Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)A:--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

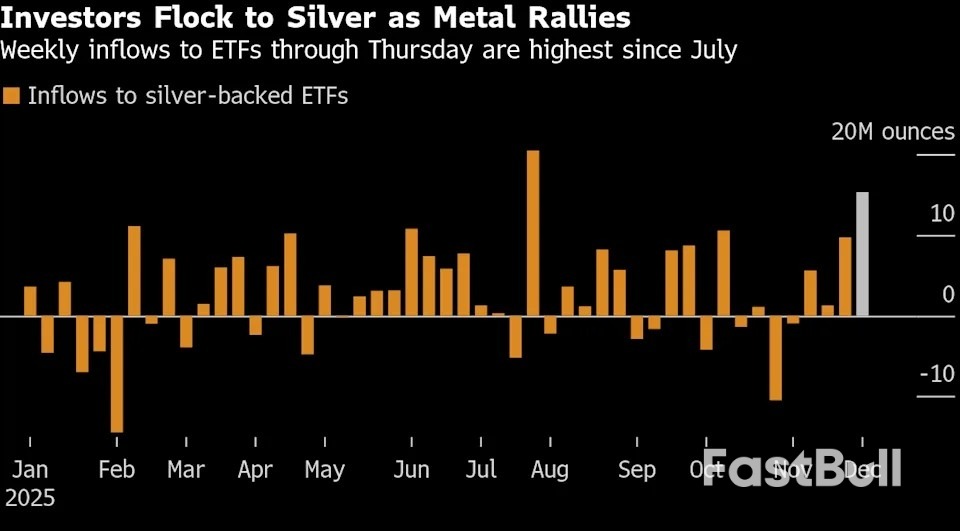

Total additions to silver-backed ETFs in the four days through Thursday are already the highest for any full week since July, a strong indicator of investor appetite despite signs silver’s gains may be overdone.

U.S. consumer spending increased moderately in September after three straight months of solid gains, suggesting a loss of momentum in the economy at the end of the third quarter as a lackluster labor market and rising cost of living curbed demand.

The report from the Commerce Department on Friday also showed annual inflation rising at its fastest pace in nearly 1-1/2 years in September. President Donald Trump's sweeping tariffs on imported goods have raised prices for consumers, though the increase has been gradual.

Trump is taking heat from Americans frustrated over high inflation, with his approval rating declining in recent weeks. A survey from the University of Michigan said the overall tenor of households' views in early December was "broadly somber as consumers continue to cite the burden of high prices."

"The fundamentals for consumers look challenging," said Oliver Allen, senior economist at Pantheon Macroeconomics. "The soft September sets the stage for more consumer weakness in the fourth quarter."

Consumer spending, which accounts for more than two-thirds of economic activity, rose 0.3% after a downwardly revised 0.5% gain in August, the Commerce Department's Bureau of Economic Analysis said. Economists polled by Reuters had forecast consumer spending advancing 0.3% after a previously reported 0.6% rise in August.

The report was delayed by a record 43-day government shutdown. The increase in spending reflected higher prices, particularly for gasoline and other energy goods. Outlays on motor vehicles, recreational goods and vehicles as well as other long-lasting manufactured products fell. Spending on clothing and footwear declined. Overall outlays on goods were unchanged.

Spending on services increased 0.4%, led by housing and utilities. Consumers also boosted spending on healthcare, financial services and insurance as well as hotel and motel rooms, and transportation services like airline tickets.

Economists have attributed the increased spending on services to high-income households whose wealth was boosted by a stock market rally. Labor market stagnation has hurt middle- and lower-income households, which are also being squeezed by tariffs, economists said, creating what they called a K-shaped economy.

Economists at Goldman Sachs in a note this week expected weak income growth because of tepid job growth and cuts to government assistance programs like Medicaid and Supplemental Nutrition Assistance Program benefits, formerly known as food stamps, to weigh on spending by low-income households in 2026.

When adjusted for inflation, spending was unchanged after rising 0.2% in August. Still, consumer spending likely grew at a brisk pace in the third quarter, underpinning the overall economy. The Atlanta Federal Reserve is estimating gross domestic product grew at a 3.8% annualized rate in the July-September quarter, which would match the second quarter's pace.

The BEA will publish its delayed initial third-quarter GDP estimate on December 23. Businesses have either absorbed the import duties or sold inventory accumulated before the taxes kicked in, limiting the pace of increase in inflation.

