Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

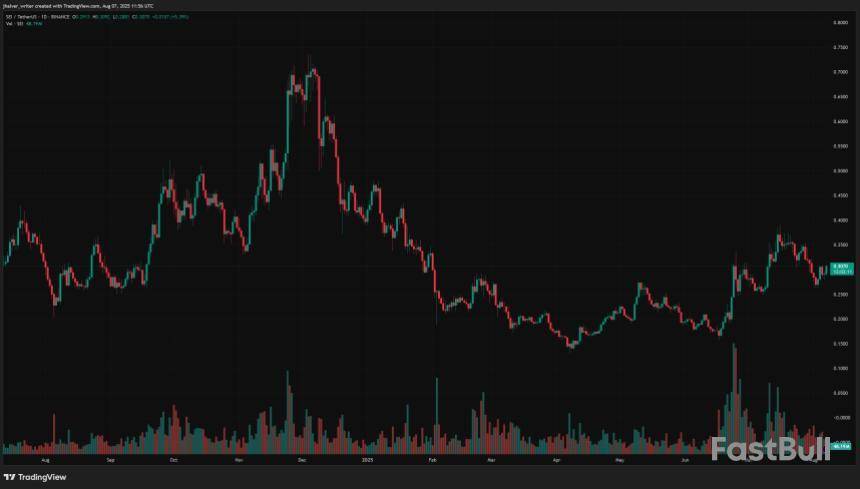

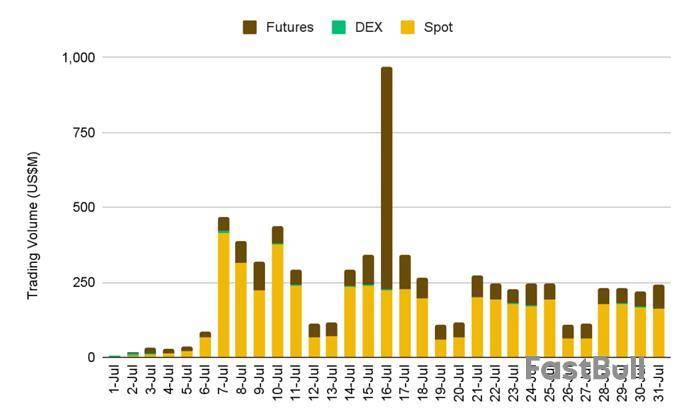

MetaMask, one of the most widely used Web3 wallets with over 100 million users, has officially integrated the Sei Network, a Layer-1 blockchain known for its speed and scalability.

This major update now allows users to access Sei’s decentralized applications (dApps), tokens, NFTs, and perform SEI transactions directly from MetaMask, without the need for third-party tools or bridges.

With this integration, the total number of supported blockchains in MetaMask rises to 11, further strengthening its position as a leading multi-chain wallet. A dedicated Sei section within the MetaMask Portfolio now offers users a smooth entry point to the network’s gaming, DeFi, and NFT ecosystem.

Sei’s Ecosystem Growth Fuels Investor Optimism

The timing of this integration couldn’t be better for the token. The network has recently achieved significant growth milestones: over 4.2 million daily transactions, a TVL surpassing $600 million, and 11 million monthly active users, all since launching its EVM-compatible chain less than a year ago.

The tokenimproved accessibility through MetaMask is expected to attract more developers and users alike, expanding the reach of its high-performance blockchain infrastructure. According to Justin Barlow of the Sei Development Foundation, this marks a strategic leap toward making Sei the “best EVM ecosystem.”

Market interest in the SEI token has already responded positively, with a 2.5% uptick post-announcement, and more upside could be in play.

Several technical indicators are flashing green for the token. The Supertrend indicator has flipped bullish on the weekly chart, a signal previously followed by substantial price increases. Supporting metrics include:

Crypto analyst @ali_charts predicts SEI could soon reach $0.54, citing strong chart structure and renewed investor confidence. With growing on-chain activity, seamless MetaMask access, and technical support, the SEI token appears poised for a breakout.

The MetaMask’s Sei integration is not just a win for convenience, it signals a bullish bet on the future of decentralized interoperability as Web3 shifts toward a multi-chain reality.

Cover image from ChatGPT, SUIUSD chart from Tradingview

Web3-powered AI project Perle has raised an additional $9 million in a seed round led by Framework Ventures. This brings the startup’s funding to a total of $17.5 million as it looks to build a product that “rewards users for reviewing and contributing accurate data sets to AI systems.”

With the fresh injection of capital, Perle will launch Perle Labs, a product using blockchain rails and incentives for user payments and onchain attributions in an attempt to improve how AI models are trained. Perle offers "curated" data and human reviewers, according to its website.

