Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Geiger Counter Limited Plc

Monthly Investor Report 26 November 2025

(All Factsheet data is at 31 October 2025)

The full monthly factsheet is now available on the Company's website and a summary can be found below.

NCIM - Geiger Counter Ltd - Fund Page for Geiger Counter Ltd

Enquiries:

For the Investment Manager

Craig Cleland

Manulife CQS Investment Management

0207 201 5368

For the Company Secretary and Administrator

R&H Fund Services (Jersey) Limited

Jane De Barros/Katie De La Cour

01534 825259/01534 825337

-----------------------------------------------------------------------

Fund Description

The objective of Geiger Counter Limited is to provide investors with the potential for capital growth through investment primarily in the securities of companies involved in the exploration, development and production of energy, predominantly within the uranium industry. Up to 30% of the value of the Company's investment portfolio may be invested in other resource- related companies from outside the energy sector.

Portfolio Managers

Keith Watson and Robert Crayfourd

Key Advantages for the Investor

· Access to mining assets in the uranium sector

· May benefit from embedded subscription share

· Low correlation to major asset classes

Key Fund Facts1

Total Gross Assets | £103.5m |

Reference Currency | GBP |

Ordinary Shares: | |

Net Asset Value | 82.27p |

Mid-Market Price | 61.50p |

Net gearing4 | 14.30% |

Discount | (25.25%) |

Ordinary Share and NAV Performance2

One Month | Three Months | One Year | Three Years | Five Years | |

(%) | (%) | (%) | (%) | (%) | |

NAV | 13.55 | 55.84 | 38.29 | 57.94 | 429.75 |

Share Price | 3.89 | 30.02 | 33.70 | 18.27 | 275.00 |

Commentary3

The Fund's NAV rose 13.6% in October, broadly in line with the Solactive Uranium Pure Play Index and ahead of the Sprott Uranium Mining ETF, which limits investments to equities allocating at least 50% of assets toward uranium mining, that returned 7% in sterling terms over the month. The ETF limits investments to equities allocating at least 50% of assets toward uranium resource exploration or development.

The U₃O₈ spot price recovered from a mid-month dip to close October at $82.13/lb, up 0.5%. The most significant development was the US announcement of $80bn in funding for nuclear reactor construction. Under an agreement with Westinghouse (owned by Brookfield and Cameco), the US government will arrange financing and secure permits for AP-1000 reactor development in exchange for a 20% share of future profits and a potential future listing of Westinghouse. Additionally, Japan agreed to participate in funding as part of its trade agreement with the US, signalling a possible commitment of $330bn to support US infrastructure development.

Sector sentiment was further boosted by the Sprott Physical Uranium Trust, which acquired approximately 1.2 Mlbs of uranium following its recent equity issuance. This helped lift prices from a mid-month low of $76/lb, driving strong equity performance.

Looking ahead, uranium mining is emerging as the key bottleneck in the reinvestment cycle. While funding has focused on reactors, enrichment, and conversion capacity, little has been directed toward mining-the least flexible part of the fuel cycle. Greenfield projects face lengthy timelines for discovery, drilling, permitting, and construction, often exceeding a decade. Expanding conversion and enrichment capacity without addressing raw U₃O₈ supply risks creating even tighter markets.

Nexgen was a key contributor to Fund performance, with its share price rising nearly 12% in sterling terms ahead of the first-stage permit hearing scheduled for mid-November, followed by a second phase in February. Additional strong gains came from Energy Fuels and Paladin, which advanced 37% and 17%, respectively, in sterling terms.

