Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Recently, the MYX price has taken the spotlight in the crypto market. After a strong pump in early September, it again recorded a remarkable surge of nearly 190% in a single day and 1700% on the weekly scale.

At the time of writing, it is trading now above $17.38, MYX crypto has rapidly climbed into the top 100 altcoins, which no expert imagined such a parabolic move would be a rare sight. The growth was directly linked with its bullish momentum fueled by listings, demand, and speculation.

MYX Price Today: Rally Extends With Fresh Listings Today

The MYX price today reflects an extraordinary run, amplified by major listings and increased liquidity.

Similarly, this parabolic rally is possible from a series of bullish factors. These includes the early September WLFI token listing on the MYX exchange and debate around the unlocking of nearly 39 million MYX tokens.

However, the earlier sparked debate over a potential correction when the token traded below $10 has now been delayed, with strong demand observed on the daily chart.

Sep 09, 2025Gate繁體華語@Gate_zw

However, the persistent buying momentum and FOMO defied expectations, driving MYX price toward the $20 level, and, most recently, the addition of MYX to the GATE exchange on September 9 elevated the bullish sentiment. These developments have attracted strong speculative inflows, as the MYX price chart continues to trend steeply upward.

Leveraged Traders Amplify MYX Price Momentum

In parallel with its spot gains, the derivatives market for MYX crypto has exploded. Open interest has surged to record highs, and liquidation data reveal that a massive wave of short positions was wiped out, further accelerating the MYX price USD breakout.

Derivatives volumes show aggressive participation from leveraged traders, intensifying the bullish narrative even as technicals signal caution.

While bullish narratives dominate, indicators like the RSI suggest overheated conditions, raising questions about the sustainability of such rapid gains and shaping short-term MYX price forecast discussions.

Amid the parabolic advance, MYX crypto has established key technical support zones, which may serve as potential resting points if momentum fades. The liquidation heatmap highlights $7.74, $11.85, $14.14, and $16.08 as crucial levels to watch. These supports could help stabilize the MYX price should speculative demand temporarily cool.

A recent Node Package Manager (NPM) attack stole just $50 worth of crypto, but industry experts say the incident highlights ongoing vulnerabilities for exchanges and software wallets.

Charles Guillemet, the chief technology officer of hardware wallet company Ledger, said in a Tuesday X post that the attempted exploit was a “clear reminder” that software wallets and exchanges remain exposed to risks.

If your funds sit in a software wallet or on an exchange, you’re one code execution away from losing everything,” he said, adding that supply-chain compromises remain a powerful malware delivery vector.

Guillemet took the opportunity to advocate for hardware wallets, saying that features like clear signing and transaction checks would help users withstand such threats. “The immediate danger may have passed, but the threat hasn’t. Stay safe,” he added.

Largest NPM attack stole only $50 in crypto

The attack unfolded after hackers acquired credentials using a phishing email sent from a fake NPM support domain.

Using their newly acquired access to developer accounts, the attackers pushed malicious updates to popular libraries. This included chalk, debug strip-ansi and more.

The code they injected attempted to hijack transactions by intercepting wallet addresses and replacing them in network responses across several blockchains, including Bitcoin, Ethereum, Solana, Tron and Litecoin.

TON CTO breaks down NPM attack

Anatoly Makosov, the chief technology officer of The Open Network (TON), said that only specific versions of 18 packages were compromised and that rollbacks were already published.

Breaking down the mechanics of the attack, Makosov said compromised packages functioned as crypto clippers, which silently spoofed wallet addresses in products that relied on the infected versions.

This means web apps interacting with the aforementioned chains risked having their transactions intercepted and redirected without the knowledge of the users.

He said that developers who pushed their builds within hours of the malicious updates and apps that auto-update their code libraries instead of freezing them to a safe version were the most exposed.

Makosov shared a checklist on how developers can check if their apps were compromised. The main sign is whether the code is using one of 18 versions of popular libraries like ansi-styles, chalk or debug. He said if a project relies on these versions, it’s likely compromised.

