Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Bessent Says 'Independence Does Not Mean No Accountability' In Defending Justice Department Probe Of Fed Chief

Spot Gold Broke Through $5,380 Per Ounce, Up 3.8% On The Day. Spot Silver Extended Its Gains To 4%, Currently Trading At $116.49 Per Ounce

Jeff Rosenberg Of BlackRock: The Federal Reserve's Response Mechanism (compared To Its Focus On Price Stability) Is More Focused On The Labor Side

Chicago Wheat Futures Rose About 2.3%, Corn Rose 1%. In Late New York Trading On Wednesday (January 28), The Bloomberg Grains Index Rose 1.19% To 29.3655 Points, Reaching A Daily High Of 29.5851 Points At 23:06 Beijing Time. CBOT Corn Futures Rose 1.00%, And CBOT Wheat Futures Rose 2.29%. CBOT Soybean Futures Rose 0.70% To $10.7475 Per Bushel, Reaching A Daily High Of $10.8475 At 22:41; Soybean Meal Futures Rose 1.22%, And Soybean Oil Futures Fell 0.11%

"New Bond King" Gundlach: He Believes That Federal Reserve Chairman Powell Will Not Cut Interest Rates Again During His Term

Powell: The Message Is Simply Not About Our Credibility, Inflation Expectations Show We Have Credibility

Powell: Also Advice For The Next Fed Chair Is The Need To Earn Democratic Legitimacy With Congressional Overseers

Powell: Has Been A Divide Between Solid Growth And Weakning Labor Market, Which May Be Explained By Rising Productivity

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)A:--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. YieldA:--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)A:--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target RateA:--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)A:--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)A:--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve BalancesA:--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)A:--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate TargetA:--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)A:--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Dec)

Euro Zone M3 Money Supply YoY (Dec)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Dec)

Euro Zone 3-Month M3 Money Supply YoY (Dec)--

F: --

P: --

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)--

F: --

P: --

Euro Zone Consumer Confidence Index Final (Jan)

Euro Zone Consumer Confidence Index Final (Jan)--

F: --

P: --

Euro Zone Selling Price Expectations (Jan)

Euro Zone Selling Price Expectations (Jan)--

F: --

P: --

Euro Zone Industrial Climate Index (Jan)

Euro Zone Industrial Climate Index (Jan)--

F: --

P: --

Euro Zone Services Sentiment Index (Jan)

Euro Zone Services Sentiment Index (Jan)--

F: --

P: --

Euro Zone Economic Sentiment Indicator (Jan)

Euro Zone Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone Consumer Inflation Expectations (Jan)

Euro Zone Consumer Inflation Expectations (Jan)--

F: --

P: --

Italy 5-Year BTP Bond Auction Avg. Yield

Italy 5-Year BTP Bond Auction Avg. Yield--

F: --

P: --

Italy 10-Year BTP Bond Auction Avg. Yield

Italy 10-Year BTP Bond Auction Avg. Yield--

F: --

P: --

France Unemployment Class-A (Dec)

France Unemployment Class-A (Dec)--

F: --

P: --

South Africa Repo Rate (Jan)

South Africa Repo Rate (Jan)--

F: --

P: --

Canada Average Weekly Earnings YoY (Nov)

Canada Average Weekly Earnings YoY (Nov)--

F: --

P: --

U.S. Nonfarm Unit Labor Cost Final (Q3)

U.S. Nonfarm Unit Labor Cost Final (Q3)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Trade Balance (Nov)

U.S. Trade Balance (Nov)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

Canada Trade Balance (SA) (Nov)

Canada Trade Balance (SA) (Nov)--

F: --

P: --

U.S. Exports (Nov)

U.S. Exports (Nov)--

F: --

P: --

Canada Imports (SA) (Nov)

Canada Imports (SA) (Nov)--

F: --

P: --

Canada Exports (SA) (Nov)

Canada Exports (SA) (Nov)--

F: --

P: --

U.S. Unit Labor Cost Revised MoM (SA) (Q3)

U.S. Unit Labor Cost Revised MoM (SA) (Q3)--

F: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Ether prices could tumble a further 20% from current levels if history rhymes and the correction deepens this month.

Now that Ethereum has run the prior all-time highs in August, “I think ETH will drop back to its 21-week EMA [exponential moving average],” said ICT Crypto founder Benjamin Cowen on Monday.