Geiger Counter Ltd | |

Gross Leverage2 (%) | 115 |

Commitment Leverage3 (%) | 115 |

CQS (UK) LLP

4th Floor, One Strand, London WC2N 5HR, United Kingdom

T: +44 (0) 20 7201 6900 | F: +44 (0) 20 7201 1200

CQS (US), LLC

152 West 57th Street, 40th Floor, New York, NY 10019, US

T: +1 212 259 2900 | F: +1 212 259 2699

Tavistock Communications

18 St. Swithin's Lane, London EC4N 8AD

T: +44 20 7920 3150 | geigercounter@tavistock.co.uk

Sources: 1R&H Fund Services (Jersey) Limited, as at the last business day of the month indicated at the top of this report. 2R&H Fund Services Limited/DataStream, as at the last business day of the month indicated at the top of this report, total return performance net of fees and expenses based on bid prices. These include historic returns and past performance is not a reliable indicator of future results. The value of investments can go down as well as up. Please read the important legal notice at the end of this document. 3Market data sourced from Bloomberg unless otherwise stated. The Fund may since have exited some or all of the positions detailed in the commentary. 4 BMO, UxC, Company data September 2023. 5 www.eia.gov. 6CQS, as at the last business day of the month indicated at the top of this report. For methodology details see Article 4(3) of Directive 2011/61/EU (AIFMD) and Articles 6, 7, 9 and 10 of Delegated Regulation 231/2013. 7CQS, as at the last business day of the month indicated at the top of this report. For methodology details see Article 4(3) of Directive 2011/61/EU (AIFMD) and Articles 6, 8, 9, 10 and 11 of Delegated Regulation 3231/2013.

The Company has announced the fifth Subscription Rights Price of 37.20 pence on 1 May 2025. The exercise date for the fifth Subscription Right is expected to be 30 April 2026.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy. END DOCEAEFKASXSFFA

GAINERS

COMPANY SYMBOL LAST CHANGE PERCENT VOLUME

------- ------ ---- ------ ------- ------

Appili Therapeutics APLI 0.025 0.01 25.00 1,000

RTG Mining RTG 0.03 0.01 20.00 241,143

Black Iron BKI 0.12 0.02 14.29 278,436

Stingray Group Variable RAY.B 15.47 1.47 10.50 5,229

Wallbridge Mining WM 0.08 0.01 10.34 900,600

Enthusiast Gaming Hldgs EGLX 0.055 0.01 10.00 152,140

Genesis Land Development GDC 3.25 0.24 7.97 5,700

Medipharm Labs LABS 0.07 0.01 7.69 49,707

Stack Capital Group STCK 13.00 0.89 7.35 17,762

Condor Energies CDR 1.72 0.11 6.83 237,554

LOSERS

COMPANY SYMBOL LAST CHANGE PERCENT VOLUME

------- ------ ---- ------ ------- ------

Karnalyte Resources KRN 0.11 -0.02 -15.38 6,015

Energy Fuels EFR 18.59 -3.18 -14.61 1,761,713

Vizsla Silver VZLA 5.62 -0.95 -14.46 5,314,926

Charlotte's Web Holdings CWEB 0.12 -0.02 -14.29 25,839

Accord Financial ACD 2.42 -0.40 -14.06 35,913

Star Diamond DIAM 0.035 -0.01 -12.50 77,591

Mountain Province Diamond MPVD 0.035 -0.01 -12.50 37,000

Coppernico Metals COPR 0.23 -0.03 -11.54 81,675

Euro Sun Mining ESM 0.205 -0.03 -10.87 928,065

Robinhood Markets CDR HOOD 17.75 -2.12 -10.67 122,404

Only includes stocks with at least 1,000 shares traded today.

Data are delayed at least 15 minutes.

Source: Dow Jones Market Data

VANCOUVER, BRITISH COLUMBIA / ACCESS Newswire / November 18, 2025 / Prince Silver Corp. (OTCQB:PRNCF) ("Prince Silver" or the "Company") is pleased to announce the appointment of Mr. Derek Iwanaka as Chief Executive Officer of the Company. Mr. Iwanaka will be nominated for election to the Company's Board of Directors at its next annual general meeting, scheduled for December 23, 2025.

Mr. Iwanaka brings over 23 years of investor relations, corporate development, and capital markets experience in the mining industry. He has played key roles in advancing numerous public mining companies through various stages of growth, mergers, and project development. Over his career, he has contributed to more than 20 corporate transactions and has been instrumental in raising over US$100 million through equity financings, including one of the first at-the-market ("ATM") offerings executed by a Canadian brokerage firm.

