Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Pro-crypto Republican Sens. Cynthia Lummis and Bernie Moreno say a tax provision could have unintended consequences for companies holding digital assets and have asked the Treasury Department to step in.

In a letter sent on Tuesday by the two lawmakers to Treasury Secretary Scott Bessent, Lummis and Moreno argued that the corporate alternative minimum tax alongside new accounting standards would create unfair taxes on unrealized gains. This, they said, could ultimately discourage U.S. investment.

"Failure to provide this clarity on unrealized gains in digital assets might require corporations to sell assets just to pay the tax, and it would disincentivize entities from maintaining large holdings of digital assets," the lawmakers said in the letter.

Lawmakers passed the Inflation Reduction Act in August 2022, which included a 15% Corporate Alternative Minimum Tax on firms whose average annual adjusted financial statement income exceeds $1 billion over any consecutive three-year period prior to the initial tax year, unless an exemption applies. At the time, people didn't think it would be relevant to digital assets, a person familiar said.

After the CAMT was put in place, the Financial Accounting Standards Board clarified that firms with digital assets on their balance sheets would be required to report their holdings mark-to-market, meaning assets' value is tied to the current market price, not the original price. This was a change firms like MicroStrategy had lobbied for, because prior to this accounting standard bitcoin was treated as an "indefinite-lived intangible asset" that would be marked with a permanent impairment loss if its price fell.

However, the new FASB policy combined with the CAMT liabilities created unintended consequences, Lummis and Moreno wrote. Namely, if a firm's bitcoin holdings appreciated, it looks good on paper, but creates a tax liability on their unrealized gains, the person familiar said. As a result, firms like Strategy — and lawmakers like Lummis and Moreno — are lobbying the IRS for exemptions to mitigate this potential burden, similar to those granted for unrealized stock gains held by companies like Berkshire Hathaway.

"While this accounting standard update was beneficial for the digital asset industry, because the standard affects a corporation's AFSI [adjusted financial statement income], corporations that own enough appreciated digital assets (or have enough other book income) to be subject to CAMT must now pay tax on unrealized gains in the value of those digital assets," they said.

Lummis and Moreno are asking for the Treasury to provide updated guidance for digital assets.

"We respectfully urge Treasury to act swiftly," they said. "By issuing interim guidance and ultimately adjusting the final rule, Treasury can prevent a harmful and unintended tax policy from taking hold — one that undermines fairness, distorts markets, and penalizes U.S. companies for adopting innovative financial strategies."

The Treasury Department did not respond to a request for comment.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

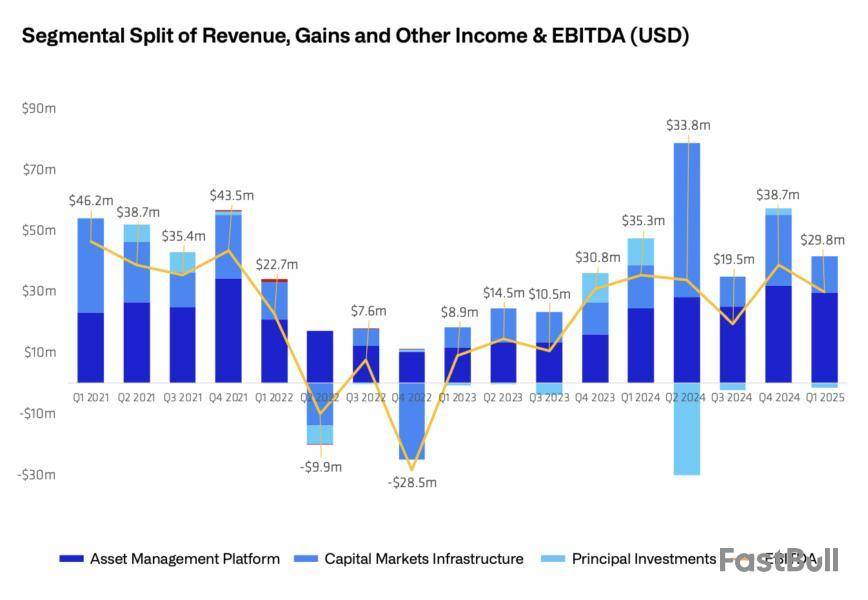

CoinShares, a digital asset investment firm with offices in the United States and Europe, said its net profit fell to $24 million in the first quarter of 2025, a 42.2% decrease from the same period a year ago.

