Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Pump.fun, reportedly seeking to raise $1 billion through an initial coin offering, is considering sharing protocol revenue with prospective token holders, according to two sources familiar with the matter.

It remains unclear how much of the Solana-based memecoin platform’s revenue—if any—will be directed to the forthcoming PUMP token through the “buyback-powered utility structure.” It is also uncertain whether this would include revenues generated from PumpSwap, the decentralized exchange launched earlier this year. Pump.fun did not respond to multiple requests for comment.

According to The Block's data, Pump.fun’s daily revenue peaked at more than $7 million on Jan. 23, though it has since declined to about $1 million per day. The platform has generated roughly $677 million in cumulative revenue since its launch in early 2024, making it one of the most lucrative startups in the crypto space.

“Some of this stuff is subject to change, but the idea is to have a buyback tied to a portion of Pump revenue generated,” someone close to the founding team, who asked to remain anonymous, told The Block. “The plan is for tokens to unlock at the TGE for people who participate in the sale, private or public.”

Pump.fun first teased a token launch last October, when a then-anonymous co-founder said during an X Spaces event that the company was “planning to launch a token in the future” to “reward our earliest users.” Earlier this week, Blockworks reported the startup is preparing for an ICO at a $4 billion valuation. The company has neither confirmed nor denied that report, which has become a much-discussed issue across the crypto industry.

The PUMP token, which will be sold to both public and private investors, is expected to be fully unlocked at the token generation event, according to two sources familiar with the plan. There may be additional token issuances, though the total supply is expected to be capped at 1 trillion tokens.

The team is currently pitching private investors at $0.004 per token, with a public sale planned within two weeks, one source said. Part of the sale will reportedly take place on exchanges including Binance, and an airdrop is expected. Approximately 25% of the token supply will go to the public sale, with another 10% reserved for the airdrop, one source estimated.

"All the money we made so far is being reinvested back into the platform," the founder said in October. "We want to create something as big as Binance — bigger than that ... our goal is to bring this to the masses."

Pump.fun is often credited with helping to revive the Solana ecosystem, which was battered by the collapse of major SOL backer Sam Bankman-Fried. The potential ICO appears to have boosted recent user activity on Pump, which was marked by a significant decline since the start of the year. According to The Block’s data, the percentage of “graduated” tokens — those that see enough market activity to move onto an affiliated decentralized exchange — has spiked to over 4% from a recent low below 1%.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Based on a Whale Alert announcement via X, 2,542,712,471,794 Shiba Inu were sent from an unknown wallet to Coinbase Institutional, worth about $31,651,684 USD.

Moving a large number of SHIB tokens to Coinbase Institutional indicates that bigger investors and institutions are involved in the transaction. As a result, there might be an increase in demand from large token holders, known as whales, and this usually plays a part in affecting prices.

If a large number of investors buy the token, it could lead to a higher price. If other market conditions are positive, SHIB’s price could also rise. So, traders should monitor the situation as it may help them profit over the short term.

Some investors may decide to explore Shiba Inu further if they believe it can be a useful addition to their portfolio in the future. With Coinbase involved in the transfer, it could heighten the coin’s trustworthiness.

With a mystery surrounding the wallet and its owner, there is a chance that a major crypto investor is selling some of their assets. Monitoring how the market responds over the next few days could teach valuable lessons about supply, demand, and the impact of big transactions.

While risks remain, prices can swing both ways. But the potential for gains makes the trend worth watching.

