Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

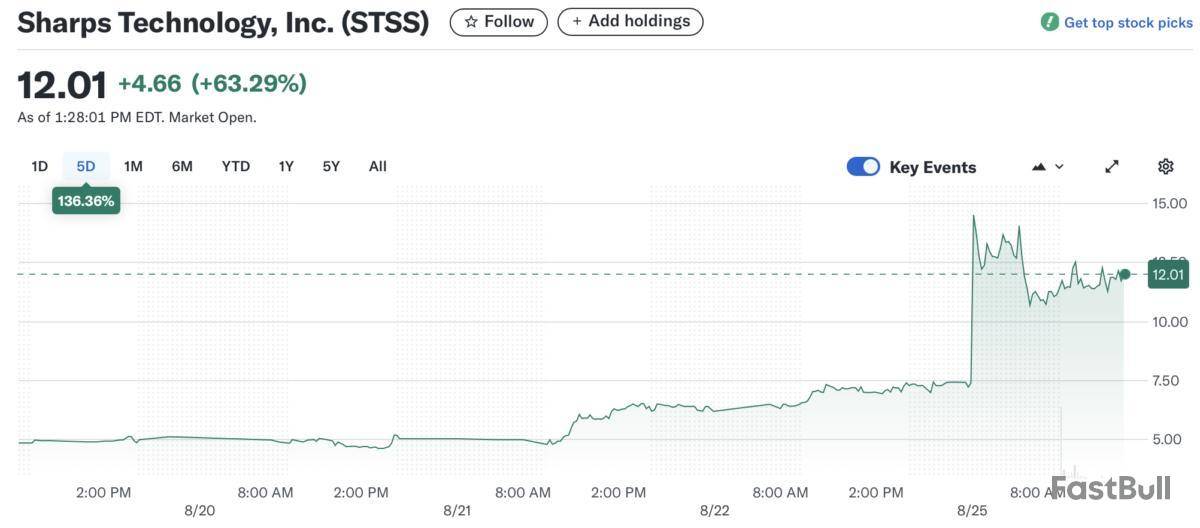

Shares of Sharps Technology nearly doubled Monday after the medical device maker announced a $400 million move to fund a new treasury strategy built around Solana’s native token. The stock jumped 96% from $7.40 to an intraday high of $14.53 before easing to $12.01 at this writing.

Sharps signed a letter of intent with the Solana Foundation to purchase Solana (SOL) tokens via a private investment in public equity (PIPE) transaction — a type of financing deal where accredited investors buy shares of a publicly traded company at a discount to the current market price.

The deal, expected to close on or around Aug. 28, would see Sharps acquire $50 million worth of SOL tokens at a 15% discount to their 30-day average price.

Investors may fund their allocations using locked or unlocked SOL, receiving pre-funded and stapled warrants in return — a structure that ties equity exposure directly to Solana.

Sharps also announced the appointed of Jambo co-founder Alice Zhang as chief investment officer to lead the shift and added James Zhang as a strategic adviser — BBoth are well-known figures in the Solana ecosystem, having launched Jambo, the first Web3 phone built on Solana.

Health sector companies pivot to crypto treasuries

Crypto treasury companies are publicly traded companies that hold digital assets like Bitcoin (BTC) or SOL on their balance sheet, giving investors indirect exposure to crypto assets through their stock. The idea was first conceived by Michael Saylor of Strategy in 2020, and has since inspired hundreds of companies to follow suit.

The model has recently gained traction in the health sector, where several small-cap and mid-cap firms have pivoted into crypto treasuries to diversify and attract investor attention.

In November 2024, Hoth Therapeutics, a New York–based biopharma developing therapies for skin, cancer and autoimmune diseases, said it would allocate $1 million in Bitcoin as a treasury asset, framing the move as an inflation hedge.

In March, the trend reached Atai Life Sciences, a Nasdaq-listed biopharma developing psychedelic-based mental health treatments. Founder Christian Angermayer said the company would purchase $5 million in Bitcoin, arguing in a Substack post that drug development is “cash-hungry” and regulatory approvals can take more than a decade.

