Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

As major gold miners report earnings, a key question is how they plan to utilize their profits amid record-high gold prices.

"With the sharp and sustained move higher in gold prices, we think that there will be an increased focus on capital allocation in the sector – whether companies might increase dividends, buyback shares... or whether any projects in the pipeline might get more attention," Bank of America analysts said in a note.

Miners face tension between several options. On the one hand, as they remove gold from the ground, they need to keep replenishing their bankable deposits by exploring, which means spending money on drill programs. They're also looking to extend the life of mines they already have, as major new gold discoveries are increasingly rare.

Also Read: Fed Rate Cut Expectations Boost Outlook For Gold, Mining Companies

They also have the choice between using free cash to pay off debt or buy other mining companies, which offers a quick way to bulk up on gold holdings but is also expensive, as the acquiring company often must pay a premium for the target company.

Other options for cash flow include returning money to shareholders in the form of share buybacks or dividends, or simply keeping cash on hand for a rainy day.

This earnings season, gold miners are expected to report significantly higher cash flow.

RBC analysts are expecting senior producers in its coverage universe to report free cash flow at 2.5-year quarterly highs and a 45% increase in quarter-on-quarter earnings even though production will be flat, as all in sustaining costs, a key metric for miners, will rise just 1%.

"Investor preferences have been biased to share buy backs more recently, given the underperformance of gold equities’ operating leverage vs. gold," RBC Capital Markets analysts said in a note. "However, operators have leaned to focus on project opportunities and a prioritization of debt repayment ahead of meaningful return of capital."

Do Newmont's Results Offer a Crystal Ball?

Last week, Newmont Corp. , the biggest gold miner in the world, reported earnings and revenue that beat expectations even though its production was down because of problems at several mines.

The company's free cash flow surged almost 14 times to $594 million as its average realized gold price jumped more than 19% to $2,347 per ounce, but all-in sustaining costs—an important mining metric—rose just 6% to $1,562 per ounce.

That offers an example of why mining companies are considered a leveraged play on the price of gold. Because their costs are relatively fixed, an increase in the price of gold can boost their margins at a faster rate than the rising price of gold itself.

With Newmont's results perhaps providing a rough template for what's to come, here's a look at three other senior gold producers that are scheduled to report financial results in coming days.

Agnico Eagle Reports Wednesday

With much of the low-hanging fruit already picked in terms of gold deposits, it is crucial for companies to increase their resource estimates and develop new mines.

Agnico is developing an underground mine at its existing Detour Lake open pit mine site, with a view to boosting the mine’s production to a million ounces a year over 14 years starting in 2030, Zacks Equity Research notes.

"The company continues to lower debt levels while focusing on capital discipline and cost control, investing in its project pipeline, and providing returns to shareholders," Zacks said.

With recent gold price strength, the Bank of America analysts said that they'll be looking for the company's updated views on capital allocation for debt repayment versus share buybacks or investment in exploration and growth.

"AEM repurchased $20mn of shares on its buyback in Q1’24, but we still think debt reduction is a key priority for the company as they have been messaging so," the analysts said.

The Bank of America analysts will also be looking for operational, development or exploration updates for various assets the company has, as well as inflation commentary as there have been rising labor costs because of competition for talent in certain areas where Agnico operates.

The RBC analysts are forecasting another quarter of healthy free cash flow generation for the company and are also expecting that capital allocation could be discussed.

"AEM previously outlined it would prioritize repayment of some near-term debt maturities, and it has completed modest share buybacks, while growth capital allocation could increase with various projects potentially advancing," the RBC note said.

Jefferies analysts said they are expecting higher quarter-on-quarter earnings and cash flow because of stronger gold prices in the second quarter.

Kinross Gold Corp. Reports Wednesday

When Kinross reports this week, the Bank of America analysts expect all eyes to be on operational performance.

They will be focused on exploration progress, permitting and any updates on the timing of a preliminary economic assessment for the company's Great Bear property. They'll also be looking to hear about how its Tasiast mine is performing after an expansion, and updates for its Manh Choh property, which is expected to deliver first production in the third quarter.