“As AI models grow more sophisticated, their success hinges on how well they handle the long tail of data inputs — those rare, ambiguous, or context-specific scenarios,” said Ahmed Rashad, CEO of Perle and former Scale AI employee. “By decentralizing this process, we can unlock global participation, reduce bias, and dramatically improve model performance.”

The product is based on the idea that the progress in AI “will be driven more by better data than by simply scaling models,” Framework co-founder Vance Spencer said in a statement.

"LLMs aren't failing because they run out of room to think—they're failing because they don't know how to think when abstraction breaks their training patterns," Perle wrote in a recent paper. "Instead of asking LLMs to magically reason through complexity, we need to feed all AI systems better, more structured inputs."

Although companies like Anthropic, OpenAI, and xAI have released powerful closed-source text and image generation models, it is sometimes unclear for casual users to judge the quality of the input data — a process Perle thinks can be improved through “high-quality human feedback.”

The startup will offer a “self-serve platform” for the full AI development lifecycle — from multimodal audio, image, and text data collection to model fine-tuning, according to the announcement.

Perle previously raised an $8.5 million pre-seed round in October 2024 led by CoinFund.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Earlier today, the odds of the U.S. Securities and Exchange Commission (SEC) approving an XRP exchange-traded fund (ETF) plunged to 66%, the lowest level since January.

However, according to Eric Balchunas, senior exchange-traded fund (ETF) analyst for Bloomberg, this is an overreaction.

Eric Balchunas@EricBalchunasAug 07, 2025Interesting, trades reporting how Polymarket odds of XRP ETF approval went down to 62% after the votes were disclosed showing Crenshaw voting no, but a) she's gonna vote no on EVERYTHING and b) it's meaningless, she's outnumbered = we haven't changed our odds, still at 95%. https://t.co/TamMn8DHVh pic.twitter.com/Ip9G748HrU

Bloomberg experts have so far refrained from changing their approval odds for an XRP ETF, maintaining them at 95%.

"Outnumbered"

The plunge in the Polymarket occurred after it transpired that Democratic Commissioner Caroline Crenshaw voted against each of the 13 initiatives related to crypto ETFs on July 29. Crenshaw was the only "no" vote in each case, with Chairman Paul Atkins and Republican Commissioners Hester Peirce and Mark Uyeda always voting in favor.

Balchunas remains optimistic about XRP approval odds since Crenshaw, a strong crypto critic, is expected to vote against crypto ETFs, given that she also opposed the approval of spot Bitcoin ETFs.

However, the leading Bloomberg expert argues that her opposition is essentially meaningless since Crenshaw is a lone anti-crypto commissioner who will always get outnumbered.

Crenshaw’s criticism of Ripple settlement

As reported by U.Today, Crenshaw previously criticized the SEC's decision to reach a settlement with Ripple.

The SEC commissioner argued that the SEC was actually "worried" that it could win its appeal against Ripple.

The settlement was then rejected by the judge, and Ripple then moved to drop its cross-appeal against the SEC. It is worth noting that the SEC has yet to reciprocate.

Tyler and Cameron Winklevoss, the twin brothers who are co-founders of the Gemini cryptocurrency exchange, have invested bitcoin in American Bitcoin Corp., a mining firm linked to President Donald Trump's sons Eric and Donald Jr., according to a Bloomberg report.

American Bitcoin Corp., which is about 20% owned by the Trump sons, was spun off from publicly traded bitcoin miner Hut 8 and is seeking to go public itself through a merger with Gryphon Digital Mining. Gryphon shareholders are currently voting on whether to approve the merger; Hut 8 and the Trumps will retain about 98% ownership in the new entity.

The investment was part of a private placement by American Bitcoin Corp. The offering generated aggregate gross proceeds of about $220 million in cash and BTC and was "oversubscribed," according to Hut 8 CEO Asher Genoot.

The size of the investment was not disclosed in the report, but the Winklevoss brothers have donated millions in bitcoin to President Trump's campaign and pro-Trump super PACs in the past. Gemini is currently looking to go public, filing a draft registration statement with the Securities and Exchange Commission in early June. Gemini could not immediately be reached for comment by The Block.

Bloomberg also previously reported that Eric Trump's stake in the firm could be worth $367 million when American Bitcoin Corp. goes public. The company is expected to be listed on the Nasdaq stock exchange.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Union Jack Oil, a publicly traded UK energy company, has announced plans to convert natural gas from its West Newton site into electricity to power Bitcoin mining, marking what could become one of the country’s first “oil-to-crypto” monetization projects.

The move could generate early cash flow from wells that would otherwise remain undeveloped, the company said on Thursday in an operations report.

