Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Phala Network will host a community call on May 7th at 15:00 UTC, where representatives of CrunchDAO will discuss the collaboration between the two projects.

PHA Info

Phala Network is a confidential platform built on the Polkadot Substrate for data processing. The platform was created with the aim of ensuring privacy and security in the decentralized world, enabling users to control and protect their data.

Phala Network employs unique encryption technologies to safeguard data, and its structure ensures maximum confidentiality in data processing. The protocol processes data in such a way that no party has complete control over the information. This makes it an ideal solution for privacy in decentralized finance (DeFi), personal data processing, and other applications that require a high level of confidentiality.

Phala Network operates on two types of nodes: TEE (Trusted Execution Environment) workers and Gatekeepers. TEE workers, operating on tamper-proof processors, execute confidential contracts and ensure decentralization, robust operation, and censorship resistance. On the other hand, Gatekeepers maintain the Phala blockchain, managing the keys for miners essential for confidential contracts, verifying the security of workers’ hardware and software, and managing the state by recording transactions. Both contribute to a secure and efficient network operation.

The platform’s native token, PHA, plays a key role in the ecosystem. The token can be used for staking and voting in the decentralized autonomous organization (DAO) governance system, providing users with the opportunity to participate in decision-making about the project’s future. PHA is also used to reward network participants for their contributions to the security and stability of the network.

TRON will host a community call on May 7th at 07:00 UTC featuring recently elected super representatives, updates from the TRON Builder League and insights from recent conferences.

The session will include representatives from Nansen, P2P.org, Kiln and Luganodes, who are expected to discuss developments within the network’s infrastructure and community governance.

TRX Info

Tron (TRX) is a blockchain project designed to enable the creation of decentralized applications (dApps). Originally built on the Ethereum blockchain in 2017, Tron later migrated to its own network protocol. The Tron network offers high throughput and scalability, making it suitable for applications with a high volume of transactions, such as gaming and social media platforms.

One of the unique features of Tron is its three-layer architecture, consisting of the storage layer, the core protocol layer, and the application layer. This architecture provides great flexibility for developers and allows the creation of complex and functional applications.

The TRX token serves as the primary asset within the Tron network and is used to manage network resources, participate in voting, pay fees, and earn rewards through staking.

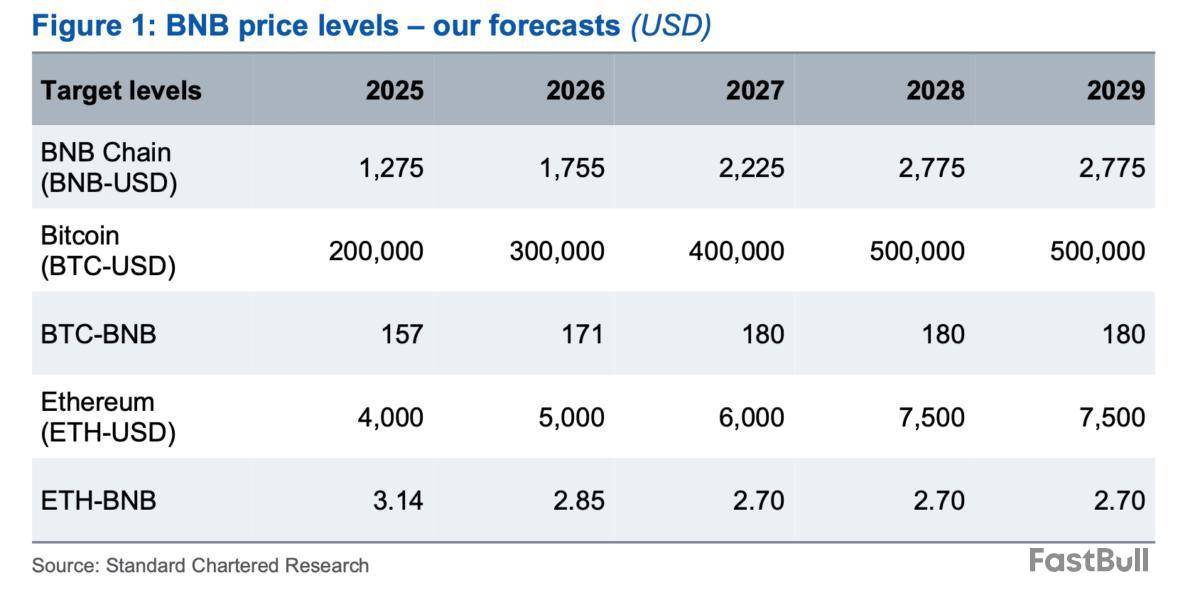

Standard Chartered has initiated coverage on Binance's BNB token, forecasting its price to climb to $2,775 by the end of 2028 — a gain of over 360% from current levels.

