Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

XRP exchange reserves jump by 300 million tokens in 24 hours

XRP is back in the news after 300 million tokens, worth almost $885 million, were moved into crypto exchanges in just 24 hours. The surge lifted exchange reserves above $10.3 billion and set the stage for what may be a major price swing for the popular cryptocurrency.

Scale of inflows: 300,000,000 XRP entered exchanges in 24 hours, raising liquidity to multi-month highs.

Price reaction: XRP rebounded from $2.77 to $2.95 but has yet to break the $3.07 resistance.

Risk ahead: Extra supply on exchanges could tilt the balance toward selling pressure.

XRP's position at the moment is tricky, to say the least. On the one hand, bouncing back from $2.77 and holding the 100-day EMA suggests that bulls are still in charge. But if there is fresh supply coming into exchanges, it might increase the risk of sell pressure if whales decide to offload.

What to watch out for next is the $3.07 barrier, which lines up with the 50-day EMA. Should it break, the path toward the $3.30-$3.50 region will open, and that is where selling picked up during previous rallies. If XRP does not clear that line, though, it risks falling back to $2.77, with the 200-day EMA at $2.53 acting as a deeper support "cushion."

For now, with relative strength holding near the midline and trading volumes low, the market is waiting for confirmation of direction. It is pretty likely that there will be some volatility, but the endgame will depend on whether the reserves are used to aggressively sell or to keep as strategic liquidity.

Bitcoin faces "quantum threat" again, but it's still only theory

The "FUD of the week" award goes to Josh Mandell, a former Wall Street trader, who caused a big stir in the crypto community, by saying that quantum computing is already being used to steal coins from old Bitcoin wallets.

Mandell’s claim: Quantum tech has apparently let a "big player" drain some long-dormant wallets.

Community reaction: Bitcoin analysts dismissed the idea as unrealistic and mocked the theory online.

Reality check: Breaking Bitcoin security still requires technology decades away.

What happened is that Mandell argued on X that stolen Bitcoin is being quietly accumulated off-market, with on-chain analysis as the only safeguard. However, experts immediately pushed back, stressing that the millions of qubits needed to break Bitcoin simply do not exist today.

In particular, security researchers like Harry Beckwith and Matthew Pines labeled the suggestion false, while other commentators openly ridiculed it.

There are some concerns in place as quantum computing is advancing — Microsoft and Google recently unveiled new chips — but specialists agree it will take decades before such machines could threaten Bitcoin’s encryption.

Some, like cypherpunk Jameson Lopp, still urge long-term preparation in case quantum attacks become feasible, but even he points to the distant horizon, not the present. For now, Bitcoin’s cryptography remains safe, according to common knowledge.

Shiba Inu's 2025 breakout setup comes into focus

Being the biggest meme coin on Ethereum means always headlining the news, and Shiba Inu delivers. In today's digest, the highlight is the fact that the meme cryptocurrency's price is tightening inside a symmetrical triangle pattern, preparing for one of its biggest moves of the year.

Key resistance: The upside targets are defined by $0.00001297 (100-day EMA) and $0.00001388 (200-day EMA).

Support levels: The base is still at $0.00001200, but if SHIB loses that, it could be exposed to $0.00001150 and $0.00000950.

Indicators: The RSI is at 47 and falling, and there has been a bit of indecision before a breakout.

The way things are set up right now puts SHIB in a bit of a tricky position, just like XRP. The bullish scenario is that a breakout above $0.00001297 backed by strong volume drives Shiba Inu toward $0.00001450-$0.00001500, the same region where sellers capped the July rally. Clearing that ceiling shifts the broader picture back toward bullish control for the Shiba Inu coin.

Failure to defend $0.00001200, however, turns the structure bearish, exposing $0.00001150 per SHIB as the next stop and reopening the path down to $0.00000950, last touched in early summer. With RSI neutral and volume thinning, the pattern is nearly at its peak, and the outcome promises to be SHIB’s most significant move of 2025. Call it the potential Breakout of the Year.

