Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

CSX Corporation CSX is currently mired in multiple headwinds, which, we believe, have made it an unimpressive investment option.

Let us delve deeper.

Southward Earnings Estimate Revisions of CSX: The Zacks Consensus Estimate for current-year earnings has been revised downward from $1.93 per share to $1.84 in the past 60 days. For the next year, the consensus mark for earnings has moved 4.7% south in the same time frame. The unfavorable estimate revisions indicate brokers’ lack of confidence in the stock.

CSX’s Zacks Rank: CSX currently carries a Zacks Rank #5 (Strong Sell).

Underperformance of CSX: The CSX stock has gained 2.5% year to date compared with the S&P 500’s 24.7% growth. Moreover, CSX’s current Momentum Style Score of F shows its short-term unattractiveness.

Other Headwinds of CSX: CSX’s prospects have been primarily hurt by the high debt load and soft coal market. The weak coal market has resulted in below-par coal revenues. Coal revenues fell 7% year over year to $553 million in the September-end quarter. Coal volumes decreased 2%. Revenues in the fourth quarter are likely to have been down moderately (approximately by $200 million) due to lower fuel prices and softer coal markets. A weak trucking market is another challenge. Supply-chain disturbances and network-related issues too represent major challenges for CSX.

Elevated capital expenditures also represent a cause of worry. CSX's management expects 2024 capex to be approximately $2.5 billion, which is higher than 2023 actuals. The company’s shares are more volatile than the market.

Stocks to Consider

Investors interested in the Zacks Transportation sector may consider stocks like Matson MATX and Expeditors International of Washington EXPD.

Matson currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Matson is a Honolulu, HI-based provider of ocean transportation and logistics services. The cost-management actions taken by the company to drive its bottom line are impressive. Efforts to reward its shareholders are commendable as well.

In the past 60 days, the Zacks Consensus Estimate for 2024 earnings has moved 15.5% north. The stock has gained 47.2% year to date.

Expeditors currently carries a Zacks Rank #2 (Buy). This Seattle, WA-based freight forwarder’s efforts to reward its shareholders are commendable. EXPD’s liquidity position is encouraging, too.

EXPD has outshined the Zacks Consensus Estimate in only one of the past four quarters (missing the mark twice and reporting in-line earnings on the other occasion). In the past 60 days, the Zacks Consensus Estimate for 2024 earnings has moved 0.6% north.

Zacks Investment Research

For Immediate Release

Chicago, IL – November 7, 2024 – Today, Zacks Equity Research discusses Expeditors International of Washington EXPD, C.H. Robinson Worldwide CHRW and Matson MATX.

Industry: Transportation

Link: https://www.zacks.com/commentary/2365137/3-transport-service-stocks-to-keep-an-eye-on-despite-industry-hiccups

The Zacks Transportation-Services industry faces headwinds from inflation-induced elevated interest rates, weak freight rates and lingering supply-chain disruptions.

Despite the shortcomings, we believe that stocks like Expeditors International of Washington, C.H. Robinson Worldwide and Matson should be on investors' watchlists.

About the Industry

The companies housed in the Zacks Transportation-Services industry offer transporters logistics, leasing and maintenance services. Some industry players focus on global logistics management, including international freight forwarding. Third-party logistics entities provide innovative supply-chain solutions. They also focus on services like product sourcing, warehousing and freight shipping.

These companies have expertise in trucking, air and ocean transportation. Some players in this industry deliver domestic and international express delivery services. The well-being of the companies in this industrial cohort is directly proportional to the health of the economy. An uptick in manufactured and retail goods, favorable pricing and improvement in global economic conditions bode well for industry participants.

3 Trends Shaping the Future of the Transportation-Services Industry

Supply-Chain Disruptions & Weak Freight Rates: Although economic activities picked up from the pandemic gloom, lingering supply-chain disruptions continue to dent the industry players. Below-par freight rates are also hurting the industry's prospects. Highlighting the weak freight demand, the Cass Freight Shipment Index declined 5.2% year over year in September. This measure has deteriorated year over year in each of the last nine months, confirming the overall declining trend.

