Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)A:--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)A:--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key RateA:--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)A:--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)A:--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)A:--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)A:--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)A:--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)A:--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)A:--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)A:--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)A:--

F: --

P: --

Japan PPI MoM (Nov)

Japan PPI MoM (Nov)A:--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)A:--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)A:--

F: --

P: --

China, Mainland CPI YoY (Nov)

China, Mainland CPI YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Indonesia Retail Sales YoY (Oct)

Indonesia Retail Sales YoY (Oct)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

Italy 12-Month BOT Auction Avg. Yield

Italy 12-Month BOT Auction Avg. Yield--

F: --

P: --

BOE Gov Bailey Speaks

BOE Gov Bailey Speaks ECB President Lagarde Speaks

ECB President Lagarde Speaks South Africa Retail Sales YoY (Oct)

South Africa Retail Sales YoY (Oct)--

F: --

P: --

Brazil IPCA Inflation Index YoY (Nov)

Brazil IPCA Inflation Index YoY (Nov)--

F: --

P: --

Brazil CPI YoY (Nov)

Brazil CPI YoY (Nov)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

U.S. Labor Cost Index QoQ (Q3)

U.S. Labor Cost Index QoQ (Q3)--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. Federal Funds Rate Projections-Longer Run (Q4)

U.S. Federal Funds Rate Projections-Longer Run (Q4)--

F: --

P: --

U.S. Federal Funds Rate Projections-1st Year (Q4)

U.S. Federal Funds Rate Projections-1st Year (Q4)--

F: --

P: --

U.S. Federal Funds Rate Projections-2nd Year (Q4)

U.S. Federal Funds Rate Projections-2nd Year (Q4)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Budget Balance (Nov)

U.S. Budget Balance (Nov)--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Projections-Current (Q4)

U.S. Federal Funds Rate Projections-Current (Q4)--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Federal Funds Rate Projections-3rd Year (Q4)

U.S. Federal Funds Rate Projections-3rd Year (Q4)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

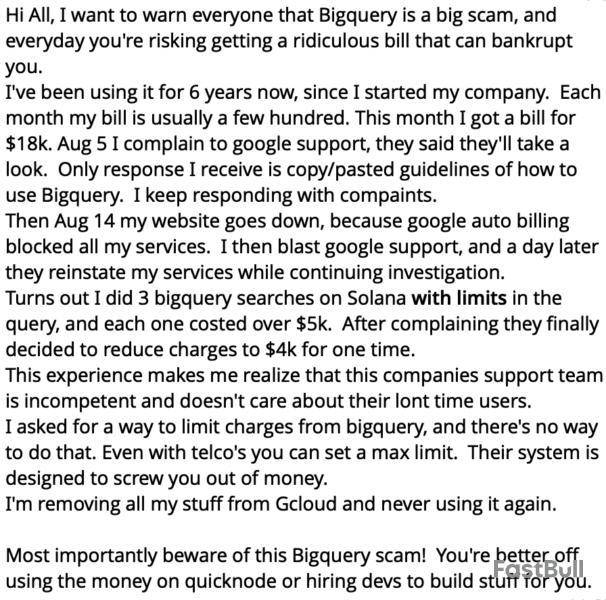

Blockchain developers are sharing "horror stories" related to eye-watering bills received from Google Cloud's BigQuery service, including a developer who was suddenly charged a total of $15,000 for performing three queries.

BigQuery is a serverless data warehouse offered by Google Cloud, designed for analyzing large sets of data via Structured Query Language (SQL) with built-in artificial intelligence (AI) capabilities.

“I want to warn everyone that BigQuery is a big scam and every day you’re risking getting a ridiculous bill that can bankrupt you,” wrote a pseudonymous developer in a post shared by Mikko Ohtamaa, co-founder of decentralized algorithmic trading protocol Trading Strategy, adding:

“Turns out I did 3 bigquery searches on Solana with limits in the query, and each one cost over $5k,” wrote the developer, adding that after complaining to Google support, the charges were reduced to $4k per query.

