Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

The Athens Stock Exchange Composite Index Closed Down 0.17% At 2,362.35 Points, But Rose 2.05% For The Week

[Bitcoin Breaks $69K, Bounces Nearly 15% From Low] February 6Th, According To Htx Market Data, Bitcoin Broke Through $69,000, With The Current Price At $69,017. The Rebound From Today'S Low Of $60,010 Has Reached Nearly 15%

US State Dept: Identifying 14 Shadow Fleet Vessels As Property Of Entities Involved In Transportation Of Iranian Petroleum, Other Products

The Ukrainian Energy Minister Spoke With U.S. Energy Secretary Wright To Discuss The Transportation Of U.S. Liquefied Natural Gas

Laurence Mutkin, Head Of Interest Rate Strategy At BmoEmea, Said That Federal Reserve Chairman Nominee Kevin Warsh (after Being Confirmed By The U.S. Senate And Taking Office) Could Learn From The Bank Of England's Experience In Reducing The Balance Sheet

The U.S. Gateway Commission Has Suspended Construction Of A New Tunnel Between New York And New Jersey

Pjm Interconnection Ltd., A U.S. Grid Operator, Predicts A 60 GW Power Shortage In The United States Over The Next Decade. Without Action, This Shortage Could Balloon From 6.5 GW To 60 GW

U.S. Lawmakers Are Seeking Records Of Communications Between The Justice Department And Apple And Alphabet's Google. They Are Investigating The Justice Department's Role In President Trump's Immigration And Customs Enforcement (ICE) Tracking Apps

Lebanese Armed Group Hezbollah Accepts Senior Official Wafiq Safa's Resignation, Sources Familiar With The Group To Reuters

Dollar Pares Some Losses Versus Yen After University Of Michigan Surveys, Last Down 0.1% At 156.92

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Reserve Bank of Australia Governor Bullock testified before Parliament.

Reserve Bank of Australia Governor Bullock testified before Parliament. Japan Foreign Exchange Reserves (Jan)

Japan Foreign Exchange Reserves (Jan)A:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

Japan Leading Indicators Prelim (Dec)

Japan Leading Indicators Prelim (Dec)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Dec)

Germany Industrial Output MoM (SA) (Dec)A:--

F: --

Germany Exports MoM (SA) (Dec)

Germany Exports MoM (SA) (Dec)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Jan)

U.K. Halifax House Price Index YoY (SA) (Jan)A:--

F: --

U.K. Halifax House Price Index MoM (SA) (Jan)

U.K. Halifax House Price Index MoM (SA) (Jan)A:--

F: --

France Trade Balance (SA) (Dec)

France Trade Balance (SA) (Dec)A:--

F: --

Canada Leading Index MoM (Jan)

Canada Leading Index MoM (Jan)A:--

F: --

Mexico Consumer Confidence Index (Jan)

Mexico Consumer Confidence Index (Jan)A:--

F: --

P: --

Canada Employment (SA) (Jan)

Canada Employment (SA) (Jan)A:--

F: --

Canada Full-time Employment (SA) (Jan)

Canada Full-time Employment (SA) (Jan)A:--

F: --

Canada Part-Time Employment (SA) (Jan)

Canada Part-Time Employment (SA) (Jan)A:--

F: --

Canada Unemployment Rate (SA) (Jan)

Canada Unemployment Rate (SA) (Jan)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Jan)

Canada Labor Force Participation Rate (SA) (Jan)A:--

F: --

P: --

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11.

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11. U.S. UMich Consumer Sentiment Index Prelim (Feb)

U.S. UMich Consumer Sentiment Index Prelim (Feb)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Feb)

U.S. UMich Consumer Expectations Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Jan)

Canada Ivey PMI (Not SA) (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Feb)

U.S. UMich Current Economic Conditions Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (SA) (Jan)

Canada Ivey PMI (SA) (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Jan)

China, Mainland Foreign Exchange Reserves (Jan)--

F: --

P: --

Russia Retail Sales YoY (Dec)

Russia Retail Sales YoY (Dec)A:--

F: --

P: --

Russia Unemployment Rate (Dec)