"BNB has traded almost exactly in line with an unweighted basket of Bitcoin and Ethereum since May 2021 in terms of both returns and volatility," Geoffrey Kendrick, Standard Chartered's global head of digital assets research, wrote in a report published Tuesday and shared with The Block. "We expect this relationship to continue to hold, driving BNB's price from around $600 currently to $2,775 by end-2028."

Kendrick views BNB as a benchmark-like asset within the crypto market. While it may underperform bitcoin and ether both in real terms and as measured by market cap in circulation, BNB’s deflationary nature and its link to Binance's centralized exchange support its long-term value, according to Kendrick.

'BNB Chain is highly centralised relative to other chains'

BNB Chain, Binance's Layer 1 blockchain, uses a consensus model called "proof of staked authority," where just 45 validators are elected every 24 hours based on staked token amounts. This setup makes BNB Chain far more centralized than peer networks like Ethereum, which has over a million validators, Kendrick said.

BNB Chain's centralized structure and stagnant use cases since the 2021 DeFi boom have resulted in very low developer activity compared to peers like Avalanche and Ethereum, Kendrick noted. He added that upgrades such as the recent Pascal hard fork and the upcoming Maxwell upgrade in June could help improve developer engagement over time.

Still, the BNB token maintains strong user demand, supported by its integration with Binance's centralized exchange, where token holders receive trading fee discounts based on their BNB balance and volume, Kendrick said. This exchange-linked utility, along with the dominance of decentralized exchanges like PancakeSwap within BNB Chain, has helped the BNB Chain retain activity even as competition from other ecosystems like Solana grows, Kendrick noted.

BNB also benefits from a deflationary supply model and token burn mechanisms, Kendrick said. The token currently trades "rich" on Standard Chartered's preferred valuation metric for smart contract Layer 1 platforms — market cap-to-GDP — likely due to both its exchange tie-ins and its deflationary nature, Kendrick said.

Kendrick has made a string of crypto predictions in recent months. He expects bitcoin to reach $200,000 by the end of 2025 and $500,000 by the end of 2028. Kendrick sees Avalanche's AVAX token climb more than tenfold to $250 by 2029 and sees XRP hitting $12.50 by 2028, representing a gain of over 500%. Meanwhile, he revised his ether forecast downward, setting a 2025 target of $4,000. He also anticipates a surge in stablecoin adoption, projecting the total market to approach $2 trillion by the end of 2028.

Kendrick told The Block last month that neither he nor Standard Chartered’s crypto research team holds any digital assets.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Ripple, the blockchain technology company, has announced a significant commitment of $25 million aimed at supporting US classrooms and teachers.

This initiative is designed to equip both students and educators with essential resources to improve academic outcomes, foster economic resilience, and prepare for a rapidly changing job market.

Ripple’s $25 Million Initiative

Despite the known correlation between educational success and long-term economic opportunity, the blockchain payment company stated on Monday that many classrooms across the country continue to struggle with inadequate resources.

Ripple highlighted a recent Gallup survey that revealed that 55% of US parents and adults expressed dissatisfaction with K-12 education quality, alleging widespread concerns about funding constraints in the education sector.

Ripple’s pledge seeks to address these challenges by providing critical support to students, teachers, and school staff, ultimately helping to rebuild confidence and drive positive results in the classroom.

“Ripple has always championed financial and educational access for all, and we’re partnering with some of the most impactful organizations—DonorsChoose and Teach For America—to benefit thousands of classrooms across the US,” said Brad Garlinghouse, CEO of Ripple.

He emphasized the hope that this initiative will inspire others to contribute, starting with Teacher Appreciation Week and continuing throughout the year to ensure that educators and students have the necessary resources to create a brighter future.

In a unique approach, the majority of the $25 million grant will be disbursed in Ripple USD (RLUSD), the company’s US dollar-backed stablecoin.

Educational Opportunities For Students

Ripple’s partnerships with these organizations will focus on a range of innovative initiatives throughout the year. This includes funding for thousands of classroom projects and teacher requests during Teacher Appreciation Week, supporting Teach For America’s Ignite tutoring program nationwide, and launching a national STEM Innovation Challenge.

Additionally, Ripple unveiled that the collaboration aims to enhance financial literacy among students and educators, equipping them with the skills necessary for success in a dynamic job market.

“Teachers are going the extra mile for their students’ education, even spending hundreds—sometimes thousands—of dollars out-of-pocket for their classrooms,” said Alix Guerrier, CEO of DonorsChoose.

