Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

The NASDAQ 100 Index Fell As Much As 2%, The S&P 500 Fell 1.22%, The Dow Jones Industrial Average Fell 0.82%, The Nasdaq Fell 1.94%, And The Semiconductor Index Fell 3.18%

New York Fed Accepts $1.785 Billion Of $1.785 Billion Submitted To Reverse Repo Facility On Feb 03

Deutsche Bank: The Federal Reserve Is Likely To Remain An Active Buyer Of Short-term U.S. Treasury Bonds Over The Next 5-7 Years

White House Press Secretary Leavitt: President Trump Believes That A Government Shutdown Would Only Harm The Economy

[Ethereum Price Drops Below $2200, Down 6.72% In 24 Hours] February 4Th, According To Htx Market Data, Ethereum Fell Below $2,200, Now Trading At $2,197, A 24-Hour Decrease Of 6.72%

Intel CEO Says Knowledgeable People Told Him USA Is Behind China Now On Open Source Ai - Cisco Ai Summit

LME Copper Rose $586 To $13,478 Per Tonne. LME Aluminum Rose $50 To $3,106 Per Tonne. LME Zinc Rose $15 To $3,338 Per Tonne. LME Lead Was Unchanged At $1,964 Per Tonne. LME Nickel Rose $620 To $17,447 Per Tonne. LME Tin Rose $3,531 To $50,122 Per Tonne. LME Cobalt Was Unchanged At $56,290 Per Tonne

Google Is Exploring A Major Expansion In India, While US President Trump Is Trying To Restrict Visas

If Iraq's Sh'Ite Alliance Decides To Replace My Nomination, I Would Welcome It 'With Open Arms', Ex Prime Minister Nouri Al-Maliki Tells Al-Sharqiya TV

Erdogan's Office: Erdogan Tells Salman That Turkey's Support For Stability In Syria Will Continue And Turkey Will Work In Cooperation With Saudi Arabia For Reconstruction Of Syria

According To Foreign Media Reports, A US Official Revealed On Tuesday That The US Military Shot Down An Iranian Drone That Approached The USS Abraham Lincoln Aircraft Carrier In The Arabian Sea. The Iranian Shahed-139 Drone Was Flying Towards The Carrier When It Was Shot Down By A US F-35 Fighter Jet

Iran Is Also Seeking To Change The Scope Of The Friday Talks To Only Focus On The Nuclear File, Does Not Want The Direct Participation Of Regional Countries - Regional Diplomat

USA Military Shot Down An Iranian Drone That Approached US Navy Aircraft Carrier In Arabian Sea, US Official Tells Reuters

Turkey Trade Balance (Jan)

Turkey Trade Balance (Jan)A:--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)A:--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)A:--

F: --

P: --

US President Trump delivered a speech

US President Trump delivered a speech South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)A:--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)A:--

F: --

P: --

Australia Building Approval Total YoY (Dec)

Australia Building Approval Total YoY (Dec)A:--

F: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)A:--

F: --

Australia Building Permits YoY (SA) (Dec)

Australia Building Permits YoY (SA) (Dec)A:--

F: --

P: --

Australia Private Building Permits MoM (SA) (Dec)

Australia Private Building Permits MoM (SA) (Dec)A:--

F: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key RateA:--

F: --

P: --

RBA Rate Statement

RBA Rate Statement Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction YieldA:--

F: --

P: --

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown.

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown. Saudi Arabia IHS Markit Composite PMI (Jan)

Saudi Arabia IHS Markit Composite PMI (Jan)A:--

F: --

P: --

RBA Press Conference

RBA Press Conference Turkey PPI YoY (Jan)

Turkey PPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Jan)

Turkey CPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)A:--

F: --

P: --

U.K. 10-Year Note Auction Yield

U.K. 10-Year Note Auction YieldA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

Mexico Manufacturing PMI (Jan)

Mexico Manufacturing PMI (Jan)A:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

Japan IHS Markit Services PMI (Jan)

Japan IHS Markit Services PMI (Jan)--

F: --

P: --

Japan IHS Markit Composite PMI (Jan)

Japan IHS Markit Composite PMI (Jan)--

F: --

P: --

China, Mainland Caixin Services PMI (Jan)