He said the fix is to switch back to safe versions, reinstall clean code and rebuild applications. He added that new and updated releases are already available and urged developers to act quickly to clear out the malware before it can affect their users.

On-chain data shared by the @XRPwallets analytics account on the X platform shows that there is now one fewer cold XRP wallet at the largest U.S.-based cryptocurrency exchange, Coinbase.

According to the tweet, the number of cold XRP wallets at Coinbase has been falling quickly, along with the XRP stash held in those wallets.

Minus 16.5 million XRP at Coinbase

The XRP-focused analytics account @XRPwallets shared that over the past 24 hours, Coinbase has seen another 16.5 million XRP leave it into the ether from a cold wallet.

Instead of the eight cold wallets remaining today, Sept. 9, there are only seven wallets with 16.5 million XRP in each of them.

XRP_Liquidity (Larsen/Britto/Escrow/ODL/RLUSD)@XRPwalletsSep 09, 20257 Cold Wallets Remaining at 16.5M XRP each https://t.co/02lO6GOPaO pic.twitter.com/GHfm5w9wn8

Three months ago, on June 9, the same account had tracked 52 cold wallets in total at Coinbase. Ten wallets among them contained 26.8 million XRP each, and 42 wallets held 16.5 million XRP each. Now, instead of 42 wallets with this amount of XRP, there are only seven remaining at Coinbase.

BlackRock uses XRP but does not launch ETF

As reported by U.Today earlier, this summer, the world’s largest wealth management company, BlackRock, inked a collaboration with the aforementioned crypto exchange, Coinbase. This platform is not only a custodian for its spot Bitcoin ETF. As of this summer, Coinbase began providing XRP to institutional customers of BlackRock’s investment firm, Aladdin.

The firm started offering Bitcoin services only, but now it has expanded its range of products. While BlackRock is using XRP in this way, it does not have plans so far to launch a spot XRP ETF, even though it has already rolled out ETFs based on Bitcoin and Ethereum.

But some experts believe that BlackRock’s rejection of this ETF might not last long.

Bitcoin and Ethereum are holding steady as optimism over potential U.S. rate cuts drives a cautiously bullish mood in the crypto market. Bitcoin has managed to sustain levels above $112K, reflecting resilience despite recent macro headwinds, while Ethereum trades around $4,300, showing relative stability amid mixed altcoin performance. Investors are increasingly pricing in Federal Reserve easing this month, with expectations ranging from a 25 bps to a 50 bps cut. This growing rate-cut optimism is fueling liquidity-driven bets, though caution remains ahead of the Fed’s September decision.

Bitcoin Breaks the Resistance

The BTC price has broken an important resistance zone, which validates a revival of a bullish trend. The token is consolidating above $112,000, a zone that has emerged as near-term support. In the times when the price was expected to test the support of the descending parallel channel, the potential rate cut has turned into a huge bullish catalyst. Now the question arises whether the current upswing is short-lived.

The Bollinger bands are going parallel, while the OBV continues to descend, which suggests the bears are holding a notable dominance. However, a resistance has formed around $115K to $117K, where profit-taking could intensify. A confirmed breakout above this region may open the door for a rally toward $120K, while a failure could drag the levels close to $110K. The market is showing signs of accumulation, but the traders remain cautious given the potential for volatility around FED announcements.

Ethereum Price Remains Stable

Ethereum is holding around $4,300, supported by steady institutional interest and ongoing ecosystem growth. Meanwhile, the price has been consolidating within a very narrow range since the start of the month and failing to rise above $4500. Now that the short-term resistance lies near $4,450, there is strong support around $4,200. Now the question arises whether the tight consolidation will lead towards a macro trigger.

The ETH price seems to be consolidating within a predefined resistance and support, as it did before. A massive upswing followed that elevated the levels to a new ATH. Currently, the price is consolidating within a similar pattern, while the bulls are trying for a trend reversal. As the MACD suggests a potential bullish crossover, the ETH price is expected to undergo a parabolic recovery and rise by another 10% to 12% to mark a new ATH.

