Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

24K99讯 现货黄金价格周二(9月2日)惊现暴涨行情,一举突破3500美元/盎司关口,创下历史新高,分析师指出,投资者大举加码,反映对美联储本月降息的深切预期,同时也显示对经济和经济风险的担忧。

黄金避险买盘高涨

美国彭博社分析称,由于美国降息前景增强黄金的吸引力,且交易员在股票和债券市场遭遇抛售后寻求避险,黄金价格周二连续六个交易日上涨,创下历史新高。

现货黄金周二收盘暴涨57.04美元,涨幅1.64%,报3533.35美元/盎司。

现货金价格周二盘中一度上涨1.8%,达到3540.04美元/盎司,刷新纪录高位。

由于对美联储未来前景的担忧重燃,以及发达国家对预算的担忧,黄金的避险需求受到金融市场避险情绪的提振,股市和长期政府债券承压。

渣打银行贵金属分析师Suki Cooper说:“黄金市场正进入季节性消费旺季,再加上对美联储9月降息的预期,我们看好黄金将继续创历史新高。”

根据芝加哥商品交易所集团(CME)的“美联储观察工具”,市场认为美联储在9月17日会议上降息25个基点的机率接近92%。

分析师表示,黄金今年之所以创历史新高,主要受益于央行买盘持续、远离美元的多元化投资、地缘政治和贸易摩擦下的弹性避险需求,以及美元普遍疲软。

今年以来,黄金价格已上涨近34%,成为表现最佳的主要大宗商品之一。

美联储主席鲍威尔谨慎地为降息敞开大门后,市场预期美联储本月将降息,这推动金价最新上涨。

分析师并指出,ETF资金流入也刺激黄金的涨势。

上周五的数据显示,全球最大黄金ETF——SPDR Gold Trust持仓量增加1.01%,至977.68吨,创下2022年8月以来最高水平。

聚焦非农报告

本周五公布的8月美国非农就业报告可能会进一步加剧劳动力市场日益低迷的迹象,从而支持降息的理由。低利率环境往往利好无收益的黄金。

OANDA MarketPulse分析师Zain Vawda指出,如果本周就业数据表现疲软,可能让投资者重新讨论美联储降息50个基点的可能性。

过去三年来,黄金和白银价格均上涨一倍多,地缘政治、经济和全球贸易领域的风险不断增加,推动对这些历史悠久的避险资产的需求增加。

今年,美国总统特朗普对美联储的攻击不断升级,加剧人们对美联储独立性受到威胁的担忧。

市场目前正在等待一项具有里程碑意义的裁决,以确定特朗普是否有正当理由将美联储理事库克从美联储免职。如果裁决合法,此举将允许特朗普用一位鸽派官员取代她。

合约 | 目标位($代表美元) | 支撑位/阻力位($代表美元) |

布兰特原油 | $68.70/$68.11 | 阻力位 $69.18/$69.67 |

棕榈油(主力合约) | 4,506/4,530马币(林吉特) | 支撑位 4,468/4,444/4,427马币(林吉特) |

西德克萨斯中质油(WTI)* | $65.41/$65.11/$64.93 | 阻力位 $65.72/$65.89/$66.08/$66.38 |

现货金 | $3,507/$3,508/$3,491 | 阻力位 $3,543/3,560/$3,576 |

LME期铜* | $10,030/$10,057/$10,101 | 支撑位 $9,987/$9,960/$9,943 |

LME期铝* | $2,633 | 支撑位 $2,615/$2,607/$2,595 |

CBOT大豆 | $10.40-1/2, $10.35-1/2 | 阻力位 $10.48-1/2, $10.53-1/4, $10.61-1/4 |

CBOT玉米 | $4.26, $4.27-3/4 | 支撑位 $4.22-1/2, $4.20-1/4, $4.19 |

CBOT小麦 | $5.31, $5.32-3/4 | 支撑位 $5.26-1/4, $5.24-1/4 |

纽约咖啡* | $3.6325/$3.5870 | 阻力位 $3.7515/$3.8245/$3.8980 |

纽约可可* | $7,216/$7,005 | 阻力位 $7,774/$8,023 |

* 报价有延迟,预测可能会受到影响。(完)

