Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Bitcoin price and the crypto market remain under pressure as the sector enters a low volatility period. While a lot of traders were expecting a big move yesterday, following the US Federal Reserve (Fed) decision on rate cuts, the cryptocurrency held its current levels.

Despite the relative resilience in the top crypto and other cryptocurrencies, the Bitcoin price is showing signs of potential downside. At the time of writing, BTC trades at around $105,000 with a 2.3% decline over the past seven days.

Bitcoin Price’s Stuck, But Not for Long?

Analyst Daan Crypto shared insights regarding the current Bitcoin price action. The analyst believes that BTC has been compressing over the past weeks. In that sense, a lot of traders are expecting a spike in volatility.

As seen on the image below, the Bitcoin price has been trading within a tight range form by its monthly high sitting at $110,600 and a monthly low at around $100,000. Within this range, there are two key levels to watch: the area between $109,000 and $103,000.

A breakout or breakdown from this range might signal the return of volatility to the Bitcoin price action. Thus, the cryptocurrency might reclaim or return to either or the previously mentioned levels on higher timeframes.

The analyst stated the following:

BTC Still hanging around the $105K area which is the middle of the monthly range and right at the monthly open. Price has been compressing and it’s clear that the market is waiting for a big move to occur. The statistics still heavily favor a further displacement this week and especially this month. So keep an eye on these levels and play accordingly.

On a separate report, trading desk QCP Capital claims that the Bitcoin price might be affected by ‘summertime blues.’ In other words, the firm predicts a decline in volatility as institutions and traders exit the market over July and August.

QCP Capital claims that there are signs of this sluggishness affecting the market, including BTC’s implied volatility. This indicator is currently sitting below 40%. In addition with a hawkish Fed, the trading desk predicts more dull price action over the coming weeks and caution amongst operators:

(…) the Fed held interest rates steady. But its stance remains hawkish. Inflation expectations are still elevated, with tariffs flagged as a key upside risk. The Fed prefers to “wait and see” until there is more clarity on inflation’s path. While some macro watchers expect softening labor and economic data to eventually push the Fed dovish, the current numbers say otherwise.

Cover image from ChatGPT, BTC/USD chart from Tradingview

Blockchain monitoring firm Whale Alert has identified a massive transfer of 26,671,734 XRP ($58,002,329) into leading U.S.-based crypto exchange Coinbase on June 19.

XRP has remained in the spotlight in recent days due to its ongoing legal battle with the SEC and the recent launch of an XRP ETF in North America.

As such, the large XRP transfer today has sparked debates. Significant crypto transfers to exchanges like Coinbase are often seen as a sign that a whale may be preparing to sell off assets.

XRP whale activity sparks concerns

The massive XRP transfer comes after a period of high volatility in the broader crypto market, with prices of leading cryptocurrencies dropping to unexpected lows.

Although the market has begun to show slight signs of recovery, the large transfer has raised concerns among investors. Given the market's current fragile state, both retail and institutional players are closely watching on-chain movements.

According to Whale Alert, the massive XRP transfer was executed by an unknown wallet address in a single transaction, suggesting a possible sell-off attempt.

Notably, the multi-million-dollar XRP transfer, which occurred during the late hours of the day, has stirred concern within the XRP community, especially since the motive behind the move remains unclear.