Besides, altcoins such as XRP, Solana, and Dogecoin have shown sharper gains compared to BTC and ETH, reflecting higher beta behavior in response to rate-cut speculation. However, these moves remain largely range-bound, signalling that investors are not yet in full risk-on mode.

The crypto market’s trajectory in September hinges heavily on the Fed’s rate decision. While Bitcoin and Ethereum are showing stability, volatility is expected to rise as investors react to policy signals. A dovish Fed could reinforce bullish momentum, pushing BTC toward $120K and ETH closer to $4,600. On the other hand, a smaller-than-expected cut—or cautious Fed guidance—may trigger short-term pullbacks.

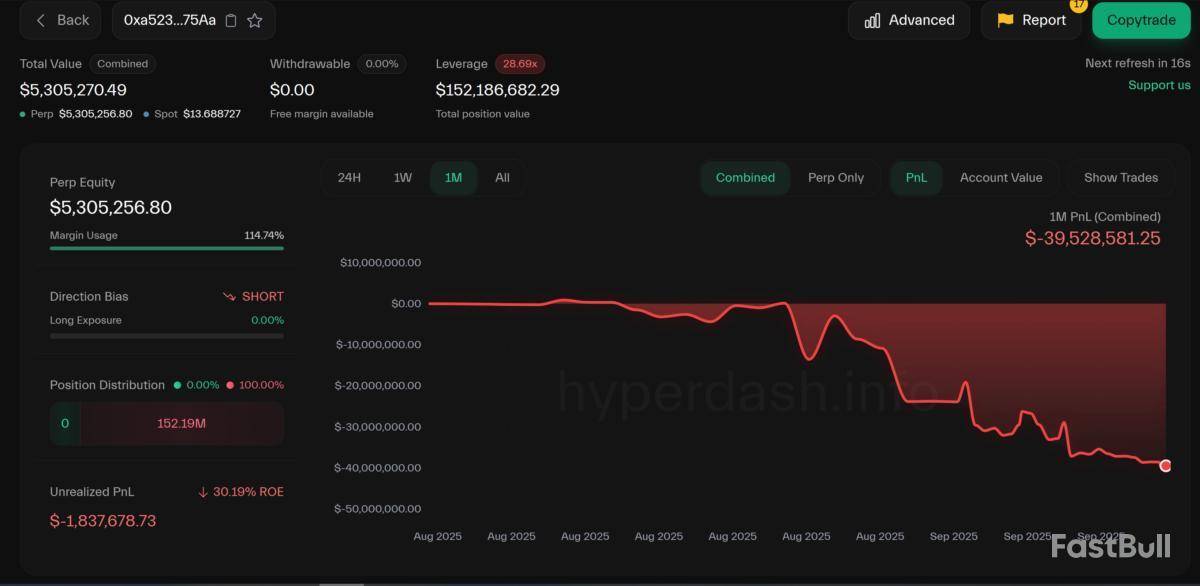

Hyperliquid trader “0xa523” has overtaken James Wynn to become the platform’s largest losing whale, racking up over $40 million in losses in under a month, according to onchain data.

In a Tuesday post on X, Lookonchain revealed that the trader’s downfall was driven by a string of high-leverage missteps, including a $39.66 million loss on Hyperliquid (HYPE), where he sold 886,287 tokens before the asset rebounded. Had he held the position, it would now be worth nearly $9 million more.

He later lost over $35 million on a long Ether (ETH) position, flipped to a short, and then lost another $614,000. His current Bitcoin (BTC) short is also underwater, showing an unrealized loss of $1.8 million, according to data from Hyperdash.

Hyperdash shows the wallet is running a $152 million position with 28.69x leverage and has a combined monthly loss of $39.5 million. Margin usage stands at 114.74%, with full exposure to short positions.

