Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Reserve Bank Of Australia Governor Bullock: Economy Is Actually Doing Ok, Labour Market Is Good News

Reserve Bank Of Australia Governor Bullock: Will Continue To Look At Data, Will Act If Inflation Seems Entrenched

Reserve Bank Of Australia Governor Bullock: Will Find It Hard To Grow Economy Above 2% Without Rise In Productivity

Reserve Bank Of Australia Governor Bullock: Higher A$ And Higher Rates Will Help Drive Demand Down Into Balance

Peabody Energy CEO Jim Grech: The Company Is Working With The Trump Administration On The Possibility Of Building New Coal-fired Power Plants

[Shooting Outside School In Washington, D.C.] CCTV Reporters Have Learned That A Shooting Occurred Outside A School In Washington, D.C. On The 11th Local Time, Leaving Two People Wounded

U.S. Interior Secretary Burgum: The United States Is On The Right Track In Issuing Mining Licenses To Venezuela

U.S. Energy Secretary Wright: We Hope To Attract Investment Through Fair Business Conditions (business Environment)

Mcdonald's Exec - Saw Severe Weather Impacts In US In Late January That Pressured Traffic, Caused Restaurant Close Or Reduced Hours For Several Days

On Wednesday (February 11), In Late New York Trading, S&P 500 Futures Ultimately Rose 0.07%, Dow Jones Futures Fell 0.11%, And NASDAQ 100 Futures Rose 0.29%. Russell 2000 Futures Fell 0.30%

Reserve Bank Of Australia Governor Bullock: Board Decided Inflation At 3-Point Something Was Unacceptable

On Wednesday (February 11) At The Close Of Trading In New York (05:59 Beijing Time On Thursday), The Offshore Yuan (CNH) Was Quoted At 6.9095 Against The US Dollar, Up 26 Points From The Close Of Trading In New York On Tuesday. It Traded In The Range Of 6.9195-6.9059 During The Day, Hitting A New Daily Low When The US Non-farm Payrolls Report Was Released

Federal Trade Commission (FTC) Official Ferguson Wrote To Apple CEO Tim Cook Regarding Apple News

On Wednesday (February 11), Spot Silver Rose 4.20% To $84.2080 Per Ounce In Late New York Trading, Continuing Its Upward Trend Since The Start Of The Asian Session, Reaching A Daily High Of $86.3058 At 8:00 PM Beijing Time. Comex Silver Futures Rose 4.42% To $83.935 Per Ounce. Comex Copper Futures Rose 1.27% To $5.9885 Per Pound. Spot Platinum Rose 2.48%, And Spot Palladium Rose 0.61%

Mexico Industrial Output YoY (Dec)

Mexico Industrial Output YoY (Dec)A:--

F: --

P: --

Brazil PPI MoM (Dec)

Brazil PPI MoM (Dec)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Russia Trade Balance (Dec)

Russia Trade Balance (Dec)A:--

F: --

P: --

U.S. Average Weekly Working Hours (SA) (Jan)

U.S. Average Weekly Working Hours (SA) (Jan)A:--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Jan)

U.S. Private Nonfarm Payrolls (SA) (Jan)A:--

F: --

U.S. Manufacturing Employment (SA) (Jan)

U.S. Manufacturing Employment (SA) (Jan)A:--

F: --

P: --

U.S. Labor Force Participation Rate (SA) (Jan)

U.S. Labor Force Participation Rate (SA) (Jan)A:--

F: --

P: --

U.S. Average Hourly Wage MoM (SA) (Jan)

U.S. Average Hourly Wage MoM (SA) (Jan)A:--

F: --

U.S. U6 Unemployment Rate (SA) (Jan)

U.S. U6 Unemployment Rate (SA) (Jan)A:--

F: --

P: --

U.S. Average Hourly Wage YoY (Jan)

U.S. Average Hourly Wage YoY (Jan)A:--

F: --

U.S. Unemployment Rate (SA) (Jan)

U.S. Unemployment Rate (SA) (Jan)A:--

F: --

P: --

U.S. Nonfarm Payrolls (SA) (Jan)

U.S. Nonfarm Payrolls (SA) (Jan)A:--

F: --

Canada Building Permits MoM (SA) (Dec)

