Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

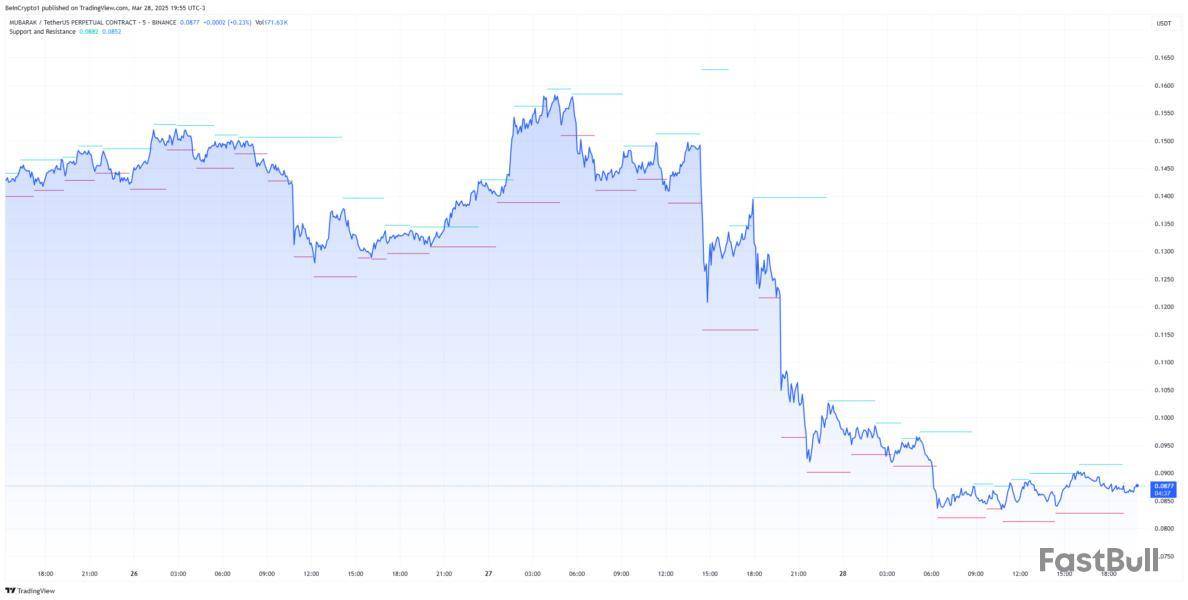

MUBARAK’s sharp 40% drop after its Binance listing has reignited debate around centralized exchange listing practices and the broader state of the meme coin ecosystem.

This came alongside growing scrutiny over speculative meme coin launches like JELLY, which recently triggered a short squeeze and dragged HYPE down, sparking fears of deeper structural risks.

MUBARAK Made The Community Discuss CEX Listing Processes

The steep drop in MUBARAK, now down 40% since its Binance debut, has reignited concerns about the quality of recent listings on centralized exchanges. Binance recently ended its first listing vote, with BROCCOLI and Tutorial surging.

Critics argue that these incidents undermine trust in both DeFi and CEX platforms, as meme coins continue to dominate headlines while more stable crypto sectors struggle for attention.

Still, some platforms like Pump.fun are pushing for innovation, introducing features like token burning and revenue sharing in an effort to steer meme coins toward a more sustainable future.

These concerns have only grown louder following the listing of speculative meme coins on Binance, including BNB Chain tokens like JELLY, which have added to the scrutiny.

Binance founder Changpeng Zhao (CZ) has addressed this criticism, stating that token listings should not dictate long-term price action.

While listings can offer liquidity and improve market access, CZ emphasized that any price impact should be short-term. In the long run, token value should reflect real fundamentals—such as team commitment, development activity, and network performance.

Still, even as the community pushes for more transparency, Binance Alpha has continued to list controversial tokens, including two Studio Ghibli-themed meme coins.

Hyperliquid Crisis Made Users Question Meme Coins

MUBARAK’s drop was not the only crisis in the meme coin ecosystem this week. HYPE experienced a sharp decline following the JELLY short squeeze, triggering widespread speculation about the role of Hyperliquid and meme coins in the crypto ecosystem.

Some users have even questioned if this could be the beginning of an FTX-style collapse as concerns grow over the unchecked volatility tied to meme coin derivatives.

