Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Let’s dig into the relative performance of DocuSign and its peers as we unravel the now-completed Q2 productivity software earnings season.

Rising employee costs and the shift to more remote work has increased the ever-present pressure to improve corporate productivity, which in turn has driven rising demand for productivity software that enables remote work, streamline project management and automate business tasks.

The 17 productivity software stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 4.5% while next quarter’s revenue guidance was in line.

Luckily, productivity software stocks have performed well with share prices up 10.3% on average since the latest earnings results.

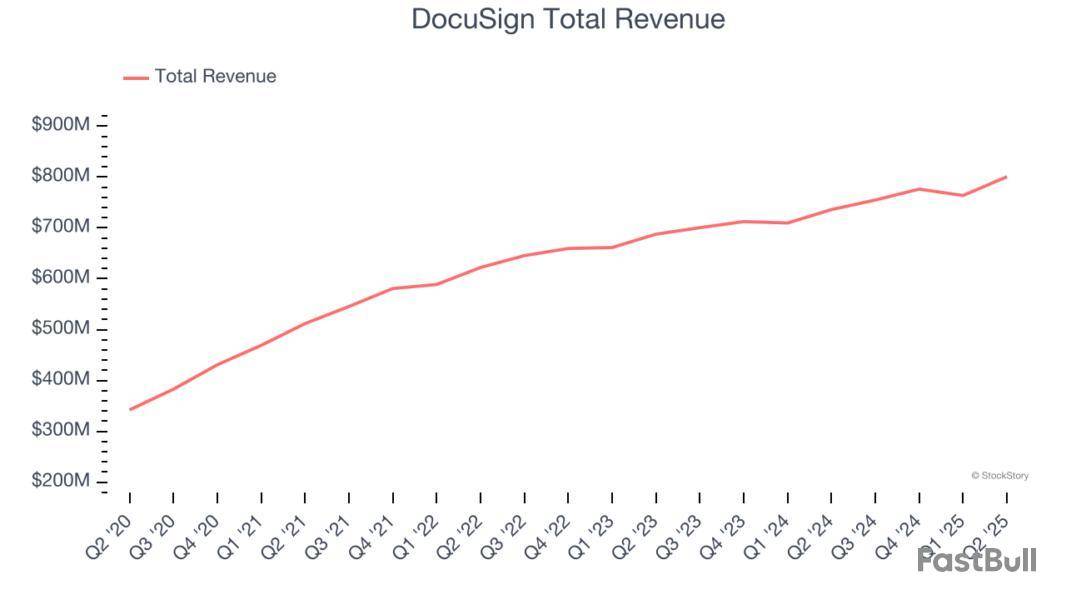

Creating the digital equivalent of "sign on the dotted line" for over a billion users worldwide, DocuSign provides an agreement management platform that enables businesses to electronically prepare, sign, and manage documents and contracts.

DocuSign reported revenues of $800.6 million, up 8.8% year on year. This print exceeded analysts’ expectations by 2.5%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ billings estimates and an impressive beat of analysts’ annual recurring revenue estimates.

"Q2 was an outstanding quarter, with AI innovation launches and recent go-to-market changes leading to strong performance across the eSignature, CLM, and IAM businesses," said Allan Thygesen, CEO of Docusign.

Interestingly, the stock is up 6.2% since reporting and currently trades at $81.

Is now the time to buy DocuSign? Access our full analysis of the earnings results here, it’s free.