He praised Ripple’s initiative for providing direct support to teachers, enabling them to access materials that enhance learning experiences and set students on a path to a successful future.

Aneesh Sohoni, CEO of Teach For America, expressed gratitude for Ripple’s transformative support. “This funding will expand our Ignite Tutoring Fellows program, drive innovation in our Reinvention Lab, and provide crucial financial assistance to thousands of new corps members during their teacher preparation. With Ripple’s partnership, we’re advancing our mission to ensure every child has access to an excellent education and the opportunity to thrive.”

At the time of writing, XRP, Ripple’s related token, is trading at $2.13, down 8% for the week.

Featured image from DALL-E, chart from TradingView.com

Benchmark has initiated coverage on Nasdaq-listed Canaan (ticker: CAN) with a “buy” rating and a $3 price target, calling the micro-cap bitcoin miner a long-term value play trading at a steep discount.

Equity analyst Mark Palmer cited Canaan’s vertically integrated business model — combining bitcoin mining hardware production with its own proprietary mining operations — as a key differentiator poised to benefit from rising bitcoin prices.

"CAN's vertically integrated approach differentiates it within the bitcoin mining space while positioning it to capitalize on both chip/rig sales and proprietary mining revenues," Palmer wrote in a note to clients. "We believe the company’s ADRs are very inexpensive...and expect their price to appreciate as it executes on its strategy, with a potential tailwind coming from the rising price of bitcoin."

Canaan, which introduced the first ASIC-powered bitcoin mining rigs in 2013 under its Avalon brand, recently began mass delivery of its A15 series machines. The company sold a record 9.1 million TH/s in the fourth quarter, up 66% year-over-year, with equipment revenue hitting a two-year high of $73 million. Canaan also completed the tape-out of its next-generation A16 series, which is expected to deliver up to 300 TH/s in its standard air-cooled configuration.

The company is also scaling its self-mining operations. While only 16.3% of 2024 revenue came from self-mining, Canaan aims to boost its computing power to 10 EH/s in North America and 15 EH/s globally by mid-2025, up from 3.02 and 8.11 EH/s, respectively, as of March 31.

Canaan is also expanding into the consumer market with the Avalon Q, a professional-grade miner designed for residential use. The device delivers up to 90 TH/s and features adjustable power consumption and low-noise operation, positioning the company to diversify its revenue base.

The company's bitcoin holdings provide an additional valuation floor. As of March 31, Canaan held 1,408 BTC, valued at approximately $133 million, equivalent to nearly 70% of its market capitalization. With shares currently trading at 0.2 times projected 2025 revenue, Palmer said the stock appears meaningfully undervalued relative to peers.

Canaan's stock trades around $0.60 per share with a market cap of $245 million. The stock is down more than 30% over the past year.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Solana has emerged as a leader in blockchain infrastructure, attracting attention for both its speed and the breadth of its decentralized financial applications. As competition in the staking and MEV landscape intensifies, new solutions are charting the future of the validator economy.

BeInCrypto interviewed Brian Smith, Executive Director of Jito Foundation, during TOKEN2049 Dubai. Smith discussed Jito’s strategy, its place at the heart of Solana’s MEV infrastructure, and the pivotal choices underpinning its continued growth.

Smith oversees Jito’s products and governance, including its innovative liquid staking solution JitoSol, restaking initiatives, and MEV tooling. At the interview, he shared his views on decentralization, building trust, responsible MEV participation, and fostering institutional adoption to drive Solana’s DeFi ecosystem forward.

This conversation offers a close look at how Jito tackles network scalability, transparency, governance, and the introduction of disruptive primitives while focusing on sustainable value for the community.

Jito’s Role in the Solana Validator Economy and MEV Innovation

I think that Jito is just the core infrastructure for the economic engine of Solana. And you see this across a few products with the original kind of MEV product that was completely novel for Solana at the time.

Then also the leading stake pool, Jito Sol, that helps distribute staking rewards as well as MEV rewards to stakers, and now restaking, which is kind of a third layer on top. So as you see, just economic value flows across Solana, then Jito wants to be on the cutting edge of helping to power that in the most decentralized way possible.

Specifically on the MEV side, the product has worked quite well. It’s distributed over $1 billion in value to stakers and validators to help secure the network and a revenue stream that didn’t really exist when it was launched. And so personally, that’s been really, really interesting to see.

It has 95% of network adoption, but the Solana market is evolving quite rapidly, mostly in response to just how successful Solana has been. So volumes are consistently at all time highs. The most volume of any network in crypto, which is incredible.