Multiple other crypto industry participants joined in, alleging predatory pricing mechanisms that don't allow the setting of monthly limits.

“They intentionally don't let you set hard stops,” responded Ermin Nurovic, co-founder of Flat Money synthetic dollar protocol, adding, “Your Google Cloud function got stuck in a recursive loop costing you thousands? Too bad.”

Solana integrated with Google Cloud’s BigQuery in October 2023, allowing users to query Solana blockchain data, such as whale transactions or NFT sales, through Google Cloud’s program, providing developers more transparent access to archived blockchain data via BigQuery analytics.

Second developer “horror story” emerges with another $5K charge

Adding to the concerns around the service’s billing mechanisms, a second pseudonymous developer emerged, who was charged $5,000 for “one query select from a Solana table,” which “accidentally” scanned multiple terrabytes of data.

“Thankfully that time, our company was connected to Google locally, which helped us escalate the issue and refunded us,” wrote the developer in the post shared by Ohtamaa.

Since the billing incident, the developer has never queried “any blockchain data in BigQuery without checking the partitions first.”

The developer added that this pricing model makes it unimaginable for AI algorithms to rely on BigQuery services.

Opinion by: Mitchell Amador, founder and CEO of Immunefi

Crypto’s best defense against catastrophic hacks isn’t code — it’s incentives. Bug bounties have prevented billions in losses, and it’s important to emphasize that these billions could have been exploits, not responsible disclosures, if the right incentives hadn’t been set up. This protection only works when the incentives for white hat behavior clearly outweigh those for exploitation, and current market trends are now tilting that balance in dangerous ways.

The scaling bug bounty standard means the reward size should grow with the amount of capital at risk. If a vulnerability could drain $10 million, the bounty should offer up to $1 million. These are life-changing incentives for security researchers to disclose rather than exploit, and they’re cost-effective for protocols compared to the devastating alternative of getting hacked. This scaling approach protects entire protocols from destruction and ensures the continual growth of onchain finance.

The problem is that market competition is warping these incentives. Some platforms are now tying their lowest-cost service plans to capped bounty rewards, sometimes no higher than $50,000. This pricing structure pressures protocols to minimize rewards and reduce costs, creating conditions for the next catastrophic hack.

Bug bounties as defense mechanisms

Cork Protocol’s recent $12-million hack offers a telling example. The protocol had set its critical bug bounty at just $100,000, a fraction of the funds at risk. This misalignment creates a simple economic calculation: Why spend hundreds of hours finding a vulnerability if the capped payout is 120 times lower than the exploit value? Such math doesn’t discourage exploitation; it encourages it.

Bug bounties are critical defense mechanisms that only work when they align with risk. When protocols with tens of millions in total value locked offer bounties in the low five figures, they’re effectively betting that hackers will choose ethics over economics. That’s not a strategy — that’s hope.

The million-dollar standard exists for a reason

Crypto’s security standards were forged through million-dollar moments. MakerDAO set a $10-million bounty that signaled what protection was worth. Wormhole’s $10-million payout after a critical exploit cemented the precedent that meaningful security requires meaningful incentives. Security researchers need life-changing reasons to choose disclosure over destruction in an industry where exploits can drain treasuries in minutes.

This scaling approach has demonstrably worked. When critical vulnerabilities can affect millions in user funds, bounties should offer proportional rewards, typically around 10% of the capital at risk. These economics help ensure the best researchers stay in the ecosystem and remain motivated to report vulnerabilities.

Market forces are creating dangerous precedents

The race to capture market share has led some platforms to compete on price rather than security outcomes. By linking platform fees to capped bounty rewards, they create a perverse incentive structure; protocols choose lower rewards to minimize costs, not because risk justifies it, but because pricing encourages it. This is a fundamental misunderstanding of what bug bounties are. They aren’t just expenses; they’re insurance policies whose value must scale with what they protect.