Russia Unemployment Rate (Dec)--

F: --

P: --

Russia Quarterly GDP Prelim YoY (Q1)

Russia Quarterly GDP Prelim YoY (Q1)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Consumer Credit (SA) (Dec)

U.S. Consumer Credit (SA) (Dec)--

F: --

P: --

Japan Wages MoM (Dec)

Japan Wages MoM (Dec)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Dec)

Japan Trade Balance (Customs Data) (SA) (Dec)--

F: --

P: --

Japan Trade Balance (Dec)

Japan Trade Balance (Dec)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Feb)

Euro Zone Sentix Investor Confidence Index (Feb)--

F: --

P: --

Mexico CPI YoY (Jan)

Mexico CPI YoY (Jan)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Jan)

Mexico 12-Month Inflation (CPI) (Jan)--

F: --

P: --

Mexico PPI YoY (Jan)

Mexico PPI YoY (Jan)--

F: --

P: --

Mexico Core CPI YoY (Jan)

Mexico Core CPI YoY (Jan)--

F: --

P: --

ECB Chief Economist Lane Speaks

ECB Chief Economist Lane Speaks Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Wholesale Sales MoM (SA) (Dec)

U.S. Wholesale Sales MoM (SA) (Dec)--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks U.K. BRC Overall Retail Sales YoY (Jan)

U.K. BRC Overall Retail Sales YoY (Jan)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Jan)

U.K. BRC Like-For-Like Retail Sales YoY (Jan)--

F: --

P: --

Indonesia Retail Sales YoY (Dec)

Indonesia Retail Sales YoY (Dec)--

F: --

P: --

France ILO Unemployment Rate (SA) (Q4)

France ILO Unemployment Rate (SA) (Q4)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Jan)

U.S. NFIB Small Business Optimism Index (SA) (Jan)--

F: --

P: --

Brazil IPCA Inflation Index YoY (Jan)

Brazil IPCA Inflation Index YoY (Jan)--

F: --

P: --

Brazil CPI YoY (Jan)

Brazil CPI YoY (Jan)--

F: --

P: --

U.S. Retail Sales YoY (Dec)

U.S. Retail Sales YoY (Dec)--

F: --

P: --

U.S. Labor Cost Index QoQ (Q4)

U.S. Labor Cost Index QoQ (Q4)--

F: --

P: --

U.S. Import Price Index MoM (Dec)

U.S. Import Price Index MoM (Dec)--

F: --

U.S. Export Price Index YoY (Dec)

U.S. Export Price Index YoY (Dec)--

F: --

P: --

U.S. Export Price Index MoM (Dec)

U.S. Export Price Index MoM (Dec)--

F: --

P: --

No matching data

View All

No data

The XRP price is once again at the center of discussion in the cryptocurrency market after a market expert reiterated their bold long-term forecast. The founders of EasyA, Dom and Phil Kwok, say the token still has the potential to hit $1,000, even if it takes longer than first expected. They explain that the short-term view is not yet clear, but the long-term case for XRP remains strong.

EasyA Founders Stand By $1,000 XRP Price Prediction

Dom and Phil Kwok joined host Tony Edward on the Thinking Crypto podcast to share their updated thoughts on XRP. Edward recalled their earlier bold forecast of $1,000 by 2030, which still excites many supporters. Dom Kwok made it clear that the short-term outlook is still “formulating,” meaning they are not ready to set a concrete target for the current cycle. However, he confirmed that the long-term thesis remains intact, and the bold forecast is still alive.

According to Dom, a significant amount of new money could enter the market once the rules are clarified. When those approvals are in place, Dom believes that large amounts of new capital could flow into XRP.

The market expert noted that the legal teams of hedge funds and asset managers are working out the rules to determine how they can start investing in other tokens. With the SEC lawsuit against Ripple now resolved, many of the barriers that held back institutions are gone. For the EasyA founders, this shift in the investment landscape is key to why the XRP $1,000 price target remains in place.

Network Effects And Developer Momentum Strengthen XRP’s Case

Phil Kwok spoke about another driver for the XRP’s growth: network effects. He explained that when prices rise, more developers become involved and build. Recent performance shows why the EasyA founders remain confident. The XRP price has climbed 456% since last year, trading above $3, and it is now the best-performing large-cap altcoin.

