Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

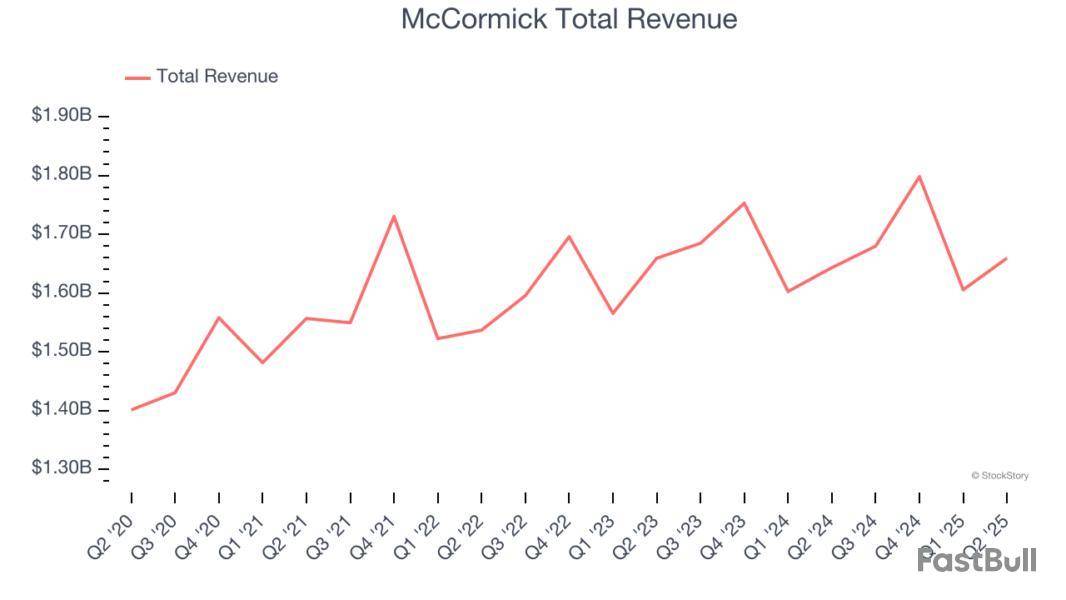

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how shelf-stable food stocks fared in Q2, starting with McCormick .

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

The 21 shelf-stable food stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1.2% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 7.8% since the latest earnings results.

The classic red Heinz ketchup bottle’s competitor, McCormick sells food-flavoring products like condiments, spices, and seasoning mixes.

McCormick reported revenues of $1.66 billion, flat year on year. This print was in line with analysts’ expectations, and overall, it was a satisfactory quarter for the company with a solid beat of analysts’ EBITDA estimates but a slight miss of analysts’ gross margin estimates.

Brendan M. Foley, Chairman, President, and CEO, stated, "We are pleased with our strong results for the first half of the year, as we are managing in a dynamic environment. Our continued volume-driven performance and share gains across core categories reflect the success of our prioritized investments in the areas that are driving the greatest value and will sustain our momentum for the remainder of 2025 and beyond.

The stock is down 11.6% since reporting and currently trades at $65.10.

Is now the time to buy McCormick? Access our full analysis of the earnings results here, it’s free.