China, Mainland Caixin Services PMI (Jan)--

F: --

P: --

China, Mainland Caixin Composite PMI (Jan)

China, Mainland Caixin Composite PMI (Jan)--

F: --

P: --

India HSBC Services PMI Final (Jan)

India HSBC Services PMI Final (Jan)--

F: --

P: --

India IHS Markit Composite PMI (Jan)

India IHS Markit Composite PMI (Jan)--

F: --

P: --

Russia IHS Markit Services PMI (Jan)

Russia IHS Markit Services PMI (Jan)--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Jan)

South Africa IHS Markit Composite PMI (SA) (Jan)--

F: --

P: --

Italy Services PMI (SA) (Jan)

Italy Services PMI (SA) (Jan)--

F: --

P: --

Italy Composite PMI (Jan)

Italy Composite PMI (Jan)--

F: --

P: --

Germany Composite PMI Final (SA) (Jan)

Germany Composite PMI Final (SA) (Jan)--

F: --

P: --

Euro Zone Composite PMI Final (Jan)

Euro Zone Composite PMI Final (Jan)--

F: --

P: --

Euro Zone Services PMI Final (Jan)

Euro Zone Services PMI Final (Jan)--

F: --

P: --

U.K. Composite PMI Final (Jan)

U.K. Composite PMI Final (Jan)--

F: --

P: --

U.K. Total Reserve Assets (Jan)

U.K. Total Reserve Assets (Jan)--

F: --

P: --

U.K. Services PMI Final (Jan)

U.K. Services PMI Final (Jan)--

F: --

P: --

U.K. Official Reserves Changes (Jan)

U.K. Official Reserves Changes (Jan)--

F: --

P: --

Euro Zone Core CPI Prelim YoY (Jan)

Euro Zone Core CPI Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim YoY (Jan)

Euro Zone Core HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone PPI MoM (Dec)

Euro Zone PPI MoM (Dec)--

F: --

P: --

Euro Zone HICP Prelim YoY (Jan)

Euro Zone HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim MoM (Jan)

Euro Zone Core HICP Prelim MoM (Jan)--

F: --

P: --

Italy HICP Prelim YoY (Jan)

Italy HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core CPI Prelim MoM (Jan)

Euro Zone Core CPI Prelim MoM (Jan)--

F: --

P: --

Euro Zone PPI YoY (Dec)

Euro Zone PPI YoY (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

No matching data

View All

No data

Regulator Mike Selig has been nominated to serve as the next chairman of the U.S. Commodity Futures Trading Commission.

In his social media post, Selig stated that he would help to make the US "the crypto capital of the world," echoing the pro-cryptocurrency talking points of some other US government officials.

"Chairman Selig is going to do a great job at the CFTC. I have full confidence in his ability and leadership," he said.

Pro-XRP stance

Notably, Selig is a vocal supporter of XRP. He repeatedly showed support for the popular altcoin while Ripple was in the middle of a momentous legal fight between Ripple and the U.S. Securities and Exchange Commission (SEC)

"XRP itself is simply computer code. A fungible commodity, like gold or whiskey - both of which can also be sold as part of investment schemes that implicate securities laws," Selig said back in 2023.

Last year, he also slammed the SEC for asking Ripple to pay $2 billion.

"SEC can’t argue a $2b penalty against Ripple with a straight face any better than it can the security status of XRP," he said.

Industry support

Selig has already received overwhelming support from the industry.

"Chairman Selig is going to do a great job at the CFTC. I have full confidence in his ability and leadership," Selig said.

"Great to see Mike Selig nominated to chair the CFTC. The timing couldn’t be more important—market structure legislation needs to cross the finish line to deliver clear, workable rules for builders and consumers," venture capitalist Chris Dixon said.

Crypto influencer Coach JV has reiterated his long-term faith in XRP and other digital assets, saying the current moment marks “the greatest shift in humanity.”

According to his post on X, he updated a ranked list of his top holdings and urged patience, arguing that the next five years will reshape how money moves and how families hold wealth.

Analyst’s Updated Holdings

His current ranking places XRP first, followed by Bitcoin, Solana (SOL), Stellar (XLM), WLFI, Hedera (HBAR), and VeChain (VET). He said he favors assets with real-world use and lasting value over quick trades.