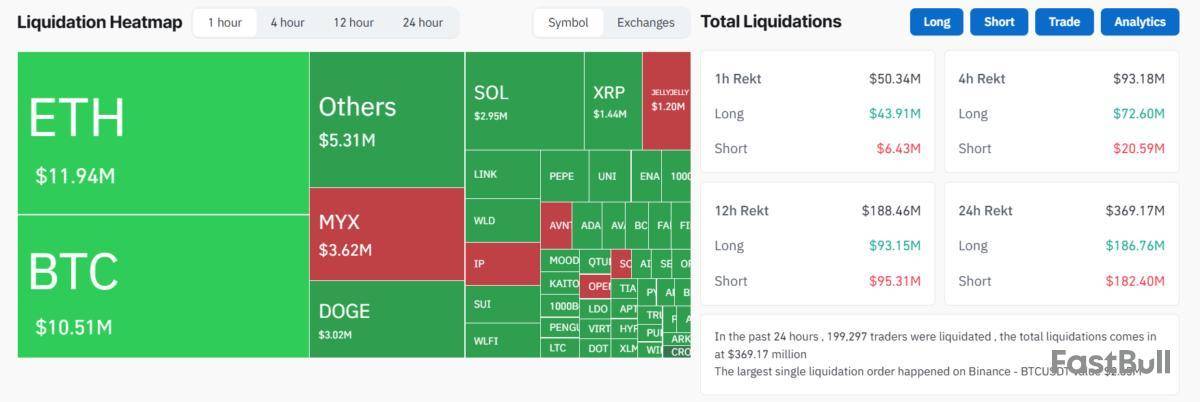

Bitcoin and Ethereum fell sharply on Tuesday after Israel launched an unprecedented strike in Qatar, targeting senior Hamas officials. The escalation rattled global markets, sending investors rushing into gold and oil while crypto prices sank.

Bitcoin and Ethereum immediately dropped over 1%, while Solana and XRP each lost 1.5%. Dogecoin led losses, sliding 3.2%. Liquidation data reveals more concerning risks ahead.

Another Geopolitical Conflict To Derail The Bull Market?

Data from Coinglass showed heavy liquidations as volatility surged. Nearly $52 million in leveraged positions were wiped out in the last hour.

Long traders bore the brunt, with $44 million liquidated. Ethereum accounted for $11.9 million in liquidations, followed by Bitcoin with $10.5 million.

The scale of losses highlights how quickly leverage unraveled. In total, liquidations amounted to $370 million over the past 24 hours. Most positions were long bets on continued gains, exposing optimism ahead of the strike.

In contrast, gold surged to a record high immediately after Israel attacked Qatar as demand for safe-haven assets spiked.

Oil prices climbed by $1 per barrel, trading just under $67. Analysts called these moves rational responses to geopolitical risk, though oil gains may prove short-lived.

The divergence reflects Bitcoin’s struggle to live up to its “digital gold” label. While gold rallied, Bitcoin behaved like a high-beta risk asset.

Correlation data confirms the shift, with the 30-day rolling link between the two assets turning slightly negative.

The strike on Doha carries major diplomatic implications, but markets reacted first to its immediate risk signals. Traders rapidly de-risked, moving out of volatile tokens into stablecoins and traditional havens.

Until confidence in its safe-haven qualities strengthens, Bitcoin is likely to follow equities and risk assets during crises, rather than diverge from them.

According to a recent report published by Dutch mobile security firm ThreatFabric, there is a new advanced piece of malware called "RatOn" that is posing a threat to cryptocurrency wallets.

This is a new sophisticated type of RAT (Remote Access Trojan), which makes it possible for attackers to take over an infected device remotely.

RatOn combines various attack techniques from various malware families, which makes it more dangerous than run-of-the-mill banking trojans.

