Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

[Ethereum Surges Above $2,100, Up 10.9% In 24 Hours] February 7Th, According To Htx Market Data, Ethereum Has Rebounded And Broken Through $2100, Currently Trading At $2114, A 24-Hour Increase Of 10.9%

Booz Allen Hamilton Maintains Its Fiscal Year Guidance After Treasury Cancels Contracts And Trump Sues IRS For $10 Billion. Consulting Giant Booz Allen Hamilton Confirmed Its Fiscal Year Guidance Remains Unchanged, Expecting The Treasury Department's Contract Cancellations By President Trump To Have An Impact Of Less Than 1.0% On Overall Revenue For The Fiscal Year (the 12 Months Ending March 31, 2027). In Late January, The U.S. Treasury Announced The Cancellation Of 31 Contracts With The Company—with Total Annual Expenses Of $4.8 Million

US Plans Initial Payment Towards Billions Owed To UN In A Matter Of Weeks - Washington's UN Envoy Mike Waltz Tells Reuters

[Bitcoin Touched $71,751 This Morning, Rebounding Nearly 20% From The Low.] February 7Th, According To Htx Market Data, Bitcoin Rebounded This Morning To Touch $71,751, A 19.58% Increase From The Intraday Low Of $60,000, Making It The Day With The Highest Single-Day Price Increase During This Bull-Bear Cycle

In The Week Ending February 6, The US Stock Market's "interest Rate Cut Winners" Index Rose 4.41% Cumulatively. The "Trump Tariff Losers" Index Rose 4.03% Cumulatively, And The "Trump Financial Index" Rose 2.46% Cumulatively. The Retail Investor-heavy Stock Index/meme Stock Index Fell 3.35% Cumulatively

US Defense Secretary Hegseth: His Dept Is Formally Ending All Professional Military Education, Fellowships, And Certificate Programs With Harvard University

[Deutsche Bank: Large-Cap Tech Stocks Fall To Bottom Of 10-Year Trend Channel Relative To S&P 500] Deutsche Bank Strategists, Including Parag Thatte, Wrote In A Research Report That On Thursday, Large-cap And Tech Stocks Rebounded From The Bottom Of A 10-year Trend Channel Relative To The Rest Of The S&P 500, And Continued Their Rally On Friday. The Strategists Stated That Historically, This Group Has Typically Seen A Rally After Hitting The Bottom Of The Channel, Especially Against A Backdrop Of Rising Earnings. The Report Noted That This Year's Performance "is Entirely Driven By Changes In Valuation Multiples, Rather Than Adjustments In Earnings Expectations, A Stark Contrast To Last Year When It Was Entirely Driven By Upward Revisions In Earnings Expectations."

[German Industrial Output Shrinks For Fourth Consecutive Year] Data Released By The Federal Statistical Office Of Germany On February 6 Showed That, Affected By Factors Such As Weak Production In The Automotive Industry, German Industrial Output Will Decline By 1.1% In 2025 Compared To The Previous Year, Marking The Fourth Consecutive Year Of Decline. Statistics Show That, Excluding The Construction And Energy Sectors, Output In Other German Industrial Sectors Will Decline By 1.3% In 2025. Among Them, Key Sectors Such As The Automotive Industry And Machinery Manufacturing Saw The Most Significant Declines, Falling By 1.7% And 2.6% Respectively

India Repo Rate

India Repo RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

Japan Leading Indicators Prelim (Dec)

Japan Leading Indicators Prelim (Dec)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Dec)

Germany Industrial Output MoM (SA) (Dec)A:--

F: --

Germany Exports MoM (SA) (Dec)

Germany Exports MoM (SA) (Dec)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Jan)

U.K. Halifax House Price Index YoY (SA) (Jan)A:--

F: --

U.K. Halifax House Price Index MoM (SA) (Jan)

U.K. Halifax House Price Index MoM (SA) (Jan)A:--

F: --

France Trade Balance (SA) (Dec)

France Trade Balance (SA) (Dec)A:--

F: --

Canada Leading Index MoM (Jan)

Canada Leading Index MoM (Jan)A:--

F: --

Mexico Consumer Confidence Index (Jan)

