Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Skechers U.S.A., Inc. SKX has seen a substantial surge in its stock price over the past year, climbing 45.3% and significantly outperforming the Zacks Shoes and Retail Apparel industry’s steep decline of 12.4%. The company's success can be attributed to its investments in omnichannel capabilities, infrastructure and global market expansion, which have driven notable growth in both its wholesale and direct-to-consumer segments.

This strategy, coupled with SKX's dedication to product innovation and its focus on expanding in international markets, has enabled the company to outpace the broader Consumer Discretionary sector's 7.8% growth and the S&P 500 Index's 26.7% rise over the said period. Skechers’ stock closed at $70.15 on Monday, trading 6.6% below its 52-week high of $75.09 reached on June 12, 2024.

Technical indicators also support Skechers’ robust performance, as the stock is trading above its 50-day and 200-day moving averages, indicating strong upward momentum and price stability. This technical strength reflects positive market sentiment and confidence in SKX's financial health and prospects.

From a valuation perspective, Skechers’ shares present an attractive opportunity, trading at a discount relative to historical and industry benchmarks. With a forward 12-month price-to-earnings ratio of 15.26, below the five-year median of 15.41 and the industry’s average of 23.15, the stock offers value for investors seeking exposure to the sector. Additionally, SKX’s current Value Score of A reinforces its attractiveness.

Skechers Enhances Market Position With Multi-Brand Growth

Skechers is reinforcing its foothold in the footwear industry through a diverse brand portfolio that spans fashion, athletic, non-athletic and work footwear. This multi-brand approach allows the company to introduce new products without cannibalizing existing lines, thereby effectively catering to a broad customer base. Recently, Skechers has shifted its focus toward comfort-driven footwear and apparel, responding to the growing demand for more relaxed styles.

To bolster its omnichannel capabilities and expand its DTC business, Skechers is investing in global infrastructure, including retail stores, e-commerce platforms and distribution centers. Key digital initiatives include enhanced website features, mobile apps, loyalty programs and upgraded point-of-sale systems to increase customer engagement.

Skechers anticipates continued growth in its wholesale segment throughout fiscal 2024, driven by sustained product demand and strategic investments in logistics and retailer relationships. In the second quarter, it reported a 5.5% year-over-year increase in wholesale sales, reaching $1.13 billion, fueled by a 14% rise in domestic wholesale sales, with strong gains in men’s and kids’ footwear, along with women’s footwear.

The DTC segment also delivered robust performance, with sales increasing 9.2% year over year to $1.03 billion in the second quarter. This growth highlights the success of Skechers' strategies to enhance direct consumer engagement and elevate the retail experience. International DTC sales surged 15.2% year over year while domestic sales experienced a modest 1.4% increase.

SKX’s International Growth Drives Global Market Success

Skechers' international operations play a vital role in its overall growth strategy. The company’s success in global markets highlights its ability to adapt to diverse consumer preferences, seize emerging trends and implement effective regional distribution strategies.

In the second quarter, international sales grew 6.9% year over year, representing 60% of the company's total revenues. This underscores the importance of its global presence. Notably, the EMEA region saw a 13.7% increase in sales year over year while the APAC region and China experienced growth rates of 2.2% and 3.4%, respectively.

Skechers Raises 2024 Outlook, Eyes $10 Billion Sales by 2026

For fiscal 2024, Skechers has raised its sales forecast to the range of $8.88 - $8.98 billion from the previously projected $8.73-$8.88 billion. This reflects an increase from $8 billion reported in fiscal 2023. The company also expects earnings per share (EPS) to be between $4.08 and $4.18 compared with the earlier guided range of $3.95-$4.10, indicating growth from $3.49 reported last year.

Skechers plans to invest between $325 million and $375 million in capital expenditures. This spending will support crucial strategic initiatives, including new store openings, the expansion of omnichannel capabilities and enhancements to distribution infrastructure. The company remains on track to reach its ambitious target of $10 billion in annual sales by 2026.

How are SKX’s Earnings Estimates Holding up?

