Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Bitcoin advocate, army veteran and Fox & Friends Weekend co-host Pete Hegseth has been nominated for Secretary of Defense by President-elect Donald Trump.

Hegseth has publicly expressed support for the crypto industry in recent years, discussing his personal investment in cryptocurrencies and highlighting bitcoin's value in its lack of government control.

Speaking after crypto exchange Coinbase’s IPO in April 2021, Hegseth described it as the "tip of the iceberg" for cryptocurrency. "Crypto has arrived. Bitcoin is not a person, it's not a company, it's not a place. It's tougher to stop than you would think. And that finite supply in a world of printing money, is very very powerful," he said at the time, as noted by VanEck head of digital assets research Matthew Sigel.

“Look at Trump, making bitcoin great again,” Hegseth said on Monday in an interview with Fox Business following the Republican’s U.S. presidential election victory as bitcoin surged above $80,000 for the first time. “All it took was signaling to that market that they weren’t going to be overregulated. Trump embraced them.”

Asked if he intended to sell any of his bitcoin holdings amid the price spike, Hegseth said, “I did sell some pretty high … but I’m holding a bunch as well so I feel good.”

“I am honored to announce that I have nominated Pete Hegseth to serve in my Cabinet as The Secretary of Defense," the President-elect said in a Trump-Vance transition statement on Tuesday. “Pete has spent his entire life as a Warrior for the Troops, and for the Country. Pete is tough, smart and a true believer in America First. With Pete at the helm, America’s enemies are on notice - Our Military will be Great Again, and America will Never Back Down.”

Hegseth is an army veteran of Iraq, Afghanistan and Guantanamo Bay, earning two Bronze Stars and a Combat Infantryman’s Badge, according to his website. He is also the author of the New York Times bestseller “Battle for the American Mind.”

However, most high-level nominees for the U.S. federal government, such as the Secretary of Defense, require Senate confirmation to officially assume their roles.

The Block earlier reported Trump had chosen Tesla CEO Elon Musk and Strive Enterprises co-founder Vivek Ramaswamy to lead his new Department of Government Efficiency (D.O.G.E) amid a surge in the price of the Musk-supported namesake memecoin.

Anti-crypto Senator Elizabeth Warren criticizes Hegseth’s nomination

Not everyone is happy about Hegseth’s nomination, with anti-crypto Elizabeth Warren — who recently won a fourth term in the Senate after defeating the crypto-friendly Republican candidate John Deaton — one of the first to criticize his potential appointment.

“A Fox & Friends Weekend co-host is not qualified to be the Secretary of Defense,” Warren said in a post on X. “I lead the Senate military personnel panel. All three of my brothers served in uniform. I respect every one of our servicemembers. Donald Trump’s pick will make us less safe and must be rejected.” She also criticized Trump’s Department of Government Efficiency plans.

However, others disagreed with Warren’s stance, pointing to Hegseth’s more than 15-year military record in qualifying him for the role.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2024 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

According to data provided by SoSoValue, BlackRock's Bitcoin exchange-traded fund (ETF) has already surpassed $40 billion in total assets.

It took this product just 211 days to reach this groundbreaking milestone. The previous record (1,253 days) was held by iShares Core MSCI Emerging Markets ETF (IEMG).

As noted by prominent ETF analyst Eric Balchunas, IBIT is now in the top 1% of all ETF products by total assets despite the fact that it was launched just 10 months ago.

Balchunas even struggled to come up with an appropriate sports metaphor in order to describe the groundbreaking success of Bitcoin ETFs.

"I'm trying to think of a sports metaphor, like Tiger Woods in '96 or Jordan as a rookie but I don't even those are appropriate given the velocity of the records being broken at only 10mo in the game," Balchunas quipped in a social media post.

The high-flying Bitcoin ETF is already bigger than 2,800 ETFs launched over the past 10 years.

On Nov. 12, IBIT logged $817 million worth of fresh inflows. Its cumulative net inflows are now approaching the $30 billion mark.

U.S. ETFs are currently on a wild ride. Over the past week alone, they have taken in a whopping $67 billion worth of inflows. These products are now on track to break the all-time annual record of $910 billion. According to Balchunas, they are likely to surpass $1 trillion.

The crypto market shows renewed momentum in 2024 after a challenging period, marked by a historic new all-time high for bitcoin and steady ownership rates across major markets. The top cryptocurrency is currently trading at an all-time high of above $88,000, according to CoinMarketCap.

