Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

UBS CEO: As We Approach End Of Integration, Confident In Ability To Capture Remaining Synergies By Year-End, Which We Increased By $500 Million To $13.5 Billion

UBS: Remain On Track To Complete Integration By Year-End, With Greater Proportion Of Net Saves Weighted To H2 2026

UBS: Continued Wind-Down Of Non-Core And Legacy Risk-Weighted Asset, Reducing Rwa To $28.8 Billion

Kazakhstan's Kaztransoil: Supplies Of 1.017 Million Tons Of Oil, Including 863000 Tons Of Russian Oil, To China In January Via Kazakhstan

Hsi Closes Midday At 26724, Down 109 Pts, Hsti Closes Midday At 5347, Down 119 Pts, Tencent Down Over 3%, Xinyi Glass, Techtronic Ind, Wharf Reic, Yankuang Energy, China East Air Hit New Highs

US President Trump delivered a speech

US President Trump delivered a speech South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)A:--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)A:--

F: --

P: --

Australia Building Approval Total YoY (Dec)

Australia Building Approval Total YoY (Dec)A:--

F: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)A:--

F: --

Australia Building Permits YoY (SA) (Dec)

Australia Building Permits YoY (SA) (Dec)A:--

F: --

P: --

Australia Private Building Permits MoM (SA) (Dec)

Australia Private Building Permits MoM (SA) (Dec)A:--

F: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key RateA:--

F: --

P: --

RBA Rate Statement

RBA Rate Statement Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction YieldA:--

F: --

P: --

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown.

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown. Saudi Arabia IHS Markit Composite PMI (Jan)

Saudi Arabia IHS Markit Composite PMI (Jan)A:--

F: --

P: --

RBA Press Conference

RBA Press Conference Turkey PPI YoY (Jan)

Turkey PPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Jan)

Turkey CPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)A:--

F: --

P: --

U.K. 10-Year Note Auction Yield

U.K. 10-Year Note Auction YieldA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

Mexico Manufacturing PMI (Jan)

Mexico Manufacturing PMI (Jan)A:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

Japan IHS Markit Services PMI (Jan)

Japan IHS Markit Services PMI (Jan)A:--

F: --

P: --

Japan IHS Markit Composite PMI (Jan)

Japan IHS Markit Composite PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Services PMI (Jan)

China, Mainland Caixin Services PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Composite PMI (Jan)

China, Mainland Caixin Composite PMI (Jan)A:--

F: --

P: --

India HSBC Services PMI Final (Jan)

India HSBC Services PMI Final (Jan)A:--

F: --

P: --

India IHS Markit Composite PMI (Jan)

India IHS Markit Composite PMI (Jan)A:--

F: --

P: --

Russia IHS Markit Services PMI (Jan)

Russia IHS Markit Services PMI (Jan)A:--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Jan)

South Africa IHS Markit Composite PMI (SA) (Jan)--

F: --

P: --

Italy Services PMI (SA) (Jan)

Italy Services PMI (SA) (Jan)--

F: --

P: --

Italy Composite PMI (Jan)

Italy Composite PMI (Jan)--

F: --

P: --

Germany Composite PMI Final (SA) (Jan)

Germany Composite PMI Final (SA) (Jan)--

F: --

P: --

Euro Zone Composite PMI Final (Jan)

Euro Zone Composite PMI Final (Jan)--

F: --

P: --

Euro Zone Services PMI Final (Jan)

Euro Zone Services PMI Final (Jan)--

F: --

P: --

U.K. Composite PMI Final (Jan)

U.K. Composite PMI Final (Jan)--

F: --

P: --

U.K. Total Reserve Assets (Jan)

U.K. Total Reserve Assets (Jan)--

F: --

P: --

U.K. Services PMI Final (Jan)

U.K. Services PMI Final (Jan)--

F: --

P: --

U.K. Official Reserves Changes (Jan)

U.K. Official Reserves Changes (Jan)--

F: --

P: --

Euro Zone Core CPI Prelim YoY (Jan)

Euro Zone Core CPI Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim YoY (Jan)

Euro Zone Core HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone PPI MoM (Dec)

Euro Zone PPI MoM (Dec)--

F: --

P: --

Euro Zone HICP Prelim YoY (Jan)