Dom also pointed out that price charts matter because falling prices scare off both users and builders. With the XRP price showing steady gains, it is drawing more investors and developers to its network. The short-term outlook is still uncertain, but the long-term belief in $1,000 continues to drive discussion. While Dom and Phil Kwok stand by their bold forecast, other experts, such as Matthew Brienen of CryptoCharged, have suggested that the price could reach that level by 2035 instead.

Even with the extended timeline, XRP’s strong position, growing utility, and the attention of institutions and developers all point toward a long-term path of significant growth. For many in the XRP community, the $1,000 price target remains a central rallying point, even if the timeline shifts.

Vet, a validator on the XRP Ledger, claims that he has voted to veto the Token Escrow amendment.

Reason behind the veto

He argues that it would be more prudent to wait until the token escrow is fixed so that it can properly support multi-purpose tokens (MPTs), which is a new standard on the ledger that makes it possible to support various types of tokens, including real-world assets (RWAs).

If both the Token Escrow amendment and MPTs were enabled at once, there could be bugs and unintended behavior.

According to Vet, the amendment is already just one vote away from passage.

A fix is ready

The validator has explained that a fix is ready for a future release. No timeline yet for that release but please don't worry, everyone wants Token Escrows and it will come to the XRPL as evident by the Yes votes thus far, Vet explained.

The boldest step yet

Solana has always pitched itself as the blockchain for speed. With Alpenglow, it’s attempting a quantum leap.

Validators have voted overwhelmingly in favor of the upgrade, with almost 99% support across the network. If successfully implemented, Alpenglow is expected to reduce transaction finality from roughly 12.8 seconds to just 100 to 150 milliseconds.

That’s close to a hundred times faster than current speeds and well within the range of internet benchmarks most people take for granted.

To put that into perspective, a Google search averages about 200 ms. Payment processors like Visa settle card transactions in a similar timeframe. If Solana can truly operate in that window, blockchain applications might feel indistinguishable from traditional systems.

The shift could redefine user expectations of crypto entirely.

How Solana stacks up against rivals

Even before Alpenglow, Solana carved out a reputation as one of the fastest major blockchains.

Its 12.8-second finality already outpaces Ethereum’s confirmation cycle, which typically takes 12 seconds for inclusion and around 12 minutes to reach true finality through its checkpointing mechanism.

By comparison, Sui, a layer-1 built for performance, boasts around 400-ms finality, which is impressive but still more than double what Alpenglow targets.

If Solana delivers on its promises, the gap could reshape the competitive landscape. For decentralized exchanges, derivatives platforms and blockchain-based games, sub-second finality becomes a prerequisite for real-time interaction.

Users who have grown accustomed to the lag of most Web3 systems could experience something far closer to the immediacy of Web2.

Did you know? In 2024, CoinGecko Research revealed that Solana garnered a whopping 38% of global crypto investor interest in chain-specific narratives, surpassing Ethereum’s 10%.