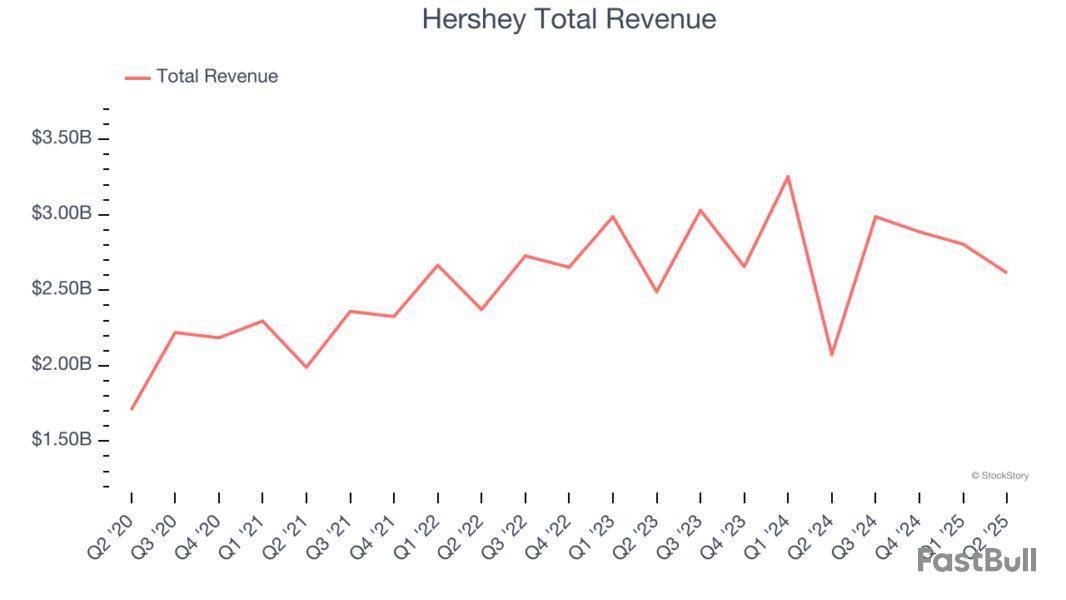

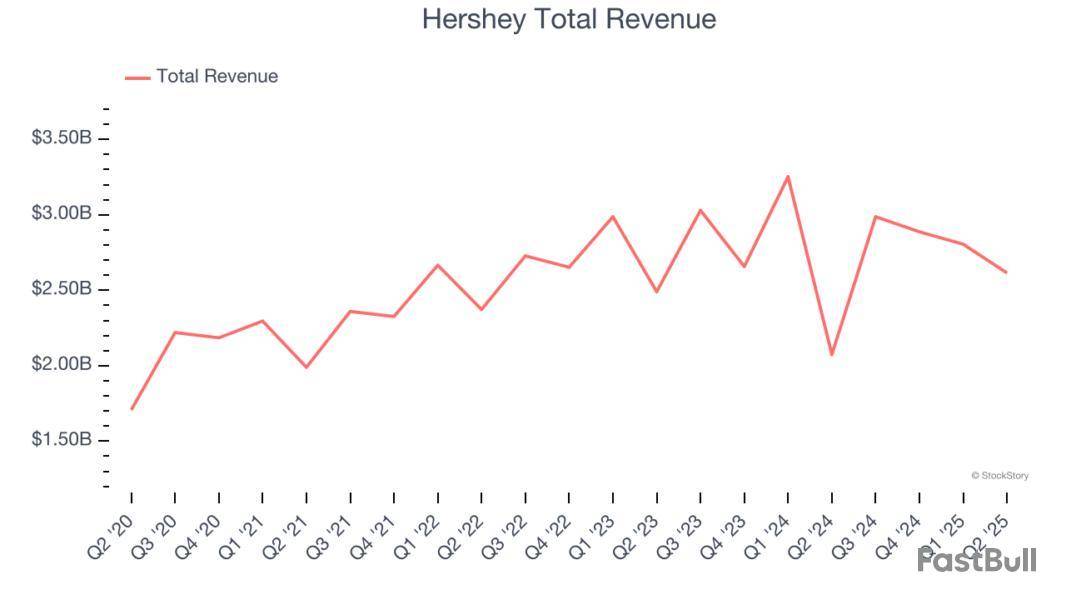

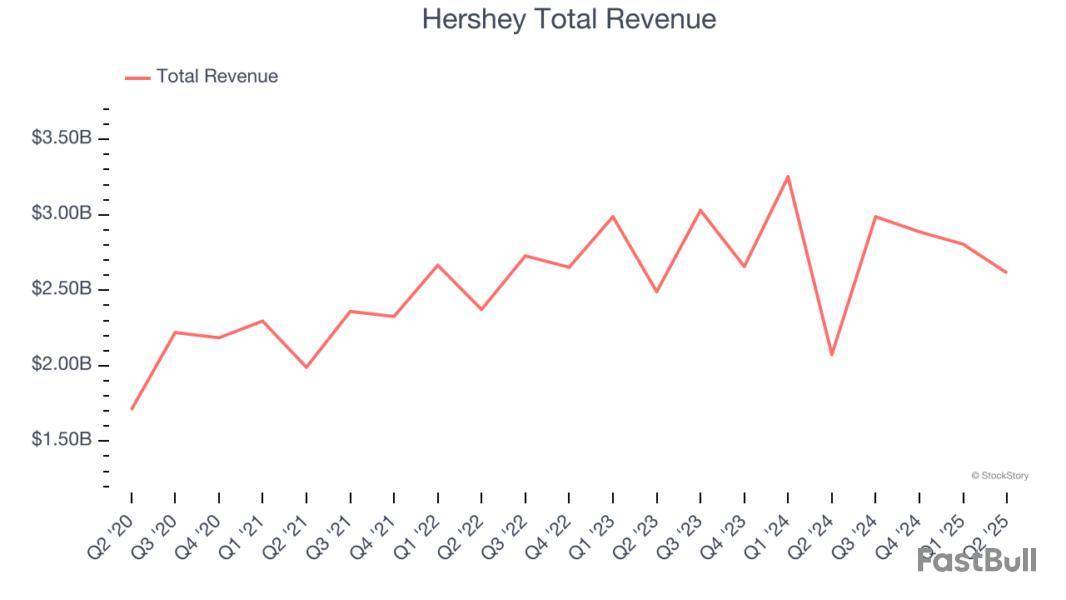

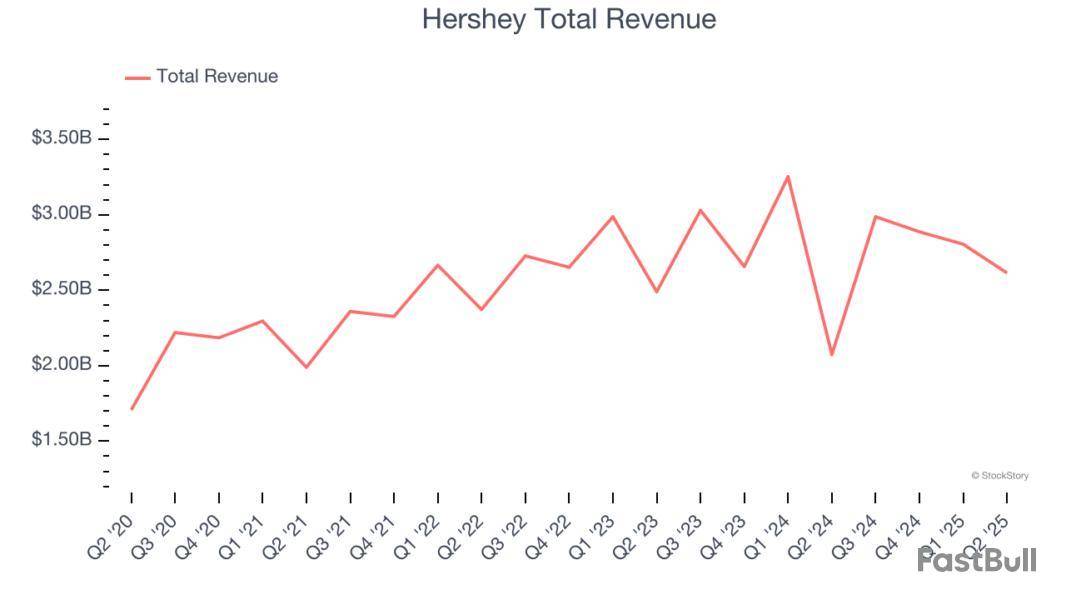

Best known for its milk chocolate bar and Hershey's Kisses, Hershey is an iconic company known for its chocolate products.

Hershey reported revenues of $2.61 billion, up 26% year on year, outperforming analysts’ expectations by 3.1%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA and organic revenue estimates.

Hershey pulled off the fastest revenue growth among its peers. However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $185.36.

Is now the time to buy Hershey? Access our full analysis of the earnings results here, it’s free.

Sold in over 75 countries around the world, Hain Celestial is a natural and organic food company whose products range from snacks to teas to baby food.