Analysts have responded positively to Skechers’ prospects, reflected in upward revisions to the Zacks Consensus Estimate for EPS. In the past 30 days, analysts have increased their estimates for the current year by 5 cents. The consensus estimate for earnings is pegged at $4.16 per share. The estimate for the next year has also been raised by 5 cents to $4.83 per share.

Skechers' Rising Costs, Regional Issues- A Key Hurdle

Despite positive factors, rising operating expenses could impact margins and profitability if not managed effectively, especially amid revenue challenges in certain segments and regions. In the second quarter, total operating expenses increased 16% year over year to $977.9 million.

The Zacks Rank #3 (Hold) company also faces significant regulatory and market challenges in key regions such as China and India, which could negatively affect its stock price. Economic instability and reduced consumer demand in China present ongoing risks while new regulatory standards in India have hurt sales and led to inventory issues. These problems have already resulted in flat international wholesale growth and may pressure the company’s future performance if macroeconomic and regulatory challenges continue.

Nonetheless, SKX’s achievements in both DTC and wholesale channels underscore its robust operational performance and extensive market reach. Additionally, favorable market sentiment and increased earnings revisions reflect confidence in Skechers’ continued success and growth potential.

Key Picks

Some better-ranked stocks are Boot Barn Holdings, Inc. BOOT, Abercrombie & Fitch Co. ANF and Steven Madden, Ltd. SHOO.

Boot Barn operates as a lifestyle retail chain devoted to western and work-related footwear, apparel and accessories. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Boot Barn’s fiscal 2025 earnings and sales indicates growth of 8.9% and 10.7%, respectively, from the fiscal 2023 reported figures. BOOT has a trailing four-quarter average earnings surprise of 7.1%.

Abercrombie is a specialty retailer of premium, high-quality casual apparel. It has a Zacks Rank #2 (Buy) at present. ANF delivered a 28.9% earnings surprise in the last reported quarter.

The consensus estimate for Abercrombie’s fiscal 2024 earnings and sales indicates growth of 52.4% and 11.3%, respectively, from the fiscal 2023 reported levels. ANF has a trailing four-quarter average earnings surprise of 210.3%.

Steven Madden designs, sources, markets and sells fashion-forward name-brand and private-label footwear. It currently has a Zacks Rank of 2.

The Zacks Consensus Estimate for Steven Madden’s 2024 earnings and sales indicates growth of 6.9% and 12.4%, respectively, from the year-ago actuals. SHOO has a trailing four-quarter average earnings surprise of 9.5%.

Zacks Investment Research

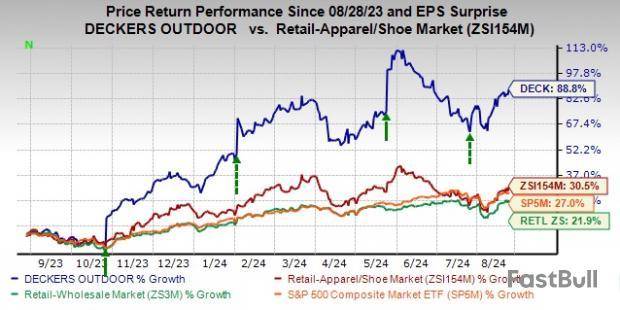

Deckers Outdoor Corporation DECK has experienced a remarkable jump in its stock price over the past year. The stock has surged 88.8%, comfortably outpacing the Zacks Retail-Apparel and Shoes industry’s rise of 30.5%. This strong growth can be attributed to the company's efforts to expand its brand presence and enhance its direct-to-consumer channels.

Additionally, Deckers’ emphasis on product innovation and international market expansion has enabled it to outshine the broader Retail-Wholesale sector and the S&P 500 index, which posted growth of 21.9% and 27%, respectively, in the same period.

Technical indicators also support Deckers' robust performance, as the stock is trading above its 50-day and 200-day moving averages, indicating strong upward momentum and price stability. This technical strength reflects positive market sentiment and confidence in DECK's financial health and prospects. The stock currently has a Value Score of A, further validating its appeal.