With strong gold prices, the analysts are also looking for whether management will offer views on potential mine life extensions.

As with Agnico, capital returns could be a hot topic.

"What will be KGC’s focus with respect to capital returns in 2024, particularly how it views the current dividend versus buy-back opportunities and also balancing that against key projects such as Great Bear amongst others," the Bank of America analysts said. "Additionally, we’ll be seeking color on whether the recent run-up in gold prices to record highs changes management’s capital returns thinking at all."

The RBC analysts are expecting a slight decline in production and higher costs quarter-on-quarter for Kinross. They're also expecting higher second quarter free cash flow generation on higher gold prices despite higher cash taxes.

The RBC analysts are also looking for word on the status of the Tasiast ramp up after the expansion and performance of a solar power plant there after it was completed in the first quarter.

"We expect higher Q2 gold prices to offset a dip in production and drive a quarterly step up in earnings and cash flow," the Jefferies analysts said.

Barrick Gold Corp. Reports on Aug. 12

Barrick Gold, the world's No. 2 producer of the precious metal after Newmont, is scheduled to report on Aug. 12.

Jefferies analysts are expecting quarter-on-quarter earnings and cash flow to be higher because of gold sales from the company's African assets and higher gold prices.

"Lumwana, North Mara, Kibali, Tongon and Bulyanhulu should be responsible for the bulk of the sequential production/sales increase, and costs should remain relatively flat," the analysts said.

Elsewhere in Africa, there are reports that authorities in Mali could be seeking to expropriate Barrick's Loulo-Gounkoto complex.

The Bank of America analyst said they'll be looking for management to offer any updates on negotiations or discussions with the government on that.

Investors and analysts are waiting on word of the ramp-up at Barrick's Pueblo Viejo in terms of increasing production and decreasing costs, the analysts said.

"With the recent gold price strength, we’ll be seeking updated views on capital allocation priorities: particularly capital return (the buy back) and investment in exploration and projects," the analysts said.

The RBC analysts are expecting low output and higher tax payments to weigh on Barrick's free cash flow during the quarter.

"Capital allocation priorities will be of note as Barrick has outlined a shift to copper growth investment at Reko Diq and the Lumwana Superpit projects, where FSs (feasibility studies) are guided to be completed by YE24," RBC said. "Barrick previously approved a share buyback which has not been utilized, despite higher gold prices ytd and weak share performance—any potential commentary on this will be of note."

Read Next:

Benzinga Mining is the bridge between mining companies and retail investors. Reach out to licensing@benzinga.com to get started!

Photo: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

It doesn't matter your age or experience: taking full advantage of the stock market and investing with confidence are common goals for all investors. Luckily, Zacks Premium offers several different ways to do both.

The popular research service can help you become a smarter, more self-assured investor, giving you access to daily updates of the Zacks Rank and Zacks Industry Rank, the Zacks #1 Rank List, Equity Research reports, and Premium stock screens.

Zacks Premium also includes the Zacks Style Scores.

What are the Zacks Style Scores?

Developed alongside the Zacks Rank, the Zacks Style Scores are a group of complementary indicators that help investors pick stocks with the best chances of beating the market over the next 30 days.

Each stock is assigned a rating of A, B, C, D, or F based on their value, growth, and momentum characteristics. Just like in school, an A is better than a B, a B is better than a C, and so on -- that means the better the score, the better chance the stock will outperform.

The Style Scores are broken down into four categories:

Value Score

For value investors, it's all about finding good stocks at good prices, and discovering which companies are trading under their true value before the broader market catches on. The Value Style Score utilizes ratios like P/E, PEG, Price/Sales, Price/Cash Flow, and a host of other multiples to help pick out the most attractive and discounted stocks.

Growth Score

While good value is important, growth investors are more focused on a company's financial strength and health, and its future outlook. The Growth Style Score takes projected and historic earnings, sales, and cash flow into account to uncover stocks that will see long-term, sustainable growth.

Momentum Score

Momentum investors, who live by the saying "the trend is your friend," are most interested in taking advantage of upward or downward trends in a stock's price or earnings outlook. Utilizing one-week price change and the monthly percentage change in earnings estimates, among other factors, the Momentum Style Score can help determine favorable times to buy high-momentum stocks.