Hain Celestial reported revenues of $363.3 million, down 13.2% year on year, falling short of analysts’ expectations by 2.3%. It was a disappointing quarter as it posted a significant miss of analysts’ organic revenue and adjusted operating income estimates.

Hain Celestial delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 25.9% since the results and currently trades at $1.60.

Read our full analysis of Hain Celestial’s results here.

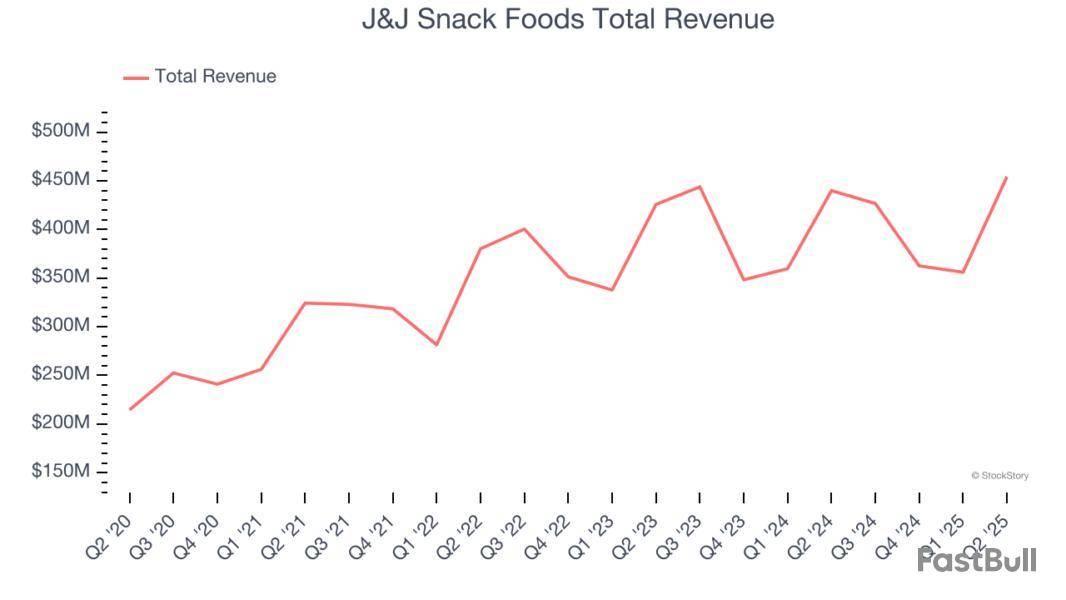

Best known for its SuperPretzel soft pretzels and ICEE frozen drinks, J&J Snack Foods produces a range of snacks and beverages and distributes them primarily to supermarket and food service customers.

J&J Snack Foods reported revenues of $454.3 million, up 3.3% year on year. This result surpassed analysts’ expectations by 2%. Overall, it was a very strong quarter as it also recorded an impressive beat of analysts’ EBITDA estimates.

The stock is down 17.3% since reporting and currently trades at $95.35.