Mr. Iwanaka most recently served as Vice President, Investor Relations and Corporate Development at BeMetals Corp., a precious and base metals exploration company founded largely by former B2Gold Corp. and Bema Gold Corp. executives. At BeMetals, he was part of the leadership team for its strategic acquisitions, project advancements, and investor engagement as the company established its diversified metals portfolio.

Prior to that, he was Vice President, Investor Relations at First Mining Gold Corp., where he helped guide the company's evolution from a mineral bank to a gold project developer in eastern Canada. During his tenure, First Mining completed seven corporate transactions, consolidating a large NI 43-101 compliant gold resource base and growing its market capitalization from approximately CAD$45 million to over CAD$500 million.

From 2010 to 2015, Mr. Iwanaka was Director of Investor Relations at Uranerz Energy Corp., a U.S.-based in-situ recovery uranium producer that completed a CAD$320 million business combination with Energy Fuels Inc. in 2015. Earlier in his career, he managed investor relations at Brilliant Mining Corp., a nickel producer recognized twice in the TSX Venture 50™, and began his career in 2002 with Bema Gold Corp., a mid-tier gold producer that was later acquired by Kinross Gold Corporation for US$3.1 billion.

Mr. Iwanaka holds a Bachelor of Commerce degree with a major in Marketing from the University of Northern British Columbia.

"We are excited to welcome Derek as our new CEO," said Ralph Shearing, President & Director of Prince Silver. "Derek's track record in building shareholder value, executing strategic transactions, and leading investor communications makes him a tremendous asset as we advance Prince Silver's vision. His leadership will be critical as we position the Company for its next stage of growth."

"I'm honoured to join Prince Silver at such a pivotal time in its evolution," said Derek Iwanaka, incoming CEO of Prince Silver. "With such a compelling precious metals assets located in one of the world's best mining jurisdictions, I look forward to working with the team to unlock value for shareholders and advance the Company's strategic objectives."

The Company also announces that it has extended the date of its annual general meeting which was previously scheduled to be held on December 16, 2025, to now be on Tuesday, December 23, 2025 at 11 a.m. Pacific Standard Time at Suite 2500 - 700 West Georgia Street, Vancouver BC V7Y 1B3. The record date for the meeting will remain unchanged at November 11, 2025.

About Prince Silver Corp.

Prince Silver is a silver exploration company focused on advancing the Prince Silver Project in Nevada, USA. The known deposit identified with historic drilling is open in all directions and is near surface. The Company also holds an interest in the Stampede Gap Project, a district scale copper-gold-moly porphyry system located ~15km north-northwest of the Prince Silver Project.

On Behalf of the Board of Directors

Ralph Shearing, Director, President

Tel: 604-764-0965

Email: rshearing@princesilvercorp.com

Website: www.princesilvercorp.com

Forward-Looking Information

Certain statements in this news release are forward-looking statements, including with respect to future plans, and other matters. Forward-looking statements consist of statements that are not purely historical, including any statements regarding beliefs, plans, expectations or intentions regarding the future. Such information can generally be identified by the use of forwarding-looking wording such as "may", "expect", "estimate", "anticipate", "intend", "believe" and "continue" or the negative thereof or similar variations. Some of the specific forward-looking information in this news release includes, but is not limited to, statements with respect to: completion of the Acquisition and related transactions, proposed drill programs, amendments to the Company's website, property option payments and regulatory and corporate approvals. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company, including but not limited to, business, economic and capital market conditions, the ability to manage operating expenses, dependence on key personnel, completion of satisfactory due diligence in respect of the Acquisition and related transactions, and compliance with property option agreements. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which the Company will operate in the future, anticipated costs, and the ability to achieve goals. Factors that could cause the actual results to differ materially from those in forward-looking statements include, the continued availability of capital and financing, litigation, failure of counterparties to perform their contractual obligations, failure to obtain regulatory or corporate approvals, exploration results, loss of key employees and consultants, and general economic, market or business conditions. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The reader is cautioned not to place undue reliance on any forward-looking information.

