Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Story Highlights

XRP, one of the top five crypto assets known for its role in cross-border payments, is drawing increased attention as institutional adoption grows and its long-standing legal battle nears a conclusion.

Since President Trump took office, Ripple XRP has gained significant traction, fueled by rising on-chain activity, bullish market sentiment, and increasing speculation around a potential XRP ETF Approval in 2025.

With these developments in play, XRP price prediction is becoming a major focus for investors. Can XRP reach $100? Is a $500 target realistic in the long term?

This article dives deep into XRP price prediction for 2025 and beyond through 2030.

Table of contents

CoinPedia’s Ripple Price Prediction 2025

With regulatory clarity from the SEC case and Ripple accelerating its expansion, we at CoinPedia are optimistic about the XRP forecast. We expect the XRP coin price to reach $5.81 in 2025.

| Year | 2025 |

| Potential Low | $2.3 |

| Potential Average | $4.89 |

| Potential High | $5.81 |

XRP Price Today

| Cryptocurrency | |

| Token | |

| Price | |

| Market cap | |

| Circulating Supply | |

| Trading Volume | |

| All-time high | $3.84 Jan 04, 2018 |

| All-time low | $0.002802 Jul 07, 2014 |

XRP Crypto Price Prediction June 2025

XRP is currently in a pullback phase after testing the upper boundary of a multi-month descending wedge at $2.65 in mid-May. Since then, it has slipped below a key high-volume profile level.

In June, XRP is trying to hold above the previous month's swing low support at $2.10. However, any upside potential has been limited under worsening geopolitical conditions with the Iran and Israel conflict. Many were expecting a catalyst on June 16th with a favorable lawsuit update, but that, too, ended up in a 60-day pause in appeals.

Also, on June 17th, the SEC delayed Franklin Templeton XRP spot ETF amid ongoing conflicts. In the third week of June, the US bombed some Iranian nuclear sites, shaking investor sentiment seen even in top crypto. As a result of the past few days ' internal and external developments, the XRP price marked a low of $1.94, breaking below the 200-day EMA and alongside last month's swing low support area.

However, a quick climb in XRP price was witnessed on June 24th, rising over 12% with a ceasefire announced, turning it into a short-term battle. The improved investor sentiment shows less panic among investors this time, and a tremendous "buy-the-dip" philosophy has been exercised amid the chaos of battle.

Yet, danger still lingers for XRP amid the renewed bullishness. If a ceasefire is broken, then the pressure could rise. That could push the XRP price down because a bearish crossover between the 20-day and 50-day EMAs remains active.

If selling pressure continues and XRP breaks below the $2.10 support—which aligns closely with the 200-day EMA—the price could decline to $1.88 or even $1.63.

On the upside, if any external or internal factor becomes a catalyst and boosts XRP price, XRP must break past the short-term EMA crossover and reclaim the key $2.40 resistance. Doing so could trigger a rally toward $2.80, with a chance to retest the all-time high of $3.40 later in June or July.

However, momentum depends heavily on a substantial rising volume, as witnessed last April to mid-May. On comparing volume to June, the rise in whale transaction count (>1m USD) contributed to increased exchange outflow. The volume is currently testing a declining trendline; if volume spikes more and breaches this volume trendline, a spark could be witnessed in sessions ahead. However, things would reverse if no clear and strong catalyst appeared, and then a flash crash could occur on the bearish plate.

| Year | June 2025 |

| Potential Low | $1.7 |

| Potential Average | $2.45 |

| Potential High | $3.40 |

XRP Price Prediction 2025

If XRP successfully breaks its all-time high of $3.40 in May 2025—a major supply zone on the chart—it could realistically target $5 by year-end, fueled by growing optimism from banks, institutions, and potential ETF support.

Ripple’s stablecoin, RLUSD, is now integrated into its cross-border payments system, Ripple Payments, further strengthening its position in global finance.

