Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Collaboration kicks off with inaugural Mastercard ASEAN Inclusive Growth Summit in Kuala Lumpur in late October

KUALA LUMPUR, MY / ACCESS Newswire / September 2, 2025 / Mastercard

The Mastercard Center for Inclusive Growth (the Center) announced a landmark collaboration with the Association of Southeast Asian Nations (ASEAN) Business Advisory Council to host the inaugural Mastercard ASEAN Inclusive Growth Summit (the Summit) in Kuala Lumpur in late October - the first of three convenings set to take place in Southeast Asia over the next three years. This significant collaboration deepens Mastercard's commitment to economic growth supporting consumers and small businesses in the Asia-Pacific region.

The collaboration underscores the company's alignment with the Business Advisory Council's focus on sustained, inclusive economic growth in the region, amidst an evolving global and economic landscape. The Summit builds on the success of the Center's Global Inclusive Growth Summit and aims to catalyze sustainable economic growth and advance ASEAN's collective prosperity by demonstrating how regional and business leaders can come together to create opportunities for all. The event aims to spur an exchange of ideas between leaders in the East and West, opening the door to innovation, partnerships, shared collaboration and outcomes for the region.

"This collaboration with Mastercard sets the stage for a long-term platform to advance inclusive economic growth in ASEAN. The Summit creates space for meaningful dialogue and collaboration, where regional challenges can be addressed through practical, locally relevant solutions. As we look ahead, our goal is to strengthen ASEAN's position as a driver of sustainable, inclusive prosperity," said Tan Sri Nazir Razak, Chairman of ASEAN Business Advisory Council.

"Southeast Asia is at a pivotal moment where growth must be paired with security, inclusion and access," said Jon Huntsman, Vice Chairman and President, Strategic Growth at Mastercard. "As the region navigates challenges from economic fragmentation to digital disruption, our collaboration with the ASEAN Business Advisory Council reflects our commitment to helping individuals and businesses unlock economic opportunities, so everyone can benefit from the digital economy."

According to the World Data Lab, more than 1.1 billion people will join the global middle class in the next decade (by 2035), with individuals in Asia driving the majority of that growth. In the ASEAN region, economies have reached a tipping point where half of its citizens belong to the middle class. By 2035, the ASEAN region's middle class is projected to reach 450 million, representing 56% of the population.

At the same time, Southeast Asia's digital economy is expected to grow exponentially, reaching US$560 billion in gross merchandise value by 2030 from US$263 billion in 2024[1]. This digital growth requires deliberate policies, infrastructure investment, cross-sector collaboration and targeted solutions so that the benefits of digitalization can reach more people. Coupled with the region's fast-growing young, digital-first population, the opportunity to build a more inclusive, secure and sustainable digital economy is both immense and critical.

The Summit will bring together government leaders, business pioneers, and development organizations in a high-level forum focused on inclusive and sustainable growth, with a spotlight on micro-, small- and medium-sized enterprises (MSMEs), digital innovation and impact-driven partnerships. The Summit builds on Mastercard's existing efforts in the ASEAN region, including:

Investing in small business development - MSMEs make up more than 97 percent of all businesses in Southeast Asia and provide 85 percent of the employment[2]. In Malaysia, MSMEs contribute roughly 40% of GDP, employing over seven million people[3]. The Mastercard Center for Inclusive Growth supports this vital segment through its flagship Mastercard Strive programs in Malaysia and Indonesia, aiming to uplift 400,000 MSMEs across the two countries through digital upskilling programs, mentoring and networking opportunities, and essential resources for accessing credit. Complementing these efforts, the Center is collaborating with the Asian Development Bank (ADB) to catalyze up to US$1 billion in credit through ADB financing for MSMEs across Asia Pacific, with at least half focused for women-led or climate-focused enterprises.

Strengthening cyber resilience - Recognizing that an economy is only as strong as its weakest link in cybersecurity, Mastercard has collaborated with the ASEAN Foundation to roll out a range of initiatives to enhance the cybersecurity capabilities of public sector entities and small and medium-sized enterprises (SMEs) in the region, by equipping them with critical knowledge, tools and training. In addition, Mastercard has also been actively championing industry collaboration to drive collective action to prevent, detect, and respond to evolving cyber threats. For instance, Mastercard played a key role in initiating the Singapore and Indonesia chapters of the Global Anti Scam Alliance (GASA), serving as Chair and Vice-Chair respectively, and joined hands with the United Nations Development Programme (UNDP) in its global alliance in combating scams.