Although CoinShares’s profits and EBITDA remained positive in Q1 2025, the margins declined compared to the same period in 2024. Last year, CoinShares posted a net profit of $41.5 million and an EBITDA of $35.5 million in the first three months. Year-over-year, CoinShares’s net profit dropped 42.2% and its EBITDA fell 15.5%.

The firm’s ETPs contributed to the quarter's performance. For Q1 2025, CoinShares’s ETPs saw net inflows of $268 million, with $202 million coming from its Physical Bitcoin (BITC) ETP. Revenue related to assets under management increased from $24.5 million to $29.6 million, a rise of 20.8%.

Year-to-date, CoinShares’s stock is down 9.4%, according to Google Finance.

In a letter to shareholders, the company's CEO, Jean-Marie Mognetti, said macroeconomic headwinds during the quarter exceeded market movements. “What we are witnessing is not mere market volatility — it is a wholesale transformation of the global economic order.”

According to Mognetti, Ether's underperformance over the quarter led to $23 million in outflows from its CoinShares Physical Staked Ethereum ETP (ETHE). "Due to broader market corrections — including a 12.1% decline in Bitcoin prices — assets under management (AuM) fell 10.7%, closing Q1 at $1.52 billion.”

Crypto companies show mixed results during market upheaval

The first wave of Q1 2025 earnings from crypto firms suggests a broadly negative quarter, with revenue declines across sectors.

Coinbase revenue, for instance, fell 10% quarter-over-quarter in Q1 2025, as transaction revenue plummeted 19% to $1.3 billion. Kraken, another US-based cryptocurrency exchange, saw its revenue decline 7% from Q4 2024. Michael Saylor’s Bitcoin treasury company, Strategy, also missed Wall Street's estimates, alongside Bitcoin miner Core Scientific.

The quarter was marked by high volatility across financial markets after US President Donald Trump unleashed global tariffs on trade partners, dragging the BTC price to lows of $78,000 over the period. Ether (ETH) also experienced a significant pullback.

Magazine: Financial nihilism in crypto is over — It’s time to dream big again

Ethereum is up $203.28 today or 8.17% to $2690.74

Note: The Ethereum price is a 5 p.m. ET snapshot from Kraken

Data compiled by Dow Jones Market Data

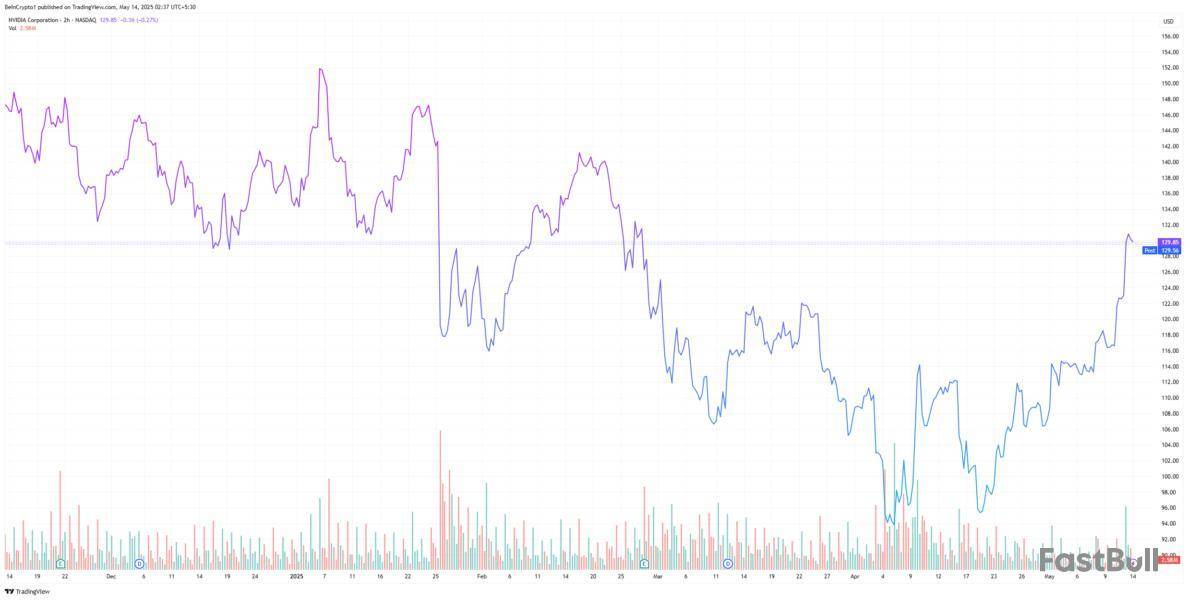

Speculation about Nvidia adding Bitcoin to its treasury reserves has surfaced recently. These unconfirmed reports lead to questions about the potential for increased institutional adoption of Bitcoin and the possible performance of such a move for Nvidia, whose stock value has fallen considerably this year.

