Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

A newly-discovered malware called ModStealer is targeting crypto users across macOS, Windows and Linux systems, posing risks to wallets and access credentials.

Apple-focused security firm Mosyle uncovered the malware, saying it remained completely undetected by major antivirus engines for almost a month after being uploaded to VirusTotal, an online platform that analyzes files to detect malicious content, 9to5mac reported.

Mosyle said ModStealer is designed to extract data, with pre-loaded code that steals private keys, certificates, credential files and browser-based wallet extensions. The security researchers found targeting logic for different wallets, including extensions on Safari and Chromium-based browsers.

The security firm said the malware persists on macOS by abusing the system to register as a background agent. The team said the server is hosted in Finland but believes the infrastructure is routed through Germany to mask the operators’ origin.

Security firm warns of fake job ads

The malware is reportedly being distributed through fake job recruitment ads, a tactic that has been increasingly used to target Web3 developers and builders.

Once users install the malicious package, ModStealer embeds itself into the system and operates in the background. It captures data from the clipboard, takes screenshots and executes remote commands.

Stephen Ajayi, DApp and AI audit technical lead at blockchain security firm Hacken, told Cointelegraph that malicious recruitment campaigns using fraudulent “test tasks” as a malware delivery mechanism are becoming increasingly common. He warned developers to take extra precautions when asked to download files or complete assessments.

“Developers should validate the legitimacy of recruiters and associated domains,” Ajayi told Cointelegraph. “Request that assignments be shared via public repositories, and open any task exclusively in a disposable virtual machine with no wallets, SSH keys or password managers.”

Emphasizing the importance of compartmentalizing sensitive assets, Ajayi advised teams to maintain a strict separation between their development environments and wallet storage.

“A clear separation between the development environment ‘dev box’ and wallet environment ‘wallet box’ is essential,” he told Cointelegraph.

Hacken security lead shares practical steps for users

Ajayi also stressed the importance of basic wallet hygiene and endpoint hardening to defend against threats like Modstealer.

“Use hardware wallets and always confirm transaction addresses on the device display, verifying at least the first and last six characters before approving,” he told Cointelegraph.

Ajayi advised users to maintain a dedicated, locked-down browser profile or a separate device exclusively for wallet activity, interacting with only the trusted wallet extensions.

For account protection, he recommended offline storage of seed phrases, multifactor authentication and the use of FIDO2 passkeys when possible.

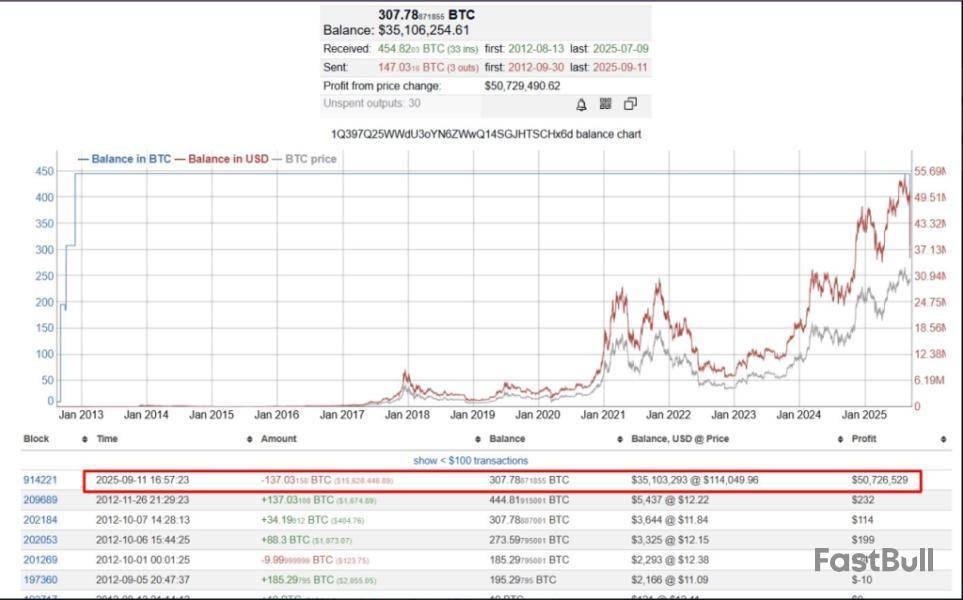

Bitcoin is back in the spotlight after reports confirmed that coins untouched since 2012 have been moved for the first time.

The reactivation of an old wallet came at a moment when the market is already buzzing with strong ETF inflows and record levels of stablecoin liquidity.