Read our full, actionable report on J&J Snack Foods here, it’s free.

Committed to clean-label foods, SunOpta is a sustainability-focused food and beverage company specializing in the sourcing, processing, and packaging of organic products.

SunOpta reported revenues of $191.5 million, up 12.9% year on year. This print topped analysts’ expectations by 3.1%. It was a strong quarter as it also produced a beat of analysts’ EPS estimates and full-year revenue guidance slightly topping analysts’ expectations.

SunOpta pulled off the highest full-year guidance raise among its peers. The stock is up 15.4% since reporting and currently trades at $5.98.

Read our full, actionable report on SunOpta here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Let’s dig into the relative performance of J&J Snack Foods and its peers as we unravel the now-completed Q2 shelf-stable food earnings season.

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

The 21 shelf-stable food stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1.2% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 5.6% since the latest earnings results.

Best known for its SuperPretzel soft pretzels and ICEE frozen drinks, J&J Snack Foods produces a range of snacks and beverages and distributes them primarily to supermarket and food service customers.

J&J Snack Foods reported revenues of $454.3 million, up 3.3% year on year. This print exceeded analysts’ expectations by 2%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ EBITDA estimates. estimates.

Dan Fachner, J&J Snack Foods Chairman, President, and CEO stated, “We delivered strong third quarter results, achieving record performance across key financial metrics, including net sales of $454.3 million and adjusted EBITDA of $72.0 million. These results reflect the resilience of our business, the strength of our diversified portfolio, the continued appeal of our brands, and our team’s relentless focus on disciplined execution in the face of a cautious consumer environment and weather-related headwinds.

The stock is down 13.2% since reporting and currently trades at $100.00.

Is now the time to buy J&J Snack Foods? Access our full analysis of the earnings results here, it’s free.

Best known for its milk chocolate bar and Hershey's Kisses, Hershey is an iconic company known for its chocolate products.

Hershey reported revenues of $2.61 billion, up 26% year on year, outperforming analysts’ expectations by 3.1%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA and organic revenue estimates.

Hershey achieved the fastest revenue growth among its peers. The market seems content with the results as the stock is up 1.4% since reporting. It currently trades at $189.01.

Is now the time to buy Hershey? Access our full analysis of the earnings results here, it’s free.

Sold in over 75 countries around the world, Hain Celestial is a natural and organic food company whose products range from snacks to teas to baby food.

Hain Celestial reported revenues of $363.3 million, down 13.2% year on year, falling short of analysts’ expectations by 2.3%. It was a disappointing quarter as it posted a significant miss of analysts’ organic revenue and adjusted operating income estimates.

Hain Celestial delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 29.2% since the results and currently trades at $1.53.

Read our full analysis of Hain Celestial’s results here.

Best known for its Atkins brand that was inspired by the popular diet of the same name, Simply Good Foods is a packaged food company whose offerings help customers achieve their healthy eating or weight loss goals.

Simply Good Foods reported revenues of $381 million, up 13.8% year on year. This number met analysts’ expectations. Overall, it was a satisfactory quarter as it also produced a decent beat of analysts’ EBITDA estimates.

The stock is down 18.9% since reporting and currently trades at $26.25.

Read our full, actionable report on Simply Good Foods here, it’s free.

Spun out of Post Holdings in 2019, Bellring Brands offers protein shakes, nutrition bars, and other products under the PowerBar, Premier Protein, and Dymatize brands.

BellRing Brands reported revenues of $547.5 million, up 6.2% year on year. This print surpassed analysts’ expectations by 3%. It was a strong quarter as it also put up an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ organic revenue estimates.

The stock is down 33% since reporting and currently trades at $36.

Read our full, actionable report on BellRing Brands here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