BeInCrypto interviewed representatives from Banxe, FINEQIA, CoinShares, Bitunix, and Acre BTC to discuss Bitcoin’s potential benefits for Nvidia and explore whether such an investment would ultimately benefit the company in the long run.

Rumors of Nvidia’s Potential Bitcoin Investment

Over the past few weeks, several reports have surfaced across social media suggesting that Nvidia, a pioneer in GPU-accelerated computing, is considering adding Bitcoin to its balance sheet.

These reports remain purely speculative at the time of press, given that Nvidia has not made any official statements on the topic. When BeInCrypto reached out for clarification, an Nvidia spokesperson declined to comment.

Even as rumors, these reports highlight the significant impact of such a decision on Bitcoin’s public perception. Given Nvidia’s current economic circumstances, marked by a substantial drop in stock value, an announcement of this nature would not be completely unexpected.

Recent Economic Challenges

Over the past five months, Nvidia has navigated economic and geopolitical obstacles that have substantially impacted the company’s operations and overall financial performance.

Between Biden-era export restrictions and Trump’s recent trade policies, with global inflation risks, a weakened US dollar, and increased competition from other GPU manufacturers, Nvidia has faced issues on all fronts.

“Risk-on assets have generally underperformed in the early months of 2025, despite signs of a recent recovery. Furthermore, growing competition, particularly in the GPU and AI sectors, poses a threat to NVIDIA’s market leadership and raises the possibility of reduced market share. Ongoing US tariffs also present a significant risk, with little clarity on their future direction. Taken together, these elements likely prompted some investors to reduce their exposure to NVIDIA, locking in profits after a remarkable rally that saw the stock price rise about x9 between early 2023 and the start of 2025,” Matteo Greco, Senior Associate at FINEQIA, told BeInCrypto.

As such, Nvidia’s stock price has taken a hit. According to recent reports, Nvidia stock has fallen 35% since its latest price peak in January.

Nvidia’s stock reacted especially poorly to the news that China’s Huawei Technologies is testing a new AI chip potentially more powerful than Nvidia’s H100.

Given these circumstances, Nvidia can mitigate current economic challenges by diversifying its treasury assets.

Should Nvidia Consider Adding Bitcoin to Its Balance Sheet?

With its uncorrelated behavior relative to traditional markets and its capped supply, Bitcoin presents a strong inflation-hedging opportunity for companies.

If Nvidia were to consider this, it would follow a trend established by other companies that have invested in this asset class for similar reasons over the past few years.

“We have already seen similar cases when MicroStrategy and Tesla made headlines by allocating portions of their treasury into Bitcoin. Those cases demonstrated that a bold crypto strategy can capture market attention and align a company with forward-looking investors. In fact, as of April 2025, companies holding Bitcoin on their balance sheets collectively control over 630,000 BTC (more than 3% of the supply), so NVIDIA wouldn’t be entirely alone in exploring this path,” Banxe CEO Alex Guts noted.

Such a move would significantly alter how other institutional investors view Bitcoin, potentially encouraging more companies to adopt a similar strategy. The crypto community would likely celebrate the news, believing it would solidify Bitcoin’s legitimacy as an asset class.

“There’s also a stakeholder and market perception benefit. Holding Bitcoin might broaden NVIDIA’s appeal to a new class of investors or partners. It could attract interest from the crypto community and younger tech-savvy investors who see the company as aligned with their values. It could even factor into employee perception– many tech employees are enthusiastic about crypto, so this can help in positioning NVIDIA as a forward-thinking, attractive place to work,” Guts added.

This potential move by Nvidia would also align with the company’s existing ties to the cryptocurrency space, given its technology’s crucial role in Bitcoin mining.

Nvidia’s Role in the Bitcoin Ecosystem

Bitcoin mining, particularly its Proof-of-Work consensus mechanism, is a natural application for NVIDIA’s products.