Decoding the Growth Drivers Behind Deckers

Deckers has thrived by concentrating on profitable markets, driving product innovation, expanding its store footprint and enhancing e-commerce capabilities. The company has broadened its brand offerings, launched innovative products and optimized distribution channels, thereby boosting the popularity of its UGG and HOKA brands, and strengthening its international presence. Deckers aims to elevate HOKA into a multibillion-dollar brand, establish UGG as a global lifestyle brand and further develop its DTC business.

The company’s DTC and omnichannel expansion strategies have been robust, with DTC net sales rising 24% year over year in the first quarter of fiscal 2025. Deckers' success is driven by aligning product development, marketing and distribution with consumer needs, leading to substantial growth. Strategic initiatives, including store openings and targeted market expansions, are increasing brand accessibility and enhancing consumer experiences.

Product innovation remains central to Deckers' strategy, as seen in the launch of the latest styles and collections. The company engages with consumers through brand activations, collaborations and social listening, fostering brand loyalty. Products like the Cielo X1 and Skyward X demonstrate Deckers' commitment to performance and technological advancement.

The wholesale channel continues to be vital, with fiscal first-quarter revenues increasing 21% year over year, particularly strong in the United States and Europe. Deckers' international expansion has also been effective, with international sales rising 20.8% year over year, driven by strong DTC growth and wholesale partnerships, especially in China and the EMEA region. This approach has solidified Deckers' position as a leader in the global footwear market.

DECK’s Strong Financial Position & Shareholder Confidence

Deckers demonstrates strong liquidity, supported by a robust cash position. As of Jun 30, 2024, the company held $1.44 billion in cash and cash equivalents, bolstering its financial flexibility. Notably, it had no outstanding borrowings during this period, underscoring a healthy balance sheet. The net cash flow from operating activities stood at $112.7 million as of Jun 30, 2024.

In the fiscal first quarter, DECK also showed confidence in its financial stability by repurchasing approximately 177,000 shares, totaling $152 million. This move reflects management's commitment to enhancing shareholder value and their confidence in the company’s prospects. As of Jun 30, 2024, DECK had $789.7 million remaining under its share repurchase authorization.

Deckers’ Strong Outlook for Fiscal 2025

The company anticipates a 10% year-over-year increase in net sales for fiscal 2025, reaching $4.7 billion. The HOKA brand is expected to grow 20%, fueled by consumer gains in the DTC channel, expansion with strategic partners, and growth in the international markets. UGG is projected to see mid-single-digit growth, supported by international expansion and a strong U.S. market. Earnings for fiscal 2025 are forecast between $29.75 and $30.65 per share, suggesting growth from the $29.16 reported in the previous year.

Estimate Revision Favoring DECK Stock

The Zacks Consensus Estimate for earnings per share has seen upward revisions, reflecting positive sentiments around Deckers. Over the past 30 days, analysts have increased their estimates for the current and next fiscal years by 2.5% to $31.58 and 2.4% to $35.25 per share, respectively, indicating year-over-year growth rates of 8.3% and 11.6%.

Conclusion

Despite a positive outlook, Deckers anticipates some pressure on the gross margin due to rising freight costs and a return to more typical promotional activities. However, the company has adeptly leveraged its strategic initiatives to achieve substantial growth. By concentrating on expanding its brand presence, enhancing direct-to-consumer channels and driving product innovation, Deckers has significantly strengthened its market position.

Supported by a solid financial foundation and robust shareholder confidence, the company is well-positioned for success. Looking ahead, Deckers expects continued growth for both HOKA and UGG brands. Recent upward revisions in earnings estimates reflect optimism for Deckers. The company currently has a Zacks Rank #2 (Buy), further reinforcing its strong prospects.

Other Key Picks

Some other top-ranked stocks in the retail space are Boot Barn Holdings, Inc. BOOT, Abercrombie & Fitch Co. ANF and Steven Madden, Ltd. SHOO.