In July, 180 Life Sciences, a biotech working on anti-inflammatory therapeutics, rebranded as ETHZilla and announced plans to build a $425 million Ether treasury after its stock had fallen 99%.

Wall Street firm Charles Schwab recently warned in an educational video that companies “putting large chunks of cash in a historically volatile asset that isn’t tied to their core business has raised a red flag or two.”

While the broader crypto market rallied in August, XLM often moved in the opposite direction. Over the past month, the XLM price has dropped 11%, and in the last 24 hours alone, it slipped another 4.2%, more than the market’s overall 2% decline.

These repeated dips have left traders wondering whether a recovery is even on the table. On-chain and technical patterns suggest a downtrend, unless bulls can step in. Stellar may be staring at new lows if one bearish crossover confirms.

Social Dominance Drop Aligns With Bearish Crossover Risk

The first warning comes from social dominance, which measures how much of the crypto conversation a coin commands compared to the rest of the market. For Stellar, attention has fallen sharply — from 1.71% on July 13 to just 0.51% at press time, a near 70% decline.

History shows that when social dominance forms this type of low pattern, it often lines up with extended corrections. For instance, in March, a similar collapse was followed by the XLM price drop from $0.35 to $0.25, close to 30%.

If the Stellar social dominance and price correlation play out again, a similar drop might not be out of the equation.

Moreover, on the 4-hour chart, the 50 EMA or Exponential Moving Average (orange line) is about to cross below the 200 EMA (blue line).

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

An Exponential Moving Average (EMA) tracks price trends by giving more weight to recent candles. On shorter charts like the 4-hour, traders often watch if the 50 EMA falls below the 200 EMA. This forms a ‘death cross,’ which is seen as bearish because it shows short-term momentum is fading against the longer trend, often leading to sharper drops if support levels fail.

If confirmed, this bearish “Death” crossover would be the technical trigger that validates what social dominance has hinted: that Stellar’s momentum is slipping and deeper losses may be on the horizon. Together, the weakening social chatter and looming crossover create the setup for a heavy downside scenario.

Clustered XLM Price Supports Could Give Way to $0.24

At present, the XLM price trades around $0.39, holding just above thin support at $0.38. If this line breaks, the price could quickly slide to $0.36, and from there, weakness could extend to $0.24.

That would mark a nearly 40% correction from current levels. The problem for Stellar is that the supports under $0.39 are clustered very close together. When that happens, a sharp move can sweep through multiple levels in one go, leaving the XLM price with little to no cushion until much lower.

For any recovery, bulls would need to retake $0.43–$0.45. Only then could Stellar reclaim the $0.52 high charted earlier. Without this, the downside case dominates, and the bearish crossover, once confirmed, could accelerate losses.

CoinDesk Bitcoin Price Index is down $1883.48 today or 1.67% to $110694.91

Note: CoinDesk Bitcoin Price Index (XBX) at 4 p.m. ET close

Data compiled by Dow Jones Market Data

Today’s recovery attempt by most cryptocurrencies turned out to be a fakeout as the market has turned red once again.

This time, Ethereum has taken the painful main stage, dumping by over 11% since its all-time high registered just over 24 hours ago.

The landscape around the world’s second-largest cryptocurrency changed for the better on Friday evening, after Jerome Powell’s rather promising speech about future key interest rate cuts. ETH reacted with an immediate price surge that drove it from $4,200 to a new all-time high of almost $4,900.

After a much calmer 48-hour period during the weekend, the asset went on the offensive once again on Sunday evening and set another record of over $4,950. That’s where the situation changed for the worse, and ETH, alongside BTC and the rest of the market,tumbledhard.

Bitcoin’s priceplungedto a six-week low, leaving over $300 million in longs liquidated in just one hour before it dumped further to $110,000 today. BTC took yesterday’s correction a lot worse, while ETH, perhaps aided by the continuous big purchases from whales and corporations, performed slightly better.

