Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Apple device management and security firm Mosyle uncovered new malware dubbed "ModStealer" on Thursday — undetected by antivirus tools since first appearing nearly a month ago.

The malware doesn't just target macOS systems, but is cross-platform and purpose-built for stealing data, Mosyle told 9to5Mac. ModStealer's chief purpose is data theft — particularly targeting cryptocurrency wallets, credential files, configuration details, and certificates.

Mosyle found that ModStealer is spreading via fake recruiter ads targeting developers. The malware uses a heavily obfuscated JavaScript file to evade detection and includes pre-loaded scripts targeting 56 browser wallet extensions, including Safari, designed to extract private keys and sensitive account data. Windows and Linux systems are also at risk, according to Mosyle's analysis.

Furthermore, Mosyle's researchers discovered that ModStealer is capable of clipboard and screen capture, as well as remote code execution, giving attackers near-total control of infected devices. On macOS, it persists by abusing Apple's launchctl tool to run as a LaunchAgent, silently exfiltrating data to a remote server that appears to be located in Finland but linked to infrastructure in Germany — likely designed to mask the operators' real location.

The researchers added that ModStealer fits the growing Malware-as-a-Service "business model" increasingly popular among cybercriminal gangs, where ready-made infostealers are sold to affiliates with minimal technical skills.

"For security professionals, developers, and end users alike, this serves as a stark reminder that signature-based protections alone are not enough," Mosyle said. "Continuous monitoring, behavior-based defenses, and awareness of emerging threats are essential to stay ahead of adversaries."

Crypto malware attacks on the rise

On Monday, Ledger CTO Charles Guillemet warned crypto users to halt onchain transactions following a widespread Node Package Manager supply chain attack. The attackers used spoofed NPM support emails to steal developer credentials, allowing them to publish malicious packages designed to hijack crypto transactions across Ethereum, Solana, and other chains by secretly swapping destination addresses.

However, Guillemet later said the attack had "fortunately failed," impacting "almost no victims," with Arkham tracking data suggesting that just $1,000 in crypto was stolen before the compromise was detected and shut down. "The immediate danger may have passed, but the threat hasn't," Guillemet wrote on X, urging users to favor hardware wallets and clear signing protections.

By early Tuesday, multiple crypto teams, including Uniswap, MetaMask, OKX Wallet, Sui, Aave, Trezor, and Lido, reported they were not affected. Security collective SEAL Org called the outcome "lucky," noting a compromised account with packages downloaded "billions" of times weekly could have yielded "untold riches" had the payload been stealthier.

Last week, a report by ReversingLabs also found that threat actors were using Ethereum smart contracts to conceal two NPM packages used to spread malicious instructions before the malware family was taken down.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

This is not another story about a flashy crypto marketplace or a new DeFi protocol. This is about a Rwandan-founded startup, Afrikabal, pushing to rewire the backbone of African trade.

Built on the Lisk protocol and shaped in Rwanda’s pro-innovation environment, Afrikabal’s ambition is simple but seismic. It wants to become the SWIFT of agriculture for the Global South.

The Problem: Trillions in Trade, Stuck on Paper

Every enduring monopoly begins with a secret. For Afrikabal, it is that agriculture is the world’s largest industry without a trust fabric.

This is to say that finance has Visa and SWIFT, whereas logistics has Maersk and DHL. Meanwhile, agriculture, which employs hundreds of millions, still runs on pen, paper, and middlemen. That vacuum isn’t inefficiency; it’s opportunity.

Agriculture moves trillions of dollars across Africa, yet the systems behind it remain antiquated. Logistics are opaque, settlements drag for weeks, and smallholder farmers face crippling delays in receiving payments.

For Afrikabal’s founders, Oghenetejiri Jesse (CEO) and Joseph Rukundo (CTO), this inefficiency is more than a technical flaw. It is a structural bottleneck that keeps African trade locked out of its own potential.

“Most platforms in the space are built for one-off interactions. A farmer here, a buyer there. But what’s missing is an operating system that connects the entire trade cycle with verified trust,” Jesse told BeInCrypto.