The forward-looking statements contained in this news release are made as of the date of this news release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

This news release does not constitute an offer to sell, or a solicitation of an offer to buy, any securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States or to U.S. Persons (as defined under the U.S. Securities Act) unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

SOURCE: Prince Silver Corp.

View the original press release on ACCESS Newswire

USA Rare Earth Inc. USAR stock has risen 5% since it reported third-quarter 2025 results last week. USAR posted a net loss of 25 cents per share, wider than the Zacks Consensus Estimate of a loss of six cents per share. Despite the loss, the market reacted positively to the company’s efforts in building an integrated mine to magnet manufacturing, given positive updates on its business and recently announced acquisition bid for Less Common Metals Ltd. (“LCM”).

USAR announced today that the LCM deal has received the clearance from the UK Minister of State, the only regulatory apporval required. The company expects to close the acquisition in the fourth quarter of 2025.

Year to date, USAR shares have gained, outperforming the Zacks Mining - Miscellaneous industry’s 25.2% growth, the Zacks Basic Materials sector‘s 20.8% rise and the S&P 500’s gain of 18%.

USA Rare Earth has, however, trailed other names in the rare earths space like MP Materials MP and Energy Fuels UUUU, which have advanced 297% and 205.7%, respectively, in the same timeframe.

USAR's YTD Price Performance vs Industry, Sector, S&P 500 & Peers

Before addressing the critical question of how investors should position themselves regarding the stock, let us first review the company’s third-quarter results.

USA Rare Earth’s Losses Widen on Higher Costs

USA Rare Earth is developing a rare earth sintered neo magnet (NdFeB) manufacturing plant in Stillwater, OK, which is expected to start production in early 2026. It also holds certain mining rights to the Round Top Mountain deposit near Sierra Blanca, TX, but has not begun mineral extraction.

The company has not generated any revenues since its inception and continues to incur losses from operations.

Selling, general and administrative expenses climbed to $11.4 million in the third quarter from $0.8 million in the year-ago quarter, driven by an increase in legal and consulting costs, higher headcount and recruiting fees and other costs. Research and development expenses were $4.45 million compared with $1.16 million due to an increase in employee-related expenses related to a rise in headcount, and other costs.

The absence of revenues and higher expenses, somewhat offset by higher interest and dividend income due to higher balances in its money market funds, led to the 25 cents per share loss in the quarter.

USAR’s Strategic Developments Strengthen Long-Term Outlook

USA Rare Earth ended the third quarter with $258 million in cash and no significant debt. The company received a $125 million common equity investment providing capital to execute its growth plans.

In a major strategic move, the company inked a deal to acquire LCM, a UK-based manufacturer of specialized rare earth metals and both cast and strip cast alloys. LCM is the only proven ex-China producer of both light and heavy rare earth permanent magnet metals and alloys at scale.

The acquisition will significantly accelerate USA Rare Earth’s mine-to-magnet strategy, establishing an end-to-end rare earth supply chain.

USA Rare Earth announced today that it has received the approval from the UK Minister of State for the LCM acquisition. With the only regulatory approval required now being cleared, USAR expects to close the acquisition in the ongoing quarter.

Meanwhile, the company maintained that the Stillwater, OK magnet facility remains on track for commercial-scale production in first-quarter 2026. USAR is also progressing toward pilot-scale testing of its swarf recycling flow sheet. This marks an important step in closing the loop between mining, processing and recycling. It also expects to complete the Pre-Feasibility Study for the Round Top development project in the second half of 2026.

The company has signed an agreement with Enduro Pipeline Services for the delivery of neo magnets in early 2026. USAR also entered into a joint development agreement with ePropelled to develop a strategic supply and purchase relationship of sintered neo magnets for use in the latter’s state-of-the-art motors.

How Did USA Rare Earth’s Peers Fare in Q3?

Energy Fuels reported a loss of seven cents per share in third-quarter 2025, in line with the year-ago quarter and beating the Zacks Consensus Estimate of a loss of eight cents. Energy Fuels’ revenues were reported at $17.7 million, surpassing the consensus estimate of $10 million. Energy Fuels had reported revenues of $4 million in the year-ago quarter.