“NVIDIA is a company known for being at the cutting edge of tech (AI, graphics, etc.). By adding Bitcoin, they’d reinforce that image of being visionary. In fact, some would say this move leverages NVIDIA’s legacy in the crypto space– their GPUs were instrumental in cryptocurrency mining during the last decade,” Guts told BeInCrypto.

To that point, Greco added:

“There is already a natural link between NVIDIA and Bitcoin, so seeking direct exposure to the asset appears logical. Bitcoin’s hashrate, a key metric measuring the network’s computing power, has been steadily climbing, repeatedly reaching new all-time highs. In that context, NVIDIA backing Bitcoin can also be interpreted as NVIDIA backing its own growth. A rise in demand for GPUs among Bitcoin miners could translate into increased revenue for the company.”

However, the extent to which Nvidia requires Bitcoin for stability remains controversial.

Risks of Adding Bitcoin to Nvidia’s Treasury

As it is, Nvidia already has other strategies that help the company hedge against volatility and inflation. Adding Bitcoin into the mix may seem excessive.

“Bitcoin offers diversification benefits as an uncorrelated asset and a potential hedge against long-term dollar depreciation. However, in practice, NVIDIA already uses FX hedging strategies to manage currency risk,” Satish Patel, Senior Investment Analyst at CoinShares, told BeInCrypto.

This becomes especially true when considering just how volatile Bitcoin itself can be. Though the asset can generate significant gains during bullish periods, the losses it can cause are equally severe.

“The first risk to be weighed must be price volatility. A significant decline could result in a significant unrealized loss on the balance sheet in the short term; under current accounting standards, Bitcoin is treated as an “intangible asset” and the decline would not be amortized, which would have a direct impact on the income statement,” explained Bitunix analyst Dean Chen.

As such, Bitcoin might not be the natural choice to defend Nvidia from its current stock declines. An investment of this kind would need to reflect a long-term strategy rather than an impulse decision.

Would BTC Even Make a Difference on Nvidia’s Share Price?

Bitcoin has demonstrated high returns over the long term, though with considerable volatility. For companies able to withstand the associated risks, including large price fluctuations, it offers the potential for significant future profits.

“Looking at historical performance, Bitcoin has been the best-performing asset of the past 15 years. This makes it, at least on paper, a strategic addition to enhance a company’s treasury,” Greco said.

With its substantial financial resources, Nvidia could absorb Bitcoin’s volatility without a major impact on its balance sheet. In this sense, the company has little to lose, but also little to gain.

“Unless the Bitcoin allocation is significant, the impact on NVIDIA’s long-term share price is likely to be muted. Even Tesla, with over 11,500 BTC, has not been widely reclassified by investors as a crypto treasury play. Ultimately, such a move would likely benefit Bitcoin’s market perception more than NVIDIA’s share price, at least until digital assets are more broadly accepted in mainstream finance,” Patel added.

Ultimately, Nvidia’s decision to invest in Bitcoin hinges on timing and urgency, particularly given recent developments that have alleviated some pressures on the company.

Easing Export Restrictions: A Boost for Nvidia

Last week, the Trump administration announced its plans to roll back certain Biden-era export restrictions on advanced semiconductor chips.

Biden’s ‘AI Diffusion Rule’ established these restrictions to enhance US technological leadership by preventing advanced chips from being diverted to countries of concern, especially China. Given that China was Nvidia’s main buyer, the rule significantly hampered its sales.

“The US embargo on chip shipments to China has caused NVIDIA’s projected revenue to decrease by approximately $5.5 billion per quarter since 2025 Q1. In addition, AI chip testing and breakthroughs by Huawei and others have put NVIDIA in direct competition in strategic markets,” Chen said.

A rollback would be highly advantageous for Nvidia’s sales, especially amid this new wave of chipmakers.

Similarly, the recent US-China tariff pause led to Nvidia’s stock price rise. Despite its temporary nature, the news is a positive sign for the company, promising reduced uncertainty and potential gains in sales and supply chain stability.

Considering these developments, adding Bitcoin to Nvidia’s balance sheet may no longer be urgent. If Nvidia were to make such a decision out of haste, it might also drive away traditional investors and long-time buyers.

Many areas of traditional finance remain highly skeptical of Bitcoin due to its short history and highly volatile nature. If Nvidia adds Bitcoin as a treasury asset, traditional investors might view it as a poor decision, potentially alienating long-time clients.