Strong Financial Returns for Shareholders: With economic activities gaining pace from the pandemic lows, more companies are allocating their increasing cash pile through dividends and buybacks to pacify long-suffering shareholders. This underlines their financial strength and confidence in business. Among the Transportation - Services industry players, Expeditors announced a 5.8% increase in the quarterly dividend in May 2024. Matson announced a quarterly dividend increase in June.

Focus on Cost Cuts to Drive Bottom line: Despite cooling inflation, we are by no means out of the woods. The hotter-than-expected inflation reading for September substantiates our view. We note that the industry has been experiencing significant levels of inflation, including higher prices for labor, freight and fuel. The industry players are focusing on cost-cutting measures, and improving productivity and efficiency to mitigate high expenses and a weaker-than-expected demand scenario.

Zacks Industry Rank Indicates Dull Prospects

The Zacks Transportation - Services industry is a 24-stock group within the broader Zacks Transportation sector. The industry currently carries a Zacks Industry Rank #191, which places it in the bottom 24% of 250 plus Zacks industries.

The group's Zacks Industry Rank, the average of the Zacks Rank of all member stocks, indicates dismal near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry's position in the bottom 50% of the Zacks-ranked industries is a result of a negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually losing confidence in this group's earnings growth potential. The industry's 2025 earnings estimates have decreased 22.3% from 2024 estimates.

Before we present a few stocks from the industry that you may want to buy, let us take a look at the industry's recent stock market performance and the valuation picture.

Industry Lags Sector & S&P 500

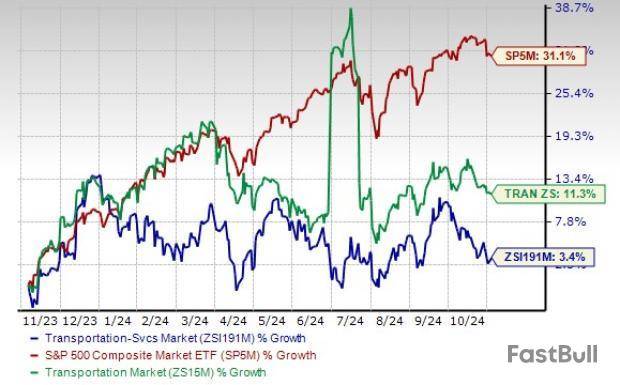

The Zacks Transportation-Services industry has underperformed the Zacks S&P 500 composite and the broader Transportation sector in a year.

The industry has gained 3.4% over this period compared with the S&P 500's appreciation of 31.1% and the broader sector's uptick of 11.3%.

Industry's Current Valuation

Based on the forward 12-month price-to-sales, a commonly used multiple for valuing Transportation-services stocks, the industry is currently trading at 2.18X compared with the S&P 500's 5.04X. The value is, however, higher than the sector's trailing 12-month P/S of 1.82X.

Over the past five years, the industry has traded as high as 2.52X, as low as 1.55X and at the median of 2.02X.

3 Transport Services Stocks to Keep Tab On

Matson: This Honolulu, HI-based provider of ocean transportation and logistics services currently sports a Zacks Rank #1 (Strong Buy). We are impressed by the cost-management actions taken by the company to drive its bottom line. Efforts to reward its shareholders are commendable as well.

Over the past 60 days, the stock has seen the Zacks Consensus Estimate for 2025 earnings move 7.6% north. The stock has gained 74.5% over the past year.

You can see the complete list of today's Zacks #1 Rank stocks here.

Expeditors currently carries a Zacks Rank #2 (Buy). This Seattle, WA-based freight forwarder's efforts to reward its shareholders are commendable. EXPD's liquidity position is encouraging as well.

EXPD has outshined the Zacks Consensus Estimate in two of the past four quarters (missing the mark once and reporting in-line earnings on the other occasion). Over the past 60 days, the stock has seen the Zacks Consensus Estimate for 2024 earnings move 0.6% north.