The project is being pursued in partnership with Rathlin Energy and Texas-based 360 Energy, which specializes in turning stranded or flared gas into power for on-site data centers.

Under a non-binding letter of intent, the companies aim to deploy 360’s In-Field Computing technology to begin mining Bitcoin directly at the West Newton A site, subject to regulatory approvals.

If successful, the new project could also lead to Union Jack “introducing a new Bitcoin Treasury strategy,” according to Executive Chairman David Bramhill.

West Newton: Discovered but still undeveloped

Union Jack Oil acquired its stake in West Newton in 2019, after operator Rathlin Energy struck gas at the site. Further drilling in the following years placed it among the largest onshore gas discoveries in the UK.

However, the site remains on hold due to planning delays and regulatory uncertainty, which have slowed the development of infrastructure needed to bring the gas to market.

“Regulatory uncertainty has unduly hampered progress,” Bramhill said, saying that projects like West Newton have suffered from a perception problem despite their commercial appeal.

Instead of waiting for full-scale approvals and infrastructure, Union Jack plans to use the gas on-site to power Bitcoin mining rigs, generating early revenue without relying on traditional development timelines.

“Onshore developers and producers have been forced to think outside the box to make progress and deliver growth,” Bramhill said. He described the proposed Bitcoin mining venture as “innovative” and offering “strong scope for a sustainable return.”

A shift in how energy is monetized

Union Jack Oil’s mining initiative is part of a broader shift in how energy companies think about underused resources. Many oil and gas firms are experimenting with Bitcoin mining to monetize stranded or flared gas that would otherwise be wasted.

The model is to convert gas into electricity on-site and use it to power mining rigs, avoiding the delays and costs of connecting to grids or building pipelines. Specialized providers like 360 Energy and Crusoe have been working on making this approach modular and scalable.

The strategy is being deployed elsewhere. In the US state of North Dakota, ConocoPhillips launched a pilot program to supply excess gas to Bitcoin miners rather than flare it.

In Argentina, oil firm Tecpetrol began using leftover gas from its drilling operations to run mining rigs after facing limits on how much it could release into the environment.

And in June 2025, Canadian company AgriFORCE launched an operation in Alberta that harnesses stranded natural gas to power 120 Bitcoin mining rigs, with plans to expand to two more sites.

Magazine: How crypto laws are changing across the world in 2025

A new analysis by popular crypto chartist EGRAG CRYPTO on the social media platform X provides an in-depth look at five technical markets on XRP’s path forward. Notably, XRP’s price action has been experiencing a slight retracement and consolidation in early August following a rally in July during which XRP broke above $3 and reached new all-time highs.

Key Things To Watch Out For With XRP’s Price Action

Currently trading just around the $3.00 psychological level, XRP’s price action is witnessing volatile candles across shorter timeframes. However, according to the technical outlook from EGRAG CRYPTO, XRP bulls appear to be defending key zones around $2.90, amidst the broader market sentiment remaining cautiously optimistic.

The first key thing to watch out for is bullish closings above $3. Zooming into the 4-hour timeframe, EGRAG’s first key observation is that XRP has managed to close multiple candlesticks above the $3.00 threshold. This level is not only psychological but also a strong confidence booster for traders looking for confirmation of bullish continuation.

Secondly, the charts show that most of the candle wicks are forming from the upside, a sign that while sellers are active, they have not overwhelmed the buying strength just yet.

However, the third key thing to watch out for is a possible correction. Particularly, EGRAG noted that a retest of the $2.96 to $2.93 price zone is possible in the near term. This price range has been marked as a short-term support zone, where buyers could look to reload if XRP briefly dips.

That being said, the more critical level for bulls to protect is $2.80, which is the fourth key thing to watch out for. According to the analyst, closing below $2.80 again would undermine the bullish structure and could cause downside momentum. As such, holding above this level is crucial for maintaining bullish momentum.

Price Target Goals

The fifth key thing to watch out for as the bull market unfolds is price targets that can confirm bullish momentum. In terms of price targets and resistances, EGRAG noted specific price levels that would reflect new bullish energy and possibly a breakout to new all-time highs.

The first milestone is a close above $3.185. This level previously acted as a rejection zone in late July. Therefore, breaching $3.185 with conviction would flip sentiment more decisively in favor of the bulls. Above that, the analyst highlighted $3.25 as the next key checkpoint, and surpassing it would put XRP in a strong technical position.

The resistance targets beyond that are $3.33 and $3.45, and these are breakout zones that could cause a new all-time high scenario. These targets align with the upper resistance blocks illustrated on EGRAG’s charts, and any solid close above $3.45 can be interpreted as a move to at least $3.65.