XRP has gained significant momentum over the past several days, posting a sharp 24% rally since last week as bullish sentiment returns to the broader crypto market. With Bitcoin holding above $100K and Ethereum reclaiming the $2,200 mark, altcoins like XRP are beginning to show strength after months of subdued performance. Analysts are now calling for a potential breakout, emphasizing the importance of XRP reclaiming key resistance levels in the coming days to confirm a sustained move higher.

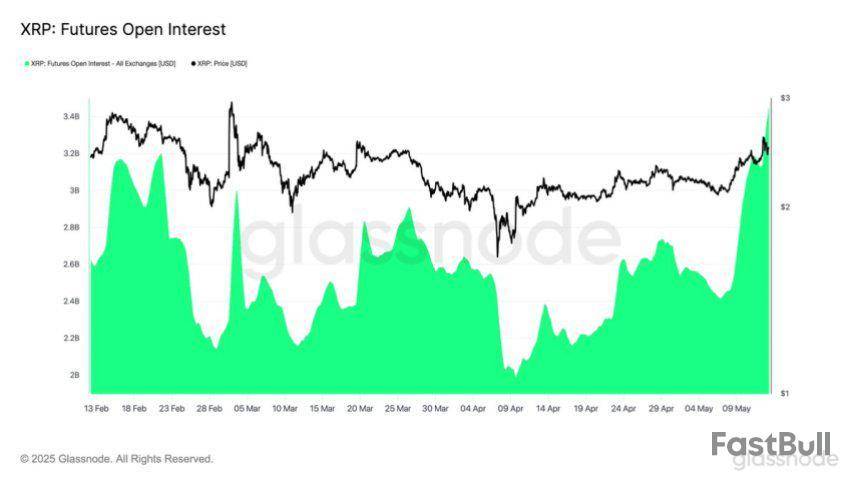

Fueling this optimism is new data from Glassnode revealing a dramatic surge in XRP Futures Open Interest. The metric has climbed over $1 billion in just one week, rising from $2.42 billion to $3.42 billion—a 41.6% increase. This spike suggests a growing wave of speculative interest and directional conviction among traders.

As leverage builds, all eyes are on XRP’s next move to determine whether this momentum can evolve into a full-blown rally. The rise in open interest alongside price appreciation often points to sustained bullish intent, adding weight to calls for a continued surge. With volatility returning to the altcoin market, XRP could be gearing up for one of its most critical breakouts in months.

XRP Leads With Strong Momentum And Rising Leverage

XRP is emerging as one of the strongest performers in the market, displaying remarkable resilience during recent downtrends and now showing clear strength in the current bullish environment. After consolidating through volatile conditions, XRP has surged above the $2.50 level, firmly positioning itself as a leader among large-cap altcoins. The price action remains tight, with bulls continuing to test the $2.60 zone while bears are unable to push the price below the new support levels formed near $2.35.

This price compression, combined with broader market optimism, suggests that XRP may be gearing up for a major move. With Bitcoin consolidating near its all-time highs and Ethereum testing crucial resistance zones, analysts are paying close attention to XRP’s trajectory. The altcoin market is heating up, and XRP’s technical structure hints at a bullish expansion phase if current levels are maintained or reclaimed with volume.

Supporting this bullish outlook is recent data from Glassnode, showing that XRP Futures Open Interest has soared by over $1 billion in the past week. It jumped from $2.42 billion to $3.42 billion—a 41.6% increase—coinciding with a price rally from $2.14 to $2.48.

This surge in leverage underscores growing speculative interest and strong directional conviction among traders. Elevated open interest, particularly when paired with upward price movement, often signals sustained momentum and institutional participation. With XRP firmly above key support and showing signs of renewed investor confidence, the next few sessions could be pivotal for determining whether XRP will finally break out into a new macro trend.

Price Action Signals Strength Amid Market Momentum

XRP is showing strong bullish momentum as it continues to trend higher, currently trading around $2.55. The chart reveals a well-established uptrend, with XRP recently breaking above key resistance levels and holding above both the 200-day Simple Moving Average (SMA) and Exponential Moving Average (EMA), currently at $2.13 and $2.02, respectively. This alignment of moving averages below the current price reinforces the bullish structure.

Over the past two weeks, XRP has surged more than 24%, confirming higher lows and higher highs in the process. After briefly stalling at $2.60, the price is now consolidating with low volatility just below that level—indicating potential for another breakout if buying pressure resumes. Volume also picked up significantly during the initial leg of this move, signaling strong interest from market participants.