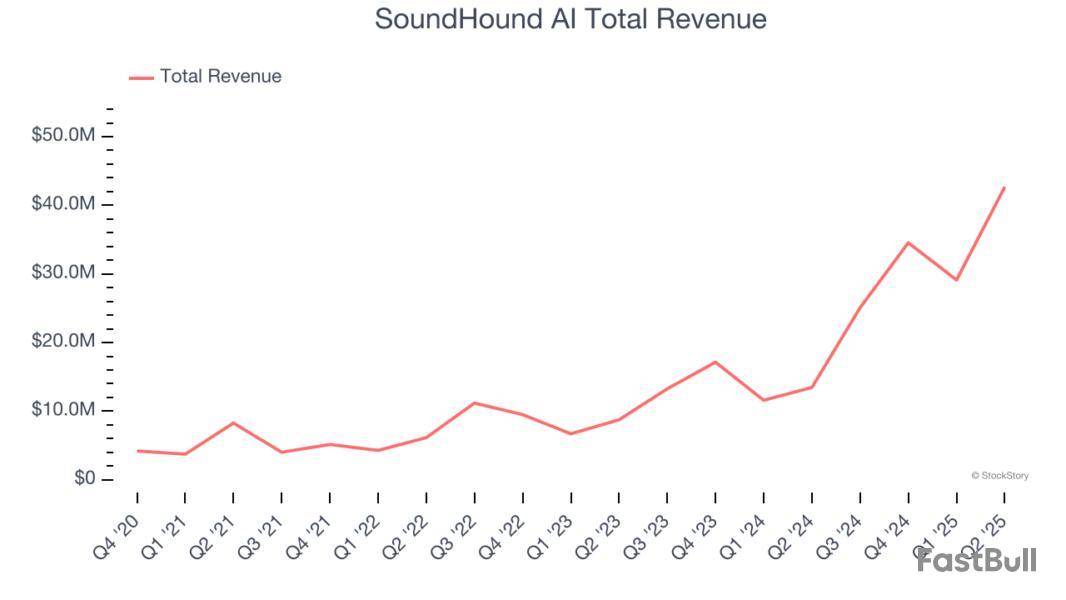

Born from the idea that machines should understand human speech as naturally as people do, SoundHound AI develops voice recognition and conversational intelligence technology that enables businesses to integrate voice assistants into their products and services.

SoundHound AI reported revenues of $42.68 million, up 217% year on year, outperforming analysts’ expectations by 31.2%. The business had an incredible quarter with a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

SoundHound AI delivered the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 33.5% since reporting. It currently trades at $14.35.

Is now the time to buy SoundHound AI? Access our full analysis of the earnings results here, it’s free.

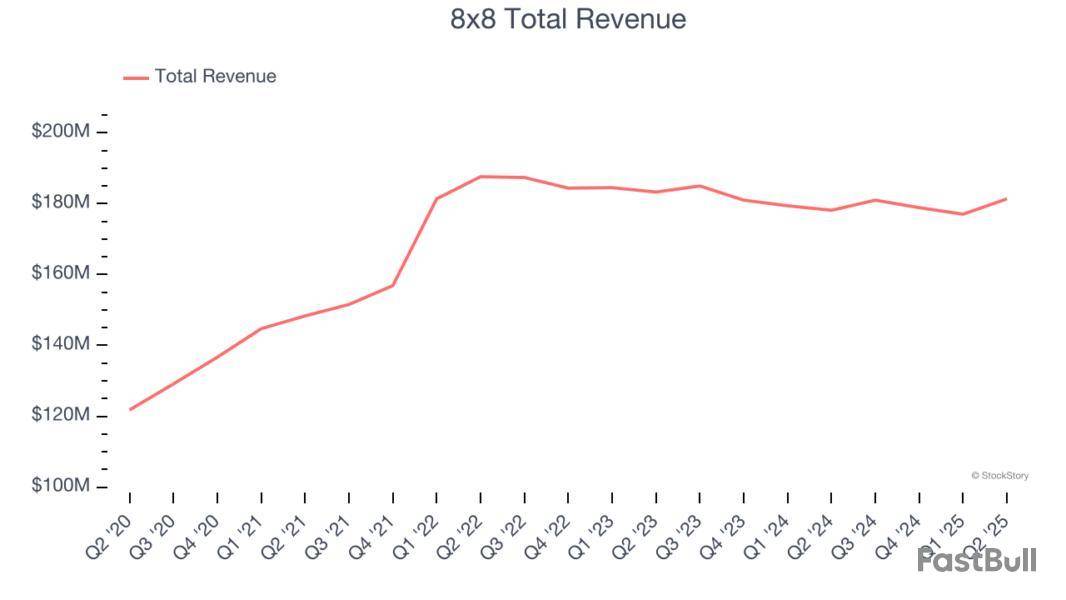

Named after its founding year (1987) with "8x8" representing binary code for communications, 8x8 provides cloud-based contact center and unified communications solutions that enable businesses to manage customer interactions and internal communications through a single platform.

8x8 reported revenues of $181.4 million, up 1.8% year on year, exceeding analysts’ expectations by 2.2%. Still, it was a mixed quarter as it posted a significant miss of analysts’ EBITDA estimates.