How it works

The new malware was first seen in June 2025, and it became increasingly active throughout August.

It supports multiple languages on top of English, including Czech and Slovak.

What makes RatOn increasingly dangerous is that this sort of malware is not widely detected by multivirus engines.

Are crypto holders at risk?

Notably, RatOn is specifically targeting popular cryptocurrency wallets such as MetaMask, Trust Wallet, Phantom, and Blockchain.com.

The new malware automates the steps that are needed for hijacking a new cryptocurrency wallet.

It launches the wallet app on the victim's phone and uses stolen PINs that were captured earlier with kelogging or overlays.

The malware then helps the attacker to automatically navigate the interface of the app and reveal the secret recovery phrase.

Cboe Global Markets plans to launch continuous bitcoin and ether futures, the exchange said on Tuesday.

Continuous futures are different from traditional futures in that they don’t need frequent rolling. They are instead set up as single contracts that last up to 10 years, which can make it easier when managing positions.

"These contracts will be cash-settled and aligned to real-time spot market prices through daily cash adjustments, using a transparent and replicable funding rate methodology," Cboe said in a statement. They will begin trading Nov. 10, pending regulatory review.

"Perpetual-style futures have gained strong adoption in offshore markets. Now, Cboe is bringing that same utility to our U.S.-regulated futures exchange and enabling U.S. traders to access these products with confidence in a trusted, transparent and intermediated environment," Cboe's Global Head of Derivatives Catherine Clay said in the release.

Cboe, short for the Chicago Board Options Exchange, became the first U.S. exchange to offer bitcoin futures in 2017, but then halted adding new contracts roughly two years later when a market downturn caused interest to wane. Recently, with crypto enjoying a bullish market, Cboe has been especially active when it comes to trying to list more and more exchange-traded funds that track specific digital assets.

"The new bitcoin and ether continuous futures will be cleared through Cboe Clear U.S., a CFTC-regulated derivatives clearing organization," the exchange said Tuesday.

"We expect Continuous futures to appeal to not only institutional market participants and existing CFE customers, but also to a growing segment of retail traders seeking access to crypto derivatives," Clay added.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

By Chris Wack

QMMM Holdings shares were 42% higher, at $16.04, after the company it was using its technology to enter into the cryptocurrency sector.

The stock hit its 52-week high of $22.24 earlier in the session, and is 148% higher in the past 12 months.

The company said its expansion will integrate artificial intelligence and blockchain technology to create next-generation cryptocurrency analytics and a crypto-autonomous ecosystem.

QMMM said it is aiming to connect data providers and consumers through a decentralized data marketplace powered by blockchain.

The company also plans to establish a diversified cryptocurrency treasury initially targeting Bitcoin, Ethereum, and Solana. The treasury is expected to reach an initial scale of $100 million.

Write to Chris Wack at chris.wack@wsj.com

Coinbase’s XRP reserves continue to shrink. According to XRP Liquidity, Coinbase has now fallen out of the top 10 exchanges by XRP holdings, after its reserves dropped by a staggering 83% in just two months.

Coinbase’s XRP Reserves Plunge 83%

Two months ago, Coinbase was the fifth-largest XRP holder among exchanges, with 780 million XRP. As of yesterday, that number has fallen to just 132.4 million XRP, surprising many in the XRP community.

XRP_Liquidity (Larsen/Britto/Escrow/ODL/RLUSD)@XRPwalletsSep 08, 2025Top 10 Exchanges XRP holdings

1. Upbit 5.871B

2. Binance 2.822B

3. Uphold 1.739B

4. Bithumb 1.655M

5. Bitbank 575M

6. Coincheck 555.4M

7. Etoro 472.3M

8. Cryptocom 378.7M

9. Coinone 295.18M

✅10. Kraken 185.13M

Dropped from Top 10

❌ Coinbase 132.4M

❌ SBI VC 61.7M https://t.co/gfMYwntrL4

Currently, the largest XRP holders among exchanges are:

Other exchanges holding significant amounts include Coincheck with 555 million, eToro with 472 million, Crypto.com with 380 million, Coinone with 295 million, and Kraken with 185 million.