That is what Afrikabal is building, with Lisk’s protocol making it deployable, scalable, and accessible for builders in Africa.

This mindset shift ought to be encouraged, with several founders telling BeInCrypto that Lisk gives builders this kind of support from the very early stages.

“The main thing is that many founders get caught up in chasing easy money within crypto—whether it’s grants, early users through DeFi apps, or marketing airdrops. What’s often missing is the founder who says, ‘I want to build something for the right reasons—to solve a real-world problem,” Dominic Schwenter, COO at Lisk, told BeInCrypto.

Beyond Consumer Apps: Infrastructure First

In a region where blockchain often gets reduced to quick-win products, staking schemes, token speculation, or small consumer wallets, Afrikabal is taking a contrarian stance. Its bet is on infrastructure, not retail hype.

By using blockchain as a secure verification and settlement layer, Afrikabal aims to create rails that governments, cooperatives, and large institutions can trust.

This goes beyond “putting money in and getting money out.” It’s about building a backbone for billions in agricultural flows.

“In Africa, the problem is not the lack of ideas. It’s the lack of infrastructure that institutions can adopt at scale. That’s why Afrikabal isn’t a consumer play. We’re building something governments and big players can actually use,” Jesse says.

Schwenter echoed that view, noting that infrastructure, not hype, will define the next era of blockchains.

“If you’re not pushing speculative use cases or launching lots of tokens at once, then in certain industry metrics, you might not shine as brightly. But we see those metrics as short-term noise. Moving forward, every chain must specialize instead of chasing every possible use case,” the Lisk executive articulated.

For instance, Jamit, built on the Lisk blockchain, utilizes Lisk’s Layer-2 (L2) blockchain to offer creators lower costs and enhanced efficiency. They also enjoy better scalability for their audio content.

Meanwhile, listeners get engagement rewards while creators reserve ownership of their content. This dynamic reshapes the podcasting sector by putting ownership, rewards, and creative freedom at the forefront of audio content.

Why Lisk, Why Now?

Jesse says Afrikabal’s choice to build on the Lisk blockchain was intentional, citing developer-friendly architecture and focus on accessibility. Lisk allows startups to build quickly without compromising scalability.

For Afrikabal, Lisk provides the technical runway to move beyond pilots into real-world trade integration. This sentiment resonates with recent remarks from Ikenna Orizu, founder and CEO of Jamit.

“Every major blockchain pitched us, and we even tested a few, but we picked the chain that showed up. Lisk already has what the others have and the edge that matters the most for us: intentional, hands-on support for African founders building for a global audience,” Orizu said in an exclusive statement to BeInCrypto.

Beyond Lisk, the Afrikabal executive also highlighted Rwanda’s unique positioning, indicating how it completed the equation for them.

Rwanda’s Builder Advantage

Often called one of Africa’s most forward-looking innovation hubs, Rwanda offers more than favorable regulation. It provides an ethos.

“Startups in Kigali are encouraged to solve real problems, with the government actively supporting technology that improves efficiency and transparency,” Jesse pointed out.

This environment has made it fertile ground for builders like Afrikabal, who don’t just want to chase speculative capital but want to build infrastructure that lasts.

In Rwanda, Afrikabal sees a chance to scale, not in spite of regulation, but with it.

From Marketplace to Operating System

Afrikabal insists it is not just another marketplace. While most platforms in agri-trade connect buyers and sellers, Afrikabal is positioning itself as the operating system for verified trade.

That means integrating payments, logistics, and compliance into one blockchain-secured layer.

If it succeeds, the result could be transformative, potentially delivering a pan-African and eventually global infrastructure where agricultural trade settles with the same reliability as cross-border finance.

The Long Game: Becoming the SWIFT of Agriculture

Afrikabal’s vision is bold: to evolve into the SWIFT of agricultural trade. That means becoming the rails upon which institutions, governments, and multinationals rely for secure, verifiable, and fast transactions.