However, Ethereum has dumped hard now, losing over $550 since yesterday’s peak in a drop to $4,400 marked minutes ago. This price dump is rather surprising given the fact that large entities continue to accumulate the token en masse, including this massive $2.5 billion purchase reported by Arkham Intelligence.

THIS MASSIVE WHALE JUST BOUGHT AND STAKED $2.5 BILLION USD OF ETH

This guy just bought $2.55B USD of ETH from Hyperunit and staked it ALL through the same staking contract.

His last deposit was only 1 HOUR ago. Will he keep buying? pic.twitter.com/YAAPHkfwIM

— Arkham (@arkham) August 25, 2025

The liquidations are once again on the rise. In the past hour alone, the total value has risen to nearly $285 million, with longs representing the majority of that amount. ETH leads the pack, with over $110 million in longs wrecked.

Almost 180,000 traders have been liquidated in the past day, with the single largest wiped out position taking place on Binance. It was worth north of $7 million and involved ETH.

UAE has joined the long list of nations stacking up on Bitcoin, but its Bitcoin accumulation is based on its sophisticated infrastructural capabilities, according to recent data shared by Arkham Intelligence Firm.

The data reveals that the UAE Royal Group’s Citadel Mining has accumulated a massive amount of Bitcoin in an unusual way and now holds over 6,300 BTC worth over $706 million.

UAE stuns with infrastructural BTC bets

While countries holding large amounts of BTC are known to acquire their assets via purchases or legal dealings, the UAE has stirred reactions across the crypto community as reports revealed its massive Bitcoin holdings were primarily accumulated through direct mining operations.

Notably, the UAE Royal Group owns a large share of Citadel Mining, and it has continued to scoop up the world’s leading crypto through block rewards.

With the Bitcoin ecosystem consistently making waves since its halving in 2024, the UAE has seen its Bitcoin stash grow significantly. Following the event, recent daily transfers of around 2 BTC in rewards have been traced to mining pools like Foundry Digital, and the rewards have been sent directly to Citadel’s mining wallets, boosting the country’s BTC holdings.

Nonetheless, with its incredible ability to generate Bitcoin through mining, the UAE has become one of the richest countries with the largest Bitcoin stash without having to spend a dime of its funds to purchase the asset.

UAE joins leading Bitcoin holding countries

Apart from institutions and retailers, the crypto industry has also spotted increasing demand for Bitcoin among countries as the world’s largest cryptocurrency by market capitalization continues to gain mainstream appeal.

Joining the Bitcoin bandwagon is increasingly becoming a global trend since Bitcoin’s explosive growth witnessed in 2024. While the asset has become the center of attention among institutions, governments are increasingly weighing its value as a strategic reserve asset.

While the United States is known as the largest Bitcoin holding country with around 200,000 BTC in its portfolio, the UAE has also joined the list, as its holding is expected to continue doubling as more BTC gets mined.

Following this trend, Bitcoin’s adoption is gradually shifting from retail investors to major corporations amid surging interest from large holders.

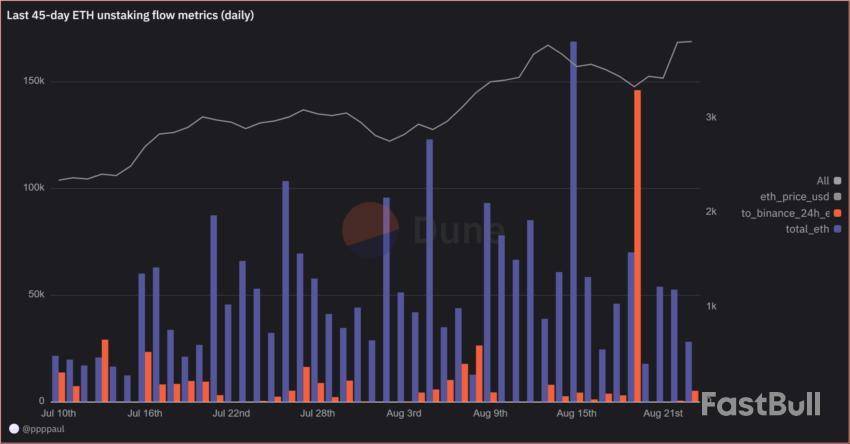

The cryptocurrency market fell nearly 4% Monday, intensifying concerns over a surge in Ethereum unstaking. On-chain data shows 1.18 million ETH are queued for withdrawal, the largest backlog in months.