Driving in-bound tourism - Mastercard is working with tourism ministries and authorities across Southeast Asia to help spur growth and create value for the tourism sector - building on the sector's proven role as a key driver of inclusive economic growth. For instance, Mastercard has been collaborating with Tourism Malaysia to transform and digitize the traveler experience, attract high-value inbound visitors through targeted outreach and unique offerings, and position Malaysia as a premier travel destination, supporting the country's Visit Malaysia (VM) 2026 goals. These collaborations not only fuel growth for the travel sector, but also benefit local small businesses of all stripes, creating more jobs and making a positive impact that extends well beyond tourism itself.

Accelerating the adoption of digital payments - Mastercard has been actively driving the adoption of digital and contactless payments in Southeast Asia to enable secure and seamless everyday transactions and open up access to a broader market for businesses through digital acceptance.

Recently, Mastercard expanded its open-loop payments solutions for transit to the Philippines and Vietnam, bringing commuters greater flexibility and convenience, driving the use of contactless payments, and helping to modernize public transportation systems in Southeast Asia.

Mastercard is collaborating with national digital payments networks to enable real-time payments in Thailand and the Philippines. These real-time payments platforms, PromptPay in Thailand and InstaPay in the Philippines, have brought about widespread adoption of digital payments and is the ubiquitous payment method for everyday transactions among individuals. Now, even the smallest of merchants can go cashless and accept digital payments, connecting them to the digital financial ecosystem and unlocking new opportunities.

Innovative, cost-effective acceptance solutions such as Tap on Phone have further enabled small businesses and mobile merchants across Southeast Asia to accept contactless payments easily and on-the go using just their smartphones, making digital acceptance more accessible and eliminating the need for hardware terminals.

The inaugural edition of the Mastercard ASEAN Inclusive Growth Summit, hosted by the Center, will take place ahead of the 47th ASEAN Summit in Kuala Lumpur, on October 24, 2025; followed by two summits in the region in 2026 and 2027.

Visit the Mastercard ASEAN Inclusive Growth Summit website at https://globalinclusivegrowthsummit.com/ for more information.

Media Contacts

Shazleen Shaik, Mastercard

shazleen.shaik@mastercard.com

Media Contacts

Amalia Rosshaimi, Redhill

amalia.rosshaimi@redhill.asia

Mastercard Center for Inclusive Growth

The Mastercard Center for Inclusive Growth advances equitable and sustainable economic growth and financial inclusion around the world. The Center leverages the company's core assets and competencies, including data insights, expertise, and technology, while administering the philanthropic Mastercard Impact Fund, to produce independent research, scale global programs, and empower a community of thinkers, leaders, and doers on the front lines of inclusive growth. For more information and to receive its latest insights, follow the Center on LinkedIn, Instagram and subscribe to its newsletter.

ASEAN-BAC

Established by the ASEAN Leaders at the 7th ASEAN Summit in November 2001 in Bandar Seri Begawan, Brunei Darussalam and launched in 2003, the ASEAN Business Advisory Council (ASEAN-BAC) is the apex private sector body mandated to provide private sector feedback and guidance to boost ASEAN's efforts towards economic integration, and further identify priority areas for consideration of ASEAN leaders. The ASEAN-BAC will lead in coordinating inputs from established business councils and entities in their interactions with various ASEAN sectoral groups.

ASEAN-BAC Malaysia

The ASEAN-BAC Malaysia chapter is an integral member in the regional ASEAN-BAC with regular participation at all Council Meetings and Consultation with ASEAN Leaders. Since 2003, ASEAN-BAC Malaysia has provided policy input at various consultations with the ASEAN Leaders, ASEAN Economic Ministers and ASEAN Sectoral bodies. Notably, ASEAN-BAC Malaysia was the Chair in 2015 when Malaysia announced the formation of the ASEAN Community. ASEAN-BAC Malaysia is represented by Chairman Tan Sri Nazir Razak alongside council members Tan Sri Tony Fernandes and Mr. Lim Chern Yuan.

