Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Vitalik Buterin, who co-founded Ethereum, recently shared an optimistic forecast about the future of Ethereum's ecosystem. He highlighted some big improvements in cross-L2 interoperability that could make a big difference to how users experience Layer 1, rollups and sidechains.

Buterin highlighted the commitment and drive within the Ethereum community to tackle these interoperability issues and set out a plan for how these improvements will be made.

In response to Buterin's prediction, Shytoshi Kusama, the anonymous lead of the Shiba Inu community and development, posted a short reaction: "I wouldn't be surprised." Kusama's response is worth noting, given that Shiba Inu's own Layer-2 EVM blockchain solution, Shibarium, is marking its first anniversary this August.

I won't be surprised one bit. #shibarmy https://t.co/RhSpLLyOXV— Shytoshi Kusama™ (@ShytoshiKusama) August 7, 2024

Shibarium's year

Shibarium has made some great progress over the past year. The numbers show some impressive growth: an average block time of 26.726 seconds, over 416 million completed transactions and more than 1.8 million total addresses. The platform has seen a lot of activity, with almost 1.8 million BONE transfers and over 11,000 tokens in circulation.Source: Shibariumscan

Shibarium is still a new project, but it is already looking good. Buterin thinks L2s are going to be big, and Kusama is pretty confident too. One thing for sure, many SHIB enthusiasts cannot wait to see what happens with Shiba Inu's blockchain infrastructure over the next year.

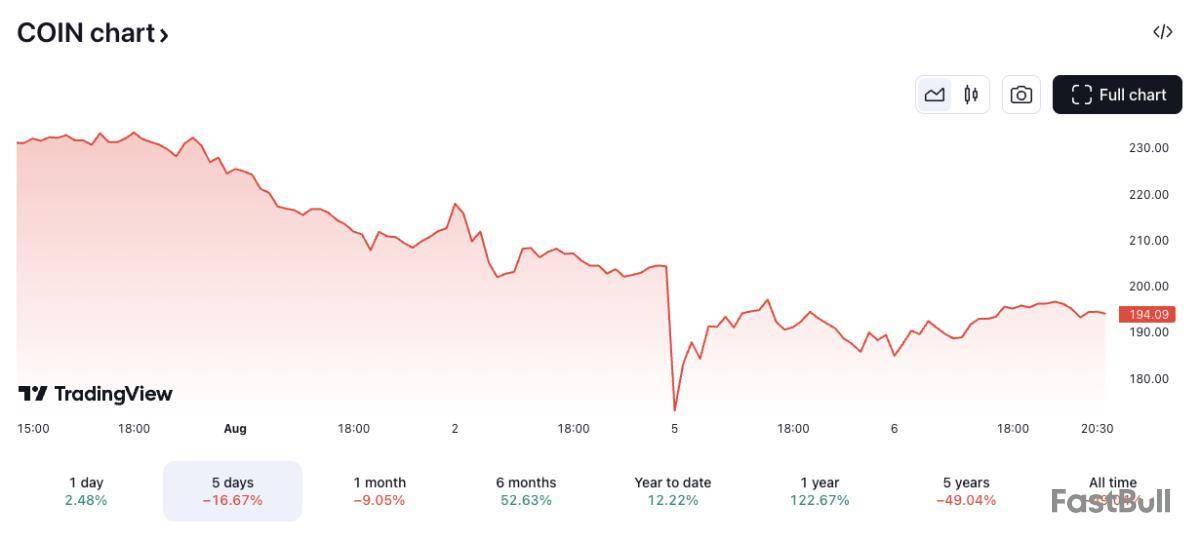

Ark Invest bought another 19,892 Coinbase shares, worth $3.9 million, across three of its exchange-traded funds on Tuesday as it continued to rebalance its fund weightings following Monday’s market plunge.

The Cathie Wood-led investment firm purchased 13,833 shares ($2.7 million) for its Innovation ETF (ARKK), 2,743 shares ($533,000) for its Next Generation Internet ETF (ARKW), and 3,316 shares ($644,000) for its Fintech Innovation ETF (ARKF), according to Ark's latest trade filings.

The latest acquisitions follow the $17.8 million worth of Coinbase shares Ark bought for the same funds on Monday — the first time the firm had bought back Coinbase stock since purchasing $21 million worth of COIN in June 2023. The stock’s subsequent rise of more than 250% led to Ark offloading COIN numerous times during the period.

Ark’s investment strategy involves letting no individual holding take up more than 10% of an ETF’s portfolio. This is to maintain diversification within its funds — meaning Ark is likely to continue rebalancing its COIN weightings if the stock rises or falls significantly relative to Ark's other holdings in its funds.

