Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Rep. Nydia M. Velázquez, D-N.Y., introduced a bill Tuesday aimed at closing a cryptocurrency tax loophole in Puerto Rico.

According to a press release issued Tuesday, the Fair Taxation of Digital Assets in Puerto Rico Act would subject income derived from cryptocurrency staking, mining, or trading in Puerto Rico to federal taxation.

Under current law, individuals who live in Puerto Rico for at least six months may be able to exempt their crypto-based income from federal taxes.

Tax breaks for wealthy investors are projected cost Puerto Rico around $4.5 billion in revenue between 2020 and 2026, which may grow more as more crypto investors relocate to Puerto Rico, the release said.

"For years, some of the wealthiest U.S. investors in digital assets have used Puerto Rico to avoid paying federal taxes," Velázquez said in the release. "This influx has not brought promised economic growth, instead it has raised costs and driven displacement on an island where the poverty rate is already 40 percent. It’s about fairness. If you’re making money from digital assets, you should be paying your share — no matter your zip code."

Velázquez's push to close a crypto-based tax loophole comes amid broader efforts to end tax laws benefiting the wealthy in Puerto Rico. In October 2024, Velázquez co-led the United with Puerto Ricans Opposed to Act 22 Risks (UPROAR) Act, which seeks to change current federal tax rules that it claims enable millionaires and billionaires to avoid both local and federal taxes.

Velázquez, the first Puerto Rican woman elected to the U.S. House of Representatives, has served in Congress since 1993, according to her website.

Puerto Rico is an unincorporated U.S. territory with 3.2 million inhabitants who are American citizens and must pay federal taxes. In recent years, the island has emerged as a popular destination for crypto investors, thanks in large part to its favorable tax laws and active courting of the industry.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Washington, D.C.--(Newsfile Corp. - April 22, 2025) - The Securities and Exchange Commission today charged Ramil Palafox for orchestrating a fraudulent scheme that raised approximately $198 million from investors worldwide and for misappropriating more than $57 million of investor funds.

According to the SEC’s complaint, Palafox’s company, known as PGI Global, claimed to be a crypto asset and foreign exchange trading company. From January 2020 through October 2021, Palafox offered and sold PGI Global “membership” packages, which he claimed guaranteed investors high returns from PGI Global’s supposed crypto asset and foreign exchange trading and offered members multi-level-marketing-like referral incentives to encourage them to recruit new investors. However, as the complaint alleges, Palafox misappropriated more than $57 million in investor funds to buy Lamborghinis, items from luxury retailers, and for other personal expenses. He also used the majority of the remaining investor funds to pay other investors their purported returns and referral rewards in a Ponzi-like scheme until its collapse in late 2021.

“As alleged in our complaint, Palafox attracted investors with the allure of guaranteed profits from sophisticated crypto asset and foreign exchange trading, but instead of trading, Palafox bought himself and his family cars, watches, and homes using millions of dollars of investor funds,” said Scott Thompson, Associate Director of the SEC’s Philadelphia Regional Office. “We will continue to investigate and take action against bad actors who take advantage of investors with promises of guaranteed passive income and other lies and deceit.”

“Palafox used the guise of innovation to lure investors into lining his pockets with millions of dollars while leaving many victims empty-handed,” said Laura D’Allaird, Chief of the Commission’s new Cyber and Emerging Technologies Unit. “In reality, his false claims of crypto industry expertise and a supposed AI-powered auto-trading platform were just masking an international securities fraud.”

The SEC’s complaint, filed in the U.S. District Court for the Eastern District of Virginia, charges Palafox with violating the anti-fraud and registration provisions of the federal securities laws. The complaint seeks permanent injunctive relief, conduct-based injunctions preventing Palafox from participating in multi-level-marketing programs involving the offer or sale of securities and offerings of crypto assets bought or sold as a security, disgorgement of ill-gotten gains with prejudgment interest, and civil penalties. The complaint also names BBMR Threshold LLC, Darvie Mendoza, Marissa Mendoza Palafox, and Linda Ventura as relief defendants and seeks disgorgement of their ill-gotten gains and prejudgment interest.

In a parallel action, Palafox was arraigned in U.S. District Court on criminal charges brought by the U.S. Attorney’s Office for the Eastern District of Virginia.

The SEC’s ongoing investigation is being conducted by Michael Cuff and Polly Hayes of the Philadelphia Regional Office and Assunta Vivolo of the SEC’s Market Abuse Unit. It is being supervised by Ms. D’Allaird and Mr. Thompson. The litigation will be conducted by Spencer Willig and Gregory Bockin of the Philadelphia Regional Office and Eugene Hansen of SEC Headquarters. The Commission appreciates the assistance of the U.S. Attorney’s Office, the FBI, and the IRS.