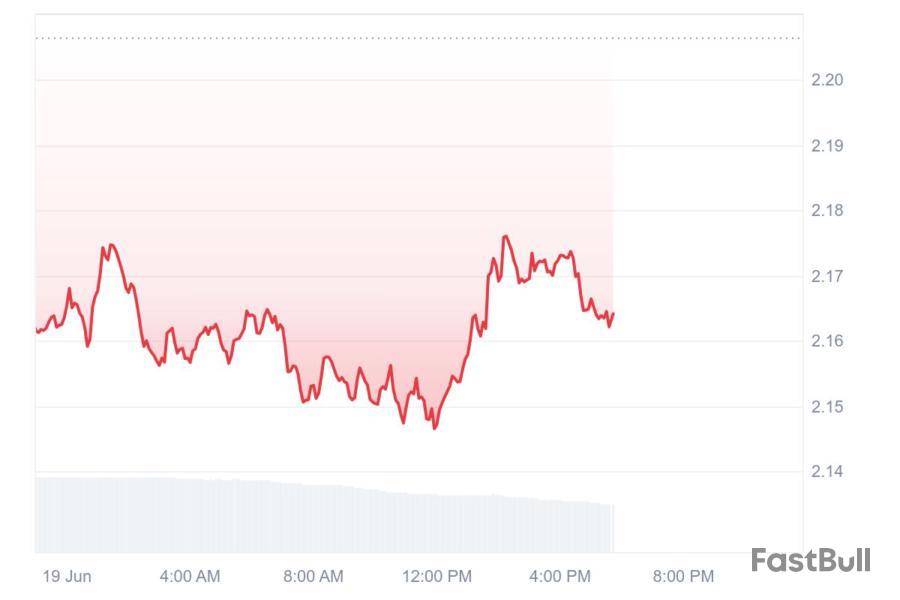

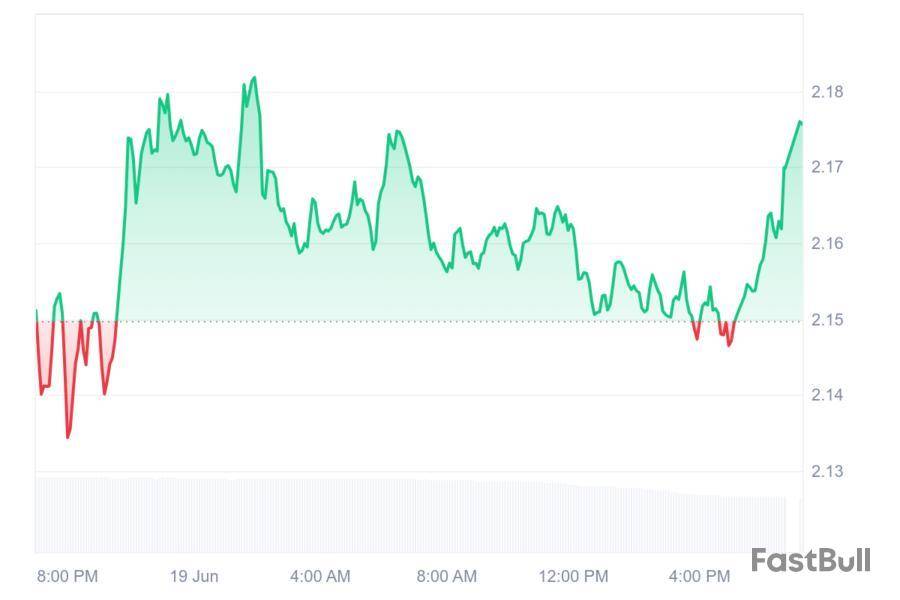

Following the transfer, XRP has continued to show signs of weakness, with both whales and retail holders potentially offloading their tokens. Over the past 24 hours, CoinMarketCap data indicates that XRP experienced a 0.36% price drop, following heavier losses seen the previous day.

CoinMarketCap ">

As of press time, XRP is trading at $2.16, with a notable 36.57% decrease in its overall trading volume from the day before.

While the move aligns with the broader downtrend in the crypto market, investors are left wondering whether this transfer will lead to a sharper price decline or set the stage for a possible rebound.

The latest Coinglass data indicates that the market is moving in a different direction, and XRP traders are more positive about its price movement.

At the time of writing, the long position was 55.06% of total trades and the short position was 44.94%, while the long/short ratio is currently 1.2252.

A sign of increased confidence

The increase in longs indicates greater optimism among traders that XRP will increase in price. A long/short ratio of more than 1 is usually an indication of bullish prospects.

It suggests that market participants are willing to hold onto XRP in anticipation of gains rather than betting on a decline. The chart shows a sharp uptick in this ratio, confirming growing optimism.

Over the past few days, this ratio has fluctuated near the neutral zone, mostly balanced between buyers and sellers. But the recent changes show that traders are no longer undecided. Instead, they are leaning toward a breakout or upward momentum in XRP’s price.

A higher long/short ratio doesn’t guarantee a price rise, but it reflects market confidence. When confidence builds, momentum often follows. That can trigger stronger buying interest and create opportunities for entry before a potential move.

Bullish sentiment builds ahead of potential XRP price breakout

Traders could also benefit from this kind of setup. A market with more longs and fewer shorts can sometimes push prices higher during quick rallies. It is important to pay attention to price movement, particularly when other bullish indicators align in the same direction.

XRP has not yet made a significant price move, but sentiment is shifting and that is often a sign that price is about to change.

CoinMarketCap shows the current price of XRP to be $2.17, with a 1.73% increase in the last 24 hours. XRP traded at around $2.15–$2.18 in the price chart during this period, showing a consolidation phase.

Its trading volume, however, has declined by 26.47% to $2.11 billion. This indicates that investor confidence is still present, but short-term trading has slowed.

Meanwhile, Purpose Investment has announced that it will not request any management fee for its new product (the spot XRP ETF).

Earlier, the tightening of the Bollinger Bands for this cryptocurrency on the daily timeframe hinted that an XRP rebound may be happening soon.

BingX listing for TAGGER may give a chance for big price action. New exchange access often brings new buyers and more attention. TAG concerns both content and AI, which could be a strong trend now. If traders from BingX are interested, price may go up. But sometimes listings cause a fast jump and then a fast drop, as early holders might sell their tokens right away. Check if BingX brings new investors or just short-term trading. Longer price growth needs real demand, not just hype from the listing. source

BingX@BingXOfficialJun 19, 2025Where content meets compensation. $TAG is coming soon to BingX Spot. @taggerai

Deposit Time: 2025-06-19, 12:00:00 (UTC+0)

Trading Time: 2025-06-20, 10:00:00 (UTC+0)

Withdrawal Time: 2025-06-21, 10:00:00 (UTC+0)

Listing details: https://t.co/OSc1fnStKh pic.twitter.com/Gtasi2kacH

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up