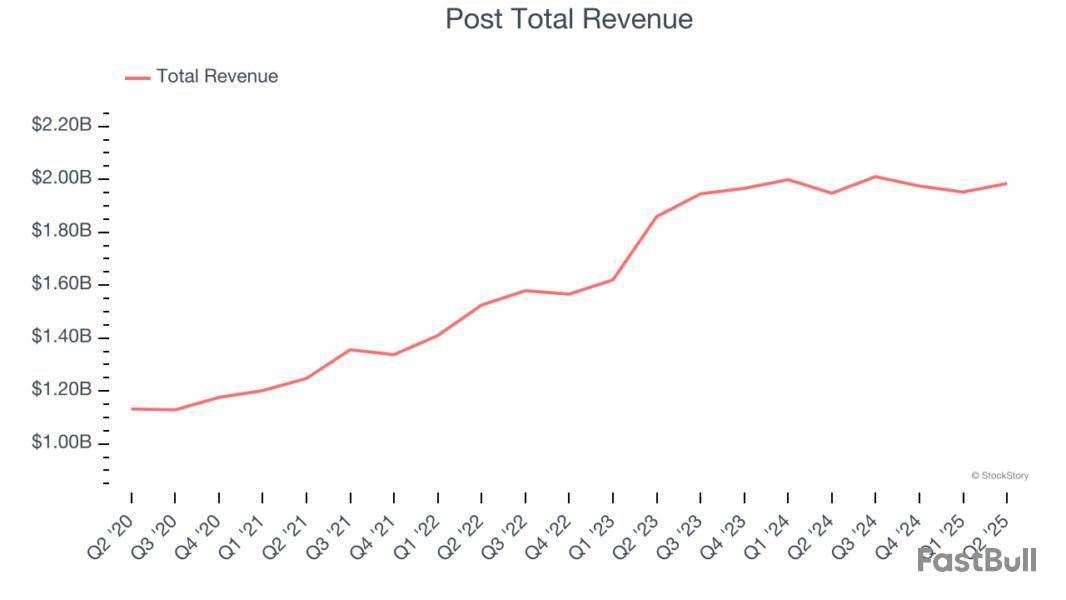

As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q2. Today, we are looking at shelf-stable food stocks, starting with Post .

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

The 21 shelf-stable food stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1.2% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 5.8% since the latest earnings results.

Founded in 1895, Post is a packaged food company known for its namesake breakfast cereal and healthier-for-you snacks.

Post reported revenues of $1.98 billion, up 1.9% year on year. This print exceeded analysts’ expectations by 1.9%. Overall, it was a strong quarter for the company with a beat of analysts’ EPS and EBITDA estimates.

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $102.88.

Is now the time to buy Post? Access our full analysis of the earnings results here, it’s free.

Best known for its milk chocolate bar and Hershey's Kisses, Hershey is an iconic company known for its chocolate products.

Hershey reported revenues of $2.61 billion, up 26% year on year, outperforming analysts’ expectations by 3.1%. The business had an exceptional quarter with an impressive beat of analysts’ EBITDA and organic revenue estimates.

Hershey scored the fastest revenue growth among its peers. The market seems content with the results as the stock is up 2.5% since reporting. It currently trades at $191.06.

Is now the time to buy Hershey? Access our full analysis of the earnings results here, it’s free.

Sold in over 75 countries around the world, Hain Celestial is a natural and organic food company whose products range from snacks to teas to baby food.

Hain Celestial reported revenues of $363.3 million, down 13.2% year on year, falling short of analysts’ expectations by 2.3%. It was a disappointing quarter as it posted a significant miss of analysts’ organic revenue and adjusted operating income estimates.

Hain Celestial delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 33.2% since the results and currently trades at $1.44.

Read our full analysis of Hain Celestial’s results here.

Started as a small grocery store in New York City, B&G Foods is an American packaged foods company with a diverse portfolio of more than 50 brands.

B&G Foods reported revenues of $424.4 million, down 4.5% year on year. This print came in 1.2% below analysts' expectations. Overall, it was a softer quarter as it also recorded EPS in line with analysts’ estimates and a miss of analysts’ EBITDA estimates.

B&G Foods had the weakest full-year guidance update among its peers. The stock is up 10.4% since reporting and currently trades at $4.56.

Read our full, actionable report on B&G Foods here, it’s free.

Best known for its SuperPretzel soft pretzels and ICEE frozen drinks, J&J Snack Foods produces a range of snacks and beverages and distributes them primarily to supermarket and food service customers.

J&J Snack Foods reported revenues of $454.3 million, up 3.3% year on year. This result surpassed analysts’ expectations by 2%. Overall, it was a very strong quarter as it also produced an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ adjusted operating income estimates.

The stock is down 10.6% since reporting and currently trades at $102.98.

Read our full, actionable report on J&J Snack Foods here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

A company that generates cash isn’t automatically a winner. Some businesses stockpile cash but fail to reinvest wisely, limiting their ability to expand.

Cash flow is valuable, but it’s not everything - StockStory helps you identify the companies that truly put it to work. Keeping that in mind, here are three cash-producing companies to avoid and some better opportunities instead.

Elastic (ESTC)

Trailing 12-Month Free Cash Flow Margin: 20.2%

Built on the powerful open-source Elasticsearch technology that powers search functionality for thousands of websites worldwide, Elastic provides a search and AI platform that helps organizations find insights from their data, monitor applications, and protect against security threats.

Why Does ESTC Give Us Pause?

Elastic’s stock price of $86.31 implies a valuation ratio of 5.3x forward price-to-sales. Dive into our free research report to see why there are better opportunities than ESTC.

J&J Snack Foods (JJSF)

Trailing 12-Month Free Cash Flow Margin: 4.2%

Best known for its SuperPretzel soft pretzels and ICEE frozen drinks, J&J Snack Foods produces a range of snacks and beverages and distributes them primarily to supermarket and food service customers.

Why Do We Think Twice About JJSF?

J&J Snack Foods is trading at $103.53 per share, or 19.4x forward P/E. Check out our free in-depth research report to learn more about why JJSF doesn’t pass our bar.

Crane (CR)

Trailing 12-Month Free Cash Flow Margin: 13%

Based in Connecticut, Crane is a diversified manufacturer of engineered industrial products, including fluid handling, and aerospace technologies.

Why Should You Dump CR?

At $182.79 per share, Crane trades at 31.1x forward P/E. Read our free research report to see why you should think twice about including CR in your portfolio.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return).

