Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Mexico Core CPI YoY (Dec)

Mexico Core CPI YoY (Dec)A:--

F: --

P: --

Mexico PPI YoY (Dec)

Mexico PPI YoY (Dec)A:--

F: --

P: --

Mexico CPI YoY (Dec)

Mexico CPI YoY (Dec)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Dec)

U.S. Challenger Job Cuts MoM (Dec)A:--

F: --

P: --

U.S. Challenger Job Cuts (Dec)

U.S. Challenger Job Cuts (Dec)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Dec)

U.S. Challenger Job Cuts YoY (Dec)A:--

F: --

P: --

U.S. Exports (Oct)

U.S. Exports (Oct)A:--

F: --

P: --

U.S. Trade Balance (Oct)

U.S. Trade Balance (Oct)A:--

F: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

Canada Imports (SA) (Oct)

Canada Imports (SA) (Oct)A:--

F: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

Canada Exports (SA) (Oct)

Canada Exports (SA) (Oct)A:--

F: --

Canada Trade Balance (SA) (Oct)

Canada Trade Balance (SA) (Oct)A:--

F: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)A:--

F: --

P: --

U.S. Wholesale Sales MoM (SA) (Oct)

U.S. Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

U.S. Consumer Credit (SA) (Nov)

U.S. Consumer Credit (SA) (Nov)A:--

F: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Dec)

Japan Foreign Exchange Reserves (Dec)A:--

F: --

P: --

China, Mainland CPI YoY (Dec)

China, Mainland CPI YoY (Dec)A:--

F: --

P: --

China, Mainland PPI YoY (Dec)

China, Mainland PPI YoY (Dec)A:--

F: --

P: --

China, Mainland CPI MoM (Dec)

China, Mainland CPI MoM (Dec)A:--

F: --

P: --

Japan Leading Indicators Prelim (Nov)

Japan Leading Indicators Prelim (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Nov)

Germany Industrial Output MoM (SA) (Nov)A:--

F: --

Germany Exports MoM (SA) (Nov)

Germany Exports MoM (SA) (Nov)A:--

F: --

France Industrial Output MoM (SA) (Nov)

France Industrial Output MoM (SA) (Nov)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Nov)

Italy Retail Sales MoM (SA) (Nov)--

F: --

P: --

Euro Zone Retail Sales MoM (Nov)

Euro Zone Retail Sales MoM (Nov)--

F: --

P: --

Euro Zone Retail Sales YoY (Nov)

Euro Zone Retail Sales YoY (Nov)--

F: --

P: --

Italy 12-Month BOT Auction Avg. Yield

Italy 12-Month BOT Auction Avg. Yield--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Brazil IPCA Inflation Index YoY (Dec)

Brazil IPCA Inflation Index YoY (Dec)--

F: --

P: --

Mexico Industrial Output YoY (Nov)

Mexico Industrial Output YoY (Nov)--

F: --

P: --

Brazil CPI YoY (Dec)

Brazil CPI YoY (Dec)--

F: --

P: --

U.S. Building Permits Revised YoY (SA) (Oct)

U.S. Building Permits Revised YoY (SA) (Oct)--

F: --

P: --

U.S. Building Permits Revised MoM (SA) (Oct)

U.S. Building Permits Revised MoM (SA) (Oct)--

F: --

P: --

U.S. Average Hourly Wage MoM (SA) (Dec)

U.S. Average Hourly Wage MoM (SA) (Dec)--

F: --

P: --

U.S. Average Weekly Working Hours (SA) (Dec)

U.S. Average Weekly Working Hours (SA) (Dec)--

F: --

P: --

U.S. New Housing Starts Annualized MoM (SA) (Oct)

U.S. New Housing Starts Annualized MoM (SA) (Oct)--

F: --

P: --

U.S. Total Building Permits (SA) (Oct)

U.S. Total Building Permits (SA) (Oct)--

F: --

P: --

U.S. Building Permits MoM (SA) (Oct)

U.S. Building Permits MoM (SA) (Oct)--

F: --

P: --

U.S. Annual New Housing Starts (SA) (Oct)

U.S. Annual New Housing Starts (SA) (Oct)--

F: --

P: --

U.S. U6 Unemployment Rate (SA) (Dec)

U.S. U6 Unemployment Rate (SA) (Dec)--

F: --

P: --

U.S. Manufacturing Employment (SA) (Dec)

U.S. Manufacturing Employment (SA) (Dec)--

F: --

P: --

U.S. Labor Force Participation Rate (SA) (Dec)

U.S. Labor Force Participation Rate (SA) (Dec)--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Dec)

