Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

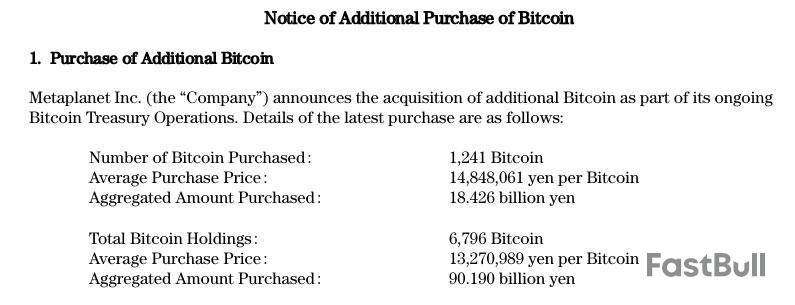

Japanese investment firm Metaplanet has added another $129 million to its Bitcoin treasury, pushing its total holdings past the Bitcoin-stacking country of El Salvador.

“Metaplanet now holds more Bitcoin than El Salvador. From humble beginnings to rivaling nation-states, we’re just getting started,” said CEO Simon Gerovich on X after the latest purchase announcement.

On May 12, the Tokyo-listed firm announced that it had acquired 1,241 Bitcoin for 14.8 million yen ($101,843) per coin.

The total buy, at its highest ever purchase price, is worth around $129 million at current market prices.

This brings the firm’s total holdings to 6,796 Bitcoin, currently worth around $707 million, and the average purchase price is $91,000 per Bitcoin. Metaplanet started its BTC accumulation strategy in April 2024.

El Salvador is the sixth-largest nation-state holder of the asset with 6,714 Bitcoin worth around $642 million, according to the National Bitcoin Office.

The Japanese investment firm also reported a Bitcoin Yield, which measures the ratio of percentage change in Bitcoin holdings per fully diluted share, of 38% for the current quarter to date. The firm achieved a BTC Yield of 95.6% during the first quarter of 2025.

Metaplanet has been more aggressive in its accumulation of the asset in recent months, with a purchase of 5,555 Bitcoin on May 7, four purchases in April totaling 18,586 BTC, and six purchases in March totaling 18,925 BTC, each buy larger than the previous.

The firm is the largest holder of Bitcoin in Asia and the tenth largest globally, according to BiTBO.

Saylor hints at another buy

Meanwhile, Michael Saylor hinted at another purchase by his firm, Strategy, on May 12, by posting a screenshot of the “Saylor Tracker” chart, which tracks the firm’s Bitcoin treasury portfolio. “Connect the dots,” was the accompanying comment.

Saylor has made similar Monday posts with a cryptic comment many times in the past, which have been followed by a BTC acquisition announcement.

Strategy currently holds 555,450 BTC worth around $57.8 billion at current prices, according to the tracker.

Solana started a fresh increase above the $162 zone. SOL price is now consolidating near $175 and might extend gains above the $180 zone.

Solana Price Consolidates Gains

Solana price formed a base above the $150 support and started a fresh increase, like Bitcoin and Ethereum. SOL gained pace for a move above the $155 and $162 resistance levels.

However, the bears were active below the $180 resistance zone. A high was formed at $180.10 and the price corrected some gains. The price dipped below $175 and $172. A low was formed at $169.53 and the price is now attempting another increase.

There was a move above the 50% Fib retracement level of the downward move from the $180 swing high to the $170 low. Solana is now trading above $172 and the 100-hourly simple moving average. There is also a short-term rising channel forming with support at $172 on the hourly chart of the SOL/USD pair.

On the upside, the price is facing resistance near the $176 level and the 61.8% Fib retracement level of the downward move from the $180 swing high to the $170 low. The next major resistance is near the $180 level.

The main resistance could be $185. A successful close above the $185 resistance zone could set the pace for another steady increase. The next key resistance is $192. Any more gains might send the price toward the $200 level.

Downside Correction in SOL?

If SOL fails to rise above the $176 resistance, it could start another decline. Initial support on the downside is near the $172 zone. The first major support is near the $170 level.

A break below the $170 level might send the price toward the $162 zone. If there is a close below the $162 support, the price could decline toward the $150 support in the near term.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is gaining pace in the bullish zone.

Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is above the 50 level.

Major Support Levels – $172 and $170.

Major Resistance Levels – $176 and $180.

BitMart will list Infinaeon (INF), allowing people to trade it more easily. When a coin appears on a big exchange, it can attract new buyers. This often brings more attention and can cause the price to rise. However, sometimes the price goes up before the event and falls after the listing (“sell the news”). Traders should also look at how popular the coin is and how much trading volume it gets. If many people start trading INF on BitMart, price could move strongly. See the announcement here.

