Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Bitcoin (BTC) has been in a corrective phase for roughly three weeks amid declining demand and rising selling pressure. Although September has historically been a weak month for the digital asset, analysts believe the market could hit its bottom for this downturn as the month progresses.

A weekly report by the crypto exchange Bitfinex revealed that September has marked cyclical lows in post-halving years. These lows are usually followed by a rally into the fourth quarter – these surges often mark the end of bull runs and the onset of bear cycles. So, September provides the foundation for renewed rallies into October and November.BTC to Hit Cyclical Low in September

BTC recentlyfellbelow $110,000, even slipping under its January 2025 high of $109,590. This range served as resistance for at least six months before bitcoin broke it in July. As BTC has ended a third consecutive week of decline from the $123,640 all-time high (ATH), market participants wonder if this is a temporary pause or the beginning of a deeper correction.

Amid the speculation, Bitfinex analysts have identified some factors that suggest the market is in the late stages of its corrective phase. Notably, pullbacks from cycle highs average around 17% peak-to-trough before new ATHs are eventually reached. With BTC already 13% down from its recent ATH, there may still be a little room for more downside. Regardless, BTC is nearing the upper limit of this corrective phase.

To substantiate its claims, Bitfinex cited the Cost Basis Distribution (CBD) heatmap. This metric shows where supply is concentrated across BTC acquisition prices, revealing the levels at which large portions of coins were last moved. This, in turn, highlights natural support and resistance zones.Altcoins Experience Pullback

Currently, BTC is trading at $110,000, a level below the lower boundary of a gap created when its price rallied sharply without substantial supply. These gaps have historically been revisited and filled – this is why analysts have been expecting the ongoing drawdown.

The gap has been gradually getting filled, with the ongoing retracement triggering the redistribution of supply at discounted prices. With a dense supply clutter between $93,000 and $110,000, the market would require either a wave of acute short-term sell pressure or an extended demand pause for a deeper correction to occur.

Meanwhile, altcoins have not escaped unscathed in this drawdown. The altcoin sector endured a challenging week, with most of the top ten major assets experiencing significant declines in value. Ether (ETH), for one, recently hit an ATH, buttumbledafterward, despite persistentaccumulationfrom institutions and exchange-traded funds.

CoinDesk Bitcoin Price Index is up $1473.67 today or 1.33% to $112266.22

Note: CoinDesk Bitcoin Price Index (XBX) at 4 p.m. ET close

Data compiled by Dow Jones Market Data

European Central Bank President Christine Lagarde warned that the EU must close gaps in stablecoin regulation to avoid destabilizing runs on reserves, Reuters reported. She told lawmakers that both EU and foreign issuers should face equal requirements.

Stablecoin Risks Under EU Rules

The EU’s Markets in Crypto-Assets Regulation (MiCAR) requires stablecoins to be fully backed. Lagarde said the framework leaves room for risk if non-EU firms operate under looser rules. She urged lawmakers to demand equivalence regimes from foreign jurisdictions.

“European legislation should ensure that such schemes cannot operate in the EU unless supported by robust equivalence regimes in other jurisdictions and safeguards relating to the transfer of assets between the EU and non-EU entities,” she said.

Lagarde warned that holders may choose to redeem in the EU, where MiCAR bans fees and imposes stricter safeguards. That could concentrate pressure on reserves based in the bloc.

“In the event of a run, investors would naturally prefer to redeem in the jurisdiction with the strongest safeguards, which is likely to be the EU,” she said. “But the reserves held in the EU may not be sufficient to meet such concentrated demand.”

International Cooperation Needed

Lagarde added that without global standards, risks will shift to weakly regulated markets. “Without a level global playing field, risks will always seek the path of least resistance,” she said.

Federico Cornelli, a commissioner at Italy’s market watchdog CONSOB, said EU rules must also reinforce that cryptocurrencies are not legal tender. “Only the euro issued by our ECB is legal tender, and this must be made very clear to all citizens,” he said.

Related: ECB President Dismisses Bitcoin as EU Reserve amid CNB's $7B Proposal

The ECB, as chief banking supervisor and lender of last resort in the eurozone, has placed stablecoin oversight at the center of its stability mandate.

Early this year, Lagarde said Bitcoin (BTC) is unlikely to be adopted as a reserve asset by EU banks. Her remarks came after the Czech National Bank (CNB) put forward a proposal to allocate 5% of public funds to Bitcoin as part of a diversification plan.

The CNB was scheduled to review the proposal on January 30, with the potential allocation amounting to more than $7.3 billion, based on its $146 billion in total reserves.