U.S. Private Nonfarm Payrolls (SA) (Dec)--

F: --

P: --

U.S. Unemployment Rate (SA) (Dec)

U.S. Unemployment Rate (SA) (Dec)--

F: --

P: --

U.S. Nonfarm Payrolls (SA) (Dec)

U.S. Nonfarm Payrolls (SA) (Dec)--

F: --

P: --

U.S. Average Hourly Wage YoY (Dec)

U.S. Average Hourly Wage YoY (Dec)--

F: --

P: --

Canada Full-time Employment (SA) (Dec)

Canada Full-time Employment (SA) (Dec)--

F: --

P: --

Canada Part-Time Employment (SA) (Dec)

Canada Part-Time Employment (SA) (Dec)--

F: --

P: --

Canada Unemployment Rate (SA) (Dec)

Canada Unemployment Rate (SA) (Dec)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Dec)

Canada Labor Force Participation Rate (SA) (Dec)--

F: --

P: --

U.S. Government Employment (Dec)

U.S. Government Employment (Dec)--

F: --

P: --

Canada Employment (SA) (Dec)

Canada Employment (SA) (Dec)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Palm oil closed higher, tracking strength in the Dalian palm olein market and firmer soybean oil prices during Asian trading, says David Ng, a trader at Kuala Lumpur-based Iceberg X. Ng says palm oil prices find support above 4,000 ringgit a ton, with resistance at 4,150 ringgit a ton. Downside pressures from declines in other edible oils and the prospect of profit-taking ahead of next week's Malaysian Palm Oil Board data release appears limited by holiday-season demand and signs of stronger export flows in early January, Kenanga Futures says in a research note. The Bursa Malaysia Derivatives contract for March delivery ended 9 ringgit higher at 4,042 ringgit a ton. (jason.chau@wsj.com)

Lithium carbonate futures in China soared past CNY 138,000 per tonne in January, the highest in over two years, as strong demand magnified the outlook of capped supply.

Ambitious bets in power and datacenter infrastructure by the Chinese government was combined with the announcement of higher power storage spending, supporting the outlook for lithium and other battery metals.

This was combined with Beijing stating it would double EV charging capacity to 180 gigawatts by 2027, supporting lithium-rich energy storage systems. Besides domestic expenditure, foreign storage system sales from Chinese companies rose to $66 billion in the first 10 months of the year, overtaking $54 billion from electric vehicle exports.

Meanwhile, authorities stated 27 mining permits were canceled in the lithium hub of Jiangxi, aligned with the earlier suspension of activity in CATL's Jianxiawo lithium mine amid Beijing's anti-involution campaign.