VGM Score

If you like to use all three kinds of investing, then the VGM Score is for you. It's a combination of all Style Scores, and is an important indicator to use with the Zacks Rank. The VGM Score rates each stock on their shared weighted styles, narrowing down the companies with the most attractive value, best growth forecast, and most promising momentum.

How Style Scores Work with the Zacks Rank

The Zacks Rank is a proprietary stock-rating model that harnesses the power of earnings estimate revisions, or changes to a company's earnings expectations, to help investors build a successful portfolio.

Investors can count on the Zacks Rank's success, with #1 (Strong Buy) stocks producing an unmatched +25.41% average annual return since 1988, more than double the S&P 500's performance. But the model rates a large number of stocks, and there are over 200 companies with a Strong Buy rank, plus another 600 with a #2 (Buy) rank, on any given day.

But it can feel overwhelming to pick the right stocks for you and your investing goals with over 800 top-rated stocks to choose from.

That's where the Style Scores come in.

You want to make sure you're buying stocks with the highest likelihood of success, and to do that, you'll need to pick stocks with a Zacks Rank #1 or #2 that also have Style Scores of A or B. If you like a stock that only as a #3 (Hold) rank, it should also have Scores of A or B to guarantee as much upside potential as possible.

Since the Scores were created to work together with the Zacks Rank, the direction of a stock's earnings estimate revisions should be a key factor when choosing which stocks to buy.

For instance, a stock with a #4 (Sell) or #5 (Strong Sell) rating, even one that boasts Scores of A and B, still has a downward-trending earnings forecast, and a much greater likelihood its share price will decline as well.

Thus, the more stocks you own with a #1 or #2 Rank and Scores of A or B, the better.

Barrick Gold Corporation, based in Toronto, Canada, is one of the largest gold mining companies in the world. The company has many advanced exploration and development projects located across five continents.

GOLD is a #2 (Buy) on the Zacks Rank, with a VGM Score of A.

Momentum investors should take note of this Basic Materials stock. GOLD has a Momentum Style Score of B, and shares are up 8.5% over the past four weeks.

Four analysts revised their earnings estimate upwards in the last 60 days for fiscal 2024. The Zacks Consensus Estimate has increased $0.10 to $1.16 per share. GOLD boasts an average earnings surprise of 18.3%.

With a solid Zacks Rank and top-tier Momentum and VGM Style Scores, GOLD should be on investors' short list.

Zacks Investment Research

As the summer of 2024 heats up, so does my excitement for under-$10 stocks. I believe these affordable picks strike a sweet spot between volatility and medium-term potential. Sure, penny stocks and most sub-$10 shares often get lumped together, and for good reason – many smaller companies have struggled in the market despite the broader rally. However, these budget-friendly stocks are still worth a closer look.

Why? They offer an enticing balance of risk and reward. Plus, as interest rates inevitably cool off in the coming quarters, it could be just the catalyst needed to push these stocks to new heights. I’m not saying it’ll be a smooth ride, but for those willing to buckle up, the potential payoff could be well worth it. Let’s take a look!

Udemy (UDMY)

Udemy is an online learning platform that offers courses in various fields to over 64 million learners worldwide. The company recently reported strong first-quarter 2024 results, with 24% year-over-year revenue growth in its Business segment and expansion to over 16,000 enterprise customers globally. This is the biggest segment now, as the Consumer segment has been declining.

I believe Udemy is well-positioned for long-term success as demand for online learning and upskilling continues. Analysts seem bullish on Udemy’s prospects, with firms like Keybanc, Cantor Fitzgerald, and Needham maintaining positive ratings and price targets indicating significant upside. Cantor Fitzgerald’s Brett Knoblauch reiterated an Overweight rating with a $20 price target, implying a 122% upside from current levels. While I’m encouraged by the optimism, I would caution that such a lofty target may be overly ambitious in the near term.