Euro Zone HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim MoM (Jan)

Euro Zone Core HICP Prelim MoM (Jan)--

F: --

P: --

Italy HICP Prelim YoY (Jan)

Italy HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core CPI Prelim MoM (Jan)

Euro Zone Core CPI Prelim MoM (Jan)--

F: --

P: --

Euro Zone PPI YoY (Dec)

Euro Zone PPI YoY (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Brazil IHS Markit Composite PMI (Jan)

Brazil IHS Markit Composite PMI (Jan)--

F: --

P: --

Brazil IHS Markit Services PMI (Jan)

Brazil IHS Markit Services PMI (Jan)--

F: --

P: --

U.S. ADP Employment (Jan)

U.S. ADP Employment (Jan)--

F: --

P: --

The U.S. Treasury Department released its quarterly refinancing statement.

The U.S. Treasury Department released its quarterly refinancing statement. U.S. IHS Markit Composite PMI Final (Jan)

U.S. IHS Markit Composite PMI Final (Jan)--

F: --

P: --

U.S. IHS Markit Services PMI Final (Jan)

U.S. IHS Markit Services PMI Final (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing Price Index (Jan)

U.S. ISM Non-Manufacturing Price Index (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing Employment Index (Jan)

U.S. ISM Non-Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing New Orders Index (Jan)

U.S. ISM Non-Manufacturing New Orders Index (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing PMI (Jan)

U.S. ISM Non-Manufacturing PMI (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing Inventories Index (Jan)

U.S. ISM Non-Manufacturing Inventories Index (Jan)--

F: --

P: --

No matching data

View All

No data

Smurfit Westrock plc

('Smurfit Westrock')

TOTAL VOTING RIGHTS

DUBLIN (February 02, 2026)

In accordance with DTR 5.6.1 of the UK's Financial Conduct Authority's Disclosure Guidance and Transparency Rules, Smurfit Westrock announces that:

As of 31 January 2026, Smurfit Westrock's issued share capital consists of 522,400,578 Ordinary Shares of nominal value $0.001 each. Smurfit Westrock does not hold any Ordinary Shares in treasury. Therefore, the total number of voting rights in Smurfit Westrock is 522,400,578.

The above figure may be used by shareholders as a denominator for the calculations by which they will determine if they are required to notify their interest in, or a change to their interest in, Smurfit Westrock under the UK's Financial Conduct Authority's Disclosure Guidance and Transparency Rules.

February 02, 2026

CONTACT:

Gillian Carson-Callan

Group SVP Finance & Company Secretary

+353 (0)1 202 7000

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy. END TVREASAAEFKKEFA

The FTSE 100 was down 0.07% at 10,143.44, while the more domestically-focused FTSE 250 slipped 0.23% to 23,317.53.

As AJ Bell’s Dan Coatsworth put it, “it’s a calmer end to a chaotic week on the markets,” noting that after recent swings “it’s only natural for people to pause and take stock of events.”

The bid for safety remained evident in precious metals, with gold continuing to attract inflows despite easing immediate market stress.

Coatsworth said the metal had “nudged ahead to trade ever closer to $5,000 an ounce as investors were reluctant to let go of their safety blanket, just in case Donald Trump woke up with another controversial idea.”

That caution helped temper equity gains even as broader risk sentiment stabilised.

UK economic data helps underpin sentiment

Sentiment was underpinned by a raft of upbeat UK economic data.

The S&P Global flash UK PMI composite output index rose to 53.9 in January from 51.4 in December, its strongest reading since April 2024 and the ninth consecutive month above the 50 mark that separates expansion from contraction.

Services activity climbed to a 21-month high of 54.3, while manufacturing output also strengthened, with the PMI rising to 51.6.

Chris Williamson at S&P Global said businesses had “kicked up a gear” at the start of the year, pointing to resilient demand and optimism consistent with quarterly GDP growth approaching 0.4%, though he cautioned that job losses persisted as firms grappled with high costs.

PwC economist Jake Finney said the data suggested the economy had begun 2026 on a firmer footing, but warned that persistent cost pressures, particularly in services, could keep the Bank of England on hold in February.

Official figures also showed UK retail sales beat expectations in December, with volumes rising 0.4% against forecasts for a decline.

