Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Average Hourly Wage MoM (SA) (Oct)

U.S. Average Hourly Wage MoM (SA) (Oct)A:--

F: --

P: --

U.S. Average Hourly Wage YoY (Oct)

U.S. Average Hourly Wage YoY (Oct)A:--

F: --

P: --

U.S. Retail Sales (Oct)

U.S. Retail Sales (Oct)A:--

F: --

P: --

U.S. Core Retail Sales MoM (Oct)

U.S. Core Retail Sales MoM (Oct)A:--

F: --

U.S. Core Retail Sales (Oct)

U.S. Core Retail Sales (Oct)A:--

F: --

P: --

U.S. Retail Sales MoM (Oct)

U.S. Retail Sales MoM (Oct)A:--

F: --

U.S. Private Nonfarm Payrolls (SA) (Oct)

U.S. Private Nonfarm Payrolls (SA) (Oct)A:--

F: --

U.S. Average Weekly Working Hours (SA) (Oct)

U.S. Average Weekly Working Hours (SA) (Oct)A:--

F: --

P: --

U.S. Labor Force Participation Rate (SA) (Nov)

U.S. Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

U.S. Retail Sales YoY (Oct)

U.S. Retail Sales YoY (Oct)A:--

F: --

P: --

U.S. Manufacturing Employment (SA) (Oct)

U.S. Manufacturing Employment (SA) (Oct)A:--

F: --

U.S. Government Employment (Nov)

U.S. Government Employment (Nov)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Dec)

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Dec)A:--

F: --

P: --

U.S. IHS Markit Composite PMI Prelim (SA) (Dec)

U.S. IHS Markit Composite PMI Prelim (SA) (Dec)A:--

F: --

P: --

U.S. IHS Markit Services PMI Prelim (SA) (Dec)

U.S. IHS Markit Services PMI Prelim (SA) (Dec)A:--

F: --

P: --

U.S. Commercial Inventory MoM (Sept)

U.S. Commercial Inventory MoM (Sept)A:--

F: --

P: --

BOC Gov Macklem Speaks

BOC Gov Macklem Speaks Argentina GDP YoY (Constant Prices) (Q3)

Argentina GDP YoY (Constant Prices) (Q3)A:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

Australia Westpac Leading Index MoM (Nov)

Australia Westpac Leading Index MoM (Nov)A:--

F: --

Japan Trade Balance (Not SA) (Nov)

Japan Trade Balance (Not SA) (Nov)A:--

F: --

P: --

Japan Goods Trade Balance (SA) (Nov)

Japan Goods Trade Balance (SA) (Nov)A:--

F: --

P: --

Japan Imports YoY (Nov)

Japan Imports YoY (Nov)A:--

F: --

P: --

Japan Exports YoY (Nov)

Japan Exports YoY (Nov)A:--

F: --

P: --

Japan Core Machinery Orders YoY (Oct)

Japan Core Machinery Orders YoY (Oct)A:--

F: --

P: --

Japan Core Machinery Orders MoM (Oct)

Japan Core Machinery Orders MoM (Oct)A:--

F: --

P: --

U.K. Core CPI MoM (Nov)

U.K. Core CPI MoM (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

U.K. Core Retail Prices Index YoY (Nov)

U.K. Core Retail Prices Index YoY (Nov)--

F: --

P: --

U.K. Core CPI YoY (Nov)

U.K. Core CPI YoY (Nov)--

F: --

P: --

U.K. Output PPI MoM (Not SA) (Nov)

U.K. Output PPI MoM (Not SA) (Nov)--

F: --

P: --

U.K. Output PPI YoY (Not SA) (Nov)

U.K. Output PPI YoY (Not SA) (Nov)--

F: --

P: --

U.K. Input PPI YoY (Not SA) (Nov)

U.K. Input PPI YoY (Not SA) (Nov)--

F: --

P: --

U.K. CPI YoY (Nov)

U.K. CPI YoY (Nov)--

F: --

P: --

U.K. Retail Prices Index MoM (Nov)

U.K. Retail Prices Index MoM (Nov)--

F: --

P: --

U.K. CPI MoM (Nov)