Reports have disclosed that WLFI — the token tied to the Trump family’s World Liberty Financial — has not rallied since its September launch and is down about 71% from its peak on September 1.

Still, Coach JV wrote that WLFI is “making moves up [his] ranking,” signaling increased confidence in the token despite its recent drop.

Coach, JV@Coachjv_Oct 24, 2025My top holding have adjusted a bit. In order (just my journey do you)

XRP BITCOIN SOL XLM WLFI (making moves up my ranking) HBAR VET

This is the greatest shift in humanity.

Looking forward to coming back to this in 2030.

XRP As A Core Holding

Coach JV argued that XRP’s fixed supply, speed, and scalability make it useful for cross-border payments. He has described XRP and Bitcoin as stores of family wealth.

He told followers that fiat currency loses buying power over time and that crypto can help preserve purchasing power across generations.

Coach JV also predicted that by 2030 he will look back and see early conviction rewarded. He went further, saying he expects XRP to surpass Bitcoin and Ethereum to become the top cryptocurrency by 2030 and that Ripple could act like a future bank. Community Response And Timing

Meanwhile, reports have highlighted renewed optimism in the XRP community after pro-XRP engineer Vincent Van Code posted that “we might see some big announcements in favor of XRP.”

Van Code suggested such news could come as soon as the US government reopens. Concerns over regulatory delays have been raised elsewhere; several observers say a temporary US shutdown slowed progress on approvals for an XRP exchange-traded fund and other regulatory milestones. Those delays are often cited as reasons why some market-moving updates remain pending.

Vincent Van Code@vincent_vancodeOct 24, 2025Boy wait til the government reopens again soon. We might see some big announcements in favor of XRP.

Market figures underline that conviction does not equal short-term gains. WLFI’s fall of about 71% from its peak on September 1 is a sharp example. Price moves like that were recorded after the token’s September debut.

Investors quoted in social posts have pushed back, reminding followers that publicity and social confidence do not guarantee future returns.Outlook And Advice

According to Coach JV, patience is central: he told his audience to think in decades, not days, and wrote, “Looking forward to coming back to this in 2030.”

That view is shared by some supporters, while others urge caution and point to clear losses in tokens like WLFI as reasons to manage risk.

For now, Coach JV’s stance is public and firm, and it has sparked renewed debate about what role XRP and related projects will play in mainstream finance over the coming years.

Featured image from Unsplash, chart from TradingView

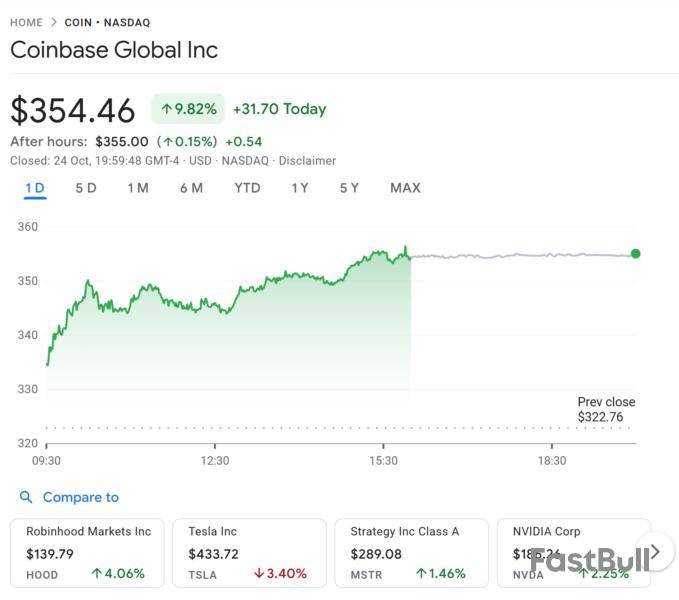

Coinbase CEO Brian Armstrong has outlined an ambitious plan to move every stage of a startup’s journey, from incorporation to fundraising and public trading, onto the blockchain.

Speaking on the TBPN podcast, Armstrong described his vision for an onchain lifecycle where founders could incorporate their startups, raise seed rounds, receive instant capital in USDC (USDC) and eventually go public through tokenized equity.

“You can imagine this whole life cycle coming onchain,” he said, adding that such a shift could “increase the number of companies who go raise capital and get started out there in the world.”