And we see a lot of new technologies and new strategies being deployed on-chain. I personally think that it’s critical for Solana’s MEV infrastructure to stay ahead of that and continue to evolve. That looks like making the software more transparent so that everyone can kind of see how these transactions, specifically Jito executed or submitted transactions, are being prioritised.

And then also more attribution about what validators are doing. And so that’s really the critical idea, is just continuing to innovate on Solana and improving the transparency of the system while continuing to provide best in class rewards for all constituents on Solana.

JitoSOL and Liquid Staking: Differentiators, Growth, and DeFi Integration

JitoSol today is the largest LST on Solana by a decent share, with 17.5 million Sol, which is a little over $2.5 billion of TVL.

And I think it’s innovated in a few ways. It has best in class DeFi penetration in terms, there’s a lot of LSTs on Solana given its interesting market structure, but it’s quite fragmented. And so a lot of those are usable in some liquid staking protocol or some DeFi protocols, not others.

So JitoSol has by far the deepest liquidity, which is really critical given liquidity is one of the main benefits of LSTs. And then I also think it is just like the level of institutional preparation that has been in JitoSol. And so it has a system that autonomously does all of the delegation.

It is completely managed by the DAO in a trustless way. And so it has just much more resiliency, which is something that when we talk to institutional clients thinking about how they should allocate their stake, they’re really prioritising. So we think that there’s going to be a next wave of growth of holders of Solana that have historically used native staking that will be coming into liquid staking because of these attributes and choosing JitoSol for that.

I think JITO SOL should continue to grow as the number one asset in all of Solana DeFi.

So when new liquidity pairs are established on AMM, it should be paired with JITO SOL instead of SOL because you get that yield bearing aspect, which is just uniformly better. And so I think it will continue to grow its penetration. It’s the largest token in most DeFi protocols today.

And then I think the other thing is kind of how we merge the new institutional players I referenced earlier into liquid staking, specifically onboarding them instead of native staking and then moreover, getting them as users of Solana DeFi, which is really an opportunity to grow the market by many multiples.

Restaking: Capital Efficiency and Disruptive Potential

Restaking is a much, much more powerful primitive than people assume it is. There was a lot of conversation about how restaking would help with the Ethereum scaling roadmap that was done by EigenLayer and their very good work introducing the primitive. But it goes way beyond that.

That’s what we’re most excited about on Solana: how versatile it is. So I think we’re going to see a lot of interesting work where restaking helps power new DeFi protocols on Solana, which are decentralised physical infrastructure and helps them go to market faster, launch better products.

And then we’re also seeing it as a way where other DeFi protocols on Solana are able to use it to improve their product’s resilience and then also provide utility to their native tokens via the restaking infrastructure.

So it just makes developers’ life much, much easier to use that as opposed to recreating similar infrastructure from scratch.

TipRouter, MEV Distribution, and Transparency

TipRouter was a way to decentralise Jito’s MEV infrastructure that has over a billion dollars in value distributed. It was previously in a permission to model where a single entity was saying exactly how all of this value should be distributed each epoch.

And that just presented a single point of failure and significant trust guarantees to Solana. As the usage and value in that protocol grew, it became suboptimal.

TipRouter was a way for any validator on Solana to participate in helping verify that this is distributed accurately. It’s done by a handful of third-party operators with over 250 million stake that are helping to do that. And it’s also evolved into a primitive that is used around something called priority fees, which are a different form of execution fees on Solana, where those can be distributed to stakers.

And so we see that it’s very flexible, and it’s really helping usher in a new era of how stakers and validators can receive their rewards for doing good work on Solana.

Balancing MEV Rewards and Solana’s Mission

I think JITO has always taken an extremely long-term view.

It only operates on Solana. And we have been building on Solana since 2021. And in 2023, when a lot of people thought Solana would die.

So we have a long term perspective. JITO will never be successful if Solana is not successful. So our vantage point is that JITO should always do what is best for Solana, and then find a way to provide the most value within that framework.

There’s a symbiotic relationship of providing these new mechanisms and giving the most possible rewards to Solana while continuing to fund the infrastructure that is required for this.

Encouraging Institutional Participation and Governance

JITO is the governance token of the JITO network. It controls core infrastructure across liquid staking, MEV on Solana.

Already today, we see significant participation from institutional players that include Coinbase, Blockworks, and a variety of other firms. And so the level of discourse there is quite significant.

And I think what the next step is, is really to kind of grow the level of participation from all of these parties that are, on a day-to-day basis, earning rewards from JITO and are critically impacted by that. So we can find the best balance between what is the right solution for JITO, what is the right solution for Solana, and how to move forward on key strategic questions.