Mexico Consumer Confidence Index (Jan)A:--

F: --

P: --

Canada Employment (SA) (Jan)

Canada Employment (SA) (Jan)A:--

F: --

Canada Full-time Employment (SA) (Jan)

Canada Full-time Employment (SA) (Jan)A:--

F: --

Canada Part-Time Employment (SA) (Jan)

Canada Part-Time Employment (SA) (Jan)A:--

F: --

Canada Unemployment Rate (SA) (Jan)

Canada Unemployment Rate (SA) (Jan)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Jan)

Canada Labor Force Participation Rate (SA) (Jan)A:--

F: --

P: --

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11.

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11. U.S. UMich Consumer Sentiment Index Prelim (Feb)

U.S. UMich Consumer Sentiment Index Prelim (Feb)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Feb)

U.S. UMich Consumer Expectations Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Jan)

Canada Ivey PMI (Not SA) (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Feb)

U.S. UMich Current Economic Conditions Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (SA) (Jan)

Canada Ivey PMI (SA) (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)A:--

F: --

P: --

Russia Retail Sales YoY (Dec)

Russia Retail Sales YoY (Dec)A:--

F: --

P: --

Russia Unemployment Rate (Dec)

Russia Unemployment Rate (Dec)A:--

F: --

P: --

Russia Quarterly GDP Prelim YoY (Q1)

Russia Quarterly GDP Prelim YoY (Q1)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Dec)

U.S. Consumer Credit (SA) (Dec)A:--

F: --

China, Mainland Foreign Exchange Reserves (Jan)

China, Mainland Foreign Exchange Reserves (Jan)A:--

F: --

P: --

Japan Wages MoM (Dec)

Japan Wages MoM (Dec)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Dec)

Japan Trade Balance (Customs Data) (SA) (Dec)--

F: --

P: --

Japan Trade Balance (Dec)

Japan Trade Balance (Dec)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Feb)

Euro Zone Sentix Investor Confidence Index (Feb)--

F: --

P: --

Mexico CPI YoY (Jan)

Mexico CPI YoY (Jan)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Jan)

Mexico 12-Month Inflation (CPI) (Jan)--

F: --

P: --

Mexico PPI YoY (Jan)

Mexico PPI YoY (Jan)--

F: --

P: --

Mexico Core CPI YoY (Jan)

Mexico Core CPI YoY (Jan)--

F: --

P: --

ECB Chief Economist Lane Speaks

ECB Chief Economist Lane Speaks Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

China, Mainland M0 Money Supply YoY (Jan)

China, Mainland M0 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Jan)

China, Mainland M2 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks U.K. BRC Overall Retail Sales YoY (Jan)

U.K. BRC Overall Retail Sales YoY (Jan)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Jan)

U.K. BRC Like-For-Like Retail Sales YoY (Jan)--

F: --

P: --

Indonesia Retail Sales YoY (Dec)

Indonesia Retail Sales YoY (Dec)--

F: --

P: --

France ILO Unemployment Rate (SA) (Q4)

France ILO Unemployment Rate (SA) (Q4)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Jan)

U.S. NFIB Small Business Optimism Index (SA) (Jan)--

F: --

P: --

Brazil IPCA Inflation Index YoY (Jan)

Brazil IPCA Inflation Index YoY (Jan)--

F: --

P: --

Brazil CPI YoY (Jan)

Brazil CPI YoY (Jan)--

F: --

P: --

U.S. Retail Sales YoY (Dec)

U.S. Retail Sales YoY (Dec)--

F: --

P: --

U.S. Labor Cost Index QoQ (Q4)

U.S. Labor Cost Index QoQ (Q4)--

F: --

P: --

U.S. Import Price Index MoM (Dec)

U.S. Import Price Index MoM (Dec)--

F: --

P: --

U.S. Export Price Index YoY (Dec)

U.S. Export Price Index YoY (Dec)--

F: --

P: --

U.S. Export Price Index MoM (Dec)

U.S. Export Price Index MoM (Dec)--

F: --

P: --

U.S. Import Price Index YoY (Dec)

U.S. Import Price Index YoY (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Dec)

U.S. Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales MoM (Dec)

U.S. Core Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales (Dec)

U.S. Core Retail Sales (Dec)--

F: --

P: --

No matching data

View All

No data

Shiba Inu team has revealed a crucial security upgrade for Shibarium, which strengthens decentralization and removes single points of failure that can affect stability.