(本文内容不应被视为商业、金融或法律建议。读者应该谘询自己的专业或其他顾问,寻求有关本文提及产品的商业、金融及法律建议。)

中国央行自2023年以来积极买入黄金,这引发一个问题:中国政府会将储备提高到什么程度?目前中国正试图减少对美元的依赖,使黄金持有量与其作为世界第二大经济体的地位相称。

与此同时,黄金自2023年至2025年一路飙升,在周二更创下每盎司3,508.5美元的历史新高。

2022年西方制裁导致俄罗斯3,000亿美元的官方储备被冻结,约占储备总额的一半,之后黄金价格的飙升凸显出发展中经济体寻求储备多元化、摆脱单一依赖美元的大趋势。

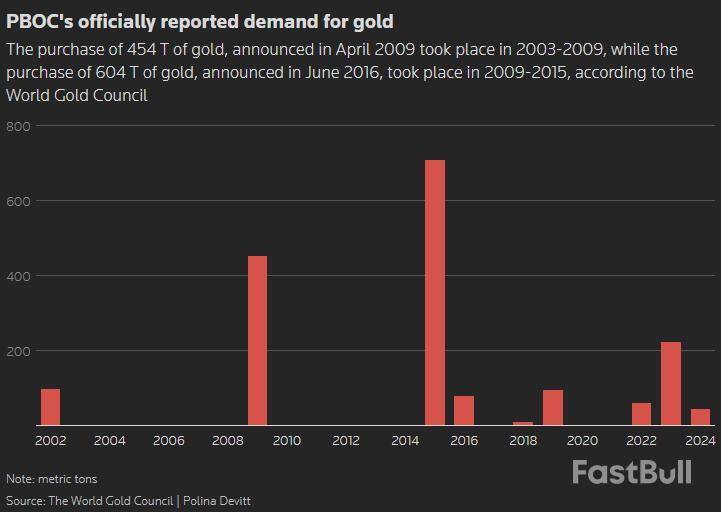

中国人民银行今年迄今已购买21吨黄金。去年和前年分别购买了44吨和225吨,是全球央行中最大的买家。未来的购买计划属于国家机密,路透在撰写本报道时并未打听官方未来的购买目标,而是基于分析师的估计。

2009年,时任中国黄金协会副会长的侯惠民提出了5,000吨的目标,理由是中国的国际地位不断提高以及2008年的全球金融危机。

法国巴黎银行分析师David Wilson说,如果中国在 2009 年以5,000 吨作为目标,那么随着中国经济的快速发展,现在的目标可能会更高。

"随着中国继续推进储备的多元化和去美元化,我们将看到中国人行的需求不断,"Wilson说。

图:过去25年中国经济不断增长

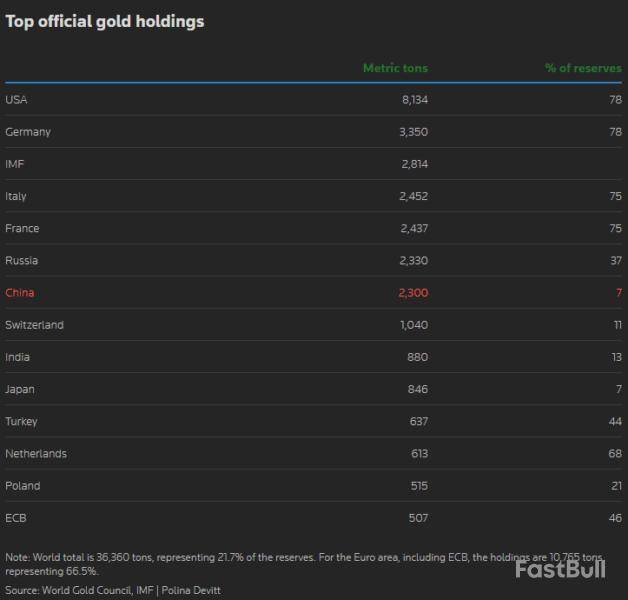

黄金储备达到或超过5,000吨,将使中国央行成为全球第二大黄金官方持有者,仅次于持有 8,133.5 吨黄金的美国,超过法国、德国和意大利。

"现在情况不同了,不确定性本身已成为系统性,"联合国贸易与发展机构周一在其全球贸易最新情况中指出,这对发展中经济体的打击最大。

今年的不确定性包括美国总统特朗普对西方安全政策的颠覆、他与中国等国家的贸易战,以及他对美国联邦储备理事会(美联储/FED)主席鲍威尔的批评引发了对美联储独立性的怀疑。这些风险都没有得到解决。