Coinbase’s XRP reserves may be declining for a few reasons. XRP is being shifted into liquidity programs, investment products, and trust accounts, which makes less of it visible on the exchange. XRP may be moving from Coinbase’s wallets to institutions, who manage and hold it themselves. Also, Coinbase may have cut back on XRP holdings when the token reached its all-time high.

Bill Morgan Jokes About Coinbase

In response to Coinbase dropping out of the top 10 XRP holders, Attorney Bill Morgan quipped that the exchange might delist XRP again, but this time “by not holding any.”

bill morgan@Belisarius2020Sep 09, 2025Maybe it will delist XRP again, this time by not holding any. 🤣 https://t.co/SjBgKTA2LI

Coinbase’s relationship with XRP has been marked by regulatory challenges.

In response to the U.S. SEC lawsuit against Ripple Labs, Coinbase had suspended XRP trading on January 19, 2021. Further, in January 2023, Coinbase had announced that it would delist XRP, along with Bitcoin Cash, Ethereum Classic, and Stellar from its wallet due to “low usage.”

After a federal court ruling that XRP sales on exchanges did not qualify as securities, Coinbase resumed XRP trading in July 2023.

Coinbase’s Moves Show Support for XRP

While XRP reserves have dropped, Coinbase has not signaled any plans to remove the token from its platform.

In fact, just recently Coinbase launched 5x leverage perpetual futures for XRP, signaling renewed interest in the token. CEO Brian Armstrong also praised the move, calling it “great progress on U.S. perpetual futures.”

Recently, there was also speculation within the community about potential price manipulation by Coinbase. However, Morgan dismissed these claims and pointed out that XRP’s price has moved in much the same way even during the years Coinbase had delisted the asset.

So, despite the reduction in XRP holdings, and concerns within the community, Coinbase’s recent actions suggest a continued commitment to support the token.

Joseph Lubin’s SharpLink Gaming (ticker SBET) has begun using its newly authorized $1.5 billion share repurchase program, buying back about 939,000 shares of SBET at an average $15.98. This implies a $15 million spend as of Sept. 9.

According to the company's statement, repurchases are immediately accretive while shares trade below net asset value. SBET shares rose over 4%, The Block's stock price page shows.

NAV is the per-share value of SharpLink's balance sheet, primarily its ETH holdings and cash, minus liabilities, divided by shares outstanding. If SBET trades below NAV, the market is valuing the stock for less than the company’s underlying assets. It suggests that repurchasing shares is typically accretive, since it increases ETH and cash per share for remaining holders.

Notably, the price of ether, staking income, buybacks, and any new financing will impact SharpLink's NAV.

"We believe the market currently undervalues our business," said Joseph Chalom, SharpLink’s co-CEO. "Rather than issue equity while trading below NAV, we are focused on disciplined capital allocation – including share repurchases – to increase stockholder value."

The move follows an August authorization of the $1.5 billion buyback and recent disclosures that its ETH stack has grown to about 837,000 ETH, worth an estimated $3.6 billion. SharpLink’s latest disclosure said the firm has no debt, with nearly 100% of its ether treasury ETH staked and generating revenue.

Staking the full balance at current market-rate yields implies roughly 15,700–35,200 ETH in annual rewards using an APY range of 1.87%–4.20%. With ether trading around $4,300 on Tuesday, that equates to about $67 million–$151 million per year before validator costs, pool fees, MEV/execution-layer variance, and any downtime or slashing risks.

Additional buybacks will be considered based on market conditions and funded with cash on hand, staking income, or other financing, the company added. SharpLink also reiterated that it has not used its ATM facility while trading below NAV, but may do so if accretive.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up