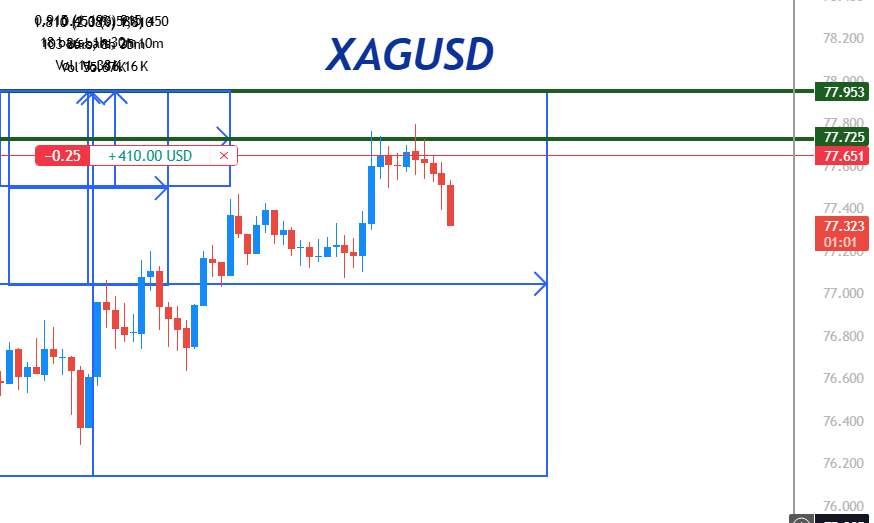

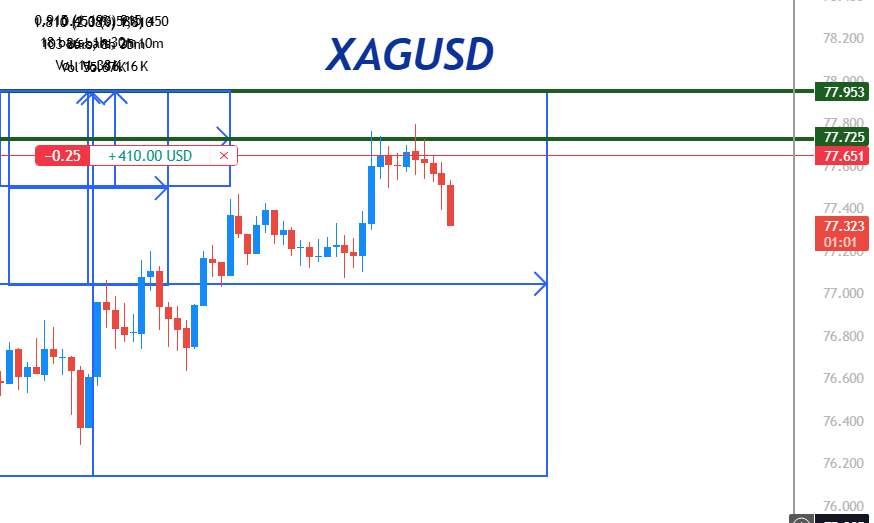

The most recent moves in gold and silver markets were driven by flows rather than fundamentals, says Carsten Menke, Julius Baer's head of next generation research. Speculative activity in the futures markets has strengthened in the past few weeks, particularly for silver and on the Shanghai Futures Exchange, he adds. A fundamental element that seems to have further fueled the bullish mood in the silver market is China's announcement of export controls, he says. That said, Julius Baer thinks that they are very similar to Beijing's controls on rare earths, which didn't impede shipments for long, he adds. Meanwhile, the silver market seems to be overlooking developments in China's solar industry, where three manufacturers have announced a shift away from silver due to cost reasons. (jiahui.huang@wsj.com; @ivy_jiahuihuang)

By Nina Kienle

Zalando said it would close its fulfillment center in Erfurt, Germany, as part of a plan to reshape its pan-European logistics network to strengthen its position.

The German online retailer on Thursday said the closure puts 2,700 jobs at risk and is planned for the end of September.

It also plans to discontinue operations at three warehouses outside Germany that external providers operate for both Zalando and About You, it added.

Zalando said it would begin negotiations with the Erfurt works council immediately and that it has developed some support offers to assist its employees.

With this change, Zalando Group logistics network will comprise 14 fulfillment centers across seven countries, it added.

Write to Nina Kienle at nina.kienle@wsj.com

The Canadian dollar falls to a one-month low and the Norwegian krone hits a two-and-a-half-week low against the U.S. dollar on broad-based risk aversion and concerns over the implications of the U.S. taking control of Venezuelan oil. The White House said the U.S. will control sales of sanctioned Venezuelan oil "indefinitely" after a military operation to remove its leader Nicolas Maduro. Sales are expected to start with 30 million to 50 million barrels of oil. The announcement revived concerns about a medium-term supply glut, Monex Europe analysts say in a note. The U.S. dollar rises to highs of 1.3888 Canadian dollars and 10.1266 Norwegian krone. (renae.dyer@wsj.com)

President Donald Trump said the United States would assume control over Venezuela’s vast oil reserves and enlist American energy companies to invest billions of dollars in rebuilding the country’s severely degraded oil infrastructure.

Despite Venezuela holding the largest proven oil reserves in the world, the oil market’s initial reaction was strikingly muted. Crude prices barely moved, a reminder that today’s global energy system is impacted less by headline shocks and more by structural supply and demand fundamentals. Still, beneath the surface, the arrest of Maduro carries profound implications for oil geopolitics, US energy strategy and long-term price formation.

Why Maduro, Why Now?

Timing matters. Venezuela under Maduro had become increasingly aligned with China, Russia and Iran, allowing rival powers to deepen their presence in what Washington still considers its strategic sphere of influence. Caracas had accepted non-dollar payments for crude, strengthened ties with the BRICS bloc and reportedly hosted Iranian drone manufacturing facilities while Russian military advisers operated on Venezuelan soil.

From Washington’s perspective, Venezuela was no longer just a failed petrostate but a geopolitical outpost. The intervention therefore appears less about drug trafficking and short-term oil supply but more about reclaiming strategic control over energy flows, limiting rival influence in Latin America and reasserting leverage over a resource that still underpins global powers.

Saturday’s events highlight a deepening geopolitical fragmentation. The United States is recalibrating its economic and strategic relationships with the world, as outlined in its latest National Security Strategy. We are closely monitoring how this regional fragmentation unfolds and the broader implications it may carry.

