Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

XRP price continues to surprise traders by staying largely unaffected by major catalysts in the crypto market. Despite Ripple’s courtroom victories in the ongoing Ripple vs. SEC case and Jerome Powell’s recent Jackson Hole speech sparking rallies in Bitcoin and Ethereum, XRP remains range-bound. This unusual detachment has left investors questioning why XRP trades differently from other top altcoins. Understanding XRP’s muted price reaction requires a closer look at liquidity, investor psychology, regulatory overhang, and its real-world utility.

XRP’s price immunity is not random but linked to strong market factors and investor behaviour shaping the token’s movement. Here are some of them.

XRP Price Prediction: Will it Reach $10?

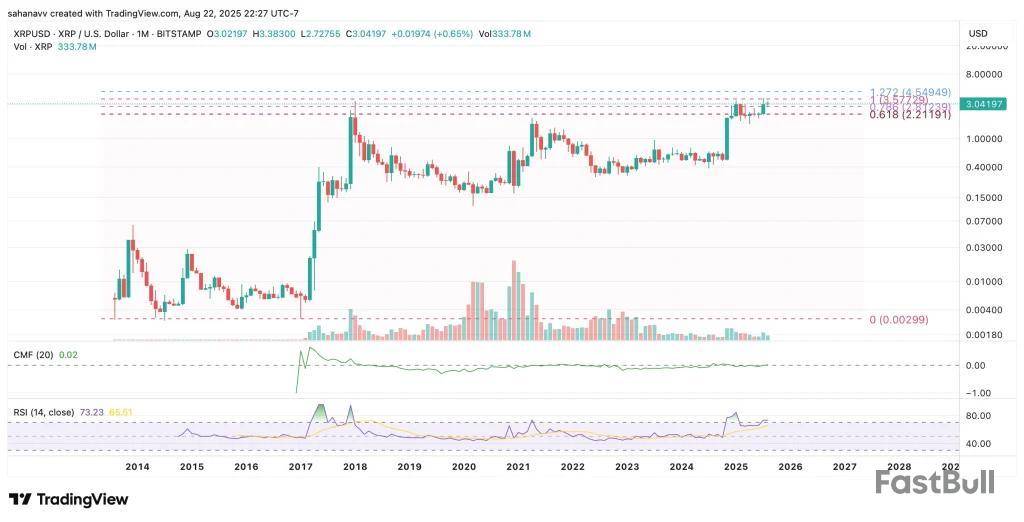

XRP price has been experiencing acute price compression in the past few months, which has kept the rally within a confined range. Meanwhile, the start of the monthly trade was bullish, but the current chart patterns suggest that the bullish strength is faltering. Now the question arises: what could be next for the XRP price rally?

After surpassing the final barrier and smashing a new ATH, the XRP price is consolidating within a narrow range between 0.618 FIB and 0.786 FIB. However, the price surged past the range but failed to reach 1 FIB. Interestingly, the monthly CMF has remained flat since 2018, which suggests no major influx of liquidity since then, but has not dropped into the negative range either. On the other hand, the monthly RSI continues to remain incremental and has also entered the overbought range.

Therefore, the XRP price continues to remain within the bullish range and could eventually mark a new ATH, but considering the above points, reaching $10 could be a tedious job for the third-largest token.

Solana price has staged an impressive rally, chugging up 12.82% to $206.70. Its valuation now stands at $112.02 billion, while the intraday trading volume has exploded 157.88% to $11.93 billion. With prices ranging between $177.47 and $205.20 in the last day, Solana’s recovery is drawing both retail and institutional interest. With the token trading just 30% below its all-time high of $294.33, marketers are curious about SOL price future.

Key Reasons Behind the Surge

The launch of Kanye West’s YZY token on August 21 created a frenzy on Solana’s network. The YZY token spiked 6,800% to $3.16 before retracing to $1, generating $386 million in daily trading volume. This fueled a 139% jump in network activity and boosted Solana’s TVL by 25% to $15.3 billion.

On the institutional side, Tidal Trust II filed for a 2x leveraged Solana ETF on August 21. While regulatory approval could take longer than for Bitcoin or Ethereum products, the move validates growing institutional interest. With 70% of SOL’s supply currently staked, the limited liquid supply could magnify future price swings as demand increases.