图:各经济体官方黄金储备持有情况

按名义国内生产总值(GDP)计算,中国的经济规模相当于美国GDP的 64%。按照这一比例计算,美国的黄金储备为 8,133.5 吨,意味着中国应为 5,205 吨。

这比中国当前持有量高出一倍多。根据官方数据,中国人民银行 7 月份的黄金储备为 2,300.4 吨,价值 2,440 亿美元。西方分析人士称,其他国有或国家控制实体可能在中国的金库中储存了更多的黄金。

图:中国央行官方公布的黄金需求

在报告 2023 年以来黄金购买量的国家中,中国和波兰的央行是最积极的买家,波兰已经实现其设定的目标。

鉴于俄乌冲突的前线可能接近波兰边境,波兰在 2023 年、2024 年以及2025年迄今总共购买了 287 吨黄金,黄金在储备中的占比达到了央行目标20%。

与此同时,美国的黄金储备在过去 25 年中基本保持不变,占其外汇储备的 78%。

分析师表示,中国未来几年的经济增长可能将决定其央行持有多少储备。独立咨询师Robin Bhar说,如果中国在未来几十年成为世界最大经济体,其黄金储备应超过 8,000 吨。

中国官方黄金持有量占其总储备的 7%,这意味着,与全球 22% 的平均水平相比,中国的黄金持有量还是偏低。

这部分是因为包括黄金在内的中国储备总额高达 3.6 万亿美元,规模庞大,要提高其中的占比很困难。

然而,据业内人士称,中国作为主要黄金生产国,在2024年总供应量 4,974.5吨中占比达8%,这会对其提高黄金储备有所帮助,而且中国还有其它实体并未公布黄金持有量。

"我感觉市场有购买黄金的欲望,但不会追高,"独立分析师Ross Norman说,"中国的黄金储备无疑是个谜团,谜中有谜"。(完)

请点选括号内代码或连结,即可读取所需新闻内容。

基本金属及贵金属

> 全球金市:黄金攀升至逾3,500美元的纪录高位,因美国降息押注和经济风险

> 金属期市:铜价触及两个月最高,受助于美元回落和积极中国数据

能源类报导

> 国际油市:油价上扬,此前美国针对伊朗石油收入来源实施制裁

> 《亚洲油市综述》超低硫燃料油现货升水回落,柴油裂解价差连升三日

农产品报导

> 芝加哥期市:大豆期货跌至一周半新低,因中国对美国大豆需求不足

《其他消息》

| 股市新闻 | 能源类新闻 |

| 债市新闻 | 金属类新闻 |

| 汇市新闻 | 农产品类新闻 |

| 快速浏览 | 橡胶类稿件 |

如果您在读取查看上述报导时遇到“资料无法提供”(Data not available)时,欢迎致电以下服务热线(Help Desk):

中国客户服务中心:4008-811-408

台湾客户服务中心:0800-666-061

香港客户服务中心:852-30095616

巴西国家石油公司(Petrobras) 首席执行官Magda Chambriard周二表示,印度和中国对其产品的需求一直很强劲,并指出这两个国家可以使该公司免受美国潜在关税的影响。

Chambriard在彭博于圣保罗举办的一次活动上表示,如果美国总统特朗普对进口巴西石油征收了关税,该国可以"轻松地调整出口方向"。

"印度向巴西和巴西国家石油公司表示,可以成为我们想要出口的任何产品的买家,"她说。(完)

FX168财经报社(欧洲)讯 黄金市场过去两年的持续上涨,背后央行需求发挥了关键作用。尽管连续三年录得创纪录的购金规模,但分析师认为,官方储备仍有充足的增长空间。

周二(9月2日),Crescat Capital合伙人兼宏观策略师塔维·科斯塔(Tavi Costa)在接受Kitco News采访时表示,当前央行的购金力度相较上世纪80年代仍处于相对低位。