That said, with Udemy guiding for profitability in 2024 and analysts projecting 54 cents in earnings per share in 2026, the current valuation of under 17x 2026 earnings looks quite reasonable for a high-growth software name. If Udemy executes well, there could still be plenty of room for upside.

Taboola.com (TBLA)

Taboola is an advertising technology company that provides content recommendation services. The company has been navigating a challenging environment, but I believe it is well-positioned to benefit from the accelerating shift of advertising dollars to digital channels.

In today’s world, content consumption is increasingly moving online. People are spending more time than ever watching videos, reading articles and otherwise engaging with digital media. Naturally, advertisers are following suit by allocating larger portions of their budgets to online channels and sponsored content. This mega trend plays right into Taboola’s wheelhouse. Despite near-term headwinds, Taboola delivered solid Q1 2024 results, beating the high end of its guidance across all key metrics.

Revenues grew 26% year-over-year to $414 million, while ex-TAC gross profit increased 20% to $139 million. The company is making good progress on strategic priorities like ramping up its Yahoo partnership and driving advertiser success through AI-powered tools. The expected growth in the coming years is very promising, too.

Taboola’s stock has been flat over the past year and is down 17.6% year-to-date, but I view this as an attractive entry point.

Kinross Gold (KGC)

Kinross Gold Corporation , a Canadian-based gold mining company, has been striking it rich thanks to soaring gold prices. With economic uncertainty driving investors towards safe havens like gold, Kinross has seen its stock rise by 77% over the past year.

The company posted strong Q1 2024 results, with margins jumping 20% to $1,088 per ounce sold. The analyst consensus is bullish, but bears argue the stock may be getting ahead of itself. Personally, I’m in the bull camp and believe gold prices have room to run.

Kinross is making smart moves, like investing in the promising Manh Choh project in Alaska. The company also published an impressive sustainability report to boost ESG.

Regardless, Kinross’ fortunes are closely tied to the price of gold. If the yellow metal loses its luster, expect KGC shares to follow suit. But for now, I’m excited to see how this gold rush plays out. With Q2 results due out soon, Kinross investors could be in for another pleasant surprise.

Aware (AWRE)

Aware receives limited analyst coverage, but those who follow it see long-term potential due to the increasing global need for secure biometric solutions. Craig-Hallum analyst Jeff Van Rhee recently reiterated his “Buy” rating on Aware.

However, Aware’s financial performance has been volatile, and the company is still unprofitable. In Q1 2024, Aware reported a 3% year-over-year increase in revenue to $4.4 million, while its net loss improved to $1.0 million from $1.6 million in the prior year period. I believe that if Aware continues to execute on its strategy, it could reach profitability in the near future.

The rise of AI could disrupt many existing verification systems, potentially driving companies to rapidly adopt more advanced biometric solutions. This trend could benefit Aware as businesses turn to the company’s expertise in biometric software.

UP Fintech Holding (TIGR)

UP Fintech Holding operates an online brokerage platform focusing on global Chinese investors. The company has faced challenges in recent years, with its stock price down significantly from 2021 highs and trading mostly below $5 for over two years now.

However, I believe UP Fintech is starting to turn things around financially and could deliver solid upside if it maintains its current trajectory. While the stock is flat year-to-date, I expect positive moves going forward as the company reported total revenue of $78.9 million in Q1 2024, a 19% increase year-over-year. Both GAAP and non-GAAP net income also saw significant growth.

Of course, skepticism still abounds regarding the Chinese economy, but I don’t necessarily view that as a negative for UP Fintech. As the “largest online broker focusing on global Chinese investors in terms of U.S. securities trading volume,” the company could actually benefit from Chinese investors increasingly looking abroad amidst a poorly performing Hang Seng Index.

Red Cat Holdings (RCAT)

Red Cat Holdings is a small drone drone startup. The company recently reported revenue of $5.8 million in fiscal Q3 2024, representing 250% year-over-year increase and marking the third consecutive quarter of double-digit sequential growth. The growth ahead looks solid, too.