Inside the governance vote

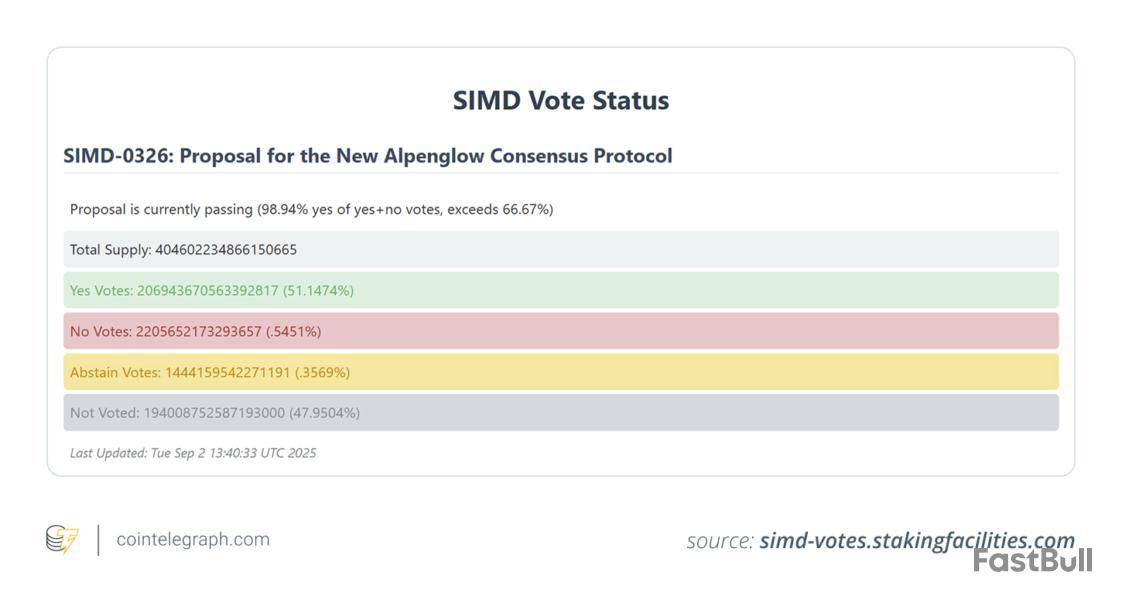

The governance process for Alpenglow kicked off on Aug. 21, 2025, spanning epochs 840 through 842.

Participation was strong right from the outset. Validators and stakers quickly cleared the 33% quorum requirement, ensuring the proposal couldn’t stall out.

As ballots rolled in, support proved overwhelming. Early tallies showed backing between 99.6% and 99.7%, with only a sliver of participants voting against.

By the time the vote closed on Sept. 4, 2025, 98.94% of all participating stakeholders had approved the measure. Roughly 0.5% opposed, and another almost half-percent abstained.

Crucially, participation hit around 52% of the network’s total stake, comfortably above the minimum threshold and strong enough to suggest broad legitimacy.

Such near-unanimity is unusual in decentralized governance, where divisions often emerge even on technical upgrades. For Solana, the outcome shows alignment among stakeholders regarding Alpenglow’s necessity.

The mechanics of Alpenglow

At Alpenglow’s core are two new architectural components: Votor and Rotor.

These systems overhaul how Solana processes and finalizes transactions, allowing the chain to confirm blocks in 100-150 ms. Instead of waiting for multiple rounds of validator communication, the upgrade enables faster consensus without compromising security guarantees.

Alongside speed, Alpenglow introduces a new economic model. Validator Admission Tickets (VATs) aim to streamline validator onboarding while reducing operational costs.

Paired with the “20 20” resilience model, where the network can tolerate up to 20% of validators failing and another 20% behaving maliciously, Solana gains robustness against disruptions.

Now, building decentralized finance (DeFi) platforms, trading engines or multiplayer games will be possible without the awkward delays users often endure. Transactions could feel instant, which will likely unlock use cases that previously required centralized infrastructure.

Risks native to Solana

Alpenglow’s promise is extraordinary, but the upgrade doesn’t erase every concern hanging over Solana.

The network still depends almost entirely on Agave, its main validator client. A bug or exploit in that client could ripple across the entire ecosystem.

However, relief is coming in the form of Firedancer, a second validator client built by Jump Crypto.

Expected to debut on the mainnet later this year, Firedancer could diversify the network’s software base and drastically improve resilience.

Having multiple independent clients is standard in other ecosystems (Ethereum runs on Geth, Nethermind, Besu and Erigon), so Solana’s reliance on just one remains a red flag until Firedancer is fully operational.

There are also questions about centralization.

While VATs and cost reductions aim to lower entry barriers, some critics argue that fixed-tier fees and fault-tolerance thresholds could favor larger validators with deeper resources.

If that dynamic plays out, the network risks trading one bottleneck (speed) for another (concentration of power).

Did you know? Researchers recently uncovered specialized phishing techniques targeting Solana (coined “SolPhish”) that have led to $1.1 million in losses. Ahead of this, they developed SolPhishHunter, a pioneering detection tool for the ecosystem.

Why it matters beyond speed

The headline number (150 ms) grabs attention, but the real story is what that speed enables.