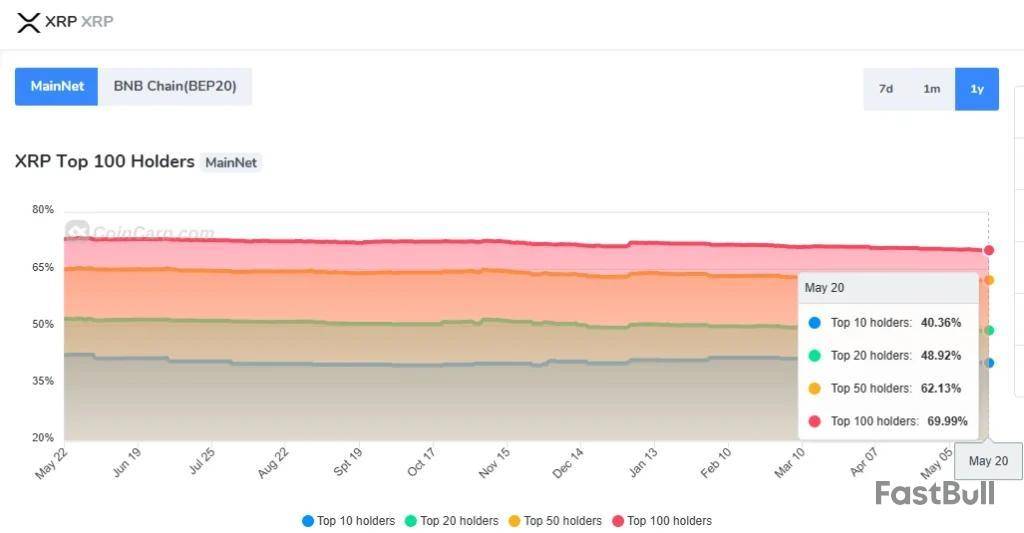

Notably, institutional dominance is evident, with the top 100 addresses holding 70% of the circulating supply, positioning XRP as the third-largest cryptocurrency by market cap at $138 billion.

| Year | 2025 |

| Potential Low | $2.05 |

| Potential Average | $3.45 |

| Potential High | $5.05 |

Ripple XRP Price Prediction 2026 – 2030

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2026 | 5.50 | 6.25 | 8.50 |

| 2027 | 7.00 | 9.0 | 13.25 |

| 2028 | 11.25 | 13.75 | 16.00 |

| 2029 | 14.25 | 16.50 | 21.50 |

| 2030 | 17.00 | 19.75 | 26.50 |

XRP Price Prediction 2026

XRP cost will likely witness strong growth in 2026. There is a possibility that XRP can break through the $8.50 level and hold the price by the end of 2026. The minimum price of XRP will be around $5.50, with an average trading price of $6.25.

Ripple Price Prediction 2027

By 2027, market analysts and experts predict that XRP coin price will range between $7.00 to $13.25. XRP price might record an average level of $9.00.

XRP Price Prediction 2028

As per our XRP price prediction 2028, Ripple could increase its use cases. We expect the XRP future price to range between $11.25 to $16.00. The average trading price of Ripple could be around $13.75.

XRP Price Prediction 2029

Partnerships with multiple governments and wider adoption might strengthen XRP’s price in 2029. The price of XRP might record a trading range between $14.25 to $21.50, with an average price of $16.50.

XRP Price Prediction 2030

The XRP prediction 2030 depends on Ripple’s ability to expand its offerings across the crypto market. If everything remains positive, the Ripple coin price could scale between $17.00 to $26.50. With that price range, the average tag could be $19.75.

Ripple Price Projection 2031, 2032, 2033, 2040, 2050

Based on historic price sentiments and XRP’s rising popularity, here are the XRP future price projections for 2031, 2032, 2033, 2040, and 2050.

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2031 | 25.00 | 29.50 | 35.25 |

| 2032 | 31.50 | 36.75 | 41.25 |

| 2033 | 35.75 | 42.25 | 47.75 |

| 2040 | 97.50 | 135.50 | 179.00 |

| 2050 | 219.25 | 331.50 | 526.00 |

Market Analysis

| Firm Name | 2025 | 2026 | 2030 |

| Changelly | $2.05 | $3.49 | $17.76 |

| Coincodex | $2.38 | $1.83 | $1.66 |

| Binance | $2.16 | $2.27 | $2.76 |

Institutional XRP Price Targets for 2025

| Name | Target |

| Standard Chartered | $5.50 |

| Sistine Research | $33 to $50 |

Final Thoughts: Is XRP Still a Good Investment?

