump on Monday that saw Bitcoin temporarily dip below $90,000 and other digital assets see significant losses, the markets began to recover following positive U.S. inflation data. Daily Chart, Courtesy: TradingView">

At the time of writing, DOGE was up 10.03% in the last 24 hours to $0.411. Dogecoin started to rise after hitting support at lows of $0.30 on Jan. 13. The dog coin is currently on track to mark four out of five days in the green since this date.

The recent rise has caused DOGE to gain ground above the closely monitored 50-day SMA at $0.3714, signaling a bullish bias. The surge has left traders speculating whether DOGE is set for a more extended rally if the current price shift above the daily SMA 50 results in sustained positive momentum.

Is this just the beginning?

January has historically been the best-performing month for Dogecoin, with an average return of 85%, despite outlier performances of 250% and 700% in 2014 and 2021, respectively. It has a median performance of 5%, which is the second highest after 8% in October. So far, Dogecoin is up nearly 30% this January.

According to Ali, a crypto analyst, during the latest bull cycle, Dogecoin began its second leg up on Jan. 25, 2021, following a 56% price correction. DOGE has lost 46% of its value in recent weeks. Ali predicts that if history repeats itself, Dogecoin's next leg up might begin shortly.

Some might reach $1 in 2025, which is nearly 45% more than the coin's all-time high of $0.737 reached in May 2021. "Dogecoin will finally hit $1, with the world’s largest and oldest meme coin touching a $100 billion market cap," Galaxy Digital's Head of Research Alex Thorn stated in a year-end market prediction post.

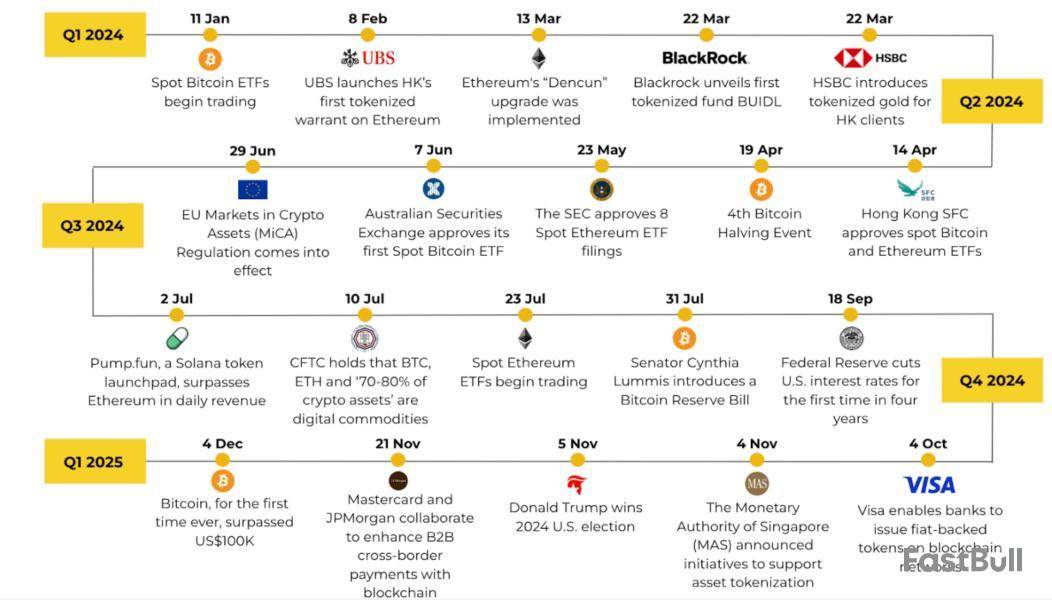

Bitcoin-based decentralized finance applications saw a breakout year after in 2024 after April’s Bitcoin halving, with the industry’s value experiencing an over 22-fold increase driven by infrastructure development and soaring Bitcoin prices.

Bitcoin-based decentralized finance (DeFi), also known as BTCFi, is a new technological paradigm that aims to bring DeFi capabilities to the world’s first blockchain network.

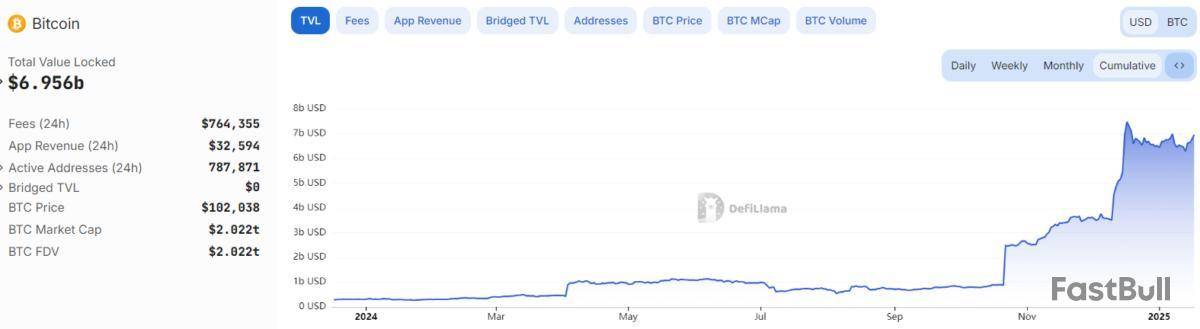

The total value locked (TVL) in Bitcoin saw an over 2,000% increase during 2024, from $307 million in Jan. 2024, to above billion to over $6.5 billion on Dec. 31, 2024, DefiLlama data shows.