As Malaysia is the ASEAN Chair in 2025, ASEAN-BAC Malaysia is proud to take the lead in all private sector policy initiatives and programmes, supporting Malaysia's Chairmanship vision and Priority Economic Deliverables (PEDs). In realising the vision, ASEAN-BAC Malaysia has begun to roll out 12 policy initiatives and over 60 programmes throughout the year aimed at advocating and pushing for the deepening of ASEAN economic integration, and the promotion of increased cross-border business cooperation.

About Mastercard

Mastercard powers economies and empowers people in 200+ countries and territories worldwide. Together with our customers, we're building a resilient economy where everyone can prosper. We support a wide range of digital payments choices, making transactions secure, simple, smart and accessible. Our technology and innovation, partnerships and networks combine to deliver a unique set of products and services that help people, businesses and governments realize their greatest potential.

www.mastercard.com

[1] Source: Google, Temasek, and Bain, e-Conomy SEA 2024 report

[2] Source: https://asean.org/our-communities/economic-community/resilient-and-inclusive-asean/development-of-micro-small-and-medium-enterprises-in-asean-msme/

[3] Source: Mastercard Center for Inclusive Growth and The Asia Foundation launch Strivers' Hub to empower Malaysia's women entrepreneurs

Originally published by Mastercard

Follow along Mastercard's journey to connect and power an inclusive, digital economy that benefits everyone, everywhere.

Jon Huntsman (2nd from left), Vice Chairman & President, Strategic Growth at Mastercard, Tan Sri Nazir Razak (3rd from left), Chairman of ASEAN Business Advisory Council (ABAC) Malaysia, Safdar Khan (1st from left), Division President, Southeast Asia, Mastercard, and Jukhee Hong (1st from right), Executive Director, ASEAN Business Advisory Council (ABAC) Malaysia at the signing ceremony to host the Mastercard ASEAN Inclusive Growth Summit across Southeast Asia over the next three years.

View additional multimedia and more ESG storytelling from Mastercard on 3blmedia.com.

Contact Info:

Spokesperson: Mastercard

Website: https://www.3blmedia.com/profiles/mastercard

Email: info@3blmedia.com

SOURCE: Mastercard

View the original press release on ACCESS Newswire

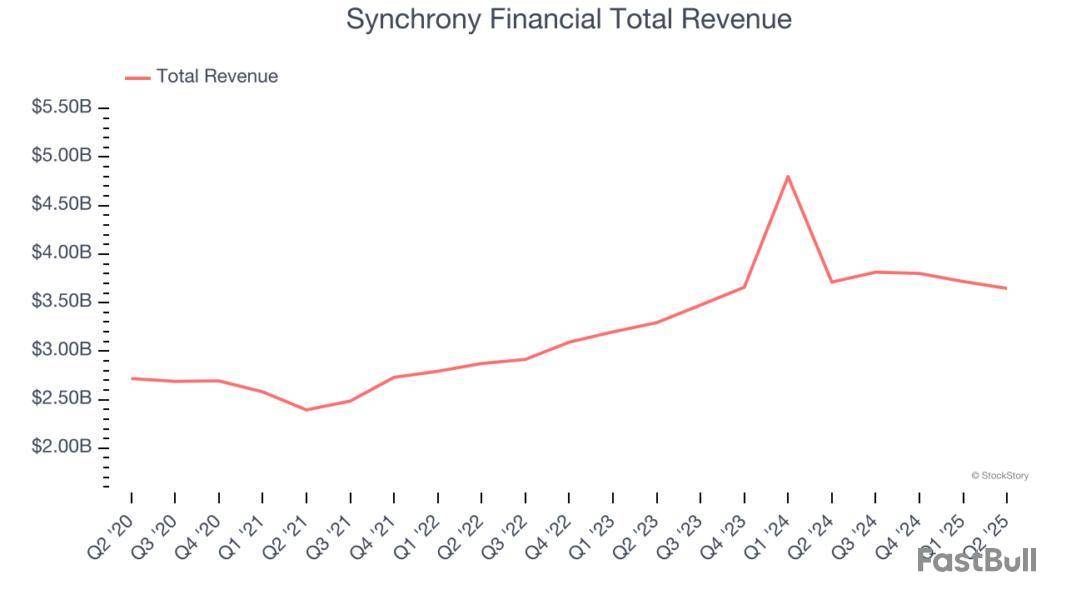

Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at Synchrony Financial and its peers.