User Behavior: Staking, Restaking, and DeFi Trends

I think what we’re seeing is a steady trend towards more liquid staking over native staking. It remains less than 10% of the total stake on Solana, which is quite low relative to what you see on most other networks.

And as the market continues to see the utility of liquid staking, we expect that to go up. And then the question is really kind of, how do we see additional yield on that? Should people be using DeFi? Should people be using restaking?

I think to date, the majority of assets are still used in DeFi, because that’s just more of a known primitive on Solana. So there are very good opportunities in providing liquidity with relatively safe yields on that.

And we see the lending market continues to grow on Solana. And then lastly is restaking, the incremental opportunities there for restakers on Jito Sol and other LSTs are quite strong, but really need to have the restaking ecosystem mature and continue growing. So that can support additional capital there, but we see a lot of excitement about those opportunities.

DAO Governance, Transparency, and Community Participation

I think JITO DAO is one of the most engaged and thoughtful DAOs in all of Solana.

And I’m really excited about how it has evolved since the token launched about a year and a half ago. And so what’s next is I think there are increasingly meaningful opportunities and key decisions. So today there is a major discussion around tokenomics for the JTO token, including how fees should be attributed.

We’ve seen some of the smartest investors in this space, including Multicoin Capital, North Island Ventures, and Pantera Capital, all of them weighing in on the distribution of fees.

So I think that JTO governance is going to have a very exciting 2025.

Restaking Competition and Jito’s Unique Approach

JTO restaking is kind of prioritising different things.

The goal from day one for me has been to provide real and sustainable yield to people participating in the restaking network. And so we’ve seen that the TVL on JTO restaking is smaller than some of the other peers. But the yield is actually much higher.

And it doesn’t come from token emissions. It comes from sustainable fee generation.

So I think that will continue to be a focus on sustainable yield. And then I think the other focus is on powering different consumer DeFi apps. So as I said earlier, not about scaling Solana or L2s, because that’s not something that is a priority for Solana right now.

Leadership Decisions and Lessons for Protocol Builders

So, the most controversial decision I was involved in was Jito Labs’ decision to deprecate the mempool, a product that wasn’t native to Solana but was part of Jito’s initial MEV stack.

And that enabled people to see pending transactions comparable to what you can see in Ethereum. The end product was that this led to a lot of front-running of user trades on Solana. And with 95% of the stake, it was virtually every trade that could be front-run.

And Jito Labs elected to terminate its hosted mempool. That was a tough decision because it had a negative impact on Jito Labs’ revenue, as well as the revenue attributed to everyone on the MEV stack. But I think it was still ultimately the right decision.

Because if users are getting better execution on a centralised exchange compared to trading on DeFi, then they will continue to use a centralised exchange. My vision is Nasdaq on-chain on Solana, and we need best execution there. And so it was really about prioritising long term health of Solana over short term metrics and potential controversy in the market.

Brian Smith Shares His Final Thoughts

Solana has been number one in economic value generated of real fees for any crypto network over the last six months. That appears to be on pace to continue.

It is just extremely exciting to see that it is now larger than many of the EVM competitors that were kind of unforeseen when I first joined Solana. And the momentum in the ecosystem is overwhelming. And so really excited for how Solana is headed and what that means for users of the network.

Peter Schiff, one of the most vocal critics of cryptocurrencies, has not changed his mind. His latest take is that Bitcoin is a total scam, and the current price has little to do with real market value and everything to do with government-driven money flows.

Schiff Bitcoin's rise is just the latest chapter in a long story of speculation fueled by easy money. The U.S. government's policies, especially around liquidity and stimulus, have artificially increased demand for risk assets - and Bitcoin, he says, fits that category more than ever.

To him, it is not a safe haven, not a currency, and not a store of value - just a high-risk trade built on 100% faith.

Peter Schiff@PeterSchiffMay 06, 2025Bitcoin is only where it is do to U.S. government pumping. It's a total scam.

Comparing Bitcoin to gold, Schiff says that the precious metal is the only real way to protect your money when inflation and market volatility are a concern.

Even though both assets are going up, they rarely move in sync. Recently, as U.S. stock futures and the dollar moved lower, gold inched up while Bitcoin dropped. This reinforced the common view that Bitcoin acts more like a tech stock than digital gold.

The critic is also not convinced that Bitcoin will ever be used as a base-layer currency or financial standard. He does not think the cryptocurrency has any real value, no solid backing and no place in a solid monetary system - it is all about hype and marketing.

Beyond the asset itself, Schiff is skeptical of government involvement in the space. He has been against the use of public funds to support or invest in crypto, saying that it is not the job of regulators to back what he sees as a purely speculative sector.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up