Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

By Alexander Osipovich

Starting Tuesday, some FTX customers are set to get their money back, more than two years after Sam Bankman-Fried's cryptocurrency exchange filed for bankruptcy.

Initial payouts starting this week will go to smaller customers with claims of less than $50,000. Ultimately, the bankruptcy estate plans to repay billions of dollars.

FTX collapsed in November 2022 after it couldn't fulfill a surge of customer-withdrawal requests. It emerged that Bankman-Fried's trading firm, Alameda Research, had tapped FTX client funds to fund risky trading strategies. Bankman-Fried was convicted of fraud and sentenced to 25 years in prison.

The bankruptcy estate has since raised funds to repay customers by selling off FTX's digital-token holdings and other assets, such as a stake in artificial-intelligence startup Anthropic, and by clawing back funds from crypto firms that did business with FTX.

The estate last year forecast creditors would get 118% of their funds back.

Getting full repayment of claims is unusual in bankruptcy. Many FTX customers were still unhappy, though, because payouts are calculated in dollars based on what their holdings were worth in November 2022-a low point for the crypto markets. Bitcoin and other digital currencies have since soared in price.

Some former customers have also expressed frustration, saying they haven't been able to provide sufficient documentation to be eligible to get their money back. To receive payouts, claimants must pass a know-your-customer process, to prove the funds they had on FTX weren't the result of illegal activity.

As of November, about 162,000 small claimants were approved to get payouts. An estimated 457,000 small claimants had valid claims but hadn't passed the verification process yet, according to a court filing by a consultant for the bankruptcy estate.

"Our team has been working relentlessly to deliver an efficient process for as many customers as we can," an FTX spokesperson said, noting there would be delays given the scale of the distributions.

"We must take every precaution to ensure that distributions are fully compliant with applicable Know Your Customer and anti-money laundering laws," the spokesperson added.

This item is part of a Wall Street Journal live coverage event. The full stream can be found by searching P/WSJL (WSJ Live Coverage).

The 'Future of Wallets Talk' includes key figures like the co-author of EIP-7702 and major blockchain projects. Discussions about wallet technology advancements could influence the perception and adoption of related cryptoassets. If new wallet features improve security or usability significantly, this could lead to broader adoption and drive up ACH and Arbitrum USDC prices. However, if discussions do not translate into immediate technological changes, short-term price impact might be minimal. This event could pique interest in Alchemy Pay and Arbitrum Bridged USDC as part of broader ecosystem improvements. For more information, visit the source.

Alchemy@AlchemyFeb 17, 2025When we take up an hour of your time, we make sure it’s worth it.

EIP-7702's co-author, two major chains, and the teams building and securing wallets come together to discuss how this changes everything.

From @Alchemy @cantinaxyz @ethereum @OffchainLabs @Optimism pic.twitter.com/Z4HKrD7W0y

KelVPN is set to list on BitMart with a KEL/USDC trading pair. Such listings often increase a cryptoasset's visibility and liquidity, which can boost its price. Increased access can attract new investors, pushing demand for KEL. If the listing on BitMart goes smoothly and garners trading interest, KEL might see a price increase. However, if the market shows little enthusiasm or if broader market conditions are unfavorable, the impact might be less significant. This event is noteworthy for potential price movement in the short term. More details are available in the source.

BitMart@BitMartExchangeFeb 18, 2025#BitMart is thrilled to announce the primary listing of KelVPN(KEL) @KelvpnNetwork

Trading pair: KEL/USDC

Deposit: 2/17/2025 4:00 PM UTC

Trading: 2/18/2025 4:00 PM UTC

Learn more: https://t.co/iH6x3dEyEi pic.twitter.com/NX1E0FbHad

Swell's announcement of a 125 million SWELL fund during the X Spaces event could have a noticeable price impact. The fund aims to boost restaking innovation, potentially increasing returns for users and attracting new investors. If the fund successfully drives technical and network growth, SWELL's value may rise due to increased usage and demand for the token. The market will watch closely to see if funds lead to significant milestone achievements. An effective event could build confidence and potentially uplift SWELL’s market price. Further details are available in the source.