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

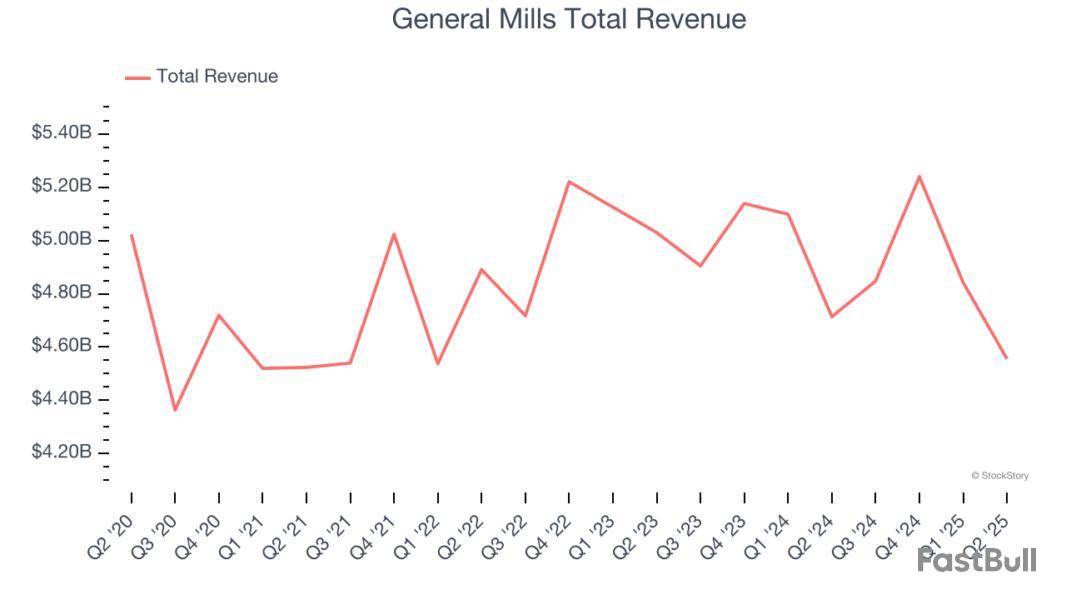

As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q2. Today, we are looking at shelf-stable food stocks, starting with General Mills .

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

The 21 shelf-stable food stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1.2% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 6.3% since the latest earnings results.

Best known for its portfolio of powerhouse breakfast cereal brands, General Mills is a packaged foods company that has also made a mark in cereals, baking products, and snacks.

General Mills reported revenues of $4.56 billion, down 3.3% year on year. This print fell short of analysts’ expectations by 0.5%. Overall, it was a mixed quarter for the company with a narrow beat of analysts’ EBITDA estimates but a slight miss of analysts’ gross margin estimates.

“The investments we made in the second half of fiscal 2025 to bring consumers more value worked as we expected, driving improved volume and pound share trends in the fourth quarter,” said General Mills Chairman and Chief Executive Officer Jeff Harmening.

Unsurprisingly, the stock is down 7.5% since reporting and currently trades at $49.38.

Is now the time to buy General Mills? Access our full analysis of the earnings results here, it’s free.

Best known for its milk chocolate bar and Hershey's Kisses, Hershey is an iconic company known for its chocolate products.

Hershey reported revenues of $2.61 billion, up 26% year on year, outperforming analysts’ expectations by 3.1%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA and organic revenue estimates.

Hershey pulled off the fastest revenue growth among its peers. However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $185.56.

Is now the time to buy Hershey? Access our full analysis of the earnings results here, it’s free.

Sold in over 75 countries around the world, Hain Celestial is a natural and organic food company whose products range from snacks to teas to baby food.

Hain Celestial reported revenues of $363.3 million, down 13.2% year on year, falling short of analysts’ expectations by 2.3%. It was a disappointing quarter as it posted a significant miss of analysts’ organic revenue and EBITDA estimates.

Hain Celestial delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 26.4% since the results and currently trades at $1.59.

Read our full analysis of Hain Celestial’s results here.

Best known for its SuperPretzel soft pretzels and ICEE frozen drinks, J&J Snack Foods produces a range of snacks and beverages and distributes them primarily to supermarket and food service customers.

J&J Snack Foods reported revenues of $454.3 million, up 3.3% year on year. This print topped analysts’ expectations by 2%. It was a very strong quarter as it also put up a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ adjusted operating income estimates.

The stock is down 10.6% since reporting and currently trades at $103.

Read our full, actionable report on J&J Snack Foods here, it’s free.

Founded in 1919 as Nebraska Consolidated Mills in Omaha, Nebraska, Conagra Brands today boasts a diverse portfolio of packaged foods brands that includes everything from whipped cream to jarred pickles to frozen meals.

Conagra reported revenues of $2.78 billion, down 4.3% year on year. This result lagged analysts' expectations by 1.7%. It was a disappointing quarter as it also produced full-year EPS guidance missing analysts’ expectations.

The stock is down 7.4% since reporting and currently trades at $18.85.

Read our full, actionable report on Conagra here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Wrapping up Q2 earnings, we look at the numbers and key takeaways for the shelf-stable food stocks, including Mondelez and its peers.

