Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Just after multiple days of consistent price surges, the crypto market has suddenly flipped negative, pushing XRP to the negative zone.

Despite the sudden switch in investors’ sentiment, XRP still stands a chance for a massive price breakout, according to a recent prediction shared by crypto analyst Ali Martinez.

The analyst shared a 4-hour chart flashing a key buy signal, which suggests that XRP may be gearing up for a significant price bounce back soon.

The bullish flag reflected in the asset’s TD Sequential suggests that the ongoing drawdown in the price of XRP is possibly close to exhaustion.

Thus, this can only mean that the asset is set to resume its uptrend, suggesting that XRP is still headed for the $3.60 price breakout.

What’s XRP’s next target?

As of September 15, XRP has lost its resistance at $3, falling as low as $2.96 during the day. With this declining trajectory, XRP’s price is down 0.57% in the past 24 hours but shows a decent price surge of 1.16% in the last seven days.

While momentum appears to be fading, the analyst has shared reasons why the altcoin might be set for a potential rally, following signals flashed by key on-chain and technical factors.

After briefly falling below the $3 mark, XRP has slightly rebounded back to $3, hovering around $3.01 as of writing. While the downtrend has continued to persist, the TD Sequential indicator shows that XRP is still retaining the buying pressure witnessed in the previous rally.

Following the sustained buying signal reflected on the chart, indicators like this have historically signaled short-term price rallies to ease off extended bearish pressure.

The analysts have predicted that, if the buy signal holds, XRP could stage a bounce back toward the $3.05–$3.10 resistance zone. This could further lead to higher price surges, pushing XRP to the highly anticipated $3.60 mark.

Apart from the signals projected by these key indicators, crypto veterans have also expressed belief that XRP’s surge to $5 is very possible if the proposed XRP ETF products become approved by the SEC.