Gemini’s latest Global State of Crypto report highlights key trends, including a promising rebound driven by spot bitcoin ETFs and resilient long-term investors who view digital assets as a hedge against inflation.

Top 100 Cryptocurrencies

Despite the volatility that slashed the combined value of the top 100 cryptocurrencies from $2.7 trillion in 2021 to $830 billion by late 2022, ownership rates in the US, UK, France, and Singapore have remained consistent. Around 21% of adults in the US and 18% in both the UK and France reported owning crypto. Notably, Singapore saw a slight dip in ownership from 30% to 26%.

In fact, two-thirds (65%) of current crypto owners view their holdings as a long-term investment, while 38% use it as a hedge against inflation. Gemini’s report suggests that a majority of past owners (over 70%) are likely to re-enter the market soon, indicating optimism despite previous losses.

The launch of spot bitcoin ETFs in the US has been a key catalyst for the 2024 crypto market rally. This new investment vehicle has attracted billions in inflows, with Bitcoin reaching a new peak of $73,737.94 in March. Gemini’s survey reveals that 37% of US crypto owners now hold assets via ETFs, and 13% of these investors entered the market exclusively through ETFs.

The appeal of ETFs lies in their ability to provide exposure to Bitcoin’s price movements without the complexities of directly purchasing digital assets. This has opened the market to a wider audience, including institutional investors who were previously hesitant.

Regulatory Uncertainty

Despite positive signs, regulatory clarity remains a significant barrier to crypto adoption. The survey found that 38% of non-owners in the US and UK cited concerns over unclear regulations as a key reason for staying away from crypto investments.

In Singapore, this figure was even higher, with nearly half (49%) of respondents expressing regulatory concerns. In contrast, French investors showed slightly less worry about regulatory issues compared to previous years.

For the first time, crypto has emerged as a key issue in the just concluded US presidential election. The vast majority (73%) of crypto owners in the US say they will factor in candidates’ stances on digital assets when voting.

More than a third (37%) of US respondents said a candidate’s position on crypto would significantly influence their vote, indicating that regulatory clarity and supportive policies could play a pivotal role in shaping the future of the crypto industry.

The report found that 75% of past crypto owners had sold their holdings over six months ago, but now, a substantial portion express renewed interest in re-entering the market. In Singapore, bullish sentiment has rebounded sharply, with only 10% of investors selling in the past six months compared to 49% a year earlier.

Binance just announced a new zero-fee spot trading promotion for XRP, Dogecoin and Cardano trading pairs with the Japanese yen (JPY). This is great news for users in Japan's cryptocurrency market. The promotion is only for the , and pairs and runs from Nov. 15 to Nov. 27, 2024. It offers fee-free trades for new and existing users on Binance Japan's platform.

This special offer is designed to get more trading going, making the most of the power of the DOGE, XRP and Cardano communities on the Japanese exchange.

On the other hand, zero-fee trading for these specific cryptocurrencies could help them rank higher, grow in adoption and add weight to their market presence. On the other hand, Binance Japan is looking to attract more trading activity from investors interested in digital assets paired with the Japanese yen.

Crypto regulation in Japan

This promotion comes at the same time as Japan is making some changes to its rules about digital assets. The Financial Services Agency (FSA) in Japan is planning to review its regulatory framework, with several proposals to lower taxes on crypto gains and allow the launch of domestic funds investing in digital assets.

The new rules could cut the tax on cryptocurrency gains from the current rate of up to 55% to 20%. This would make crypto more tax-friendly, like stocks and other assets in Japan.

It is also possible that the ban on exchange-traded funds containing crypto will be lifted. This could definitely encourage more institutional investment, especially if the ban on Bitcoin ETFs is lifted.

According to CoinGecko, the top trending altcoins today are mostly meme coins and are on the list for different reasons. Interestingly, all of these altcoins have previously appeared on the list.

This suggests that the narrative around them could be around in the long term. While that remains uncertain, the top three trending altcoins include Peanut the Squirrel (PNUT), Notcoin (NOT), and Department of Government Efficiency (D.O.G.E)

Peanut the Squirrel (PNUT)

PNUT is one of the top trending altcoins for two reasons. First, reports emerged that the squirrel the altcoin was named after did not have rabies.

According to reports from the New York Post, Chemung County Executive Christopher Moss disclosed that the results from the test were negative. This development contradicts the report of the Department of Environmental Conservation, which claimed that the squirrel bit an agent and was decapitated for fear of rabies.