Worse, some security platforms now require exclusivity contracts that restrict where researchers can work. Others allow post-disclosure repricing that undermines researcher trust. These practices chip away at the social contract that makes bug bounties effective in the first place. If skilled researchers lose confidence in the system’s fairness, they have three options: stop hunting, shift to private audits or go dark.

The result is a chilling effect: Protocols cap rewards to cut costs. Researchers opt out because the upside isn’t worth the effort. Critical vulnerabilities go undetected. Exploits happen. Protocols cut security budgets further. It’s a death spiral that benefits no one except malicious actors.

A warning from Web2

The parallels to Web2’s bug bounty failures are troubling. There, chronic underpayment and poor treatment of researchers led many skilled white hats to abandon public programs entirely. Crypto can’t afford to make the same mistake, not when trillions in value are preparing to move onchain and institutions are watching closely.

Some argue that early-stage teams can’t afford large bounties. The truth is, however, that the cost of a successful hack will always exceed that of a well-aligned bug bounty. Losing funds is expensive. Losing trust is fatal.

The path forward requires industry coordination

Protecting crypto’s security infrastructure requires recognizing that bug bounties operate on trust and incentives. Every underpriced program weakens the social contract that keeps skilled researchers on the right side of the law.

The solution isn’t radical. Maintain bounty rewards that reflect actual risk. Ensure transparent, fair treatment of researchers. Resist the temptation to treat security as a cost center rather than a value driver.

Critically, platforms must stop incentivizing protocols to shortchange their own defense.

The decentralized economy only works when trust scales with it. If we want crypto to continue growing, with confidence from users, regulators and institutions alike, we need bounty systems that make sense, not just on paper, but in practice. Crypto thrives only to the extent that its defenders are empowered to act.

Opinion by: Mitchell Amador, founder and CEO of Immunefi.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Bitcoin may be hailed as digital gold on Wall Street, but when a real crisis hits, many will treat the cryptocurrency like fantasy play money, says Tezos co-founder Arthur Breitman.

But why on earth would a crypto builder of almost a decade say such a thing?

What about all the institutional money pouring in, the billions flowing into spot Bitcoin ETFs and its narrative as a safe-haven asset?

Breitman says no matter how strong the narrative, there will always be a cohort of Bitcoin holders who will drop it when times get tough.

If people are very uncertain about their economic future, the first thing they do is sell their funny internet money and their funny stocks, the 40-year-old Frenchman, now based in London, tells Magazine.

People might say it could be much more than funny internet money. Maybe so. But a lot of people own it on the basis that it is funny internet money; thats how they see it.

Bitcoin will always risk being a momentum asset

That doesnt mean Breitman thinks Bitcoins a joke by any means; hes just saying what many people wont admit aloud Not everyone can be truly won over by Bitcoin.

What the market is maybe lacking is really long-term fundamental buyers of Bitcoin who will basically smooth out these momentum cycles, Breitman says.

He points to the COVID-19 market crash in 2020, when Bitcoins price tanked in just days as investors fled amid global economic uncertainty.

The risks are always there because its a momentum asset, he says, explaining that more people tend to pile into Bitcoin when the price is rising.

Political uncertainty can have a similar effect. Fears around US President Donald Trumps executive order imposing tariffs on goods from China, Canada and Mexico in early February saw Bitcoin tumble below $100,000 for the first time in six days.

In April, Cointelegraph reported that numbers suggest Bitcoin is still perceived more as a speculative tech proxy and is yet to enter a new phase of market behavior.

Hype slowing down can also tip FOMO investors to panic. Breitman says:

At some point, you run out of buyers, and then it stops going up, and people say, Oh, my goodness. I thought I was buying an asset that goes up, and I was wrong. Its an asset that doesnt go up; I shall sell it.

Then everyone does, and it goes down, he says.

Breitmans unapologetic calls likely come from his time in quantitative analysis at Goldman Sachs and Morgan Stanley, where you sink if you dont speak up.

But dont mistake Breitman for a stereotypical crypto bro with Lamborghinis and private jets.

