Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Saga (SAGA) presents Stack Exploder, a new tool for DeFi builders and liquidity providers (LPs). This tool helps organize rewards and incentives on Saga’s blockchain. If it attracts more DeFi projects or new users, demand for SAGA tokens could rise. However, much depends on how many teams use Stack Exploder and whether users like it. The event will be explained in a public meeting, so the price impact may be short-term unless the community sees big value. Watch the feedback from DeFi builders for signs of a possible strong move. source

Saga ⛋@Sagaxyz__May 13, 2025Stack Exploder returns tomorrow.

Join @jinghiskwon, @internetmick, and @pablo_veyrat from @Merkl_xyz as they unpack how the top onchain incentive engine is coming to Saga, and what it unlocks for DeFi builders and LPs.https://t.co/nM5MkIjKyn

SwissBorg (BORG) is holding a vote about allowing all users to receive Earn rewards in BORG, no matter which asset is locked. If the vote passes, it could increase demand for BORG because more users may want rewards in the token. This leads to stronger community involvement and a reason for users to buy or hold BORG. However, the price move depends on the vote results and if users get excited about the change. If there is little interest or the idea is not accepted, the price may stay flat. source

SwissBorg@swissborgMay 13, 2025️ A new vote is LIVE in the app — and it pays to participate!

Hurry, the current vote closes May 16th!

Average of 2,000+ BORG staked during each vote & earn quarterly

Quarterly governance rewards

Help shape the future of SwissBorg

This vote: Should Borgers be… pic.twitter.com/DKHlOvoyCs

The Tessellation V3 upgrade for Constellation (DAG) will introduce delegated staking. This big change lets more people stake their coins and join the network. Since rewards are given to early stakers and new node operators, there may be stronger demand for DAG before and just after the update. This event could make the price go up, as users rush to join staking. But there will be some downtime for the upgrade, so price movement could be unpredictable until everything works. Watch closely to see if new users start staking in large numbers. source

Constellation Network@Conste11ationMay 13, 2025We’re thrilled to announce that the Tessellation V3 upgrade and Delegated Staking are complete!

Now, we’re focused on giving everyone a fair shot to refine their strategy and seize this opportunity, as the race for delegation will be intense.

Key Details:

️The network will… pic.twitter.com/uJMMsT2qtS

Crypto and stock trading platform eToro has boosted the size of its initial public offering to $620 million by pricing its shares above its previously suggested range.

The platform and its backers sold over 11.92 million shares for $52 each, which are slated to start trading on the Nasdaq Global Select Market on May 14 under the ticker symbol ETOR, eToro said in a May 13 press release.

Initially, the firm aimed to raise $500 million by offering 10 million shares priced between $46 to $50 each.

The share offering will remain open until at least May 15 and consists of more than 5.9 million shares sold by eToro and 5.9 million shares sold by specific existing shareholders.

The Israel-based eToro will go public as a rival to Robinhood Markets Inc. (HOOD), which went public in July 2021 and whose shares are up over 67% year to date, according to Google Finance.

Initially, eToro made confidential filings with the SEC in January for a public offering before publicly announcing the plans on March 24.

Digital banking fintech firm Chime has also applied to list its stock on the Nasdaq Global Select Market under the ticker symbol CHY. However, the number of shares and price range are still to be determined.

Investment advisory firm Renaissance Capital speculated in a May 13 note to its clients that Chime’s IPO could raise up to $1 billion.

Crypto IPOs in the works

Other crypto companies are also mulling plans to go public. Crypto exchange Kraken is reportedly considering a public offering this year.

Stablecoin issuer Circle filed with the SEC on April 1, then paused its plans after President Donald Trump’s April 2 tariff announcements tanked global markets and stopped many in-the-works public offerings.

Crypto custody services firm BitGo launched a global over-the-counter trading desk for digital assets in February, after it was reported to be gearing up for an initial public offering slated for later this year.

In December last year, crypto exchange-traded fund issuer Bitwise predicted that at least five crypto unicorns would go public in 2025: stablecoin issuer Circle, crypto exchanges Kraken and Figure, and crypto bank Anchorage Digital and blockchain analytics firm Chainalysis.

In 2021, Coinbase was the first major crypto firm to go public in the US, listing its shares on the Nasdaq.

XRP price found support at $2.420 and started a fresh increase. The price is now correcting gains from $2.60 and might aim for another increase.

XRP Price Regains Traction

XRP price remained supported above the $2.40 level and started a fresh upward wave, like Bitcoin and Ethereum. The price was able to surpass the $2.50 and $2.550 levels.