BitMart@BitMartExchangeMay 11, 2025BitMart is thrilled to announce the listing of INF @Infinaeon

Trading pair: INF/USDT

Deposit: Already Opened

Trading: 05/12/2025 3:00 PM UTC

Register Now: https://t.co/pc8zxVsQei

Learn more: https://t.co/Bo4HIjHHkW pic.twitter.com/TCmiINwQe7

Geodnet will share new progress and answer questions at their AMA session. Project updates can bring fresh news for investors, especially if achievements are bigger than expected. This could lead to higher interest and price gains. The team will talk about recent work and future plans, which helps people trust the project. An AMA with prizes may also bring more community members, which can help support the price. But if the news is not exciting, there may be little change. Read the details here.

LCX plans to announce important upgrades, which could lead to a big move in price. When a project shares news about changes, investors often get excited. Upgrades can bring better technology or new features, making the coin more useful. If people believe these upgrades will help LCX's future, there might be more buying interest. However, if news is not better than expected, or if upgrades are small, the effect on price may be less. Watching the news closely will help to understand the real impact. Review the official announcement here.

LCX@lcxMay 11, 2025Big upgrades on the way at LCX!

We’ll dive into more details tomorrow.

Which of these 4 are you most excited about?

Discover all the upgrades coming soon → https://t.co/CBO9hP4PYk

Japanese investment firm Metaplanet has purchased another $126.7 million worth of bitcoin, with its total holdings overtaking El Salvador's.

Metaplanet, often dubbed Asia's Strategy for its continued bitcoin accumulation, announced Monday that it has purchased 1,241 BTC for roughly $126.7 million at an average price of $102,119 per bitcoin.

The Tokyo-listed firm now holds 6,796 BTC, acquired for $608.2 million at an average price of $89,492, according to CEO Simon Gerovich's post on X. Based on current market prices, the company's total bitcoin holdings are worth about $706.7 million.

"Metaplanet now holds more Bitcoin than El Salvador," said Gerovich in a separate post. "From humble beginnings to rivaling nation-states, we're just getting started."

El Salvador, the Central American nation that embraced bitcoin in 2021, currently holds 6,174 BTC, according to its Bitcoin Office.

Metaplanet began accumulating bitcoin in April 2024 as part of its crypto strategy and has steadily increased its holdings since. The company aims to reach 10,000 BTC by the end of 2025 and crossed the halfway mark last month.

The company has financed its bitcoin acquisitions through a series of bond issuances. On Friday, it announced a new $21.25 million bond sale, marking its 14th issuance of ordinary bonds to date.

Metaplanet remains the largest publicly listed corporate holder of bitcoin in Asia and ranks 11th worldwide, according to data from Bitcointreasuries.net. Strategy, led by Michael Saylor, remains on top of the global rankings with 555,450 BTC.

Meanwhile, Metaplanet shares rose 3.82% in Monday trading in Japan, with markets still open.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

XRP price found support at $2.20 and started a fresh increase. The price is now gaining pace and might clear the $2.40 resistance zone.

XRP Price Eyes More Gains

XRP price remained supported above the $2.220 level and started a fresh upward wave, like Bitcoin and Ethereum. The price was able to surpass the $2.250 and $2.320 levels.

The bulls pushed the price above the $2.350 resistance zone to set the pace for more gains. Finally, it tested the $2.475 zone. A high was formed at $2.4752 before there was a pullback. The price dipped below $2.40 and tested $2.330. It is again rising with a move above the 23.6% Fib retracement level of the downward move from the $2.4752 swing high to the $2.3310 low.

The price is now trading above $2.350 and the 100-hourly Simple Moving Average. There is also a short-term rising channel forming with support at $2.3650 on the hourly chart of the XRP/USD pair.

On the upside, the price might face resistance near the $2.40 level and the 50% Fib retracement level of the downward move from the $2.4752 swing high to the $2.3310 low. The first major resistance is near the $2.420 level. The next resistance is $2.480.

A clear move above the $2.450 resistance might send the price toward the $2.50 resistance. Any more gains might send the price toward the $2.550 resistance or even $2.6350 in the near term. The next major hurdle for the bulls might be $2.750.

Another Decline?

If XRP fails to clear the $2.420 resistance zone, it could start another decline. Initial support on the downside is near the $2.3650 level. The next major support is near the $2.320 level.

If there is a downside break and a close below the $2.320 level, the price might continue to decline toward the $2.250 support. The next major support sits near the $2.220 zone.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is now above the 50 level.

Major Support Levels – $2.3650 and $2.320.

Major Resistance Levels – $2.420 and $2.480.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up