Patrick Munnelly at TickMill noted that “interpreting signals from this often-volatile series is no straightforward task,” highlighting that while sales volumes rose 2.1% on a three-month annual basis in the fourth quarter, they still fell 0.3% quarter-on-quarter.

“The reality likely lies somewhere in between,” he said, pointing to favourable weather and sporting events supporting food sales earlier in the year, while seasonal shifts such as Black Friday may have distorted more recent data.

The Office for National Statistics said strong demand for precious metals and higher supermarket sales helped offset weakness in non-food stores, with annual sales growth accelerating to 1.3%, though volumes remained below pre-pandemic levels.

ONS statistician Hannah Finselbach highlighted strong online jewellery sales driven by demand for gold and silver, while AJ Bell’s Danni Hewson said the headline increase masked a difficult Christmas for many high-street retailers amid cautious consumer spending.

Consumer confidence, however, remained subdued.

GfK’s long-running index edged up one point to -16 in January, marking a decade in negative territory.

Munnelly observed that while the headline move was modest, “perceptions of personal financial situations improved more significantly than the headline figure suggests,” even as households remained wary about the broader economic outlook.

GfK’s Neil Bellamy said consumers were showing resilience rather than optimism, focusing on what they could control while remaining unconvinced about the wider economy.

Broader global signals were meanwhile mixed.

Asian markets advanced as the dollar continued to weaken, with investors increasingly rotating into non-US assets.

Munnelly said “precious metals also soared to unprecedented levels,” with a weaker dollar helping push gold to an all-time high of over $4,965 an ounce.

In Japan, stocks rose and the yen softened after the Bank of Japan kept its policy rate unchanged at 0.75% while upgrading growth and inflation forecasts, a move that also weighed on bond futures.

Munnelly noted that signs were emerging that “investors are increasingly pulling away from US assets,” with record flows into emerging-market funds adding further pressure to the dollar.

BAE Systems higher, SSP Group reverses gains

On London’s equity markets, defence stocks were in focus, with BAE Systems trading higher as investors continued to favour names that have performed strongly over the past year.

Coatsworth said the FTSE 100 had been supported as investors “loaded up on three names that have served them well over the past year - Rolls-Royce, Endeavour Mining and BAE Systems.”

Shell rallied after a Reuters report said the oil major was considering a sale of its assets in Argentina’s Vaca Muerta shale play.

Watches of Switzerland was higher after it said late on Thursday that it had bought Texas-based Deutsch & Deutsch, a family-owned luxury watch and jewellery retailer that had been operating since the 1920s.

SSP Group reversed earlier gains despite backing full-year guidance and reporting a 5% rise in first-quarter like-for-like sales.

Babcock International edged lower after confirming chief executive David Lockwood will retire at the end of 2026, a move Coatsworth said might allow Lockwood “half a smile” given the shares had risen more than fivefold since he took the role in 2020.

C&C Group tumbled after warning on profits amid weak consumer confidence, with Coatsworth describing it as “a tough time to be running” the drinks group as profit warnings returned, while Rank Group slid after Deutsche Bank downgraded the stock to ‘hold’ and cut its price target sharply.

Reporting by Josh White for Sharecast.com.

Market Movers

FTSE 100 - Risers

BAE Systems (BA.) 2,027.00p 2.12%

BP (BP.) 443.65p 1.57%

Anglo American 3,378.00p 1.08%

FTSE 100 - Fallers

Burberry Group 1,195.50p -6.20%

Admiral Group 2,650.00p -5.76%

Aviva (AV.) 619.40p -5.17%

International Consolidated Airlines Group SA (CDI) 418.30p -2.79%

Flutter Entertainment (DI) 12,990.00p -2.70%

Smurfit Westrock (DI) 3,054.00p -2.65%

JD Sports Fashion (JD.) 82.64p -2.34%

FTSE 250 - Risers

Me Group International 139.40p 4.65%

Hochschild Mining 702.00p 3.69%

Watches of Switzerland Group 534.00p 2.99%

Ceres Power Holdings 347.20p 2.72%

Foresight Environmental Infrastructure Limited 71.90p 2.28%

Endeavour Mining 4,366.00p 2.15%

Oxford Biomedica 871.00p 2.11%

FTSE 250 - Fallers

C&C Group (CDI) 114.40p -11.04%

B&M European Value Retail S.A. (DI) 161.60p -7.18%

Wizz Air Holdings 1,318.00p -4.77%

Close Brothers Group 518.00p -2.91%

BLOCK LISTING SIX MONTHLY RETURN

INFORMATION PROVIDED ON THIS FORM MUST BE TYPED OR PRINTED ELECTRONICALLY AND PROVIDED TO A PIP.