The next resistance level to watch is near $2.80, which marked a major rejection zone earlier in the year. On the downside, the $2.35 zone has now turned into strong support and would be a critical level for bulls to defend if momentum weakens.

Featured image from Dall-E, chart from TradingView

By Frances Yue

Investors are finally seeing signs of a potential comeback for ether after months of sluggish performance by the second-largest cryptocurrency, thanks to a recent upgrade to the Ethereum blockchain and renewed appetite from investors for risk assets.

Ether (ETHUSD) was up 45% so far in May, on track for its best monthly performance since November, when it gained 47.8%, according to the Dow Jones Market Data. In comparison, bitcoin (BTCUSD) had gained 10.7% month to date, while solana (SOLUSD), one of ether's biggest competitors, had climbed 20.6% so far in May.

That's a significant shift from earlier this year and last year, when ether lagged behind both bitcoin and solana. The token didn't attract as much institutional attention as bitcoin did, while the blockchain behind ether faced strong competition from rivals like the Solana platform.

To be sure, ether still has a long way to catch up, as the crypto was trading 37% below its record high of $4,105.9 reached in November 2021. Bitcoin, by comparison, was trading only 5% below its own record high reached in January. Bitcoin was up 11.7% year to date, while ether was down 20.7% over the same period.

The most important driver of ether's recent strength might be the completion of Ethereum's long-awaited Pectra upgrade last week, the blockchain's biggest overhaul since 2022, according to Alex Cheung, over-the-counter trader at crypto broker Abra Prime. The upgrade was supposed to improve user experience and lay the groundwork for future upgrades, allowing Ethereum to become cheaper and faster while handling a growing number of transactions.

The crypto market seems to have received the Pectra upgrade well, based on market data. The ETH/BTC ratio stood at near five-year lows, at around 0.018, prior to the Pectra upgrade on May 7, but subsequently rose to as high as 0.025 on Tuesday, the loftiest level since March 9. Meanwhile, open interest in ether derivatives, or the total number of outstanding contracts, rose 21% to $25.8 billion on May 8, the day following the Pectra upgrade, showing an increase in market participation.

What's more, the funding rates on ether perpetual contracts turned positive on almost all derivatives exchanges on May 7. Funding rates are periodic payments exchanged among traders on perpetual futures contracts. When funding rates turn positive, it means that traders holding long positions, or bets the price will go up, pay a premium to traders holding short positions - an indication of bullish sentiment.

However, the changes brought by the Pectra upgrade may not be enough to power ether's turnaround, said Anthony Rousseau, head of brokerage solutions at TradeStation. Instead, ether's strength was more the result of traders piling into undervalued assets as risk-on sentiment returned to the market, he argued.

"That was more of a reversal-to-the-mean trade as capital flows to more depressed assets," Rousseau said.

Progress in trade talks between the U.S. and China over the weekend led to a surge in appetite for assets perceived as risky across markets. Both stocks and crypto rallied on Monday, with the Nasdaq Composite COMP exiting a bear market, after the U.S. and China reached a deal to slash tariffs on each other for 90 days. Stocks were mostly higher Tuesday, with the S&P 500 SPX turning positive for the year after erasing steep losses suffered last month in the wake of President Donald Trump's rollout of sweeping tariffs on April 2.

With such a backdrop, ether has attracted more attention, as the Ethereum blockchain still leads smart-contract activity among blockhains despite a sluggish ether price. Ethereum hosts around half of all smart-contract activity across all blockchains, with the total value locked on the platform standing at $63 billion, according to data from CoinGecko. Smart contracts use programs that automatically execute an agreement when its terms and conditions are met.

Ether's outperformance also likely bodes well for other smaller cryptocurrencies.

"Historical data suggest that when ETH demonstrates relative strength against bitcoin, altcoins are likely to experience a period of outperformance," noted Joel Kruger, market strategist at LMAX Group. Altcoins typically refer to crypto tokens other than bitcoin.

-Frances Yue

This content was created by MarketWatch, which is operated by Dow Jones & Co. MarketWatch is published independently from Dow Jones Newswires and The Wall Street Journal.

CoinDesk Bitcoin Price Index is up $3027.19 today or 2.97% to $104847.66

Note: CoinDesk Bitcoin Price Index (XBX) at 4 p.m. ET close

Data compiled by Dow Jones Market Data

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up