Solana Price Analysis

SOL price has broken decisively above its 50-day simple moving average at $180 and cleared a key Fibonacci resistance at $197, setting off a technical rally. The MACD histogram flipped positive at +0.33, confirming bullish momentum, while the RSI at 63.54 shows room to run before overbought territory.

The breakout above $193 triggered algorithmic buying, as reflected by a 24-hour funding rate of +0.01%, the highest in 30 days. SOL now faces immediate resistance at $209.67, the August 21 swing high, followed by a stronger barrier at $236. Key support levels are at $176.69 and $146.52.

If bullish pressure continues, SOL price could test $209 in the near term and possibly extend toward $236. However, traders should be cautious, as leveraged long positions and concentrated staking may increase volatility during pullbacks.

FAQs

Why is SOL’s price up today?Speculative trading from the YZY token launch and institutional signals like the ETF filing have boosted demand for SOL.

What are Solana’s key support and resistance levels?Immediate support is at $176.69, while resistance stands at $209.67 and $236.

Is Solana overbought right now?No, the RSI is at 63.54, leaving room for more upside before entering overbought territory.

August 23, 2025 06:32:56 UTC

Solana Price Analysis

Lark Davis@TheCryptoLarkAug 23, 2025Excellent move here by SOLANA!

Epic bounce off of the 50 day EMA, you didn't get bearish at support did you?

Price rallied right back to the resistance line at $205.

Breakout trade with targets of $220 and $240 activates if we get a daily close above the top orange line at… pic.twitter.com/JkrFqzyWhd

Crypto analyst Lark Davis highlighted Solana’s strong technical move, noting an “epic bounce” off the 50-day EMA that quickly pushed price back to the $205 resistance line. According to Davis, if Solana manages a daily close above $205, it would trigger a breakout setup with targets at $220 and $240. However, he also cautioned traders to watch for possible rejection at this resistance level. In that case, a pullback to the 20-day EMA near $185 could present an ideal re-entry point. Davis concluded that Solana is shaping up to be the “catch trade” among major altcoins, drawing attention from market watchers looking for momentum plays.

August 23, 2025 06:29:47 UTC

Dennis Porter Stresses Broad Consensus for Bitcoin Code Changes

Bitcoin advocate Dennis Porter has emphasized that any meaningful changes to Bitcoin’s code must have the backing of the community. According to him, broad support from users is essential to ensure the network’s integrity and stability. Porter cautioned that if a proposed change faces significant opposition, developers and stakeholders should consider pausing, altering, or even canceling it. He added that the worst course of action would be to ignore user resistance, as this could undermine trust in the decentralized system. His comments reflect the long-standing principle that Bitcoin’s strength lies in its consensus-driven governance, where users, miners, and developers all play a critical role in shaping its future.

August 23, 2025 06:13:27 UTC

XRP Price Prediction

Matthew Dixon – Veteran Financial Trader@mdtradeAug 23, 2025IF #XRP is labelled correctly here, as wave 1 & 2 then wave 3 will likely be much more aggressive to the upside.

Not sure whether potential upward movement would begin over the weekend or wait for next week but the backdrop of lower interest rate probabilities for September are… pic.twitter.com/aQoZNRuFuw

If the current Elliott Wave count is correct, #XRP may have already completed waves 1 and 2—setting the stage for a far more aggressive wave 3 to the upside. Traders are watching closely to see if the breakout begins this weekend or early next week. Adding fuel to the momentum, falling September rate cut odds are boosting risk assets across the board, with XRP standing out as a top candidate for a sharp rally.

August 23, 2025 06:13:27 UTC

XRP ETF News Update

Seven asset managers have filed amended S-1 forms for spot XRP ETFs with the U.S. SEC on August 22, 2025. The list includes Grayscale, Bitwise, WisdomTree, 21Shares, Franklin, CoinShares, and Canary, signaling a united push to bring XRP ETFs to market. The coordinated timing strongly suggests that issuers are responding to direct SEC feedback, aligning their filings with regulatory expectations. Market analysts believe this synchronized wave of applications significantly raises the odds of XRP ETF approval, potentially paving the way for broader institutional adoption.