I can drive, but I dont. First of all, I live in London, says Breitman. Theres not much sense for me to drive, he laughs. Instead, Breitman leans into quieter passions.

I enjoy classical singing, piano, opera and programming in my spare time, Brietman says.

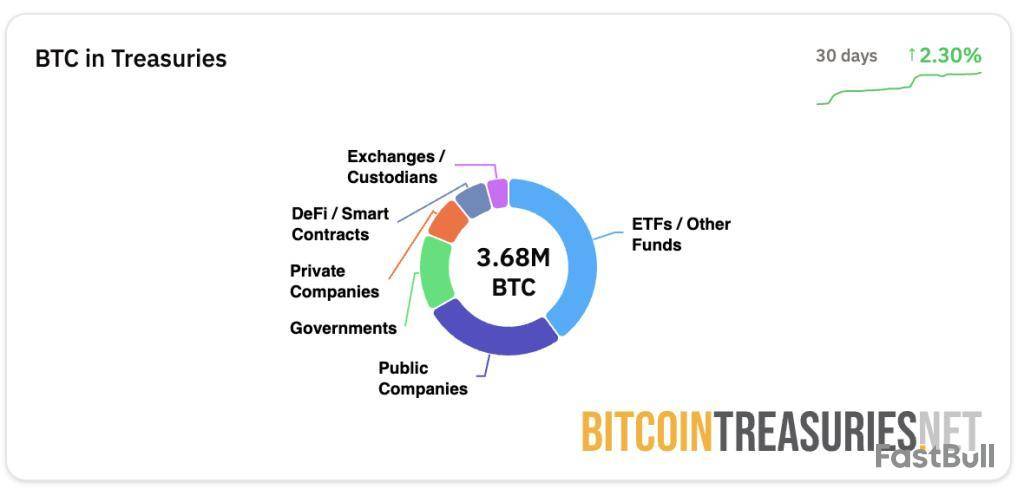

Bitcoin treasuries have risk for both the downside and upside

Breitman says one of the biggest risks for Bitcoin is the increasing number of companies adding it to their balance sheets.

They have risk on the downside and risk on the upside, Breitman says. Publicly traded Bitcoin treasuries hold roughly 984,971 BTC, worth approximately $110.97 billion at the time of publication, according to BitcoinTreasuries.NET.

The risk on the downside is that if you have a market pullback, I think a lot of people will also pull back from ownership of these stocks; as they do so, their premium will collapse, he says.

Breitman argues that the premiums propping up these Bitcoin treasury companies wont last forever. He says companies will be forced into a tough decision if the stock trades below book value. Once they collapse, panic selling will follow.

The natural thing to do would be to sell their assets and buy back their stock, he says.

Read also FeaturesBitcoin payday? Crypto to revolutionize job wages… or not

Features Terra hit us incredibly hard: Sunny Aggarwal of Osmosis LabsI think there will be tremendous shareholder pressure to do that, which further creates a sales spiral. So, thats a spiral you have on the downside. I think the premiums that those companies have are not sustainable, he says.

Venture capital firm Breed recently echoed Breitmans warning, predicting that only a few Bitcoin treasury companies will stand the test of time and avoid the vicious death spiral that will impact BTC holding companies that trade close to the NAV.

It was only in July when crypto analyst James Check said that his instinct is the Bitcoin treasury strategy has a far shorter lifespan than most expect.

Breitman says there is also risk on the upside, paradoxically, because a lot of these companies have been financing themselves with convertible debt.

Read also Features Longevity expert: AI will help us become biologically immortal from 2030 Features THORChain founder and his plan to vampire attack all of DeFiIf you look at it convertible debt its a little bit like selling covered call options, in a sense of, like, if they do too well, then the debt converts into the assets and then the upside gets clipped, Brietman says.

Breitman says it is a damn shame about Tezos ranking

Despite his controversial opinions about Bitcoin, Breitman is just as blunt about Tezos (XTZ), the native token of the open-source, self-upgradable blockchain platform he co-founded with his wife.

