Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Andrew Bary

MicroStrategy's new $1.1 billion preferred stock deal has rallied in its initial day of Nasdaq trading but still yields above 11%.

The new 10% preferred deal, which is junior to two other offerings this year, is known as STRD, pronounced "stride," for its ticker symbol. It was trading around $90 on Wednesday morning for a yield of 11.1%, based on its nominal yield of 10% divided by 0.9 of its $100 face value.

The new perpetual preferred was priced on June 6 at $85. The offering was boosted in size as investors gravitated toward the low price. MicroStrategy, which is known as Strategy, issued nearly 11.8 million shares, up from a planned 2.5 million.

Several MicroStrategy insiders bought the shares at the offering price of $85, a sign they felt the offering was attractive. These include CEO Phong Le, who bought 4,500 shares, and CFO Andrew Kang, who purchased 2,250 shares, according to filings with the Securities and Exchange Commission.

The company has issued about $3 billion in total of preferred in 2025 as it seeks to broaden its funding sources to buy Bitcoin. MicroStrategy owns about 582,000 Bitcoin, or about 3% of all the Bitcoin outstanding, a stake that is worth $64 billion with Bitcoin trading around $110,000.

The other MicroStrategy preferreds carry lower yields than the STRD offering because they are senior to the new deal. Executive Chairman and controlling shareholder Michael Saylor referred to the STRD deal as the "high yield" offering among the company's preferred.

The 8% preferred, known as STRK for its ticker symbol, is trading at $106.65, down 0.3% on the session for a 7.5% yield. This offering benefits from an out-of-the money conversion feature into 1/10 of a share of common stock. MicroStrategy common stock was little changed at $391 Wednesday.

The 10% preferred, known as STRF for its ticker, trades at $105, down 0.2%. It yields 9.5%. Saylor referred to the STRF deal as the "investment grade" offering among the three deals, although all of the offerings would likely be rated at junk if they had credit ratings. STRF is the most senior of the three preferreds.

Some investors are wary of the new MicroStrategy deal because of language in the offering document that appears to offer little dividend security. The company said that dividends on the STRD preferred "will not be mandatory." They also won't be cumulative, meaning that any missed payments don't need to be made up.

"It is criminally insane to buy the $MSTR preferred shares paying 10%, $STRD. $MSTR can stop paying the dividend at any time, for no reason," wrote Tsachy Mishal, a portfolio manager at Tam Capital Management, on X. "The dividends are non cumulative and non payment has almost no consequences on the company."

MicroStrategy now has about $300 million of annual preferred dividend payments. Its software business, the core of the company before its pivot into Bitcoin, produces about $500 million in revenue a year. There is little free cash flow and the Bitcoin holdings yield nothing.

As result, some investors have questioned the ability of the company to service the preferred dividends. The company points to the high value of the Bitcoin stake as security for deal.

The bull case for the preferred is that the shares are effectively an asset-backed security underpinned by the company's Bitcoin holdings. The company has $11 billion of debt and preferred, meaning the coverage is sizable at around six to one.

The Strategy preferreds amount to some of the highest-yielding Bitcoin-related securities in the market. Given their unusual risks, they yield much more than bank preferred from large issuers like JPMorgan Chase or Bank of America, which pay around 6%.

Write to Andrew Bary at andrew.bary@barrons.com

This content was created by Barron's, which is operated by Dow Jones & Co. Barron's is published independently from Dow Jones Newswires and The Wall Street Journal.

Another day, another viral Bitcoin move from Robert Kiyosaki. As Bitcoin marches toward a new all-time high, the "Rich Dad Poor Dad" author is not sitting on the sidelines. With a new X post, he made it clear: he is buying more Bitcoin and writing.

Kiyosaki did not mention his price targets and how much BTC he did buy, but his earlier call is still doing the rounds in the wider media field: $500,000 to $1 million Bitcoin by the end of 2025. It is a huge range, but it echoes the way he sees the world right now: debt-heavy, unstable and primed for a major shift in where value is stored.