“There’s no real solution right now in the market…If you can win that first market and prove the model, you don’t just become another startup. You become the infrastructure everyone builds on,” Jesse stated.

Why This Matters for Crypto

For crypto, Afrikabal’s story suggests that blockchain’s most profound use cases may not come from speculative finance but from solving billion-dollar bottlenecks in the Global South.

For Africa, it’s proof that innovation does not have to mimic Silicon Valley. It can originate from Kigali, built on Lisk, and scale outward.

“…the Global South’s agricultural trade may finally run on rails built not in Silicon Valley or Beijing, but in Kigali,” Jesse noted.

Afrikabal and Jamit may still be in their early innings, but their ambitions point to something larger: the rise of African builders who are not content with apps or tokens. They want to build the rails for real economies.

Afrikabal isn’t asking to be seen as just another Web3 startup. It wants to be the invisible infrastructure beneath African trade, delivering rails that make commerce faster, safer, and more inclusive.

In doing so, it reflects both the promise of Lisk as a developer platform and Rwanda’s role as a launchpad for bold, infrastructure-first builders.

With Africa’s relevance extending beyond narrative, Schwenter says Africa is not just another marketplace. Rather, it is a movement toward something bigger.

“We definitely see Africa as highly relevant. Many things can be developed here that also fit global markets, even if they start by solving a local problem. If you can build a system here and solve a real problem for a local market, it’s very likely that it will translate to other regions around the world facing similar issues.”

Key takeaways:

Michael Saylor transformed MicroStrategy from a business intelligence firm into the world’s largest corporate Bitcoin holder.

Saylor’s conviction redefined corporate strategy, turning volatility into opportunity through long-term, dollar-cost averaging purchases.

His approach set the standard for institutional Bitcoin adoption despite concerns over dilution and debt.

Saylor’s playbook highlights research, perseverance, risk control and long-term thinking in Bitcoin investing.

Saylor’s Bitcoin awakening

In August 2020, Michael Saylor transformed from a technology executive into a symbol of corporate crypto adoption.

Saylor, long known as the co-founder and head of enterprise-software firm Strategy (previously MicroStrategy), made his first bold move into cryptocurrencies by allocating $250 million of the company’s cash to purchase Bitcoin .

He cited a weakening dollar and long-term inflation risks as the underlying reasons behind this strategic move. Incidentally, it marked the largest acquisition of Bitcoin by a publicly traded company at that time and set a new precedent.

Within months, Strategy expanded its holdings: $175 million more in September, $50 million in December and a $650-million convertible-note issuance, bringing Bitcoin holdings over $1 billion.

He recognized Bitcoin as “capital preservation,” comparing it to “Manhattan in cyberspace,” a scarce, indestructible asset.

The move drew both praise and criticism. Skeptics called it reckless, while supporters saw it as a bold innovation at a time when few dared to put Bitcoin on a company’s balance sheet. For Saylor, though, it wasn’t a gamble. It was a calculated hedge against monetary uncertainty and a signal that digital assets would reshape capital strategy.

Did you know? In 2013, Saylor tweeted that Bitcoin’s days were numbered, predicting it would “go the way of online gambling.” That post resurfaced in 2020, right as he pivoted Strategy into the biggest Bitcoin holder among public companies. He has since referred to it as the “most costly tweet in history.”

Saylor’s Bitcoin expansion

From that initial entry point, Saylor doubled and tripled down on his belief in Bitcoin. He applied structured finance tools to scale holdings and shape Strategy into a “Bitcoin treasury company.”

It all started during the July 2020 earnings calls when Saylor announced his plan to explore alternative assets, such as Bitcoin and gold, instead of holding cash. He put the plan into motion with quarterly Bitcoin buys that rapidly scaled holdings to tens of thousands of coins at a favorable cost basis.

By early 2021, Saylor had borrowed over $2 billion to expand his Bitcoin position, an aggressive posture powered by conviction, not speculation. He articulated a vision of long-term ownership by saying that Strategy will hold its Bitcoin investment for at least 100 years.