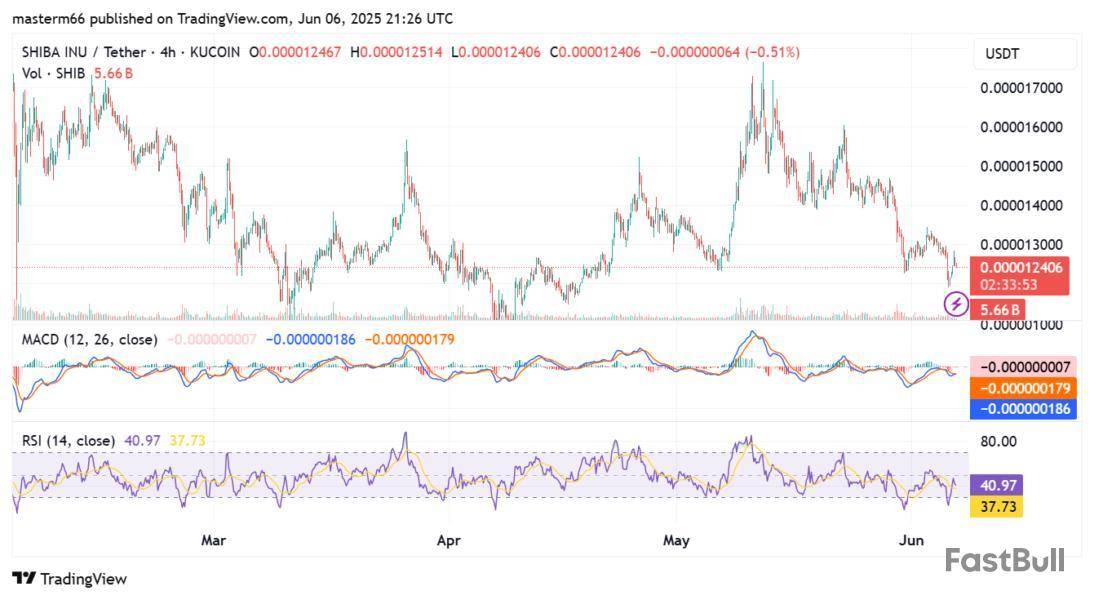

Shiba Inu shows a slight rise in value

TradingView’s chart for the 4-hour timeframe reveals that SHIB rose slightly and is currently trading at 0.000012482, an increase of just 0.10% over yesterday’s price.

TradingView">

Traders showed their even interest by recording 3.6 billion SHIB in the past 24 hours.

With an ADX indicator of 27.19, the trend for this token was slightly strong. At the same time, the MACD barely changed, and its histogram was at a small loss that rested very close to zero.

This signals that the token’s market is not heavily tilted in favor of the bulls or the bears for now. With no big changes in SHIB’s price, it indicates that it is consolidating for now.

The value of the RSI stands at 40.97, slightly crossing over the neutral level at 37.73. This means, that Shiba Inu can still gain value before being in the oversold area.

Knowing the position of the RSI gives traders the chance to decide if they should stay out of the market or plan their next action.

Exchange-traded fund (ETF) issuers VanEck, 21Shares and Canary Capital sent a letter to the US Securities and Exchange Commission (SEC) urging a return to the “first-to-file” principle of approving ETF applications in the order they were submitted to the regulator.

The companies argued that by failing to abide by the first-to-file principle, the default process for application approval until crypto ETFs debuted, the SEC diminishes healthy competition and hinders financial innovation. The letter reads:

“Continued global leadership of the United States in financial innovation is deeply connected to regulatory frameworks that actively support and reward entrepreneurship, creativity, and genuine innovation,” the letter continues.

Digital asset ETF filings accelerated following the inauguration of US President Donald Trump, as asset managers and crypto companies rushed to gain approval for new investment vehicles in anticipation of a friendlier regulatory climate in the US.

SEC delays decisions on staking, altcoin ETFs as applications multiply

Although institutional interest in altcoin and staking ETFs continues to grow and ETF filings continue to multiply, the SEC has delayed its decision on several altcoin and crypto-staking ETFs.

In May, the regulator postponed its decision deadline on listing Grayscale’s spot Solana Trust ETF to October.

SEC officials also delayed the approval of staking and XRP (XRP) ETFs in May, a development that did not surprise analysts.

“The SEC typically takes the full time to respond to a 19b-4 filing,” Bloomberg ETF analyst James Seyffart wrote in a May 20 X post.

“Almost all of these filings have final due dates in October. Early decisions are out of the norm,” the analyst wrote.

Additionally, the SEC recently responded to the effective registration statements for the REX-Osprey staked ETFs, raising concerns that the investment vehicles may not qualify as ETFs due to the business structure of the underlying fund.

This caused a delay in the ETF launch despite many analysts forecasting that the effective registration statements signaled imminent launches of these investment products.

The Tron network is seeing a disconnect between smart contract activity and TRX’s rising market value. The underlying asset, for its part, has climbed by more than 12% in the past month amidst a broader market recovery, and is currently trading at $0.275.

As token prices surge, questions are surfacing about whether on-chain fundamentals still matter – or if market sentiment has taken the driver’s seat.Smart Contract Growth Stalls

From 2017 to 2025, Tron’s ecosystem has undergone significant transformation, as reflected in the trajectory of its smart contract activity and the market price of its native token. In its early years (2017-2019), Tron experienced rapid growth. Both smart contract creation and TRX price surged, driven by strong investor interest and network excitement.