August 23, 2025 06:11:50 UTC

Bitcoin Price Today

#BTCUSD briefly spiked on Friday as a weaker DXY boosted momentum, but the broader outlook still leans bearish. Price tapped into the supply zone at 116,500–117,800 before showing rejection signs. Analysts see downside targets at 112,000 and 108,500, with invalidation above 118,200.

August 23, 2025 05:25:50 UTC

Bitcoin Rotation Looms After Ethereum’s New Highs

Ethereum’s surge to fresh all-time highs could soon trigger a major shift back into Bitcoin. Analysts suggest the rotation will begin with a correction in BTC this September, followed by a powerful rally in October. If this plays out, Bitcoin could regain dominance just as the altcoin market peaks.

After dropping below its rising trendline, which indicates a deterioration in short-term momentum, XRP is now at a pivotal point. XRP is now trading at about $2.86, having lost ground above the crucial support trendline that once directed its rally.

Although indicators suggest that buyers may be losing ground, a recovery is still possible if momentum picks back up. The Relative Strength Index (RSI), which is currently trading just below 40, is one of the best indicators. Usually, this level means that the asset is approaching oversold territory, where selling pressure might start to wear off. Notable rebounds have frequently been preceded by similar RSI readings in previous XRP cycles. Chart by TradingView">

Given that the market is at a technical crossroads, the RSI indicates that a relief rally may be possible in the upcoming sessions. This mixed picture is further compounded by the consistent drop in trading volume. Since there is less conviction behind the sell-off, a relatively small amount of buying pressure could reverse the momentum and push it back upward, as indicated by the decreased participation.

In order to regain the ascending structure and pursue additional recovery, XRP may need to regain the $2.95-$3.00 zone. But hazards still exist. Now a crucial battleground, the 50-day EMA is situated just below current prices. A breakdown below this level might hasten losses in the direction of the 100-day EMA, which is located at $2.74. This area might serve as a last line of defense prior to more significant corrections.

All things considered, the XRP chart shows weakness, but not surrender. Bulls may soon have a chance to recover lost ground if the oversold RSI reading indicates that the downside momentum may soon stall. It is still possible for XRP to recover if volume increases and stays above its moving averages.

Bitcoin's divergence

In addition to showing a pronounced bearish RSI divergence, the top cryptocurrency recently broke below its 50-day EMA, a historically significant support level. This pattern indicates that even though the price reached a new all-time high earlier this month, the underlying momentum has been gradually eroding.

This is a risky situation that frequently occurs before lengthy corrections. Because the divergence reflects market conditions observed in June 2022, when a similar setup preceded a deep and prolonged sell-off, it is especially concerning. Even though price action initially looked bullish, the RSI trended lower in both instances as the price pushed higher, indicating that buyers were losing strength. The final collapse resulted in a series of liquidations, and the state of the market now suggests that history may repeat itself.

The apparent drop in trading volume strengthens the bearish argument. Usually, a declining volume trend during a retracement indicates that there is not enough demand at the current price levels. Given that Bitcoin is currently trading just above the 100-day EMA at $110,600, the likelihood of further declines increases in the absence of strong buyer support. The 200-day EMA, at about $103,500, might be the next crucial line of defense if this level gives way.

RSI is another warning sign, as it is currently approaching the neutral 40 zone. If it falls below 40, bearish dominance would be strengthened, which could hasten the downward trend. The market is delicately balanced in light of this, and further selling pressure could trigger a further decline.

Ethereum not empty

With Ethereum displaying resilience once more, there is conjecture that a run toward $5,000 might occur as early as September. ETH had to undergo a necessary correction after weeks of sharp increases, cooling off from its peak around $4,800. Crucially, the correction happened under control, with ETH recovering from the 26-day EMA and remaining above $4,200, a level that traders are currently targeting as short-term support. Corrections are frequently seen as a way to cool down markets, and Ethereum appears to have done so successfully.

While the recent pullback cleared out speculation and excess leverage, volume patterns indicate that sellers are waning as buyers gradually regain control. The technical room for another leg higher has been created by the RSI’s normalization after it had previously entered overbought territory. The self-driven correction in ETH’s setup is what makes it so interesting. Instead of being a panic-driven sell-off, Ethereum’s decline was more of a consolidation phase than a sudden market-wide crash. Usually a bullish sign, this type of behavior indicates that the asset is stabilizing before continuing on its current course.