Armstrong said startups will no longer need banks or lawyers to handle global transfers, as funding can be raised instantly through onchain smart contracts. Once capital arrives, founders can start generating revenue, accept crypto payments, access financing and even take their companies public directly onchain.

Bringing fundraising onchain

The Coinbase CEO noted that fundraising process is currently “pretty onerous.” He suggested onchain fundraising to make capital formation “more efficient, more fair, more transparent,” leveraging Coinbase’s recent acquisition of fundraising platform Echo.

Echo, now part of Coinbase, has already helped more than 200 projects raise over $200 million. Armstrong said the company will initially operate independently but will gradually integrate with Coinbase’s ecosystem, giving founders access to its half-trillion dollars in custody assets and a global investor base.

“If we can have great builders come in who want to raise money and connect them with investors who have the money, we’re the perfect platform to help accelerate this,” he said.

Coinbase is also working with US regulators to enable broader access to onchain fundraising. Armstrong claimed that current accredited investor rules exclude many individuals from early-stage opportunities.

“In many ways the accredited investor rules are kind of unfair,” he said. “We’re hoping that we can find the right balance of consumer protection and also making these available to retail.”

JPMorgan sees $34 billion ppportunity in Coinbase’s Base

Last week, JPMorgan Chase upgraded Coinbase to “Overweight,” citing major growth potential from its Base network and revised USDC rewards strategy.

Analysts said Coinbase is “leaning into” its Base layer-2 blockchain to capture more value from the platform’s expansion. They estimated that a potential Base token launch could create a $12 billion to $34 billion market opportunity, with Coinbase’s share valued between $4 billion and $12 billion.

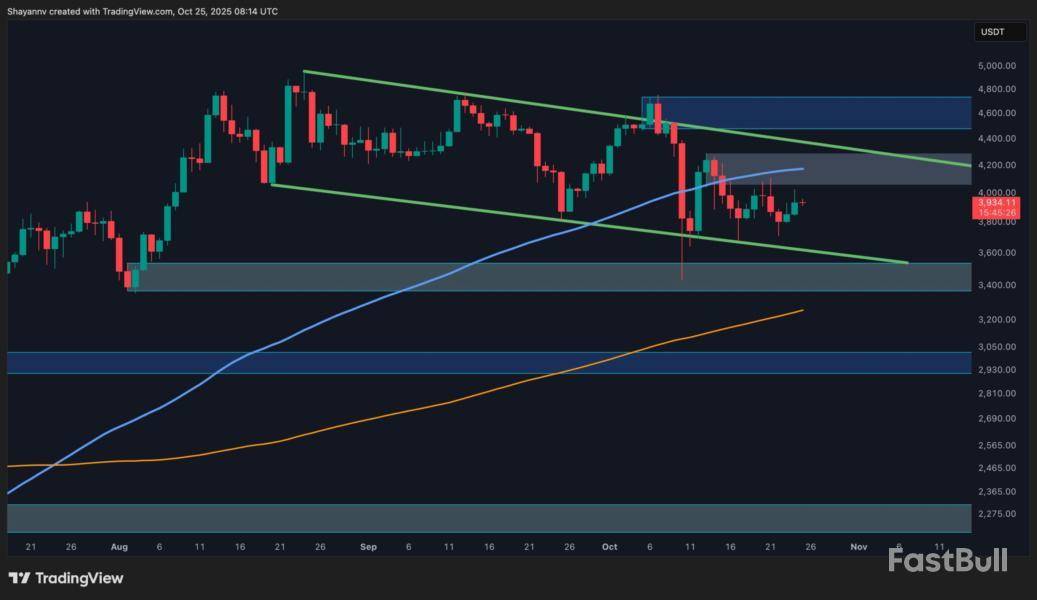

Ethereum continues to display choppy price action, remaining confined within a critical range as both buyers and sellers await a decisive breakout. Further consolidation is likely before a clear directional move takes shape.Technical Analysis

By ShayanThe Daily Chart

On the daily timeframe, Ethereum’s consolidation phase has extended, with volatility and momentum both fading. Price action remains trapped within a crucial range defined by the 100-day moving average and the flag pattern’s upper boundary near $4.1K. This region represents a key supply zone that has repeatedly rejected upward attempts.