His latest buy lines up with Bitcoin’s bounce. After dipping below $104,000 last week, BTC has climbed back above $109,000. A quick look at the daily chart shows a strong recovery over the past few sessions, with a clear bullish engulfing candle breaking short-term resistance.

And that is with the all-time high at $111,980, just 2% above the recent price point.

Robert Kiyosaki@theRealKiyosakiJun 11, 2025YOUR FUTURE is decided TODAY!!!

Saying it another way:

“TODAY is the most IMPORTANT DAY of YOUR LIFE. Please do not waste it.”

TODAY I am buying more BITCOIN and working on a new book on ENTREPRENEURSHIP.

What are you doing today….for your future?

You are important. Your…

Kiyosaki is not just reacting to charts though. His focus is bigger. He sees Bitcoin as a hedge against what he considers government mismanagement, inflation and the erosion of financial education. In his words, the cryptocurrency is the "people's money." Gold, by the way, he attributes as "God's money."

The timing is no less than notable. Bitcoin has been trading in a tighter range lately, with many market participants watching for a breakout. Moves like Kiyosaki’s do not change market structure on their own, but they do reflect a big sentiment shift. The conviction to buy during consolidation, not hype, is often the quiet part of a longer story.

Kiyosaki’s story is always about one thing: do not wait for tomorrow to take a position.

In other news, the author revealed in the same post that he is also crafting a new book on entrepreneurship. Will the best-selling author mention Bitcoin in the book? Only time will tell.

In a significant move for blockchain adoption and stablecoin utility, PayPal's CEO has officially acknowledged a key milestone in the company's dollar-pegged stablecoin expansion: PayPal USD (PYUSD) is set to launch on the Stellar network, pending regulatory approval.

Alex Chriss@acceJun 11, 2025PYUSD is coming to @StellarOrg, reaching a broader group of developers and unlocking new opportunities for the stablecoin. More blockchains, greater access – and we’re not stopping now. pic.twitter.com/DDfpb9JBzM

PayPal confirmed in an official release that the PayPal USD (PYUSD) stablecoin will soon be available on the Stellar network, pending regulatory approval by the New York State Department of Financial Services (NYDFS).

PayPal USD (PYUSD) would employ Stellar for new use cases, including extending everyday payments, remittances and "PayFi" solutions to millions of customers and merchants.

This marks a significant expansion for PYUSD, PayPal’s dollar-pegged stablecoin, beyond its existing presence on Ethereum and Solana.

Acknowledging the milestone, PayPal CEO Alex Chriss wrote, "PYUSD is coming to Stellar, reaching a broader group of developers and unlocking new opportunities for the stablecoin. More blockchains, greater access—and we’re not stopping now."

Expansion significant

An expansion to Stellar would provide PYUSD users with access to its wide network of on- and off-ramps, as well as expanded access via digital wallets and connections to local payment systems and cash networks.

Access to the Stellar infrastructure will improve how users utilize PYUSD in their everyday financial activities, including payments, remittances and merchant services.

In April, PayPal expanded its partnership with Coinbase to accelerate the adoption, distribution and use of the PayPal USD (PYUSD) stablecoin.

The Stellar Development Foundation (SDF), a nonprofit entity, recently celebrated the third anniversary of its partnership with MoneyGram, which has facilitated nearly $30 million in total transactions.

Stripe has acquired Privy, a cryptocurrency wallet infrastructure developer, for an undisclosed amount, highlighting the global payment processor’s growing pivot toward digital assets.

Privy confirmed the acquisition on Wednesday in an announcement on social media that it will continue to operate as an independent product embedded within the Stripe ecosystem.

As part of Stripe, Privy will “keep building for developers building on crypto rails [but] now with more resources, flexibility, and firepower,” the company said.

Bloomberg initially reported on the acquisition, though no financial terms were disclosed.

While not widely known in the crypto space, Privy provides infrastructure for companies developing digital asset wallets. The company says its technology supports more than 50 million crypto wallets worldwide.