Credit card companies facilitate electronic payments and extend revolving credit to consumers. Growth comes from increasing digital payment adoption, cross-border transaction growth, and value-added services for cardholders and merchants. Challenges include regulatory scrutiny of fees and practices, competition from alternative payment methods, and potential credit losses during economic downturns.

The 6 credit card stocks we track reported a strong Q2. As a group, revenues were in line with analysts’ consensus estimates.

In light of this news, share prices of the companies have held steady as they are up 4.8% on average since the latest earnings results.

Powering over 73 million active accounts and partnerships with major brands like Amazon, PayPal, and Lowe's, Synchrony Financial provides credit cards, installment loans, and banking products through partnerships with retailers, healthcare providers, and digital platforms.

Synchrony Financial reported revenues of $3.65 billion, down 1.8% year on year. This print fell short of analysts’ expectations by 1.3%, but it was still a strong quarter for the company with a beat of analysts’ EPS estimates.

Synchrony Financial delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. Interestingly, the stock is up 10.5% since reporting and currently trades at $76.75.

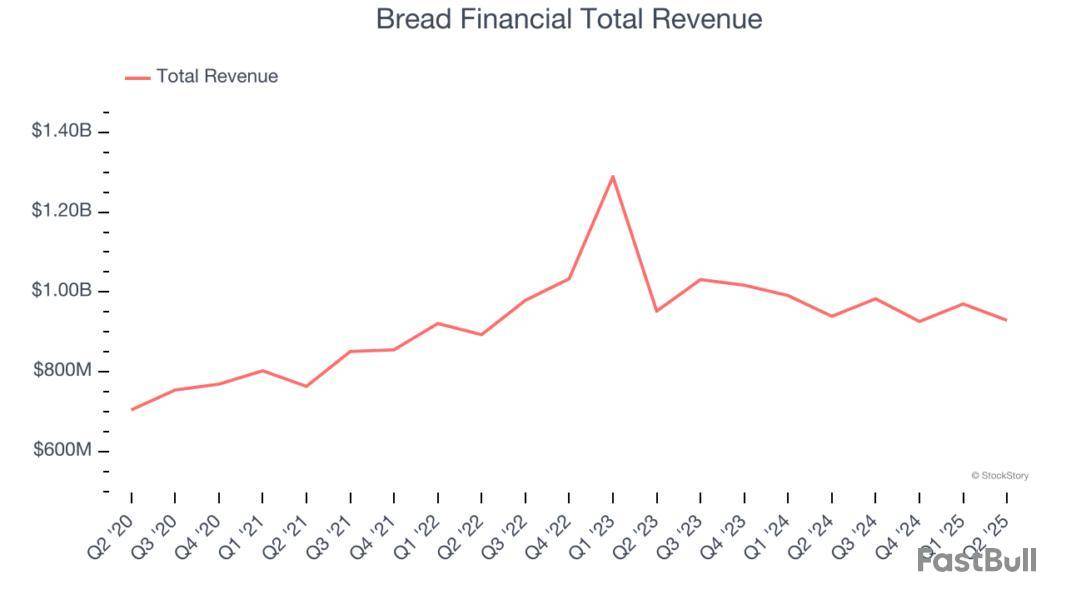

Formerly known as Alliance Data Systems until its 2022 rebranding, Bread Financial provides credit cards, installment loans, and savings products to consumers while powering branded payment solutions for retailers and merchants.

Bread Financial reported revenues of $929 million, down 1.1% year on year, falling short of analysts’ expectations by 0.6%. However, the business still had a very strong quarter with a beat of analysts’ EPS estimates.

The market seems content with the results as the stock is up 3.1% since reporting. It currently trades at $66.19.

Is now the time to buy Bread Financial? Access our full analysis of the earnings results here, it’s free.

Recognizable by its iconic green logo and the slogan "Don't leave home without it," American Express is a global payments company that issues credit and charge cards, processes merchant transactions, and offers travel and lifestyle benefits to consumers and businesses.

American Express reported revenues of $13.24 billion, up 9.4% year on year, in line with analysts’ expectations. Still, it was a satisfactory quarter.