How Venezuela Lost Its Oil Industry Under Chávez and Maduro

Venezuela’s oil collapse did not begin with US sanctions. The roots go back to the Chávez era, when foreign oil companies were forced to surrender operational control to the state-owned PDVSA. Contracts were rewritten, assets were expropriated and capital began to flee.

Chevron chose to stay, negotiating joint ventures and maintaining a reduced but continuous presence. Exxon Mobil and ConocoPhillips exited the country and later pursued international arbitration, winning multibillion-dollar claims that Venezuela never paid. As foreign expertise left, PDVSA became increasingly politicised, underfunded and incapable of maintaining even basic operations.

By the time Maduro took power, the industry was already hollowed out. US sanctions imposed in 2019 did not cause the collapse, but they accelerated it sharply by cutting off export markets, restricting access to finance and preventing the import of diluents needed to process Venezuela’s heavy crude. Production plunged from more than 3 million barrels per day in the early 2000s to roughly one million barrels per day last year, despite Venezuela sitting on an estimated 303 billion barrels of proven oil reserves.

Why Oil Prices Barely Reacted

Despite the scale of the intervention, oil prices remained muted and the explanation lies in oversupply.

New production is coming online from the United States, Brazil, Guyana and Argentina at a time when OPEC+ is unwinding voluntary output cuts and global demand growth remains subdued. In this environment, Venezuela’s current output, representing less than 1% of global supply, is simply too small to move the market.

The oil market understands that production cannot be restarted overnight and even dramatic political change does not translate into immediate barrels.

Source: TradingView. WTI Oil daily price chart as of 7 January 2026.

The Kind of Oil That Still Matters

Venezuela’s relevance is not about how much oil it produces today, but about the type and amount of oil it holds. Its crude is heavy and sour, similar to Canadian oil sands, and many US Gulf Coast refineries were originally designed to process Venezuelan barrels.

Despite being the world’s largest oil producer, the United States remains structurally dependent on heavy crude imports. A large share of US refining capacity runs most efficiently on this type of feedstock, particularly for diesel and industrial fuels. Sanctions on Venezuelan oil tightened those markets, and Canada has since become the dominant supplier.

This is where Venezuela could re-enter the system over time. Chevron is widely expected to be the anchor operator, given its continued presence and technical familiarity. Exxon Mobil and ConocoPhillips may also return, though only under new political and commercial conditions.

Rebuilding Venezuela’s Oil Industry Will Take Years

Venezuela’s oil infrastructure is severely degraded, and expectations of a rapid revival are misplaced. Pipelines are decades old, production facilities are corroded and technical capacity has eroded.

Estimates suggest it would take tens of billions of dollars just to restore production to historical peaks. Even under a stable, US-aligned government, early efforts would focus on stabilising existing output rather than expanding it. Meaningful growth would likely take close to ten years.

Washington has also made it clear that US oil companies would be expected to fund much of the rebuilding themselves before recovering compensation linked to expropriated assets. That condition introduces significant financial and political risk, making boards and shareholders cautious.

What This Means for Oil Prices

In the near term, Venezuela’s political reset changes very little for crude prices. Perception may move faster than reality, but physical supply will not. Over the longer term, however, Venezuela’s gradual return could act as a ceiling on oil prices, particularly if global oversupply persists. Additional heavy crude would pressure Canadian producers and add complexity to OPEC+ efforts to manage the market.

Why US Oil Stocks Jumped on the News

US oil majors rallied sharply following Maduro’s capture, not because investors expect an immediate surge in production, but because the event creates long-term opportunity.

Access to the world’s largest oil reserves, improved refinery economics from heavy crude availability and the prospect of strategic alignment with US policy all add to the investment case. Chevron stands out as the most direct beneficiary, while Exxon Mobil and ConocoPhillips can gain leverage if they consider re-entry.

However, this is not a short-term earnings story, rather a long-term opportunity, therefore we think the initial rebound is likely to be short lived.

Professional investors looking for magnified exposure to WTI Oil may consider Leverage Shares +3x Long Oil & Gas or -3x Short Oil & Gas ETP.

European natural-gas prices remain in a tight range, with the benchmark Dutch TTF contract down 3.2% to 27.82 euros a megawatt-hour in early trading. Prices, however, settled higher in the previous session as colder weather across Europe and storage declines provide support. According to Gas Infrastructure Europe, EU inventory levels are currently 58% full. "The latest positioning data indicate that investment funds reduced their net short position in TTF for the third consecutive week," ING analysts say. "Funds bought 6.2 TWh [terawatt-hour] over the last reporting week, leaving them with a net short of 72.4TWh." (giulia.petroni@wsj.com)

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up