Once a top-10 cryptocurrency, Tezos has slid far down the rankings based on market capitalization, a reality that clearly frustrates him.

Number 88 of the 100 is fucking damn shame, Brietman says.

Its not hard to see why. Tezos was once among the industrys most promising projects, but now he watches as memecoins like Pepe, Dogecoin, Shiba Inu and FLOKI surpass it on the charts.

In 2021, Tezos reached an all-time high market cap of $7.2 billion. By the time of publication, it had shrunk to just $883 million, according to CoinMarketCap.

Thankfully, Tezos still manages to sit three spots above Fartcoin.

At the end of the day, these things trade on sentiments, Breitman says.

Even when they have so-called protocol revenues, this is largely sensitive and hype-driven, Breitman says.

However, Breitman says Tezos back in the top 20 would be a good place to be now as altcoins finally start to look promising again.

Subscribe The most engaging reads in blockchain. Delivered once a week.Email address

SUBSCRIBE

Bitcoin is teasing a breakdown below old all-time highs at $109,300 — where will BTC price action head next?

Crypto traders are ready with BTC price targets as bulls nurse a 13% pullback from all-time highs.

Bitcoin’s key trendlines in danger

Bitcoin’s latest dive took below previous all-time highs first seen in January 2025.

That psychological level now hangs in the balance, but is not the only nearby level that observers are concerned about.

Various simple (SMA) and exponential (EMA) moving averages risk getting flipped from support to resistance as price struggles to halt its decline.

“BTC has broken below the 100 EMA on the daily chart. That’s not a good sign and could open the door for a deeper correction toward $103K,” popular trader Cryptorphic warned in an X post Tuesday.

Data from Cointelegraph Markets Pro and TradingView shows the 100-day EMA at $110,820.

The 200-day SMA, meanwhile — a classic bull market support line — sits lower at just under $101,000. The last time that traded below that trend line was in mid-April.

Speculators tipped as BTC price safety net

As Cointelegraph continues to report, some market participants have much lower BTC price targets in mind.

These include a retest of the $100,000 mark and even a drop back into five-figure territory. This is thanks to a combination of weakening onchain metrics such as trade volume and relative strength index (RSI) divergences.

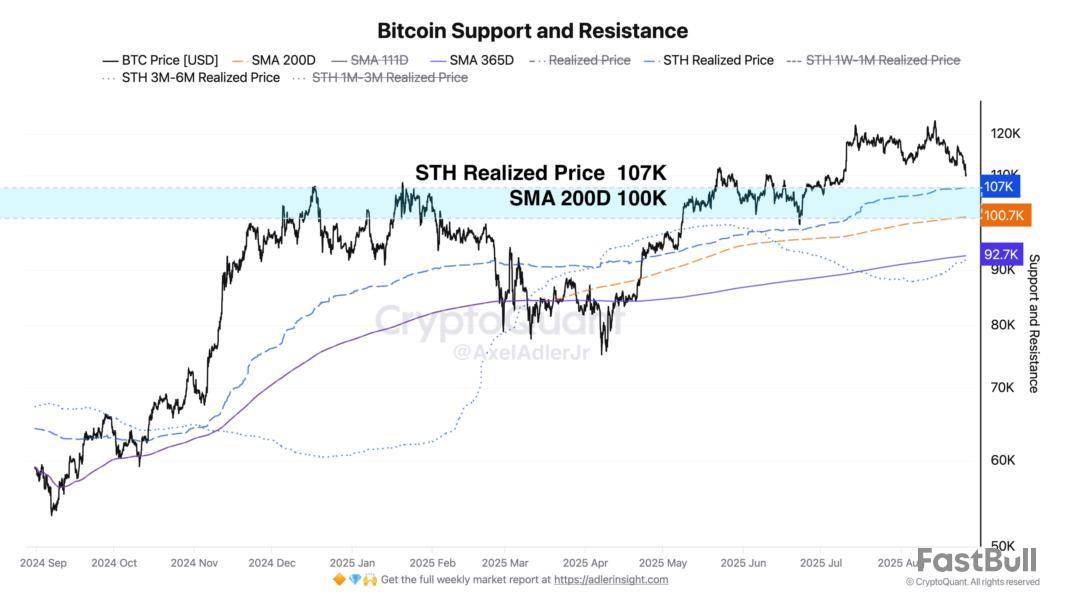

For Axel Adler Jr., a contributor to onchain analytics platform CryptoQuant, Bitcoin’s speculative investor base may be what saves the market.