At the January 30 conference, Lagarde reiterated that Bitcoin does not meet the ECB’s criteria for reserve assets, which emphasize liquidity, security, and stability.

TL;DR

Green Days Incoming?

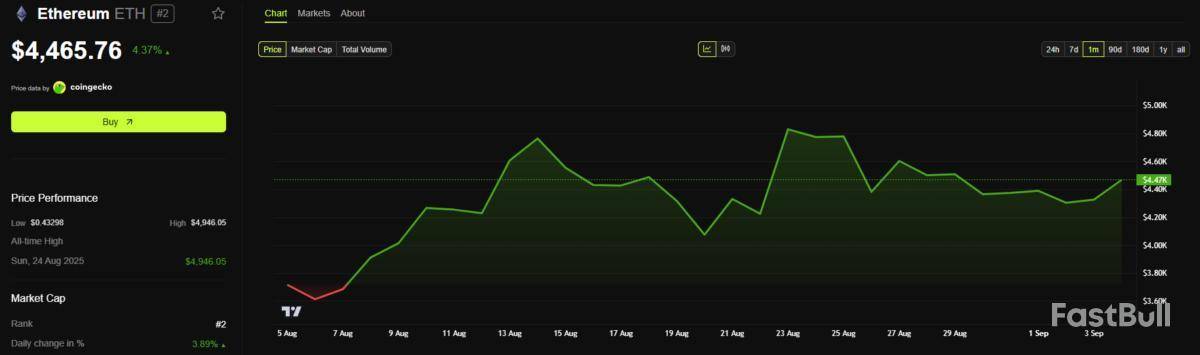

Ethereum (ETH) was at the forefront of gains in August, hitting a new all-time high of almost $5,000 towards the end of the month. Since then, though, the price headed south and is now hovering below $4,400 (per CoinGecko’s data).

Certain factors signal that the bulls might enjoy a new resurgence soon. The popular X user Ali Martinez revealed that 500,000 ETH (worth more than $2.1 billion) have been withdrawn from crypto exchanges in the past week alone.

Data compiled by CryptoQuant shows that currently, the total stash stored on such platforms is around 17.3 million tokens, which represents the lowest level witnessed since the summer of 2016. This is a clear sign that investors have been shifting from centralized exchanges toward self-custody methods, which in turn reduces the immediate selling pressure.

Meanwhile, ETH whales continue to show a huge appetite for the asset. Earlier this week, those large investors (holding between 10,000 and 100,000 coins each)accumulated260,000 tokens in just a single day. As a result, they increased their total holdings to 29.62 million ETH, which accounts for nearly a quarter of the asset’s circulating supply.

Such efforts leave fewer coins available on the open market and could push the price up (assuming demand doesn’t diminish). The whales are dominant market participants, and their activities are often followed by retail investors who might decide to mimic their move and distribute additional capital into the ecosystem.The Analysts’ Take

Many crypto enthusiasts on X seem optimistic about ETH, believing it has enough fuel left to post additional gains. The analyst with the moniker Mister Crypto thinks the price has reached its local bottom in April when plunging below $1,400 and is now headed for an “up only” trajectory.

On the other hand, Ted made a somewhat bearish forecast. He noted that ETH continues to hold the $4,200 level but claimed that the price “doesn’t look very strong” and envisioned a potential drop to $3,800 as “a final support target for the correction.”

The GENIUS Act is expected to drive global stablecoin use to new heights. With an already established market dominance position, Ethereum stands to benefit disproportionately from this transition.

In a conversation with BeInCrypto, Sanjay Shah, a researcher at venture capital firm Electric Capital, stressed that the Ethereum blockchain has unique architectural advantages that will reinforce the network’s role as the foundational layer for the incoming stablecoin economy.

Ethereum’s Market Dominance

When US President Donald Trump signed the GENIUS Act into law last month, it triggered a significant price rally across the cryptocurrency market.

However, Ethereum’s performance was unmatched. It experienced the most positive and sustained effect, surpassing any competitor in the immediate aftermath.

In the days before the bill’s passage, Ethereum’s price surged, climbing more than 20% and surpassing the $3,500 mark. The momentum continued even after the bill was signed, with the network’s value peaking at $3,875 the following week.

At the time of writing, its price rests at $4,465.

This powerful market reaction reinforced investors’ confidence in Ethereum’s ability to capitalize on a new regulatory environment.

The GENIUS Act has effectively removed major hurdles, paving the way for wider stablecoin adoption and easier global access to the US dollar, and investors are betting on Ethereum to lead the way.