The JELLY controversy has ignited debate around the fragility of emerging platforms and whether enough safeguards are in place to prevent systemic fallout from meme-driven market events. In response to the backlash, Hyperliquid announced it would strengthen its security measures to prevent similar incidents in the future.

Jean Rausis, co-founder of the decentralized finance ecosystem SMARDEX, told BeInCrypto that the DeFi ecosystem needs to think about the image it sends to the market:

“If we want DeFi to be adopted, the ecosystem needs to gain trust not only with its existing users but also in terms of the image it presents in the news. And it’s clear that with projects wrongly labelling themselves as “decentralized”, more incidents like this will happen.”

Sectors Like RWA Could Help To Grow Crypto Credibility

Kevin Rusher, founder of decentralized lending protocol RAAC, described the situation as a major blow to DeFi’s credibility. “This is another setback for DeFi adoption, but it’s not a surprise,” he said, noting that meme coins have reignited retail greed and diverted liquidity away from more sustainable sectors of the ecosystem.

He warned that tokens like TRUMP and MELANIA had captured too much mindshare during the last market surge, leaving DeFi vulnerable to speculative chaos.

Still, Rusher pointed to the growing involvement of institutions like BlackRock as a sign of hope:

“But it looks like institutions and big players like BlackRock also understand this need for stability in crypto, which is why they are now seriously focused on the tokenization of Real World Assets (RWAs). The unfortunate reality is that memecoins are likely here to stay, and they will be a real obstacle for DeFi growth in the short term. However, with RWAs bringing huge liquidity into the system from traditional finance, this sector will finally have the opportunity to grow without memecoin frenzies putting the whole ecosystem in danger.” – Rusher told BeInCrypto.

More Innovation Could Bring Renewed Interest In Meme Coins

In a recent conversation with Bankless, PumpFun co-founder Alon Cohen shared insights about the meme coins market, highlighting PumpFun’s 4Chan-inspired aesthetic, bonding curve pricing model, and new creator-focused initiatives.

Pump.fun has generated over 8.8 million tokens and once peaked with a record $14 million in daily revenue, totaling $600 million since launch.

Alon emphasized that while the meme coin market is cooling—down nearly 49% from its $125 billion peak in December 2024—Pump.fun remains committed to supporting creative and community-driven projects.

To boost long-term sustainability, the team is now introducing revenue-sharing mechanisms for token creators, a transparent fee structure, and token-burning features to reduce the extractive nature of meme coin launches.

With new mechanisms like this, more buyers could come in, and a new generation of meme coin traders could emerge as the ecosystem tries to become more sustainable.

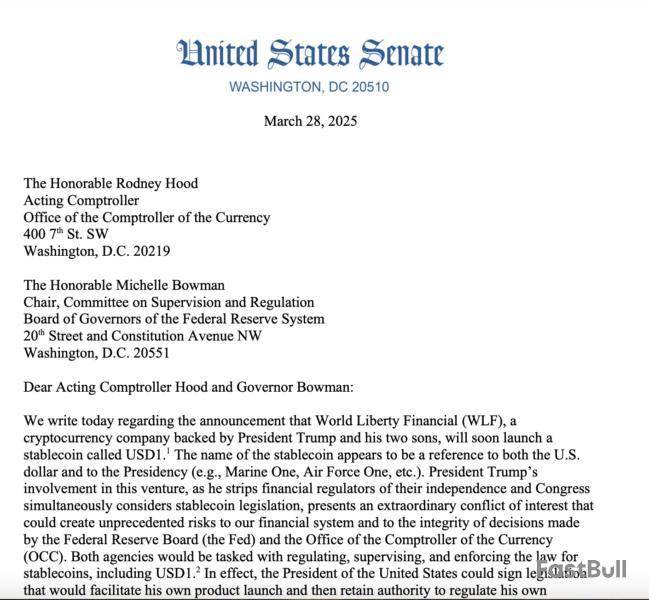

Five Democratic lawmakers in the US Senate have called on leadership at regulatory agencies to consider the potential conflicts of interest from a stablecoin launched by World Liberty Financial (WLFI), the crypto firm backed by US President Donald Trump’s family.