Despite Bitcoin’s extreme volatility, soaring to $64,000 from $11,000 in 2021 and then plunging to near $16,000 by the end of 2022, Saylor remained unwavering. In support of the claim that Bitcoin is the apex of monetary structure, his team used dollar-cost averaging to take advantage of price dips to increase holdings.

Saylor’s strategy worked: His company’s stock surged, often outperforming Bitcoin itself. By late 2024, Strategy’s stock had gained multiples of S&P 500 returns, and the business became viewed less as a software firm and more as a leveraged crypto proxy.

Saylor’s Bitcoin financing

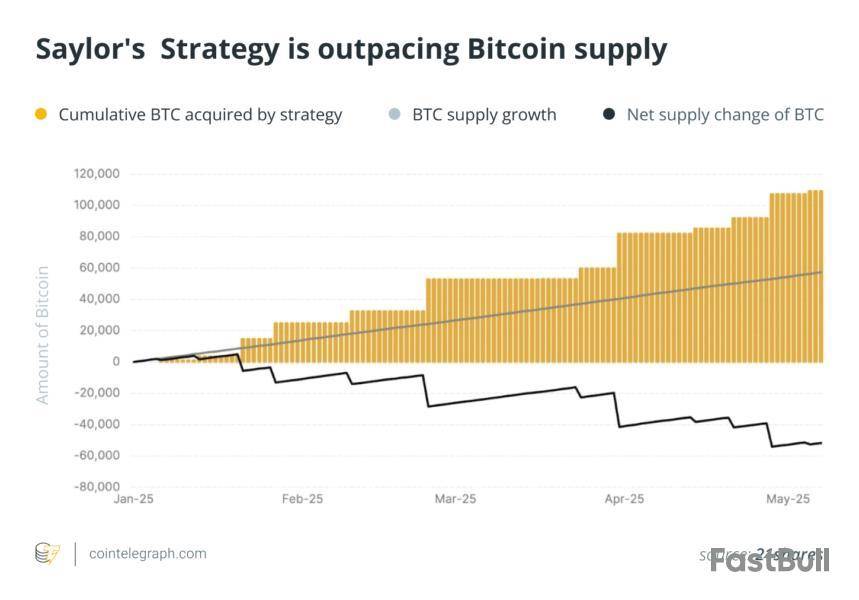

Saylor’s obsession evolved from a bold entry to dominating corporate demand for Bitcoin, shifting market dynamics through sheer scale. By early 2025, Strategy held over 2% of Bitcoin’s total fixed supply, roughly half a million BTC.

Year-to-date, Strategy acquired more than 150,000 BTC at average prices near $94,000, putting its holdings’ market value above $50 billion.

These massive allocations exert structural pressure on Bitcoin’s finite supply, and corporations now compete for scarce coins. Saylor set a benchmark that other firms began to follow. In the first five months of 2025 alone, institutional and corporate Bitcoin purchases surpassed $25 billion.

This scale shifted Strategy’s identity: Software revenue was dwarfed by Bitcoin’s impact on valuation. The equity-raising strategy, issuing stock and debt to fund purchases, was scrutinized as a recursion: If Bitcoin fell, debt could strain the company; if stock was diluted too much, investor confidence could wane.

In June 2025, Strategy added 10,100 BTC via a $1.05-billion purchase, having spent nearly $42 billion on Bitcoin overall. The company’s model was now replicable, but not without increasing systemic risk.

Saylor’s transformation from tech CEO to crypto-treasury architect made him a polarizing figure and inspired imitators. His aggressive playbook reframed not just Strategy’s valuation but the broader institutional adoption narrative.

Did you know? Saylor disclosed that prior to converting company assets into Bitcoin, he had used his own funds to buy 17,732 BTC, which at the time was valued at almost $175 million. This gave him enough conviction to push for Strategy’s corporate allocation.

What’s next for Saylor and Bitcoin?