“央行仍处于积累黄金、重建官方储备的早期阶段,”科斯塔说。“没有理由认为黄金不能占到官方储备的80%。这对金价意味着什么?随着央行持续买入黄金,我预计金价将达到现价的数倍。”

黄金在央行储备中的地位攀升

科斯塔指出,黄金迎来一个重要里程碑:自1996年以来首次,黄金在央行储备中的规模已超过美国国债。更广泛的趋势同样明显。欧洲央行今年6月发布的报告显示,黄金在全球官方储备中的占比已超过欧元。

他强调,央行加速多元化布局黄金并不令人意外,因全球主权债务正以不可持续的速度增长。尤其是美国的经常账户赤字与财政赤字,使美元的全球储备货币地位面临挑战。

“这是美国历史上首次面临如此困境,”科斯塔表示。“在这种环境下,美元相较其他法定货币被严重高估。”

科斯塔认为,容忍通胀上升是解决高企债务的有限途径之一,这意味着美元价值将进一步走弱。

新兴市场领跑,发达国家或将跟进

迄今为止,新兴市场需求是推动官方储备的关键力量。但科斯塔预计,随着美元进一步走软,发达国家央行也将逐步入场。

他解释称,部分发达经济体央行迟迟未加大购金,原因在于其储备比例已处高位。例如,美国持有的黄金占其官方储备的78%;德国央行持有3350吨黄金,占外汇储备的77.5%;葡萄牙的黄金更占到其官方储备的84%。

“如果美元和美债持续贬值,所有央行最终都将被迫买入黄金,以维护本币购买力。”科斯塔补充道。

投资者仍有长期机会

对于投资者而言,科斯塔强调,即便在当前每盎司3500美元的价位,黄金依旧是极具吸引力的长期配置资产。

短期来看,他预计即将到来的美联储降息将点燃金价在年底前的进一步动能。但他提醒投资者,不应只关注短期波动,而应着眼于长期布局。

“十年后回头看,我们会发现,认为当前价格已接近顶点是多么愚蠢,”科斯塔说。“全球宏观经济的失衡如此严重深刻,金价离其应有水平依然相距甚远。”

FX168财经报社(北美)讯 周二(9月2日),MarketGauge.com首席策略师米歇尔·施耐德(Michele Schneider)在8月28日接受Kitco News采访时表示,对于仍在观望的资金而言,当前或正是入场时机。黄金价格的上行空间难以预测。她此前曾精准预测金价将迅速突破每盎司3500美元关口。

“我们一直在等待点燃黄金的火花,回过头看,现在就是那个时机,”施耐德说。“从技术面来看,盘整时间越长,突破后的走势往往越强。我认为金价3800至4000美元是非常现实的目标,在出现获利了结前,这可能是下一个合乎逻辑的水平。即便在当前价位,投资者也没有错过机会。当市场开始在突破位加仓,这往往就是抛物线式上涨的开始。”

现货黄金最新站上每盎司3540美元,并在上周录得有史以来最佳周度收盘表现。

美联储转向推动黄金上涨

施耐德指出,黄金新一轮的动能来自美联储货币政策基调的变化。美联储主席杰罗姆·鲍威尔(Jerome Powell)在杰克逊霍尔年会上表示,经济风险的变化可能需要政策调整。他强调,当前关注点已从将通胀压回2%转向经济与就业市场放缓。

“鲍威尔向市场传递的信息是,他对迅速回到2%的通胀目标并不过度执着,”施耐德说。“这加剧了市场对美元购买力的担忧,全球投资者正逐渐丧失对美元的信心,重新将黄金视为世界货币。”

她补充称,市场普遍缺乏对美联储政策和美国政府能力的信任,这正推动避险资金持续流入黄金。

白银或迎来补涨行情

在黄金维持强势的同时,白银走势更为波动,日内下跌1%,报每盎司40.71美元。尽管如此,施耐德依然看好白银,并预计其表现将持续优于黄金。

她指出,关键在于金银比,目前在86点上方获得初步支撑。展望后市,她预计该比例将跌破80点,从而推动白银升至每盎司50美元并创下历史新高。

“相对来看,白银依然被低估,”施耐德说。“不仅黄金在上涨,白银同样具备巨大的补涨潜力,尤其在全球能源转型的背景下,白银已成为关键性金属。”

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up