C.H. Robinson currently carries Zacks Rank #3 (Hold). It operates as an asset-light logistics player. Efforts to control costs bode well for this freight broker. Measures to reward CHRW's shareholders instill further confidence in the stock. CHRW's liquidity position is encouraging as well.

Over the past 60 days, the stock has seen the Zacks Consensus Estimate for 2025 earnings move 2.6% north. The stock has gained 28% in a year.

Why Haven't You Looked at Zacks' Top Stocks?

Since 2000, our top stock-picking strategies have blown away the S&P's +7.0 average gain per year. Amazingly, they soared with average gains of +44.9%, +48.4% and +55.2% per year.

Today you can access their live picks without cost or obligation.

See Stocks Free >>

Join us on Facebook: https://www.facebook.com/ZacksInvestmentResearch/

Zacks Investment Research is under common control with affiliated entities (including a broker-dealer and an investment adviser), which may engage in transactions involving the foregoing securities for the clients of such affiliates.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

https://www.zacks.com

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss. This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole. Zacks Investment Research does not engage in investment banking, market making or asset management activities of any securities. These returns are from hypothetical portfolios consisting of stocks with Zacks Rank = 1 that were rebalanced monthly with zero transaction costs. These are not the returns of actual portfolios of stocks. The S&P 500 is an unmanaged index. Visit https://www.zacks.com/performance for information about the performance numbers displayed in this press release.

Zacks Investment Research

The Zacks Transportation-Services industry faces headwinds from inflation-induced elevated interest rates, weak freight rates and lingering supply-chain disruptions.

Despite the shortcomings, we believe that stocks like Expeditors International of Washington EXPD, C.H. Robinson Worldwide CHRW and Matson MATX should be on investors’ watchlists.

About the Industry

The companies housed in the Zacks Transportation-Services industry offer transporters logistics, leasing and maintenance services. Some industry players focus on global logistics management, including international freight forwarding. Third-party logistics entities provide innovative supply-chain solutions. They also focus on services like product sourcing, warehousing and freight shipping. These companies have expertise in trucking, air and ocean transportation. Some players in this industry deliver domestic and international express delivery services. The well-being of the companies in this industrial cohort is directly proportional to the health of the economy. An uptick in manufactured and retail goods, favorable pricing and improvement in global economic conditions bode well for industry participants.

3 Trends Shaping the Future of the Transportation-Services Industry

Supply-Chain Disruptions & Weak Freight Rates: Although economic activities picked up from the pandemic gloom, lingering supply-chain disruptions continue to dent the industry players. Below-par freight rates are also hurting the industry’s prospects. Highlighting the weak freight demand, the Cass Freight Shipment Index declined 5.2% year over year in September. This measure has deteriorated year over year in each of the last nine months, confirming the overall declining trend.

Strong Financial Returns for Shareholders: With economic activities gaining pace from the pandemic lows, more companies are allocating their increasing cash pile through dividends and buybacks to pacify long-suffering shareholders. This underlines their financial strength and confidence in business. Among the Transportation - Services industry players, Expeditors announced a 5.8% increase in the quarterly dividend in May 2024. Matson announced a quarterly dividend increase in June.

Focus on Cost Cuts to Drive Bottom line: Despite cooling inflation, we are by no means out of the woods. The hotter-than-expected inflation reading for September substantiates our view. We note that the industry has been experiencing significant levels of inflation, including higher prices for labor, freight and fuel. The industry players are focusing on cost-cutting measures, and improving productivity and efficiency to mitigate high expenses and a weaker-than-expected demand scenario.

Zacks Industry Rank Indicates Dull Prospects

The Zacks Transportation - Services industry is a 24-stock group within the broader Zacks Transportation sector. The industry currently carries a Zacks Industry Rank #191, which places it in the bottom 24% of 250 plus Zacks industries.