8x8 delivered the weakest full-year guidance update in the group. Interestingly, the stock is up 10.6% since the results and currently trades at $2.13.

Read our full analysis of 8x8’s results here.

Originally named "Micro-soft" for microcomputer software when founded in 1975, Microsoft is a global technology company that develops software, cloud services, devices, and AI solutions for consumers, businesses, and organizations worldwide.

Microsoft reported revenues of $76.44 billion, up 18.1% year on year. This result surpassed analysts’ expectations by 3.5%. Overall, it was an exceptional quarter as it also recorded a narrow beat of analysts’ revenue estimates, as Personal Computing, Intelligent Cloud, and Business Services all beat and an impressive beat of analysts’ operating income estimates.

The stock is flat since reporting and currently trades at $515.76.

Read our full, actionable report on Microsoft here, it’s free.

Born from the founders' frustration with the inefficiencies of email-based collaboration at Facebook, Asana provides a work management platform that helps organizations track projects, set goals, and manage workflows in a centralized digital workspace.

Asana reported revenues of $196.9 million, up 9.9% year on year. This print topped analysts’ expectations by 2%. It was a very strong quarter as it also put up EPS guidance for next quarter exceeding analysts’ expectations and a solid beat of analysts’ EBITDA estimates.

The company added 709 enterprise customers paying more than $5,000 annually to reach a total of 25,006. The stock is down 5.9% since reporting and currently trades at $13.40.

Read our full, actionable report on Asana here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

What Happened?

Shares of cloud communications provider 8x8 fell 5.2% in the afternoon session after investor concerns grew over its financial health and growth prospects following several downbeat financial reports.

Multiple analyses highlighted fundamental weaknesses within the company. Reports noted that 8x8's average billings growth over the last year was a weak 1.3%, with sales projected to remain flat over the next 12 months. Further compounding concerns, the company's revenue declined by 8% over the past year. The firm's balance sheet also came under scrutiny, with one report pointing to a "heavy debt load," evidenced by a high net debt to EBITDA ratio of 6.1. Profitability remains a challenge, with the company reporting negative earnings per share and a negative net margin, suggesting difficulties in managing costs effectively.

The shares closed the day at $2.11, down 5.2% from previous close.

The stock market overreacts to news, and big price drops can present good opportunities to buy high-quality stocks. Is now the time to buy 8x8? Access our full analysis report here, it’s free.

What Is The Market Telling Us

8x8’s shares are extremely volatile and have had 46 moves greater than 5% over the last year. In that context, today’s move indicates the market considers this news meaningful but not something that would fundamentally change its perception of the business.

The previous big move we wrote about was 3 days ago when the stock dropped 3.1% on the news that a significant downward revision in U.S. job creation data fueled concerns about a weakening labor market. The Bureau of Labor Statistics announced that the economy added 911,000 fewer jobs in the 12 months through March 2025 than previously reported. While this is a preliminary annual revision, it effectively halves the job growth previously thought to have occurred during that period. The update has amplified fears among investors that the job market is faltering. This weaker economic outlook is now reinforcing expectations that the Federal Reserve will cut interest rates to support the economy. According to the CME FedWatch Tool, the odds of a 25-basis-point rate cut at the next Fed meeting now stand at 90%, as a cooling labor market gives the central bank more reason to ease monetary policy.

JPMorgan Chase CEO Jamie Dimon added that the U.S. economy is "weakening," though he stopped short of predicting a recession. "Whether it's on the way to recession or just weakening, I don't know," he said. Dimon's remarks are closely watched given his influence as head of one of the nation's largest banks.

8x8 is down 21.1% since the beginning of the year, and at $2.10 per share, it is trading 39.5% below its 52-week high of $3.47 from February 2025. Investors who bought $1,000 worth of 8x8’s shares 5 years ago would now be looking at an investment worth $134.53.

Great things are happening to the stocks in this article. They’re all outperforming the market over the last month because of positive catalysts such as a new product line, constructive news flow, or even a loyal Reddit fanbase.

However, not all companies with momentum are long-term winners, and many investors have lost money by following short-term trends. On that note, here is one stock with the fundamentals to back up its performance and two best left ignored.