MP Materials' total revenues declined 14.9% year over year to $53.6 million, beating the Zacks Consensus Estimate of $53 million. MP Materials reported a loss of 10 cents per share, narrower than the Zacks Consensus Estimate of a loss of 14 cents and the year-ago quarter’s loss of 12 cents.

USAR Headed for Losses in 2025 & 2026, Sees Downward Revisions

The Zacks Consensus Estimate for USA Rare Earth earnings for 2025 is currently pegged at a loss of 65 cents per share, reflecting the lack of revenues. The consensus estimate for earnings for 2026 is a loss of 41 cents per share. The revenue estimate is $31.50 million for 2026 as it is expected to start production.

Over the past 60 days, the estimates for USAR for both years have been revised downward, as shown below.

Our Final Take on USAR Stock

USA Rare Earth’s pending acquisition of LCM and the development of its Stillwater facility position it to become a key player in rebuilding the U.S. rare earth supply chain. While the company’s mine-to-magnet integration strategy is compelling, continued losses, lack of current revenues and estimated downgrades suggest that profitability remains a few years away.

Investors already holding the stock may stay invested, given the strong long-term potential and strategic progress. However, new investors may prefer to wait for a more favorable entry point once financial visibility improves. The stock currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

GAINERS

COMPANY SYMBOL LAST CHANGE PERCENT VOLUME

------- ------ ---- ------ ------- ------

Aberdeen International AAB 0.035 0.01 16.67 2,545

Aegis Brands AEG 0.295 0.04 15.69 142,000

Profound Medical PRN 9.38 1.01 12.07 31,484

Adcore ADCO 0.24 0.02 9.09 1,000

Kits Eyecare KITS 13.57 1.06 8.47 97,147

Enthusiast Gaming Hldgs EGLX 0.065 0.01 8.33 4,767

Calian Group CGY 52.42 3.81 7.84 30,823

Eupraxia Pharmaceuticals EPRX 9.24 0.56 6.45 68,706

Auxly Cannabis Group XLY 0.17 0.01 6.25 1,047,749

Marimaca Copper MARI 11.60 0.64 5.84 46,351

LOSERS

COMPANY SYMBOL LAST CHANGE PERCENT VOLUME

------- ------ ---- ------ ------- ------

Charlotte's Web Holdings CWEB 0.185 -0.03 -11.90 22,492

Corus Entertainment Cl B CJR.B 0.04 -0.01 -11.11 153,663

AppLovin CDR APPS 18.84 -2.07 -9.90 2,161

Minco Silver MSV 0.305 -0.03 -8.96 28,855

Colabor Group GCL 0.175 -0.02 -7.89 231,421

Verde AgriTech NPK 1.02 -0.08 -7.27 42,480

Pyrogenesis PYR 0.195 -0.02 -7.14 139,860

Energy Fuels EFR 21.55 -1.58 -6.83 455,287

Hut 8 HUT 61.61 -4.44 -6.72 728,400

Mega Uranium MGA 0.385 -0.03 -6.10 246,523

Only includes stocks with at least 1,000 shares traded today.

Data are delayed at least 15 minutes.

Source: Dow Jones Market Data

Energy Fuels UUUU reported third-quarter 2025 results on Tuesday, surpassing expectations. While revenues surged sharply, the company posted a net loss of $0.07 per share, matching the year-ago quarter and beating the Zacks Consensus Estimate.

Digging Deeper Into Energy Fuels’ Q3 Results

Total revenues came in at $17.7 million, soaring 337.6% year over year, driven by higher uranium sales, which offset the decline in prices.

During the quarter, UUUU sold 240,000 pounds of uranium (including a spot sale of 100,000 pounds) at an average $72.38 per pound, generating uranium revenues of $17.37 million. In the third quarter of 2024, the company had sold 50,000 pounds of uranium on the spot market at a realized sales price of $80.00 per pound, generating $4 million of uranium revenues.

Costs applicable to revenues surged 592% to $12.78 million due to higher uranium sold at elevated per-pound costs. Exploration, development and processing expenses soared 244% year over year to $12.4 million owing to higher indirect processing costs at the White Mesa Mill related to a higher headcount, development activities at the La Sal Complex, delineation drilling at Nichols Ranch and the Juniper zone at the Pinyon Plain mine as well as increased exploration activities at other locations.