Stripe eyes $250 billion stablecoin market

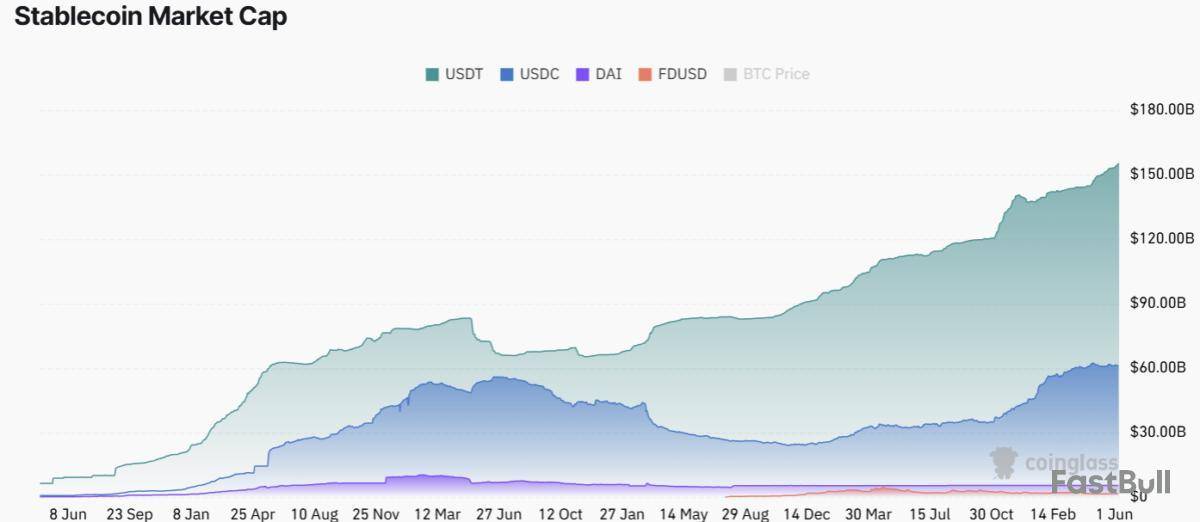

Six years after pulling back from crypto, Stripe made a major return in October last year by allowing merchants to accept stablecoin payments through USDC .

Since then, its push into stablecoin payments has gained momentum. As Cointelegraph recently reported, Stripe has rolled out stablecoin accounts to clients in over 100 countries.

As of May 7, Stripe users can send and receive US dollar-pegged stablecoins much like they would with traditional bank accounts.

Stripe co-founder and President John Collison told Bloomberg that, based on his conversations with global financial institutions, banks are showing growing interest in stablecoins.

“Banks are very interested in how they should be integrated with stablecoins into their product offerings as well,” said Collison.

However, not everyone believes traditional banks will be quick to embrace stablecoins.

NYU professor Austin Campbell recently claimed that the US banking lobby is “panicking” over yield-bearing stablecoins, which could disrupt the industry’s business model.

According to Campbell, banks fear their business could be “harmed” if stablecoins begin paying interest.

U.Today has prepared the top three news stories over the past day.

155,000,000 DOGE stuns Robinhood — What's going on?

As reported by Whale Alert blockchain tracker, yesterday, June 10, an unknown wallet transferred 155,000,000 DOGE to Robinhood, a popular trading platform. The value of the moved funds stood at $30,064,203 at the time the transfer took place. The likely reason behind the move is a whale intending to sell their funds on the aforementioned platform. The transaction coincided with a 4.6% increase in DOGE's price, pushing the asset from $0.18674 to $0.19535. Meanwhile, Dogecoin is inching closer to reaching a new adoption milestone; its holder count is currently standing at 7.97 million holders, only 30,000 short of eight million. This makes Dogecoin the third most widely held cryptocurrency after Ethereum (148.38 million holders) and Bitcoin (55.39 million holders). At press time, DOGE is changing hands at $0.2026, up almost 6% over the past 24 hours, according to CoinMarketCap data.