Boot Barn operates as a lifestyle retail chain devoted to western and work-related footwear, apparel and accessories. It currently carries a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Boot Barn’s fiscal 2025 earnings and sales indicates growth of 8.9% and 10.7%, respectively, from the fiscal 2023 reported figures. BOOT has a trailing four-quarter average earnings surprise of 7.1%.

Abercrombie is a specialty retailer of premium, high-quality casual apparel. It has a Zacks Rank of 2 at present. ANF delivered a 28.9% earnings surprise in the last reported quarter.

The consensus estimate for Abercrombie’s fiscal 2024 earnings and sales indicates growth of 52.4% and 11.3%, respectively, from the fiscal 2023 reported levels. ANF has a trailing four-quarter average earnings surprise of 210.3%.

Steven Madden designs, sources, markets and sells fashion-forward name-brand and private-label footwear. It currently has a Zacks Rank of 2.

The Zacks Consensus Estimate for Steven Madden’s 2024 earnings and sales indicates growth of 6.9% and 12.4%, respectively, from the year-ago actuals. SHOO has a trailing four-quarter average earnings surprise of 9.5%.

Zacks Investment Research

PVH Corporation PVH is likely to post a year-over-year decline in its top line when it reports second-quarter fiscal 2024 results on Aug 27, after market close. The Zacks Consensus Estimate for quarterly revenues is pegged at $2.1 billion, indicating a drop of 6.3% from the prior-year reported number.

The consensus estimate for earnings is pegged at $2.27 per share, which indicates an increase of 14.7% year over year. The consensus mark has remained stable in the past 30 days.

In the last reported quarter, the company delivered an earnings surprise of 6%. It has a trailing four-quarter earnings surprise of 9.2%, on average.

Factors to Note

PVH Corp’s quarterly performance is likely to have been buoyed by strength in its core brands and other strategic efforts. Management has been on track with the PVH+ Plan, which is likely to have resulted in substantial cost efficiencies and better productivity. It has been focused on driving digital growth by developing a holistic distribution strategy for Calvin Klein and Tommy Hilfiger, driven by direct-to-consumer channels and wholesale partnerships.

In addition, the company has been making consistent efforts to boost its international presence. Gains from these efforts are likely to have boosted the quarterly performance.

However, PVH Corp has been witnessing increased investments in the DTC and international businesses. High raw material costs and currency headwinds have been added concerns. On the last earnings call, management had guided adjusted revenues to decline in the range of 5-6% year over year for the fiscal second quarter at constant currency. This included a 3% reduction related to the Heritage Brands sale. The earnings view included unfavorable currency impacts of 5 cents per share.

Our model predicts a sales decline of 6.7% for Tommy Hilfiger for the fiscal second quarter. Sales for Calvin Klein are anticipated to decline 2.9% year over year while Heritage Brands is expected to record a sales fall of 23%.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for PVH Corp this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

PVH Corp. Price and EPS Surprise

PVH Corp. price-eps-surprise | PVH Corp. Quote

PVH Corp has an Earnings ESP of 0.00% and a Zacks Rank of 3. You can uncover the best stocks before they're reported with our Earnings ESP Filter.

Stocks to Consider

Here are some companies, which according to our model, have the right combination of elements to post an earnings beat in their upcoming releases.

Abercrombie & Fitch ANF currently has an Earnings ESP of +5.40% and a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The company is likely to register growth in the bottom and top lines when it reports fiscal second-quarter results. The Zacks Consensus Estimate for ANF’s quarterly earnings has moved up 2.4% to $2.13 per share in the past 30 days. The consensus estimate indicates 93.6% growth from the year-ago quarter’s number.

The consensus estimate for Abercrombie’s quarterly revenues is pegged at $1.1 billion, which indicates growth of 16.4% from the figure reported in the prior-year quarter.

American Eagle Outfitters AEO currently has an Earnings ESP of +1.97% and a Zacks Rank of 2. The company is likely to register growth in the bottom and top lines when it reports second-quarter fiscal 2024 results. The consensus mark for AEO’s quarterly revenues is pegged at $1.3 billion, which indicates an 8.7% rise from the figure reported in the prior-year quarter.

