Investing.com -- Wall Street ended largely lower on Thursday, though the major averages closed well off their session lows. A post-earnings plunge in Microsoft (NASDAQ:MSFT) weighed on sentiment and dragged down software services stocks. Meanwhile, gold halted a historic run that saw the yellow metal near $5,600/oz, as traders locked in gains.

Heavyweight earnings were the focus, with Apple (NASDAQ:AAPL) set to report after the bell. Meta’s (NASDAQ:META) results were cheered by investors.

The benchmark S&P 500 index slipped 0.2% to conclude at 6,963.76 points, having fallen more than 1.5% earlier in the day. The tech-heavy NASDAQ Composite fell 0.7% to finish at 23,685.12 points, having slid about 2.5% earlier. The blue-chip Dow Jones Industrial Average eked out a gain of 0.1% to settle at 49,071.56 points.

The S&P 500 briefly broke through the 7,000 threshold for the first time on Wednesday.

"Clearly Microsoft is the primary culprit behind today’s market weakness as their stock is down more than 12% today after reporting earnings that were ahead of expectations on both earnings and revenue but the sharp increase in AI infrastructure spending seems to have spooked the market. Software names are bearing the brunt of the selloff with the broader group down nearly 10% today," Andrew Goins, senior portfolio manager at Orion Advisor Solutions, said.

Meta soars, Microsoft slumps after earnings

Three of the Magnificent 7 members reported results after hours on Wednesday, with their stocks seeing a mixed response this morning.

Meta soared after the Facebook-owner forecast first-quarter revenue above market expectations, pointing to resilient advertising demand and growing returns from its investments in artificial intelligence.

The Instagram parent also said its capital expenditures would jump to as much as $135 billion this year, well above Wall Street expectations and almost doubling 2025’s total, as big spending on artificial intelligence remained a key theme of earnings.

Microsoft shares, on the other hand, fell sharply. The tech behemoth said it too had spent more on its AI build-out than many had anticipated, but worries still swirled around slightly lower growth at its key Azure cloud-computing division versus the prior quarter.

Microsoft’s results, along with SAP SE’s, raised fresh questions about the durability of cloud and AI spending, and weighed on software services stocks. Atlassian (NASDAQ:TEAM), Workday (NASDAQ:WDAY), and Intuit (NASDAQ:INTU) were among the top percentage decliners on the Nasdaq.

"We’re seeing a strong rotation into more defensive areas of the market with real estate, consumer staples, utilities, financials all in the green so far today. Along with that, value stocks are extending their year-to-date outperformance relative to growth stocks," Orion Advisor Solutions’ Goins said.

"While we’ve been talking a lot about whether AI stocks have been in a bubble over the last few quarters, today’s action along with year-to-date market movements, I think are healthy signs that investors are beginning to pay attention to the risks and the significant costs associated with the continued AI infrastructure buildout," he said.

"These digesting periods are healthy and should create better long-term opportunities. Days like today are good reminders of the benefits of diversification – there are attractive market opportunities outside of just the AI theme," Goins added.

Elsewhere, the Wall Street Journal reported that Amazon was in talks to invest up to $50 billion in ChatGPT-developer OpenAI, citing people familiar with the matter.

Fed holds rates steady, providing stability

The Federal Reserve held interest rates steady at 3.50%–3.75% on Wednesday, marking the first pause after three consecutive cuts.

In its policy statement, the Fed cited still-elevated inflation alongside solid economic growth and a stabilizing labor market, and offered little in the way of guidance on the timing of future cuts.

"Overall, the Fed struck a more positive tone on the economy, with subtle changes to the FOMC’s statement that modestly upgraded the Committee’s outlook on the labor market and conveyed slightly less concern about inflationary pressures," Brian Storey, head of multi asset strategies at Brinker Capital, said.

"Although the Fed did not update its ’dot plot’ at this meeting, it is noteworthy that there seems to be a healthy degree of alignment between the Fed and financial markets (courtesy of fed funds futures) on the likelihood of 1-2 quarter-point rate cuts by year-end," he said.

"With this alignment between the Fed and financial markets, there is a reduced likelihood of monetary policy upending equity markets as we move into the back half of the year," Storey added.

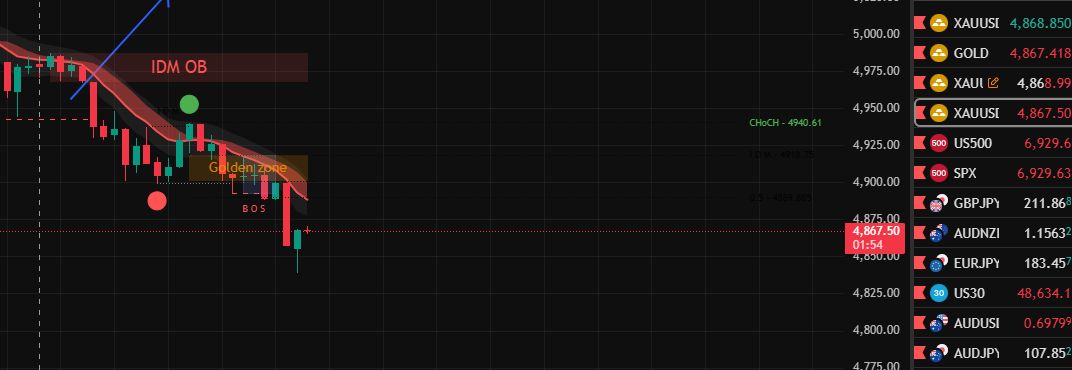

Gold halts historic run, crude pops

Gold prices earlier soared to a record high near $5,600 an ounce, extending recent gains following a report that Trump was considering a new strike on Iran. The run finally came to an end in morning trading, with spot gold sharply turning lower as some profit-taking emerged.

Silver prices also followed gold into negative territory after hitting an all-time peak of nearly $122/oz, as the white metal also benefited from outsized demand for safe havens.

The torrid metal price rally has showed few signs of slowing amid heightened global geopolitical tensions, which ramped up demand for physical assets and safe havens. A weak dollar and uncertainty over U.S. policy also provided support, with copper prices also hitting a record high on Thursday.

Oil prices also climbed strongly, with Brent trading near $70/bbl, on increasing concerns of a disruption of supply from Iran, if the key Middle Eastern producer is targeted by the U.S. for military action.

Brent futures gained 2.9% to $69.29 a barrel and Crude Oil WTI Futures rose 3.1% to $65.13 a barrel.

Both contracts have climbed over 10% this week and are at their highest since June last year.

Ayushman Ojha and Peter Nurse contributed to this article