Two Momentum Stocks to Sell:

8x8 (EGHT)

One-Month Return: +17.8%

Named after its founding year (1987) with "8x8" representing binary code for communications, 8x8 provides cloud-based contact center and unified communications solutions that enable businesses to manage customer interactions and internal communications through a single platform.

Why Do We Think EGHT Will Underperform?

8x8’s stock price of $2.18 implies a valuation ratio of 0.4x forward price-to-sales. Dive into our free research report to see why there are better opportunities than EGHT.

NN (NNBR)

One-Month Return: -5%

Formerly known as Nuturn, NN provides metal components, bearings, and plastic and rubber components to the automotive, aerospace, medical, and industrial sectors.

Why Are We Out on NNBR?

At $2.28 per share, NN trades at 66.9x forward P/E. To fully understand why you should be careful with NNBR, check out our full research report (it’s free).

One Momentum Stock to Buy:

Nextracker (NXT)

One-Month Return: +22%

With its technology playing a key role in the massive 1.2 gigawatt Noor Abu Dhabi solar farm project, Nextracker is a provider of solar tracker systems that help solar panels follow the sun.

Why Is NXT a Good Business?

Nextracker is trading at $66.50 per share, or 17.4x forward P/E. Is now the time to initiate a position? Find out in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return).

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

Small-cap stocks can be incredibly lucrative investments because their lack of analyst coverage leads to frequent mispricings. However, these businesses (and their stock prices) often stay small because their subscale operations make it harder to expand their competitive moats.

These trade-offs can cause headaches for even the most seasoned professionals, which is why we started StockStory - to help you separate the good companies from the bad. Keeping that in mind, here are three small-cap stocks to swipe left on and some alternatives you should look into instead.

8x8 (EGHT)

Market Cap: $282.3 million

Named after its founding year (1987) with "8x8" representing binary code for communications, 8x8 provides cloud-based contact center and unified communications solutions that enable businesses to manage customer interactions and internal communications through a single platform.

Why Do We Steer Clear of EGHT?

At $2.03 per share, 8x8 trades at 0.4x forward price-to-sales. Check out our free in-depth research report to learn more about why EGHT doesn’t pass our bar.

CSG (CSGS)

Market Cap: $1.78 billion

Powering billions of critical customer interactions annually, CSG Systems provides cloud-based software platforms that help companies manage customer interactions, process payments, and monetize their services.

Why Is CSGS Risky?

CSG is trading at $64.81 per share, or 13.2x forward P/E. Dive into our free research report to see why there are better opportunities than CSGS.

AvidXchange (AVDX)

Market Cap: $2.06 billion

Born from the frustration of paper-based accounting processes in the early 2000s, AvidXchange provides accounts payable automation software and payment solutions that help middle-market businesses digitize and streamline their invoice processing and payments.

Why Is AVDX Not Exciting?

AvidXchange’s stock price of $9.92 implies a valuation ratio of 36.1x forward P/E. Check out our free in-depth research report to learn more about why AVDX doesn’t pass our bar.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return).

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

Looking back on video conferencing stocks’ Q2 earnings, we examine this quarter’s best and worst performers, including 8x8 and its peers.

Work is becoming more distributed, both across geographies and devices. In order for businesses to keep functioning efficiently, they need to be able to communicate as well as they did when the teams were co-located, which drives the demand for integrated communication platforms.

The 4 video conferencing stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 1.8% while next quarter’s revenue guidance was in line.

Luckily, video conferencing stocks have performed well with share prices up 11.4% on average since the latest earnings results.

Named after its founding year (1987) with "8x8" representing binary code for communications, 8x8 provides cloud-based contact center and unified communications solutions that enable businesses to manage customer interactions and internal communications through a single platform.

8x8 reported revenues of $181.4 million, up 1.8% year on year. This print exceeded analysts’ expectations by 2.2%. Despite the top-line beat, it was still a mixed quarter for the company with an impressive beat of analysts’ billings estimates but a significant miss of analysts’ EBITDA estimates.

"Our return to growth this quarter validates the strength of our platform strategy and our alignment with how organizations are engaging customers—intelligently, flexibly, and at scale. We’re executing with purpose, and it’s paying off: product adoption has expanded, consumption-based revenue has accelerated, and we’re building a business that’s not just growing but creating long-term value for shareholders," said Samuel Wilson, Chief Executive Officer at 8x8.