The consensus mark for AEO’s quarterly earnings has moved up a penny in the past seven days to 38 cents per share. The consensus estimate indicates growth of 38% from the year-ago quarter’s actual.

lululemon athletica LULU currently has an Earnings ESP of +0.66% and a Zacks Rank of 3. The company is likely to register top-line growth when it reports fiscal second-quarter results. The consensus mark for LULU’s quarterly revenues is pegged at $2.4 billion, which indicates growth of 9.1% from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for lululemon athletica’s earnings has remained stable at $2.96 per share in the past seven days. The consensus estimate indicates a rise of 10.5% from the year-ago quarter’s actual.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Zacks Investment Research

Skechers U.S.A., Inc. SKX has experienced a remarkable jump in its stock price over the past year. The stock has rallied 26.1%, comfortably outpacing the Zacks Shoes and Retail Apparel industry’s sharp decline of 16.6%. The company adapts to evolving consumer preferences by investing in omnichannel capabilities, infrastructure and global market penetration, resulting in significant gains in both wholesale and direct-to-consumer segments.

This approach, along with SKX’s commitment to innovation in product development and a keen focus on international market expansion, has helped it outperform the broader Consumer Discretionary sector’s growth of 5.2% in the past year. Closing at $64.84 as of Aug 16, Sketchers’ stock is currently trading 13.7% below its 52-week high of $75.09 attained on Jun 12, 2024.

From a valuation perspective, Skechers’ shares present an attractive opportunity, trading at a discount relative to historical and industry benchmarks. With a forward 12-month price-to-earnings ratio of 14.15, below the five-year median of 14.41 and the industry’s average of 22.82, the stock offers compelling value for investors seeking exposure to the sector. Additionally, SKX’s current Value Score of A reinforces its attractiveness.

Decoding the Tailwinds

Skechers is solidifying its position in the footwear industry with a diverse brand portfolio that includes fashion, athletic, non-athletic and work footwear. This multi-brand strategy allows for product introductions without impacting existing lines, catering to a wide customer base. The company has shifted its focus toward comfort-based footwear and apparel to meet the growing demand for relaxed styles.

To enhance its omnichannel capabilities and expand its DTC business, Skechers is investing in global infrastructure, including retail stores, e-commerce platforms and distribution centers. Key digital initiatives include improved website features, mobile apps, loyalty programs and upgraded point-of-sale systems to boost customer engagement.

Skechers is optimistic about continued growth of its wholesale segment throughout fiscal 2024, supported by consistent product demand, and strategic investments in logistics and retailer relationships. In the second quarter, Skechers reported a 5.5% year-over-year increase in wholesale sales, reaching $1.13 billion, driven by a 14% increase in domestic wholesale sales on double-digit growth in men’s and kids’ footwear, as well as gains in women’s footwear.

The DTC segment also showcased a strong performance, with sales climbing 9.2% year over year to $1.03 billion in the second quarter. This growth underscores the effectiveness of Skechers' strategies to enhance direct consumer engagement and improve the retail experience. International DTC sales rose 15.2% year over year, while domestic sales saw a modest 1.4% increase.

Strong International Business

Skechers' international operations are crucial to its overall growth. The company's success in global markets underscores its ability to adapt to diverse consumer preferences, capitalize on emerging trends, and implement effective distribution strategies tailored to each region's unique characteristics.

In the second quarter, international sales grew 6.9% year over year, accounting for 60% of the company's total revenues, highlighting the significance of its global presence. The EMEA region excelled with a notable 13.7% year-over-year sales increase. The APAC region and China also showed strong performances, with growth rates of 2.2% and 3.4%, respectively.

Growth Prospects Ahead

For fiscal 2024, Skechers forecasts sales between $8.88 billion and $8.98 billion, up from the earlier mentioned $8.73-$8.88 billion, which indicates a rise from $8 billion reported in fiscal 2023. The company predicts earnings per share between $4.08 and $4.18 compared with the previously stated $3.95-$4.10, implying growth from $3.49 reported last year.