Secondly, following the recent development, PNUT’s price climbed by 180%. Its market cap also surged above $1 billion. On the 1-hour, the meme coin seems to be getting a high level of volume, suggesting that market interest in it is huge.

Should this continue, then PNUT’s price might continue to climb, especially as the Chaikin Money Flow (CMF) shows increased buying pressure. If that is the case, the token’s value could rise to $2. However, increased profit-taking could change things, and PNUT could drop below the $1 threshold.

Notcoin (NOT)

In the last 24 hours, NOT’s price has decreased by 12% and currently trades at $0.0070. On the daily chart, the altcoin initially broke out of a falling wedge and showed signs of rallying toward $0.012.

However, resistance at $0.0079 has invalidated that prediction. Now, with a drop in buying pressure, Notcoin’s price looks on its way to hitting $0.0056. On the flip side, if the token fails to slide below the lower trendline of the wedge, that might not happen; instead, it could rise to $0.012.

Department of Government Efficiency

Last on today’s list of trending altcoins is the Department of Government Efficiency, a Solana meme coin created in response to Elon Musk’s proposal for the incoming Donald Trump-led government.

DOGE is trending because Trump has approved the agency in his government, and Tesla CEO Elon Musk and biotech founder Vivek Ramaswamy will lead it. Moments after the development was confirmed, the altcoin’s price skyrocketed.

Further, DOGE’s price has increased by 77% in the last 24 hours and is currently trading at $0.39. The altcoin’s value might continue to climb as Musk is likely to continue talking about it until Trump’s inauguration. However, if the altcoin holders decide to sell in large volumes, the price might retrace in the short term.

Shiba Inu is consolidating after a massive rally that saw its price jump as high as $0.0000303, its highest price level since April. Shiba Inu has also drastically fallen in its burn rate metric and sliding prices. Data from Shibburn shows that approximately 4.2 million SHIB have entered burn addresses in 24 hours, with the metric falling by 94%.

Shiba Inu and major ecosystem catch

Multiple metrics measure Shiba Inu's growth performance, which has placed the token in the spotlight. At the time of writing, SHIB's price dropped by 11.82% in 24 hours, and trading volume also nosedived by 37.66%. Amid all of these metric slumps, Shiba Inu has retained a positive rally over the past week and month.

Beyond these, Shibarium has a positive growth outlook after surpassing the 500 million transaction milestone, as projected earlier. This implies that the protocol's usability or adoption is at its highest level, with daily transactions jumping in tandem.

With this rapid embrace, the meme coin might find a notable anchor to pull off a stunning comeback moving forward. Despite the consolidation on the market at the moment, SHIB's price is positioned to resist sell-offs that will see it drop below the $0.000024 level soon.

Banking on historical trends

While relatively younger than established digital currencies like Bitcoin and Ethereum, Shiba Inu has a mixed November performance record. By banking on its more than 34% rally thus far this month, Shiba Inu can ride history to correct the negative flow in its token.

Shiba Inu has defined whale activity, with Open Interest data pointing to sustained optimism among investors. Its correlation with Bitcoin might also prove to be positive for the digital currency.

Should Bitcoin plot a recovery in line with its previous ATH, this could fuel a rally in SHIB.

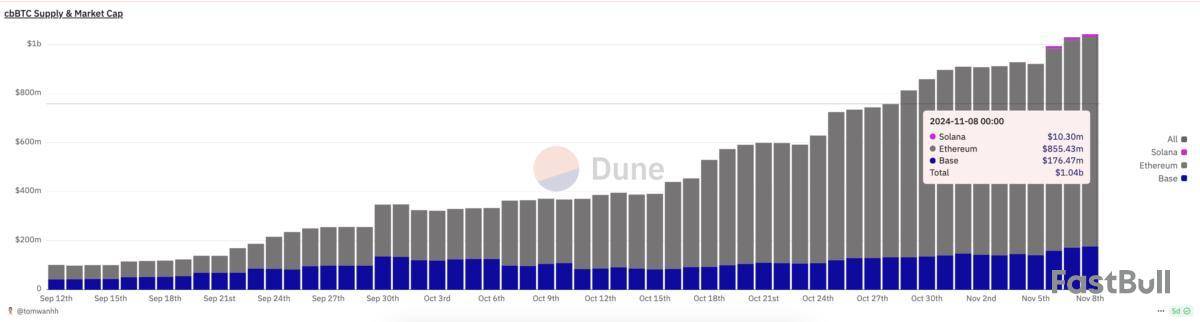

Coinbase’s Wrapped Bitcoin (cbBTC) has soared to a $1 billion market cap in just 57 days since its launch.