On the downside, the flag’s lower boundary, aligning with the $3.5K demand zone, acts as the primary support where buyers have consistently defended. Until a breakout occurs, Ethereum is expected to continue consolidating within this structure, absorbing order flow and building liquidity. A confirmed bullish breakout above $4.1K could likely trigger an impulsive rally toward a new all-time high (ATH).

The 4-hour timeframe reveals Ethereum fluctuating inside a symmetrical triangle, reflecting ongoing market indecision and equilibrium between buyers and sellers. The asset is currently trading just below the triangle’s upper boundary near $4K, with momentum still insufficient for a confirmed breakout.

This compression pattern signals a liquidity buildup phase, where traders are positioning ahead of a potential volatility expansion. If bulls manage to push above the upper trendline, a rally toward $4.1K and potentially $4.6K could follow. Conversely, a breakdown below $3.7K would expose the $3.4K demand zone once again. Until confirmation, Ethereum is likely to continue oscillating within this narrowing range — a setup that typically precedes a sharp directional breakout.

By Shayan

The 1-month liquidation heatmap for Ethereum reveals a dense liquidity pocket forming above the $4.8K swing high, situated directly beyond the current symmetrical consolidation structure. This area corresponds to a significant cluster of resting short liquidations, implying that if Ethereum reclaims the mid-range near $4.1K–$4.3K, a rapid move to absorb this overhead liquidity could follow.

Below the current price, the $3.5K range displays relatively weaker liquidation density, indicating that much of the downside liquidity was already cleared during last week’s sell-off, though a smaller residual cluster remains. This configuration reinforces the idea that Ethereum is likely to continue oscillating within its present consolidation range until one of these liquidity pockets is decisively tested.

Overall, the heatmap confirms that short-term volatility will remain concentrated within the $3.4K–$4.8K corridor, with the upper range carrying a slightly higher probability of being targeted first due to the larger liquidity concentration above current levels.

Top Stories of The Week

Trader who made $190M shorting crash also apparently bet on CZs pardon

The anonymous crypto trader who supposedly made millions shorting the crypto market before US President Donald Trumps tariff announcement appears to have profited again by betting that Trump would pardon the founder of Binance.

Onchain sleuth Euan pointed to Etherscan data to make the connection between the trader and the Polymarket account. The crypto wallet reportedly made $56,522 on Polymarket by betting that Trump would pardon Changpeng CZ Zhao sometime in 2025.

The crypto trader had already been suspected in crypto circles of having access to insider knowledge after their tightly timed Bitcoin and Ethereum shorts, just hours before Trumps tariff announcement sent prices falling.

Rumble partners with Tether to add Bitcoin tips for content creators

Video-sharing platform Rumble is preparing to roll out Bitcoin tipping for its more than 51 million monthly active users, the companys CEO Chris Pavlovski announced on Friday.

Rumble has teamed up with stablecoin issuer Tether to enable Bitcoin tipping, Pavlovski said onstage at the Plan Forum in Lugano, Switzerland.

Right now, were in the testing phase [but] were going to start rolling that out alongside Tether here in the coming weeks, he added.

Also onstage was Tether CEO Paolo Ardoino, who expects a full rollout by early to mid-December once small bugs are fixed and the UX is finessed.