Skechers plans to allocate between $325 million and $375 million for capital expenditure. This investment will support key strategic initiatives, including store openings, omnichannel capability expansion and distribution infrastructure enhancements. The company is on track to achieve its ambitious goal of $10 billion in annual sales by 2026.

Estimate Revision Favoring the Stock

Analysts have responded positively to Sketcher’s prospects, reflected in upward revisions to the Zacks Consensus Estimate for earnings per share. In the past 30 days, analysts have increased their estimates for the current quarter by 4 cents. The consensus estimate for earnings is pegged at $1.15 per share. The estimate for the next quarter has also been raised by 7 cents to 76 cents per share.

Wrapping Up

Despite the positive factors, the upward trend in operating expenses could erode margins and profitability if not effectively managed, especially in the face of revenue challenges in certain segments and regions. Notably, in the second quarter of 2024, total operating expenses grew 16% year over year to $977.9 million.

Additionally, Skechers faces significant regulatory and market challenges in key regions like China and India, which could hurt its stock price. In China, economic instability and weakened consumer demand pose ongoing risks. Similarly, India's new regulatory standards have negatively impacted sales, compounded by inventory constraints. These issues have already led to flat international wholesale growth and could pressure the company’s future performance, especially if these macroeconomic and regulatory challenges persist.

Nevertheless, SKX’s achievements in both DTC and wholesale channels underscore its robust operational performance and extensive market reach. Furthermore, positive market sentiment and upward earnings revisions indicate confidence in Sketchers’ ongoing success and growth potential. Current stakeholders should maintain their position in this Zacks Rank #3 (Hold) stock.

Key Picks

Some better-ranked stocks are The Gap, Inc. GPS, Abercrombie & Fitch Co. ANF and American Eagle Outfitters Inc. AEO.

Gap is a premier international specialty retailer that offers a diverse range of clothing, accessories and personal care products. It currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Gap’s fiscal 2024 earnings and sales indicates growth of 24.5% and 0.2%, respectively, from fiscal 2023 reported figures. GPS has a trailing four-quarter average earnings surprise of 202.7%.

Abercrombie is a specialty retailer of premium, high-quality casual apparel. It has a Zacks Rank of 2 at present. ANF delivered a 28.9% earnings surprise in the last reported quarter.

The consensus estimate for Abercrombie’s fiscal 2024 earnings and sales indicates growth of 51.1% and 11.5%, respectively, from the fiscal 2023 reported levels. ANF has a trailing four-quarter average earnings surprise of 210.3%.

American Eagle Outfitters is a specialty retailer of casual apparel, accessories and footwear. It currently has a Zacks Rank of 2.

The Zacks Consensus Estimate for American Eagle Outfitters’ fiscal 2024 earnings and sales indicates growth of 17.1% and 3.3%, respectively, from the year-ago actuals. AEO has a trailing four-quarter average earnings surprise of 28.1%.

Zacks Investment Research

How much a stock's price changes over time is a significant driver for most investors. Not only can price performance impact your portfolio, but it can help you compare investment results across sectors and industries as well.

FOMO, or the fear of missing out, also plays a role in investing, particularly with tech giants and popular consumer-facing stocks.

What if you'd invested in Deckers ten years ago? It may not have been easy to hold on to DECK for all that time, but if you did, how much would your investment be worth today?

Deckers' Business In-Depth

With that in mind, let's take a look at Deckers' main business drivers.

Founded in 1973 and headquartered in Goleta, California, Deckers Outdoor Corporation is a leading designer, producer and brand manager of innovative, niche footwear and accessories developed for outdoor sports and other lifestyle-related activities. The company sells products primarily under five proprietary brands — UGG, HOKA, Teva, Sanuk and Other brands (mainly comprised of Koolaburra).