In my view, Red Cat is a risky but intriguing investment for those seeking significant upside potential. This small drone player could hit pay dirt by landing hefty contracts as unmanned aerial vehicles gain popularity with government and military customers. After all, drones are already heavily utilized by law enforcement, and the Pentagon is just beginning to ramp up its drone deployments.

Red Cat aims to replicate that manufacturing capability domestically, and I believe it could soar if successful. The company also recently secured $4.4 million in non-dilutive financing and is poised to join the Russell Microcap Index.

Analysts seem bullish on Red Cat, with Ladenburg Thalmann initiating coverage in June with a “Buy” rating and $4 price target, implying over 75% upside from here.

PowerFleet (AIOT)

PowerFleet provides IoT and AI solutions to optimize logistics operations. The company has been pivoting to a SaaS-centric business model centered around its Unity platform.

I believe PowerFleet is well-positioned to benefit from the rapid digitization of the logistics industry. Companies are investing heavily in AI and software to maximize supply chain efficiency, and PowerFleet’s device-agnostic Unity platform puts it in the sweet spot of this trend.

The market seems to be recognizing PowerFleet’s potential. The stock has surged 76% over the past year as the company’s recurring SaaS revenue gains traction. However, it still trades 42% below pre-pandemic levels.

Analysts are overwhelmingly bullish, with all six covering the stock rating it a “Buy.” Canaccord Genuity nearly doubled its price target to $10, implying a 110% upside. While I’m not quite that optimistic, I agree PowerFleet’s valuation doesn’t reflect its growth prospects in a booming industry.

On Penny Stocks and Low-Volume Stocks: With only the rarest exceptions, InvestorPlace does not publish commentary about companies that have a market cap of less than $100 million or trade less than 100,000 shares each day. That’s because these “penny stocks” are frequently the playground for scam artists and market manipulators. If we ever do publish commentary on a low-volume stock that may be affected by our commentary, we demand that InvestorPlace.com’s writers disclose this fact and warn readers of the risks.

On the date of publication, Omor Ibne Ehsan did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

On the date of publication, the responsible editor did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Omor Ibne Ehsan is a writer at InvestorPlace. He is a self-taught investor with a focus on growth and cyclical stocks that have strong fundamentals, value, and long-term potential. He also has an interest in high-risk, high-reward investments such as cryptocurrencies and penny stocks. You can follow him on LinkedIn.

More from InvestorPlace

Barrick Gold ended the recent trading session at $17.97, demonstrating a +1.01% swing from the preceding day's closing price. The stock outperformed the S&P 500, which registered a daily gain of 0.08%. Elsewhere, the Dow saw a downswing of 0.12%, while the tech-heavy Nasdaq appreciated by 0.07%.

Coming into today, shares of the gold and copper mining company had gained 6.65% in the past month. In that same time, the Basic Materials sector lost 1.43%, while the S&P 500 lost 0.21%.

The investment community will be paying close attention to the earnings performance of Barrick Gold in its upcoming release. The company is slated to reveal its earnings on August 12, 2024. In that report, analysts expect Barrick Gold to post earnings of $0.26 per share. This would mark year-over-year growth of 36.84%. At the same time, our most recent consensus estimate is projecting a revenue of $3.02 billion, reflecting a 6.45% rise from the equivalent quarter last year.

Looking at the full year, the Zacks Consensus Estimates suggest analysts are expecting earnings of $1.16 per share and revenue of $12.9 billion. These totals would mark changes of +38.1% and +13.15%, respectively, from last year.

Investors should also note any recent changes to analyst estimates for Barrick Gold. Recent revisions tend to reflect the latest near-term business trends. As a result, upbeat changes in estimates indicate analysts' favorable outlook on the company's business health and profitability.

Our research shows that these estimate changes are directly correlated with near-term stock prices. We developed the Zacks Rank to capitalize on this phenomenon. Our system takes these estimate changes into account and delivers a clear, actionable rating model.

The Zacks Rank system, stretching from #1 (Strong Buy) to #5 (Strong Sell), has a noteworthy track record of outperforming, validated by third-party audits, with stocks rated #1 producing an average annual return of +25% since the year 1988. Over the last 30 days, the Zacks Consensus EPS estimate has witnessed a 7.44% increase. Barrick Gold is holding a Zacks Rank of #2 (Buy) right now.