Yes, XRP is still a good investment for those with a long-term view. With the Ripple vs. SEC lawsuit nearing settlement, increasing institutional interest, and rising on-chain activity, XRP’s fundamentals remain strong. The integration of RLUSD and potential ETF listings further boosts its utility and market potential.

While short-term volatility may persist, XRP price prediction models point to significant upside. If regulatory clarity continues, XRP could be well-positioned to reach ambitious targets like $100—or even higher—in the coming years.

FAQs

What price will XRP reach in 2025?XRP could reach up to $5.81 in 2025, supported by institutional demand and Ripple’s growing global adoption.

What is the XRP price prediction for 2030?By 2030, XRP is forecasted to trade between $17.00 and $26.50, depending on market trends and adoption rates.

Where will XRP be in 2040?XRP could trade between $97.50 and $179.00 in 2040 if utility grows and crypto becomes widely accepted globally.

Is XRP a good investment in 2025?Yes, XRP remains a promising 2025 investment due to strong fundamentals, stablecoin use, and potential ETF listings.

Japan-based Metaplanet announced plans to inject $5 billion in capital toward Bitcoin purchases.

The move is part of a bold escalation of its Bitcoin treasury strategy, with the repurposing to the US suggesting a change in perspective.

Metaplanet Supercharges Bitcoin Strategy With $5 Billion US Capital Injection

The company announced that its board of directors approved an additional capital contribution of up to $5 billion to Metaplanet Treasury Corp, its wholly owned US subsidiary based in Florida.

According to the official filing, the funds will be used exclusively to acquire more Bitcoin. There will be no allocations toward operations, salaries, or R&D.

The move significantly accelerates the company’s previously announced 555 Million Plan and reinforces Metaplanet’s goal of holding 210,000 BTC by the end of 2027.

“As announced in the May 1, 2025 release… the Company established Metaplanet Treasury Corporation to strengthen its global Bitcoin treasury operations…With the initial capitalization phase now successfully completed, the Company is advancing to a more aggressive stage of expansion,” the company filing stated.

Meanwhile, this development comes just one day after Metaplanet revealed it had acquired an additional 1,111 BTC, bringing its total Bitcoin holdings to 11,111 BTC.

The company has become a symbol of aggressive corporate adoption of Bitcoin, after recently overtaking Coinbase in holdings. The playbook is likened to MicroStrategy’s treasury plan, but with a sharper international focus.

From Tokyo to Florida: Jurisdictional Shift Aims to Maximize Capital Efficiency

According to Metaplanet, the US subsidiary will allow for the superior execution of large-scale Bitcoin acquisitions.

“The United States, as the world’s preeminent financial center, offers optimal conditions for efficient and large-scale Bitcoin acquisition and management,” the filing explained.

The firm also reaffirmed that the capital injection will be funded entirely by exercising its 20th to 22nd stock acquisition rights. This guideline is a warrant-like structure, allowing pre-arranged capital inflows as the company’s stock price rises.

Industry observers say the move reflects a form of jurisdictional arbitrage. Bitcoin enthusiast Adam Livingstone explains Metaplanet’s move as leveraging the US financial system’s deep liquidity, favorable regulation, and mature capital infrastructure.

“Metaplanet is moving beyond Japan’s limited capital markets and regulatory frameworks…Japan will be the R&D center, while the US becomes another capital aggregation and BTC acquisition engine,” wrote Livingstone in a post.

With the use of funds expected to remain unchanged, Metaplanet is avoiding diluting its Bitcoin-first thesis. All proceeds will go toward additional Bitcoin purchases.

“100% of this $5 billion is going into raw Bitcoin acquisition. Could not possibly be more bullish,” Livingstone added.

Notably, the immediate impact on consolidated financials is expected to be limited for the current fiscal year. Nevertheless, the long-term implications could position Metaplanet as a global leader in Bitcoin-based capital market innovation.