Consider a decentralized exchange (DEX). Today, even the best DeFi platforms can’t match the responsiveness of centralized order books. It is not unusual to see market conditions shifting considerably by the time a transaction clears.

With Alpenglow, order books could update in real time, giving traders the same fluid experience they expect from centralized platforms — without sacrificing custody.

The benefits are even more obvious with gaming. Blockchain-based games often stumble when interactions lag or require long confirmation windows. Sub-second finality could make in-game economies feel flawless, whether that’s trading items, earning rewards or settling bets.

Moreover, for payments, Alpenglow could be a breakthrough. Sending stablecoins across borders in 150 ms would put crypto payments on par with credit card networks.

Combined with Solana’s low fees, the upgrade positions the network as a genuine alternative for real-time settlement.

Infrastructure for enterprise-grade finance

Sub-second finality paired with stronger resilience mechanisms creates a blockchain that appeals greatly to businesses that can’t afford downtime.

The same goes for the 20 20 resilience model, reassuring players who worry about network stability.

The numbers already point to growing institutional trust. Three publicly listed companies have collectively staked around $1.7 billion on Solana, which demonstrates confidence in its long-term stability.

Beyond staking, the ecosystem is broadening. Tokenized real-world assets (RWAs) on Solana now total roughly $390 million, while total value locked (TVL) has climbed past $8.6 billion.

Staking yields averaging about 7% are also fueling demand for new investment products, with exchange-traded funds (ETFs) tied to Solana (SOL) recording millions in inflows.

Solana is moving well beyond retail adoption and speculation, positioning itself as infrastructure capable of supporting enterprise-level finance.

Did you know? Major financial entities, including HSBC, Bank of America, Euroclear and the Monetary Authority of Singapore, are integrating Solana into their tokenization efforts via a strategic partnership with R3.

What’s next for Solana?

With governance finalized, Solana’s roadmap is firmly in motion.

A testnet deployment of Alpenglow is scheduled for December 2025 at the Breakpoint conference, followed by a mainnet upgrade in Q1 2026. In parallel, Firedancer is progressing through a phased rollout.

Already operating in a hybrid “Frankendancer” mode on more than 10% of validators as of mid-2025 (and demonstrating throughput above 1 million transactions per second in testing), it represents a decisive step toward client diversity.

For Solana, the stakes are high as it aims for sub-100 ms finality while also ensuring resilience against single-client risk.

If successful, the combination of Alpenglow and Firedancer will both lock in Solana’s performance edge for high-throughput applications. Together, these updates will provide a more inclusive foundation for smaller validators and developers, strengthening the ecosystem’s long-term credibility.

In a recent tweet, Ripple highlights infrastructure as that key element that makes a stablecoin truly useful, with interoperability, transparency and scale underpinning this usability as infrastructure.

According to Jack McDonald, CEO of Standard Custody and SVP of Stablecoins at Ripple, the design of a stablecoin is critical. For a stablecoin to succeed, it must be interoperable across platforms and networks rather than tethered to a single brand.

Ripple@RippleSep 16, 2025What makes a stablecoin truly useful? Infrastructure.

As @_JackMcDonald_ highlights, interoperability, transparency, and scale all underpin this usability as infrastructure. https://t.co/8KO0Yn9P0v

And $RLUSD was built on these principles: an enterprise-grade, fully backed…

A stablecoin should also provide complete transparency around reserves and redemption and provide the scalability and reliability expected of a core financial infrastructure. In this regard, Ripple is committed to the full transparency of the reserves supporting RLUSD with its monthly reserve reports.

According to McDonald, the above-stated approach is not optional as those features are necessary for mainstream adoption, long-term relevance and the stability that "stablecoin" implies, forming the basis of the RLUSD stablecoin issued on both XRP Ledger and Ethereum.

The current stablecoin market capitalization is $302 billion, according to CoinMarketCap data.

Privacy coming to XRP Ledger

In a recent tweet, RippleX revealed initial discussions of an upcoming amendment that might bring privacy to the XRP Ledger.

Confidential MPT is a spec for the XRP Ledger that would bring privacy to balances and transfers. However, public auditability and validator-enforced checks would remain unchanged, creating a secure financial environment.