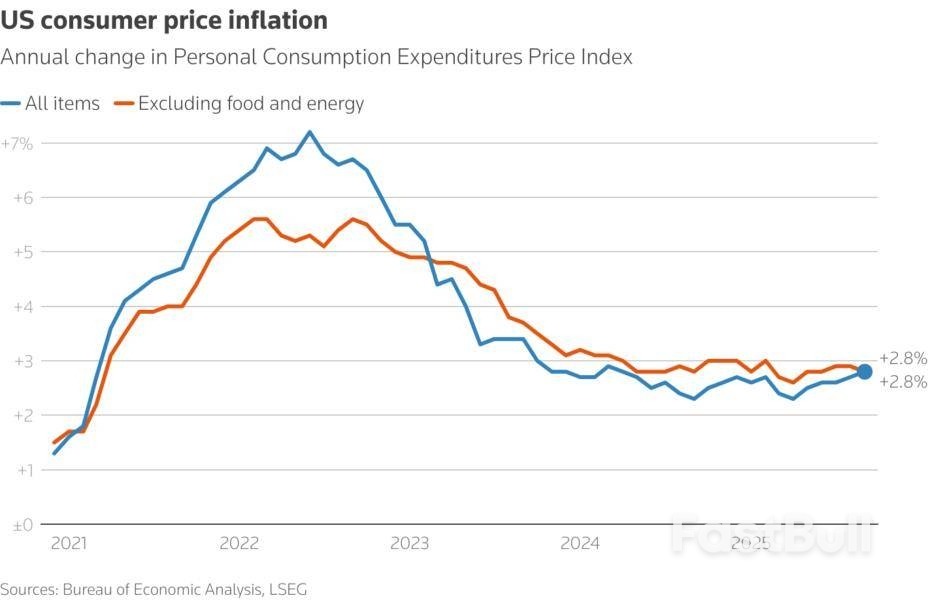

The Personal Consumption Expenditures (PCE) Price Index increased 0.3% in September, matching August's gain, the BEA said. In the 12 months through September, the PCE Price Index advanced 2.8%. That was the largest year-on-year advance since April 2024 and followed a 2.7% rise in August.

Excluding the volatile food and energy components, the PCE Price Index gained 0.2% after rising by the same margin in August. In the 12 months through September, the so-called core inflation index increased 2.8% after rising 2.9% in August.

The Federal Reserve tracks the PCE price measures for its 2% inflation target. Some economists said the outdated PCE inflation data favored the U.S. central bank cutting interest rates next Wednesday. Financial markets have almost priced in a 25-basis-point rate cut, CME Group's FedWatch tool showed.

"This likely bolsters the case for a rate cut if the focus stays on a weakening labor market amid moderate inflationary pressures," said Olu Sonola, head of U.S. economic research at Fitch Ratings.

Europe faces "civilisational erasure" and may one day lose its status as a reliable U.S. ally, the Trump administration said in a major strategy document, drawing an outcry from Europeans who compared it to the rhetoric of the Kremlin.

The new National Security Strategy, posted on the White House website overnight Thursday-to-Friday, denounced the European Union as anti-democratic, and said the goal of the U.S. should be "to help Europe correct its current trajectory".

It accused European governments of "the subversion of democratic processes", including to thwart what it said was a demand from the European public to end the war in Ukraine.

"Over the long term, it is more than plausible that within a few decades at the latest, certain NATO members will become majority non-European," the document said.

"As such, it is an open question whether they will view their place in the world, or their alliance with the United States, in the same way as those who signed the NATO charter."

The EU declined to comment and there was mostly silence from serving European leaders who have taken care to avoid antagonising President Donald Trump.

But former European officials described the rhetoric as shocking, even by the Trump administration's standards of increasingly open hostility to traditional allies.

"It's language that one otherwise only finds coming out of some bizarre minds of the Kremlin," Former Swedish Prime Minister Carl Bildt said on X, describing the document as "to the right of the extreme right in Europe".

He called it "bizarre" that the only part of the world where the strategy saw a threat to democracy was Europe.

Former Latvian Prime Minister Krisjanis Karins told Reuters: "The happiest country reading this is Russia."

"Moscow has been trying to break the transatlantic bond for years, and now it seems the greatest disruptor of this bond is the U.S. itself, which is unfortunate," he said.

One European diplomat, speaking on condition of anonymity, said: "The tone on Europe is not promising. Even worse than Vance's speech in Munich in February," referring to a hostile speech by Vice President JD Vance at a conference in Munich that alarmed European capitals soon after Trump returned to office.

The document echoed some talking points of European far-right political parties, which have grown to become the main opposition to governments in Germany, France and other traditional U.S. allies. It appeared to praise them, saying "the growing influence of patriotic European parties" gives "cause for great optimism".

Nathalie Tocci, director of Italian think tank Istituto Affari Internazionali, said it showed the Trump administration was "in the business of tearing Europe apart by supporting far right nationalists backed by Russia".

The National Security Strategy is a document released periodically by the U.S. executive branch that outlines a president's vision of foreign policy and guides government decisions.

In a foreword, Trump said the strategy document was "a roadmap to ensure that America remains the greatest and most successful nation in human history".

The new document accused the European Union of undermining political liberty and sovereignty, censoring free speech and suppressing political opposition.

European politicians and officials have bridled at the tone from Washington but as they hurry to rebuild their neglected militaries to meet a perceived threat from Russia, they still rely heavily on U.S. military support.

The document said it was in the United States' strategic interest to negotiate a quick resolution in Ukraine and to re-establish "strategic stability" with Russia.

It was released amid a stalled U.S. peace initiative, in which Washington presented a peace plan that endorsed Russia's main demands in the near four-year-old war.

"A large European majority wants peace, yet that desire is not translated into policy, in large measure because of those (European) governments' subversion of democratic processes," it said.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up