The delays highlight pressure on the Ethereum network. Normally, unstaking takes three to five days. Current applicants face up to 40 days.

ETH Unstaking Surge ≠ Selling Pressure

Unstaking does not automatically mean selling. Many holders may keep their ETH, waiting for higher prices or DeFi opportunities. Data from Dune Analytics indicates no strong link between unstaking volume and ETH price over the past 45 days.

However, when withdrawn, ETH moves to exchanges, and price drops often follow.

On August 19, large inflows to Binance coincided with a 5% ETH decline. That same day, the Nasdaq fell 1.46% on fears of delayed Federal Reserve rate cuts.

According to on-chain data, roughly 115,000 ETH will exit staking daily this week. At current prices, it is nearly $4,600, which equals $529 million in circulation each day.

The volume adds uncertainty as markets remain sensitive to macroeconomic shifts. A mix of heavy unstaking and negative news could drive sharp price swings.

Several market voices argue that the fears are overstated. Some investors compared the situation to Solana, which faced similar fears after FTX-related unstaking.

Meanwhile, CryptoQuant data highlighted that ETH supply on centralized exchanges has fallen to record lows. Only 18.3 million ETH remain, reducing immediate sell pressure.

Unstaking flows remain large, but the impact depends on exchange transfers and broader economic conditions. Analysts caution that ETH withdrawals alone are unlikely to trigger sustained sell-offs without external market shocks.

Overall, the record Ethereum unstaking backlog underscores growing investor activity, but its market impact remains uncertain.

While billions in ETH are set for release, exchange flows and global economic trends will ultimately determine whether the surge translates into selling pressure or simply reflects a maturing network.

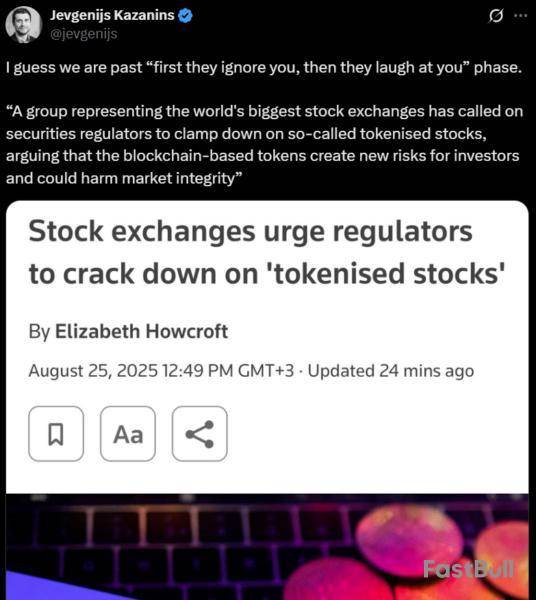

Exchange industry associations and global regulators are joining forces to curb the growth and adoption of tokenized stocks, arguing that these products do not represent actual equities and expose investors to significant risks.

According to Reuters, the European Securities and Markets Authority (ESMA), the International Organization of Securities Commissions (IOSCO), and the World Federation of Exchanges (WFE) have sent a letter to the US Securities and Exchange Commission’s (SEC) Crypto Task Force, urging stricter regulatory oversight of tokenized stocks.

The organizations argue that tokenized stocks “mimic” the equities they are designed to represent but lack the investor protections built into traditional markets.