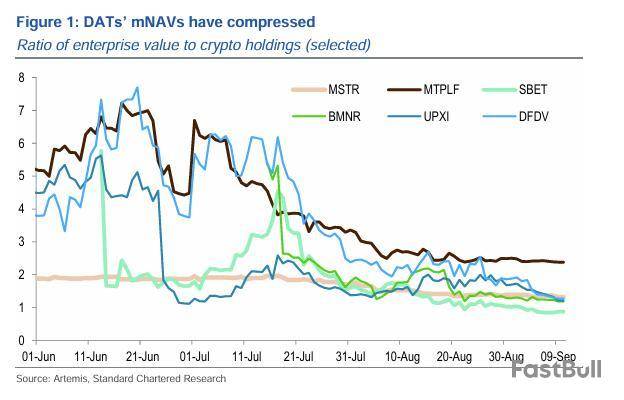

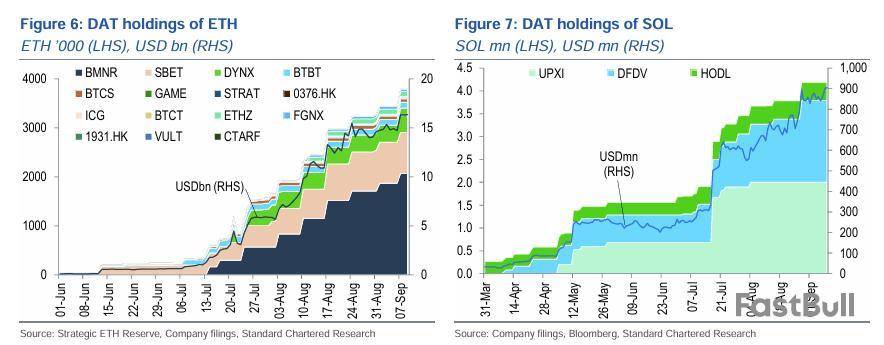

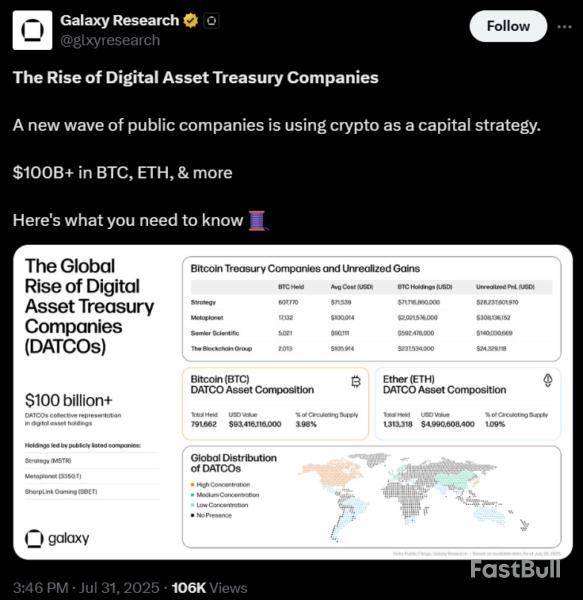

The boom in digital asset treasury (DAT) companies — fueled by the success of Strategy’s Bitcoin-buying — has shone a spotlight on cryptocurrencies such as Bitcoin, Ether and Solana. However, that spotlight has dimmed in recent weeks as the market net asset values (mNAVs) of many DATs collapsed, exposing smaller firms to growing risks, Standard Chartered warned Monday.

In the world of DATs, mNAV measures the ratio of a company’s enterprise value to the value of its cryptocurrency holdings. An mNAV above 1 allows a firm to issue new shares and keep accumulating digital assets. Below that threshold, it becomes far harder — and less prudent — to expand holdings.

Standard Chartered noted that several high-profile DATs have recently slipped below that critical level, effectively shutting off their ability to keep buying.

“The recent collapse in DAT mNAVs will likely drive differentiation and market consolidation,” the bank said. “Differentiation will favour the largest in breed, cheapest funders and those with staking yield” — a nod to big, liquid players like Strategy (MSTR) and Bitmine (BMNR), as well as firms able to raise money through low-cost debt.

The research tracked companies including Strategy, Bitmine, Metaplanet (MTPLF), Sharplink Gaming (SBET), Upexi (UPXI) and DeFi Development Corp (DFDV), highlighting how their valuations have compressed in recent weeks.

According to the bank, mNAV suppression is being driven by market saturation, growing investor caution, unsustainable business models and the rapid expansion of Ether (ETH) and Solana (SOL) treasury strategies.

“We see market saturation as the main driver of recent mNAV compression,” the analysts wrote, noting that Strategy’s success in acquiring Bitcoin (BTC) already spawned 89 imitators.

If mNAVs remain depressed, Standard Chartered expects consolidation across the sector, with larger players potentially scooping up weaker rivals. For example, Strategy could maintain its aggressive Bitcoin buying spree by acquiring treasury peers trading at discounts, the bank suggested.

Digital asset treasury companies face mounting risks

While several publicly listed companies have added cryptocurrencies to their balance sheets, digital asset treasuries have taken the approach further by making those holdings the centerpiece of their business strategy.

In addition to Standard Chartered, Cointelegraph has previously flagged the risks of this model, noting that some firms abandoned struggling core businesses to rebrand as crypto treasuries in an effort to ride the digital asset boom.

Venture firm Breed has also echoed those concerns. In June, the company cautioned that only a handful of Bitcoin treasury firms will likely escape a “death spiral” triggered by falling mNAVs.

“Ultimately, only a select few companies will sustain a lasting MNAV premium. They will earn it through strong leadership, disciplined execution, savvy marketing, and distinctive strategies that continue to grow Bitcoin-per-share regardless of broader market fluctuations,” Breed’s analysts wrote.

New York Digital Investment Group (NYDIG) has also highlighted the narrowing premiums of DATs, as the gap between stock prices and underlying crypto holdings continues to shrink.

The forces behind the compression include “investor anxiety over forthcoming supply unlocks, changing corporate objectives from DAT management teams, tangible increases in share issuance, investor profit-taking, and limited differentiation across treasury strategies,” said NYDIG’s global head of research, Greg Cipolaro.

Other observers draw sharper parallels. Josip Rupena, CEO of crypto lending firm Milo, compared DAT strategies to collateralized debt obligations — the complex financial products that helped trigger the 2008 financial crisis:

Ethereum (ETH) continues to capture institutional attention as strong inflows into spot ETFs highlight the growing demand.

According to SoSoValue, Ethereum funds recorded $638 million in net inflows between September 8–12, 2025, with Fidelity’s FETH leading at $381 million. This marked the fourth consecutive week of gains and pushed cumulative Ethereum ETF inflows above $13.3 billion.

While the inflows strengthen Ethereum’s long-term investment case, historical trends and on-chain signals suggest September profit-taking risks may resurface. Despite trading near $4,520 on September 15, ETH faces mixed market signals that could dictate its next major move.