Will the GENIUS Act Make Ethereum a Financial Anchor?

Stablecoins are set to become a central component of the global financial system, serving as a mainstream dollar rail for various transactions, from savings and payroll to cross-border payments.

The regulatory clarity provided by the GENIUS Act is the key to unlocking this widespread adoption, enabling regulated institutions to issue and utilize stablecoins confidently.

According to Shah, this transition will establish a new, open financial infrastructure, with Ethereum acting as an anchor.

“Regulated issuance will unlock distribution through banks and fintechs. Ethereum may anchor the open, global side of that system, with L2s handling high-throughput activity and L1 providing security and finality. ETH the asset may serve as the neutral, productive reserve collateral that underpins lending and other services across the finance stack,” he told BeInCrypto.

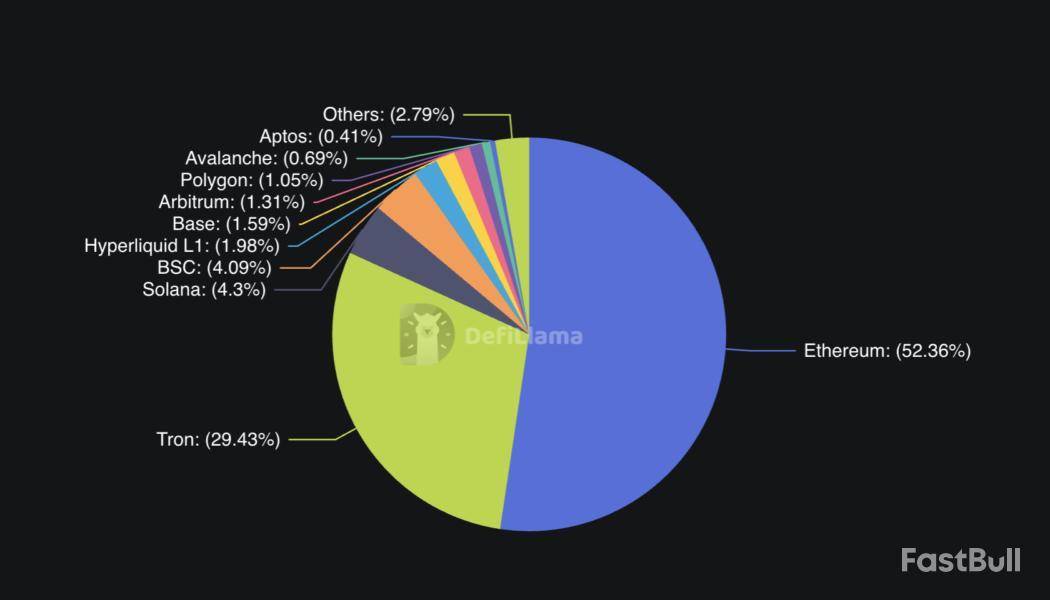

Since Ethereum already hosts most stablecoin liquidity, it will capture the lion’s share of this increased activity.

Why Ethereum Is Positioned to Lead

Ethereum’s existing stronghold is built on three key properties crucial for global, institutional adoption: global accessibility, safety for institutions, and resistance to government interference.

The legislation’s focus on compliance and security reinforces these qualities, drawing more participants into the network’s orbit. As is, Ethereum already commands the market.

According to recent data from DefiLlama, Ethereum is responsible for over 52% of the $278 billion stablecoin market capitalization.

“Ethereum may gain disproportionately from the GENIUS Act because it already dominates the parts of the crypto economy that the Act is likely to accelerate [like] USD-backed stablecoins and the financial services that grow around them,” Shah said.

He further reinforced this point by saying that the growth will naturally drift toward the established leader:

“Since Ethereum already hosts the majority of stablecoin issuance and liquidity, much of that growth may flow to its ecosystem, reinforcing the lead it already has.”

However, the incoming wave of stablecoin demand will inevitably place greater pressure on networks to process transactions effectively. This reality presents a significant challenge for Ethereum given its history of scalability issues.

According to Shah, it can easily rise to the occasion.

L2s: Addressing the Scalability Issue

Ethereum’s scalability issues have been a well-known concern in the crypto industry. Its mainnet has traditionally been limited to processing a small number of transactions per second, often leading to network congestion and elevated transaction fees during periods of high demand.

As the GENIUS Act goes into effect, the anticipated boom in stablecoin use will place unprecedented pressure on the network’s capacity.