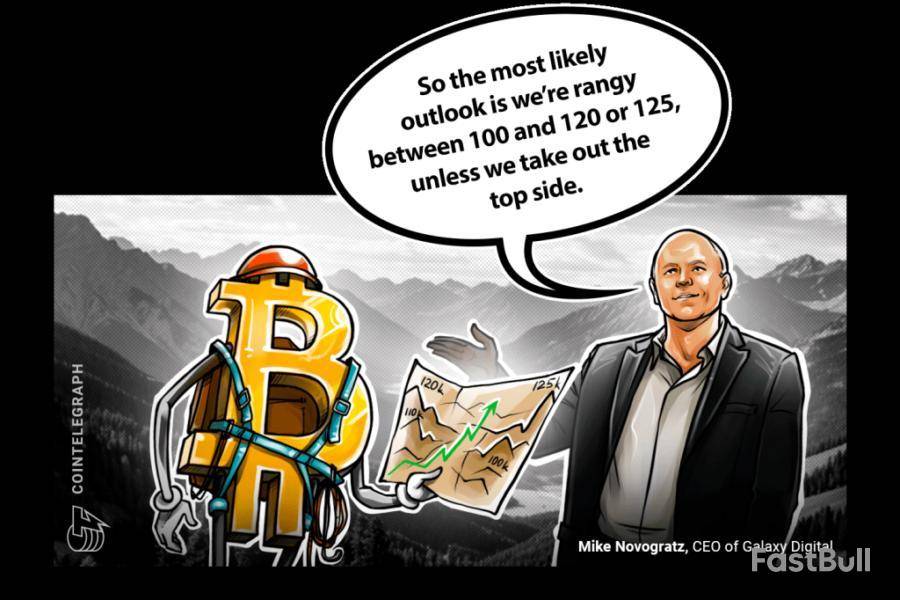

Crazy stuff needed for Bitcoin to reach $250K this year: Novogratz

Planets would almost need to align for Bitcoin to reach $250,000 by the end of the year, according to Galaxy Digital CEO Mike Novogratz.

Several crypto executives have recently doubled down on their $250,000 Bitcoin predictions by year-end.

The end of the year is only two and a half months away, Novogratz said during an interview with CNBC on Wednesday, adding: There would have to be a heck of a lot of crazy stuff to really get that kind of momentum.

Arthur Hayes calls for $1M Bitcoin as new Japan PM orders economic stimulus

Japans new Prime Minister, Sanae Takaichi, announced a package of economic stimulus measures on Tuesday to ease the impact of inflation on households. The move, some crypto observers said, may drive more capital into Bitcoin.

The stimulus measures include subsidies for electricity and gas charges, as well as regional grants to ease price pressure and encourage small to medium-sized businesses to raise wages.

BitMEX co-founder Arthur Hayes viewed the development as a precursor to more fiat money printing by Japans central bank, which may catalyze Bitcoins rise to $1 million.

Translation: lets print money to hand out to folks to help with food and energy costs, said Hayes in a Tuesday X post, adding that this dynamic may see Bitcoin rise to $1 million, while triggering a rise in the Japanese yen.

Prediction markets hit new high as Polymarket enters Sam Altmans World

World co-founder and OpenAI CEO Sam Altmans digital identity project, formerly known as Worldcoin, is expanding into prediction markets by integrating Polymarket.

World App, a mobile application that combines a digital wallet with Worlds decentralized identity tool, World ID, has integrated the Polymarket App, the company announced on Tuesday.

World App users can download and access the new Mini App today in countries where Polymarkets services are permitted, the announcement said.

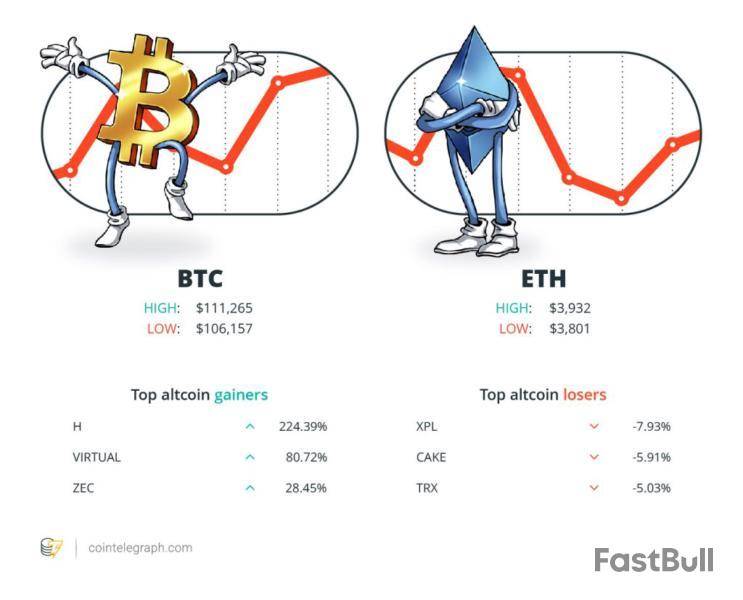

Winners and Losers

At the end of the week, Bitcoin (BTC) is at $111,265 Ether (ETH) at $3,932 and XRP at $2.60. The total market cap is at $3.61 trillion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are Humanity Protocol (H) at 224.39%, Virtuals Protocol (VIRTUAL) at 80.72% and ZCash (ZEC) at 28.45%.