ETF Inflows Signal Institutional Confidence

Ethereum ETFs are becoming a major part of the crypto market, with total assets under management surpassing $30 billion. Fidelity and BlackRock accounted for most of the latest inflows, while Grayscale and Bitwise also recorded steady gains.

Institutional accumulation continues to reshape Ethereum’s market dynamics. Exchange reserves have dropped to their lowest levels since 2016, reflecting reduced selling pressure as more ETH flows into long-term holdings.

Additionally, over 36 million ETH, about 30% of supply, is staked, further tightening liquidity.

September’s Ghost: Profit-Taking Pressures

Despite the bullish inflows, history paints a cautious picture. September has typically been a weak month for ETH, with a median return of -12.7% since its launch. Current on-chain data supports this caution: the percentage of ETH supply in profit recently peaked near 99%, signaling overheated conditions.

Past profit peaks have often led to 8–9% pullbacks. Furthermore, derivatives data shows Ethereum trading within a rising wedge pattern, a structure that often precedes corrections. Key support lies at $4,485 and $4,382, while resistance levels target $4,760 and $4,945.

Can Ethereum Break Toward $5K?

Ethereum’s fundamentals currently remain strong. ETF inflows, whale accumulation, and shrinking exchange supply provide structural support. If ETH holds above $4,700, cascading liquidations could propel a move toward the $4,900–$5,000 range.

However, traders must remain cautious. With September’s track record of corrections and elevated profit-taking signals, Ethereum could face short-term volatility even as its long-term case strengthens.

Ethereum’s next test will be whether it can sustain momentum beyond September, breaking the cycle of seasonal weakness while capitalizing on growing institutional demand.

Cover image from ChatGPT, ETHUSD chart from Tradingview

The U.S. Securities and Exchange Commission and Gemini have reached "a resolution in principle," after the agency accused the crypto exchange of not following its rules when it launched a crypto lending program.

In a court filing on Monday sent to Judge Edgardo Ramos in the U.S. District Court for the Southern District of New York, lawyers for Gemini Trust Company, LLC, and the SEC stated that they had reached a resolution and said the regulator would need to sign off.

"The parties in this case have reached a resolution in principle that would completely resolve this litigation, subject to review and approval by the Commission," they said in the filing. They also asked for all "pending dates" to be put on pause.

The SEC charged Genesis Global Capital, LLC and Gemini in January 2023 for the unregistered offer and sale of securities to retail investors through Gemini Earn. In 2021, the Winklevoss twins-led company launched Gemini Earn, allowing Gemini customers to loan their crypto to now-bankrupt Genesis Global Capital, LLC and earn up to 7.4% APY.

The SEC and Gemini did not immediately respond to a request for comment on Monday.

The regulator has turned over a new leaf over the past year since President Donald Trump took office in January. Trump tapped crypto-friendly Paul Atkins to lead the agency, who has since launched "Project Crypto" to modernize its rules around digital assets. The regulator has also dropped lawsuits against major crypto firms, including Coinbase, Binance, and Ripple.

After raising $425 million in an IPO, Gemini's stock debuted on the Nasdaq last Friday. Founded in 2014, Gemini acts as a crypto trading platform and custodian.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Strategy co-founder Michael Saylor, Marathon Digital Holdings CEO Fred Thiel, and other cryptocurrency advocates will be in Washington D.C. on Tuesday to push forward legislation that, if passed, could see the U.S. purchasing one million bitcoins.

Over a dozen crypto advocates will gather Tuesday morning on Capitol Hill at a roundtable hosted by Sen. Cynthia Lummis and Rep. Nick Begich, the Republican cosponsors of a bill looking to establish the United States' "strategic bitcoin reserve," said Hailey Miller, director of government relations and public policy at the Digital Power Network (DPN). DPN is an affiliate of The Digital Chamber.

Sen. Lummis reintroduced the "Boosting Innovation, Technology, and Competitiveness through Optimized Investment Nationwide Act," or BITCOIN Act, in March. If passed, the bill would establish a bitcoin as a strategic reserve asset, building upon President Donald Trump's executive order to create permanent bitcoin holdings similar to the country's gold cache.

Lummis's bill includes language for acquiring one million bitcoin over five years using "budget neutral strategies." The bill expands upon Trump's executive order, which prohibited the sale of bitcoin — and other crypto assets to be kept in a separate "stockpile" — forfeited to the U.S. government through criminal or civil proceedings.