This could send ETH back to around $3,500 before it recovers and pushes to a new all-time high at the end of the year.

“A lot of people will get upset with this idea, but this has been the plan since ETH ‘went home’ in April,” he said, referring to the April dump below $1,500.

Now that Ethereum has run the prior All Time Highs in August, I think ETH will drop back to its 21W EMA.

A lot of people will get upset with this idea, but this has been the plan since ETH went home in April (new ATH, then pullback to 21W EMA and find support). https://t.co/WLPBK3mHJ3 pic.twitter.com/2AalzbsMdb

— Benjamin Cowen (@intocryptoverse) September 1, 2025

Slumptember Has Arrived

During the past two bull market years, there has been a major correction inSeptember. According to CoinGlass, six of the past ten Septembers have seen price declines for ETH, with the average loss around 6%. However, ETH corrections have been much larger in bull market years.

In September 2017, ETH fell by 21.6% and in the same month in 2021, it lost 12.5%. The asset recovered to notch a new all-time high a few months after, so this month could provide a buy-the-dip opportunity. The longer-term outlook for Ethereum is extremely bullish now that Wall Street has started toembrace the asset.

Additionally, whales are still buying, with Arkham Intelligence reporting on Monday that a whale holding $5 billion of Bitcoin just bought $1 billion in ETH and has nowstaked it all.

‘DeFi Dad’ posted some Ether ‘moon math’ this week, predicting that the asset will command a much higher market capitalization than its current $523 billion.

“Based on its position as the most trusted and reliable world ledger for stablecoins, RWAs, DeFi native assets and TradFi’s default choice for tokenization… easy to imagine ETH commanding a market cap of $35 trillion or more by 2032/2034, whenever ETH inevitably catches up to or flips BTC market cap.”

Meanwhile, Ethereum educator Anthony Sassano observed that spot Ether ETFs and treasuries bought over 33 times more ETH than was issued by the network in August.

ETH purchased in August by entity:

– ETH ETFs: ~860,000 ETH – ETH treasury companies: ~1.7 million ETH

Newly net issued ETH in August: ~76,709 ETH

The ETH ETFs and treasuries bought over 33x more ETH than was net issued by the network in August.

Accelerate!

— sassal.eth/acc (@sassal0x) August 31, 2025

ETH Price Retreats

Despite these clearly bullish long-term prospects, weak retail hands keep selling the asset.

Ether has retreated again today, falling from an intraday high of $4,480 to a low of $4,250 in late trading on Monday. ETH had recovered to reach $4,350 during the Tuesday morning Asian trading session, but it has been printing lower highs and lower lows for the past week as the downtrend continues.

The chances are that this is likely to continue for most of this month before a recovery in Q4.

Starting on January 29, 2026, PENDLE will give rewards to users holding cUSD. Incentive programs like these often bring more people to use both tokens. More use can lead to more buying, which might push prices up. These programs also make both Cap USD and Pendle more well-known. If many people join to get rewards, trading volume could rise, and both tokens could see short-term price moves. Traders should check how many users take part, as weak interest might mean little price impact. Good rewards often act as a strong catalyst. source

Pendle@pendle_fiSep 01, 2025vePENDLE voting is already live, and PENDLE incentives will kick in for cUSD (29 Jan 2026) on Thursday, 00:00 UTC pic.twitter.com/BgMOMOtMHx

A new Binance listing often brings strong attention from traders because Binance is the world’s largest crypto exchange. When Somnia (SOMI) is listed with several pairs (USDT, USDC, BNB, FDUSD, TRY), buying and selling will become much easier and more active. Many new people could discover the project. This can lead to high trading volume and fast price movement, often upward. However, sometimes, early holders might sell for profits at first. It is important to watch trading, but a Binance listing is usually a big catalyst for price change. source

A token burn proposal can be very important for price. If the Marinade (MNDE) community votes yes and burns tokens, the total supply will go down. With fewer tokens, each one might become more valuable if demand stays the same or rises. A burn shows the team listens to the community, which could also build trust and attract new buyers. If the proposal does not pass, there might not be much effect on price. Watching the vote is key for traders, as the result could move MNDE up or down. source

XRP is trying to bounce back again. After sliding through much of August, the token managed a 2% rebound in the last 24 hours. The green candles may look comforting on the screen, but the larger picture tells a more complicated story where the risks still outweigh the relief.