According to the firm’s disclosures, COIN is now the third-largest holding within its ARKK ETF, with a weighting of 8.7%, worth $445.3 million, as of Aug. 6. COIN is the fourth-largest holding in its ARKW fund at 6.8%, worth $84.4 million. Coinbase shares represent Ark’s largest holding in its ARKF fund at 9.8%, worth $75.1 million.

Coinbase's share price recovers from 15% drop

Coinbase shares gained 2.5% on Tuesday to reach $194.17 by market close, according to TradingView — further recovering from an initial 15% drop on Monday morning amid market volatility surrounding U.S. recession fears and heightened geopolitical tensions. The stock is still up 123% over the past year but remains 5% down this week and 43% below its all-time high of $342.98, set in November 2021.

COIN/USD price chart. Image: TradingView.

Coinbase is valued at $36.1 billion as of Aug. 6, according to The Block’s data dashboard.

Ark buys more Robinhood shares, offloads Jack Dorsey’s Block

Ark also bought 121,979 shares in the crypto and stock trading app Robinhood for the same three funds on Tuesday, worth $2.1 million, as HOOD gained 4.8% for the day. This followed its purchase of $11.2 million worth of Robinhood stock on Monday. Robinhood is due to announce its Q2 financial results after market close on Wednesday.

However, the investment firm wasn’t only in buying mode, deciding to offload shares in Jack Dorsey’s Block, which agreed to supply Bitcoin miner Core Scientific with its new 3-nanometer mining ASICs last month. Ark sold 286,425 Block shares ($16.4 million) on Tuesday, following the $26 million worth of SQ it sold on Monday, as the stock traded flat on the day.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2024 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

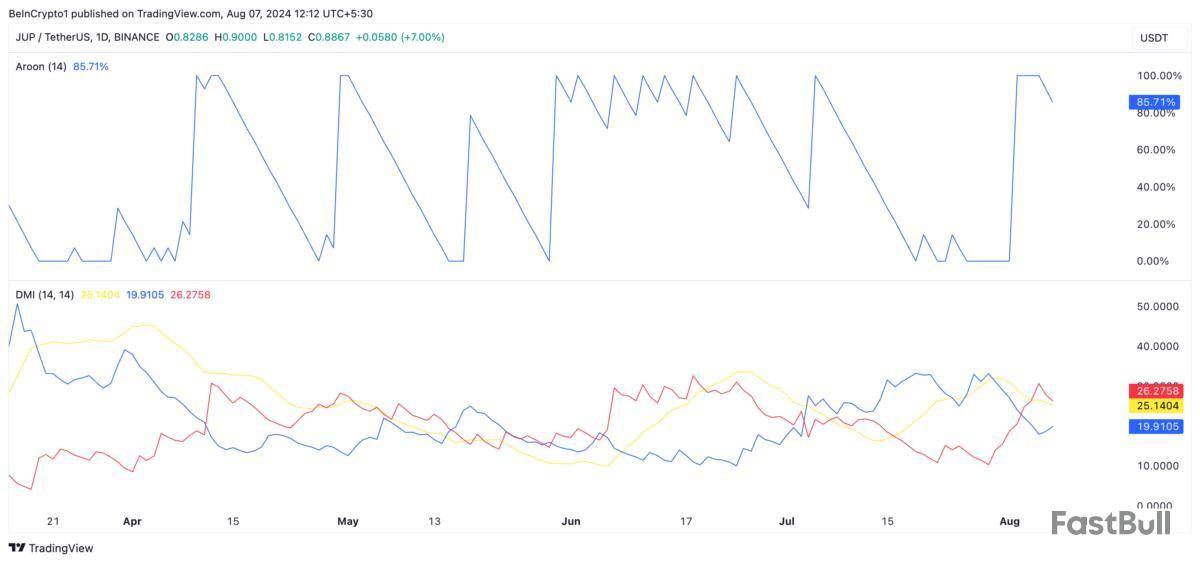

JUP, the native token of the Solana-based decentralized exchange Jupiter, has maintained a downtrend since July 29.

The altcoin’s decline was worsened by Monday’s market downturn, causing its price to plunge to a five-month low, a level it now risks revisiting.

Jupiter Bears Have the Upper Hand

At press time, JUP trades at $0.88. The broad market recovery since Tuesday has driven JUP’s price up nearly 10% in the past 24 hours. However, the 44% decline in its trading volume indicates a negative divergence.

When this divergence emerges, it indicates that the buying momentum backing the price surge is weak. Therefore, JUP’s rally might be said to have mirrored the general market rebound and not been due to significant demand from its holders.

Moreover, key momentum indicators observed on a daily chart confirm that JUP’s downtrend is strong. For example, its Aroon Down Line is 85.71% as of this writing. An asset’s Aroon indicator measures its trend strength and identifies potential price reversal points.

When the Down Line is at or close to 100%, the downtrend is very strong. It signals that the asset’s price has consistently made new lows, showing a clear downward momentum.