Saylor has shown no signs of slowing down. Strategy continues to double down on Bitcoin, even financing new purchases through convertible debt and other creative instruments. With halving cycles tightening supply and institutional interest accelerating, Saylor positions Bitcoin not just as a store of value but as a corporate treasury standard.

Looking ahead, the main questions are whether more businesses will follow Strategy’s example, how corporate adoption will be influenced by regulatory frameworks and whether Bitcoin’s function will be limited to balance sheets or extend to other areas of the financial system. If Saylor’s theory is correct, he might not only be known as a bold CEO but also as one of the key players who revolutionized business financing in relation to Bitcoin.

What can you learn from Saylor’s Bitcoin obsession?

Saylor’s journey is unique, but there are practical lessons anyone exploring Bitcoin can take from his approach:

Do your research before committing: Before making an investment, Saylor studied the fundamentals of Bitcoin for months. For novices, this means avoiding hype and beginning with reputable sources, white papers and competent analysis.

Think long term: Saylor has no intention of making a quick profit. For individuals, this translates into only investing what you can hold through volatility rather than trying to time the market.

Risk management matters: Strategy took a hazardous but audacious step by borrowing money to purchase Bitcoin. Retail investors ought to exercise greater caution, refrain from taking on excessive debt and maintain cryptocurrency as a portion of a larger portfolio.

Have conviction, but stay flexible: Throughout the years, Saylor methodically planned his purchases, but he also doubled down on Bitcoin even during downturns. For beginners, dollar-cost averaging may become a useful strategy.

Separate personal belief from company strategy: Not everyone has a corporation to back Bitcoin bets. Saylor blended personal holdings and Strategy’s treasury. For individuals, it’s better to clearly separate personal savings from speculative investments.

Even if you don’t have Saylor’s fortune, you can still use some of his strategies to better navigate Bitcoin, such as doing your own research and being patient and disciplined.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

BONK, Solana’s top memecoin, is back in the spotlight after an impressive two-day rally that lifted prices by more than 22%. Trading at $0.00002477, BONK has outperformed most rivals, held by structural demand and renewed community interest. Talking about business, the trading volume has doubled to $543.6M, while the market cap climbed past $2 billion.

This surge is not just about numbers. Safety Shot, a Nasdaq-listed company, and Bonk.fun have introduced steady buyback flows that are driving demand for BONK tokens. Add to this integration across Solana’s ecosystem, it looks like it’s more than just another memecoin hype cycle. Intriguing right? Join me as I take you through the details behind the price spike and the potential targets.

Why is BONK Price Surging?

The major catalyst behind BONK’s breakout lies in tokenomics. Safety Shot’s acquisition of a 10% revenue share in Bonk.fun means that a significant portion of fees is now being funneled into recurring BONK buybacks on OKX. At July’s pace of $35M in fees, that translates into roughly $28 million in monthly purchases, a powerful demand engine that reduces circulating supply pressure.

This structural buying pressure coincides with broader adoption tailwinds. BONK is now integrated across 400+ Solana dApps, including DeFi protocols like Marinade Finance and gaming ecosystems. Even consumer hardware is playing a role: Solana’s new Seeker phone, which sold over 150,000 units, includes BONK as a rewards currency, embedding the token deeper into the Solana user base.

BONK Price Analysis

The latest upswing began when the BONK price broke above its 7-day SMA at $0.0000221 and its pivot point at $0.00002397. This bullish momentum quickly pushed it to test the $0.00002572 high, just below the $0.000026 Fibonacci resistance. Which corresponds to the 23.6% retracement level from its all-time high of $0.00005916.

Talking about indicators, the RSI sits above 66, not yet overbought but close to exhaustion levels, hinting that the rally may need to cool off. Meanwhile, the MACD histogram flipped positive, signaling that short-term momentum still favors the bulls.

For traders, the key level to watch is above $0.000025. If BONK can hold that threshold, the next logical target is its July swing high at $0.0000282, which also coincides with profit-taking territory shown on the charts. However, a failure to defend $0.000024 could invalidate the breakout and bring a quick pullback toward $0.000021, with secondary support at $0.00002038.