“The nearest strong support zone is the 100K–107K range, where the STH Realized Price and SMA 200D intersect,” he noted Tuesday.

Adler referred to the aggregate cost basis of short-term holders, defined as entities hodling for six months or less. In bull markets, this cost basis often functions as support during pullbacks.

“Below that is additional support around 92–93K, a deeper support level reflecting the cost basis of short-term investors who held coins for 3 to 6 months. This will become a key second line of defense if the market loses the 100K–107K level,” he added.

Short squeeze to $114,000?

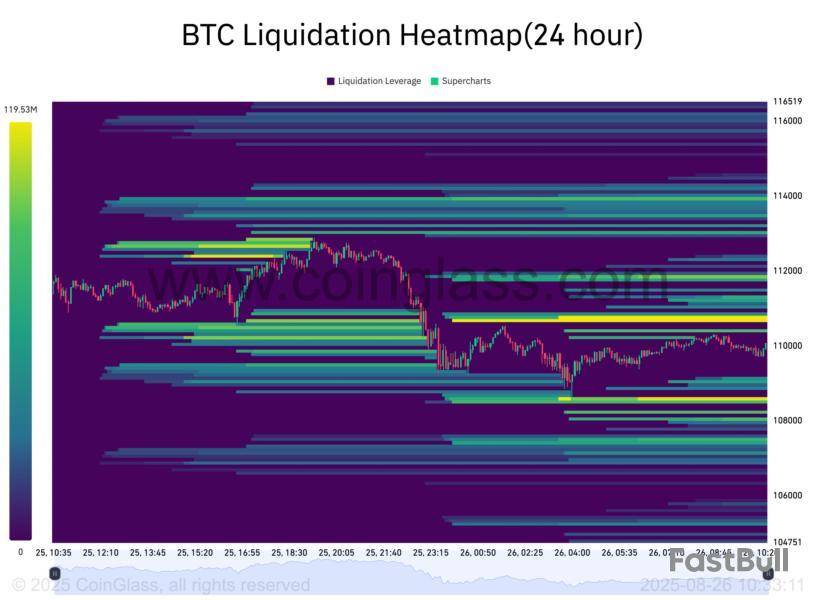

Bitcoin has sparked several major liquidation cascades in recent days as long positions get punished.

Data from CoinGlass puts total BTC long liquidations at nearly $500 million since Sunday.

Exchange order books reveal that the majority of liquidity to the downside has been taken — leading to faint hopes of a market rebound.

“$BTC downside liquidity has been hunted. And now, it seems like shorts will be liquidated next,” popular trader BitBull predicted in an X post Tuesday.

$114,000 also forms a level of interest for analytics account TheKingfisher, who sees a “huge wall” of short liquidations coming should price return there.

“Price often gets pulled to these levels. Smart money is likely using this as fuel,” it told X followers, suggesting that it could take just days for the liquidity squeeze to occur.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

By Kelly Cloonan

Trump Media & Technology Group, Yorkville Acquisition and Crypto.com have entered an agreement for a business combination to establish a digital-asset treasury company.

The companies said Tuesday the new company will be called Trump Media Group CRO Strategy. It will be focused on acquiring CRO, the native cryptocurrency token of the Cronos ecosystem.

At the close of the transaction, the three companies will have majority ownership of the new entity.

Expected funding for the digital-asset treasury will consist of $1 billion in CRO, $200 million in cash and $220 million cash-in mandatory exercise warrants, with an additional $5 billion equity line of credit from an affiliate of Yorkville.