Standby costs increased 53% year over year to $2.5 million due to advancing permitting and development on its Roca Honda Project and higher general maintenance costs. Selling, general and administration were up 109% year over year to $12.6 million, due to higher salaries and benefits on an increase in headcount, including employees retained from Base Resources following the acquisition on Oct. 2, 2024.

Despite the revenue surge, elevated expenses resulted in a loss of seven cents per share, unchanged from last year’s third quarter.

Energy Fuels ended the quarter with $298.5 million of working capital, including $94 million of cash and cash equivalents, $141.3 million of marketable securities, $12.1 million of trade and other receivables, $74.4 million of inventory, and no debt.

Looking Beyond the Loss: Key Developments in UUUU’s Q3

During the quarter, Energy Fuels mined ore containing approximately 465,000 pounds of uranium from its Pinyon Plain, La Sal and Pandora mines. Notably, the Pinyon Plain Mine continued to deliver strong results with an average grade of 1.27%, potentially positioning it as the highest-grade uranium mine in U.S. history.

The company has been making strides in Rare Earth Elements (REE) as well. In August, Energy Fuels produced its first kilogram of dysprosium (Dy) oxide at 99.9% purity, surpassing commercial benchmarks. The company has produced 29 kilograms of Dy oxide in its pilot circuit. Pilot production of Tb oxide is targeted for December 2025.

UUUU intends to construct and commission commercial-scale Dy, Tb and potentially samarium ("Sm") separation capacity at the White Mesa Mill, which could be operational by the fourth quarter of 2026.

In September, UUUU achieved a major milestone with its high-purity neodymium-praseodymium (NdPr) oxide being converted into commercial-scale rare earth permanent magnets (REPMs) by South Korea’s POSCO International Corp.

Energy Fuels also received final government approvals for the development of the Donald Project rare earth and critical mineral joint venture in Australia, along with receipt of a conditional Letter of Support from Export Finance Australia. This commits to up to A$80 million ($52 million) in senior debt project financing for developing the project.

How Did UUUU’s Peers Fare in Q3?

Cameco Corporation’s CCJ third-quarter 2025 total revenues were down 14.7% year over year to CAD 615 million ($446 million). Adjusted earnings rose 17% year over year to CAD 0.07 per share (five cents), falling short of the Zacks Consensus Estimate.

Cameco’s uranium revenues decreased 12.8% to CAD 523 million ($378 million) due to a 16% decline in sales volumes, somewhat offset by a 4% increase in average realized price.

Ur-Energy Inc. URG reported a loss of seven cents per share in the third quarter, missing the Zacks Consensus Estimate of a loss of three cents. The loss also came in wider than the year-ago quarter’s loss of two cents per share.

Ur-Energy sold 110,000 pounds of uranium during the quarter (sourced from previously purchased inventories) at an average price of $57.48 per pound. Ur Energy posted revenues of $6.32 million for the quarter, missing the Zacks Consensus Estimate of $7 million. This compares with year-ago revenues of $6.4 million.

Energy Fuels Issues Optimistic Outlook for 2025 & 2026

UUUU expects to mine 55,000-80,000 tons of ore containing approximately 875,000-1,435,000 pounds of uranium during 2025. It aims to process up to 1 million pounds of uranium this year.

It plans to sell 160,000 pounds of uranium in the fourth quarter of 2025, under its existing long-term contracts with utilities. Total uranium sales are targeted at 350,000 pounds in 2025 and 620,000-880,000 pounds in 2026, under its current portfolio of long-term uranium sales contracts. These ranges, however, exclude any potential spot sales the company may make if prices go up.

The company expects lower uranium costs starting in the fourth quarter of 2025 as it begins processing low-cost Pinyon Plain ores. Total weighted average cost of goods sold will go down to $23–$30 per pound of uranium, ranking among the lowest costs for mined uranium production in the world.