Its products are sold through specialty domestic retailers, international distributors and directly to end-users through its websites and catalogs. The company sells directly to global consumers through the Direct-to-Consumer channel, which is comprised of e-commerce websites and retail stores. The brands are sold worldwide, including in the United States, Canada, Europe, Asia-Pacific and Latin America.

The UGG brand (52.2% of fiscal 2024 total revenues) has proven to be a highly resilient line of premium footwear, apparel and accessories with expanded product offerings. The company intends to continue diversifying the brand to drive year-round product sales through the expansion of women’s spring and summer footwear, men’s products and apparel, home goods and accessories.

The HOKA brand (42.1% of fiscal 2024 total revenues) is an authentic, premium line of year-round performance footwear, apparel and accessories.

The Teva brand’s product line (3.5% of fiscal 2024 total revenues) includes a range of performance, casual, footwear and trail lifestyle products.

The Sanuk brand (0.6% of fiscal 2024 total revenues) has manifested into a lifestyle brand with a presence in the relaxed casual shoe and sandal categories.

The company's Other brands (1.6% of fiscal 2024 total revenues) is a casual footwear fashion line using sheepskin and other plush materials.

Deckers has finalized an agreement to sell off the Sanuk brand, with the transaction anticipated to be completed by August 2024.

(Notes: Zacks identifies fiscal years by the month in which the fiscal year ends, while DECK identifies its fiscal year by the calendar year in which it begins; so comparable figures for any given fiscal year, as published by DECK, will refer to this same fiscal year as being the year before the same year, as identified by Zacks.)

Bottom Line

Putting together a successful investment portfolio takes a combination of research, patience, and a little bit of risk. For Deckers, if you bought shares a decade ago, you're likely feeling really good about your investment today.

A $1000 investment made in August 2014 would be worth $10,224.99, or a 922.50% gain, as of August 16, 2024, according to our calculations. Investors should note that this return excludes dividends but includes price increases.

The S&P 500 rose 183.53% and the price of gold increased 80.83% over the same time frame in comparison.

Going forward, analysts are expecting more upside for DECK.

Deckers has shown robust growth through its strategic focus on expanding its brand presence and strengthening direct-to-consumer channels. This approach, along with a commitment to innovation in product development and a keen focus on international market expansion, has positioned the company for continued success. Deckers' commitment to elevating renowned brands like UGG and HOKA into global lifestyle icons enhances brand equity and market reach. Looking ahead, Deckers maintained its fiscal 2025 sales guidance, while raising its earnings forecast due to first-quarter gross margin expansion. However, the company foresees potential gross margin pressure on the horizon, stemming from higher freight expenses and a shift toward a more normalized promotional environment. The updated view indicates 160 basis points contraction in fiscal 2025. The stock has jumped 6.84% over the past four weeks. Additionally, no earnings estimate has gone lower in the past two months, compared to 10 higher, for fiscal 2024; the consensus estimate has moved up as well.

Zacks Investment Research

Deckers Outdoor Corporation’s DECK strong focus on product innovation, consumer engagement and strategic market expansion has driven its exceptional growth. The company's initiatives in the direct-to-consumer business, omni-channel expansion and international markets have enhanced its brand visibility and market penetration.

Additionally, DECK's robust wholesale network and commitment to adapting to consumer needs position it well for continued success in the competitive footwear industry. By leveraging its strengths and capitalizing on emerging opportunities, the company is poised for sustained growth and a solidified presence as a leading player in the global market.

Key Growth Aspects

Deckers has excelled by focusing on profitable markets, product innovation, store expansion and enhancing e-commerce capabilities. By expanding brand assortments, introducing innovative products and optimizing distribution channels, Deckers has boosted the popularity of the UGG and HOKA brands, and strengthened its international presence. The company aims to elevate HOKA into a multi-billion-dollar player, establish UGG as a global lifestyle brand and strengthen its DTC business.

DECK's DTC net sales increased 24% year over year in the first quarter of fiscal 2025. The company's alignment of product creation, marketing and distribution around consumer needs has driven significant growth. Strategic initiatives, such as store openings and targeted market expansions, are enhancing brand accessibility and consumer experiences.