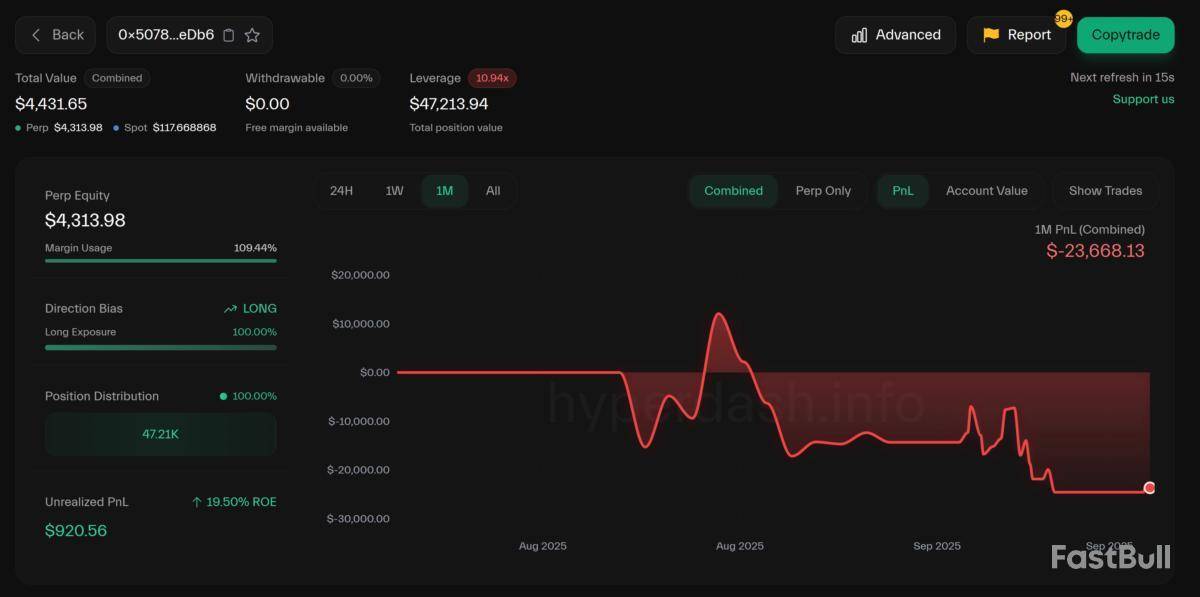

James Wynn lost $23 million in past month

Whale 0xa523’s bad trades and missteps place him at the top of Hyperliquid’s leaderboard, surpassing the previous titleholder James Wynn, who posted a $23.6 million loss last month.

In July, Wynn disappeared from social media, briefly deactivating his X account after updating his bio to simply read “broke.” He returned days later with two high-risk positions, including a 40x leveraged Bitcoin long worth $19.5 million and a 10x PEPE long valued at over $100,000.

Wynn first drew attention in late May, when his $100 million leveraged Bitcoin position was liquidated, followed by another $25 million loss on June 5. He later claimed that large market players had deliberately targeted his liquidation levels.

Tate’s Hyperliquid losses reach $726,000

Whale 0xa523 and Wynn aren’t the only ones bleeding on Hyperliquid. Last week, Andrew Tate, the former kickboxing champion and controversial influencer, opened a long position on the Trump family-linked World Liberty Financial (WLFI) token, which was liquidated for a total loss of $67,500.

The liquidation occurred less than two weeks after he opened a 3x leveraged short position on the Kanye West-linked YZY token, which also went south. Tate’s cumulative losses stand at over $726,000 on Hyperliquid.

TL;DR

XRP Trades Below Fair Value Range, Analyst Says

XRP remains in the lower range of a long-term price channel, according to a chart shared by CryptoBull. The model places current price levels under $4 in a red zone marked as “undervalued.” The following two zones are higher, $4 to $45 in dark green, and $45 to $250 in light green, suggesting upside potential if market momentum continues.