The bulls pushed the price above the $2.580 resistance zone to set the pace for more gains. Finally, it tested the $2.60 zone. A high was formed at $2.6050 before there was a pullback. The price dipped below $2.5650 and the 23.6% Fib retracement level of the upward move from the $2.4220 swing low to the $2.6050 high.

The price is now trading above $2.50 and the 100-hourly Simple Moving Average. There is also a key bullish trend line forming with support at $2.510 on the hourly chart of the XRP/USD pair.

On the upside, the price might face resistance near the $2.60 level. The first major resistance is near the $2.650 level. The next resistance is $2.720. A clear move above the $2.720 resistance might send the price toward the $2.80 resistance. Any more gains might send the price toward the $2.850 resistance or even $2.880 in the near term. The next major hurdle for the bulls might be $2.950.

Downside Correction?

If XRP fails to clear the $2.60 resistance zone, it could start another decline. Initial support on the downside is near the $2.510 level and the trend line. The next major support is near the $2.492 level and the 61.8% Fib retracement level of the upward move from the $2.4220 swing low to the $2.6050 high.

If there is a downside break and a close below the $2.4920 level, the price might continue to decline toward the $2.450 support. The next major support sits near the $2.420 zone.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is now above the 50 level.

Major Support Levels – $2.510 and $2.4920.

Major Resistance Levels – $2.60 and $2.650.

Amid its recent breakout, Ethereum (ETH) has recovered a crucial Range lost in Q1, preparing to surge to the mid-zone of this area. However, various analysts forecast potential volatility for the King of Altcoins, as it faces some resistance at the current levels.

Ethereum To Trade Sideways Before Next Jump

After surging nearly 45% in the past week, Ethereum has reclaimed its $2,200-$3,900 macro range lost in March. During the late-April market pump, the cryptocurrency recovered from its 18-month low of $1,380, jumping toward the $1,800 resistance before breaking out last Thursday.

ETH has smashed past the $2,000 resistance and regained the crucial $2,100 and $2,300 levels before retesting the $2,600 resistance over the weekend. Since then, the King of Altcoins has hovered between the $2,400-$2,600 price range, hitting a two-month high of $2,624 on Monday.

Market watcher Castillo Trading highlighted that Ethereum is “doing exactly what it should be. Taking some time to build a base at important levels before the next move.”

The analyst stated that the $2,400-$2,700 zone will likely be ETH’s trading range for the upcoming days after its retest of the range lows as support, with “some shakeouts in both directions before continuing its next leg up.”

Similarly, Daan Crypto Trades noted that the cryptocurrency’s current level is important, as it could determine its short-term direction. According to the trader, Ethereum could drop to $2,300 or below the $2,100 support level if it loses the key area. “In that case, you can simply wait for a consolidation to be formed at those levels,” he explained.

On the contrary, if ETH breaks past the $2,600 resistance, and price keeps surging, the current level may “become a nice retest of the horizontal.” Notably, the next crucial horizontal level sits around the $2,850-$2,900 range, a significant support and resistance area amid the Q3 2024 pullback and the Q4 2024 breakout.

Is A Dip Or A 15% Shakeout Coming?

Analyst Rekt Capital pointed out that Ethereum secured a key Weekly Close after closing the week at $2,514 and officially reclaiming its Macro Range. According to the analyst, history suggests that ETH will “likely lift across the Range” over time, while “any dips, if needed at all, would only solidify $2200 as Range Low support.”

He stressed that the recent Weekly Close occurred at the top of a crucial cluster, enabling a scenario where “just a small dip would suffice, if the green circled retest repeats here at ~$2468 (black).”

However, if that level is lost, ETH could see a 10%-15% pullback toward the $2,200-$2,100 mark. Rekt Capital also remarked that the second-largest crypto by market capitalization has managed to fill the $2,530-$2,630 Daily CME Gap, created in March.

Amid its breakout, ETH also formed two small CME Gaps at the $2,300-$2,400 and $2,100-$2,200 levels, which could be closed soon. The former is the “more important dipping area, as it is also a Weekly CME Gap.”

Additionally, he affirmed that Ethereum intends to fill its Macro CME Gap, between $2,900 and $3,350, signaling that a surge toward those levels could be ahead.

As of this writing, Ethereum trades at $2,597, a 5% increase in the daily timeframe.