According to public statements from Vitalik Buterin and the Ethereum Foundation, the network’s long-term answer to end a track record of scalability challenges lies in Layer 2 solutions (L2s).

These L2s process the bulk of consumer and institutional stablecoin transactions in a highly efficient, low-cost manner. This approach ensures that the network can handle mass adoption without compromising on its core principles of decentralization and security.

The Ethereum mainnet (L1) will serve a different but equally critical role as the secure settlement layer, handling the finality of transactions processed on the L2s.

According to Shah, this synergy is what makes the scaling solution viable.

“The bulk of consumer and institutional stablecoin throughput is designed to live on Ethereum L2s (e.g., Base, Optimism, Arbitrum), with L1 acting as the settlement and security layer, so scale comes from rollups while preserving Ethereum’s trust guarantees,” he said.

He also noted the flexibility and benefits this system offers to institutions:

“Today’s rollup architecture is built for high-volume, low-cost payments and financial apps, and it lets institutions choose the right trade-offs (throughput, fees, compliance features) without leaving Ethereum’s security umbrella.”

Despite the rise of competing blockchains, Ethereum’s dominance can remain firm in light of this enhanced infrastructure.

What Needs to Happen to Unseat Ethereum?

While rival blockchains like Solana and Tron have made inroads in the stablecoin market, their challenge to Ethereum’s dominance is unlikely to succeed in the long term.

A network’s long-term success in finance depends on its foundational qualities. Decentralization and security create a virtuous cycle that attracts capital and talent. Ethereum’s proven security record and decentralized nature foster an environment of institutional trust, which draws in large pools of capital, creating deep liquidity.

This rich ecosystem attracts developers to build applications and financial services on the platform. Shah argues that these core factors make Ethereum’s position difficult to challenge.

“Speed and cost are also important factors, but without the same decentralization, security history, and institutional customization options, it may be hard to dislodge Ethereum’s lead in finance.”

This reality presents a compelling case for why regulated institutions may feel more inclined to choose Ethereum, even though they can now launch their own private stablecoins.

The Path of Least Friction

Though traditional financial institutions can explore launching their own private blockchains, they might gravitate toward open, public networks.

“Some banks will pilot proprietary or permissioned rails, but settlement liquidity tends to coalesce where counterparties already are. Private networks usually bridge back to where liquidity clears,” Shah told BeInCrypto.

Though the GENIUS Act opens up new opportunities for institutions, launching and operating a private stablecoin requires a substantial operational commitment.

“The Act lowers the barrier for banks and fintechs to issue, but the path of least friction may remain issuing on, or at least interoperating with, Ethereum’s liquidity hubs and L2s to access global counterparties and composable finance,” he added.

Based on current trends, all signs suggest that Ethereum will strengthen its position as the primary settlement layer for digital dollar transactions. The asset’s rising price and growing institutional interest in the network reinforce such a trajectory.

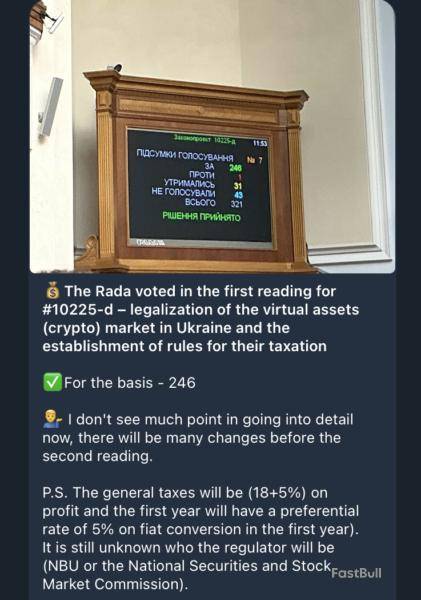

The Verkhovna Rada, Ukraine’s parliament, passed the first reading of a bill to legalize and tax cryptocurrency on Wednesday, according to lawmaker Yaroslav Zhelezniak. If signed into law, the bill would significantly shape the digital asset economy in the country, which ranks among the world's top in crypto adoption.

According to Zhelezniak’s announcement on a Telegram channel, the bill passed the first reading with 246 lawmakers voting in support. The legislation's draft outlines an income tax of 18% and a military tax of 5% on digital asset profits. The bill also sets a preferential 5% tax rate on fiat conversions its first year, according to the announcement.

The proposed taxation rate of 23% is in line with the April recommendation of Ukraine’s financial regulator. The initial recommendation exempted crypto-to-crypto and stablecoins transactions, bringing Ukraine’s crypto tax system closer to crypto-friendly countries.