According to Shibizens, a Shibarium focused account, the Shibarium RPC Migration Network upgrade is currently in progress.

Shibarium | SHIB.IO@ShibizensOct 31, 2025Shibarium RPC Migration: Network Upgrade in Progress

🔸 Legacy Endpoint Closure

The old public RPC connection for Shibarium is being retired within two weeks, ending access through the previous URL.

🔸 New Access Point

All users and developers must update their settings to use… pic.twitter.com/adcpQCNshy

The upgrade includes Legacy Endpoint Closure, which will see the old public RPC connection for Shibarium retired within two weeks, ending access through the previous URL. The move is expected to help reinforce a stronger, more distributed network built for long-term reliability.

In September, Shibarium went through a critical security incident that paused the network to prevent data corruption. The issue came from a compromised validator key, not from a flaw in the chain itself, as the attacker used short‑lived stake amplification (via a 4.6 million BONE delegation) to cross thresholds and attempt malicious control.

Following a comprehensive review and a series of security enhancements, the Plasma Bridge was restored for BONE, allowing users to bridge BONE between Ethereum and Shibarium again. New safeguards were added, including blacklisting to block malicious addresses and a seven-day withdrawal delay (finalization window).

Shiba Inu closes first red October

Shiba Inu had a monthly loss in October for the first time since it launched, snapping a winning streak that had earned the name "Uptober" among cryptocurrency traders.

Shiba Inu ended October down 15.9%, as the broader crypto market struggled in recent weeks amid market jitters and muted investor risk appetite.

October saw the largest crypto liquidation in history following trade tensions, with Shiba Inu dropping to a low of $0.0000085 during the Oct. 10 flash crash.

At the time of writing, SHIB was up 2.29% in the last 24 hours to $0.00001013 as most crypto assets traded in green at November's start.

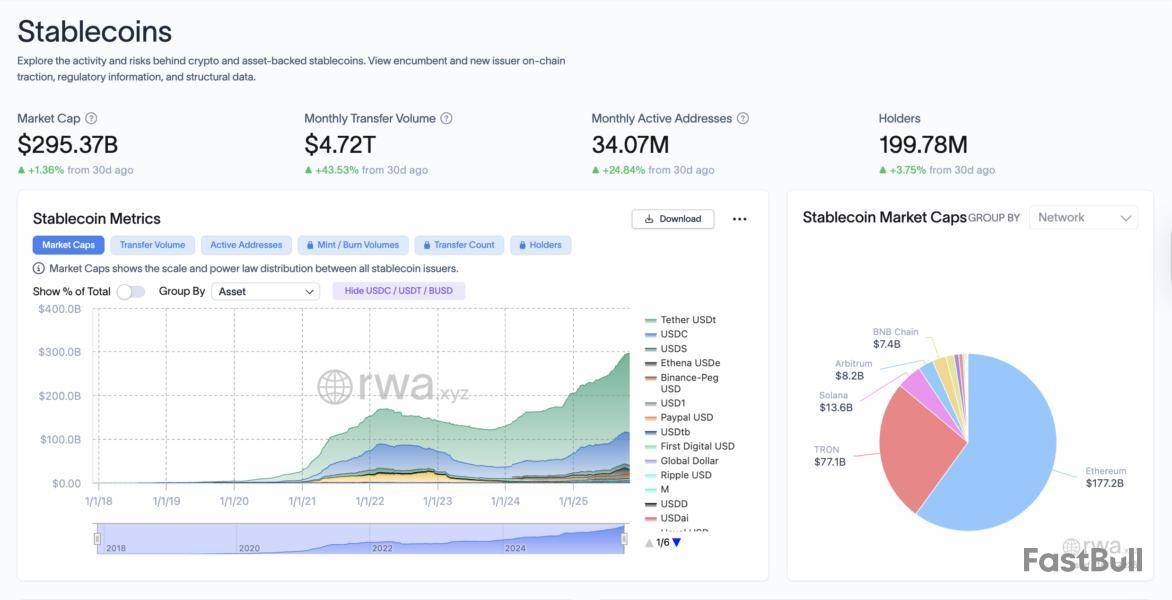

Banks and financial institutions have started experimenting with tokenized bank deposits, bank balances recorded on a blockchain, but the technology is doomed to lose out to stablecoins, according to Omid Malekan, an adjunct professor at Columbia Business School.