Wallet Reactivates After 13 Years

According to Onchain Lens, the address that first received coins on November 26, 2012, moved 132.03 BTC in a single transaction.

The transfer was worth about $15 million at current prices. The same wallet also sent five BTC to the Kraken exchange. After those moves, it still holds 308 BTC — a stash now valued at nearly $35 million.

In total, the address once controlled 444 BTC, which the report places at more than $50 million combined.

Onchain Lens@OnchainLensSep 11, 2025A dormant whale woke-up after 13 years, moved 132.03 $BTC ($15.06M) to a new address and depositing 5 $BTC into #Kraken.

The wallet still holds 307.79 $BTC ($35M). It has received these $BTC for just $5,437 at $12.22https://t.co/mhCNYQs7cA pic.twitter.com/L0ltIwu6Oe

Early Holder Made A Tiny Bet That Paid Off

Based on reports, the coins were originally bought when Bitcoin traded at about $12.22 per coin. The wallet’s total purchase cost was only $5,435.

That original outlay has turned into massive gains. The current math shows a profit in the ballpark of $15.60 million on that small initial buy. Simple numbers like that help explain why stories about old wallets get attention.

Bitcoin has pulled back above the $116,000 mark. Data from Coingecko show BTC trading at $116,083, a daily move of 0.25% and up 3% over the past week.

The market still remembers August 14, 2025, when BTC hit an all-time high of $124,450. Those price swings are part of the backdrop for why a whale moving coins draws extra interest now.

Data shows that Bitcoin spot ETFs recorded $757 million in inflows on Wednesday. That is the largest single-day number since July 17 and extends a three-day streak of positive flows.

The steady inflows suggest bigger players are adding exposure, or at least reallocating capital into the market.

Stablecoin Reserves Hit Records

Meanwhile, reports from CryptoQuant indicate Binance saw its largest net stablecoin inflow of the year on Monday, a little over $6 billion.

Binance’s stablecoin reserves are reported to be near $40 billion, while aggregate stablecoin holdings across exchanges hit about $70 billion last week.New Layer Of Intrigue

The sudden movement of coins untouched for more than a decade has added a new layer of intrigue to Bitcoin’s latest rally.

With the asset holding above $116,000, ETFs drawing hundreds of millions in inflows, and record stablecoin balances sitting on exchanges, the market is flush with liquidity and attention.

Whether this wallet activity signals profit-taking, repositioning, or something else entirely, it highlights the enduring power of early bets on Bitcoin and the continued influence of long-term holders on today’s market.

Featured image from Unsplash, chart from TradingView

On September 20, 2025, KAITO will unlock 8.35 million tokens, about 3.15% of its released supply. Such unlocks often cause short-term price drops because some holders may sell right after receiving new tokens. Still, if there is strong interest in KAITO or new products launching soon, the market may be able to absorb the supply. Watch for how much trading volume increases near this date. If selling is heavy, price can fall quickly. If interest stays high, the impact might be less. Full details are available on the source page.

Aptos will unlock 11.31 million APT tokens, or about 2.15% of its released supply, on October 11, 2025. While this is a smaller portion than some other unlocks, it still creates new supply in the market. If demand is weak, the price might go down as new tokens are sold. If the market is strong or tokens go mostly to long-term holders, effects may be small. Token unlocks often bring uncertainty and price swings, so it is important to monitor trading volume closely. More information can be found at this source.

On October 1, 2025, Plume will unlock about 100.94 million PLUME tokens, which is around 3.33% of its total released supply. This event can add strong selling pressure because people who receive these new tokens may sell them for a quick profit. If many holders sell at the same time, the price could fall. However, if most holders decide to keep their tokens, the effect may be smaller. Traders should watch market demand and the team’s actions during the unlock. Large unlocks often bring volatility. For more details, visit the source.

September 12, 2025 11:32:07 UTC

Galaxy Digital Backs $1.65B Solana Buy

Galaxy Digital is assisting Forward Industries in acquiring $1.65 billion worth of Solana . In just the past 12 hours, Galaxy Digital withdrew 1.45M ($326M) from exchanges. Forward Industries confirmed the move, saying it completed a $1.65B private placement to fund the purchase.

September 12, 2025 11:08:49 UTC

Bitcoin Price Today Back in Sell Zone, Trader Shifts to Shorts

Bitcoin has re-entered the sell/short zone, with traders calling it time to take profits on BTC, ETH, and altcoin spot bags. The strategy: offload 10% of spot holdings daily while adding to shorts. Current positioning stands at 80% USDT/shorts and 20% spot. Sentiment signals caution as the market faces selling pressure.