“I don't see much point in going into detail now, there will be many changes before the second reading,” Zhelezniak said in an translated statement. “It is still unknown who the regulator will be (NBU or the National Securities and Stock Market Commission).”

Ukraine’s parliament has been advancing crypto legislation this year as digital assets gain mainstream traction. In June, the Verkhovna Rada introduced a bill to establish a crypto asset reserve, and in August, Cointelegraph learned that a taxation bill would receive its first reading.

Ukraine ranks eighth globally in Chainalysis’s 2025 Global Crypto Adoption Index. The country scores particularly high in centralized value received across both retail and institutional categories, and also holds a top spot in DeFi value received — a sector gaining traction in Eastern Europe.

“A window of opportunity has opened for attracting crypto investments and repatriating foreign assets of Ukrainian crypto enthusiasts,” Volodymyr Nosov, CEO of European crypto exchange WhiteBIT, told Cointelegraph. “This is a key factor for revitalizing the economy and modernizing the market [...].”

Crypto tax discussions around the world

More countries are weighing tax policies for cryptocurrencies as the asset class gains global acceptance. Over the past year, Denmark, Brazil and the United States have each moved to address crypto taxation.

In October 2024, Denmark’s Tax Law Council recommended a bill to levy taxes on unrealized crypto gains. In his report, the Danish tax minister said that the bill’s approach would be a simpler way to tax crypto. It is still considered a proposal.

In June 2025, Brazil moved to end a crypto tax exemption and impose a 17.5% flat tax rate on crypto gains amid a government’s push to raise money through taxation of financial markets.

In July, representatives in the US’s lower legislative chamber were set to hold a hearing on a framework for the taxation of crypto assets in the country.

Bitcoin’s strong performance this year has been largely driven by surging demand through ETFs and Digital Asset Treasuries (DATs), but this price momentum masks a more concerning trend.

In fact, data suggest that network activity has not kept pace with demand for the asset. This divergence creates an opaque outlook for Bitcoin’s long-term health, particularly as transaction fees, the critical incentive to reward miners for securing the network, remain low.“Digital Gold” Narrative Could Backfire

Similar to how a company’s revenue drives value to its share price, fees are expected to drive value for Bitcoin’s price. With the fourth halving in April 2024, cutting block rewards, fees today account for less than 1% of miner revenues.

CoinMetrics said that this has left miners increasingly reliant on BTC price appreciation. If fees do not rise to compensate for declining issuance, many miners could be forced offline after prolonged drawdowns. This, in turn, would end up jeopardizing the network’s decentralization and censorship-resistance.

The centralization of hashpower already looms large, with Foundry commanding 30% of total hashpower and Antpool 18%. While mining pools continue to invest heavily in hardware to maintain dominance, individual minersstrugglewith profitability, often liquidating their BTC holdings to cover operational costs.

The long-term challenge becomes clearer when considering the 2028 halving, which will reduce block rewards to just 1.5625 BTC. Without higher fee revenue, the risk of miner attrition will rise, and potentially concentrate security into fewer operators.

This structural challenge is compounded by weak demand for blockspace.

Because there isn’t much demand for Bitcoin’s blockspace, transaction fees stay low. This makes it easier and cheaper for everyday users to send money on the network. However, the demand for Bitcoin as an asset, especially from large institutional investors, doesn’t translate into more transactions happening on the blockchain itself. Instead, these investors mainly treat Bitcoin as “digital gold” or a long-term store of value.

Institutional investors buying ETFs and DATs contribute to price but not to on-chain activity, leaving miners without the fee-based incentives needed for long-term security. To address this imbalance, developers are experimenting with native BTC applications that could restore fee revenue to miners instead of offshoring activity to other chains.

Projects like Babylon Genesis Chain, which allows BTC holders to stake with operators securing external proof-of-stake networks, point to how Bitcoin could expand its role beyond passive value storage. Babylon’s launch in August 2024 temporarily drove fees above $150 per block and sparked demand for blockspace. However, these spikes have proven short-lived, and fee revenue remains low.Base Layer Starves

The tokenization trend, too, reveals the risks of activity migrating elsewhere: while Coinbase’s cbBTC has grown rapidly to over 52,000 BTC in supply, largely at theexpenseof BitGo’s wBTC, much of this demand occurs outside the Bitcoin base layer. This also generates little fee income for miners.

For Bitcoin to sustain its “lofty” valuation, CoinMetrics believes that the ecosystem must find ways to stimulate more consistent network activity and create new demand for blockspace and reward miners for their role in securing the chain.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up