Overcollateralized stablecoin issuers, who must maintain 1:1 cash or short-term cash equivalent reserves to back their tokens, are safer from a liability perspective than the fractional reserve banks that would issue tokenized bank deposits, Malekan said.

Stablecoins are also composable, meaning they can be transferred across the crypto ecosystem and used in various applications, unlike tokenized deposits, which are permissioned, have know-your-customer (KYC) controls, and have restricted functionality.

Tokenized bank deposits are like a “checking account where you could only write checks to other customers of the same bank,” Malekan continued. He added:

The tokenized real-world asset (RWA) sector, physical or financial assets tokenized on a blockchain, which includes fiat currencies, real estate, equities, bonds, commodities, art, and collectibles, is projected to swell to $2 trillion by 2028, according to the Standard Chartered bank.

Stablecoin issuers will share yield one way or another

Tokenized bank deposits must also compete with yield-bearing stablecoins or stablecoin issuers that find ways of circumventing the yield prohibition in the GENIUS stablecoin Act, passing on the yield in the form of various customer rewards, Malekan argued.

The banking lobby has pushed back against yield-bearing stablecoins over fears that stablecoin issuers sharing interest with customers would erode the banking industry’s market share.

The current average yield offered on a savings account at a retail bank in the US or the UK is well under 1%, making anything above that attractive to customers.

The resistance to yield-bearing stablecoins from the banking lobby drew criticism from New York University professor Austin Campbell, who accused the banking industry of using political pressure to protect its financial interests at the cost of retail customers.

Magazine: Can Robinhood or Kraken’s tokenized stocks ever be truly decentralized?

ApeCoin’s ‘Exodus Rising’ is a special event, but few details are given. The message talks about a big change for the community and limited rockets, which may hint at a game or special launch. Usually, secret and creative events get a lot of attention and bring big moves in price. Prices can quickly go up if the event excites holders and brings new users. If it does not meet hopes, there could also be a quick drop. Traders should be careful and watch the news as the event goes live. source

ApeCoin@apecoinOct 31, 2025EXODUS RISING

Outbreak is spreading and rockets are limited.

Your community's only way out is up.

Monday 11/3 pic.twitter.com/zw2bRjmiEF

DFDVSOL will hold a recap and AMA with a new board member joining. This is a chance for the team to answer questions and share updates on their business. If big plans or partnerships are shared, this could help the price move higher. AMAs can also build trust if the team is clear and open. But, if there is no new news, the event may have little effect on price. Traders who hold DFDVSOL should listen in to learn more about the project’s future. source

DeFi Dev Corp. (DFDV)@defidevcorpOct 31, 2025Mark your calendar!

We’re going LIVE on Monday (Nov. 3) at 5 PM ET for our October 2025 Business Recap and AMA.

Joining us will be our newest board member, @TheMarginMan.

Got questions for the team?

Drop them below and set a reminder to tune in. https://t.co/OCqd1YCRXa

Creditlink Token plans a new announcement about earning $CDL with zero risk. This message will get attention because ‘zero risk’ is very attractive for many traders. If the team shares a new way to earn tokens in a safe way, this could make more people buy or hold CDL. Price could go up if this idea is really good and people trust it. But, if it is not special or does not have details, there might be no big move. Watch for news on the announcement day. source

Creditlink@creditslinkNov 01, 2025Want to earn $CDL with zero risk?

The answer drops this Monday. Stay tuned.