Interestingly, the stock is up 4.8% since the results and currently trades at $330.78.

Read our full analysis of American Express’s results here.

Starting as a credit card company in 1988 before expanding into a full-service bank, Capital One is a financial services company that offers credit cards, auto loans, banking services, and commercial lending to consumers and businesses.

Capital One reported revenues of $12.49 billion, up 31.4% year on year. This number came in 1.2% below analysts' expectations. More broadly, it was actually a strong quarter as it produced a beat of analysts’ EPS estimates.

Capital One achieved the fastest revenue growth among its peers. The stock is up 5% since reporting and currently trades at $227.97.

Read our full, actionable report on Capital One here, it’s free.

Recognizable by its iconic "Priceless" advertising campaign that has run in over 120 countries, Mastercard operates a global payments network that connects consumers, financial institutions, merchants, and businesses, enabling electronic transactions and providing payment solutions.

Mastercard reported revenues of $8.13 billion, up 16.8% year on year. This result beat analysts’ expectations by 2.1%. Overall, it was a strong quarter as it also produced a beat of analysts’ EPS estimates.

The stock is up 6.1% since reporting and currently trades at $594.50.

Read our full, actionable report on Mastercard here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

While profitability is essential, it doesn’t guarantee long-term success. Some companies that rest on their margins will lose ground as competition intensifies - as Jeff Bezos said, "Your margin is my opportunity".

Profits are valuable, but they’re not everything. At StockStory, we help you identify the companies that have real staying power. That said, here are two profitable companies that leverage their financial strength to beat the competition and one that may face some trouble.

One Stock to Sell:

McCormick (MKC)

Trailing 12-Month GAAP Operating Margin: 15.8%

The classic red Heinz ketchup bottle’s competitor, McCormick sells food-flavoring products like condiments, spices, and seasoning mixes.

Why Is MKC Not Exciting?

McCormick’s stock price of $69.60 implies a valuation ratio of 22.3x forward P/E. To fully understand why you should be careful with MKC, check out our full research report (it’s free).

Two Stocks to Watch:

Mirion (MIR)

Trailing 12-Month GAAP Operating Margin: 5.5%

With its technology protecting workers in over 130 countries and equipment used in 80% of cancer centers worldwide, Mirion Technologies provides radiation detection, measurement, and monitoring solutions for medical, nuclear energy, defense, and scientific research applications.

Why Do We Like MIR?

Mirion is trading at $20.50 per share, or 39.9x forward EV-to-EBITDA. Is now the right time to buy? See for yourself in our in-depth research report, it’s free.

Mastercard (MA)

Trailing 12-Month GAAP Operating Margin: 55.8%

Recognizable by its iconic "Priceless" advertising campaign that has run in over 120 countries, Mastercard operates a global payments network that connects consumers, financial institutions, merchants, and businesses, enabling electronic transactions and providing payment solutions.

Why Is MA a Top Pick?

At $594.50 per share, Mastercard trades at 34.8x forward P/E. Is now a good time to buy? Find out in our full research report, it’s free.

Stocks We Like Even More

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return).

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

SaveLend Group AB’s subsidiary, Billecta AB (“Billecta” or the “Company”), has been accepted into the Mastercard Lighthouse FINITIV program for the fall of 2025. After a thorough selection process involving around 80 applicants, Billecta was chosen as one of only 15 companies in the Nordics and Baltics to participate.

Mastercard Lighthouse FINITIV is a partnership program aimed at strengthening the financial services ecosystem. The program brings together the innovative power of fintechs with the global reach and stability of Mastercard, leading banks, investors, and strategic partners. Through workshops and exclusive networking events, participants gain access not only to key industry players and technical advisors, but also the opportunity to showcase themselves to Mastercard’s extensive investor network.

“Being accepted into Mastercard Lighthouse FINITIV is a significant opportunity for Billecta. It opens doors to new partnerships, provides access to strategic advice, and strengthens our position for the next stage of our growth journey,” says Mats Röjdmark, CEO of Billecta AB.

Throughout the fall, Billecta will participate in workshops, connect with industry stakeholders and business developers, and work with Mastercard and its partners to concretize new collaboration models. This participation strengthens the Company’s profile as a strong player in smart invoicing solutions and fintech services for businesses in the Nordics.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up