A Market That Remembers

According to an analyst, XRP is facing a problem: a bearish divergence that has been building for weeks. In simple terms, price has been climbing while momentum quietly faded in the background. The last time XRP faced a divergence of this size was at the turn of 2020 into 2021. Back then, the pattern was not just a warning. It preceded a painful 60 percent correction stretched across several months.

Today, the pullback is only about 20 to 25 percent from the highs. That leaves experts asking the uncomfortable question: is this correction just getting started?

The Fragile Floor

XRP lost its footing above $2.85, a level that once acted as support but now hangs over the price as resistance. The next battle zone lies at $2.75. If that floor gives way with convincing daily closes, the market could easily test deeper waters between $2.55 and $2.62.

The structure does little to inspire confidence. Price action has been compressing into a descending triangle, a formation that more often than not ends with a breakdown. Should that play out, chart projections point towards the $2.17 region, a level that would mean another 20 percent slide from here.

Between Bulls and Bears

XRP has shown it can bounce, but the chart shows the token is not yet out of danger. A convincing move back above $2.85 would help repair sentiment and challenge the bearish setup. If the price falters at $2.75, the sellers may quickly regain control.

This bounce looks less like a sign of recovery and more like a test of resilience. The next few weeks will decide whether XRP can rewrite its script or whether the market is simply pausing before another act of decline.

FAQs

Why is XRP price up today?XRP rose 2% in 24 hours due to a technical rebound after August’s slide, though the bounce lacks strong momentum and remains fragile.

How much will XRP reach in 2025?Analysts and AI forecasts project XRP could reach $5.05 by the end of 2025, driven by ETF approvals, partnerships, and regulatory clarity.

How much will 1 XRP be worth in 2030?Based on compounding growth and adoption, projections estimate XRP could trade around $26.50 by 2030, with averages near $19.75.

Is XRP a Good Investment?XRP is considered a strong investment due to its institutional adoption, regulatory progress, and role in cross-border payments. However, it carries volatility risks like all cryptocurrencies.

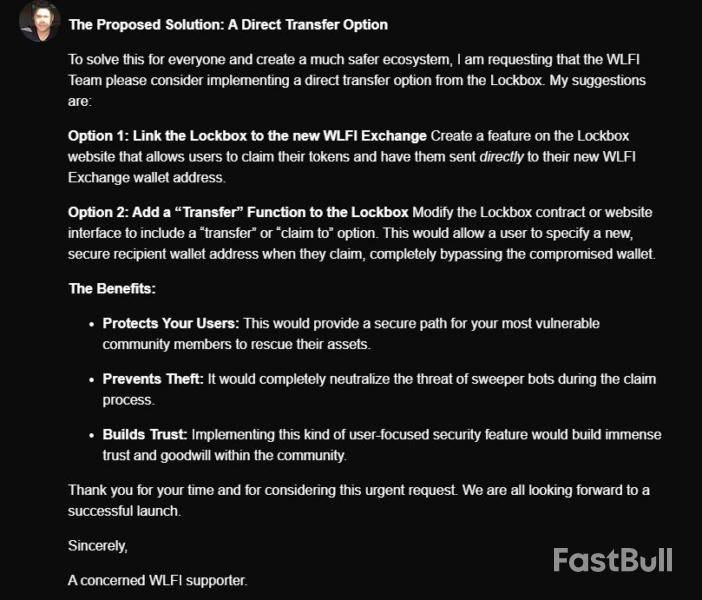

The World Liberty Financial team has put forward a proposal to allocate all fees generated from its protocol-owned liquidity toward purchasing and permanently burning WLFI tokens.

"This program removes tokens from circulation held by participants not committed to WLFI’s long-term growth and direction, effectively increasing relative weight for committed long-term holders," the proposal said.

The plan stipulates that fees collected from WLFI’s liquidity positions on Ethereum, Binance Smart Chain and Solana will be used to repurchase WLFI tokens on the open market. These tokens would then be sent to a burn address, removing them from circulation.

However, fees from community or third-party liquidity providers are not included in this program.

The proposal explained that higher protocol usage would lead to increased fees, resulting in more tokens being burned. All burn transactions would be recorded on-chain and reported to the community for transparency, the team noted.

The community can vote on three options: support directing all treasury protocol-owned liquidity fees to the buyback and burn program, oppose the plan and retain fees in the treasury, or abstain from expressing a preference.