The likelihood of Ethereum retesting $4,800 increases if it keeps its footing above $4,200 and buyers keep intervening. A run toward the psychologically significant $5,000 mark would then be possible if that resistance zone were broken. Ethereum is the focus of renewed investor interest as Bitcoin consolidates and altcoin momentum increases.

Even though there are no guarantees in the cryptocurrency space, the charts indicate that ETH has established a stronger base for future growth. Ethereum may finally make the much-awaited move above $5,000 in September.

0712 GMT - Bitcoin rises but struggles to stage a meaningful recovery after hitting a two-and-a-half-week low in the previous session. The cryptocurrency has continued to consolidate from a record high reached last week as investors take profits and look ahead to key risk events. Markets are awaiting potential clues about interest-rate cuts from Federal Reserve Chair Jerome Powell at the Jackson Hole symposium. He is due to speak at 1400 GMT. Cryptocurrencies and other risky assets could receive a boost if Powell endorses market expectations that the Fed could resume cutting rates in September. Bitcoin edges up 0.5% to $112,986 after falling to a low of $112,008 on Thursday, LSEG data show. It reached an all-time high of $124,480 on August 14. (renae.dyer@wsj.com)

0709 GMT - Germany's economic recovery continues to recede into the distance, says Carsten Brzeski at ING. Europe's most important economy shrank by 0.3% in the three months through June, according to figures released Friday. This is a revision from the previous estimate of a small 0.1% contraction. Looking ahead, tariffs will weigh on the export-oriented Germany economy, Brzeski says. "It could take until next year before a more substantial recovery starts to unfold," he warns investors in a note. (joshua.kirby@wsj.com; @joshualeokirby)

0655 GMT - Concerns over U.S. fiscal dynamics, alongside threats to the Federal Reserve's independent status, pose a risk to long-dated U.S. Treasurys, says Schroders' James Bilson in a note. This is despite Schroders' view that the Fed could reduce rates more quickly due to a weak labor market. "The outlook for longer-dated bonds in the U.S. is less positive," he says. President Trump has in the past few months pressured Fed Chair Jerome Powell to cut interest rates. (emese.bartha@wsj.com)

0645 GMT - The dollar rises as investors weigh stronger-than-expected U.S. economic data ahead of an eagerly awaited speech from Federal Reserve Chair Jerome Powell later at the Jackson Hole symposium. The U.S. purchasing managers' index survey on Thursday exceeded expectations, boosting the dollar. The data prompted investors to dial back Fed rate-cut expectations, Deutsche Bank analysts say in a note. That leaves investors in a "jittery mood" ahead of Powell's speech at 1400 GMT, they say. "Investors will be keenly watching whether Powell places more emphasis on weaker payrolls versus more stable measures of labor market slack and still-solid activity and inflation data." The DXY dollar index rises 0.1% to 98.757, having earlier reached a one-and-a-half-week high of 98.834. (renae.dyer@wsj.com)

0626 GMT - The probability of an interest-rate cut by the Federal Reserve in September might fall after Fed Chair Jerome Powell's speech at the Jackson Hole Symposium on Friday, says Pepperstone's Michael Brown in a note. With a month still to run until the September FOMC, during which time August jobs, CPI and PPI reports are due, as well as with uncertainty remaining elevated, "there is little-to-no benefit in Powell pre-committing to any action later on today," the senior rates strategist says. Consequently, the odds of a September rate cut might be closer to 50/50. Money markets currently price a 70% probability of a rate cut in September, according to LSEG data. (emese.bartha@wsj.com)

0624 GMT - U.S. Federal Reserve chairs have used the annual Jackson Hole Symposium before to communicate important shifts in guidance, but this year that is unlikely to be the case, says Commerzbank Research's Christoph Rieger in a note. "While we don't expect a major shift, in line with earlier guidance [that the Fed is waiting for more data], it would be consistent to open the door for a 25bp rate cut in September," says the head of rates and credit research. Markets price in a 70% probability of a 25bp interest-rate cut in September, according to LSEG data. (emese.bartha@wsj.com)