Confidential MPTs provide confidential transfers and balances using EC-ElGamal encryption and Zero-Knowledge Proofs (ZKPs), while preserving XLS-33 semantics.

This design aligns naturally with XLS-33, which enables flexible tokenization on the XRP Ledger; however, all balances and transfers remain publicly visible, which might limit adoption in institutional and privacy-sensitive contexts. Confidential MPTs address this gap by introducing encrypted balances and confidential transfers while preserving XLS-33 semantics.

CME Group, one of the world’s largest derivatives exchanges, plans to launch options on Solana (SOL) and XRP futures on Oct. 13, pending regulatory review.

The new contracts will include both standard and micro-sized options on SOL and XRP futures, with expiries available daily, monthly, and quarterly, CME said Wednesday. The additions are designed to give institutional and active traders more flexibility in managing exposure to the two cryptocurrencies.

Futures are contracts to buy or sell an asset at a set price on a future date. Options on futures give the holder the right — but not the obligation — to buy (a call option) or sell (a put option) those futures contracts at a specified price before or at expiration. These instruments allow traders to hedge risks or take positions with more nuanced control over potential gains and losses.

CME's growth in Solana and XRP futures

Giovanni Vicioso, CME Group’s global head of cryptocurrency products, said the planned launch follows "significant growth and increasing liquidity" across the exchange's Solana and XRP futures.

Since debuting in March, more than 540,000 Solana futures contracts — representing $22.3 billion in notional volume — have traded on CME. XRP futures, launched in May, have seen more than 370,000 contracts ($16.2 billion in notional). Both products hit records in August, with Solana futures averaging $437 million in daily notional volume and XRP averaging $385 million.

Joshua Lim, global co-head of markets at FalconX, said demand for institutional hedging tools in Solana and XRP has increased alongside digital asset treasury adoption.

"FalconX is proud to partner with CME Group to improve market efficiency and broaden the derivatives liquidity available to our clients across an expanded universe of crypto assets," he said.

The broader market is also watching for the first Solana and XRP spot exchange-traded funds. The U.S. Securities and Exchange Commission has delayed decisions on several crypto-related ETF filings, though some analysts expect approvals soon. This week, REX Shares and Osprey Funds are expected to launch an XRP ETF that will hold XRP directly while allocating at least 40% of its assets to shares of other XRP-related ETFs.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Key takeaways:

The Bitcoin options delta skew rose above the 7% neutral threshold, signaling cautious trader sentiment ahead of the US Fed decision.

The top traders’ long-to-short ratio and $292 million spot ETF inflows support optimism despite mixed BTC derivatives.

Bitcoin (BTC) approached the $117,000 level on Wednesday but failed to maintain its bullish momentum, as traders weighed the possibility that a Federal Reserve interest rate cut is already priced in. Market sentiment was further dampened by speculation about additional restrictions on artificial intelligence microchip sales to China.

Are Bitcoin traders merely hedging ahead of the US Federal Reserve decision, or are they placing bearish bets targeting $110,000 amid heightened uncertainty in AI-related demand after Nvidia (NVDA) shares traded down 2.6% on Wednesday?