The company expects to lower the cost of goods sold to approximately $50-$55 per uranium sales for the remaining 2025 sales. The weighted average cost of goods sold is projected to drop to $30-$40 per pound in the first quarter of 2026. These trends are expected to boost gross margins.

UUUU Likely Headed for a Loss in 2025, Profit Expected in 2026

The Zacks Consensus Estimate for Energy Fuels’ earnings for 2025 is currently pegged at a loss of 33 cents per share. The estimate for revenues for the year is $40.80 million, indicating a 48% year-over-year decline.

The estimate for 2026 revenues is pinned at $133.55 million, implying a 227% year-over-year upsurge. The consensus estimate for earnings is pegged at seven cents per share. This will be UUUU’s first year of profit since it started trading on the NYSE in December 2013.

Over the past 60 days, the estimates for Energy Fuels for 2025 have remained unchanged, while those for 2026 have moved up.

Energy Fuels’ Stock Outperforms Industry & Peers

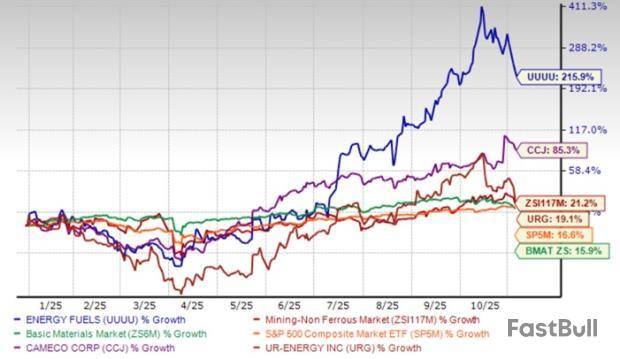

UUUU shares soared 215.9% year to date compared with the industry’s 21.2% growth. It has also outperformed the broader Zacks Basic Materials sector’s gain of 15.9% and the S&P 500’s climb of 16.6%. Energy Fuels has also outpaced Cameco and Ur Energy, which have gained 85.3% and 19.1%, respectively, year to date.

UUUU’s Valuation Looks Stretched

Energy Fuels is currently trading at a forward price-to-sales multiple of 31.27, well above the industry average of 3.47. UUUU’s Value Score of F suggests that the stock is not so cheap and indicates a stretched valuation at this moment.

Meanwhile, Cameco and Ur Energy are cheaper options, trading at price-to-sales ratios of 16.75 and 5.73, respectively.

Volatility in Uranium Prices a Concern for Energy Fuels

Uranium prices started this year at an average of around $69 per pound in January, which was well below the $100 levels last year. Prices had dipped to $63 in March but regained steam since then. In August, Cameco lowered its 2025 guidance and Kazatomprom reduced its output guidance by 10% for next year, triggering supply concerns and boosting prices to around $75 per pound. Prices had gained in September, hitting $83 levels. Prices have, however, slipped to $80 levels as concerns over supply have eased, with Kazatomprom reporting 33% growth rate in exports in the third quarter and a 10% increase in total output. This eased concerns of the earlier, tighter supply following its previous guidance.

In the event of low uranium prices, Energy Fuels abstains from making any uranium sales, which leads to revenue volatility.

UUUU Positioned for Long-Term Growth

Despite lower prices currently, the long-term outlook for uranium remains strong, driven by the growing push for clean energy. Also, the push for supply chains independent of China is a growth opportunity for UUUU. The White Mesa Mill in Utah, being the only U.S. facility able to process monazite and produce separated REE materials, gives the company an edge. Backed by its debt-free balance sheet, Energy Fuels is ramping up uranium production while developing significant REE capabilities.

Our Final Take on Energy Fuels Stock

Backed by Energy Fuels’ debt-free balance sheet, it is advancing with its growth plans to capitalize on the expected surge in uranium and REE demand. Those who already own the stock may stay invested, given UUUU’s solid long-term prospects in both these markets. However, given its premium valuation and the expected loss this year, new investors can wait for a better entry point.

The stock currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

(17:43 GMT) Energy Fuels Price Target Raised to $11.50/Share From $7.25 by Roth Capital

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up