0606 GMT - Singapore's CPI likely rose 0.75% on year in July, according to the median estimate of nine economists' polled by The Wall Street Journal using LSEG data. This would be slightly lower than June's 0.8% climb. Food prices, one of the largest components of the CPI basket, have stayed moderate, says Denise Cheok at Moody's Analytics in an email. While car prices likely remained high, relatively low oil prices due to the oil market's supply glut will likely cap petrol prices, she adds. Meanwhile, core CPI likely rose 0.6%, holding steady from June, according to eight economists' estimates. The CPI data is due Monday. (megan.cheah@wsj.com)

0605 GMT - German 10-year Bunds could be a good buy at current yield levels, says Commerzbank Research's Christoph Rieger in a note. "We suggest tactical Bund longs at 10-year yields near 2.8%," the head of rates and credit research says. With money markets still discounting a trough of 1.85% in the European Central Bank's deposit rate, two-year German Schatz yields could still test their recent highs near 2% and 10-year Bund yields near 2.8%, he says. (emese.bartha@wsj.com)

0557 GMT - U.S. Treasury yields edge marginally lower in Asian trade with investors focusing on the Federal Reserve's Jackson Hole Symposium and Fed Chair Jerome Powell's speech. Powell will likely highlight longer-term economic challenges, such as demographics and productivity, says LPL Financial chief economist Jeffrey Roach in a note. He also expects Powell to cement his legacy rather than deliver a brief, sharp message. The two-year Treasury yield falls 0.7 bp to last trade at 3.784% and the 10-year yield is at 4.328%, down 0.2 bp, according to Tradeweb. (emese.bartha@wsj.com)

0547 GMT - Money markets are potentially too optimistic about interest-rate cuts by the U.S. Federal Reserve, Societe Generale rates strategists say in a note. With U.S. inflation moving further away from target and job growth slowing, the Fed is in a tough spot, the strategists say. "However, we believe the market has overreacted to the July nonfarm payroll print, and the slowdown in job growth may be consistent with stable unemployment," they say. In their view, "too many cuts are priced in," and against this backdrop they like positions betting on the Treasury yield curve flattening over the near-term. Money markets expect two rate cuts by the Fed in 2025. (emese.bartha@wsj.com)

0534 GMT - Bond yields have been rising in August, particularly in Europe, but current high yields are likely to attract demand back, say Societe Generale rates strategists. The recent U.S.-EU trade deal has reduced uncertainty, leading markets to get closer to pricing a long pause by the European Central Bank, and driving eurozone bond yields to new highs, they say. "While this aligns with our medium-term view for rising term premiums, markets have moved ahead of fundamentals and are anticipating September supply," the strategists say. They anticipate demand to return soon at current yield levels. (emese.bartha@wsj.com)

0453 GMT - Singapore equities are likely to ride on the safe-haven appeal of the Singapore dollar, says Julius Baer's Jen-Ai Chua in a note. Singapore's currency stability and robust underlying economy enhance the Singapore dollar's appeal to investors looking for U.S. dollar alternatives. Singapore-dollar bonds provide stability and quality, and investors with a greater risk appetite could consider the city-state's equities, she says. The island nation's stock market offers the Asian region's second-highest forward dividend yield at 5.12%, she adds. Julius Baer upgrades Singapore equities to overweight from neutral, citing attractive valuations, defensive currency and anticipated liquidity boost from the city-state's equity reform program. (megan.cheah@wsj.com)

This Friday, we examine Ethereum, Ripple, Cardano, Binance Coin, and Hyperliquid in greater detail.Ethereum (ETH)

After being rejected at $4,800, Ethereum entered a significant pullback in the past two weeks. This is why the price closed this week in red with a 7% loss. Nevertheless, this is an expected pullback after the breakout at $4,000.

At the time of this post, the price holds well above the $4,000 support, and this re-test of the breakout point could be the catalyst for ETH to finally challenge and surpass its all-time high at $4,868.

Looking ahead, Ethereum buyers appear determined to have another go at breaking the ATH resistance. This could happen towards the end of August or in early September. If successful, then ETH will enter price discovery and aim for 6k and 7k next.Ripple (XRP)

XRP lost its support at $3. This is bearish and led this cryptocurrency to close this week with a 9% loss. Buyers also appear to have retreated to the $2.7 support level.