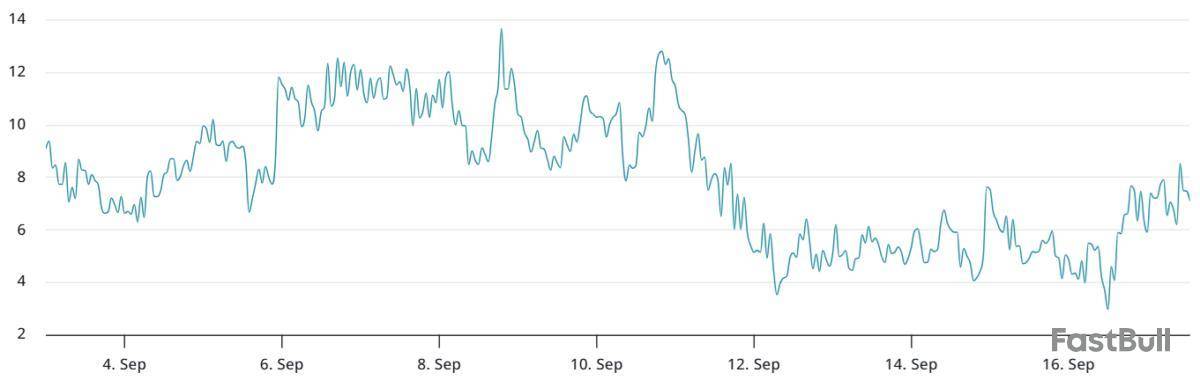

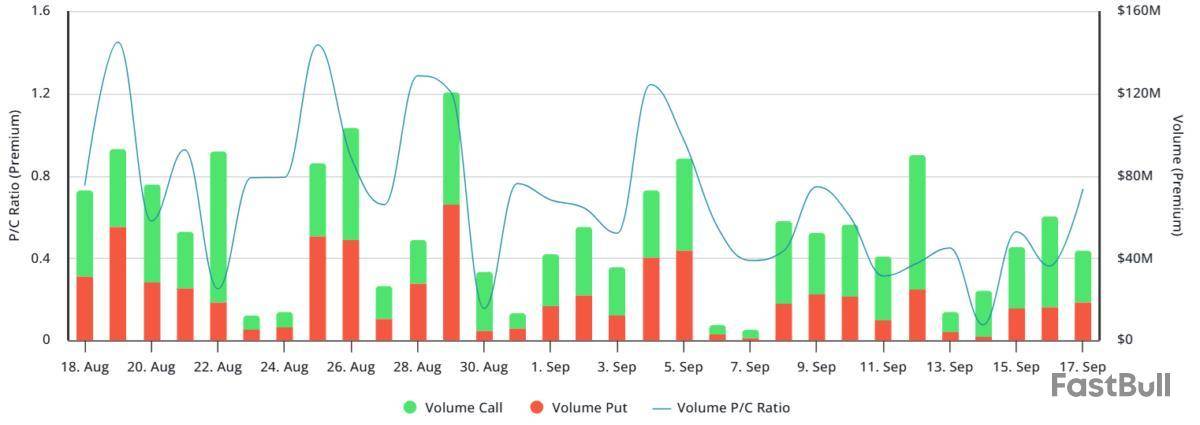

The Bitcoin options delta skew rose above the 7% neutral threshold on Wednesday, indicating put (sell) options are trading at a premium compared with call (buy) options. While not extreme, this shift is typically seen in bearish markets, contrasting with the neutral 5% level observed earlier in the week.

The Financial Times reported Wednesday that China’s internet regulator is banning companies from purchasing certain Nvidia microchips. According to AP, Nvidia’s CEO Jensen Huang said in response: “I’m disappointed with what I see, but they have larger agendas to work out, you know, between China and the United States, and I’m understanding of that, and we’re patient about it."

Bitcoin traders brace for Fed rate decision

To determine whether the higher Bitcoin options skew coincided with increased trading activity, one should closely examine the premiums effectively paid by market participants. Periods of panic are typically marked by a sharp surge in the put-to-call premium, as traders aggressively seek strategies to hedge their positions.

The BTC options put-to-call ratio at Deribit currently stands at 71%, reflecting low appetite for neutral-to-bearish positioning among traders. Levels above 180% indicate extreme fear, last observed on April 8 when Bitcoin’s price plunged below $75,000 for the first time in five months.

These data contradict the notion of a doomsday scenario or excessive caution amid artificial intelligence sector uncertainty and escalating global trade tensions. Overall, Bitcoin traders’ sentiment appears to primarily reflect anticipation of US Fed Chair Jerome Powell’s remarks following the interest rate decision announcement, rather than panic or overreaction in the market.