"Financial markets are becoming increasingly digital every day," Trump Media Chief Executive Devin Nunes said. "Companies of all sizes and sectors are strategically planning for the future by establishing digital asset treasuries anchored by assets that have created a comprehensive value proposition and are poised for even greater utility."

Yorkville Acquisition, a special-purpose acquisition company, will apply to have its Class A ordinary shares trade on Nasdaq under the symbol MCGA. The new symbol will transfer to Trump Media Group CRO Strategy upon the closing of the business combination, the companies said.

Yorkville, Trump Media and Crypto.com have agreed to a mandatory one-year initial lock-up period on their founding shareholdings, including all warrants granted, after the close of the transaction. The initial lock-up period will be followed by an additional three-year restrictive release schedule, the companies said.

Write to Kelly Cloonan at kelly.cloonan@wsj.com

Truth Social and the company behind it, Trump Media and Technology Group Corp, announced massive adoption news for the CRO token on two fronts.

The entity linked to the current US President said it will purchase around 2% of the entire token supply by spending around $105 million for 685,427,004 CRO.

The first press release informs that the Truth Social and Truth+ platforms will introduce a rewards system for their users that will utilize the crypto.com digital wallet infrastructure and adopt CRO as a utility token.

Both sides have doubled down on their joint collaborations afterpartneringto provide ETFs earlier this year. Moreover, the two parties plan to expand their partnerships:

“Further planned partnership synergies include providing Truth users the ability to pay for subscriptions and services with their Crypto.com CRO balance, and providing free or discounted Truth+ subscriptions for users who open a Crypto.com account.”

The news that Trump Media will acquire almost 700,000,000 tokens sent the underlying asset flying. CRO traded around $0.15 after the most recent market-wide pullback before it skyrocketed to its highest level this year of just over $0.21. It has retraced slightly since then but still stands close to $0.19.

“We are proud to partner with Trump Media, an innovator in digital media, to bring the utility of CRO to the Truth Social platform. This CRO integration is a historic moment for the Cronos blockchain and a testament to the loyal community of builders dedicated to broadening access to the benefits and opportunities of crypto,” commented Crypto.com’s co-founder and CEO, Kris Marszalek.

In a separate PR, though, both parties announced the creation of Trump Media Group CRO Strategy, Inc., which will serve as a digital asset treasury firm “focused on acquisition of the native cryptocurrency token of the Cronos ecosystem.”

It will be majority-owned by Yorkville, Trump Media, and crypto.com and will purchase roughly 19% of the entire CRO supply ($1 billion worth of the asset).

Trump Media and Technology Group, the owner of US President Donald Trump’s Truth Social platform, has announced a business combination with cryptocurrency exchange Crypto.com and the blank check company Yorkville Acquisition.

Trump Media, Crypto.com and Yorkville Acquisition entered into a definitive agreement to jointly establish Trump Media Group CRO Strategy, according to an official announcement on Tuesday.

The newly launched entity will be a digital asset treasury company focused on the acquisition of Cronos (CRO), the native cryptocurrency of the Cronos blockchain, developed by Crypto.com.

Majority-owned by Trump Media, Crypto.com, and Yorkville, Trump Media Group CRO Strategy aims to build a treasury of at least $6.42 billion.

“Largest publicly traded CRO treasury”

According to the announcement, Trump Media Group CRO Strategy will fund its digital asset treasury with $1B in CRO tokens, $420 million in cash and warrants, plus a $5 billion credit line from an affiliate of Yorkville.

The capital would make CRO Strategy the “first and largest publicly traded CRO treasury company,” the companies said in the announcement, adding that it would potentially become the “largest digital asset treasury company to market cap ratio in history.”

To support the long-term commitment to Trump Media Group CRO Strategy, the three partners agreed to a mandatory one-year initial lock-up period on their founding shareholdings. The lock-up will include all granted warrants, following the closing of the business combination.

An additional three-year restrictive release schedule is expected to follow the initial lock-up period.

This is a developing story, and further information will be added as it becomes available.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up