In a March 28 letter from the US Senate Banking Committee, Massachusetts Senator Elizabeth Warren and four other Democrats asked the Federal Reserve’s committee chair on supervision and regulation, Michelle Bowman, and acting comptroller of the currency, Rodney Hood, how they intended to regulate WLFI and its stablecoin, USD1.

The letter came as members of Congress are considering legislation to regulate stablecoins through the Guiding and Establishing National Innovation for US Stablecoins, or GENIUS Act. The bill, if signed into law, would essentially allow the Office of the Comptroller of the Currency (OCC) and Federal Reserve to oversee stablecoin regulation, including for issuers like WLFI and its USD1 coin.

Trump also signed an executive order in February attempting to have all federal agencies — purportedly including the OCC — “regularly consult with and coordinate policies and priorities” with White House officials, giving the US president unprecedented control.

“President Trump’s involvement in this venture, as he strips financial regulators of their independence and Congress simultaneously considers stablecoin legislation, presents an extraordinary conflict of interest that could create unprecedented risks to our financial system and to the integrity of decisions made by the [Fed and OCC],” said the letter, adding:

Since World Liberty launched in September 2024 — months before the US election and Trump’s inauguration — many of the firm’s goals have been shrouded in secrecy. The project’s website notes that Trump and some of his family members control 60% of the company’s equity interests.

As of March 14, World Liberty had completed two public token sales, netting the company a combined $550 million. On March 24, the project confirmed launching its first stablecoin on the BNB Chain and Ethereum. The president’s son, Donald Trump Jr., also pitched USD1 from the DC Blockchain Summit on March 26 with three of WLFI’s co-founders.

The launch of Alpha Season 5 in The Sandbox (SAND) with exclusive Jurassic World rewards is a significant event. This brings in excitement and could attract new users, especially fans of Jurassic World. The increase in users and activities can stimulate demand for SAND tokens, potentially increasing its price. However, if the season does not meet player expectations, there might be less interest and a chance of price stagnation. Observing user engagement and feedback will be essential to gauge the actual price impact. source

The Sandbox@TheSandboxGameMar 28, 2025The wait is almost over. Alpha Season 5 is coming on March 31st!

Pre-register now for an exclusive @JurassicWorld reward https://t.co/FlVlHgMiRV#TheSandbox #AlphaSeason5 $SAND #JurassicWorld pic.twitter.com/Hvh4PmrRGp

Alchemist AI (ALCH) is deploying important updates like Deepseek V3 and Sonnet 3.7, which could be crucial for user experience. Improved UI/UX may draw more users, increasing demand for the token. These updates can show progress and innovation, boosting investor confidence and possibly driving prices up. However, if the updates fail to meet user expectations or there's a bug, it may cause prices to drop. Attention to community feedback and update success will be vital to understand potential price changes. source

The BSCDaily X Space AMA is a big event for Solidus Ai Tech (AITECH) as it covers a huge airdrop and a new product launch. The airdrop may attract new investors, leading to a possible price increase. Revealing a new product can show the project's growth and development, which also encourages buying activity. Together, these elements could be a catalyst for a major price move. However, if the market response is lukewarm, the impact may be limited. It's important for investors to watch market sentiment during and after the AMA. source

BSCDaily@bsc_dailyMar 28, 2025EXCLUSIVE: Join our X Space AMA with @AITECHio - discussing MASSIVE Ecosystem Airdrop, NEW Product Date Reveal & 10% Supply Burn

X Spaces: https://t.co/CHKdUzV0DP

April 2nd, 13:00 UTC

$200 #Giveaways ️

Follow @AITECHio

Ask questions on X!