“We are alarmed at the plethora of brokers and crypto-trading platforms offering or intending to offer so-called tokenized US stocks,” the WFE told Reuters, without naming specific firms or platforms. “These products are marketed as stock tokens or equivalent to the stocks when they are not.”

The push carries weight given the influence of the signatories. EMSA is a European Union agency and one of the bloc’s three main financial supervisory authorities.

IOSCO is an international body that sets standards for securities regulation and investor protection across global markets.

WFE, headquartered in the UK, is an industry group representing exchanges and clearing houses worldwide.

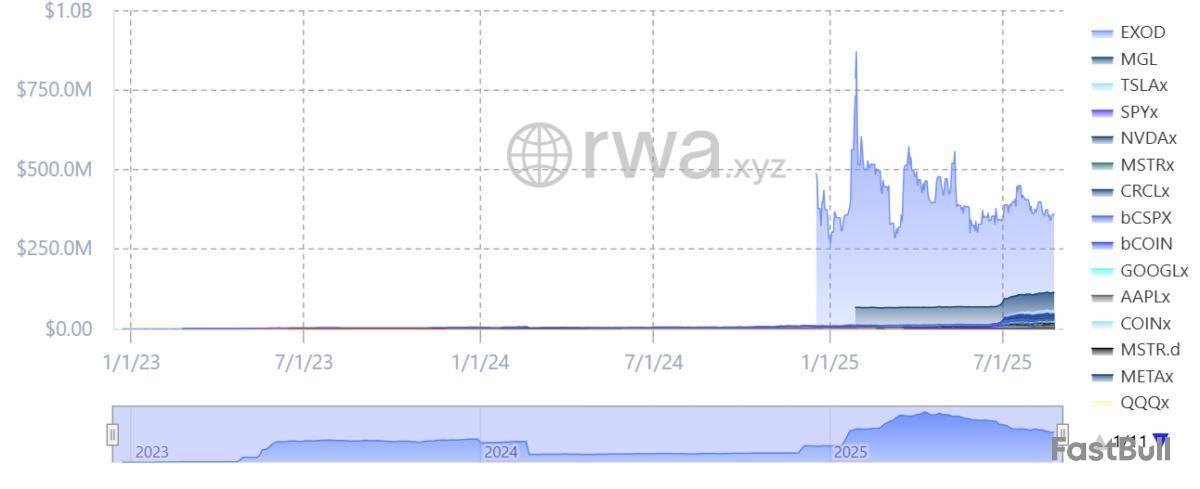

The call for clampdowns comes as tokenized securities gain traction on Wall Street and beyond, driven by the promise of greater efficiency, lower costs and broader market access through blockchain technology.

The value of tokenized assets has already climbed past $26 billion, according to industry data.

Tokenized stocks — digital representations of traditional equities issued on a blockchain — remain a small slice of that market, but their footprint is expected to grow as major platforms such as Coinbase, Kraken and Robinhood move into the space.

Lobby groups ramp up efforts to block crypto takeover

This isn’t the first time traditional industry lobbies have joined forces to slow the growth of blockchain innovation. As US lawmakers mulled over the GENIUS stablecoin bill, banking groups quietly lobbied to exclude yield-bearing stablecoins — a feature that could have directly competed with their service offerings.

They were ultimately successful, with GENIUS explicitly barring stablecoin issuers from paying interest to holders.

While the passage of GENIUS was widely seen as a win for the stablecoin industry, it also came with a trade-off. “By explicitly prohibiting stablecoin issuers from offering yield, the GENIUS Act actually protects a major advantage of money market funds,” Temujin Louie, CEO of crosschain interoperability protocol Wanchain, told Cointelegraph.

Still, the SEC appears open to tokenization at the highest levels. In July, SEC Chair Paul Atkins described tokenization as an “innovation” that should be advanced within the US economy.

That same month, SEC Commissioner Hester Peirce stressed that tokenized securities, including tokenized equities, must nonetheless comply with existing securities laws.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up