Canada Building Permits MoM (SA) (Dec)A:--

F: --

U.S. Employment Benchmark (Not SA)

U.S. Employment Benchmark (Not SA)A:--

F: --

P: --

U.S. Employment Benchmark (SA)

U.S. Employment Benchmark (SA)A:--

F: --

P: --

U.S. Government Employment (Jan)

U.S. Government Employment (Jan)A:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Jan)

China, Mainland M0 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Jan)

China, Mainland M2 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)--

F: --

P: --

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Feb)

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Feb)A:--

F: --

P: --

U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. Budget Balance (Jan)

U.S. Budget Balance (Jan)A:--

F: --

P: --

FOMC Member Hammack Speaks

FOMC Member Hammack Speaks Japan Domestic Enterprise Commodity Price Index MoM (Jan)

Japan Domestic Enterprise Commodity Price Index MoM (Jan)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Jan)

Japan Domestic Enterprise Commodity Price Index YoY (Jan)--

F: --

P: --

Japan PPI MoM (Jan)

Japan PPI MoM (Jan)--

F: --

P: --

Australia Consumer Inflation Expectations (Feb)

Australia Consumer Inflation Expectations (Feb)--

F: --

P: --

U.K. 3-Month RICS House Price Balance (Jan)

U.K. 3-Month RICS House Price Balance (Jan)--

F: --

P: --

U.K. Monthly GDP 3M/3M Change (Dec)

U.K. Monthly GDP 3M/3M Change (Dec)--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoM--

F: --

P: --

U.K. Trade Balance (Dec)

U.K. Trade Balance (Dec)--

F: --

P: --

U.K. Trade Balance Non-EU (SA) (Dec)

U.K. Trade Balance Non-EU (SA) (Dec)--

F: --

P: --

U.K. Manufacturing Output MoM (Dec)

U.K. Manufacturing Output MoM (Dec)--

F: --

P: --

U.K. Construction Output MoM (SA) (Dec)

U.K. Construction Output MoM (SA) (Dec)--

F: --

P: --

U.K. Services Index YoY (Dec)

U.K. Services Index YoY (Dec)--

F: --

P: --

U.K. Industrial Output YoY (Dec)

U.K. Industrial Output YoY (Dec)--

F: --

P: --

U.K. Services Index MoM (SA) (Dec)

U.K. Services Index MoM (SA) (Dec)--

F: --

P: --

U.K. Construction Output YoY (Dec)

U.K. Construction Output YoY (Dec)--

F: --

P: --

U.K. GDP MoM (Dec)

U.K. GDP MoM (Dec)--

F: --

P: --

U.K. Industrial Output MoM (Dec)

U.K. Industrial Output MoM (Dec)--

F: --

P: --

U.K. Trade Balance (SA) (Dec)

U.K. Trade Balance (SA) (Dec)--

F: --

P: --

U.K. Manufacturing Output YoY (Dec)

U.K. Manufacturing Output YoY (Dec)--

F: --

P: --

U.K. Trade Balance EU (SA) (Dec)

U.K. Trade Balance EU (SA) (Dec)--

F: --

P: --

U.K. GDP YoY (SA) (Dec)

U.K. GDP YoY (SA) (Dec)--

F: --

P: --

U.K. GDP Revised YoY (Q4)

U.K. GDP Revised YoY (Q4)--

F: --

P: --

U.K. GDP Revised QoQ (Q4)

U.K. GDP Revised QoQ (Q4)--

F: --

P: --

IEA Oil Market Report

IEA Oil Market Report South Africa Gold Production YoY (Dec)

South Africa Gold Production YoY (Dec)--

F: --

P: --

South Africa Mining Output YoY (Dec)

South Africa Mining Output YoY (Dec)--

F: --

P: --

India CPI YoY (Jan)

India CPI YoY (Jan)--

F: --

P: --

U.K. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Feb)

U.K. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Feb)--

F: --

P: --

South Africa Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Feb)

South Africa Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Feb)--

F: --

P: --

Brazil Services Growth YoY (Dec)

Brazil Services Growth YoY (Dec)--

F: --

P: --

Germany Current Account (Not SA) (Dec)