Deckers' commitment to product innovation is reflected in successful launches of the latest styles and collections, catering to consumer preferences and market trends. Efforts to engage consumers through brand activations, collaborations, and social listening initiatives build meaningful connections and drive brand loyalty.

The company strategically aligns with seasonal purchasing trends, focusing on expanding categories, such as casual boots, winter footwear and casual shoes. This innovation is exemplified by successful products like the Cielo X1 and Skyward X, which highlight DECK's commitment to performance and technological advancement.

The wholesale channel remains crucial, with a 21% year-over-year increase in fiscal first-quarter revenues, particularly strong in the United States and Europe. Deckers’ international expansion has also been effective, with international sales rising 20.8% year over year, driven by strong DTC growth and wholesale partnerships, particularly in China and EMEA. This strategy has solidified Deckers' position as a global footwear market leader.

Shareholder-Friendly Moves

Deckers showcases strong liquidity, backed by a solid cash position. As of Jun 30, 2024, the company held $1.44 billion in cash and cash equivalents, enhancing its financial flexibility. Importantly, the company had no outstanding borrowings during this period, reflecting a healthy balance sheet. Net cash flow provided by operating activities was $112.7 million as of Jun 30, 2024.

In the fiscal first quarter, Deckers demonstrated confidence in its financial strength by repurchasing approximately 177,000 shares, amounting to $152 million. This highlights management's commitment to enhancing shareholder value and confidence in the company's prospects. As of Jun 30, 2024, DECK had $789.7 million remaining under its share repurchase authorization.

Promising Outlook

Deckers' robust expansion strategy has been pivotal in driving its growth. The company, which shares space with Skechers SKX, Urban Outfitters URBN and Abercrombie ANF, expects fiscal 2025 net sales to increase 10% year over year and reach $4.7 billion. HOKA is projected to grow 20%, driven by consumer gains in the DTC channel, strategic partner expansion and international market growth. UGG is expected to increase in the mid-single digits, driven by international expansion and a healthy U.S. market. Fiscal 2025 earnings are predicted to be $29.75-$30.65 per share, whereas it reported $29.16 last year.

Synopsis of Other Stocks

Skechers aims to continue expanding its direct-to-consumer segment and bolstering international sales growth. The company plans to invest in opening stores, enhancing its omni-channel capabilities and constructing a second distribution center in China. These initiatives align with its long-term growth strategy, and focus on maximizing operational efficiency and customer reach. Skechers expects fiscal 2024 sales between $8.88 billion and $8.98 billion, which indicates a rise from the $8 billion in fiscal 2023. It predicts earnings per share between $4.08 and $4.18, implying growth from the $3.49 reported last year.

Urban Outfitters is pleased with strong consumer demand at the start of the second quarter of fiscal 2025 and expects this strength to continue, projecting mid-single-digit total company sales growth. The retail and wholesale segments are both anticipated to experience low-single-digit growth, whereas the Nuuly segment is projected to achieve mid-double-digit sales growth. Urban Outfitters is optimistic about the outlook for the Anthropologie consumer and expects mid-single-digit comps growth for fiscal 2025. With a planned capital expenditure of $210 million, the company will prioritize retail store expansion, including the opening of 57 stores, alongside investments in logistics and IT infrastructure to fortify its operational capabilities.

Abercrombie is on track to achieve its 2024 target of demonstrating sustainable, profitable growth. The company expects to continue benefiting from strength in its brands, driven by its focus on delivering high-quality, on-trend assortments for new and retained customers across regions and brands. It has also been focused on making strategic investments across stores, digital and technology, which are slated to aid the company in the long term. Backed by the strong first-quarter fiscal 2024 results, Abercrombie raised its sales view for fiscal 2024. It anticipates net sales for fiscal 2024 to increase 10% year over year from $4.3 billion. It earlier anticipated net sales growth of 4-5% for fiscal 2024.

Zacks Investment Research

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up