The group’s Zacks Industry Rank, the average of the Zacks Rank of all member stocks, indicates dismal near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s position in the bottom 50% of the Zacks-ranked industries is a result of a negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually losing confidence in this group’s earnings growth potential. The industry's 2025 earnings estimates have decreased 22.3% from 2024 estimates.

Before we present a few stocks from the industry that you may want to buy, let us take a look at the industry’s recent stock market performance and the valuation picture.

Industry Lags Sector & S&P 500

The Zacks Transportation-Services industry has underperformed the Zacks S&P 500 composite and the broader Transportation sector in a year.

The industry has gained 3.4% over this period compared with the S&P 500's appreciation of 31.1% and the broader sector’s uptick of 11.3%.

One-Year Price Performance

Industry's Current Valuation

Based on the forward 12-month price-to-sales, a commonly used multiple for valuing Transportation-services stocks, the industry is currently trading at 2.18X compared with the S&P 500's 5.04X. The value is, however, higher than the sector's trailing 12-month P/S of 1.82X.

Over the past five years, the industry has traded as high as 2.52X, as low as 1.55X and at the median of 2.02X.

Price-to-Sales Ratio (F12M)

3 Transport Services Stocks to Keep Tab on

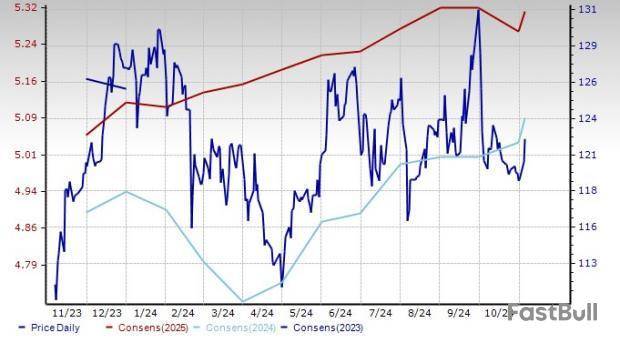

Matson: This Honolulu, HI-based provider of ocean transportation and logistics services currently sports a Zacks Rank #1 (Strong Buy). We are impressed by the cost-management actions taken by the company to drive its bottom line. Efforts to reward its shareholders are commendable as well.

Over the past 60 days, the stock has seen the Zacks Consensus Estimate for 2025 earnings move 7.6% north. The stock has gained 74.5% over the past year.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Price and Consensus: MATX

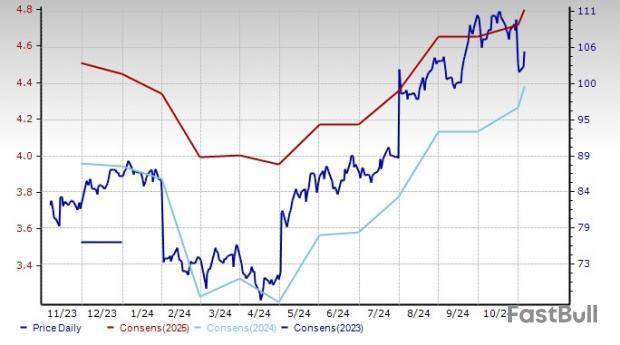

Expeditors currently carries a Zacks Rank #2 (Buy). This Seattle, WA-based freight forwarder’s efforts to reward its shareholders are commendable. EXPD’s liquidity position is encouraging as well.

EXPD has outshined the Zacks Consensus Estimate in two of the past four quarters (missing the mark once and reporting in-line earnings on the other occasion). Over the past 60 days, the stock has seen the Zacks Consensus Estimate for 2024 earnings move 0.6% north.

Price and Consensus: EXPD

C.H. Robinson currently carries Zacks Rank #3 (Hold). It operates as an asset-light logistics player. Efforts to control costs bode well for this freight broker. Measures to reward CHRW's shareholders instill further confidence in the stock. CHRW’s liquidity position is encouraging as well.

Over the past 60 days, the stock has seen the Zacks Consensus Estimate for 2025 earnings move 2.6% north. The stock has gained 28% in a year.

Price and Consensus: CHRW

Zacks Investment Research

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up