Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Analytics XPR-focused X account @XRPwallets has revealed data showing that since March this year, the amount of XRP held by Ripple (excluding escrows) has demonstrated a significant increase.

The report hints that this increase may have occurred after the statement made by Brad Garlinghouse about Ripple Market reports.

Ripple adds XRP to its active holdings

@XRPwallets quoted his own X post published on August 10 with screenshots showing how the XRP holdings of Ripple changed between the end of September and the end of October last year.

According to today’s tweet, Ripple held 4.562 billion XRP. By now, there has been an increase, leading to 4,775,602,531 XRP in total. Besides, @XRPwallets reminded the community that Ripple CEO, Brad Garlinghouse, announced that Ripple would no longer release its market reports, which usually revealed the company’s present XRP holdings.

The analyst believes that the increase of 213 million XRP confirms that not all XRP tokens released from escrow since March have been utilized so far.

XRP_Liquidity (Larsen/Britto/Escrow/ODL/RLUSD)@XRPwalletsSep 11, 2025As per Brad Garlinghouse there are no more Ripple Market Reports.

The latest Ripple Holdings are

4,775,602,531 XRP.

March 2025 there were about 4.562B XRP so as we can see there has been an increase. Which confirms not all released from Escrow were utilized approx. 213M XRP. https://t.co/KM4aIhuySF

Binance and Crypto.com see changes in their XRP stashes

The same source as above also retweeted an X post published by @xrp_rich_bot. This tweet has revealed that two major crypto exchanges, Binance and Crypto.com, have seen impressive changes in their XRP holdings.

XRP Rich List Bot@xrp_rich_botSep 11, 2025🚨 XRP Rich List Alert

📊 Changes 1Hhttps://t.co/4b1FOhgn30

↘️ -846,284 XRP (-0.2%)

Binance

↗️ +5,296,658 XRP (+0.2%)https://t.co/YDxLK6AcQ1

During the first half of 2025, Crypto.com’s holdings have declined by almost a million coins – 846,284 XRP (a 0.2% decline). As for Binance, it has welcomed a 0.2% increase in its XRP supply: 5,296,658 coins.

Dogecoin , the king of the meme coins, is generating huge buzz in the cryptocurrency space as community members anticipate big news. The frenzy is about the REX-Osprey DOGE ETF, with a ticker symbol of DOJE that is expected to launch on Sept. 11.

DOGE price targets $0.2680 resistance amid ETF buzz

The hype about this launch has triggered movement and price gains for Dogecoin on the market, with the asset climbing by over 15.59% in the last seven days. Notably, a DOGE ETF will broaden access to the meme coin by both retail and institutional investors.

Such a development could lead to increased adoption and upward price movement. The adoption will stem from the increased exposure of the meme coin to individuals and institutions that prefer not to directly hold the asset.

Market watchers expect a successful launch to impact the value of DOGE. As of press time, Dogecoin is trading at $0.2494, representing a 3.35% uptick in the last 24 hours. As launch hour approaches, DOGE has been on an upward trajectory and hit an intraday peak of $0.253 in earlier trading.

Traders are now looking forward to the next resistance level at $0.2680. However, a major hurdle to breaching the next resistance is the low trading volume. Currently, this metric remains in the red zone, down by 11.22% to $3.24 billion.

Can Dogecoin flip $0.50?

With the current exchange-traded fund hype, it could help push volume into the green zone. If Dogecoin’s volume records a spike coupled with the increased exposure the ETF would bring, the meme coin might be on a journey to $0.50.

Worthy of mention is that the last time Dogecoin soared close to that level was in early December 2024, when it changed hands for $0.4672. Meanwhile, the asset’s all-time high (ATH) stands at $0.7376, attained over four years ago in May of 2021.

Dogecoin holders and market participants alike are keenly watching to see if the king of the meme coins will perform well, like Bitcoin, when its ETF launches.