(Note: Italicised terms have the same meaning as given in the UK Listing Rules.)

Date: 12 January 2026

Name of applicant: | Smurfit Westrock plc | |||

Name of scheme: | Share plans of Smurfit Westrock, Smurfit Kappa and WestRock described in paragraph 13 (Share plans of the Combined Group) of Part 14 (Additional Information) of the prospectus published by Smurfit Westrock on 14 May 2024. | |||

Period of return: | From: | 10 July 2025 | To: | 09 January 2026 |

Balance of unallotted securities under scheme(s) from previous return: | 16,980,537 | |||

Plus: The amount by which the block scheme(s) has been increased since the date of the last return (if any increase has been applied for): | 0 | |||

Less: Number of securities issued/allotted under scheme(s) during period (see UKLR 20.6.7G): | 265,777 | |||

Equals: Balance under scheme(s) not yet issued/allotted at end of period: | 16,714,760 | |||

Name of contact: | Nicola Coyle |

Telephone number of contact: | +353 1 202 7000 |

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy. END BLRGPUQPGUPQGMP

This announcement has been issued through the Companies Announcement ServiceofEuronext Dublin.

To view the announcement in full, please click on the associated attachment

https://newsserviceweb.oslobors.no/message/84508

(19:34 GMT) Smurfit Westrock Price Target Cut to $47.00/Share From $63.00 by Barclays

Smurfit Westrock plc

('Smurfit Westrock')

TOTAL VOTING RIGHTS

DUBLIN (November 03, 2025)

In accordance with DTR 5.6.1 of the UK's Financial Conduct Authority's Disclosure Guidance and Transparency Rules, Smurfit Westrock announces that:

As of 31 October 2025, Smurfit Westrock's issued share capital consists of 522,186,327 Ordinary Shares of nominal value $0.001 each. Smurfit Westrock does not hold any Ordinary Shares in treasury. Therefore, the total number of voting rights in Smurfit Westrock is 522,186,327.

The above figure may be used by shareholders as a denominator for the calculations by which they will determine if they are required to notify their interest in, or a change to their interest in, Smurfit Westrock under the UK's Financial Conduct Authority's Disclosure Guidance and Transparency Rules.

November 03, 2025

CONTACT:

Gillian Carson-Callan

Group SVP Finance & Company Secretary

+353 (0)1 202 7000

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy. END TVREAEFDEFLSFFA

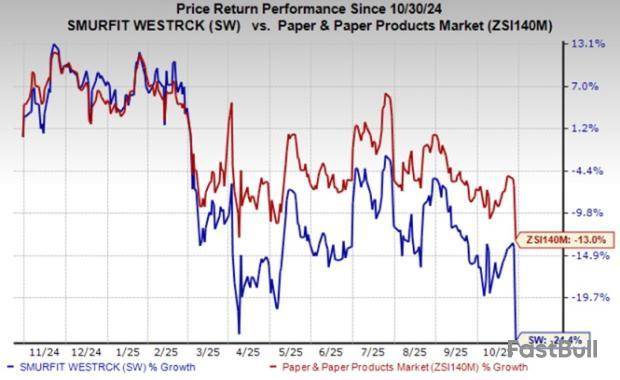

Smurfit Westrock Plc SW reported earnings of 58 cents per share in third-quarter 2025, missing the Zacks Consensus Estimate of 68 cents by 14.7%. The company reported earnings of 53 cents in the year-ago quarter.

Smurfit Westrock was created through the merger of two major paper and packaging industry players, Smurfit Kappa and WestRock, on July 5, 2024. The combined company has been reporting unified results since the third quarter of 2024. However, the year-ago quarter results excluded the financial results of legacy WestRock for the first five days of July as the combination closed on July 5, 2024.