The push for a strategic bitcoin reserve comes as lawmakers continue to advance crypto legislation. This summer, U.S. legislators successfully passed their first crypto-specific bill covering stablecoins and have now set their sights on regulating the crypto industry at large.

Miller said crypto advocates including the DPN want a strategic bitcoin reserve to be a priority and remain a priority in Washington.

"There is a lot that's been done in the digital asset space these last couple of months, and there are a whole lot more items on the agenda for this fall," Miller said in an interview with The Block. "So our real push is to ensure that the BITCOIN Act and a strategic bitcoin reserve remain a priority."

The legislation stands before the House Financial Services Committee and the Senate Banking Committee, both of which have not yet planned a hearing for the bills. Miller said she expected roundtable discussions to involve next steps for the BITCOIN Act as well as how to garner bipartisan support. The bill currently has buy in solely from Republicans.

Other Republican lawmakers will be attending the roundtable as well as several crypto executives including Bitdeer Chief Strategy Officer Haris Basit, Riot Senior Vice President of Public Policy Brian Morgenstern, and Cleanspark CEO Matt Schultz.

DPN will also share a one-pager during the roundtable that will highlight why the BITCOIN Act is needed, calling it a "bipartisan opportunity."

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

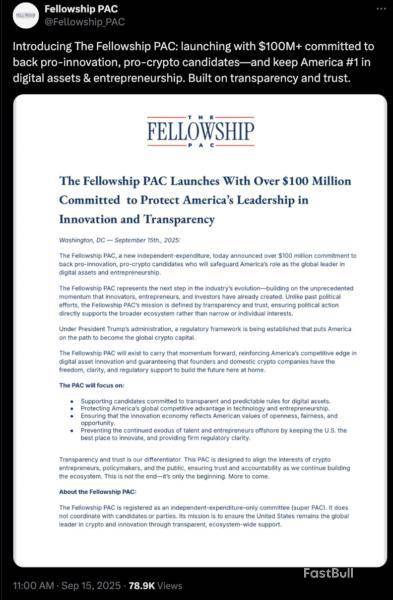

A new political action committee (PAC) focused on backing “pro-innovation, pro-crypto candidates” in the United States has launched with $100 million.

In a Monday X post, the Fellowship PAC said it had launched “with over $100 million” from unnamed sources as part of efforts to support the Trump administration’s digital asset strategy.

The PAC said it aimed to support specific candidates for federal office and prevent an “exodus of talent and entrepreneurs” from crypto companies in the US by helping provide regulatory clarity.

“This PAC is designed to align the interests of crypto entrepreneurs, policymakers, and the public, ensuring trust and accountability as we continue building the ecosystem,” said Fellowship. “This is not the end — it’s only the beginning. More to come.”

The Super PAC, focused on promoting crypto policies by potentially influencing crucial US elections in the House of Representatives and Senate, is one of many digital asset-backed interest groups.

In 2024, the Fairshake PAC, a committee backed primarily by contributions from Coinbase and Ripple Labs, spent more than $130 million on ads in congressional races — purchases that may have influenced election outcomes.

The Fellowship PAC filed a statement of organization with the US Federal Election Commission (FEC) on Aug. 7 and had reported no contributions or expenditures as of Monday.

Initial reports claimed that Coinbase and Gemini co-founders Cameron and Tyler Winklevoss contributed to the PAC’s $100 million fundraising. Cointelegraph was unable to independently verify those claims.

A Fairshake spokesperson told Cointelegraph that the PAC had seen no evidence that “Coinbase is in it,” and representatives from Coinbase, Gemini, and Fellowship had not responded to requests for comment at the time of publication.

Crypto money shaking up 2026 elections?

In August, the Winklevosses contributed more than $21 million worth of Bitcoin to PAC, intending to help US President Donald Trump’s crypto agenda by potentially influencing elections to maintain a Republican majority in Congress.

According to FEC records, the Digital Freedom Fund PAC, established in July, reported no contributions or expenditures as of Monday.

Though the US midterm elections will not be held until November 2026, there have already been a few significant races in 2025 for which money from crypto companies could have been a factor.

Democrat James Walkinshaw won a special election for Virginia’s 11th congressional district on Sept. 9 after the Protect Progress PAC, a Fairshake affiliate, spent more than $1 million supporting him in the primary.

Magazine: Can privacy survive in US crypto policy after Roman Storm’s conviction?

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up