This growth trajectory effectively represents almost 10% of the Wrapped Bitcoin market cap, which currently sits at $12.88 billion, according to CoinMarketCap.

Coinbase’s cbBTC At $1 Billion Market Cap

Data on Dune shows the cbBTC Bitcoin wrapper has a market capitalization of $1.04 billion as of this writing. The majority of this value is held on Ethereum at $855.43 million, followed by Base Layer-2 blockchain and finally Solana.

Specifically, out of a total cbBTC supply of 14,678.95, over 12,000 are held on Ethereum. Meanwhile, Base and Solana hold 2,388 and 262 tokens, respectively.

As a Bitcoin wrapper, cbBTC allows BTC to be represented on other blockchain networks. Its rise highlights an important trend: Ethereum-based assets experience faster net supply changes than other leading Bitcoin liquid staking tokens (LSTs). These include eBTC, solvBTC, BBN, and pumpBTC, among others.

“The network effect is unbeatable. They can offer rebate/discount/businesses for MMs/Funds in their diversified line of business to bootstrap liquidity, adoption very easily,” said Tom Wan, an on-chain data researcher.

This swift growth, occurring just over two months after launch, signifies a notable demand for Coinbase’s wrapped Bitcoin product. The pace also reflects an escalating preference for cross-chain compatibility within decentralized finance (DeFi).

It comes as users and protocols look for more accessible and flexible Bitcoin-pegged assets. Coinbase first revealed cbBTC’s planned debut on Base in mid-August.

The product inadvertently presented as a prospective market rival to Wrapped Bitcoin . The Bitcoin wrapper has also seen increased support and interest across decentralized finance (DeFi).

The idea of a Bitcoin wrapper is to expand users’ access to BTC. For instance, with cbBTC on Solana, holders can leverage the network’s reduced fees and high transaction speeds.

These metrics are especially relevant for high-frequency DeFi transactions. Aave, a leading DeFi protocol, is already targeting cbBTC for its V3 Protocol.

At inception, cbBTC drew attention from venture capitalists like Dan Elitzer. In August, the VC predicted that cbBTC would be “super strategic” for Coinbase. He also said it could outpace WBTC’s supply within six months.

“Frankly, I’m surprised they didn’t ship this years ago,” Elitzer remarked.

Elitzer also emphasized that cbBTC’s introduction could encourage DeFi users to seek more decentralized Bitcoin-wrapped options, given the “mishandling” of WBTC by Justin Sun-affiliated management.

Controversy Surrounding Coinbase’s PoR for cbBTC

Indeed, Coinbase’s cbBTC’s advent came against the backdrop of the WBTC controversy involving Justin Sun. WBTC, once the go-to solution for wrapped Bitcoin on Ethereum, has faced growing skepticism due to concerns over its management and transparency under Justin Sun’s influence.

The rapid rise of cbBTC has not been without controversy. Coinbase’s approach to transparency and Proof of Reserves (PoR) has invited scrutiny. Critics, in particular, remain a bone of contention.

Duo Nine, a popular user on X, warned that Coinbase’s reliance on users’ trust without providing concrete proof of BTC reserves could lead to a collapse similar to the FTX downfall. This outcome, he articulated, was contingent on Coinbase minting more cbBTC than it could back.

“They will not provide any proof of reserves for the BTC they *claim* they have, nor any proof of backing for their new paper BTC called cbBTC. If they print too much paper BTC they will go the FTX route,” Duo Nine said.

Justin Sun echoed the sentiment, raising questions regarding Coinbase’s decision to forgo standard reserve audits for cbBTC. The Tron executive argued that this lack of transparency introduces significant risk. Against such fears, Coinbase’s custodial practices came into question, prompting BlackRock to revise its custody agreement with the exchange.

This unease may have steered users towards alternatives like cbBTC, which some see as a “safer” wrapped Bitcoin option with Coinbase’s backing. As cbBTC attracts more support, it poses an increasing threat to WBTC’s long-standing dominance. Whether cbBTC will eventually surpass WBTC remains to be seen, but its rapid growth signals a significant shift in user preferences within DeFi.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up