The 2,000% increase marks a “breakout year for the sector,” according to Binance Research.

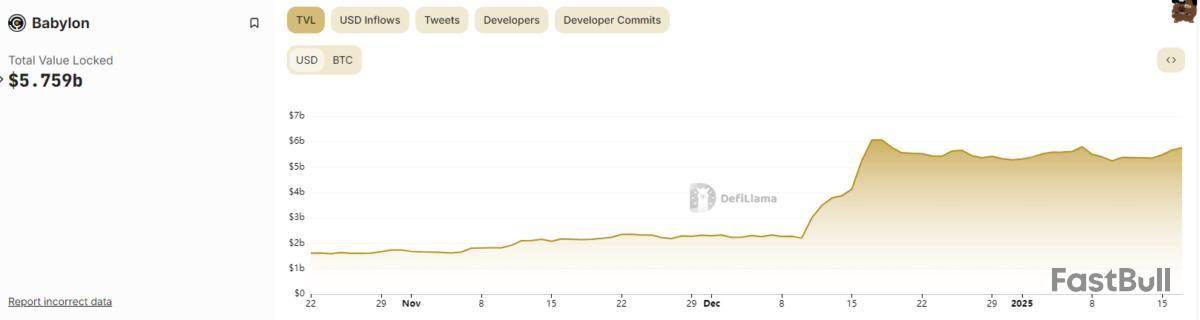

The increase is mainly attributed to growing developments around Bitcoin staking and restaking platform Babylon, which controls over 80% of TVL in BTCFi, Binance Research told Cointelegraph:

Babylon was seen as a significant opportunity for Bitcoin-based DeFi, thanks to introducing Bitcoin-native staking for the first time in crypto history.

Babylon’s TVL soared 222% in two months, from $1.61 billion on Oct. 22, to over $5.2 billion on Dec. 31, 2024.

Interest in building DeFi capabilities on the Bitcoin network has been growing since the 2024 Bitcoin halving, which introduced the Runes protocol — the first fungible token standard on the Bitcoin blockchain.

Bitcoin ETFs and soaring crypto valuations: a net positive for BTCFi

The debut of the US spot Bitcoin exchange-traded funds (ETFs) was “historically successful,” adding significant momentum to Bitcoin price and the wider Bitcoin DeFi movement, according to a research report by Binance, published on Jan. 17.

The ETF approval attracted a new source of institutional demand for Bitcoin, which helped Bitcoin’s price rise over 121% last year, significantly contributing to the growth of the BTCFi sector.

Bitcoin surpassed the $100,000 record high on Dec. 5, just a month after Donald Trump won the 2024 United States presidential election.

Bitcoin’s soaring valuation and growing popularity have invited more capital in Bitcoin-native DeFi applications, Binance Research told Cointelegraph:

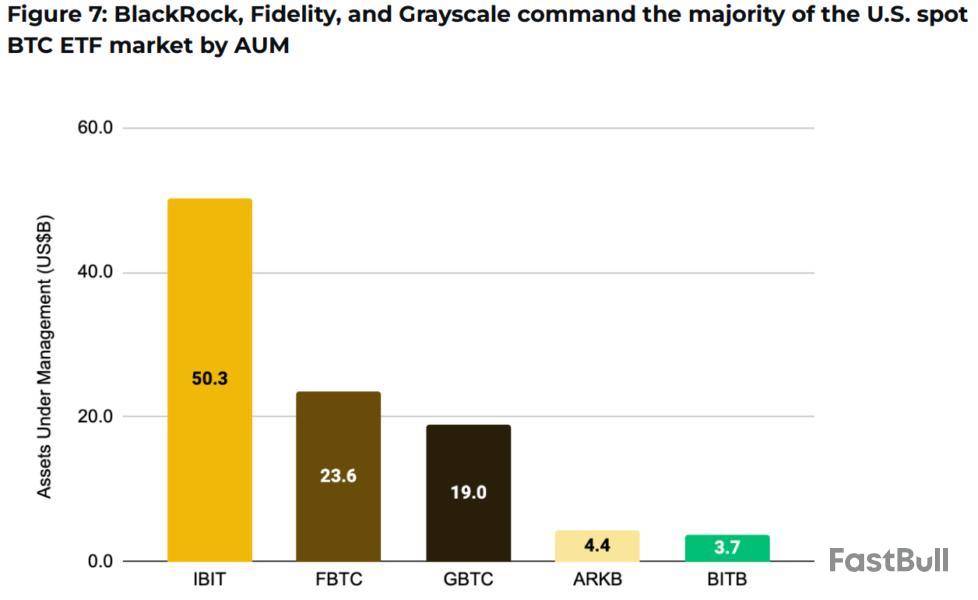

Flashing another optimistic sign for institutional adoption, the report revealed that the world’s largest asset manager, BlackRock, controls over 50.3% of the total assets under management (AUM) among all Bitcoin ETF issuers.

Fidelity is in second place, controlling over 23.6% of the US Bitcoin ETF market.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up