FAQs

Why is the BONK price going up?The rally was triggered by structural buyback demand from Bonk.fun revenues and accelerated by bullish technical momentum.

What key levels should BONK traders watch?Resistance lies near $0.000026 and $0.0000282, while support sits at $0.000024 and $0.000021.

Is BONK overbought at current levels?The RSI suggests near-overbought conditions, so short-term pullbacks are possible, but structural demand supports the broader uptrend.

Crypto markets are buzzing after Glassnode’s cofounders, posting under the handle Negentropic_ on X, predicted that Bitcoin, Ethereum, and Solana are all on track to hit new all-time highs within the next three to four weeks.

Their message to traders was sharp: “This is not the time to step in front of the freight train.”

Forget the September Effect

September is usually seen as a tough month for Bitcoin, but Glassnode believes this year is different. They call it the last chance for “September doomers” to change their stance before the market accelerates.

Optimism is also coming from outside crypto. Expectations of Federal Reserve rate cuts and fresh institutional inflows are adding momentum to the rally.

Glassnode reported that a wave of short liquidations near the $115,000 mark triggered a sharp Bitcoin push higher. This move was confirmed by Hyperliquid’s heatmap across major exchanges between 9–10 pm UTC.

Bitcoin’s Cycle Test

Market veteran Bob Loukas added context, noting that Bitcoin is in week 22 of its cycle and currently testing the underside of its 10-week moving average.

He warned that a dip toward the late August lows of $104,000–$107,000 could happen, but it might just set the stage for another breakout.

Loukas explained, “Historically, this is not the time to be fearful, but rather a time to prepare for volatility and upside.”

He described Bitcoin as entering the speculative phase of its four-year cycle. With altcoins gaining strength and Bitcoin’s dominance slipping, breaking above the 10-week average could spark sharp upside.

Market Snapshot: BTC, ETH, SOL

Each of these top coins is now within reach of its previous all-time high.

Adding to the momentum, corporate treasuries are pouring fresh billions into Ethereum and Solana, strengthening the altcoin market while Bitcoin consolidates.

Why Momentum Is Growing

With the Fed likely to cut rates and regulators signaling openness to tokenized ETFs, the setup is aligning for what could be a historic run.

If Glassnode’s forecast holds, the next month could be the moment when Bitcoin, Ethereum, and Solana all break into uncharted territory.

The countdown has already begun.

FAQs

Is Bitcoin in a bull market right now?Yes. Analysts like Bob Loukas point to Bitcoin entering the speculative phase of its four-year cycle, where volatility and upside tend to increase.

What happens if Bitcoin drops below $110,000?A dip could retest late August lows ($104K–$107K), but analysts see it as a potential setup for the next move higher, not the end of the rally.

Why are institutions buying Ethereum and Solana?Corporate treasuries are investing billions into ETH and SOL for diversification, staking rewards, and exposure to fast-growing ecosystems.

Is Solana becoming the next big institutional play?Yes. With billions in new treasuries and strong developer activity, Solana is increasingly being positioned as an institutional-grade blockchain.

Can Ethereum break its all-time high before Bitcoin?It’s possible. ETH is less than 10% away from its $4,953 ATH, while Bitcoin is ~8% away from $124,457.

The PUMP price is gaining strong traction after its Binance listing triggered a surge in interest and activity. With daily active users on the Pump.fun mobile app hitting new all-time highs and major integrations like Kamino Lend coming into play, the PUMP price today continues to draw bullish momentum.

PUMP Price Today Rises on Growing User Activity and Binance Listing

The Pump.fun mobile app has seen daily active users climb over 110% month-over-month, highlighting accelerating adoption. This rapid growth is fueling optimism around PUMP crypto.The surging user base reflects rising activity across the PUMP price chart and hints at sustained demand ahead.

pump.fun@pumpdotfunSep 11, 2025the pump fun mobile app is ACCELERATING!