U.K. CPI MoM (Nov)--

F: --

P: --

U.K. Input PPI MoM (Not SA) (Nov)

U.K. Input PPI MoM (Not SA) (Nov)--

F: --

P: --

U.K. Retail Prices Index YoY (Nov)

U.K. Retail Prices Index YoY (Nov)--

F: --

P: --

Indonesia 7-Day Reverse Repo Rate

Indonesia 7-Day Reverse Repo Rate--

F: --

P: --

Indonesia Deposit Facility Rate (Dec)

Indonesia Deposit Facility Rate (Dec)--

F: --

P: --

Indonesia Lending Facility Rate (Dec)

Indonesia Lending Facility Rate (Dec)--

F: --

P: --

Indonesia Loan Growth YoY (Nov)

Indonesia Loan Growth YoY (Nov)--

F: --

P: --

South Africa Core CPI YoY (Nov)

South Africa Core CPI YoY (Nov)--

F: --

P: --

South Africa CPI YoY (Nov)

South Africa CPI YoY (Nov)--

F: --

P: --

Germany Ifo Business Expectations Index (SA) (Dec)

Germany Ifo Business Expectations Index (SA) (Dec)--

F: --

P: --

Germany Ifo Current Business Situation Index (SA) (Dec)

Germany Ifo Current Business Situation Index (SA) (Dec)--

F: --

P: --

Germany IFO Business Climate Index (SA) (Dec)

Germany IFO Business Climate Index (SA) (Dec)--

F: --

P: --

Euro Zone Core CPI Final MoM (Nov)

Euro Zone Core CPI Final MoM (Nov)--

F: --

P: --

Euro Zone Labor Cost YoY (Q3)

Euro Zone Labor Cost YoY (Q3)--

F: --

P: --

Euro Zone Core HICP Final YoY (Nov)

Euro Zone Core HICP Final YoY (Nov)--

F: --

P: --

Euro Zone Core HICP Final MoM (Nov)

Euro Zone Core HICP Final MoM (Nov)A:--

F: --

P: --

Euro Zone Core CPI Final YoY (Nov)

Euro Zone Core CPI Final YoY (Nov)--

F: --

P: --

Euro Zone HICP MoM (Excl. Food & Energy) (Nov)

Euro Zone HICP MoM (Excl. Food & Energy) (Nov)--

F: --

P: --

Euro Zone CPI YoY (Excl. Tobacco) (Nov)

Euro Zone CPI YoY (Excl. Tobacco) (Nov)--

F: --

P: --

Euro Zone HICP Final YoY (Nov)

Euro Zone HICP Final YoY (Nov)--

F: --

P: --

Euro Zone HICP Final MoM (Nov)

Euro Zone HICP Final MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

A stock with low volatility can be reassuring, but it doesn’t always mean strong long-term performance. Investors who prioritize stability may miss out on higher-reward opportunities elsewhere.

Luckily for you, StockStory helps you navigate which companies are truly worth holding. That said, here are three low-volatility stocks to steer clear of and a few better alternatives.

Yum China (YUMC)

Rolling One-Year Beta: 0.57

One of China’s largest restaurant companies, Yum China is an independent entity spun off from Yum! Brands in 2016.

Why Does YUMC Worry Us?

Yum China is trading at $43.95 per share, or 16.1x forward P/E. To fully understand why you should be careful with YUMC, check out our full research report (it’s free).

Amneal (AMRX)

Rolling One-Year Beta: 0.68

Founded in 2002 and growing into one of America's largest generic drug producers, Amneal Pharmaceuticals develops, manufactures, and distributes generic medicines, specialty branded drugs, biosimilars, and injectable products for the U.S. healthcare market.

Why Are We Cautious About AMRX?

At $10 per share, Amneal trades at 14.2x forward P/E. Dive into our free research report to see why there are better opportunities than AMRX.

Intercontinental Exchange (ICE)

Rolling One-Year Beta: 0.56

Starting as an energy trading platform in 2000 before acquiring the iconic New York Stock Exchange in 2013, Intercontinental Exchange operates global financial exchanges, clearing houses, and provides data services and mortgage technology solutions to financial institutions and corporations.