The top three altcoin losers of the week are Plasma (XPL) at 7.93%, PancakeSwap (CAKE) at 5.91% and TRON (TRX) at 5.03%.

For more info on crypto prices, make sure to read Cointelegraphs market analysis.

Most Memorable Quotations

If Congress does not stop this kind of corruption, it owns it.

Elizabeth Warren, US senator

So the most likely outlook is were rangy between 100 and 120 or 125, unless we take out the top side.

Mike Novogratz, CEO of Galaxy Digital

Bitcoin is forming a rare broadening top on the charts. This pattern is famous for tops.

Peter Brandt, veteran trader

Sometimes were literally selling 50 million an hour or 100 million an hour and buying the $100 million of Bitcoin the same hour.

Michael Saylor, executive chairman of Strategy

So what happens there is the AI analyzes where you are, looks at the geography of what retailer [is nearby] and determines that thats the one, and then uses a blockchain to actually do a digital payment system for the tall low-fat latte.

Kevin O’Leary, multimillionaire

Ive been saying for the past two years that the influence of @paradigm within Ethereum could become a relevant tail risk for the ecosystem. I believe this will become increasingly clear to everyone in the months ahead.

Federico Carrone, Ethereum developer

Top Prediction of The Week

XRP price eyes rally to $3.45 after Ripple CEO tells investors to lock in

XRP flashes signs of a potential 35% breakout as bullish technicals align with fresh fundamentals, including Ripple CEO Brad Garlinghouses renewed push for the blockchain companys internet of value vision.

Read also Features UK cannabis millionaires legal deals on wheels via crypto Features Unlocking Cultural Markets with Blockchain: Web3 Brands and the Decentralized RenaissanceXRPs price chart technicals indicate that it has bounced from the lower trendline of its prevailing ascending triangle pattern. That support has historically marked the start of powerful rebound moves, including 70-80% jumps earlier in 2025.

Top FUD of The Week

Spot Ether ETFs see outflows for second consecutive week amid cooling demand

Spot Ethereum exchange-traded funds (ETFs) have logged two straight weeks of outflows amid cooling investor sentiment after months of strong inflows.

According to data from SoSoValue, Ether products collectively posted $243.9 million in net redemptions for the week ending on Friday, following the previous weeks $311 million outflow.

The latest data brings cumulative inflows across all Ether spot ETFs to $14.35 billion, with total net assets standing at $26.39 billion, representing about 5.55% of Ethereums market cap.

On Friday, the funds also $93.6 million in outflows. BlackRocks ETHA ETF led withdrawals with $100.99 million in outflows, while Grayscales ETHE and Bitwises ETHW posted minor inflows.

Young Australians biggest financial regret: Ignoring Bitcoin at $400

Over 40% of Australian Gen Z and Millennials say they regret not investing in cryptocurrency a decade ago, with a new survey from Australian crypto broker Swyftx suggesting they see it as one of the biggest missed opportunities of the last 10 years.

Read also Features Aligned Incentives: Accelerating Passive Crypto Adoption Features Everybody hates GPT-5, AI shows social media cant be fixed: AI EyeThe study, conducted by YouGov and released on Thursday, surveyed 3,009 people, finding that almost half of the under-35s surveyed regret missing the crypto boat.

This was followed by regret for not buying property and not buying shares in big technology companies such as Apple and Amazon.

Part of the FOMO is likely because of the structural buying of Bitcoin and Ether by corporations, sovereigns and US pension funds, according to Swyftx.

Bitcoin chart is echoing the 1970s soybean bubble: Peter Brandt

Bitcoins price chart has started to show similarities to the soybean market around 50 years ago, which saw prices top before plummeting 50% as global supply began to outweigh demand, warns veteran trader Peter Brandt.

However, other Bitcoin analysts are confident that the charts are signaling further upside ahead.

Bitcoin is forming a rare broadening top on the charts. This pattern is famous for tops, Brandt told Cointelegraph. In the 1970s, Soybeans formed such a top, then declined 50% in value.