8x8 delivered the slowest revenue growth and weakest full-year guidance update of the whole group. Interestingly, the stock is up 2.9% since reporting and currently trades at $1.98.

Read our full report on 8x8 here, it’s free.

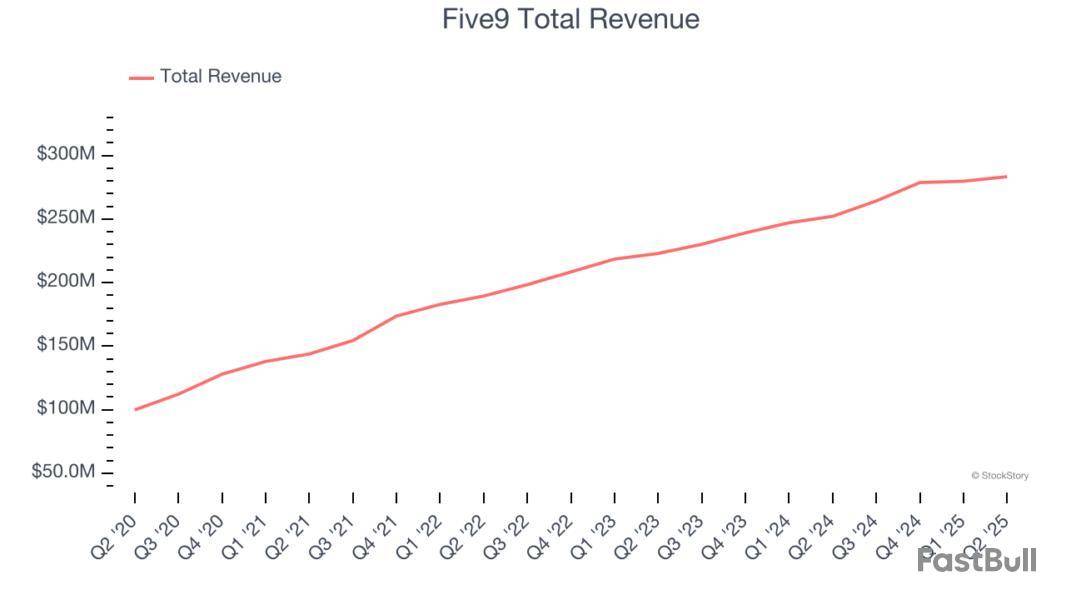

Taking its name from the "five nines" (99.999%) standard for optimal service reliability in telecommunications, Five9 provides cloud-based software that enables businesses to run their contact centers with tools for customer service, sales, and marketing across multiple communication channels.

Five9 reported revenues of $283.3 million, up 12.4% year on year, outperforming analysts’ expectations by 2.9%. The business had a very strong quarter with a solid beat of analysts’ EBITDA estimates and full-year EPS guidance exceeding analysts’ expectations.

Five9 pulled off the biggest analyst estimates beat and fastest revenue growth among its peers. However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $26.06.

Is now the time to buy Five9? Access our full analysis of the earnings results here, it’s free.

Built on its proprietary Message Video Phone (MVP) platform that unifies multiple communication methods, RingCentral provides AI-driven cloud communications and collaboration solutions that enable businesses to connect through voice, video, messaging, and contact center services.

RingCentral reported revenues of $620.4 million, up 4.6% year on year, in line with analysts’ expectations. Still, it was a satisfactory quarter as it posted an impressive beat of analysts’ EBITDA estimates.

RingCentral delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 29.3% since the results and currently trades at $30.53.

Read our full analysis of RingCentral’s results here.

Once the verb that defined remote work during the pandemic ("let's Zoom later"), Zoom provides a cloud-based platform for video meetings, phone calls, team chat, and collaboration tools that helps businesses and individuals connect virtually.

Zoom reported revenues of $1.22 billion, up 4.7% year on year. This result topped analysts’ expectations by 1.8%. Overall, it was a strong quarter as it also recorded an impressive beat of analysts’ EBITDA estimates and full-year EPS guidance exceeding analysts’ expectations.

Zoom delivered the highest full-year guidance raise among its peers. The company added 82 enterprise customers paying more than $100,000 annually to reach a total of 4,274. The stock is up 12.6% since reporting and currently trades at $82.50.

Read our full, actionable report on Zoom here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up