Why Do We Think Twice About ICE?

Intercontinental Exchange’s stock price of $175.99 implies a valuation ratio of 23.9x forward P/E. If you’re considering ICE for your portfolio, see our FREE research report to learn more.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return).

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

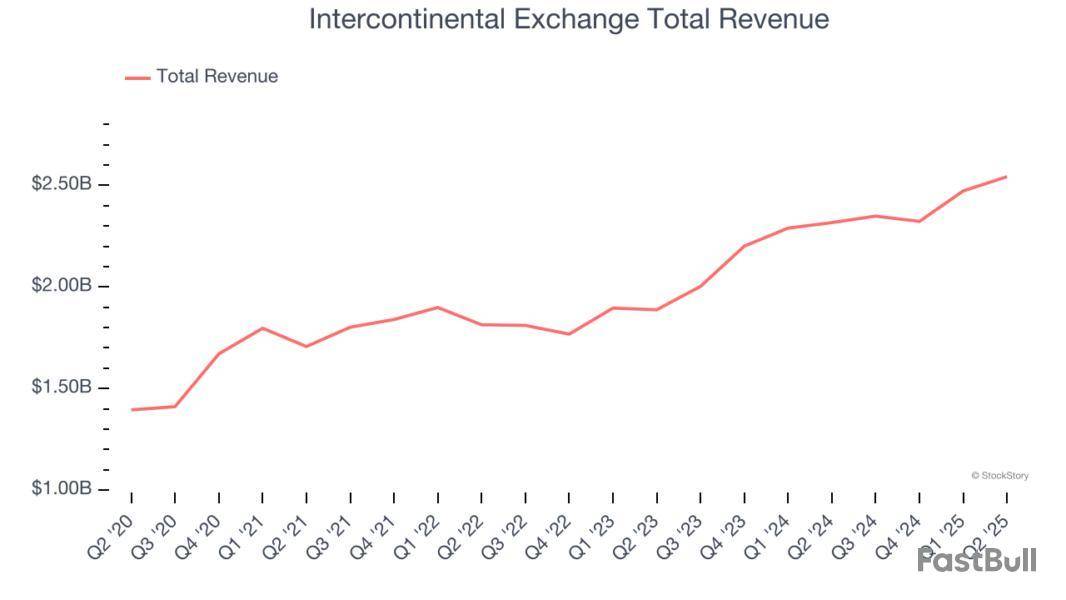

The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Intercontinental Exchange and the rest of the financial exchanges & data stocks fared in Q2.

Financial exchanges and data providers operate trading platforms and sell market information. They enjoy relatively stable revenue from trading fees and subscriptions, increasing demand for data analytics, and expansion opportunities in emerging markets. Challenges include regulatory oversight of market structure, competition from alternative trading venues, and substantial technology investments needed to maintain low-latency trading infrastructure and data security.

The 9 financial exchanges & data stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 5.5% since the latest earnings results.

Starting as an energy trading platform in 2000 before acquiring the iconic New York Stock Exchange in 2013, Intercontinental Exchange operates global financial exchanges, clearing houses, and provides data services and mortgage technology solutions to financial institutions and corporations.

Intercontinental Exchange reported revenues of $2.54 billion, up 9.8% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with a beat of analysts’ EPS estimates but a slight miss of analysts’ Exchanges segment estimates.

Unsurprisingly, the stock is down 6.7% since reporting and currently trades at $173.46.

Is now the time to buy Intercontinental Exchange? Access our full analysis of the earnings results here, it’s free.