Further, according to readings from JUP’s Directional Movement Index (DMI), its negative directional indicator (-DI) (red) currently rests above its positive directional indicator (+DI) (blue), confirming the strong bearish bias against the altcoin.

This indicator measures an asset’s trend strength. When the -DI lies above the +DI, it signals that selling pressure outweighs the demand for an asset.

JUP Price Prediction: Short Traders Ravage Market

In its futures market, JUP traders have primarily demanded short positions since the beginning of August, as evidenced by its negative funding rates. At press time, the token’s funding rate is -0.0048%.

When an asset’s aggregated funding rate across cryptocurrency exchanges is negative, it means more traders are buying the asset, expecting a decline, than those buying in anticipation of a rally.

This is a bearish signal because it reflects traders’ expectation that prices will decrease as they are willing to pay to maintain their short positions.

If JUP maintains its downtrend, its next price target is $0.65, a 26% fall from its current value.

However, if market sentiment shifts and an uptrend ensues, the altcoin may rally to $0.93.

In a recent tweet, Ripple President Monica Long revealed plans for a new independent XRP Ledger Foundation. This comes as XRP Ledger Foundation, which supports the growth and development of XRP Ledger, has now been renamed as Inclusive Financial Technology Foundation (INFTF).

Ripple's president had responded to an XRP Ledger community member who had inquired if there may be plans to end the "XRP Ledger Foundation" in the wake of the transition.

The XRP Ledger community member also sought to know Ripple's plans to support XRP Ledger and the steps being taken to ensure the continued stability, innovation and decentralization of XRPL.

Hi Jungle, thanks for your questions. As Bharath and David mentioned, more details to come but to clarify for now, the discussions with XRPLF, XRPL Labs, XRPL Commons, Ripple and others are about a new (independent) XRPL foundation -- this is different from the new INFTF…— Monica Long (@MonicaLongSF) August 7, 2024

In this regard, the Ripple president, echoing Ripple CTO statements on the matter, clarified that there are current discussions with the XRP Ledger Foundation itself, XRPL Labs, XRPL Commons, Ripple and others about a new and independent XRPL Foundation entirely different from the new INFTF entity.

In response, Ripple CTO David Schwartz stated that Ripple has been in conversation with the XRP Ledger entity to discuss the best path forward for a foundation to serve the interests of XRP Ledger and community, adding that they are aligned on the next steps, and specifics will be shared as soon as possible.

XRP Ledger Foundation rebrands to INFTF

In an Aug. 6 announcement, XRP Ledger Foundation announced its renaming to INFTF — a backronym for Inclusive Financial Technology Foundation (legally InFTF MTU).

The reason for the change was stated: "As we get deeper into the execution of our goals, it has become apparent to us that being tied to any one technology is restrictive. Very often there could be a solution that is completely outside of what is expected from an organisation known as The XRP Ledger Foundation."

The XRP Ledger Foundation stated that it has been working with several international organizations over the last year to promote global social and financial inclusion. For example, it is presently an associate member of the Organisation for Southern Cooperation, which has 28 member countries.

This change, according to the XRPLF, now presents an opportunity for various XRP Ledger stakeholders to come together to maintain the things that the Foundation is currently a custodian of: the XRP trademark, the Code Repository and the xrpl.org domain.

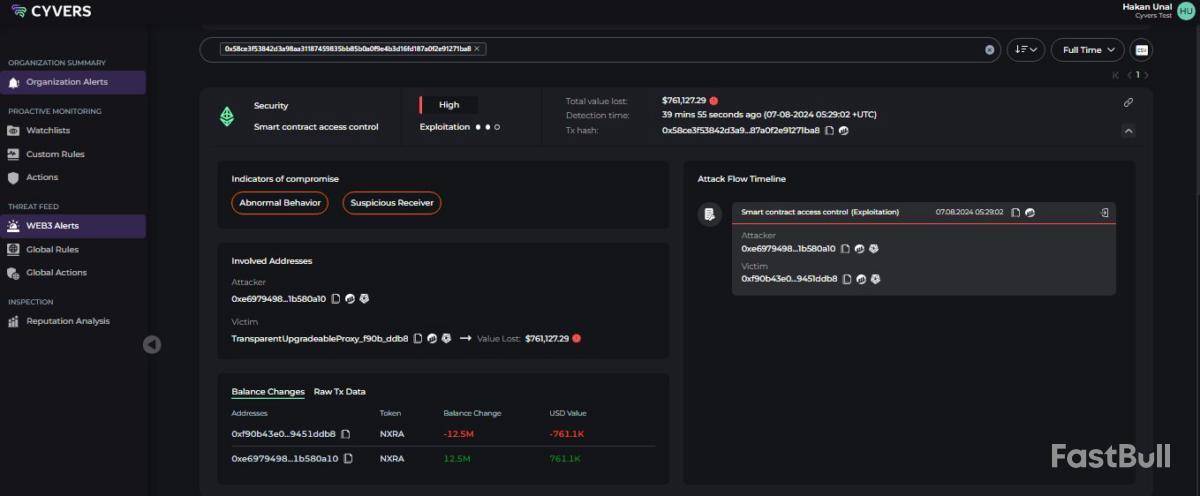

Nexera protocol has been exploited for $1.5 million worth of digital assets in another smart contract security incident.