At the time of writing, XRP is trading at $3, up by 2.4% in the past 24 hours.

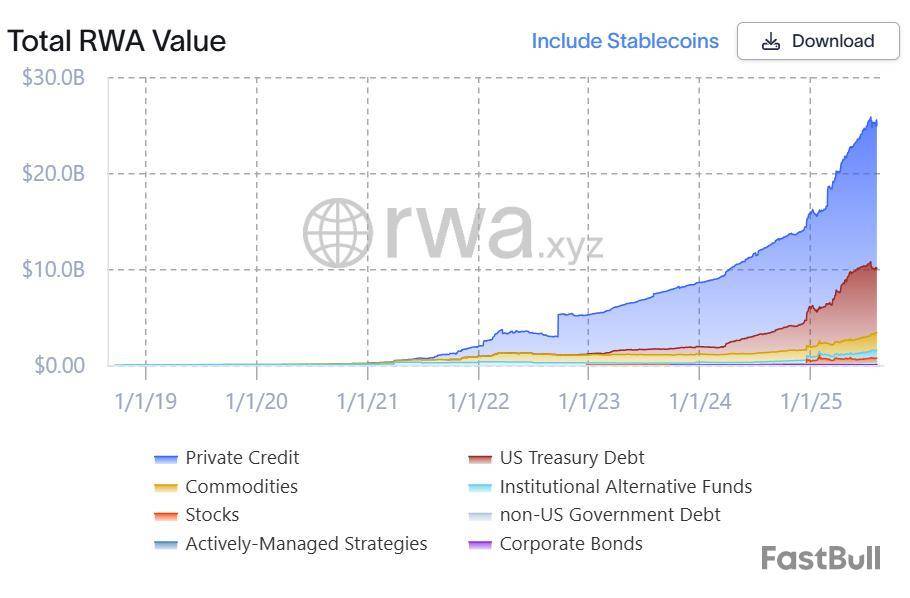

Web3 company Animoca Brands has launched a new marketplace for investors to access tokenized real-world assets (RWAs), fixing what its CEO calls a “fragmented” tokenization marketplace at a time of growing institutional interest in the technology.

The new platform, called NUVA, was developed in partnership with ProvLabs, the organization behind the Provenance Blockchain, according to a joint announcement on Thursday.

The NUVA marketplace will leverage Provenance Blockchain’s existing ecosystem of RWAs, which currently holds assets valued at approximately $15.7 billion.

At launch, NUVA will offer exposure to two tokenized products from Figure Technologies: YLDS, the first yield-bearing stablecoin security approved in the US, and HELOC, a pool of fixed-rate home equity lines of credit.

These assets will be offered through “vaults,” a structure that enables easier and more efficient investor access to tokenized products.

Vault-based marketplaces are increasingly recognized for expanding accessibility, particularly for investors who are traditionally underserved or lack access to conventional financial platforms.

“The vault tokens are liquid claims to the yielding real-world assets stored in each vault,” ProvLabs CEO Anthony Moro told Cointelegraph in a written statement, adding:

These so-called nuAssets bring liquidity to traditionally illiquid RWAs, giving investors the option to trade and transfer them across chains and decentralized finance exchanges.

Animoca Brands’ co-founder and executive chairman, Yat Siu, said NUVA is intended to tap into a growing RWA market that remains “fragmented across chains and marketplaces, [which] limits their reach and impact.”

NUVA intends to fix this gap by making “institutional-quality assets radically more accessible across a unified, multichain ecosystem,” said Siu.

Tokenization boom expected to accelerate with supportive regulations

Tokenized finance is emerging as one of the most influential trends shaping the crypto industry in 2025, with the rise of RWA tokenization driven by growing demand for products like private credit and US Treasury bonds.

As Cointelegraph reported, the tokenized RWA market — excluding stablecoins — has surged by as much as 380% since 2022.

Tokenized stocks are also gaining momentum, reaching a total market capitalization of $370 million by the end of July, representing a 220% increase in just one month, according to Binance Research.

Industry experts told Cointelegraph that recent regulatory developments in the US, particularly those surrounding stablecoins, could create a more favorable environment for the continued expansion of RWA tokenization in the years ahead.

Major institutions are also taking notice. JPMorgan recently highlighted the role of tokenized money market funds as a way to preserve the appeal of cash in digital ecosystems.

“Instead of posting cash, or posting Treasurys, you can post money-market shares and not lose interest along the way,” said JPMorgan strategist Tereso Ho said, referring to the operational benefits of tokenized money market funds

Paul Brody, EY’s global blockchain leader, added that tokenized deposits and tokenized money market funds “could find a significant new opportunity onchain,” signaling strong institutional confidence in the sector’s future.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up