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

The 20 shelf-stable food stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was in line.

While some shelf-stable food stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 3.6% since the latest earnings results.

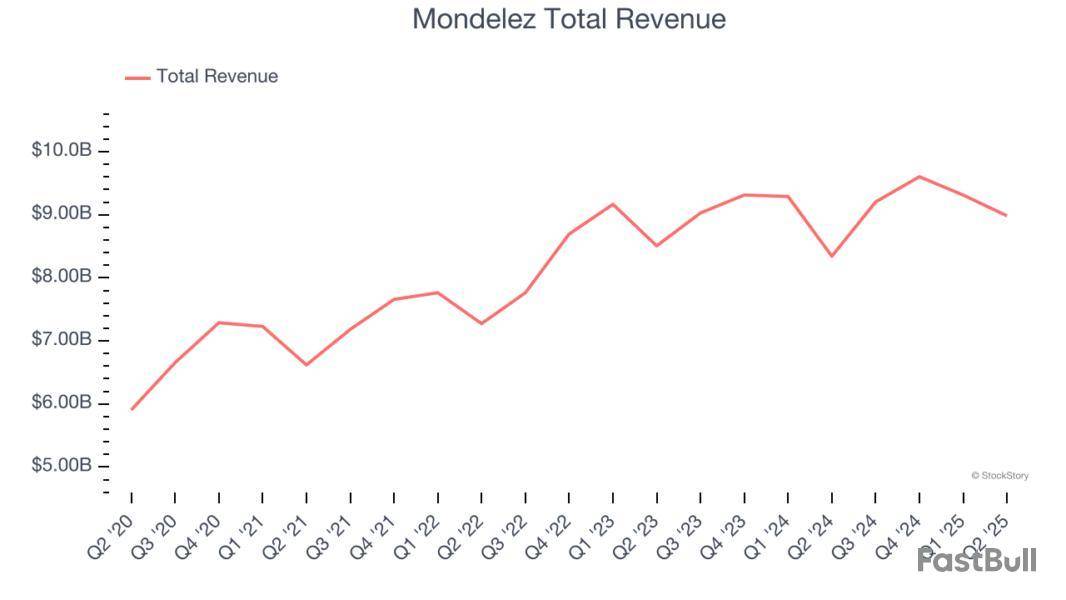

Founded as Nabisco in 1903, Mondelez is a packaged snacks powerhouse best known for its Oreo, Cadbury, Toblerone, Ritz, and Trident brands.

Mondelez reported revenues of $8.98 billion, up 7.7% year on year. This print exceeded analysts’ expectations by 1.5%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EBITDA estimates and a decent beat of analysts’ adjusted operating income estimates.

“We posted accelerated top-line growth in Q2 2025 underpinned by strong pricing execution in our chocolate business and robust growth across the vast majority of our geographies,” said Dirk Van de Put, Chair and Chief Executive Officer.

The stock is down 11.2% since reporting and currently trades at $61.95.

Is now the time to buy Mondelez? Access our full analysis of the earnings results here, it’s free.

Best known for its milk chocolate bar and Hershey's Kisses, Hershey is an iconic company known for its chocolate products.

Hershey reported revenues of $2.61 billion, up 26% year on year, outperforming analysts’ expectations by 3.1%. The business had an exceptional quarter with an impressive beat of analysts’ EBITDA and organic revenue estimates.

Hershey delivered the fastest revenue growth among its peers. However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $185.50.

Is now the time to buy Hershey? Access our full analysis of the earnings results here, it’s free.

Founded in 1919 as Nebraska Consolidated Mills in Omaha, Nebraska, Conagra Brands today boasts a diverse portfolio of packaged foods brands that includes everything from whipped cream to jarred pickles to frozen meals.

Conagra reported revenues of $2.78 billion, down 4.3% year on year, falling short of analysts’ expectations by 1.7%. It was a disappointing quarter as it posted full-year EPS guidance missing analysts’ expectations.

Conagra delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 5.5% since the results and currently trades at $19.24.

Read our full analysis of Conagra’s results here.

Best known for its Grown in Idaho brand, Lamb Weston produces and distributes potato products such as frozen french fries and mashed potatoes.

Lamb Weston reported revenues of $1.68 billion, up 4% year on year. This result topped analysts’ expectations by 5.7%. Overall, it was a very strong quarter as it also put up an impressive beat of analysts’ EBITDA estimates and an impressive beat of analysts’ organic revenue estimates.

Lamb Weston pulled off the biggest analyst estimates beat among its peers. The stock is up 14.8% since reporting and currently trades at $56.42.

Read our full, actionable report on Lamb Weston here, it’s free.

Best known for its SuperPretzel soft pretzels and ICEE frozen drinks, J&J Snack Foods produces a range of snacks and beverages and distributes them primarily to supermarket and food service customers.

J&J Snack Foods reported revenues of $454.3 million, up 3.3% year on year. This number beat analysts’ expectations by 2%. It was a very strong quarter as it also logged an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ adjusted operating income estimates.

The stock is down 8.9% since reporting and currently trades at $105.