Germany Current Account (Not SA) (Dec)--

F: --

P: --

No matching data

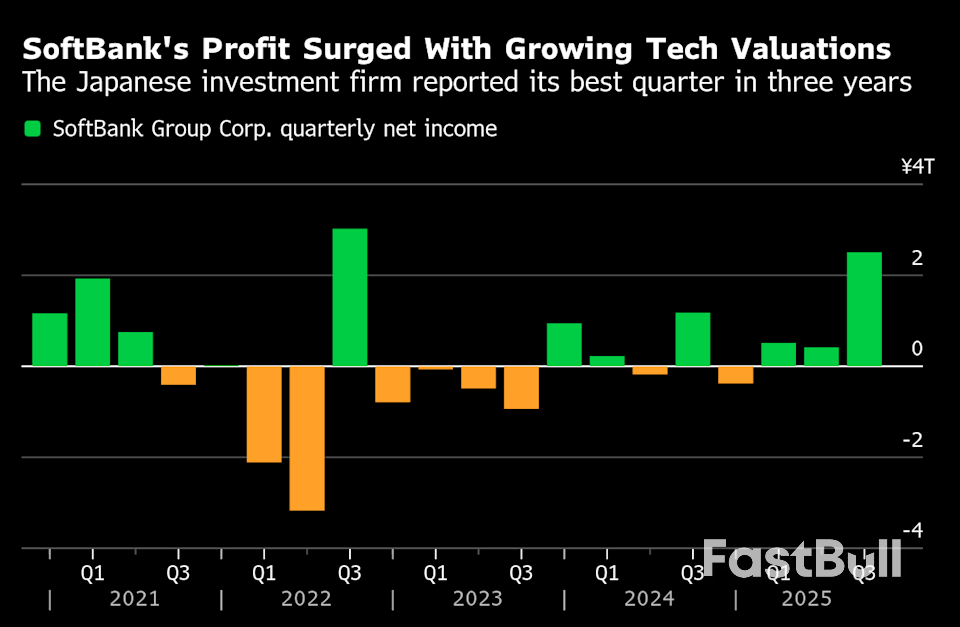

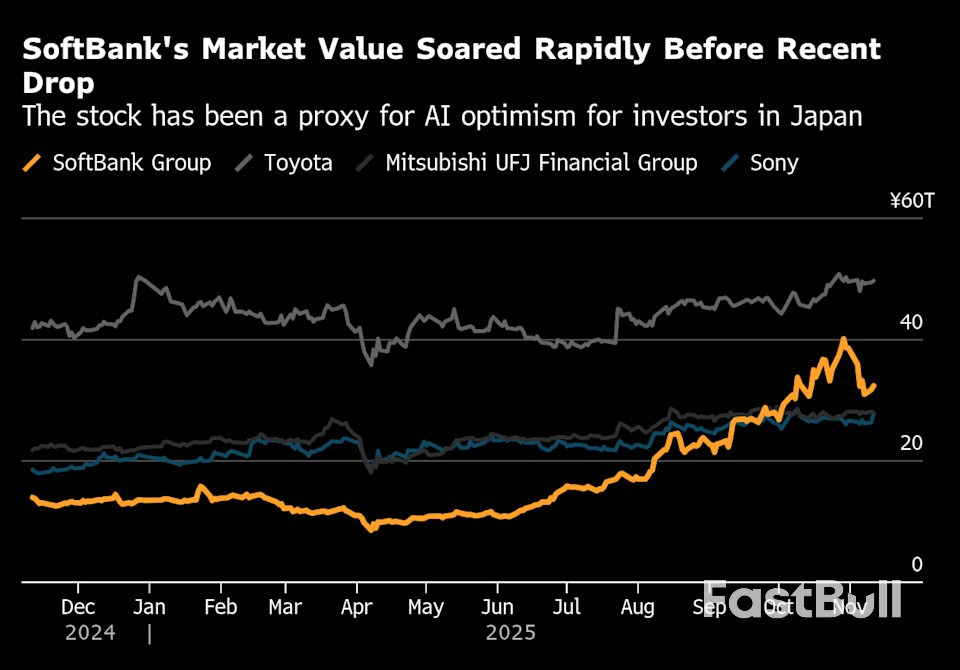

SoftBank sold its entire $5.8B Nvidia stake to fund major AI investments, including data centers and robotics. The sale boosts liquidity as SoftBank expands stakes in OpenAI and other AI ventures despite bubble concerns.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up