#XRP is still within the undervalued red zone. Dark green price is $4-$45 and light green is $45-$250. pic.twitter.com/pGdI6F1Cwf

— CryptoBull (@CryptoBull2020) September 8, 2025

At present, XRP is trading at $3, with a 24-hour trading volume of $6.62 billion. The token has gained 2% in the last 24 hours and 7% over the past week. Based on this model, the asset has yet to enter what the analyst considers a fair value zone.Long-Term Structure Shows Multi-Phase Accumulation

Another analyst, Jackis, shared a broader view of XRP’s structure, identifying three main accumulation phases. The first phase began in 2022 and lasted until early 2024. A second phase followed in early 2025, showing a base forming between previous highs and support levels.

A third, smaller accumulation area is forming just under the 2017 all-time high, which was near $3.80. The price is now holding just below that level, in what Jackis called the “last tiny re-accumulation.” They noted, “XRP has not said its last word,” and suggested that moves like this often occur beforebreakouts.

They added that each accumulation phase has taken less time than the one before. This kind of structure, known for time compression, can signal that a larger move may be building. If current levels hold, their chart points to a possible move beyond $7.00 later this year.XRP Breaks Trendline After 49-Day Slide

XRP has also broken out of a downtrend that lasted 49 days, according to CryptoWZRD. The move came after the token pushed above a lower high trendline. If momentum holds, the analyst says $3.65 could be the next level to watch.

Meanwhile, exchange reservesreacheda 12-month high, suggesting more tokens have moved onto trading platforms.

Separately, Federal Reserve futures show a 78% chance of a 25-basis point rate cut on September 17. A rate cut would weaken the dollar, which often supports crypto assets like XRP.

In addition, over a dozen spot XRP ETF applications are currently under review by the SEC. The filings are expected to be addressed in October and are seen as a potential driver for market attention.

Bybit is stepping up its game for institutional investors. The world’s second-largest crypto exchange by trading volume has announced a strategic partnership with Switzerland’s Sygnum Bank to deliver bank-grade, off-exchange custody for crypto assets.

The move brings together Bybit’s deep liquidity and wide product range with Sygnum’s reputation for secure, regulated digital asset banking. For institutions looking for safer ways to trade crypto, this could be a game-changer.

Easy Trading Without Moving Funds

The partnership is centered around Sygnum Protect, a custody platform that lets institutions keep their assets off Bybit’s balance sheet while still trading spot and derivatives on the exchange.

Instead of shifting funds back and forth between the bank and the exchange, clients’ balances are mirrored on Bybit. Trading profits and losses are settled every eight hours, a setup designed to improve transparency and capital efficiency.

Swiss Security Standards at the Core

Sygnum is already the largest bank-operated off-exchange custody platform, supporting over half of global spot and derivatives trading volumes. Assets on the platform are protected under Swiss banking laws and secured by strict governance, independent audits, and advanced hardware and software controls.

Adding Bybit to its roster, which already includes Binance and Deribit, boosts Sygnum’s growing influence in institutional crypto services.

Bybit’s Custody Network Keeps Growing

For Bybit, this deal is part of a larger push to strengthen its custody offerings. The exchange already works with Fireblocks, Copper, and Cactus. With Sygnum on board, it now offers regulated Swiss-level custody within its ecosystem.

“Crypto and stablecoin infrastructure is evolving, and managing counterparty risks is essential for further institutional adoption,” said Yoyee Wang, Head of Bybit’s Business-to-Business Unit. “Our partnership with Sygnum Bank not only gives clients access to Bybit’s industry-leading products and liquidity, but also ensures their assets are safeguarded with the highest standards of Swiss banking.”

Dominic Lohberger, Chief Product Officer at Sygnum, added, “The rapid adoption of Sygnum Protect by institutional clients trading on Binance, Deribit, and now Bybit, demonstrates the urgent need for bank-grade, off-balance sheet custody solutions.”

Exchanges and banks are working closer than ever to make crypto safer for institutions. Bybit’s latest move shows that the demand for regulated, reliable custody is only getting stronger.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up