Thrive Protocol@thriveprotocolFeb 17, 2025Last week we launched our 125M SWELL fund to accelerate restaking innovation on @swellnetworkio.

Join us live tomorrow at 8 AM EST / 1 PM UTC to learn how impactful builders can participate.

Set reminder https://t.co/0AwYUni5c9

Thrive Swellchain Builders =… https://t.co/aSskyEMWiM

By George Glover

XRP was among the cryptocurrencies falling Tuesday, putting digital assets on course to extend their recent bad run.

The token, which is used to settle and facilitate transactions on Ripple Labs' digital-payments platform, slid 3.6% to $2.59 in early trading. It's down 19% over the past month.

Bar a brief bout of speculation about the potential launch of an exchange-traded fund tracking XRP, the cryptocurrency has been going through a rough patch ever since U.S. President Donald Trump returned to the White House. The new administration is yet to follow through on Trump's campaign promise to establish a Bitcoin strategic reserve, which has left crypto bulls feeling disappointed.

Other cryptocurrencies were also falling Tuesday. Bitcoin slipped 0.3%, Ethereum fell 2.9%, and Solana was down 6.9%.

Write to George Glover at george.glover@dowjones.com

This content was created by Barron's, which is operated by Dow Jones & Co. Barron's is published independently from Dow Jones Newswires and The Wall Street Journal.

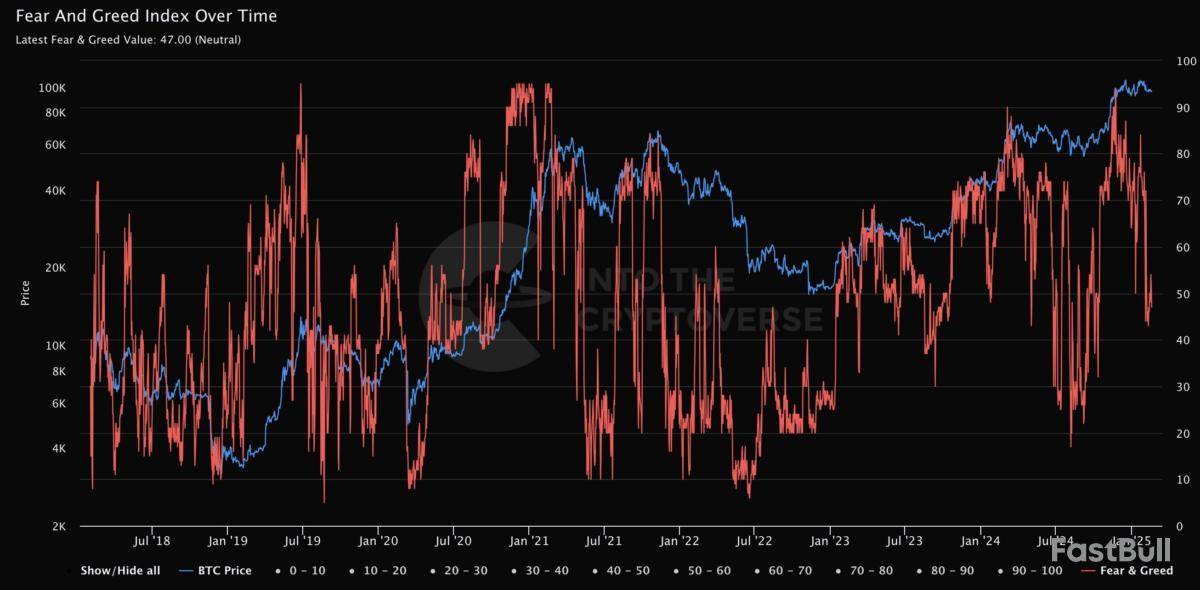

Finally, the Fear and Greed index for Bitcoin reached a neutral point, effectively resetting. The change in the index's behavior might improve the short-term outlook for the digital and open up a way to $100,000. The sentiment on the market is getting better, but if it falls further, it might not benefit the bullish momentum.