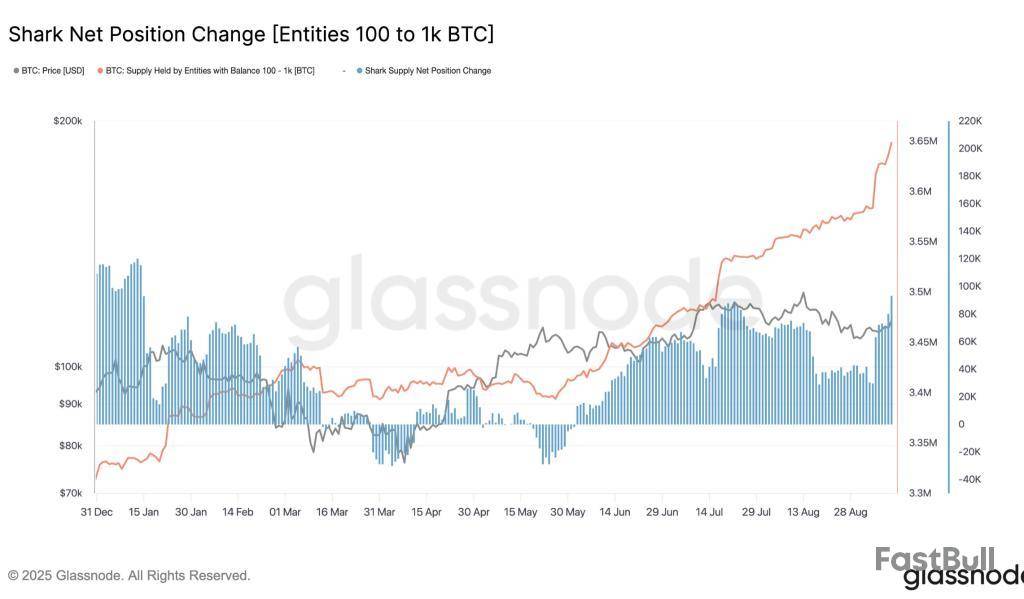

Bitcoin price continues to trade in a tight range between $90,000 and $100,000, but on-chain data reveals that mid-sized whales, also known as “sharks” (wallets holding 100–1,000 BTC), are quietly reshaping the market. According to Glassnode, these entities have ramped up their accumulation aggressively since July 2025, pushing their total holdings to a fresh all-time high of over 3.65 million BTC. This growing concentration of supply in stronger hands could have a significant impact on Bitcoin’s next major price move.

Shark Accumulation at Record Highs

The latest data shows that shark entities are not only accumulating but doing so at the fastest pace seen this year. The Shark Net Position Change has turned strongly positive, meaning these holders are consistently adding to their stacks rather than selling into rallies. This type of accumulation has historically preceded major bullish phases in Bitcoin, as it reflects strong conviction from entities with substantial capital at stake.

The data from Glassnode suggests that Bitcoin entities holding 100 to 1000 BTC, which are called ‘Sharks,’ have been accumulating the token progressively. In the past seven days, their holdings have risen by nearly 65,000 BTC, with the total holdings recording nearly 3.65 million. This aggressive buying from large holders is pushing BTC net supply into a deficit, with these holders absorbing both new issuance and secondary market coins.

Why It Matters for Bitcoin’s Price

Bitcoin is holding above the critical $112,000 support, which has acted as a strong demand zone in recent weeks. Moreover, the latest jump above $113,800 has attracted huge buying across the platform. As a result, the momentum has flipped in favour of the bulls, suggesting a continuation of a breakout. However, to do so, the BTC price is required to clear a major resistance that could elevate the token above bearish influence.

Bitcoin is consolidating around $113,957, with Bollinger Bands tightening, hinting at a volatility-driven move. Key resistance levels stand at $114,827 and $118,617. A breakout above $115K could open the path toward $120,000–$125,000 in the short term. On the downside, immediate support is at $113,345, followed by $107,274 and $103,950. A breakdown below $103K could extend losses toward $98,200. Overall, holding above $113K keeps the bias bullish, with the next upside target set at $125K.