If approved, WLFI intends to explore expanding the program to include additional sources of protocol revenue, with the goal of scaling the initiative as the ecosystem grows.

While details on voting and implementation schedules are yet to be announced, a majority of the replies on the proposal are currently positive.

WLFI Launch

World Liberty Financial's native token started trading on crypto exchanges on Monday. The token started trading at $0.32, then subsequently plunged 34% to a low of $0.21, according to The Block's WLFI price page. It is currently trading at around $0.23 as of 12:30 a.m. on Tuesday.

CoinGecko data shows that over $2.5 billion worth of WLFI has been traded since launching on the major exchanges, including Binance, Coinbase and Upbit. Around 27.35 billion WLFI tokens are currently in circulation, out of a total of 100 billion.

Even with the token's significant price drop from its launch, its pre-sale investors remain well in profit, as they acquired it at just $0.015 each. According to Bubblemaps, Tron Founder and crypto billionaire Justin Sun's WLFI holdings are still up roughly tenfold.

World Liberty Financial was founded in 2024 as a DeFi and crypto company, publicly backed by U.S. President Donald Trump and his family. It has also launched its dollar stablecoin USD1, which is currently ranked as the sixth-largest stablecoin with a $2.6 billion market capitalization.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

World Liberty Financial’s (WLFI) governance tokenholders are being hit with a known phishing wallet exploit using Ethereum’s EIP-7702 upgrade, SlowMist founder Yu Xian says.

Ethereum's Pectra upgrade in May introduced EIP-7702, which allows external accounts to temporarily act like smart contract wallets, delegating execution rights and allowing batch transactions, which are aimed at streamlining a user’s experience.

Xian said in an X post on Monday that hackers are exploiting the upgrade to pre-plant a hacker-controlled address in victim wallets, then, when a deposit is made, they quickly “snatch” the tokens, which in this case, is affecting WLFI tokenholders.

“Encountered another player whose multiple addresses’ WLFI were all stolen. Looking at the theft method, it’s again the exploitation of the 7702 delegate malicious contract, with the prerequisite being private key leakage,” Xian said.

The Donald Trump–backed World Liberty Financial (WLFI) token began trading Monday morning, with a total supply of 24.66 billion tokens.

How it works

In the lead-up to the official launch, an X user reported on Aug. 31 that a friend had their WLFI tokens drained after transferring Ether (ETH) into their wallet.

In a reply, Xian said it was clearly an example of the “Classic EIP-7702 phishing exploit,” where the private key was leaked, and the bad actor then pre-plants a delegate smart contract into the victim’s wallet address connected to the key.

In a previous post, Xian said the private keys are usually stolen through phishing.

“As soon as you try to transfer away the remaining tokens in it, such as these WLFI that were thrown into the Lockbox contract, the gas you input will be automatically transferred away,” he said.

Xian suggested to “cancel or replace the ambushed EIP-7702 with your own,” and transferring away tokens from the compromised wallet as a possible solution.

Crypto users discuss thefts on WLFI forums

Some have been reporting similar issues in the WLFI forums. One posting under the handle hakanemiratlas said his wallet was hacked in October last year and now worries his WLFI tokens are at risk.

“I managed to transfer only 20% of my WLFI tokens to a new wallet, but it was a stressful race against the hacker. Even sending ETH for gas fees felt dangerous, since it could have been stolen instantly as well,” they said.

“Currently, 80% of my WLFI tokens are still stuck in the compromised wallet. I am extremely worried that once they unlock, the hacker might immediately transfer them away.”

Another user under the handle Anton said many other people are facing a similar issue because of how the token drop was implemented. The wallet used to join the WLFI whitelist needs to be used to participate in the presale.

“The instant the tokens arrive, they will be stolen by automated sweeper bots before we have a chance to move them to a secure wallet,” he said.

Anton is also requesting the WLFI Team to consider implementing a direct transfer option for the tokens.

Scammers targeting token launch

Numerous WLFI scams have appeared in the lead-up and post token launch. Analytics firm Bubblemaps identified several “bundled clones” look-alike smart contracts that imitate established crypto projects.

Meanwhile, the WLFI team has warned that it doesn’t contact via direct message on any platform, with the only official support channels through email.

“If you receive a DM claiming to be from us, it is fraudulent and should be ignored. If you receive an email, always double-check that it is coming from one of these official domains before responding,” the WLFI team said.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up