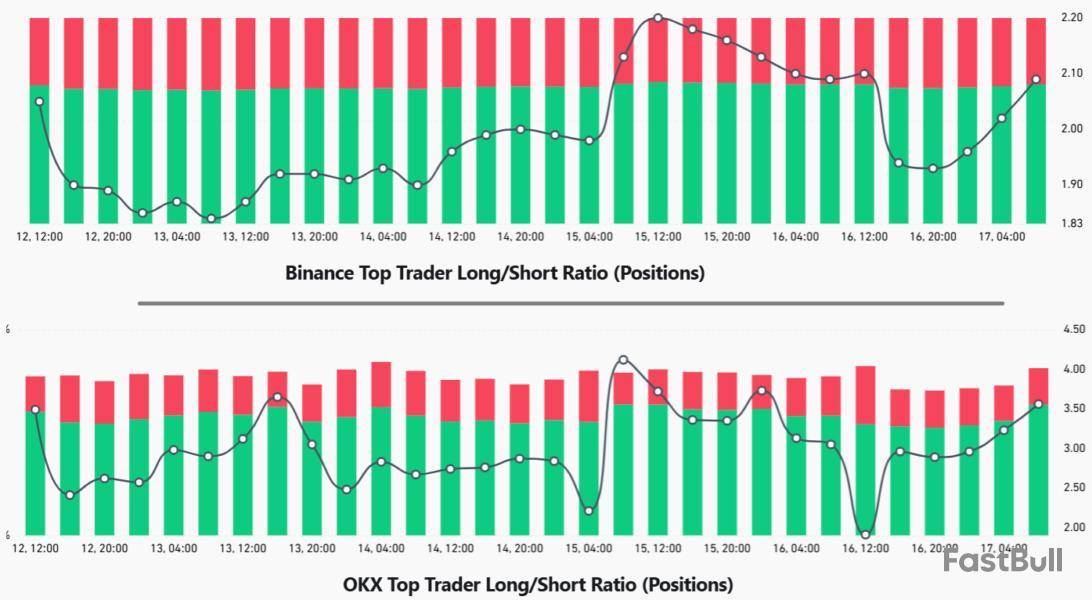

Top traders bullish as spot ETFs inflows support Bitcoin optimism

The exchanges’ top traders' long-to-short ratio provides a broader gauge of market sentiment, as it includes futures, margin, and spot markets.

Top traders’ long (bullish) positions at Binance and OKX rose on Wednesday compared with the previous day, signaling optimism for Bitcoin despite mixed signals from BTC options markets. In effect, whales and market makers anticipated price gains but were caught off guard when Bitcoin slipped to $115,540.

The $292 million net inflows into Bitcoin spot exchange-traded funds (ETFs) on Tuesday likely supported trader optimism, reinforcing expectations of $120,000 and higher. However, the ultimate outcome will depend on the probability of a less restrictive US monetary policy and potential further de-escalation in the US-China import tariffs debate.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Aave CEO and founder Stani Kulechov has broken his silence on a major upgrade coming to Aave in Q4, 2025.

The Aave v4 upgrade is anticipated to be one of the major events in DeFi in 2025, including features such as a Hub-and-Spoke architecture, reinvestment module and others, boosting Aave liquidity and saving gas.

The upgrade will also include UX improvements and a new liquidation engine. The Reinvestment Module would help Aave earn more from unused capital, utilizing idle liquidity.

On Sept. 15, the Aave founder informed the crypto community of the Aave v4 upgrade roadmap, which highlights where the project is currently at in its development.

Aave CEO reacts

The Aave founder commented in reaction to a tweet highlighting the features of Aave V4, "very nice overview of the Aave V4 feature," adding that the Reinvestment Module was not part of the initial design.

Stani.eth@StaniKulechovSep 17, 2025Very nice overview of the Aave V4 features.

Interestingly, the Reinvestment Module wasn’t part of our original design a couple of years ago when we laid down the protocol architecture. It actually emerged later as an unexpected, but exciting, "last-minute" addition.

The… https://t.co/Zkp3bmrCAZ

"Interestingly, the Reinvestment Module wasn’t part of our original design a couple of years ago when we laid down the protocol architecture. It actually emerged later as an unexpected, but exciting, last-minute addition," Kulechov added.

The Aave CEO explained the reinvestment feature further as one that allows the protocol to deploy pool float into low-risk, highly liquid yield strategies, creating additional efficiency for LPs. The feature is somewhat inspired by Ethena’s rebalance to USDtb but applied natively within Aave.

The Aave team shared the launch roadmap for the Aave upgrade on Sept. 15, revealing a recent V4 Development Update.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up