September 12, 2025 10:51:58 UTC

$1.35M Stolen From Thorchain Cofounder

A Thorchain cofounder has lost $1.35 million after malware stole keys from a software wallet. The attacker didn’t need a malicious transaction — the malware directly accessed the wallet keys. The incident highlights a major risk: keeping large funds in software wallets is unsafe. Experts warn it’s not a matter of if, but when such wallets will be drained.

September 12, 2025 10:51:58 UTC

Polygon Labs Teams Up With Cypher Capital in the Middle East

Polygon Labs has announced a partnership with Cypher Capital to boost institutional access to POL across the Middle East. The initiative aims to channel long-term capital into the Polygon ecosystem, giving institutions exposure to POL while driving yield, growth, and network security

September 12, 2025 10:40:50 UTC

Trader Closes L Short, Warns of Sharplink Effect

A trader has closed his L short despite being in profit, saying it “feels like a crime about to happen” — similar to past surprise rallies like on Base.

He expects potential headlines around Sharplink building on Linea, which could trigger a sudden short squeeze. While the token might bleed for weeks, he warns of a possible FU candle once the ETH <> Sharplink narrative gains traction.

Sharplink has already confirmed plans to stake on Linea, and with Linea’s ETH burn + buyback mechanism, the setup looks strong. The trader draws parallels with:

He suggests shorts could be caught off guard if the narrative reignites.

September 12, 2025 10:40:50 UTC

Crypto Market Today: Whale Rakes in $57M Profit

An early whale wallet (0x7dac) has cashed out another 67,006 worth $3.82M. The whale originally bought 1.26M for $9.51M at an average of $7.52 and also received 22,270 at genesis. He has already sold 385,513 for $16.15M at an average of $41.9, while still holding 900,663 valued at $50.5M. His total profit now stands at an eye-watering $57M+, making him one of the biggest winners in the market.

September 12, 2025 10:39:37 UTC

Gemini’s $425M Nasdaq Debut Boosts Bitcoin Hype

CNBC reports that the Winklevoss twins’ Bitcoin exchange Gemini has raised $425 million through its Nasdaq IPO. The strong debut highlights soaring Wall Street demand for Bitcoin, signaling growing mainstream acceptance of crypto.

September 12, 2025 10:34:29 UTC

Bitcoin News Today: BTC Liquidation Map Shows Longs at Risk

The green line marks Bitcoin’s current price. The big red and orange bars to the left? Those are long liquidations sitting below the price — and smart money is watching them closely. On the right, short liquidation levels are light, meaning most of the risk is stacked on the long side right now. This shorter-timeframe map (from “optical_opti”) usually clears within days. Think of it as a pain map price often gravitates toward these zones to wipe out over-leveraged positions.

TheKingfisher@kingfisher_btcSep 12, 2025Here's the deal on this BTC liquidation map.

That green line? That's current price. See those big red and orange bars to the left? Those are long liquidations getting wiped out under current price. Smart money is watching those levels.

The lines to the right are short… pic.twitter.com/0IFksy1bC9

Charles Guillemet, the chief technology officer at Ledger wallet, has spread the word about the founder of THORChain and Vultisig falling for a trick pulled off by scammers who stole $1.35 million worth of crypto from his old Metamask software wallet, which he had “completely forgotten about”.

The Ledger CTO issued a security warning to the community after the Thorchain cofounder shared the details of what happened. Other sources add that the hackers were likely from North Korea.

Deep-fake Zoom call worth $1.35 million

The victim, @jpthor, shared the details of the hack in several bullet points. He mentioned that his friends’ Telegram account was compromised, and then he, @jpthor, received what was most likely a fake Zoom link for a conference call, which later proved to be a deep-fake one.

The key to the wallet was stored in his iCloud Keychain system, which obviously was also accessed by the hackers – this was a comment from the Ledger CTO: “the malware simply stole the keys,” and @jpthor did not even have to sign that transaction.

Charles Guillemet@P3b7_Sep 12, 2025$1.35M was stolen from a Thorchain cofounder. Yet another reminder: if your keys are stored in a software wallet, you’re only one malicious code execution away from losing everything.

In this case, the victim didn’t even sign a malicious transaction, the malware simply stole the… pic.twitter.com/nLS4nWNFyt

The overall amount of crypto lost to the hackers was worth approximately $1.35 million.

The Ledger CTO said that holding that much money in a software wallet was insane, and holding a lot of crypto in such an online wallet means “it’s not a question of if you’ll be drained, but when.”

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up