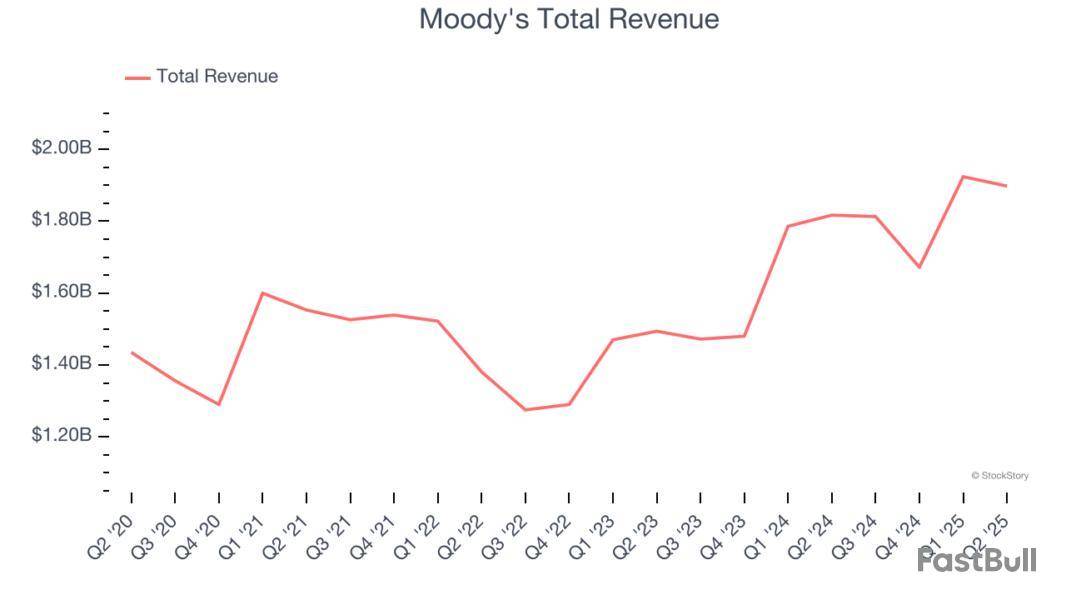

Founded in 1900 during America's railroad boom when investors needed reliable information on bond risks, Moody's provides credit ratings, risk assessment tools, and analytical solutions that help organizations evaluate financial risks and make informed investment decisions.

Moody's reported revenues of $1.90 billion, up 4.5% year on year, outperforming analysts’ expectations by 2.9%. The business had a strong quarter with a solid beat of analysts’ Investor Services segment estimates and an impressive beat of analysts’ EBITDA estimates.

Moody's delivered the biggest analyst estimates beat among its peers. The market seems content with the results as the stock is up 1.6% since reporting. It currently trades at $507.

Is now the time to buy Moody's? Access our full analysis of the earnings results here, it’s free.

Founded in 1996 as one of the pioneers in electronic bond trading, Tradeweb Markets builds and operates electronic marketplaces that connect financial institutions for trading across rates, credit, equities, and money markets.

Tradeweb Markets reported revenues of $513 million, up 26.7% year on year, in line with analysts’ expectations. It was a slower quarter as it posted a significant miss of analysts’ EPS estimates and transaction volumes in line with analysts’ estimates.

As expected, the stock is down 13.7% since the results and currently trades at $119.26.

Read our full analysis of Tradeweb Markets’s results here.

Founded in 1978 when financial data was still primarily delivered through paper reports, FactSet provides financial data, analytics, and technology solutions that investment professionals use to research, analyze, and manage their portfolios.

FactSet reported revenues of $585.5 million, up 5.9% year on year. This print surpassed analysts’ expectations by 0.7%. Taking a step back, it was a mixed quarter as it also produced a decent beat of analysts’ EBITDA estimates but a miss of analysts’ EPS estimates.

The stock is down 11.8% since reporting and currently trades at $373.

Read our full, actionable report on FactSet here, it’s free.

Born from the Chicago Mercantile Exchange founded in 1898 as a butter and egg trading venue, CME Group operates the world's largest derivatives marketplace where traders can buy and sell futures and options contracts across interest rates, equities, currencies, commodities, and more.

CME Group reported revenues of $1.69 billion, up 10.5% year on year. This number met analysts’ expectations. Aside from that, it was a mixed quarter as it underperformed in some other aspects of the business.

The stock is down 5.2% since reporting and currently trades at $260.50.

Read our full, actionable report on CME Group here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up