With the sell pressure building up, a test of the $2.7 support could follow in the days to come. It is critical for XRP to hold here, as losing this support would open the way for sellers to take the price much lower and towards $2.5.

Looking ahead, the downtrend appears to be accelerating based on the 3-day MACD, which did a bearish cross this past week. This makes lower price levels likely in the days and weeks to come. Hopefully, buyers will return to stop the downtrend soon.Cardano (ADA)

Cardano had a good shot at reclaiming a price above $1, but sellers only allowed it to stay there for less than a day. Since then, ADA has been correcting and is under $0.90 at the time of this post.

While this pullback is normal, it will be challenging for ADA to return above $1 if the overall market remains bearish. The current support is found at $0.77, and buyers still have an advantage with clearly higher highs and lows on the chart.

Looking ahead, this cryptocurrency is much better positioned to return on an uptrend compared to XRP. For example, its 3-day MACD is still bullish, and buy volume is making higher highs. Ideally, this will allow ADA to secure $1 as support later on, which will open the way for higher price levels like $1.3.Binance Coin (BNB)

Binance Coin is the undisputed champion of this week after it managed to make a new all-time high at $883 yesterday. Since then, the asset has entered a pullback, which has brought it to similar levels to last week.

The current support is found at $830, and this level was already tested and confirmed several times to date. Nevertheless, if this support is put under pressure again, that could be a sign of weakness as sellers are becoming more insistent.

Looking ahead, BNB has to hold here if it wants to capitalize on this recent rally. Otherwise, bears will take advantage and push it into a more significant correction. Even so, the chart remains bullish as long as the price is above $800.Hype (HYPE)

HYPE has been struggling since early July when it failed to move above $50. Most recently, buyers tried again to break this key psychological level in mid-August, but were rejected a second time by sellers. This is bearish, and the price closed the week with a 17% loss.

At the time of this post, the price is close to $41, and the current formation on the chart looks similar to a double top. If sellers put more pressure, the asset has good support at $39 and $37.

Looking ahead, if HYPE loses its support at $37, then the price will likely fall towards $30. This would end its uptrend and push buyers to find a new support base to recover from. The most likely candidates for that are the $30 and $27 levels.

Financial and risk advisory firm Kroll is facing a class-action lawsuit for alleged negligent behavior over a data breach that impacted creditors of FTX, BlockFi, and Genesis.

The lawsuit was filed on Tuesday in a US district court by Hall Attorneys on behalf of FTX customer Jacob Repko and other crypto creditors who were affected by Kroll’s data breach.

The suit claims that crypto creditors have been facing phishing attacks, a cybercrime where malicious actors try to gain sensitive information, due to a data breach that Kroll faced in August 2023, in which malicious actors managed to attain personal information of crypto creditors.

The complaint pointed out that Kroll was solely reliant on email-only outreach. Further, the suit states that the claims verification process was compromised, which led to delays and even loss of funds.

Apart from damages, the lawsuit intends to fix the communication issue that creditors have been facing due to Kroll’s single point of communication.

In a Thursday X post, Sunil Kavuri, a prominent FTX creditor, said that creditors have been getting phishing emails on a daily basis, showing he just received one recently with his name included in the scam email.

In another screenshot, Kavuri shows that he has received multiple phishing emails from Aug. 14 to Aug. 17.

Another user replied stating that they, too, have received similar emails.

Nicholas Hall, Bankruptcy and Complex Litigation at Hall Attorneys, responded to a user telling them that eligible participants might get monetary compensation, and could cause operational changes at Kroll depending on the court ruling.

Hall also operates the FTX Claims website to help FTX creditors with their respective claims.

Earlier in March, Kroll reportedly suffered another data breach where details such as client invoicing, accounts payable, and email addresses were obtained by malicious actors.

Third round of FTX reimbursement in September

The third round of reimbursement to FTX creditors is set to commence on Sept. 30, with the payout amounting to $1.9 billion.

The payout will likely exclude foreign creditors, which include creditors from China, Russia, and more restricted countries.

More than $5 billion was distributed in the second round of reimbursement, which was announced in May.

In February, FTX laid out its plans to distribute $1.2 billion to users whose claims were up to $50,000.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up