Daily Active Users hit new all time highs, up over 110% since last month 🔥

there are TONS of new features coming to the pump fun mobile app 👇 pic.twitter.com/sH7zbwnGGe

Adding to the bullish backdrop, Binance announced the official listing of PUMP with a Seed Tag on its global platform, while Binance.US had already opened deposits for the PUMP/USDT pair on September 9, with trading starting on September 10.

Following this listing, a clear spike in PUMP price USD confirms that a large portion of recent demand came directly from Binance-driven exposure.

Kamino Lend Onboarding Boosts PUMP Crypto Liquidity

In parallel, PUMP has been onboarded to Kamino Lend with a dedicated Pump Market, adding another crucial liquidity avenue for the token.

Kamino@KaminoFinanceSep 11, 2025The ticker is BINANCE:PUMPUSDTBINANCE:PUMPUSDT has officially been onboarded to Kamino Lend, in a new, dedicated Pump Market.

Welcome to Kamino, @pumpdotfun pic.twitter.com/PKC9Acsogw

This integration is expected to deepen the PUMP ecosystem, enabling users to lend and borrow using PUMP as collateral and further embedding it within Solana’s broader DeFi network.

PUMP Price Prediction Targets $0.01 on Double Bottom Breakout

From a technical standpoint, the PUMP price forecast suggests a tilted double bottom pattern is unfolding, with the September 9 Binance listing confirming the neckline retest.

If the bullish momentum holds and demand persists, this structure could push PUMP price up nearly 60% toward the $0.01 level before September ends.

Ethena Labs, the team behind USDe, has withdrawn from the race to issue Hyperliquid’s USDH stablecoin.

This can reshape the governance vote, where several top crypto teams are battling for control.

Why Did Ethena Withdraw?

Ethena was one of the leading contenders, but the team decided to step back after taking on board feedback from community members and validators. In a recent post on X, founder Guy Young acknowledged the following key concerns.

Young notes that while the outcome seems clear, they are withdrawing its USDH proposal, giving validators the freedom to support other teams.

Young also congratulated Native Markets, calling their success a perfect example of what makes Hyperliquid special. “It is a level playing field where emergent players can win the hearts of the community and are given a fair shot at succeeding,” he said.

Markets React: Ethena Drops 3%

Ethena fell nearly 3% after the team withdrew from Hyperliquid’s USDH stablecoin contest. USDH is designed as a native digital dollar, and several top teams, including Native Markets, Agora, Sky, Frax Finance, and Paxos are competing to issue it.

Native Markets, the lead contender, is proposing a Hyperliquid-native stablecoin via Stripe’s Bridge, offering yield-sharing to the Assistance Fund and HYPE token buybacks.

The USDH vote is Hyperliquid’s first major governance decision beyond routine changes. The final vote is set for Sunday, 10:00–11:00 UTC.

Ethena was also one of the top contenders. Its initial bid proposed issuing USDH via Anchorage’s USDtb token, backed by BlackRock’s $2B BUIDL fund. It also pledged to return 95% of reserve revenues to Hyperliquid through community funds, buybacks, or validator rewards.

Native Markets Leads, but Critics Question Fairness

Polymarket now gives Native Markets over 90% chance of winning the USDH bid, with Paxos following next. However, not everyone agrees the process has been fair.

Haseeb Qureshi, managing partner at Dragonfly believes this whole USDH RFP was basically custom made for Native Markets, despite proposals from established teams like Ethena, Paxos, and Agora over the brand-new Native Markets.

Native Markets’ proposal came out right after the USDH RFP was announced, giving them a clear head start while other teams rushed to put theirs together over the weekend.

What’s Next For Ethena on Hyperliquid?

Despite the setback, Ethena will continue moving forward on Hyperliquid, with the following plans. They are collaborating with native teams to develop-

Additionally, Ethena is exploring the wide design space of HIP-3 markets, including-

Despite stepping back from the USDH race, Ethena remains committed to building innovative products that push the ecosystem forward.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up