Read our full, actionable report on J&J Snack Foods here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

As the Q2 earnings season wraps, let’s dig into this quarter’s best and worst performers in the shelf-stable food industry, including Hormel Foods and its peers.

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

The 20 shelf-stable food stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was in line.

While some shelf-stable food stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 3.6% since the latest earnings results.

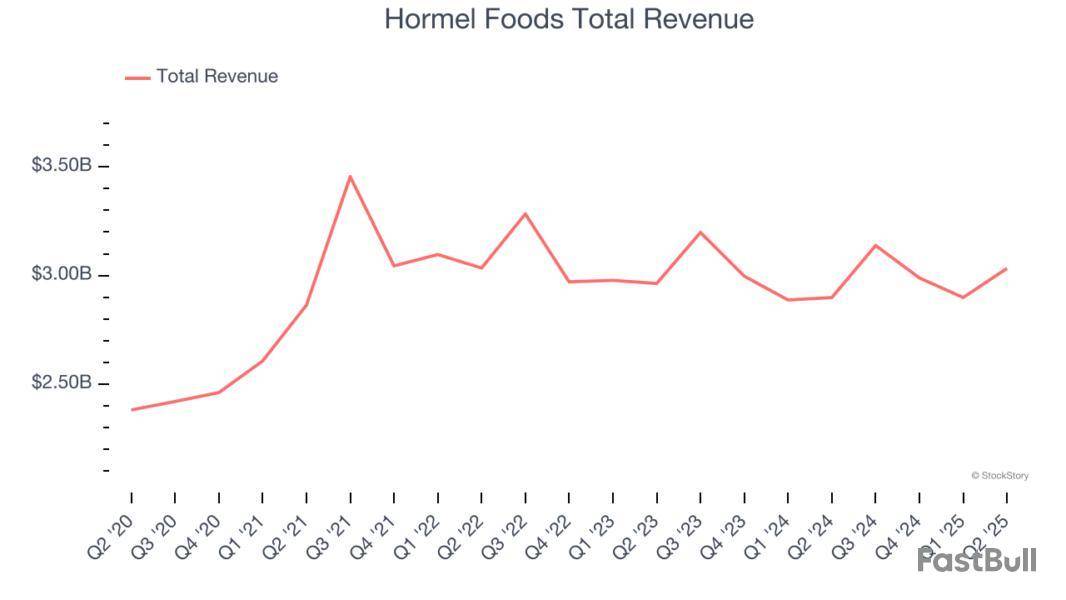

Best known for its SPAM brand, Hormel is a packaged foods company with products that span meat, poultry, shelf-stable foods, and spreads.

Hormel Foods reported revenues of $3.03 billion, up 4.6% year on year. This print exceeded analysts’ expectations by 1.7%. Despite the top-line beat, it was still a disappointing quarter for the company with a significant miss of analysts’ adjusted operating income estimates.

"I am honored to rejoin this great company and partner with John Ghingo and the entire leadership team to focus on restoring profitable growth," said Jeff Ettinger, interim chief executive officer.

Unsurprisingly, the stock is down 13% since reporting and currently trades at $25.24.

Read our full report on Hormel Foods here, it’s free.

Best known for its milk chocolate bar and Hershey's Kisses, Hershey is an iconic company known for its chocolate products.

Hershey reported revenues of $2.61 billion, up 26% year on year, outperforming analysts’ expectations by 3.1%. The business had an exceptional quarter with an impressive beat of analysts’ EBITDA and organic revenue estimates.

Hershey delivered the fastest revenue growth among its peers. However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $185.50.

Is now the time to buy Hershey? Access our full analysis of the earnings results here, it’s free.

Founded in 1919 as Nebraska Consolidated Mills in Omaha, Nebraska, Conagra Brands today boasts a diverse portfolio of packaged foods brands that includes everything from whipped cream to jarred pickles to frozen meals.

Conagra reported revenues of $2.78 billion, down 4.3% year on year, falling short of analysts’ expectations by 1.7%. It was a disappointing quarter as it posted full-year EPS guidance missing analysts’ expectations.

Conagra delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 5.5% since the results and currently trades at $19.24.

Read our full analysis of Conagra’s results here.

Best known for its SuperPretzel soft pretzels and ICEE frozen drinks, J&J Snack Foods produces a range of snacks and beverages and distributes them primarily to supermarket and food service customers.

J&J Snack Foods reported revenues of $454.3 million, up 3.3% year on year. This number topped analysts’ expectations by 2%. Overall, it was a very strong quarter as it also recorded an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ adjusted operating income estimates.

The stock is down 8.9% since reporting and currently trades at $105.

Read our full, actionable report on J&J Snack Foods here, it’s free.

Founded in 1895, Post is a packaged food company known for its namesake breakfast cereal and healthier-for-you snacks.

Post reported revenues of $1.98 billion, up 1.9% year on year. This print beat analysts’ expectations by 1.9%. It was a strong quarter as it also put up a beat of analysts’ EPS estimates and a decent beat of analysts’ EBITDA estimates.

The stock is up 2% since reporting and currently trades at $104.98.

Read our full, actionable report on Post here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up