Electric Coin Co. (ECC), the firm which created Zcash (ZEC) and develops the Zashi wallet, has unveiled its roadmap for the fourth quarter of 2025, amid a surge in the privacy-oriented token's shielded supply and price.

ECC's roadmap lists four key priorities: adding ephemeral addresses for every swap to ZEC using the multichain NEAR Intents protocol, generating a new transparent address after a user's current address receives funds, allowing Keystone hardware wallet users to resync their devices, and supporting Pay-to-Script-Hash (P2SH) multisig wallets in Keystone. ECC plans to use one such multisig wallet to secure the management of Zcash developer funds.

"This quarter, ECC’s focus is on reducing technical debt, improving privacy and usability for Zashi users, and ensuring smooth dev fund management," the firm's announcement states. "As market conditions and other factors impact ECC revenue (positively or negatively), we will re-tune our approach, refocus our efforts, and step on the gas."

These moves build on Zashi’s recent decentralized off-ramp for shielded ZEC, from Aug. 28, and the decentralized on-ramp (“Swaps”) release from Oct. 1, after which ECC temporarily disabled the Coinbase on-ramp over a new session-token requirement it viewed as privacy-unfriendly. The planned Q4 features effectively harden that flow by minimizing address reuse around swaps and simplifying hardware-signer ops.

The roadmap comes as Zcash's shielded supply and price have ballooned in recent months. The token currently trades at around $420, according to The Block's Zcash Price page, up from just $50 in mid-September. The token's market capitalization recently flipped that of competing privacy coin Monero.

The supply of shielded tokens in Zcash's Orchard privacy protocol, the most recent version of Zcash's protocol (though it maintains backwards compatibility with the earlier Sprout and Sapling versions), recently surpassed 4.1 million tokens, according to ZecHub data. The bulk of the growth in supply since mid-September has been in the Orchard protocol.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Bitcoin appears to be gearing up for a major move as key technical patterns align. A strong triangle support structure and a developing inverse head and shoulders pattern are signaling a potential bullish reversal. Momentum is tightening, suggesting that a breakout could be closer than it seems.

Massive Triangle Formation Holds Firm Amid Market Shakeouts

Batman, a well-known crypto analyst, recently highlighted that Bitcoin has been consolidating for several weeks within a massive descending triangle formation. Despite multiple shakeouts attempting to push the price lower, the key support level has consistently held firm, signaling underlying strength in the market.

Related Reading: Bitcoin At Key Retest: Bounce Or $98,000 Next?

He noted that the current setup represents a classic, textbook pattern often seen before an explosive breakout in price. Each test of support has been met with strong buying interest, showing that bulls are actively defending the lower boundary of the structure. The classic textbook formation suggests that Bitcoin’s price is coiling up energy for a potential breakout once momentum returns.

Batman remains highly optimistic about Bitcoin’s next move, stating that his target remains clear at $126,000. He cautioned traders not to underestimate the setup, emphasizing that the current price action could mark the calm before a major surge. In his view, this represents a big opportunity for those watching closely, as the market prepares for what could be the next explosive leg higher.

Technical Setup Hints At Shift From Consolidation To Expansion

According to GandalfCrypto in a current update, Bitcoin is currently forming a potential inverse Head & Shoulders pattern, which often signals a major trend reversal in technical analysis. The structure has been developing over the past few weeks, with clear left and right shoulders forming, while the neckline sits around the $115,000–$116,000 range. This area has become a key zone to monitor, as it represents the boundary between continued consolidation and a potential bullish breakout.

Related Reading: Here’s Why Bitcoin Market Dynamics Are Evolving As New Developments Surface Overnight

GandalfCrypto explained that if Bitcoin successfully breaks above this neckline with strong volume, it would validate the reversal pattern and likely trigger a surge toward the $130,000 target. Such a move would confirm renewed strength among buyers and could mark the beginning of a sustained bullish phase after weeks of sideways movement and uncertainty.

He further noted that momentum indicators are coiling tightly, reflecting a buildup of energy beneath the surface. GandalfCrypto emphasized the importance of patience and precision, waiting for a confirmed breakout rather than preempting the move, as this will distinguish traders who capture the next leg higher from those caught in false starts.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up