However, this early phase was followed by a period of stabilization, where contract deployment and price action flattened. A second wave of growth began in 2019, as the rise of DeFi sparked increased use of smart contracts across the ecosystem. TRX price responded positively, which, according to CryptoQuant, suggested a healthy relationship between on-chain activity and market valuation.

From 2022 onward, this alignment began to break down. While smart contract deployment showed signs of stagnation, as it became “sporadic and less sustained,” TRX’s price continued to rise, particularly through 2023 and 2024.

Such a divergence indicates that off-chain factors, including speculative sentiment or macro market conditions, have become stronger drivers of TRX’s value. Sharp but brief spikes in contract activity during this period are likely tied to isolated technical events or short-lived projects, rather than sustained ecosystem growth.

The ongoing decoupling between developer activity and price raises important questions about the network’s long-term health. While TRX maintains market momentum, the flat trend in smart contract creation could reflect declining developer interest or a maturing ecosystem with fewer novel deployments. The report further stated,

“Sustainable growth in both metrics likely depends on real-world utility and ongoing developer innovation. If the downward trend in contract deployment persists, it may be necessary to investigate what’s driving TRX’s price separation from core on-chain activity.”

While smart contract creation has shown signs of stagnation since 2022, user-level activity on the Tron network continues to rise.User Activity Surges on Tron

The network now averages over 8 million daily transactions. This figure was up more than 30% in the past four months and was largely driven by increased participation in existing services and decentralized applications. This divergence further indicates that while innovation may have slowed, demand for current offerings remains strong.

Additionally, TRX’s monthly transfer volumesurgedto an all-time high in May this year, reaching a whopping $132.4 billion.

Ethereum is up $102.01 today or 4.25% to $2501.35

Note: The Ethereum price is a 5 p.m. ET snapshot from Kraken

Data compiled by Dow Jones Market Data

The XRP price action is drawing significant attention, as analysts highlight a distinct wave structure suggesting increased volatility ahead. According to technical patterns on the XRP chart, the cryptocurrency could soon face wild fluctuations on its potential path to retesting its all-time high and aiming for the $4 mark.

XRP Wave Map Lays Out Path To A New ATH

The XRP price is currently trading at $2.13 after enduring a months-long downtrend that has prevented any upward movement toward revisiting all-time highs. However, despite these momentum struggles, a certified crypto and Elliott Wave analyst, XForceGlobal, has boldly predicted on X (formerly Twitter) that XRP is on a clear path toward a $4 all-time high.

The analyst shared a detailed Elliott Wave chart of XRP, suggesting that while the digital asset is poised for a new ATH, it is also set to face significant volatility on its way to this price high. The chart illustrates a well-defined pattern of corrective and impulsive wave structures that signal both short-term turbulence and long-term bullish potential for XRP.

XForceGlobal’s chart analysis begins by identifying a major correction that unfolded from XRP’s high in January through a low in April. This move is labeled with a complex wave formation, especially a double zigzag (W-X-Y), showing strong symmetry across multiple degrees of wave structures.

Interestingly, the analyst notes that the precision of these wave structures aligns almost perfectly with classic Fibonacci extension levels on the way down, including the 61.8% and 100% retracements. This indicates that the corrective cycle followed a technically sound and predictable path, leading to the conclusion that the worst of the downtrend may be over, and XRP could be entering a new wave sequence with bullish implications.

The chart analysis also highlights a critical accumulation zone marked between $1.84 and $2.25. This range coincides with Fibonacci Retracement thresholds and represents a crucial decision point in XRP’s price structure.

Recently, XRP dipped into this zone and appears to be bouncing off it, potentially setting the stage for the next impulsive wave higher. Based on this setup, XForceGlobal forecasts an initial rally toward the $3.20 and $3.80 zone, followed by a short-term correction and then an eventual push toward a fresh ATH near $4 or higher.

Analyst Predicts XRP Price In Next 3-6 Months

A crypto market expert identified as ‘Steph is Crypto’ on X has declared that an XRP price explosion is imminent. The analyst shared a chart, predicting that the cryptocurrency could soon skyrocket to a jaw-dropping all-time high of $50.

Notably, the chart indicates that this bullish projection will only occur after XRP crosses the $2.5 resistance threshold. From there, the path could see a steady ascent through $5, $10, and even $22, ultimately aiming for the ambitious $50 milestone.

What’s even more striking is the timeline of this bullish forecast—— Steph predicts that XRP could achieve a $50 valuation within just 3 to 6 months. If realized, this would amount to an astonishing 2,280% increase from the current price of nearly $2.1 before the end of the year.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up