The stabilization close to neutral indicates that traders are hesitating and cautious about what will happen with Bitcoin next. Given that Bitcoin is still trading in a sideways consolidation range between $92,500 and $107,000, this lack of strong sentiment in either direction is consistent with recent price action. For weeks, Bitcoin has been stuck in a horizontal range without showing any discernible trend.

Fear and Greed Index">

Around $92,500, the lower support level and the upper boundary, which is close to $107,000, has served as resistance. The asset's midterm trajectory will be largely determined by a breakout in either direction. A rally toward the much-anticipated $100,000 milestone becomes feasible if Bitcoin can break above $107,000. In spite of this ambivalence, Bitcoin's future prospects are still bright. Significant breakouts frequently follow protracted consolidation phases, according to historical patterns.

A rebound in buying pressure driven by institutional interest or macroeconomic variables may push Bitcoin above its prior highs. Any bullish momentum could be delayed, though, if Bitcoin fails to hold important support levels and retests $90,000 or lower. The market may be cautious according to the Fear and Greed Index reset, but Bitcoin's technical setup is still sound.

Whether Bitcoin is prepared to push toward $100,000 or if more consolidation is required before the next significant move will be shown by a breakout from its current sideways channel. Key levels remain at around $100,000 and might be broken in a rapid fashion, so it is important to manage your local stop-losses.

The recent performance of XRP has attracted substantial attention, as its open interest has increased to $4.3 billion.

This surge has occurred in the context of a substantial price increase, with XRP reaching a one-week high of over $2.50. The resurgence indicates the potential for sustained momentum, which represents a departure from the decline observed in February.

XRP: Rebound In Open Interest

The recent increase in XRP’s open interest is indicative of the fact that a greater number of investors are making bets on the token’s ongoing expansion.

The open interest was approximately $7.86 billion as of mid-January. However, in the first week of February, it fell precipitously by half to almost $3.4 billion, data from Coinglass shows. This significant decline came after the altcoin’s price dropped to about $1.80 at the time.

On the other hand, new data shows a big recovery; as of February 16, the numbers had reached $4.30 billion.

Chad Steingraber@ChadSteingraberFeb 16, 2025XRP Open Interest is pumping up again.. now at $4.2Billion.

After dropping out… we’re ready to go! https://t.co/I5UbCtBj3r pic.twitter.com/4QWI9Y5aA4

At the time of this writing, the amount of open interest in XRP has stayed the same at around $4 billion. The increase in market participation frequently corresponds with the rise in open interest, which may induce price fluctuations.

Upward Trajectory Ahead?

The surge in the price of XRP, which reached $2.80, has been a significant factor in the overall increase in open interest. The price action of the past few days has substantiated speculations that XRP may continue its upward trajectory, with numerous market observers anticipating additional gains.

After a period of relative stagnation, the surge has occurred, and investors are now anticipating that the momentum will persist in the short term. Rising Market Sentiment

The rise in the open interest of XRP has made investor views on the altcoin more optimistic since traders assume positions depending on expected future profits.

Still, the market is wary and many investors are intently observing any signals of instability that can compromise this increasing trend.Looking Ahead: What’s Next For XRP?

Given the present strong levels of open interest, the issue of sustainability of this development comes first. Should XRP keep its current pricing, the open interest could keep increasing.

On the other hand, a fast unwinding of holdings could follow any significant price drop. Though the market is right now in a condition of expectation, XRP’s prospects seem to be cautiously bright.

The rising open interest in XRP and price spike suggest that the market is expecting more positive developments. Though the length of this trend is unknown, XRP should be on a good footing in the days or weeks ahead.

Featured image from 99Bitcoins, chart from TradingView

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up