The SEC’s Office of Investor Education and Advocacy directs investors to resources on detecting and avoiding pyramid schemes posing as multi-level marketing programs. Investors can find additional information at Investor.gov.

Ethereum is up $121.34 today or 7.70% to $1697.36

Note: The Ethereum price is a 5 p.m. ET snapshot from Kraken

Data compiled by Dow Jones Market Data

Bitcoin surged to a 45-day high above $91,000 on April 22, and the upward movement coincided with gold reaching a new all-time high. The price gains reflect investors' concerns over a potential economic recession amid ongoing global trade tensions.

The tides are shifting, but does data support a Bitcoin price rally above $95,000?

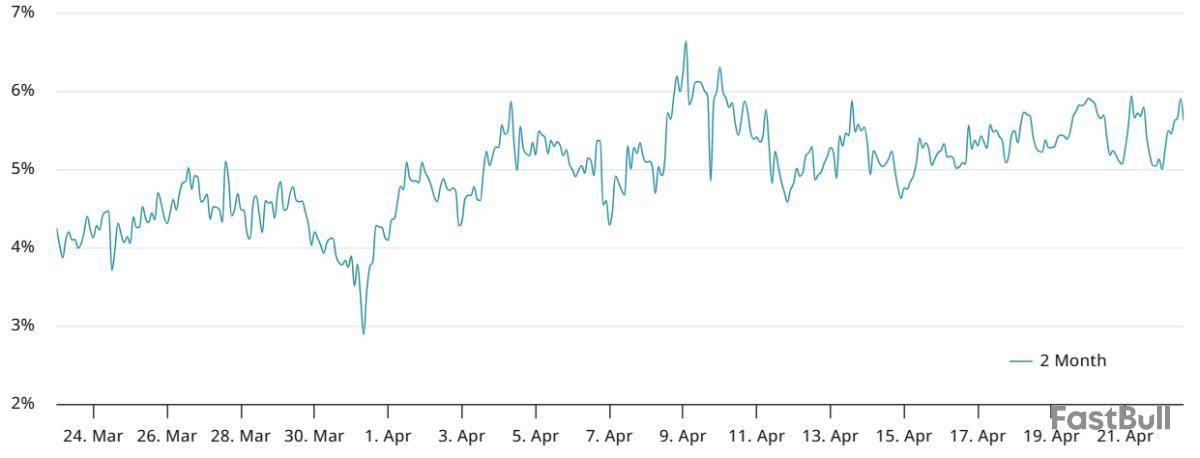

In neutral markets, the Bitcoin futures premium typically ranges between 5% and 10% to compensate for the longer settlement period. At present, the annualized premium stands at 6%, which is not considered particularly bullish, even though BTC appreciated by $6,840 between April 20 and April 22. Some analysts interpret this as a sign that Bitcoin is beginning to decouple from the stock market.

Traders’ PTSD could emerge around BTC’s $90K zone

Part of this skepticism among traders stems from Bitcoin’s repeated inability to sustain levels above $90,000 in early March. For example, Bitcoin tested the $95,000 mark on March 3, only to fall to $81,464 the following day. This inconsistent performance since the $109,346 peak on Jan. 20 has contributed to a lack of conviction among bullish investors, especially as gold has continued to set new all-time highs during the same period.

Currently, Bitcoin is trading 16% below its all-time high, a figure that closely mirrors the S&P 500’s decline of 14.5%. This suggests that the recent era of excessive risk-taking may be behind us. Notably, even at its lowest point below $75,000, Bitcoin’s 32% drawdown was less severe than those experienced by Nvidia (NVDA), Amazon (AMZN), Facebook (META), and Tesla (TSLA).

Comments from US Treasury Secretary Scott Bessent on April 22 contributed to easing investor concerns. As reported by Bloomberg, Bessent described the ongoing tariff standoff with China as “unsustainable,” suggesting an increased likelihood of de-escalation. In contrast, US President Donald Trump took to social media to assert that US Federal Reserve Chair Jerome Powell is hindering economic growth by not reducing interest rates.

Bitcoin’s gains contrast with investors’ shift to government bonds

Regardless of where the blame lies for the subdued economic growth in the United States, demand for short-term US Treasurys has risen, as evidenced by the yield on the 2-year note declining to 3.81% from 4.04% a month earlier. Essentially, investors are accepting lower returns in exchange for the perceived safety of government bonds. Against this backdrop, Bitcoin’s 6.3% price increase over the past 30 days stands out as particularly notable.