Nexera, a decentralized finance (DeFi) protocol aiming to bridge DeFi with traditional finance, was hacked for $1.5 million worth of Nexera (NXRA) tokens, according to an Aug. 7 X post by Cyvers, that wrote:

While the $1.5 million counts as a relatively small incident, it comes only a day after Ronin Network was exploited for $9.8 million worth of Ether tokens, by a suspected white hat hacker, who returned all the lost funds within a few hours.

Related: $510B crypto sell-off wipes 2024 gains for top 50 coins

This is a developing story, and further information will be added as it becomes available.

Solana (SOL) is leading the crypto market recovery following the massive Monday crash. SOL registered some of the largest gains after reclaiming the $140 support zone on Tuesday morning. Its strength was highlighted by several market watchers, who shared their bullish predictions for the token. However, an analyst warned investors of a key level to watch out.

Solana Leads The Market Recovery

As the crypto market recovers, Solana saw a massive 30% bounce from its lowest trading price of $110, registered on Monday. This performance crowned SOL the biggest gainer among the top 10 cryptocurrencies by market capitalization, surpassing Bitcoin (BTC) and Ethereum (ETH)’s recovery.

Pseudonym trader Glitch Capital compared BTC, ETH, and SOL’s charts, deeming Solana’s the “best looking one out of the three” by far. To the trader, SOL “swept lows into $120 support and held nicely” compared to the two largest cryptocurrencies.

Per the post, the token is testing its M15 trend as resistance, which could give SOL a decent push,” if it can flip this trend into support. Similarly, trader Eugene Ng Ah Sio praised the token’s performance. “One thing of note is the absolute monstrous strength $SOL shows, whether it’s rain or shine,” said the trader in an X post.

Based on the chart, the trader believes “it’s pretty much given” that the cryptocurrency will hit a new all-time high (ATH) “at some point” during this cycle as “there are simply more buyers than sellers.”

Crypto Jelle, market analyst and investor, reaffirmed his SOL forecast as the token was “still holding the key support area, and the weekly candle is green.” In a previous analysis, Jelle stated that Solana looked “ripe to push higher.” Jelle predicts the token will reach a new ATH during Q4 2024 and set a $600 price target for this cycle.

SOL Price Could See Another 10-15% Drop

Despite the bullish sentiment, Ali Martinez revealed that SOL’s TD Sequential indicator showed a sell signal on the hourly chart. This signal suggested the token could potentially lose the $140 support zone, which it’s been testing throughout the day.

Failing to maintain this support level could trigger a retrace to the $135-$130 price range. According to the analyst, Solana could find some relief at the $146 mark as “breaking the risk line (…) would invalidate this signal.” Moreover, reclaiming this level could “potentially drive SOL up to $150-$166” resistance levels.

Altcoin Sherpa believes investors have a good accumulation range within the $125-$150 prices. To him, Solana remains one of the strongest performers of the bull run and will be “one of the best retail chains this cycle.”

Additionally, Sherpa highlighted SOL’s “strong reactions today” but forecasted another drop to the $125 mark soon. “I still think you get another shot at $125 or lower in a few weeks, personally,” said the analyst. As of this writing, Solana is trading at $148, a 10% surge in the last 24 hours.

Bitcoin payments app Strike has joined forces with crypto exchange Bitstamp to accelerate its expansion in the European Union by making fiat-to-crypto on-ramp easier for users, the companies announced Wednesday.

Stripe, led by Chicago-based Zap Solutions and entrepreneur Jack Mallers, launched its services in Europe in April after expanding to Africa in February.

The fintech firm offers a customizable widget that developers can embed into their product to allow conversion of crypto and instant settlement of transactions. It currently supports multiple cryptocurrencies, including bitcoin {{BTC}}, Ethereum {{ETH}}, Solana {{SOL}}, Stellar {{XLM}}, and USD Coin {{USDC}}. The widget won't be available to UK customers, the two companies said in a press release.

Bitstamp will help the fintech firm manage fiat-to-cryptocurrency conversion and transfers to consumers. This, in turn, will expand the crypto exchange’s Bitstamp-as-a-service product, the white-label version of its crypto trading services to banks and fintechs.

On June 6, the popular trading firm Robinhood (HOOD) said it would buy Bitstamp in a $200 million all-cash deal. The move aims to expand the exchange's reach beyond the U.S. and compete with peers including Coinbase.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up