Flow has confirmed that Forte, its latest protocol upgrade, will go live on the testnet on September 17. The upgrade is set to precede Flow’s appearance at the ETHGlobal hackathon in New Delhi.

Refer to the official tweet by FLOW:

Flow.com@flow_blockchainSep 10, 2025Flow is headed to @ETHGlobal Hackathon in New Delhi!

$10K in prizes across tracks:

Best Killer App on Flow

Best Automation & Actions

This will be the first hackathon after Forte goes live on testnet on September 17th

Check out where you can find the Flow team â¤µï¸ pic.twitter.com/U2VM7w1hE2

FLOW Info

Flow is a fast, decentralized, and developer-friendly blockchain by Dapper Labs, designed as the foundation for a new generation of games, apps, and the digital assets that power them. It is based on a unique, multi-role architecture, and designed to scale without sharding, allowing for massive improvements in speed and throughput while preserving a developer-friendly, ACID-compliant environment.

In contradistinction to Ethereum, which uses a proof-of-work (PoW) model, Flow employs a novel multi-level consensus architecture that enables high throughput without compromising decentralization. This separation allows different nodes in the network to perform distinct functions, thereby improving efficiency.

Flow also provides low-cost interaction for developers and users, making it an ideal blockchain for social and entertainment applications.

Flow (FLOW) is the primary utility token of the Flow blockchain, which can be used for network governance, transaction fee payments within the Flow network, and staking.

A bold prediction by entrepreneur Fred Krueger is stirring debate in crypto circles. He believes the United States could one day use tariff revenue to buy Bitcoin, a move that could completely reshape global markets.

Tariffs as a Bitcoin War Chest

U.S. Commerce Chief Howard Lutnick recently said tariffs could generate as much as $50 billion per month. Krueger argues that if even part of this money flowed into Bitcoin, the scale would be historic.

“At current prices, $50 billion equals nearly 400,000 BTC in just one month—far beyond the roughly 19,000 coins mined daily,” Krueger noted.

Such large-scale buying could send Bitcoin prices soaring. Krueger believes this kind of demand would change Bitcoin’s behavior forever.

“This wouldn’t follow normal supply-and-demand models,” he said. “It could break the power law of Bitcoin and push it into a new phase as a true macroeconomic asset.”

U.S. Strategic Bitcoin Reserve

The idea isn’t completely new. Earlier this year, the U.S. created a strategic Bitcoin reserve using confiscated coins. Treasury Secretary Scott Bessent has given mixed signals about future purchases, but recently left the door open for “budget-neutral ways to add more Bitcoin.”

That’s why Krueger suggests tariff revenue, which doesn’t directly impact taxpayers, could be the perfect funding source.

Is It Realistic?

Critics say the plan is unlikely, warning it could create political backlash and financial instability. Still, the very fact that this idea is being discussed shows how far Bitcoin has come.

Whether or not the U.S. takes Krueger’s advice, the speculation highlights Bitcoin’s shift from a fringe asset to a serious policy discussion.

FAQs

How much Bitcoin could the U.S. buy with tariffs?At current prices, $50B in monthly tariff revenue could purchase ~400,000 BTC, vastly exceeding the ~19,000 new coins mined daily.

What impact could this have on Bitcoin’s price?Such large, consistent buying could break Bitcoin’s existing price models, sending it soaring and establishing it as a macro asset.

Is this plan realistic?Critics are skeptical, citing potential political and financial instability. However, the discussion shows Bitcoin is shifting from a fringe asset to a serious policy topic.

Bitcoin holders with balances between 100 and 1,000 coins have accumulated a record 3.65 million Bitcoin, according to blockchain analytics firm Glassnode.

These investors, termed "sharks" by Glassnode, added approximately 65,000 Bitcoin to their holdings over the past seven days. The buying pace has accelerated, with this group recording a net increase of 93,000 Bitcoin over the past 30 days.

The accumulation pattern represents the highest total holdings on record for this investor category, which sits between smaller retail investors and large institutional holders or "whales" that typically hold more than 1,000 Bitcoin.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up