Smurfit Westrock PLC Price, Consensus and EPS Surprise

Smurfit Westrock PLC price-consensus-eps-surprise-chart | Smurfit Westrock PLC Quote

Smurfit Westrock’s net sales in the third quarter of 2025 were $8 billion, which beat the Zacks Consensus Estimate of $7.98 billion. The year-ago quarter’s sales were $7.67 billion.

SW Reports Higher Gross Profit & Adjusted EBITDA

The reported cost of sales was $6.43 billion in the third quarter of 2025, up 1.8% year over year. The gross profit increased 16% year over year to $1.57 billion. The gross margin was 19.6% compared with 17.6% in the year-ago quarter.

Selling, general and administrative expenses were down 4.7% year over year to $960 million. Operating profit was $526 million, marking a significant improvement from $55 million reported in the year-ago quarter.

The adjusted EBITDA was $1.3 billion compared with $1.26 billion in the year-ago quarter. The adjusted EBITDA margin was 16.3% compared with 16.5% in the year-ago quarter.

SW’s Segment Performances in Q3

The company operates under three reportable segments.

Europe, MEA & APAC: This segment includes operations in Europe, the Middle East and Africa, and the Asia Pacific. Sales for the segment were $2.82 billion, up 6.5% year over year. The segment’s adjusted EBITDA was up 2% year over year to $419 million.

North America: This segment includes operations in the United States, Canada and Mexico. Sales for the North America segment were $4.6 billion, a 2% increase from the year-ago quarter. The segment’s adjusted EBITDA rose 4% to $810 million from the year-ago quarter’s $780 million.

LATAM: This segment includes operations in Central America and the Caribbean, Argentina, Brazil, Chile, Colombia, Ecuador and Peru. Sales for this segment were $545 million, up 10% year over year. The segment’s adjusted EBITDA was $116 million, in line with the year-ago quarter.

Smurfit Westrock’s Cash Position & Balance Sheet Updates

SW had cash and cash equivalents of $851 million at the end of the third quarter of 2025 compared with $855 million as of the end of 2024.

Net cash provided by operating activities was $1,133 million compared with $320 million in the year-ago quarter. The company announced a quarterly dividend of 43.08 cents per share. It will be paid out on Dec. 18, 2025, to shareholders of record at the close of business on Nov. 14, 2025.

SW Lowers FY25 Adjusted EBITDA Outlook

Smurfit Westrock expects adjusted EBITDA in 2025 to be $4.9-$5.1 billion, lower than the earlier projection of $5-$5.2 billion. This reflects additional economic downtime in the fourth quarter to optimize its system.

The company had reported 2024 adjusted EBITDA of $4.7 billion.

Smurfit Westrock Stock’s Price Performance & Zacks Rank

Shares of the company have fallen 26.5% in the past year compared with the industry’s 16.7% decline.

The company currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

A Paper & Related Product Stock Awaiting Results

Rayonier Advanced Materials RYAM is set to release third-quarter 2025 results on Nov. 4. The Zacks Consensus Estimate for the bottom line is pegged at a loss of seven cents per share. The company posted a loss of 12 cents per share in the year-ago quarter.

The consensus estimate for Rayonier Advanced Materials’ top line is pegged at $376 million, indicating a 6.1% decline from the prior-year reported figure.

Performance of Other Packaging Stocks in Q3

Packaging Corporation of America PKG posted adjusted earnings per share of $2.73 in the third quarter of 2025, missing the Zacks Consensus Estimate of $2.83 by 4%.

The bottom line, however, increased 3% year over year, supported by higher prices and mix in both the segments, along with lower fiber costs and maintenance outage expense. Packaging Corp.’s sales in the third quarter grew 6% year over year to $2.3 billion. The top line beat the Zacks Consensus Estimate of $2.26 billion.

International Paper Company IP has reported third-quarter 2025 adjusted loss of 43 cents per share, which missed the Zacks Consensus Estimate for earnings of 53 cents. This includes $675 million of accelerated depreciation associated with mill closures and 80/20 strategic actions.

The adjusted loss for the quarter compares unfavorably with the company’s restated adjusted earnings of 33 cents per share for the year-ago quarter. Net sales were $6.22 billion in the quarter under review, up 56.4% from the year-ago quarter, driven by the acquisition of DS Smith. The top line missed the Zacks Consensus Estimate of $6.89 billion.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up