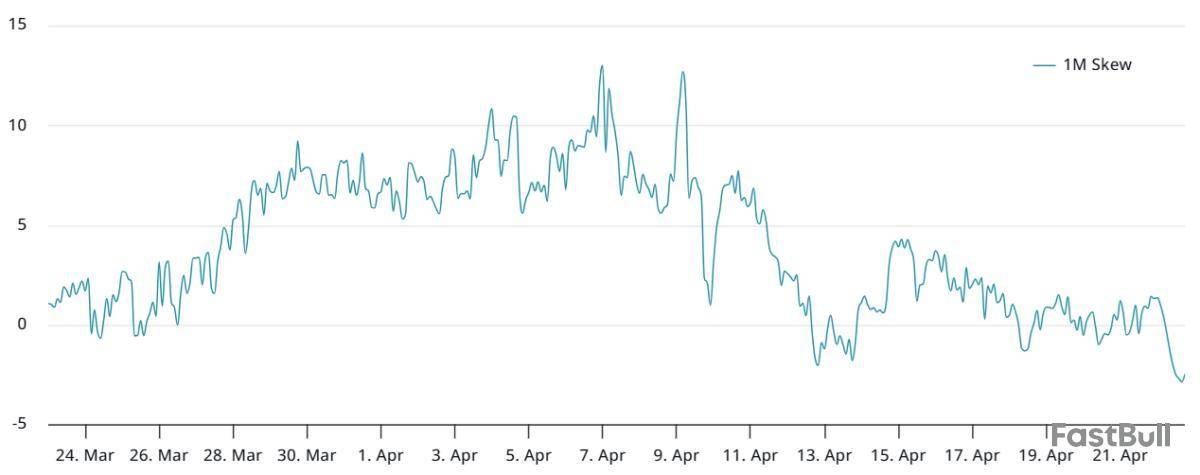

To determine whether these recent gains have affected professional traders’ sentiment, it is important to examine the BTC options markets. If traders expect a correction, put (sell) options tend to trade at a premium, causing the 25% delta skew metric to rise above 6%. Conversely, bullish sentiment pushes the indicator below -6%.

Currently, the Bitcoin options market reflects limited enthusiasm following the recent surge to $91,000, with the 25% delta skew indicator at -2%, which remains within the neutral range. According to this metric, the last period of bullish sentiment occurred on Jan. 30, when Bitcoin traded near $105,000. Therefore, there is no clear evidence that large investors or market makers are anticipating a sustained rally above $95,000.

Despite some weak macroeconomic data, market participants expect a relatively strong first-quarter earnings season. FactSet reports that the “Magnificent 7” companies are projected to achieve earnings growth of 14.8% for the first quarter compared to the prior year.

While Bitcoin still has a reasonable chance of revisiting $95,000 or higher, many traders appear to be waiting for further developments in the US-China trade war before placing additional bullish bets.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

ZURICH, April 22, 2025 (GLOBE NEWSWIRE) — The long-awaited $XPL token distribution has officially begun, signaling a pivotal moment in the XploraDEX journey as the platform transitions from presale to active deployment. For the next 7 days, early investors will receive their tokens, while new participants still have a final opportunity to join the presale and secure their stake in the first AI-powered DEX on XRPL.

As token allocations begin hitting wallets, the energy in the community is electric. After weeks of anticipation and record-breaking wallet signups, XploraDEX is delivering on its roadmap—starting with the real-time distribution of $XPL to thousands of early supporters around the world.

Join $XPL Presale

Unlike other presales that delay activation, XploraDEX is going live during its token distribution window. Investors can still enter at presale pricing while rewards, staking, and onboarding processes roll out. It’s a unique dual-phase designed to offer latecomers one last chance to secure $XPL before listings go public.

What’s happening now:

Participate in $XPL Presale

With a huge number of $XPL allocation already claimed, this week represents the final chance for investors to join XploraDEX before the price adjusts to market-driven dynamics on decentralized exchanges. Once the presale ends, the open trading era begins—at a premium.

Why now is the time to act:

Purchase $XPL Tokens

The XploraDEX ecosystem is built on speed, intelligence, and community. With its AI-driven infrastructure, the platform is poised to give XRPL traders a smarter, faster, and more data-rich trading experience than ever before.

This is not just the next chapter for XploraDEX—it’s the ignition. The next 7 days will define who enters early and who enters late. And in DeFi, timing is everything.