Like & RT… pic.twitter.com/RgAGkWwF7T

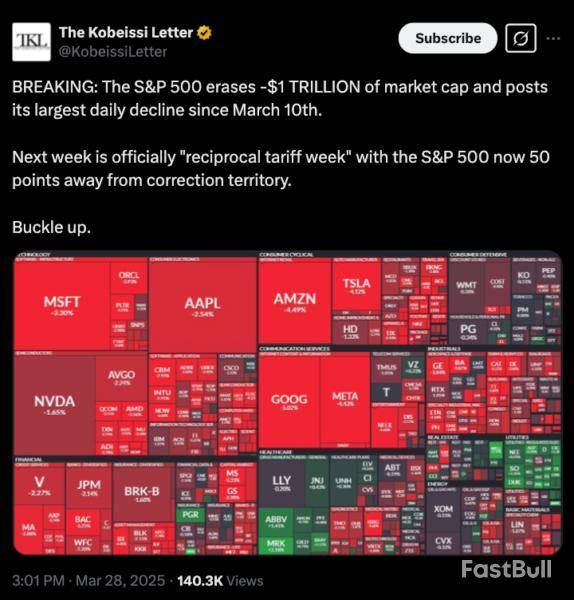

Bitcoin price extended its decline on March 28, falling for a fourth consecutive day to paint an intra-day low of $83,387. BTC’s (BTC) decline mirrored the Wall Street sell-off, where the DOW closed 700 points lower, alongside the S&P 500 index, which dropped 112 points.

The sell-off in equities is widely attributed to investors increasing worries over inflation after the core Personal Consumption Expenditures index data from February rose to 2.8% (a 0.4% monthly increase), which was higher than expected.

The sell-off was further amplified by the markets’ response to US President Trump’s newly levied “reciprocal tariffs,” which applied a 25% tariff to “all cars that are not made in the United States.”

The chances for a Bitcoin relief rally or oversold bounce are likely diminishing as traders cautiously keep an eye on April 2, the day Trump has labeled “Liberation Day,” where additional tariffs, including “pharmaceutical tariffs,” are expected to be unveiled.

Bitcoin price to fall to $65K?

According to veteran trader Peter Brandt, Bitcoin could be on the path to $65,635.

In an X social post, Brandt confirmed the completion of a “bear wedge” pattern and said,

Crypto trader ‘HTL-NL’ agreed with Brandt, suggesting that Bitcoin’s failure in “breaking the ice” of a long-term descending trendline and the confirmation of the bear wedge are proof that BTC is destined to revisit its range lows.

From a purely technical point of view, it’s difficult to project a swift reversal in Bitcoin’s price action as many of its daily timeframe metrics are not oversold. Despite the absence of strong spot market demand in the current price zone, crypto trader Cole Garner says that “whales are going wild right now.”

According to Garner, the Bitfinex spot BTC margin longs to margin shorts metric just fired a powerful signal which shows historical returns of 50%+ returns “within 50 days.”

Beyond the day-to-day price fluctuations, positive crypto industry developments continue to occur on the regulatory front.

On March 28, White House AI and Crypto Czar David Sacks commended the FDIC and its Acting Chairman Travis Hill for clarifying the “process for banks to engage in crypto-related activities.”

Essentially, the Federal Deposit Insurance Corporation’s letter to institutions under its oversight provided clear guidance on their ability to engage in and provide crypto-related products and services without needing to notify the FDIC first.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Bangalore, India--(Newsfile Corp. - March 28, 2025) - KoinBX, a rapidly growing crypto exchange, recently listed the native Gala token of the Gala ecosystem - which includes music, games and entertainment in web3.

Image 1

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8717/246556_006c370b1469cbe6_001full.jpg

With the growing interest in play-2-earn and Web3 entertainment projects, the listing of Gala aligns with KoinBX's mission of betterment for the project.

Saravanan Pandian, CEO and founder of KoinBX said, "Entertainment and gaming is undergoing a revolutionary change in the Web3 domain. As KoinBX continues to expand its GameFi offerings, we are thrilled to bring GALA to our global community."

With strategic partnerships across the gaming and entertainment industries, including collaborations with gaming giants, Gala is at the forefront of the $200 billion global gaming industry's transition to Web3.

Key Listing Details

Token: GALA

Trading Pair: GALA/USDT, GALA/INR

Deposit Opened: March 13, 2025

Trading Started: March 13, 2025

About KoinBX:

KoinBX is an institutional grade crypto exchange that offers fairness, transparency, compliance and access for all. It has proprietary trade matching technology along with the secure custody, architecture, and resilience business continuity standards. Established with a mission to democratize access to financial opportunities and pave the way for a more inclusive and interconnected global economy, KoinBX offers a wide range of digital assets, and robust security measures to ensure seamless transactions and safeguard user assets.

For more information visit: koinbx.com

Contact Details

Aheli Raychaudhuri

aheli@koinbx.com | +91 98844 25592

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/246556

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up