Top Magazine Stories of The Week

Mysterious Mr Nakamoto author: Finding Satoshi would hurt Bitcoin

The Mysterious Mr Nakamoto author chased suspects across the globe. Hes now open to the idea Satoshi might be an ex-cypherpunk working for the NSA.

Most wealthy Hong Kong investors plan to buy crypto, Japans Bitcoin plan: Asia Express

Hong Kongs rich investors are planning to enter crypto this year, South Korea to ban stablecoin yields, and more.

Cliff bought 2 homes with Bitcoin mortgages: Clever or insane?

Buy a house on credit and keep your Bitcoin Bitcoin-backed mortgages sound great, but what are the drawbacks?

Subscribe The most engaging reads in blockchain. Delivered once a week.Email address

SUBSCRIBE

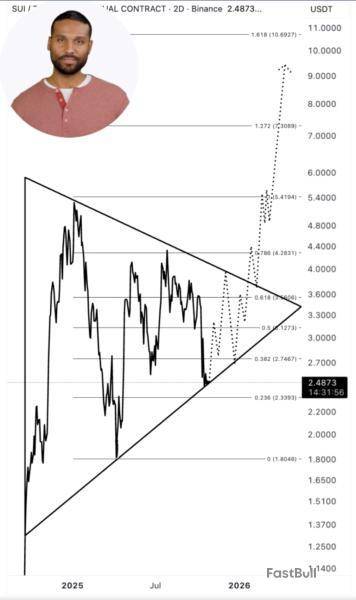

The SUI price has had quite a disappointing performance in 2025, despite having started the year with a red-hot streak. The cryptocurrency’s price rode this new year’s momentum to a new all-time high of $5.35 as early as January 4, 2025.

However, the SUI price currently sits more than 53% away from this record price, putting the altcoin’s struggles into perspective. According to a popular analyst on the social media platform X, the price of SUI could be gearing up for a run-up to a new all-time high.

SUI To Surge 260% If It Breaks Out Of This Pattern

In a recent post on X, market pundit Ali Martinez put forward a $9 target for the SUI price over the next few months. The crypto analyst identified four reasons why the altcoin’s price could be on its way to a new all-time high.

Firstly, Martinez highlighted the current technical setup of the SUI token, which is trading within a symmetrical triangle on the 2-day timeframe. For context, the symmetrical triangle is a technical analysis pattern characterized by a diagonal falling upper trendline and a rising lower trendline.

The asset’s price typically narrows and moves towards the apex of the triangle pattern, either breaching the upper trendline for a breakout or the lower trendline for a breakdown. In essence, this symmetrical triangle formation often serves as a continuation or reversal pattern depending on the direction of the price break.

Given that this technical pattern tends to be a continuation signal, Martinez expects the SUI price to break above the upper trendline, resuming its initial upward movement before entering the triangle. According to the analyst, the token could go as high as $9 if there is a sustained close above this upper boundary at the $3.6 mark

As of this writing, the SUI price stands at around $2.51, reflecting an over 1% jump in the past day. And a move to around $9 would represent an over 260% surge from the current price point.

On-Chain Catalysts For SUI Price

To support this bullish technical structure, Martinez also highlighted three positive on-chain developments in recent weeks. Firstly, the crypto analyst mentioned that the total value locked (TVL) on SUI just hit a new all-time high of $2.6 billion, indicating strong capital inflow on the blockchain.

Meanwhile, the volume of decentralized exchange (DEX) activity on SUI has also been on the rise, reaching a new record high $20.33 billion in October. According to Martinez, this recent spike was driven by real network activity, and not just incentives.

The third on-chain development highlighted is the stablecoin market cap on SUI, which has now climbed to $1.15 billion. Martinez noted that this surge in stablecoin volume underscores the network’s steady growth and strong demand. Ultimately, these positive on-chain fundamentals add to the bullish case of the SUI price.

Listing BIM on Dex-Trade, a known exchange, helps the token become easier to buy and sell for more people. The team will also add more BIM tokens for trading, which can help the price stay stable. Many new users join after such listings, and this can push the price up. However, Dex-Trade is smaller than top exchanges, so the price effect may be limited compared to a major listing. Watch for increased interest as news spreads. More details at source.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up