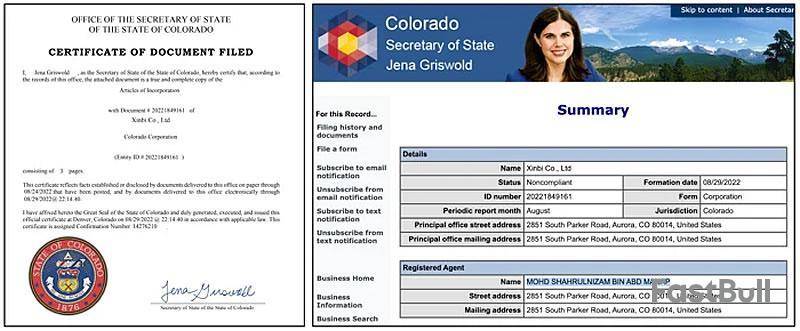

A Colorado-incorporated firm has been linked to a Chinese illicit marketplace that has served scammers in Southeast Asia and has been used to channel billions of dollars worth of crypto.

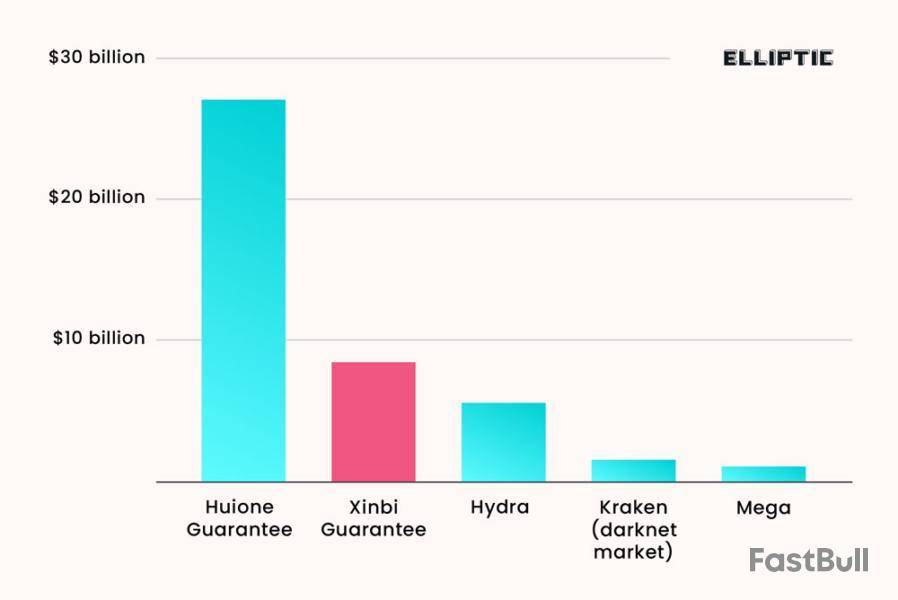

The marketplace, called Xinbi Guarantee, has received $8.4 billion, primarily in Tether stablecoin transactions to date, blockchain security firm Elliptic reported on May 13.

Merchants on the Chinese-language, Telegram-based illicit marketplace sell technology, personal data, and money laundering services to Southeast Asian scammers who target victims using pig butchering scams.

On its website, Xinbi describes itself as an “investment and capital guarantee group company” and claims to operate through Xinbi Co. Ltd, a Colorado-incorporated company incorporated in 2022.

“In January 2025, the corporation was updated to ‘Delinquent’ for failing to file a periodic report,” Elliptic reported.

Key services offered on the black marketplace are money laundering services, which are the largest category, as well as technology such as Starlink equipment for scammers, stolen personal data for targeting victims and fake IDs and other fraudulent documents.

Xinbi is the second-largest illicit online marketplace discovered so far, with transaction volume growing rapidly. Q4 2024 saw over $1 billion transacted, and evidence links the platform to North Korean hackers laundering stolen funds, the Elliptic researchers said.

Elliptic identified thousands of crypto addresses used by Xinbi Guarantee and the merchants on it, and stated that the $8.4 billion in transactions “should be considered as lower bounds of the true volume of transactions on the platform.”

The platform, which has 233,000 users, operates on a “guarantee model,” requiring vendor deposits to prevent fraud.

Second to Huione Guarantee

In July 2024, Elliptic exposed a similar Telegram-based Chinese marketplace known as Huione Guarantee.

The firm found that the wider Huione Group of companies had facilitated over $98 billion in crypto transactions.

In early May, it was designated by the US Treasury as a money-laundering operation and was to be severed from the US banking system.

These platforms also provide a window into a “China-based underground banking system,” based around stablecoins and other digital payments, “which is being leveraged for money laundering on a significant scale,” Elliptic concluded.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up