From a valuation perspective, Barrick Gold is currently exchanging hands at a Forward P/E ratio of 15.39. For comparison, its industry has an average Forward P/E of 15.28, which means Barrick Gold is trading at a premium to the group.

Meanwhile, GOLD's PEG ratio is currently 0.47. Comparable to the widely accepted P/E ratio, the PEG ratio also accounts for the company's projected earnings growth. The Mining - Gold industry had an average PEG ratio of 0.76 as trading concluded yesterday.

The Mining - Gold industry is part of the Basic Materials sector. This group has a Zacks Industry Rank of 51, putting it in the top 21% of all 250+ industries.

The Zacks Industry Rank is ordered from best to worst in terms of the average Zacks Rank of the individual companies within each of these sectors. Our research shows that the top 50% rated industries outperform the bottom half by a factor of 2 to 1.

Be sure to use Zacks.com to monitor all these stock-influencing metrics, and more, throughout the forthcoming trading sessions.

Zacks Investment Research

Newmont Corporation appears an attractive pick given a noticeable improvement in the company's earnings outlook. The stock has been a strong performer lately, and the momentum might continue with analysts still raising their earnings estimates for the company.

The upward trend in estimate revisions for this gold and copper miner reflects growing optimism of analysts on its earnings prospects, which should get reflected in its stock price. After all, empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock price movements. Our stock rating tool -- the Zacks Rank -- has this insight at its core.

The five-grade Zacks Rank system, which ranges from a Zacks Rank #1 (Strong Buy) to a Zacks Rank #5 (Strong Sell), has an impressive externally-audited track record of outperformance, with Zacks #1 Ranked stocks generating an average annual return of +25% since 2008.

For Newmont, there has been strong agreement among the covering analysts in raising earnings estimates, which has helped push consensus estimates considerably higher for the next quarter and full year.

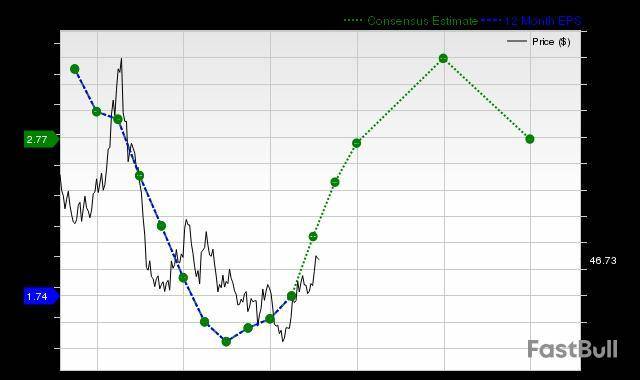

The chart below shows the evolution of forward 12-month Zacks Consensus EPS estimate:

12 Month EPS

Current-Quarter Estimate Revisions

The earnings estimate of $0.72 per share for the current quarter represents a change of +100% from the number reported a year ago.

Over the last 30 days, the Zacks Consensus Estimate for Newmont has increased 12.86% because one estimate has moved higher compared to no negative revisions.

Current-Year Estimate Revisions

For the full year, the company is expected to earn $2.67 per share, representing a year-over-year change of +65.84%.

The revisions trend for the current year also appears quite promising for Newmont, with three estimates moving higher over the past month compared to one negative revision. The consensus estimate has also received a boost over this time frame, increasing 7.67%.

Favorable Zacks Rank

Thanks to promising estimate revisions, Newmont currently carries a Zacks Rank #2 (Buy). The Zacks Rank is a tried-and-tested rating tool that helps investors effectively harness the power of earnings estimate revisions and make the right investment decision. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Our research shows that stocks with Zacks Rank #1 (Strong Buy) and 2 (Buy) significantly outperform the S&P 500.

Bottom Line

Investors have been betting on Newmont because of its solid estimate revisions, as evident from the stock's 11.6% gain over the past four weeks. As its earnings growth prospects might push the stock higher, you may consider adding it to your portfolio right away.

Zacks Investment Research

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up