With capital pre-baked, regulatory clarity in hand, and 210,000 BTC in sight, Metaplanet’s strategy represents one of the boldest bets on Bitcoin in corporate history.

Elsewhere, reports also indicate that Fidelity has added Bitcoin worth over $105 million to its crypto treasury, alongside other assets.

Analysts say this is a strong confidence signal. The increased corporate BTC adoptions present the pioneer crypto as a flight to safety amid escalating geopolitical tension.

Cardano is witnessing a significant rebound as bulls in the ecosystem appear determined to push the asset to reclaim lost gains. According to CoinMarketCap data, the price of ADA has spiked by 10% in the last 24 hours as traders are actively buying the coin.

Key resistance at $0.60 as Cardano investors eye $1

Notably, ADA’s value climbed from a low of $0.5308 to a peak of $0.5932 as transactions intensified. As of press time, investors have pulled back, leading to a slight drop in the value of Cardano on the crypto market.

Cardano now exchanges at $0.5813, representing a 6.01% increase. However, trading volume is still up by double digits at 11.92%, translating to $1.17 billion in fiat currency.Cardano Daily Price Chart | Source: CoinMarketCap">

This development suggests that investors actively transact the coin in anticipation of further positive price movements. ADA's technical charts signal that it has the potential to reach higher levels if supported by ecosystem bulls.

Cardano has been trapped in consolidation for the last couple of days, with the $0.52 level as crucial support. With this recovery, ADA must breach the $0.60 resistance level to confirm a bullish trend.

The coin could record explosive growth if Cardano bulls can push ADA and sustain its value above $0.70. If the broader crypto market is bullish, it will likely retest the psychological $1 level, which it last hit in February 2025.

Cardano Lace Wallet integration of Bitcoin sparks optimism

Meanwhile, positive developments that could further drive adoption have been rolled out in the Cardano ecosystem. According to Charles Hoskinson, Cardano founder, Lace Wallet has fully integrated Bitcoin on the mainnet and is now live.

There are also expectations that more notable assets like XRP might be next for integration. As users anticipate what comes next, integrating Bitcoin to Lace 1.24 might support bulls in driving Cardano’s value toward the elusive $1 mark.

Lately, a rumor has been going viral in the crypto world about whether XRP holders might be getting free NIGHT tokens, and “If so, how much can they expect?” Let’s break down what’s happening, using the latest details from the Midnight Glacier airdrop event.

Let’s sort out the facts from the noise.

What’s the Claim?

Many posts on X and Telegram groups are saying, “If you held XRP during the snapshot, you’re getting NIGHT tokens for free.”

It sounds exciting — who wouldn’t want free tokens just for holding crypto?

So, What’s the Truth?

Yes, XRP holders will receive NIGHT tokens, but only if they meet the eligibility. According to the official 45-page whitepaper released by the Midnight team, the airdrop is being shared across eight blockchains. These include Cardano, Bitcoin, Ethereum, Solana, BNB Chain, Avalanche, BAT, and XRP.

To qualify, you needed to hold at least $100 worth of XRP when the snapshot was taken on June 11, 2025.

There’s no need for KYC or any fees—claiming is as simple as signing with your wallet and submitting a valid Cardano address. However, the tokens will be locked at first, and 25% will unlock slowly over a year.

How Did We Find That Out?

The Midnight team detailed all of this in their whitepaper, breaking down the token supply and distribution plan. Out of the total NIGHT token supply, 50% (12 billion tokens) is set aside for Cardano holders.

Bitcoin holders will receive the next biggest share, 20%, which is about 4.8 billion NIGHT tokens.

The final 30% (7.2 billion NIGHT tokens) will be shared equally among six other blockchains: XRP, BAT, ETH, BNB, SOL, and AVAX.

That means XRP holders are eligible to claim around 1.2 billion NIGHT tokens from this pool.

So yes, if you held XRP during the eligible snapshot, you could qualify for a piece of that 1.2 billion NIGHT allocation. But your share depends on how much XRP you held at the snapshot time

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up