Shiba Inu's Shibarium skyrockets 7,154% as adoption hits new highs

Shiba Inu's layer-2 platform Shibarium has recently caught the community's attention with an impressive 7,154% increase in daily transactions; in just five days, they surged from 63,820 on June 4 to 4.63 million on June 9. Shibarium transactions stagnated from late May to early June, as profit-taking and macroeconomic uncertainty led to market declines and dampened investor optimism. Data from Shibariumscan shows that as of now, the Shibarium network's transaction count stands at 1,225,512,216. Total blocks amount to 11,459,115, with total addresses standing at 264,554,578. In the meantime, Shiba Inu holders hit a new all-time high; as shared by Shiba Inu's marketing lead Lucie, the number of wallets that currently hold SHIB has reached 1,511,101, which accounts for 0.011% of the global population.

Is Bitcoin safe from quantum computers? Michael Saylor shares bullish take

Michael Saylor, Strategy’s executive chairman, recently appeared on The Jordan B. Peterson Podcast, sharing how and why he began accumulating Bitcoin. According to Saylor, it all started in 2020 when the pandemic broke out. Back then, Strategy's executive chairman sought a secure store of value for his half-billion-dollar portfolio, considering real estate, stocks, art and gold. However, he ultimately found them less appealing due to market conditions and their lack of liquidity or growth potential. Saylor decided on Bitcoin because of its liquidity, fungibility and resilience, despite initially viewing it as a scam coin. Among other things, Saylor shared his take on whether quantum computers will be able to harm Bitcoin. He believes that Bitcoin is "the most anti-fragile and indestructible thing in the world." Saylor also calls it "an ideology that is manifested as a protocol," stating that even if future quantum computers can break Bitcoin’s passwords, they will not be able to hack the basics of Bitcoin, which is fundamental math.

Bitcoin large holders on the Binance exchange are sending a bullish signal to the broader cryptocurrency market. According to an update from CryptoQuant, an on-chain analytics platform, the volume of Bitcoin inflows from whales has dropped to about $3 billion.

Bitcoin whale pressure in spotlight

Notably, this is a bullish signal as it suggests that Bitcoin whales on the Binance exchange are massively accumulating the coin. This marks a shift from previous patterns, when whales sent Bitcoin to exchanges such as Binance when they plan to sell during periods of high price margin.

As of press time, the Bitcoin price was changing hands at $110,348.60, representing a 1.52% increase in the last 24 hours. This places BTC less than 2% away from flipping its all-time high (ATH) of $111,970 in May 2025.

Despite the spike in price, Bitcoin whales are not depositing on the Binance exchange, which implies that these large holders are not planning to sell just yet.

CryptoQuant.com@cryptoquant_comJun 11, 2025A strong bullish signal from Binance whales!

“Today, however, inflows are just around $3 billion and are continuing to decline, suggesting that these whales prefer to keep holding.” – By @Darkfost_Coc

Full analysis ⤵️https://t.co/T1FlLnM4nK pic.twitter.com/O3XrqhAyEc

CryptoQuant is highlighting that with just a $3 billion inflow to the exchange, whales on Binance are holding onto their Bitcoin. This suggests that they anticipate further price increases in the current market rally of the leading digital currency.

Generally, when whales refuse to sell during periods of price spikes, it indicates huge confidence in the asset’s potential to record more gains. This development also places less downward pressure on price, which fuels the bullish rally even more.

Can Bitcoin price hit $120,000?

Interestingly, about 10 days before Bitcoin posted its current ATH of $111,970, Bitcoin whales moved $50 million worth of the coin from the Binance exchange. The bullish behavior might be in play again, but this time, whales are choosing to hold onto their coins.

With current market dynamics, Bitcoin has a high chance of setting a new ATH. The development has set the broader crypto space buzzing with predictions. Some expect Bitcoin to soar to a new high of $120,000 in the coming days.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up