Secure Your $XPL Tokens Before the Presale Closes: https://sale.xploradex.io

Live Updates on Launch: Website | $XPL Token Presale | X | Telegram

Contact:

Oliver Muller

oliver@xploradex.io

contact@xploradex.io

Disclaimer: This press release is provided by the XploraDEX. The statements, views, and opinions expressed in this content are solely those of the content provider and do not necessarily reflect the views of this media platform or its publisher. We do not endorse, verify, or guarantee the accuracy, completeness, or reliability of any information presented. We do not guarantee any claims, statements, or promises made in this article. This content is for informational purposes only and should not be considered financial, investment, or trading advice.

Investing in crypto and mining-related opportunities involves significant risks, including the potential loss of capital. It is possible to lose all your capital. These products may not be suitable for everyone, and you should ensure that you understand the risks involved. Seek independent advice if necessary. Speculate only with funds that you can afford to lose. Readers are strongly encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. However, due to the inherently speculative nature of the blockchain sector—including cryptocurrency, NFTs, and mining—complete accuracy cannot always be guaranteed.

Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release. In the event of any legal claims or charges against this article, we accept no liability or responsibility.

Legal Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/7e7224d5-c160-4dee-9236-a27e1da8dda9

XploraDEX

XploraDEX

US Securities and Exchange Commission member Hester Peirce, currently leading the agency’s crypto task force, offered a preview of what the industry could expect now that Paul Atkins has been sworn in as the regulatory body’s chairman.

Speaking to Cointelegraph before the US Senate confirmed Atkins’ nomination and he took his position as SEC chair, Peirce said she welcomed the opportunity to work again with the incoming agency leader. Peirce worked as Atkins’ counsel from 2004 to 2008 during the then-commissioner’s first term at the SEC.

“He cares about economic growth and how the markets that we regulate can support economic growth,” Peirce told Cointelegraph. “I would love the chance to work with [Atkins] on trying to reorient the agency so that it does take into consideration all aspects of our mission.”

Atkins, appointed by US President Donald Trump in what many saw as a nod to the crypto industry to replace former chair Gary Gensler, was sworn in on April 21. During his confirmation hearing in the Senate Banking Committee, lawmakers questioned Atkins on his ties to the crypto industry, potentially presenting conflicts of interest in his role helping regulate digital assets.

“I expect that he will continue to follow the ethics rules,” said Peirce on Atkins. “I worked for [him] and I have very high regard for his integrity.”

SEC’s priorities under new leadership

Atkins, now chair, comes to the SEC as the fourth commissioner, with five members typically filling the agency’s leadership positions. Gensler and former Commissioner Jaime Lizárraga stepped down in January. Commissioner Caroline Crenshaw is expected to be the next to depart before 2026, leaving a panel of only three Republican commissioners unless Trump nominates a Democrat.

Commissioner Mark Uyeda, whom Trump named as acting chair on Jan. 20, was still scheduled to oversee some of the SEC’s proceedings, including an April 25 roundtable event discussing crypto custody. Uyeda said on April 21 that he was planning to return to his “regular role” as a commissioner, suggesting that Atkins may soon assume all his responsibilities as chair.

The shakeup in leadership comes amid many in the industry looking for clarity from the SEC, the courts, and lawmakers after Gensler’s departure. Under the former chair, many accused the SEC of enacting a “regulation by enforcement” approach to crypto, resulting in several high-profile lawsuits against firms including Coinbase, Ripple Labs, and Binance. Since January, the commission has dropped many of the cases.

“I think we’re all trying to get to a good place, which is putting some clarity around crypto, some regulatory clarity,” said Peirce.

The seven-day moving average (7DMA) of the number of active addresses on Aptos has dropped to a yearly low of approximately 644,000. This marks its lowest level since the third week of November 2024 and continues a sharp downtrend that began after hitting an all-time high in February 2025.

Specifically, on Feb. 1, the figure peaked at 1.56 million after a steady seven-month climb that saw gradual and consistent growth. However, in the three months since that peak, active addresses have fallen by over 40%.

Meanwhile, the 7DMA of the number of new addresses on Aptos has followed a similar pattern. From August 2024 to February 2025, this figure rose steadily to a record high of 525,000 new addresses on Feb. 1. Since then, this figure has experienced an even steeper decline of over 80% over the past three months.

The parallel drop in both active and new addresses strongly suggests that the increase in user activity from August 2024 to February 2025 was heavily driven by newly created addresses that lacked long-term retention. In other words, much of the address growth appears to have been "non-sticky," failing to translate into meaningful user engagement. This implies a surge of low-value addresses, such as bots, airdrop farmers, or short-term opportunistic participants, rather than genuine, recurring user growth.

The price of the APT token itself has declined by over 35% since Feb. 1.

This is an excerpt from The Block's Data & Insights newsletter. Dig into the numbers making up the industry's most thought-provoking trends.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up